Overview

The article primarily aims to delineate the essential steps for effective post-insolvency planning targeted at small and medium enterprises. It asserts that a systematic approach, which includes:

- Comprehensive financial assessments

- Interim management

- Stakeholder engagement

- Ongoing improvement practices

is crucial for organizations to not only recover but also attain sustainable growth following insolvency.

Introduction

In the challenging aftermath of insolvency, small and medium businesses embark on a formidable journey toward recovery. The path to revitalization is often fraught with complexities; however, with the right post-insolvency consulting strategies, organizations can not only survive but thrive. This article explores essential practices that empower businesses to navigate their recovery landscapes—ranging from:

- Conducting thorough financial assessments

- Implementing interim management

- Developing clear restructuring plans

- Effectively engaging stakeholders

By delving into these targeted approaches, companies can unlock new opportunities, stabilize operations, and foster sustainable growth in an increasingly competitive environment.

Transform Your Small/ Medium Business: Comprehensive Post-Insolvency Consulting

Post-insolvency planning is crucial for small and medium enterprises striving to navigate the complexities of recovery. At Transform Your Small/Medium Enterprise, we offer tailored strategies that address specific challenges, enabling organizations to optimize operations, reduce expenses, and ultimately enhance revenue growth. By concentrating on the unique needs of each client, our consultants empower companies not merely to survive but to thrive in a competitive landscape.

This process encompasses a comprehensive assessment of the organization’s financial health and operational capabilities, facilitating targeted interventions that promote sustainable growth. For instance, organizations engaging in our consulting after insolvency often witness significant improvements in performance metrics, as evidenced by case studies showcasing transformational change.

One notable case study illustrates how our customized consulting approach, including the innovative 'Rapid30' plan, resulted in a remarkable turnaround for a struggling business, underscoring the effectiveness of these strategies.

As CFOs assess their circumstances, post-insolvency planning should involve embracing a structured consulting approach that entails regular monetary evaluations to conserve cash and minimize liabilities. To adeptly navigate their post-insolvency landscape and emerge stronger, CFOs ought to consider implementing a structured post-insolvency planning strategy that encompasses regular assessments and adjustments based on performance metrics.

Conduct Thorough Financial Assessments to Identify Opportunities

Carrying out a comprehensive economic evaluation is crucial for companies striving to bounce back from insolvency. This process involves identifying underlying organizational issues and working collaboratively to create a plan that mitigates weaknesses while allowing entities to reinvest in key strengths. A thorough examination of cash flow, obligations, and overall performance enables companies to identify areas for cost savings and efficiency enhancements. By utilizing economic modeling and forecasting methods, such as scenario evaluation and sensitivity assessment, companies can pinpoint opportunities to maintain cash and enhance profitability. For instance, a monetary evaluation can unlock additional funding options, which are vital for growth in small to medium enterprises.

Moreover, frequent evaluations not only assist companies in remaining flexible in a changing market but also aid long-term recovery initiatives by ensuring they can adjust to new challenges. Statistics suggest that enterprises that engage in thorough monetary evaluations after insolvency frequently encounter cost reductions averaging 20%, thereby improving their prospects for sustainable growth. As Angie Peterson, CHRO of CAR∙TOYS Inc., noted, 'I felt we could completely trust your guidance as you’d really taken the time to understand us and our needs, at a very detailed level.' This emphasizes the significance of customized insights in the evaluation process.

In addition, the incorporation of real-time analytics enables companies to consistently track their economic health and operational viability, ensuring that they can make well-informed choices rapidly. The case study named 'Testing the Waters for CFO Services' demonstrates how performing an assessment can act as an initial step prior to collaborating with an outsourced CFO firm, enabling owners to evaluate the consulting company's expertise and dependability without entering into a prolonged leadership agreement. The importance of cash flow analysis in ensuring effective post-insolvency planning cannot be overstated, as it provides a clear picture of financial health and operational viability. Furthermore, our pragmatic approach to data involves testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

Implement Interim Management for Operational Stability

Interim management serves as a vital strategy for businesses involved in post-insolvency planning while grappling with operational instability. By appointing experienced interim leaders, organizations can sustain essential functions while developing a robust restoration plan. These leaders offer fresh insights and specialized expertise, enabling them to adeptly navigate the complexities of restructuring. Their ability to make swift decisions and implement necessary changes is crucial for sustaining stakeholder confidence and ensuring operational continuity.

Our pragmatic approach emphasizes testing every hypothesis to deliver maximum return on invested capital, which is essential during this critical phase. Data from B. Riley Farber suggest that interim leaders can be implemented within 48 hours of recognizing the necessity, significantly speeding up the restoration process. Additionally, our client dashboard offers real-time analytics, enabling ongoing assessment of performance and the well-being of the organization.

Case studies, such as 'How to Navigate Change and Prepare for Bankruptcy in Commercial Real Estate,' illustrate how interim executives have effectively stabilized companies, emphasizing the importance of their role in post-insolvency planning. Their involvement not only aligns with long-term objectives but also guarantees the execution of effective strategic initiatives, ultimately paving the way for sustainable growth. As one expert noted, CROs ensure companies receive highly competent leadership during restructuring, highlighting the critical role these professionals play in navigating challenging times.

