Overview

The article emphasizes the pivotal role CFOs play in driving financial success within small and medium businesses through adept stakeholder management, specifically by addressing critical PMP stakeholder management questions. Engaging stakeholders is shown to yield superior project outcomes, enhance operational efficiency, and boost profitability. Research indicates that organizations that involve stakeholders in decision-making are significantly more likely to achieve project goals and improve financial performance. This underscores the importance of strategic stakeholder engagement as a cornerstone of effective financial leadership.

Introduction

Efficient stakeholder management stands as a pivotal element for the success of small and medium businesses, particularly in an increasingly competitive landscape. By delving into essential PMP stakeholder management questions, CFOs can unlock the potential of stakeholder engagement, which leads to improved decision-making and enhanced financial outcomes. However, as organizations strive for collaboration, how can financial leaders effectively navigate the complexities of stakeholder relationships to ensure alignment and drive success?

Transform Your Small/ Medium Business: How Stakeholder Management Drives Financial Success

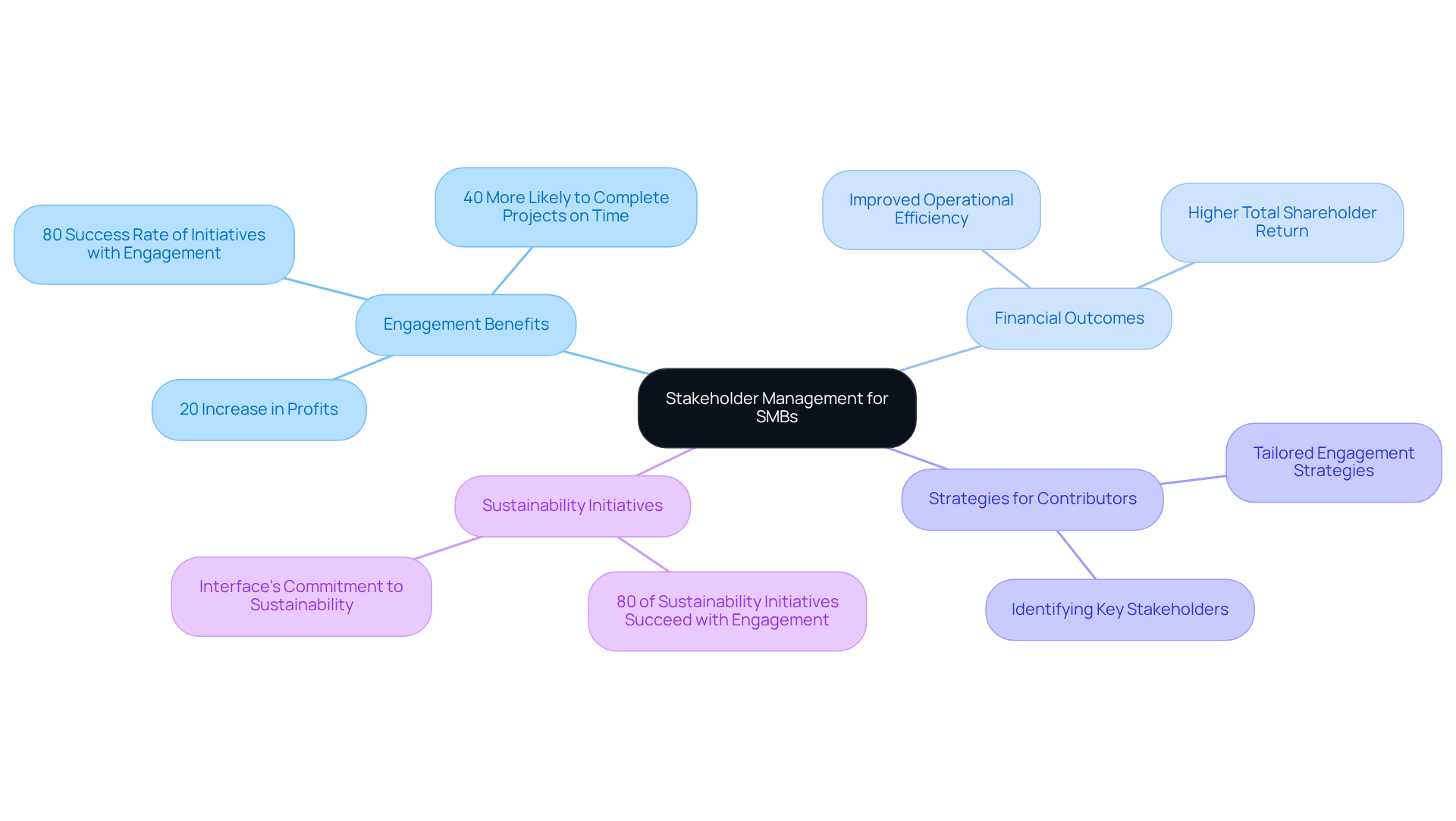

Efficient stakeholder management is essential for small and medium businesses (SMBs), as evidenced by various pmp stakeholder management questions that significantly influence economic outcomes. Engaging key stakeholders—employees, customers, suppliers, and investors—allows CFOs to address pmp stakeholder management questions while aligning expectations and fostering a collaborative environment. This alignment enhances decision-making and drives economic success through improved operational efficiency and revenue growth.

Transform Your Small/Medium Business offers extensive turnaround and restructuring consulting services, including interim management and fiscal evaluation, empowering executives to optimize operations and reduce overhead, ultimately leading to enhanced economic performance. Research indicates that companies that actively involve stakeholders in financial planning, addressing pmp stakeholder management questions, are 40% more likely to complete projects on time and within budget, underscoring the tangible benefits of engagement and its link to improved financial performance.

Understanding the perspectives of stakeholders helps CFOs to effectively answer pmp stakeholder management questions, enabling them to identify potential risks and opportunities while facilitating proactive measures that can protect the business during challenging times. Organizations that address pmp stakeholder management questions are more likely to cultivate strong relationships, fostering loyalty and innovation. Additionally, firms that effectively engage stakeholders can see a 20% increase in profits, as highlighted by research from McKinsey & Company, which found that strong relationships with these groups correlate with a 20% higher total shareholder return.

In 2025, financial leaders must adopt tailored engagement strategies for various contributor groups to maximize contributions and enhance overall financial results. Furthermore, it is noteworthy that 80% of sustainability initiatives succeed with active participant involvement, further illustrating the critical role of engagement in achieving broader organizational objectives.

