Introduction

In the complex landscape of modern finance, the importance of rigorous financial risk assessments cannot be overstated. These evaluations serve as a vital tool for organizations aiming to navigate the uncertainties of economic fluctuations, regulatory challenges, and operational disruptions. For CFOs, mastering the intricacies of risk assessment is not just an option; it is a necessity that underpins sound financial management and strategic decision-making.

As the frequency of unexpected events grows—exemplified by recent large-scale data breaches in the healthcare sector—

the call for proactive risk management becomes ever more urgent. By embedding comprehensive risk assessment practices into their financial strategies, organizations can not only safeguard their assets but also enhance their resilience against potential crises, ensuring long-term stability and success.

This article delves into the essential components of effective financial risk assessments, the consequences of neglecting them, and the innovative technologies that can elevate these processes to new heights.

Understanding Financial Risk Assessments: Importance and Necessity

Financial evaluations are a cornerstone for any organization aiming for stability and growth. These evaluations provide an organized structure to recognize fundamental business problems, examine, and reduce possible monetary threats that can interfere with operations by utilizing a financial reporting risk assessment template. For CFOs, understanding the importance of these evaluations is essential to effective management of resources.

Regular risk evaluations, facilitated by a financial reporting risk assessment template, empower entities to make informed, strategic decisions, enhancing resilience against economic uncertainties. Furthermore, they play a vital role in aligning economic strategies with overarching business objectives while streamlining decision-making processes. In today’s competitive environment, neglecting such evaluations could jeopardize a company’s stability.

The rising frequency of significant healthcare data breaches (500+ records), which exceeded 700 in both 2021 and 2022, highlights the urgency for healthcare entities to conduct thorough financial evaluations. Additionally, organizations must continually monitor their performance through real-time analytics, ensuring readiness to respond to emergencies, including natural disasters and pandemics. This proactive strategy not only encourages compliance and operational efficiency but also protects against long-term challenges.

For example, efficient Master Data Management (MDM) improves data integrity, patient safety, regulatory compliance, and operational effectiveness, thus minimizing uncertainties and strengthening the case for regular monetary evaluations as an essential element of any strong organizational strategy. Moreover, by incorporating a 'Test & Measure' approach, organizations can validate their hypotheses using a financial reporting risk assessment template to ensure maximum returns on investment, further solidifying the need for ongoing evaluations and adjustments in their economic strategies.

Key Components to Include in Your Financial Reporting Risk Assessment Template

A comprehensive reporting vulnerability evaluation template must include the following essential components:

- Risk Identification: Clearly delineate potential financial threats, which should encompass market fluctuations, credit challenges, and operational obstacles.

- Threat Assessment: Assess the probability and effect of each identified threat, prioritizing them based on their seriousness to ensure that critical issues are handled swiftly.

- Mitigation Strategies: Formulate actionable plans for each threat, specifying detailed steps designed to lessen their potential impact on the organization.

- Monitoring and Reporting: Create a thorough framework for the ongoing oversight of threats, combined with regular reporting systems to keep key stakeholders informed.

- Compliance Considerations: Incorporate checks within the template to ensure adherence to relevant monetary regulations and standards, such as the 2 CFR 200 requirements, thereby avoiding penalties associated with non-compliance, including disallowed costs or even suspension of grants.

- Stakeholder Involvement: Clearly identify the key stakeholders engaged in the evaluation process to promote collaboration and accountability across the organization.

- Review and Update Procedures: Establish a systematic schedule for regular evaluations and updates of the template, ensuring it remains aligned with evolving business conditions and regulatory requirements.

As Nina Kelleher aptly points out,

Such a narrow focus is detrimental to investors as it can result in material dangers to the business going unaddressed and undisclosed, thereby diminishing the quality of monetary information.

By incorporating these components, CFOs can enhance their entity's ability to efficiently handle monetary challenges while utilizing a financial reporting risk assessment template to maintain the integrity of fiscal reporting. Furthermore, referencing the case study named 'Best Practices for Subrecipient Evaluations,' entities can implement effective strategies such as creating a framework for evaluation and performing ongoing reviews throughout the grant period, ultimately promoting continuous enhancement in management.