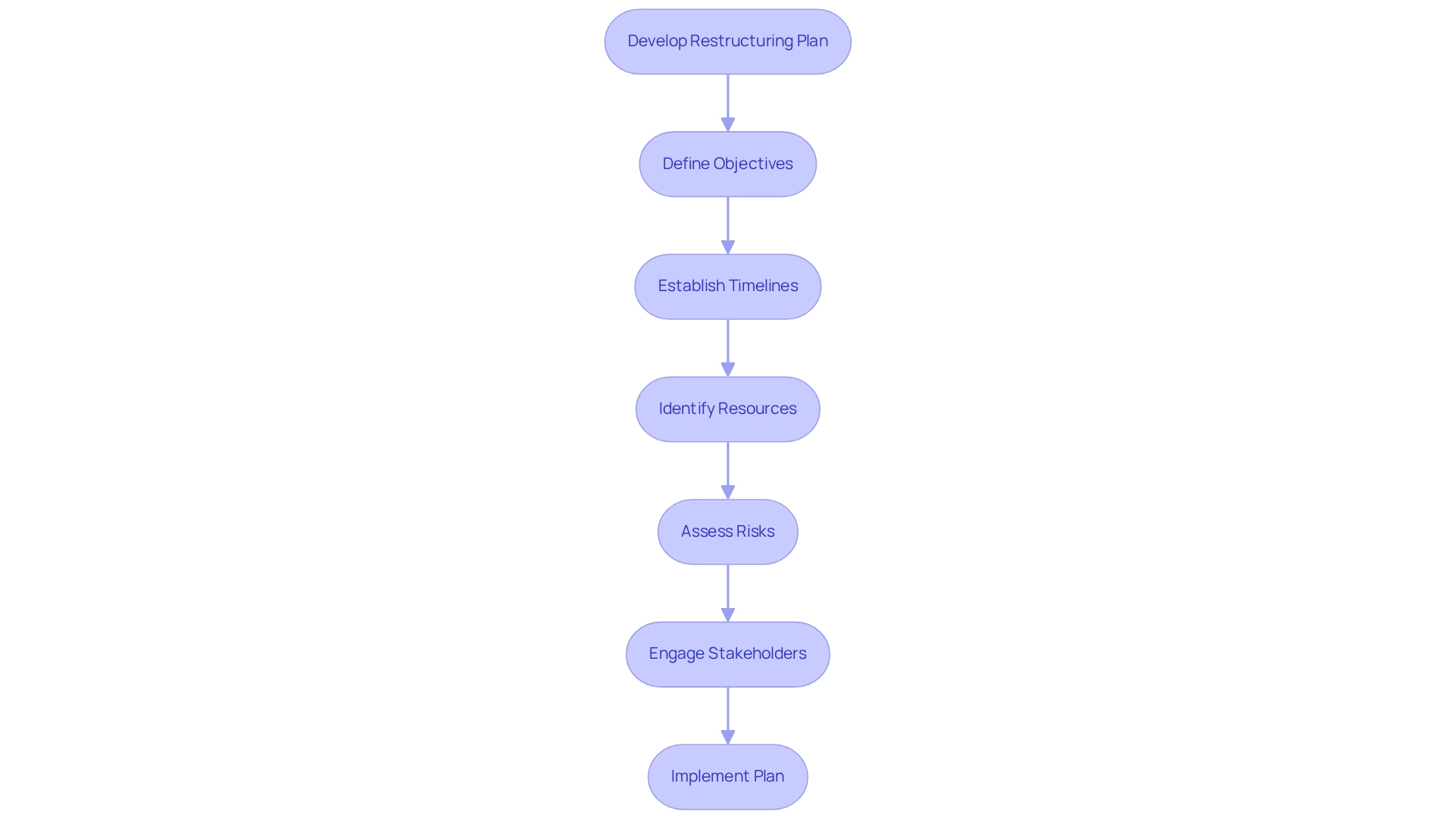

Develop a Clear Restructuring Plan to Guide Recovery

A well-defined restructuring plan is essential for steering an organization through recovery. This plan must delineate specific objectives, establish timelines, and identify the necessary resources for execution. It should also take into account potential risks and outline effective mitigation strategies. Engaging stakeholders throughout the planning process is vital; their buy-in and support significantly enhance the likelihood of successful implementation.

Our team will identify underlying organizational issues and collaborate to create a plan that mitigates weaknesses, enabling the organization to reinvest in key strengths. Research indicates that companies may release cash reserves in net working capital during a liquidity crisis, underscoring the importance of effective cash flow management.

Moreover, firms with clear post-insolvency planning experience higher success rates, emphasizing the significance of a systematic approach. A comprehensive plan not only addresses immediate challenges but also lays the groundwork for long-term sustainability, empowering businesses to thrive in a competitive landscape.

We adopt a pragmatic approach to data, rigorously testing every hypothesis to ensure maximum return on invested capital in both the short and long term.