Stakeholder Grid Dimensions: Key Metrics for Effective Engagement

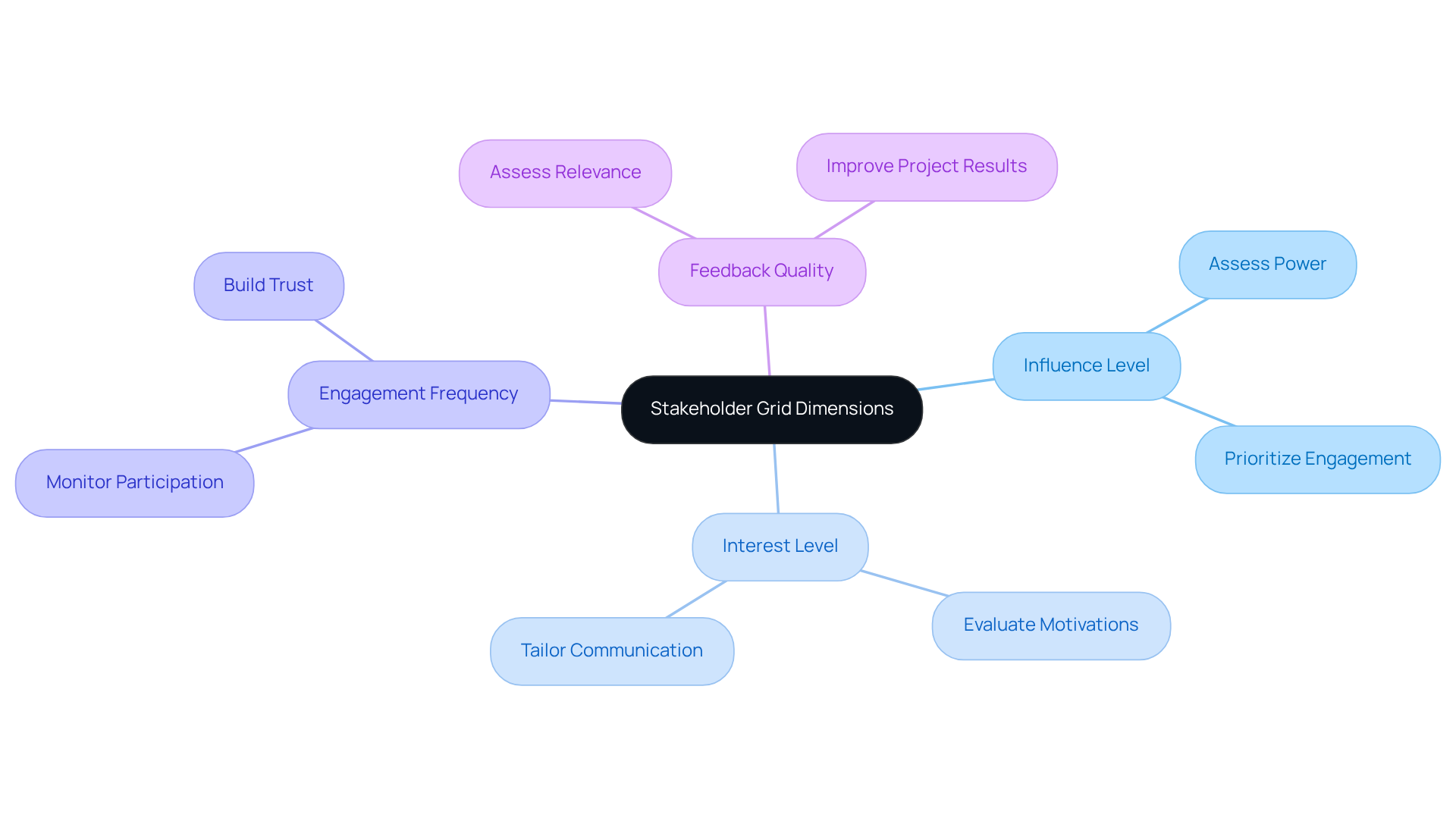

To effectively manage interested parties, CFOs should implement a grid that categorizes them based on their influence and interest, which is essential for answering pmp stakeholder management questions. This strategic approach allows for targeted engagement, which is crucial for business success. Key metrics to consider include:

- Influence Level: Assess the power a stakeholder has to impact project outcomes. High-influence parties can significantly sway decisions, making them crucial in pmp stakeholder management questions and should be prioritized in engagement efforts.

- Interest Level: Evaluate the degree of interest that involved parties have in the project or business. Understanding their motivations helps tailor communication and involvement strategies.

- Engagement Frequency: Monitor how often participants take part in discussions or decision-making processes. Consistent involvement builds trust and keeps interested parties informed, which is linked to project success.

- Feedback Quality: Assess the relevance and constructiveness of feedback obtained from contributors. High-quality feedback can offer insights that improve project results and client satisfaction.

By examining these dimensions and addressing pmp stakeholder management questions, financial leaders can prioritize their engagement efforts, ensuring that high-influence and high-interest parties receive the attention necessary to drive success. Moreover, employing tools such as a client dashboard can enable real-time analytics, allowing CFOs to track engagement of involved parties and apply insights gained from previous experiences. This approach not only improves financial management but also strengthens relationships, ultimately leading to enhanced project outcomes. Case studies have demonstrated that organizations that effectively utilize participant metrics see a significant increase in project success rates, underscoring the importance of this approach in today's dynamic business environment.