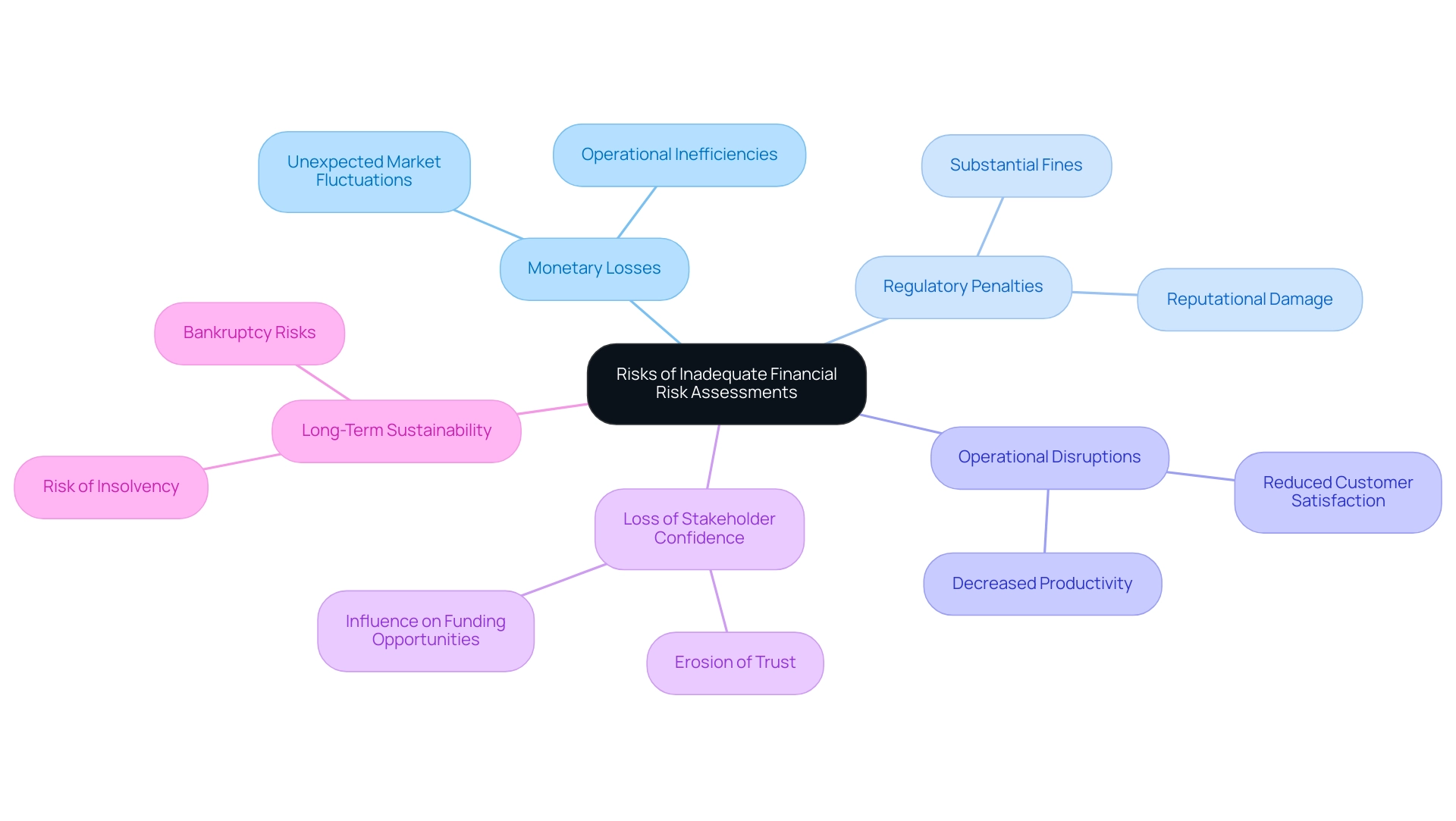

The Risks of Inadequate Financial Risk Assessments: Costs and Consequences

Ignoring monetary evaluations can result in a series of significant expenses and outcomes, such as:

- Monetary Losses: Insufficient evaluations frequently lead to unexpected monetary losses arising from market fluctuations or operational inefficiencies. With the growing occurrence of rare events—such as the 100-year storms—entities can find themselves ill-prepared for sudden changes in the economic environment.

- Regulatory Penalties: Non-compliance with monetary regulations can incur substantial fines, alongside reputational damage that may linger long after the penalties are paid.

- Operational Disruptions: Failing to identify operational hazards can precipitate disruptions that adversely affect productivity and service delivery, potentially leading to a decrease in customer satisfaction and loyalty.