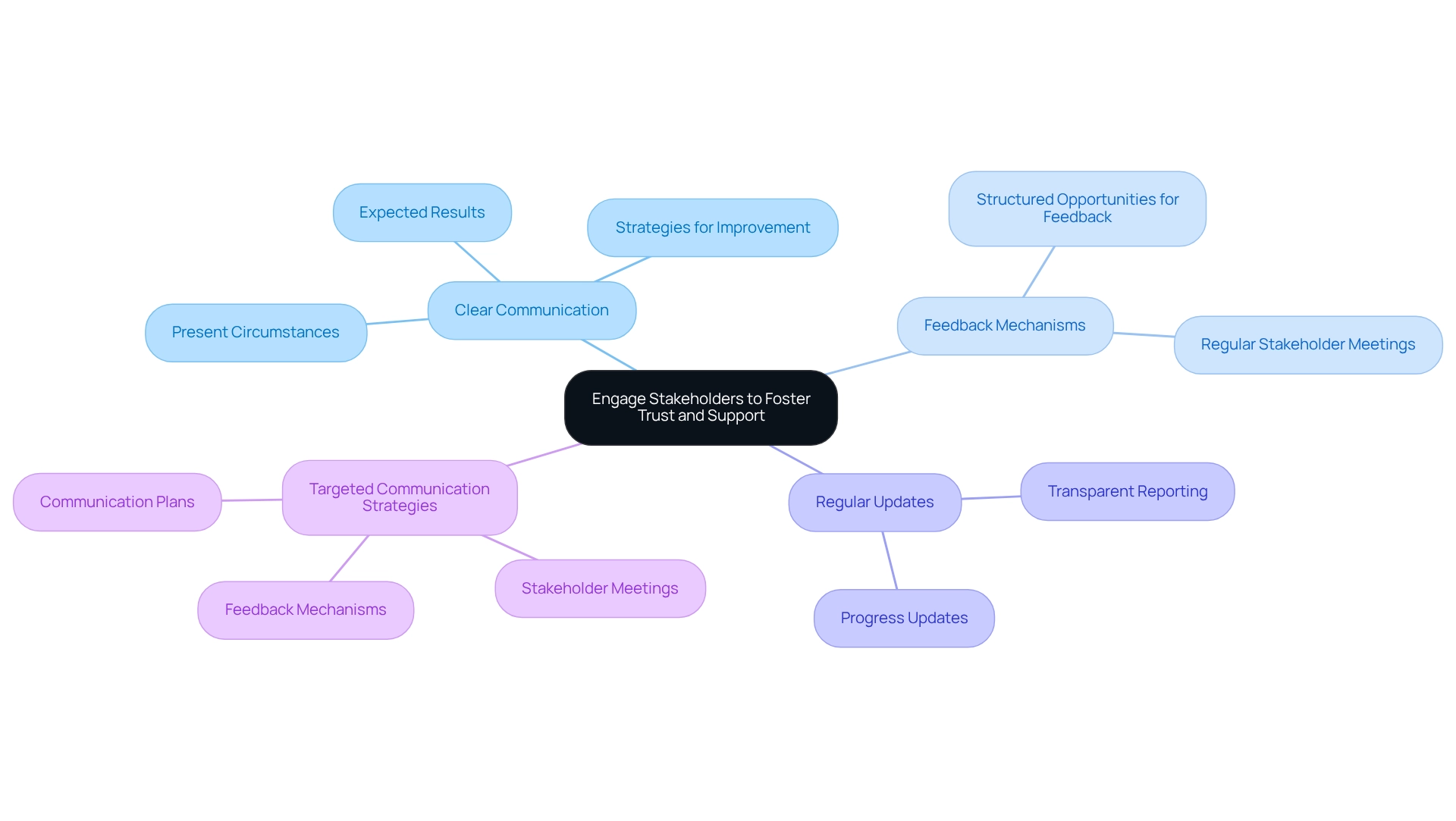

Engage Stakeholders to Foster Trust and Support

Effective stakeholder engagement is crucial during the restoration process, significantly impacting a company's capacity to rebound. Clear communication regarding the company's present circumstances, strategies for improvement, and expected results is vital. Our team advocates for an expedited decision-making cycle during the turnaround process, empowering your team to take decisive action to safeguard your organization.

Regular updates and structured opportunities for feedback not only foster trust but also encourage support from key stakeholders, including employees, creditors, and investors. Notably, 50% of a firm's worth frequently derives from only 15-20 essential stakeholder positions, underscoring the significance of their participation in restoration initiatives.

By cultivating a cooperative atmosphere and implementing the lessons learned through the turnaround process, companies can harness the insights and resources of their stakeholders, thereby enhancing the prospects of a successful comeback.

Implementing targeted communication strategies, such as regular stakeholder meetings, transparent reporting, and feedback mechanisms, is crucial for post-insolvency planning to rebuild trust with stakeholders, ensuring that they remain engaged and supportive throughout the recovery journey.