Stakeholder Register: Essential Tool for Managing Relationships

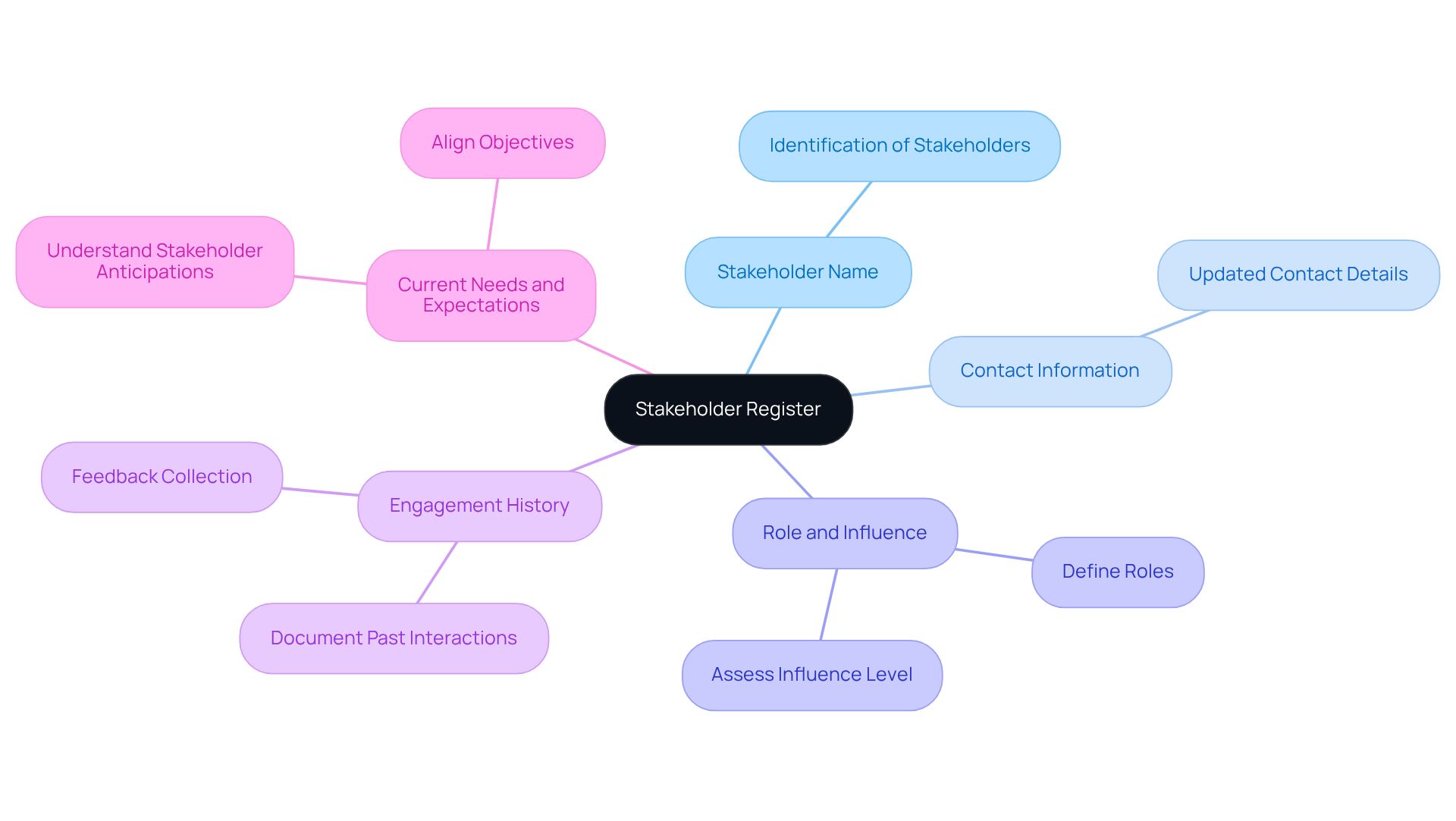

A participant register is a vital instrument for CFOs aiming to address pmp stakeholder management questions effectively. This document should encompass the following essential components:

- Stakeholder Name: Clearly identify each stakeholder involved in the project.

- Contact Information: Maintain updated contact details to facilitate seamless communication.

- Role and Influence: Define each participant's role and assess their level of influence on the project results.

- Engagement History: Document past interactions and feedback to inform future communications.

- Current Needs and Expectations: Understand what each party anticipates from the business, ensuring alignment with their objectives.

Research suggests that organizations employing thorough participant registers experience enhanced communication and collaboration, which are essential for fostering trust. For instance, case studies demonstrate that financial executives who actively manage relationships with interested parties through organized records can significantly improve project success rates by addressing pmp stakeholder management questions. By keeping all relevant parties informed and engaged, financial leaders not only foster collaboration but also position their organizations for sustainable growth and effective financial management.

To implement a register for interested parties effectively, financial executives should conduct regular updates with involved parties to ensure ongoing alignment and communication. Utilizing real-time analytics can aid in tracking performance and applying lessons learned, ultimately resulting in stronger, lasting relationships. This proactive method is vital, particularly as 82% of financial leaders indicate increased responsibilities, emphasizing the crucial necessity for efficient management of pmp stakeholder management questions. As Gerardo Adame mentions, finance must collaborate with the business, highlighting the significance of engaging with interested parties.

Critical Success Factors: Identifying What Matters Most

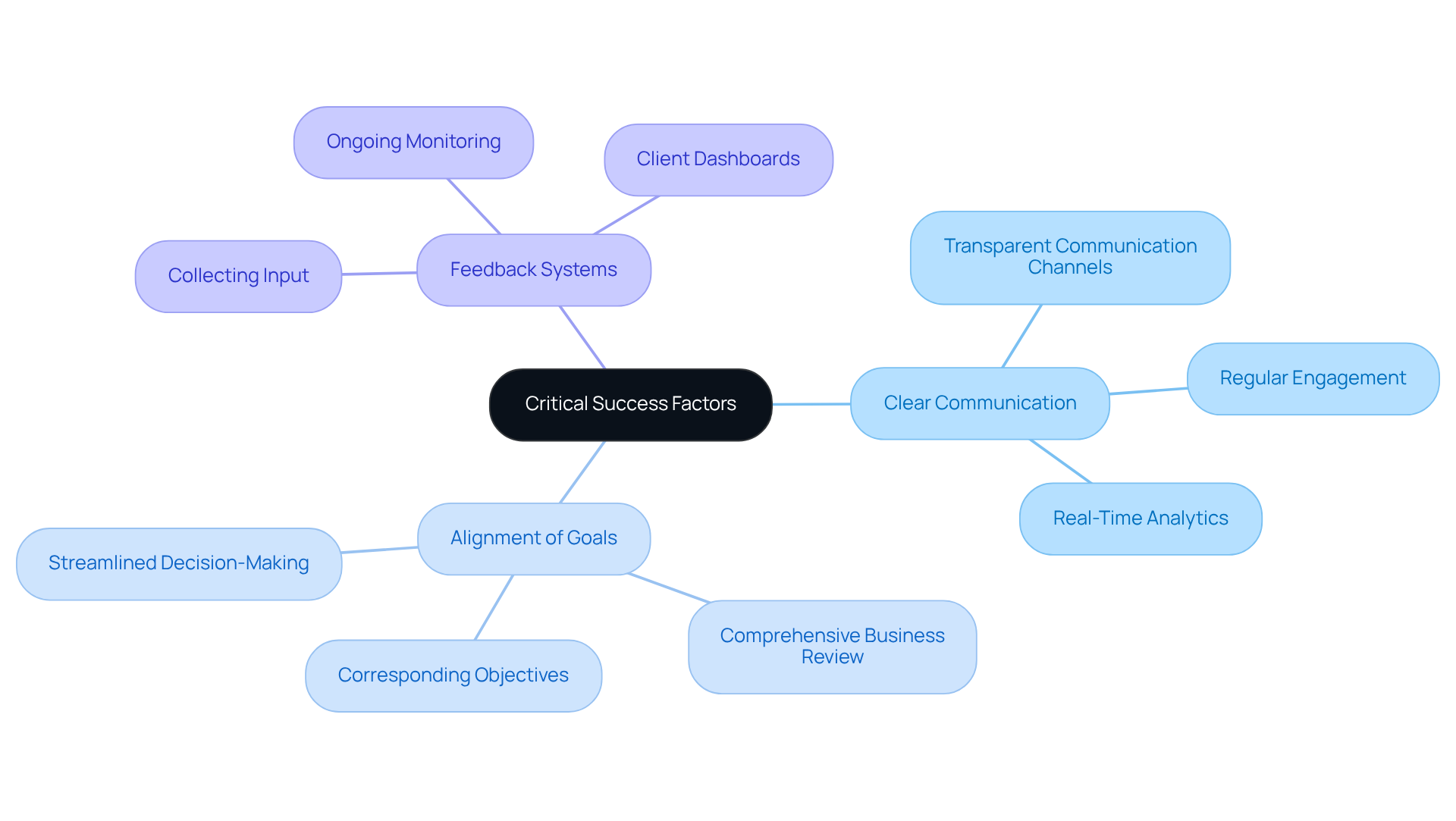

CFOs must identify critical success factors (CSFs) that significantly affect the management of pmp stakeholder management questions. Key CSFs include:

-

Clear Communication: Establishing transparent communication channels is essential for keeping stakeholders informed and engaged. Effective communication in pmp stakeholder management questions promotes trust and cooperation, ensuring that involved parties feel appreciated and comprehended. Regular engagement involving pmp stakeholder management questions facilitates consistent interaction with involved parties, which helps build strong relationships and trust. Regular updates and meetings can facilitate open dialogue, which is crucial for addressing pmp stakeholder management questions and proactively identifying concerns and opportunities. This is further improved by real-time analytics that offer insights into participant sentiments and organizational health.