- Loss of Stakeholder Confidence: Investors and stakeholders may quickly lose confidence in a company that appears unprepared for economic challenges. This erosion of trust can greatly influence funding possibilities and overall backing.

- Long-Term Sustainability: Ultimately, insufficient evaluations endanger the long-term sustainability of the entity. The cumulative effects of ignoring monetary hazards can lead to insolvency or bankruptcy, highlighting the critical importance of effective management practices. As emphasized by the fscom Team,

So, here is the fscom guide to the common pitfalls of composing an evaluation for your firm <— this serves as a reminder to prioritize thorough and proactive assessments in fiscal planning.

Moreover, the concept of 'Black Swans'—unforeseen events that can have severe consequences—illustrates how entities often fail to consider rare but impactful occurrences in their evaluations. It is essential to recognize that uncertainty management has limitations and cannot guarantee the reliability of all processes. Recognizing these constraints is essential for groups seeking to improve their ability to withstand unforeseen economic difficulties.

Identifying Key Types of Financial Risks in Assessments

A thorough evaluation of potential hazards should address several critical types of threats that can significantly affect an organization's economic well-being:

-

Market Risk: This refers to the potential losses that may arise from fluctuations in market conditions, such as changes in stock prices, interest rates, and foreign exchange rates. As market volatility continues to rise, understanding these dynamics is essential for maintaining strategic monetary planning.

Credit Exposure: This type of exposure involves the possibility that a counterparty may default on its obligations, leading to significant financial losses. With the current economic climate, organizations must develop robust credit assessment tools to evaluate the creditworthiness of their partners and clients.

-

Operational Hazard: These challenges arise from internal processes, human errors, or system failures that may disrupt operations. Significantly, a case study from 2020 emphasized the dangers of voice recognition technology when cybercriminals replicated the voice of a company director in the U.A.E., successfully initiating a $35 million bank transfer. Such incidents emphasize the urgent need for effective operational management strategies.

Liquidity Risk: This risk relates to a company's inability to meet short-term monetary obligations due to insufficient cash flow. In today's fast-paced business environment, having a clear liquidity management plan is vital to ensuring financial stability.

-

Reputational Risk: Negative publicity or loss of consumer trust can severely affect a company's revenue and growth. As over 77 percent of entities lack a structured incident response plan, according to Cybint, it is essential for CFOs to include reputation management in their assessments.

Compliance Threat: This includes dangers linked to not following laws and regulations, possibly leading to legal penalties and monetary losses. With the healthcare sector facing 32 percent of all documented data breaches between 2015 and 2022, it is essential for organizations in regulated industries to prioritize compliance to reduce threats effectively.

Staying informed about these key types of economic threats allows CFOs to implement effective strategies for threat mitigation and to protect their organizations against potential economic challenges.

Leveraging Technology for Effective Financial Risk Assessment

Technology is crucial in improving monetary evaluations, offering CFOs tools to boost precision and responsiveness. Here are several strategies to harness technology effectively:

- Data Analytics: Implement cutting-edge data analytics tools to uncover trends and patterns within financial data, facilitating proactive risk identification. A thorough monetary review can help identify opportunities that not only preserve cash but also reduce liabilities. Our team conducts thorough fiscal reviews to identify opportunities for cash preservation and liability reduction. Expert Joshua Henderson highlights, "Data analytics can greatly lessen exposure to monetary uncertainties by delivering actionable insights," stressing its essential role in economic evaluations.

- Risk Management Software: Implement a financial reporting risk assessment template through specialized software that automates risk assessment processes, ensuring consistency and enhancing accuracy across evaluations. This approach minimizes human error and enables more reliable decision-making, which is essential for utilizing the financial reporting risk assessment template to uncover hidden value and reduce costs during budget reviews.

- Cloud Solutions: Utilize cloud-based platforms to enable real-time data access and enhance collaboration among stakeholders. This immediacy facilitates timely decision-making, a crucial factor in the fast-paced economic environment, particularly during turnaround processes.

- Artificial Intelligence: Utilize AI-driven solutions to quickly examine large datasets, revealing potential issues that conventional analyses might overlook. Notably, JPMorgan Chase has successfully implemented advanced AI technologies to detect fraud, demonstrating the practical advantages of these tools. As part of their investment in fraud prevention, banks are increasingly focusing on training employees and developing new fraud detection software to stay ahead of evolving threats.