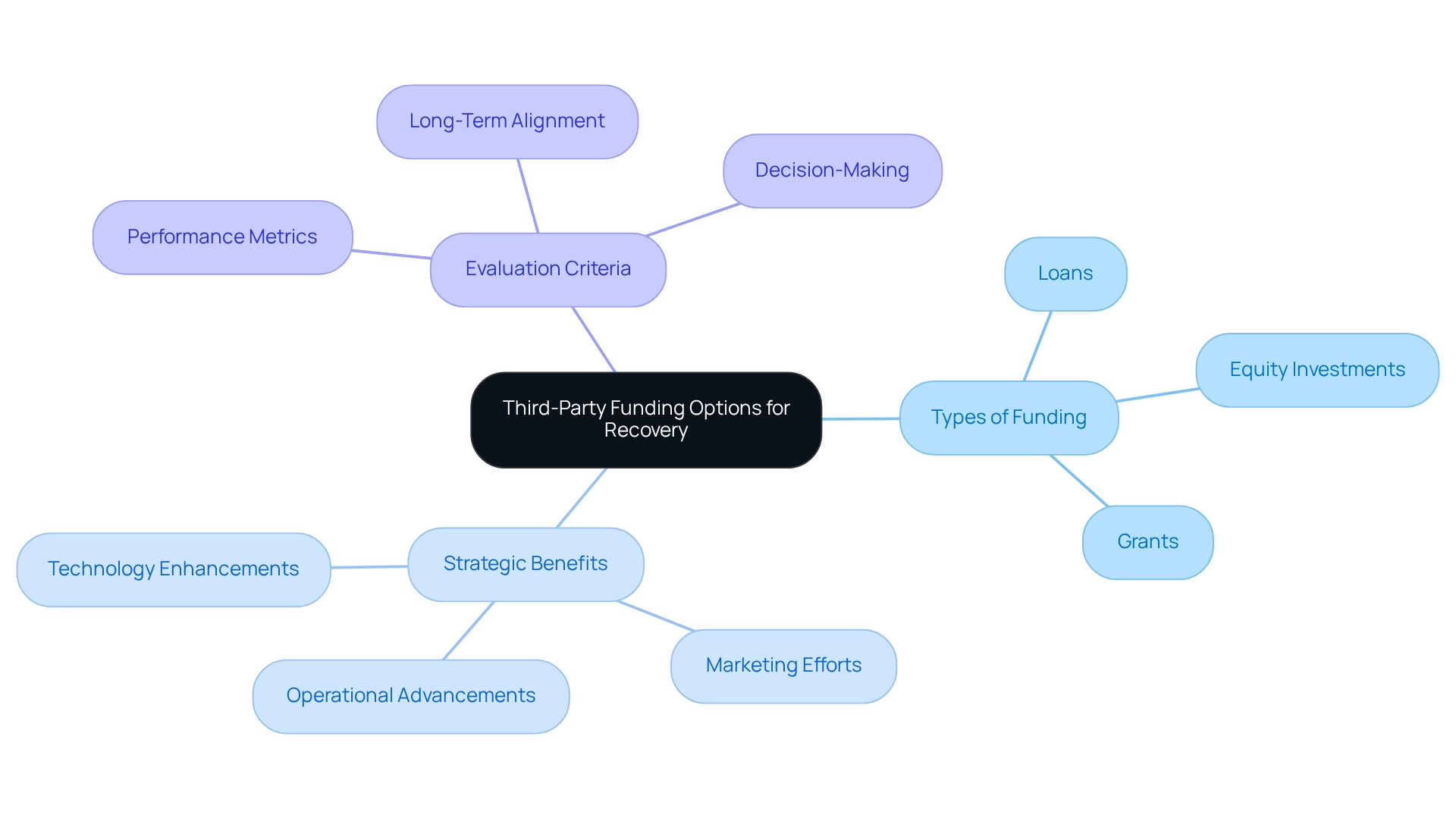

Explore Third-Party Funding Options to Support Recovery

Exploring third-party funding options is essential for enterprises seeking to stabilize and grow post-insolvency. This can include loans, equity investments, or grants from private investors, venture capitalists, or government programs. By obtaining extra funding, companies can invest in essential areas such as technology enhancements, marketing efforts, or operational advancements. This strategic approach not only addresses immediate financial needs but also facilitates the identification of underlying operational issues and the planning of effective solutions.

To maximize returns on investment, it is crucial to test and measure the effectiveness of funding decisions through data analysis. For example, CFOs can apply performance metrics to assess the influence of new investments on operational activities. Moreover, it is important to carefully evaluate the terms and implications of any funding arrangement to ensure alignment with long-term business goals. This attention to detail facilitates streamlined decision-making and continuous performance monitoring.

Ensure Compliance with Legal and Regulatory Requirements

Ensuring compliance with legal and regulatory requirements is a critical pillar of post-insolvency planning. Businesses must adhere to all relevant laws, including those related to financial reporting, employee rights, and creditor obligations. Regular audits and consultations with legal experts serve to identify potential compliance issues before they escalate. By maintaining a robust compliance posture, businesses not only shield themselves from legal repercussions but also bolster their credibility with stakeholders.