-

Alignment of Goals: Alignment of goals is crucial for ensuring that participant objectives correspond with the organization's financial aims while addressing pmp stakeholder management questions. This alignment not only improves collaboration but also fosters shared success, as participants are more inclined to support initiatives that align with their interests, which is crucial when considering pmp stakeholder management questions. A comprehensive business review at the start of engagements can help identify these alignments and streamline decision-making processes by addressing pmp stakeholder management questions.

-

Feedback Systems: Implementing systems to collect and respond to input from interested parties is vital for continuous improvement, particularly in relation to pmp stakeholder management questions. By actively seeking feedback through pmp stakeholder management questions, financial leaders can adjust strategies to better address the needs of interested parties, ultimately enhancing engagement and satisfaction. Ongoing monitoring via client dashboards enables prompt adjustments based on feedback from interested parties and business performance.

Concentrating on these critical success factors allows chief financial officers to enhance their management strategies by addressing pmp stakeholder management questions, resulting in improved collaboration and superior monetary outcomes.

Assessing Stakeholder Needs: Aligning Financial Goals with Expectations

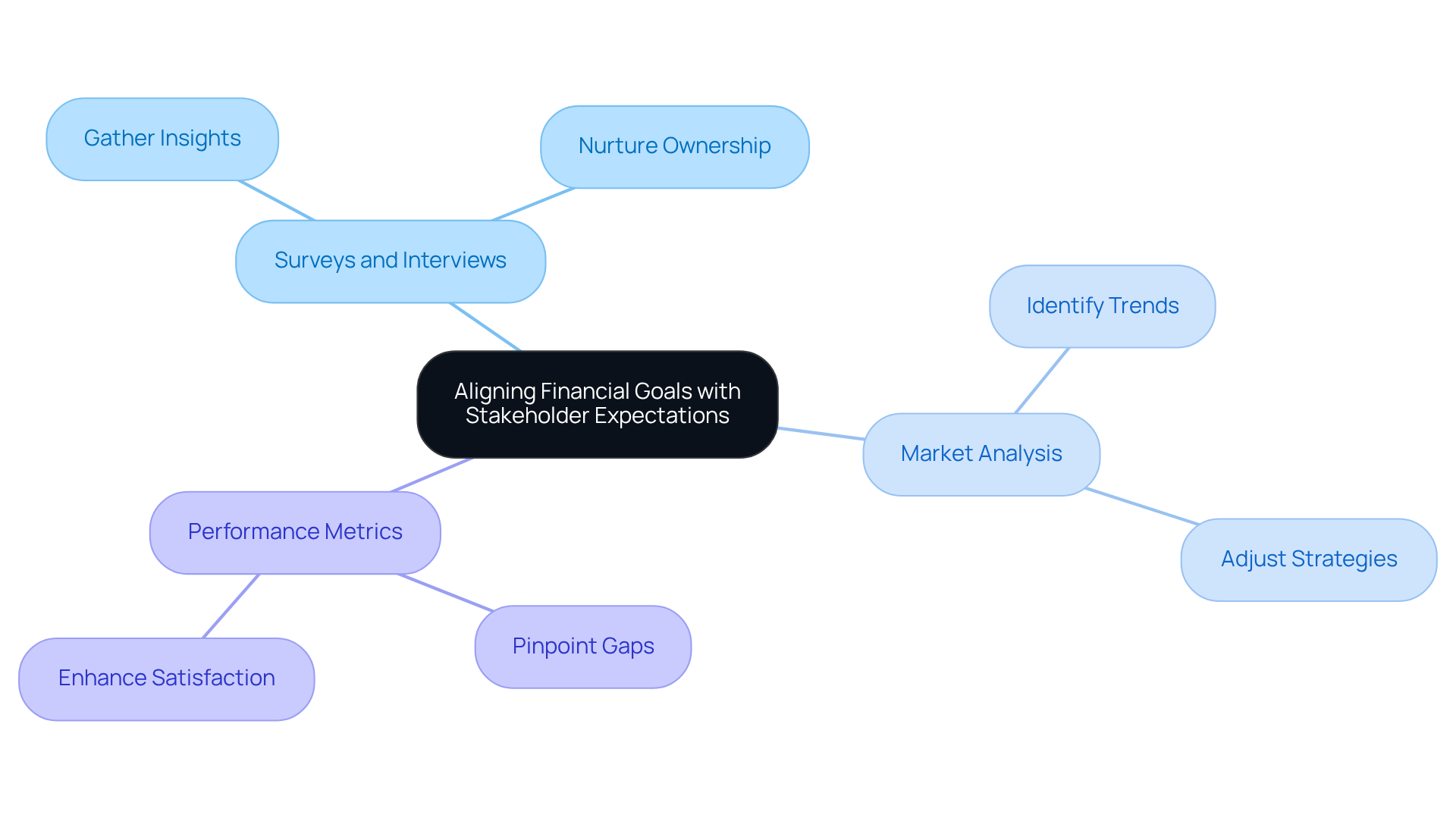

Chief financial officers play a crucial role in evaluating the needs of interested parties by addressing pmp stakeholder management questions to ensure alignment with the organization's financial objectives. This alignment can be effectively achieved through several key methods:

-

Surveys and Interviews: Regularly conducting surveys and interviews allows CFOs to gather valuable insights into stakeholder expectations. This proactive approach not only clarifies pmp stakeholder management questions but also nurtures a sense of ownership among participants, motivating them to engage more deeply with the organization.

-

Market Analysis: Understanding current market trends is essential for identifying factors that may influence the interests of involved parties. By staying informed about shifts in the market, financial executives can anticipate alterations in investor expectations and adjust strategies accordingly.

-

Performance Metrics: Examining performance metrics assists in pinpointing areas where the needs of interested parties may not be fully satisfied. This data-driven method enables CFOs to identify gaps and implement targeted strategies to enhance satisfaction among stakeholders.

Aligning financial goals with the expectations of interested parties, as explored in pmp stakeholder management questions, fosters a collaborative environment, ultimately driving improved financial performance. As noted by industry leaders, effective management of involved parties transcends mere expectation fulfillment; it is about cultivating a culture of transparency and engagement that supports long-term success.