- Continuous Monitoring: Utilize technology for constant observation of economic metrics, enabling organizations to make prompt adjustments in reaction to emerging threats. Utilizing our client dashboard, we provide real-time analytics to monitor business health and adjust strategies as needed. This ongoing performance monitoring is crucial, particularly considering recent findings from the US Department of the Treasury concerning AI-specific cybersecurity threats.

By integrating these technological solutions, CFOs can significantly enhance their financial evaluations, leading to improved decision-making and greater organizational resilience. As illustrated by recent developments, such as MasterCard's focus on enhancing consumer protection with generative AI, staying abreast of technological advancements is critical for effective risk management in 2024.

Conclusion

In the evolving landscape of finance, the significance of thorough financial risk assessments cannot be overstated. By systematically identifying and analyzing potential risks, organizations can fortify their financial strategies against market volatility, regulatory changes, and operational disruptions. For CFOs, the mastery of these assessments is essential—not only for safeguarding assets but also for enhancing the organization's resilience in an unpredictable environment.

The article highlights the critical components necessary for an effective risk assessment template, such as:

- Risk identification

- Analysis

- The formulation of mitigation strategies

It is evident that neglecting these evaluations can lead to severe consequences, from financial losses to regulatory penalties, ultimately jeopardizing the long-term viability of the organization. The discussion on key financial risks—market, credit, operational, liquidity, reputational, and compliance—further underscores the need for a comprehensive approach to risk management.

Leveraging technology emerges as a powerful strategy for improving financial risk assessments. By utilizing:

- Data analytics

- Risk management software

- Cloud solutions

- AI-driven tools

CFOs can enhance accuracy and responsiveness in their evaluations. This proactive adoption not only streamlines processes but also ensures that organizations are well-prepared to navigate the complexities of modern finance.

In conclusion, embedding rigorous financial risk assessments into organizational practices is not just a best practice; it is a fundamental necessity. By prioritizing these evaluations and embracing technological advancements, CFOs can lead their organizations toward sustained success and stability, ensuring they remain resilient in the face of future challenges. Now is the time to take decisive action and elevate financial risk management to its rightful place at the heart of strategic decision-making.

Frequently Asked Questions

Why are financial evaluations important for organizations?

Financial evaluations are essential for organizations as they help identify fundamental business problems, assess and mitigate monetary threats, and support effective resource management, ultimately contributing to stability and growth.

How do regular risk evaluations benefit organizations?

Regular risk evaluations enable organizations to make informed, strategic decisions, enhance resilience against economic uncertainties, align economic strategies with business objectives, and streamline decision-making processes.

What recent trend underscores the need for thorough financial evaluations in healthcare?

The increasing frequency of significant healthcare data breaches, exceeding 700 incidents in both 2021 and 2022, highlights the urgency for healthcare entities to conduct comprehensive financial evaluations.

What are the essential components of a comprehensive financial reporting risk assessment template?

The essential components include: 1. Risk Identification 2. Threat Assessment 3. Mitigation Strategies 4. Monitoring and Reporting 5. Compliance Considerations 6. Stakeholder Involvement 7. Review and Update Procedures.

What potential consequences can arise from ignoring financial evaluations?

Ignoring financial evaluations can lead to monetary losses, regulatory penalties, operational disruptions, loss of stakeholder confidence, and jeopardize long-term sustainability.

What types of threats should be addressed in financial evaluations?

Key types of threats include: 1. Market Risk 2. Credit Exposure 3. Operational Hazard 4. Liquidity Risk 5. Reputational Risk 6. Compliance Threat.

How can technology improve financial evaluations?

Technology can enhance financial evaluations through data analytics for trend identification, risk management software for automation, cloud solutions for real-time access, AI for data analysis, and continuous monitoring of economic metrics.

What role does data analytics play in financial evaluations?

Data analytics helps uncover trends and patterns within financial data, facilitating proactive risk identification and enabling organizations to preserve cash and reduce liabilities.

Why is stakeholder involvement important in financial evaluations?

Stakeholder involvement promotes collaboration and accountability across the organization, ensuring that various perspectives are considered in the evaluation process.

How can organizations ensure their financial reporting risk assessment template remains effective?

Organizations can ensure effectiveness by establishing a systematic schedule for regular evaluations and updates, keeping the template aligned with evolving business conditions and regulatory requirements.