Moreover, consider the implications of non-compliance: legal challenges can divert resources and tarnish reputations. Therefore, it is essential to prioritize compliance as a strategic advantage. Engage with legal professionals and implement comprehensive training for employees to foster a culture of compliance within the organization. Consequently, by taking proactive steps, businesses can navigate the complexities of the regulatory landscape effectively and emerge stronger through post-insolvency planning.

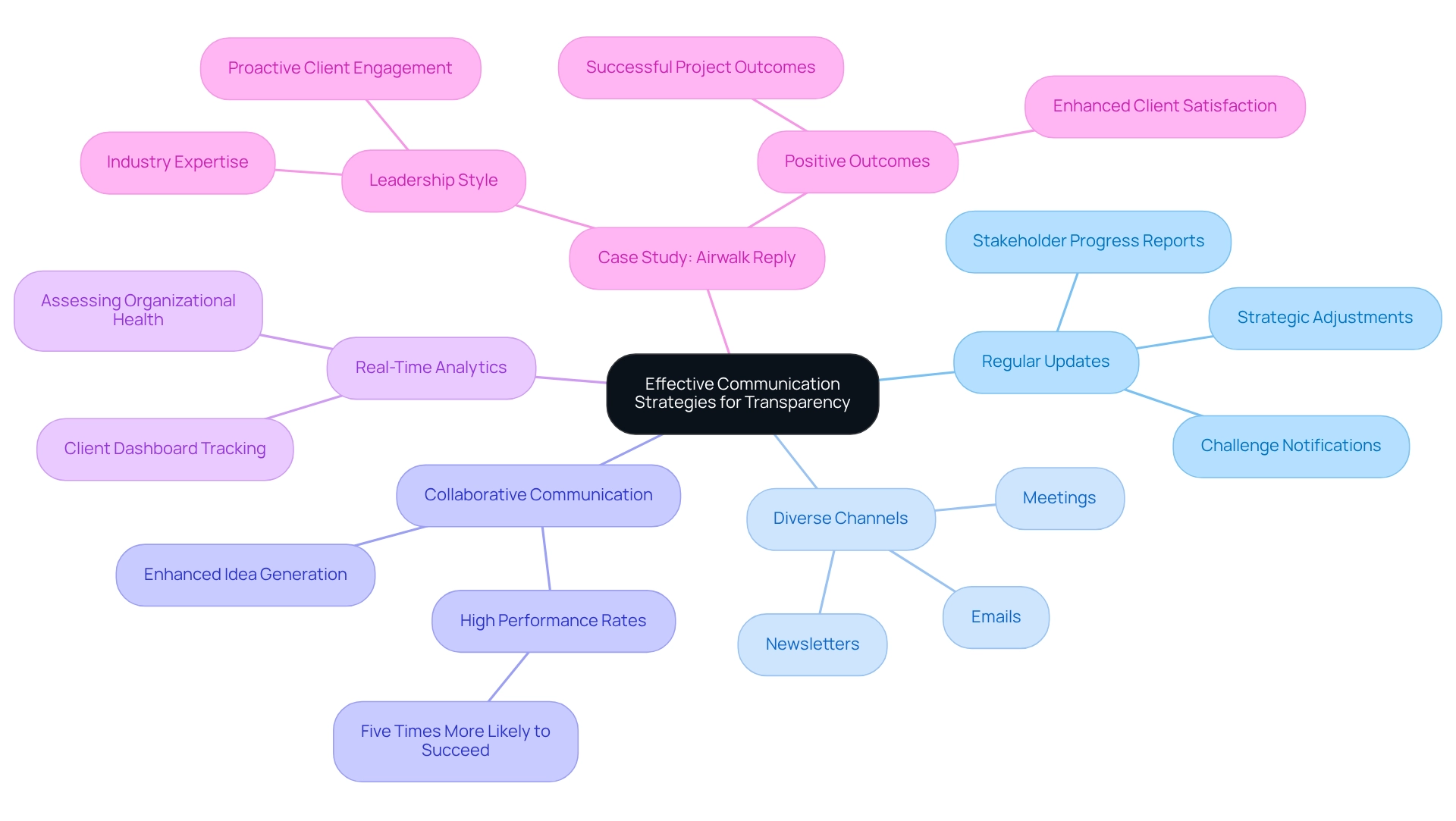

Establish Effective Communication Strategies for Transparency

Establishing effective communication strategies is essential for promoting transparency throughout the healing process. Regular updates to stakeholders regarding progress, challenges, and strategic adjustments are critical. Our team advocates for an expedited decision-making cycle during the turnaround process, enabling your organization to take decisive action to safeguard its interests.

Employing diverse communication channels—such as emails, newsletters, and meetings—ensures that all stakeholders remain informed and engaged. Research indicates that companies prioritizing collaborative communication are five times more likely to achieve high performance. Transparency not only cultivates trust but also fosters collaboration and support from stakeholders, which is vital for successful recovery.