Engagement Strategies: Enhancing Stakeholder Relationships for Better Outcomes

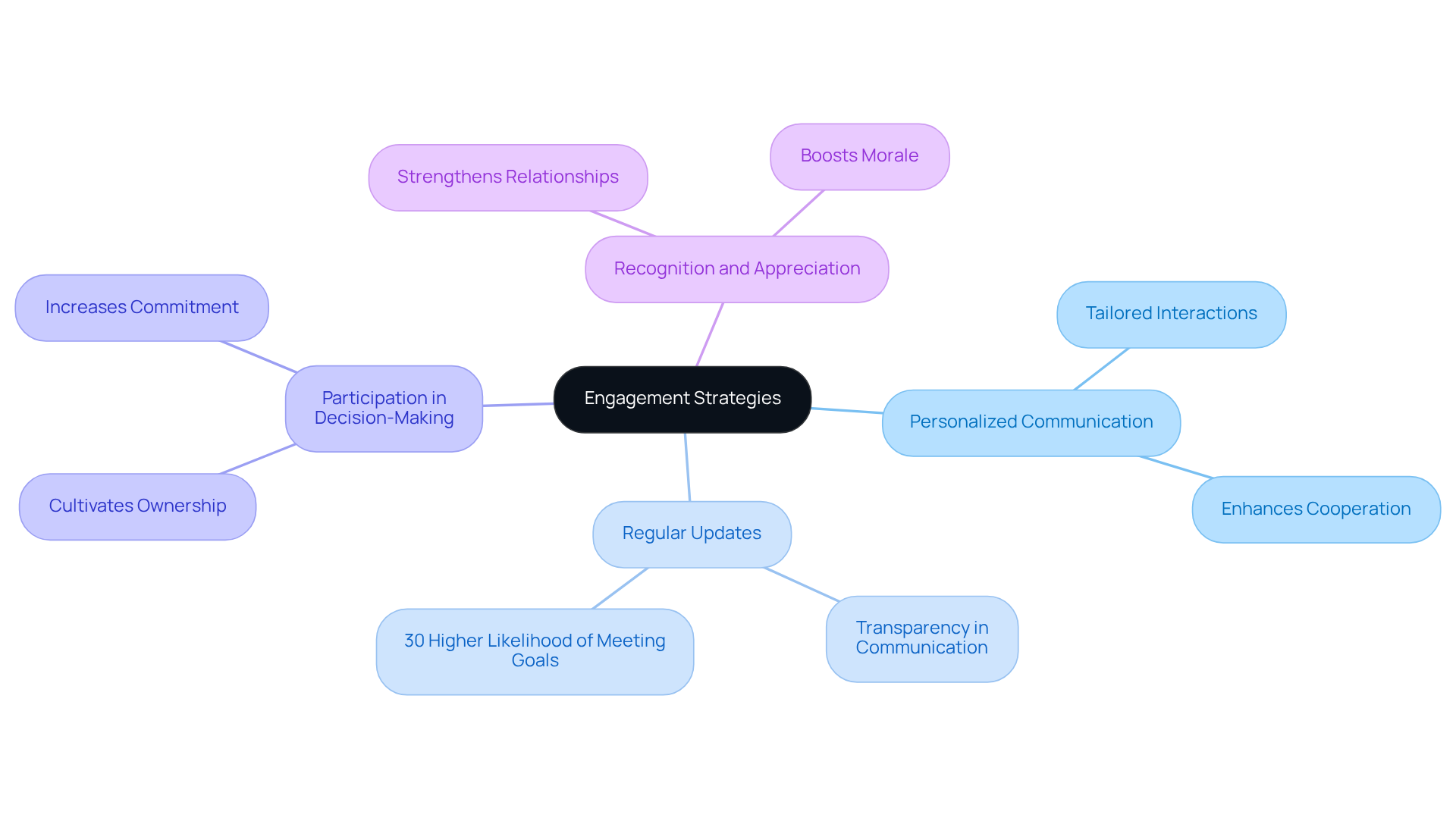

To enhance stakeholder relationships, CFOs must employ effective engagement strategies that resonate with their audience.

-

Personalized Communication: Tailoring communication to meet the specific needs of different stakeholders is essential. Such interactions significantly enhance cooperation, as participants feel appreciated and understood.

-

Regular Updates: Consistently providing stakeholders with updates on financial performance and strategic initiatives is crucial. Research shows that companies with strong participant engagement are 30% more likely to meet project goals, underscoring the effectiveness of regular communication in fostering trust and transparency.

-

Participation in Decision-Making: Involving stakeholders in key decision-making processes cultivates a sense of ownership and commitment. When stakeholders are engaged, they are more likely to support initiatives, feeling that their input is valued and considered.

-

Recognition and Appreciation: Acknowledging the contributions of stakeholders and expressing gratitude for their support can strengthen relationships. Celebrating milestones and achievements not only boosts morale but also fortifies the teamwork essential for achieving financial objectives.

By implementing these strategies, financial leaders can cultivate stronger connections with stakeholders, ultimately resulting in increased cooperation and improved financial outcomes.

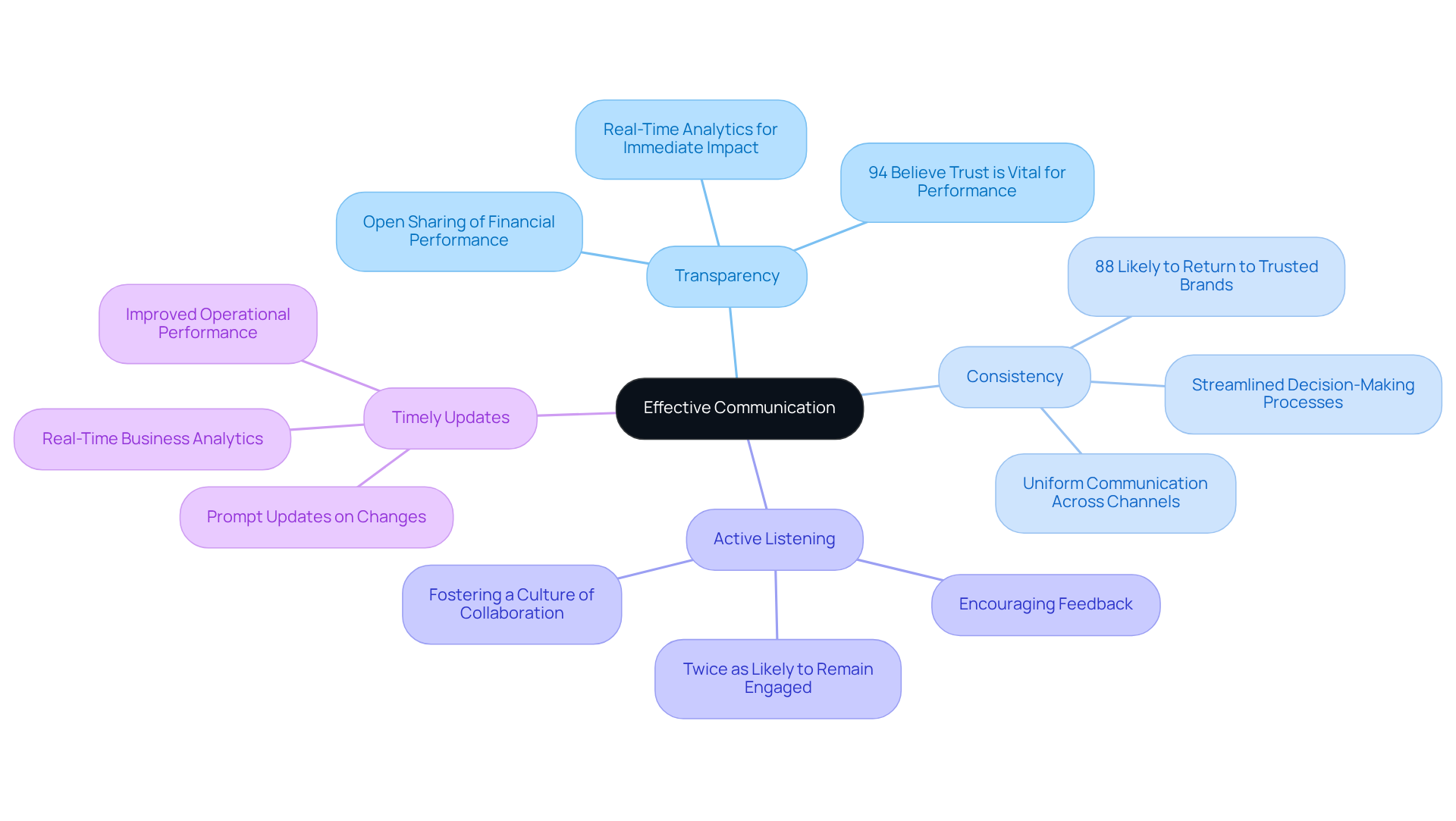

Effective Communication: Building Trust with Stakeholders

Building trust with stakeholders hinges on effective communication strategies that CFOs must prioritize. Key elements include:

- Transparency: Openly sharing financial performance and challenges fosters trust and accountability. Research indicates that 94% of respondents believe trust is vital for organizational performance, directly impacting financial outcomes. This transparency is further enhanced by real-time analytics via our client dashboard, enabling participants to observe the immediate impacts of decisions and strategies.

- Consistency: Maintaining uniform communication across all channels is essential. Organizations that engage consistently with interested parties see improved relationships and enhanced loyalty, with 88% of customers likely to return to brands they trust. Streamlined decision-making processes support this consistency, ensuring that all communications reflect the same strategic direction.

- Active Listening: Encouraging feedback and genuinely listening to concerns from involved parties can significantly strengthen relationships. Stakeholders who feel their feedback is valued are twice as likely to remain engaged throughout a project. This active engagement is crucial for operationalizing lessons learned during the turnaround process, fostering a culture of collaboration.

- Timely Updates: Providing prompt updates on changes that may impact interested parties is crucial. Consistent updates regarding milestones and challenges keep interested parties informed and engaged, which is associated with improved operational performance. Employing real-time business analytics from our client dashboard enables financial officers to provide prompt updates, ensuring interested parties are consistently informed.

By prioritizing these effective communication strategies and committing to implementing lessons learned, financial leaders can cultivate stronger connections with partners, ultimately leading to improved financial performance and organizational resilience in 2025 and beyond.

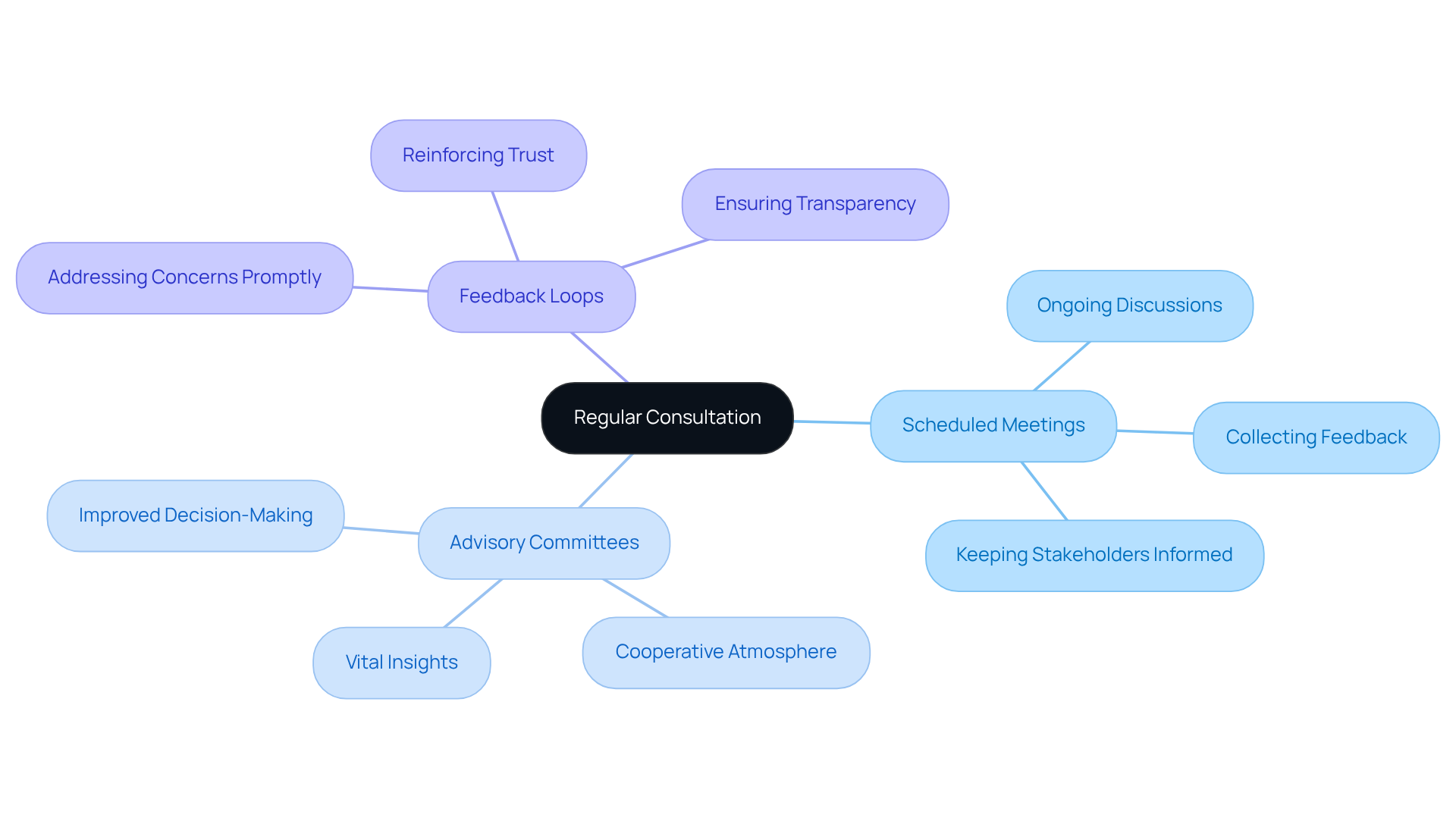

Regular Consultation: Maintaining Alignment with Stakeholders

CFOs must prioritize regular consultation with stakeholders to maintain alignment, which can be effectively achieved through several strategies:

- Scheduled Meetings: Organizing consistent meetings allows for ongoing discussions about progress and the collection of valuable feedback, ensuring that all parties remain informed and engaged.