As Sonia Sarrami, Ph.D., notes, to mitigate negative feedback from reports, previous reports should outline potential risks associated with the project, underscoring the importance of transparency in stakeholder engagement. We continuously track the effectiveness of our strategies and teams via our client dashboard, offering real-time analytics to assess your organization's health.

A notable example of effective communication in post-insolvency planning is demonstrated by the leadership style of Airwalk Reply, which received commendation for its industry knowledge and proactive approach to addressing client needs. This leadership contributed to successful project outcomes and a positive working environment, enhancing overall client satisfaction.

Clear and consistent messaging, combined with real-time analytics, can significantly enhance stakeholder engagement and support during challenging times.

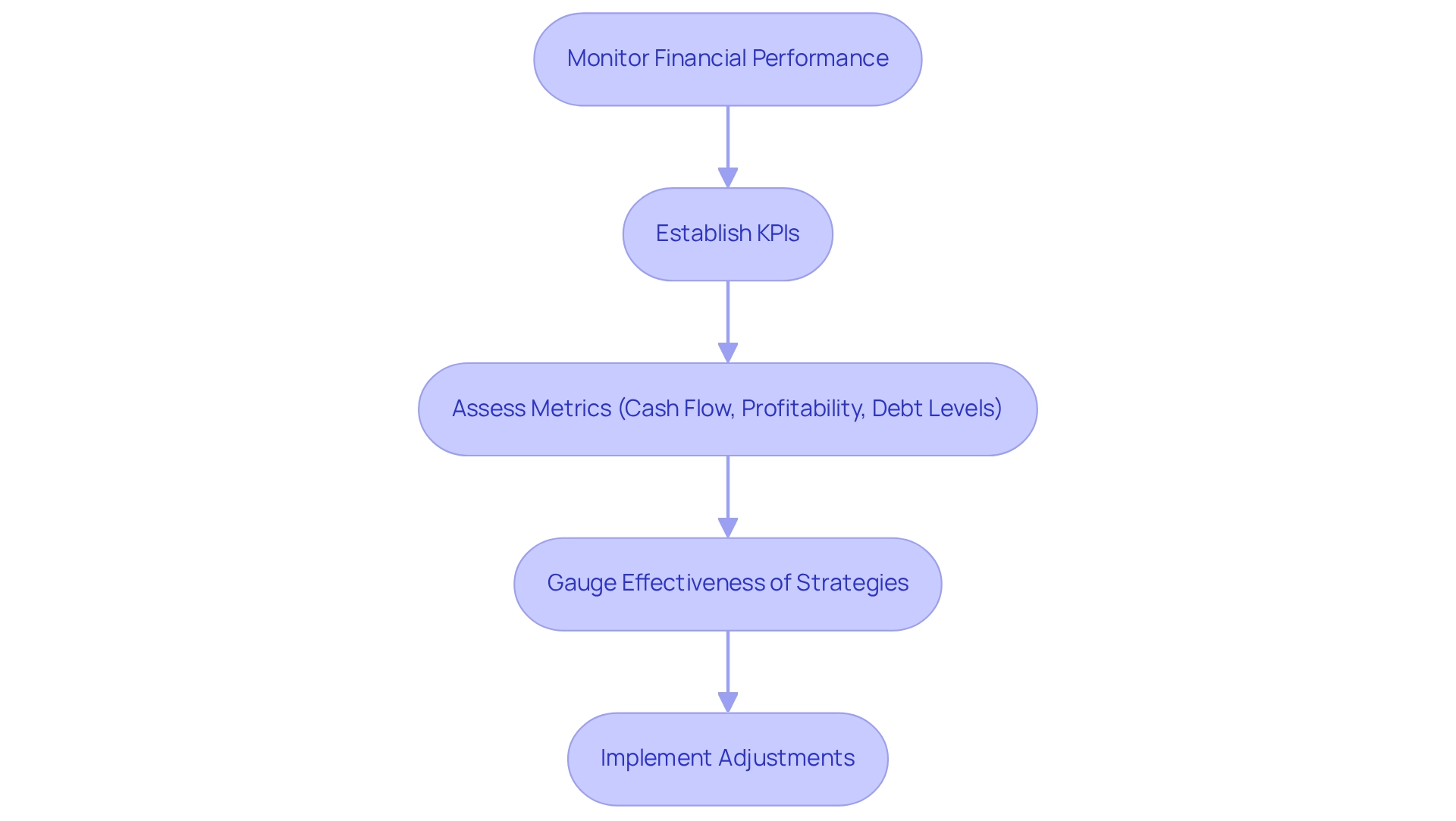

Monitor Financial Performance to Track Recovery Progress

Supervising monetary performance is crucial for observing improvement progress in post-insolvency planning situations, particularly in light of the persistent economic challenges faced by enterprises in the post-pandemic context. Businesses must establish key performance indicators (KPIs) that align with their recovery objectives, focusing on critical metrics such as cash flow, profitability, and debt levels.

For instance, the total company insolvency rate reached 53.8 per 10,000 companies in October 2024, underscoring the urgent need for robust financial oversight. Consistently assessing these metrics allows companies to gauge the effectiveness of their strategies and implement timely adjustments. This proactive strategy not only keeps organizations aligned with their recovery objectives but also prepares them to swiftly tackle emerging challenges.