- Advisory Committees: Forming advisory committees consisting of essential participants can offer vital insights and direction, promoting a cooperative atmosphere that improves decision-making.

- Feedback Loops: Implementing structured feedback loops ensures that concerns from interested parties are addressed promptly, reinforcing trust and transparency in the relationship.

By committing to regular consultation, CFOs can synchronize stakeholder expectations with organizational objectives, ultimately resulting in enhanced collaboration and better economic outcomes. Moreover, focusing on cash preservation and financial efficiency during these consultations can uncover hidden value and optimize balance sheets. Utilizing real-time analytics from the client dashboard further supports these efforts, allowing for continuous monitoring of business performance and informed decision-making.

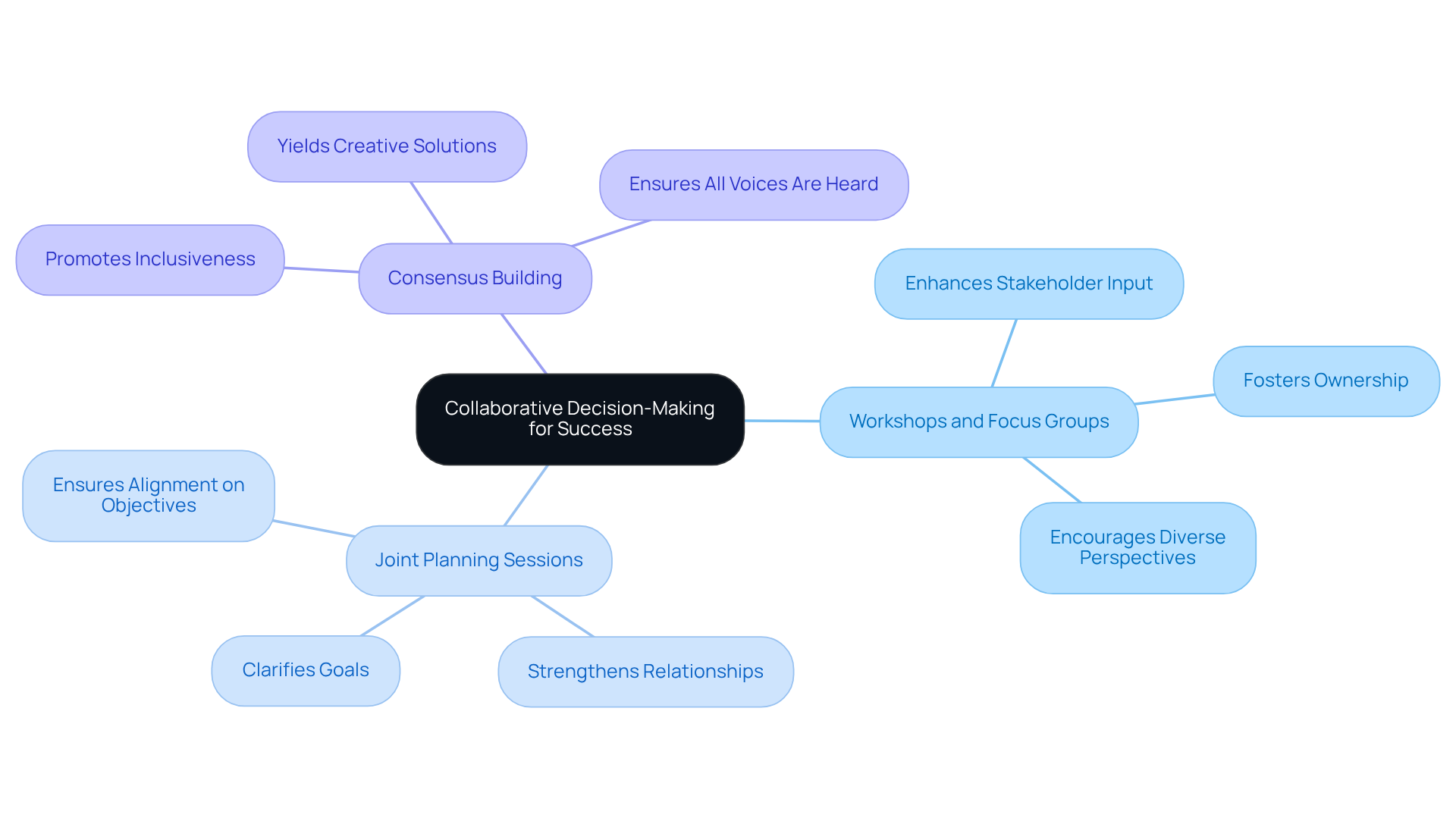

Involving Stakeholders: Collaborative Decision-Making for Success

CFOs must prioritize participant involvement in decision-making processes to cultivate collaboration and drive success. This approach is not merely beneficial; it is essential for effective leadership. Consider the following strategies:

-

Workshops and Focus Groups: Organizing workshops or focus groups significantly enhances stakeholder input on critical decisions. These interactive sessions allow for diverse perspectives, fostering a sense of ownership among participants.

-

Joint Planning Sessions: Conducting joint planning sessions with involved parties ensures alignment on objectives and strategies. This collaborative approach clarifies goals and strengthens relationships, leading to more effective implementation.

-

Consensus Building: Utilizing consensus-building techniques is crucial for ensuring that all voices are heard and considered. This method promotes inclusiveness and can yield creative solutions that represent the shared interests of all parties involved.

By actively involving interested parties in decision-making and addressing pmp stakeholder management questions, financial leaders can enhance commitment and backing for initiatives, ultimately leading to better financial results. Case studies have shown that organizations adopting collaborative decision-making experience improved participant satisfaction and operational efficiency. This underscores the importance of these practices in today's intricate corporate landscape. Therefore, it is imperative for CFOs to embrace these strategies and foster a culture of collaboration.