Financial analysts emphasize that effective monitoring of KPIs is crucial for post-insolvency planning, as it provides a clear framework for assessing performance and guiding decision-making. Significantly, as a direct consequence of increasing inflation, nearly a third (31%) of companies are seeking additional funding, with this number climbing to two-fifths (42%) for the hospitality and leisure sectors.

Successful instances of enterprises that have effectively monitored their progress demonstrate the value of this approach, showcasing how targeted KPI tracking can lead to sustainable growth and enhanced financial health. Typical KPIs monitored by companies during resurgence phases generally encompass metrics like liquidity ratios, operational efficiency, and revenue growth, offering CFOs a clearer framework for focus.

Moreover, by implementing the lessons learned through the turnaround process and utilizing real-time analytics, organizations can improve their decision-making cycles, ensuring they remain agile and responsive to market changes. The case study titled 'Future Outlook for Insolvency Services' highlights the ongoing demand for insolvency services, reinforcing the importance of effective monitoring in achieving recovery.

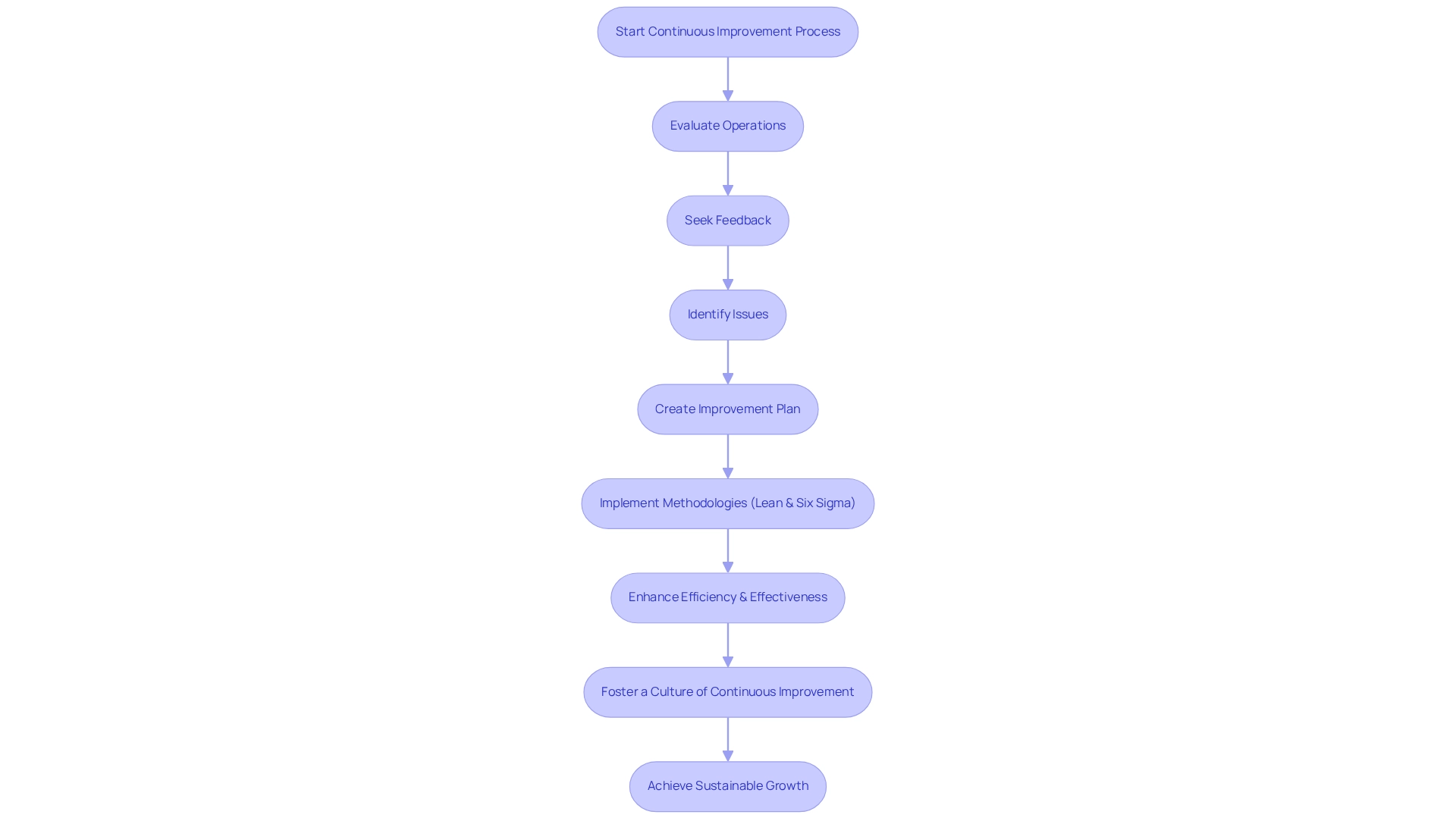

Implement Continuous Improvement Practices for Sustainable Growth

Implementing continuous improvement practices is essential for achieving sustainable growth in the context of post-insolvency planning. This process necessitates a systematic evaluation of operations, actively seeking feedback, and making iterative enhancements. Our team will identify underlying organizational issues and work collaboratively to create a plan that mitigates weaknesses, enabling the organization to reinvest in key strengths.