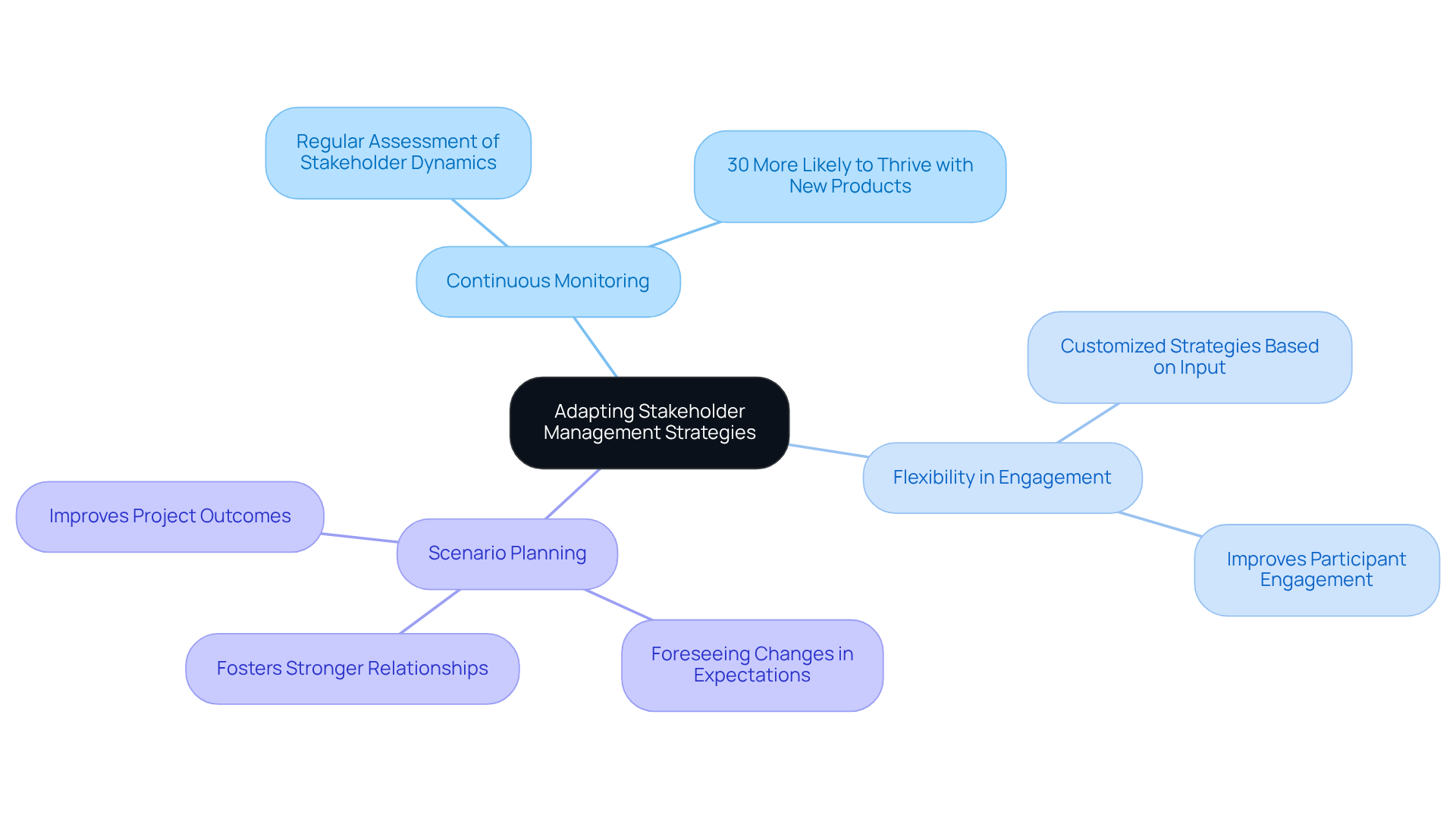

Adapting Strategies: Evolving Stakeholder Management for Project Agility

CFOs must proactively adjust their management strategies for key partners to ensure agility in today's dynamic business environment. This can be accomplished through several key approaches:

-

Continuous Monitoring: Regular assessment of stakeholder dynamics is essential. Studies show that organizations that participate in ongoing monitoring are 30% more likely to thrive with new products, highlighting the significance of remaining aware of the needs and feelings of interested parties.

-

Flexibility in Engagement: Being open to modifying engagement methods based on input from involved parties is crucial. A customized strategy improves participant engagement, as various contributors possess differing degrees of interest and influence.

-

Scenario Planning: Employing scenario planning enables financial leaders to foresee possible changes in participant expectations. This proactive strategy enables organizations to remain responsive and adaptable, ultimately fostering stronger relationships and improving project outcomes.

By implementing these adaptive strategies, CFOs can ensure that their stakeholder management remains effective and aligned with the evolving business landscape, addressing important pmp stakeholder management questions and thereby supporting overall financial success.

Conclusion

Efficient stakeholder management stands as a cornerstone for driving financial success in small and medium businesses. Engaging key stakeholders—employees, customers, suppliers, and investors—enables CFOs to address critical management questions that align expectations and foster collaboration. This approach not only enhances decision-making but also leads to improved operational efficiency and revenue growth, ultimately positioning organizations for sustainable success.

Throughout the article, various strategies and insights have been discussed, including:

- The importance of a stakeholder grid for effective engagement

- The role of a stakeholder register in managing relationships

- Critical success factors such as clear communication and alignment of goals

Each element contributes to building strong relationships with stakeholders, essential for achieving better financial outcomes. Furthermore, the article emphasizes the need for regular consultation and adaptive strategies to ensure that stakeholder management remains effective in a dynamic business environment.

In conclusion, the significance of stakeholder management cannot be overstated. By prioritizing engagement and collaboration, CFOs can not only meet but exceed stakeholder expectations, leading to enhanced financial performance and organizational resilience. It is imperative for financial leaders to embrace these practices, fostering a culture of transparency and continuous improvement that drives success in an ever-evolving marketplace.

Frequently Asked Questions

Why is stakeholder management important for small and medium businesses (SMBs)?

Stakeholder management is crucial for SMBs as it enhances decision-making, aligns expectations, and fosters a collaborative environment, which ultimately drives economic success through improved operational efficiency and revenue growth.

What are the benefits of involving stakeholders in financial planning?

Companies that actively involve stakeholders in financial planning are 40% more likely to complete projects on time and within budget, and can see a 20% increase in profits, linking engagement to improved financial performance.

How can CFOs effectively manage stakeholders?

CFOs can effectively manage stakeholders by implementing a grid that categorizes them based on their influence and interest, allowing for targeted engagement strategies that are essential for business success.

What key metrics should CFOs consider when managing stakeholders?

Key metrics include influence level, interest level, engagement frequency, and feedback quality. These metrics help prioritize engagement efforts and improve project outcomes.

What is a stakeholder register and why is it important?

A stakeholder register is a document that identifies stakeholders, their contact information, roles, influence, engagement history, and current needs. It is important for enhancing communication, collaboration, and fostering trust among stakeholders.

How can organizations improve stakeholder engagement?

Organizations can improve stakeholder engagement by conducting regular updates with involved parties, utilizing real-time analytics to track performance, and applying lessons learned to foster stronger relationships.

What role does engagement play in sustainability initiatives?

Engagement is critical in sustainability initiatives, with research indicating that 80% of such initiatives succeed with active participant involvement, highlighting the importance of collaboration in achieving broader organizational objectives.