Employing methodologies such as Lean and Six Sigma can significantly boost efficiency and effectiveness. As a leader once stated, 'Effective communication and collaboration are vital for successful ongoing enhancement projects.'

Moreover, by fostering a culture of continuous enhancement, organizations can swiftly adapt to changing market conditions, innovate their product offerings, and ultimately achieve long-term success. Successful case studies, such as 'Improving Quality and Reducing Errors,' demonstrate that organizations embracing these practices not only reduce errors but also enhance the quality of their outputs, fostering greater customer trust and satisfaction.

While specific statistics on the benefits of Lean and Six Sigma methodologies in post-insolvency planning are not detailed here, it is widely recognized that businesses implementing these methodologies experience marked improvements in operational efficiency, positioning them favorably in competitive markets.

In addition, our pragmatic approach to data ensures that we test every hypothesis and measure outcomes to deliver maximum return on invested capital in both the short and long term.

Conclusion

Navigating the complexities of post-insolvency recovery presents a formidable challenge that small and medium businesses must confront head-on. By implementing targeted strategies—such as thorough financial assessments, interim management, and clear restructuring plans—organizations can effectively stabilize operations and chart a course toward sustainable growth. Moreover, engaging stakeholders and exploring third-party funding options enhances the potential for recovery, ensuring that businesses not only survive but thrive in a competitive landscape.

The importance of continuous monitoring and improvement cannot be overstated. By establishing key performance indicators and maintaining compliance with legal requirements, businesses can track their recovery progress and make informed decisions that align with long-term objectives. Ultimately, fostering a culture of transparency and collaboration builds trust among stakeholders and creates a resilient foundation for future success.

As businesses embark on this transformative journey, the integration of strategic consulting practices becomes essential. With the right support and a commitment to ongoing improvement, organizations can emerge from insolvency not merely as survivors, but as revitalized entities poised for growth and innovation. Embracing these principles is crucial for any business looking to navigate the complexities of recovery and secure a prosperous future.

Frequently Asked Questions

What is post-insolvency planning and why is it important for small and medium enterprises?

Post-insolvency planning is a crucial process that helps small and medium enterprises navigate the complexities of recovery after experiencing financial distress. It involves tailored strategies to optimize operations, reduce expenses, and enhance revenue growth, enabling organizations to not only survive but thrive in a competitive landscape.

How does Transform Your Small/Medium Enterprise assist businesses in post-insolvency planning?

Transform Your Small/Medium Enterprise offers customized consulting services that include a comprehensive assessment of an organization’s financial health and operational capabilities. Their approach promotes sustainable growth through targeted interventions, helping businesses improve performance metrics and recover effectively.

What is the 'Rapid30' plan mentioned in the article?

The 'Rapid30' plan is an innovative consulting strategy utilized by Transform Your Small/Medium Enterprise that has demonstrated effectiveness in turning around struggling businesses. It is part of their customized consulting approach aimed at facilitating significant improvements in performance.

What role do CFOs play in post-insolvency planning?

CFOs are responsible for assessing their organization's circumstances and implementing a structured consulting approach that includes regular monetary evaluations. This helps conserve cash, minimize liabilities, and navigate the post-insolvency landscape effectively.

Why is a comprehensive economic evaluation important for companies recovering from insolvency?

A comprehensive economic evaluation helps identify underlying organizational issues and facilitates the creation of a plan that mitigates weaknesses while reinvesting in strengths. It enables companies to examine cash flow, obligations, and overall performance, identifying areas for cost savings and efficiency enhancements.

How can frequent evaluations benefit companies after insolvency?

Frequent evaluations keep companies flexible in a changing market and support long-term recovery initiatives. They help organizations adjust to new challenges and have been shown to lead to average cost reductions of 20%, improving prospects for sustainable growth.

What is the significance of cash flow analysis in post-insolvency planning?

Cash flow analysis is critical as it provides a clear picture of an organization’s financial health and operational viability. It informs decision-making and ensures effective post-insolvency planning.

What is interim management and how does it support post-insolvency planning?

Interim management involves appointing experienced leaders to maintain essential functions while developing a robust restoration plan. These leaders provide fresh insights and specialized expertise, making swift decisions necessary for sustaining stakeholder confidence and operational continuity.

How quickly can interim leaders be implemented in a company?

Interim leaders can be implemented within 48 hours of recognizing the need for their expertise, significantly speeding up the restoration process for companies facing operational instability.

What benefits do interim leaders bring to organizations during restructuring?

Interim leaders stabilize companies and align with long-term objectives, ensuring the execution of effective strategic initiatives that pave the way for sustainable growth. Their leadership is crucial during challenging times, providing competent guidance throughout the restructuring process.