Overview

This article presents a compelling exploration of strategies aimed at redefining corporations through effective stakeholder management and the enhancement of organizational wealth. It underscores the critical importance of balancing the interests of diverse stakeholders, implementing purpose-driven leadership, and leveraging technology to foster engagement and drive sustainable growth. These approaches are not merely beneficial; they are essential for achieving long-term corporate success.

Introduction

In the dynamic realm of business, small and medium enterprises encounter numerous challenges that jeopardize their sustainability and growth. From financial limitations to the intricacies of stakeholder management, these organizations must traverse a complex landscape of obstacles to not merely survive but to thrive.

This article explores the pivotal elements of turnaround and restructuring consulting, highlighting the significance of:

- Strategic planning

- Purpose-driven leadership

- Operational efficiency

By examining innovative strategies for stakeholder engagement and financial assessments, businesses can unlock their potential for sustainable growth and resilience. As the corporate landscape transitions towards a more responsible and inclusive model, grasping these dynamics becomes crucial for any organization striving to secure its future in a competitive market.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

Turnaround and restructuring consulting is vital for small to medium enterprises grappling with economic challenges. By conducting a thorough analysis of a company's operations and financial status, consultants can identify critical areas for improvement. This typically involves:

- Streamlining processes

- Reducing overhead costs

- Implementing effective management strategies

For instance, our 'Rapid30' plan empowers companies to quickly identify and address key issues, paving the way for meaningful enhancement. The consultant's expertise is essential in guiding these transformations, ensuring that businesses not only endure but also emerge stronger and more competitive in their markets.

Transform Your Small/Medium Business offers comprehensive turnaround and restructuring consulting services, including:

- Interim management

- Financial evaluation

These services are tailored specifically for small to medium enterprises. Our methodology prioritizes transparency, collaboration, and expert guidance—elements that are crucial for stabilizing financial positions and improving operations.

Recent trends reveal that over 30% of the corporate restructuring market is now led by firms with multiple locations, highlighting the increasing significance of strategic consulting in this domain. Client testimonials affirm our effectiveness:

"Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years."

As we advance through 2025, the focus on clear communication with stakeholders during restructuring processes remains paramount, which is essential for redefining the corporation: stakeholder management and organizational wealth, emphasizing the necessity for businesses to engage openly with their communities and partners. This engagement is essential not only for sustaining trust but also for amplifying the overall impact of restructuring on profitability.

Stakeholder Management: Balancing Interests for Organizational Success

Recognizing and addressing the diverse needs and expectations of all parties involved with an organization, including employees, customers, suppliers, and investors, is vital for redefining the corporation: stakeholder management and organizational wealth. A balanced approach is crucial; neglecting any group can lead to conflicts and inefficiencies. For instance, implementing regular feedback sessions can significantly enhance employee engagement and satisfaction. Statistics reveal that 92% of individuals believe constructive criticism effectively improves performance, underscoring the value of consistent feedback. Moreover, a case study on feedback consistency highlights that regular input not only boosts performance but also acclimates employees to receiving and responding to feedback, fostering a culture of continuous improvement. Significantly, 32% of employees have indicated waiting more than three months for responses from their managers, which can adversely affect productivity and morale.

In today's competitive environment, effective engagement strategies are not merely advantageous but essential. Organizations that actively engage participants create a more inclusive environment, which drives innovation and enhances overall performance. By streamlining decision-making processes and utilizing real-time analytics, companies can monitor business performance continuously and adjust strategies as needed. This method not only enhances relationships with interested parties but also puts into practice lessons learned during turnaround efforts, ensuring that all parties are aligned and informed. As industry leaders emphasize, balancing the interests of all parties is pivotal for organizational success in 2025. By adopting best practices in managing interests, grounded in expert insights, companies can navigate complexities and achieve sustainable growth. These strategies enhance stakeholder relationships and contribute to redefining the corporation: stakeholder management and organizational wealth, ultimately resulting in a more resilient and thriving organization.

Organizational Wealth: Strategies for Sustainable Financial Growth

To achieve the goal of redefining the corporation: stakeholder management and organizational wealth, building organizational wealth requires a multifaceted strategy that encompasses revenue optimization, cost management, and strategic investments in growth opportunities. To attract and retain talent—an essential component for fostering a committed workforce—firms must clearly define their core purpose. Key tactics include:

- Diversifying product lines

- Enhancing customer engagement

- Leveraging technology to promote economic stability

Consider a restaurant chain that could expand its market reach by introducing catering services or delivery options, thereby tapping into new customer segments. This approach mirrors how alternative asset managers are focusing on strategies to attract and retain retail investors amidst changing market dynamics. Moreover, conducting regular monetary evaluations is crucial for identifying areas where expenses can be reduced without sacrificing quality, thus maintaining cash flow and enhancing profitability.

As highlighted by Wealth Management Statistics, 79% of clients seek assistance from relationship managers (RMs) to help manage their monetary decisions. This statistic underscores the importance of customer engagement in optimizing revenue streams. By 2025, companies that adopt these practices while considering financial, operational, cultural, and regulatory factors will be better positioned to navigate market challenges and achieve sustainable growth.

To enhance cash flow and profitability, organizations should master the cash conversion cycle and implement streamlined decision-making processes supported by real-time analytics. This alignment with the principles of business ethics and redefining the corporation: stakeholder management and organizational wealth will be critical for achieving future success.

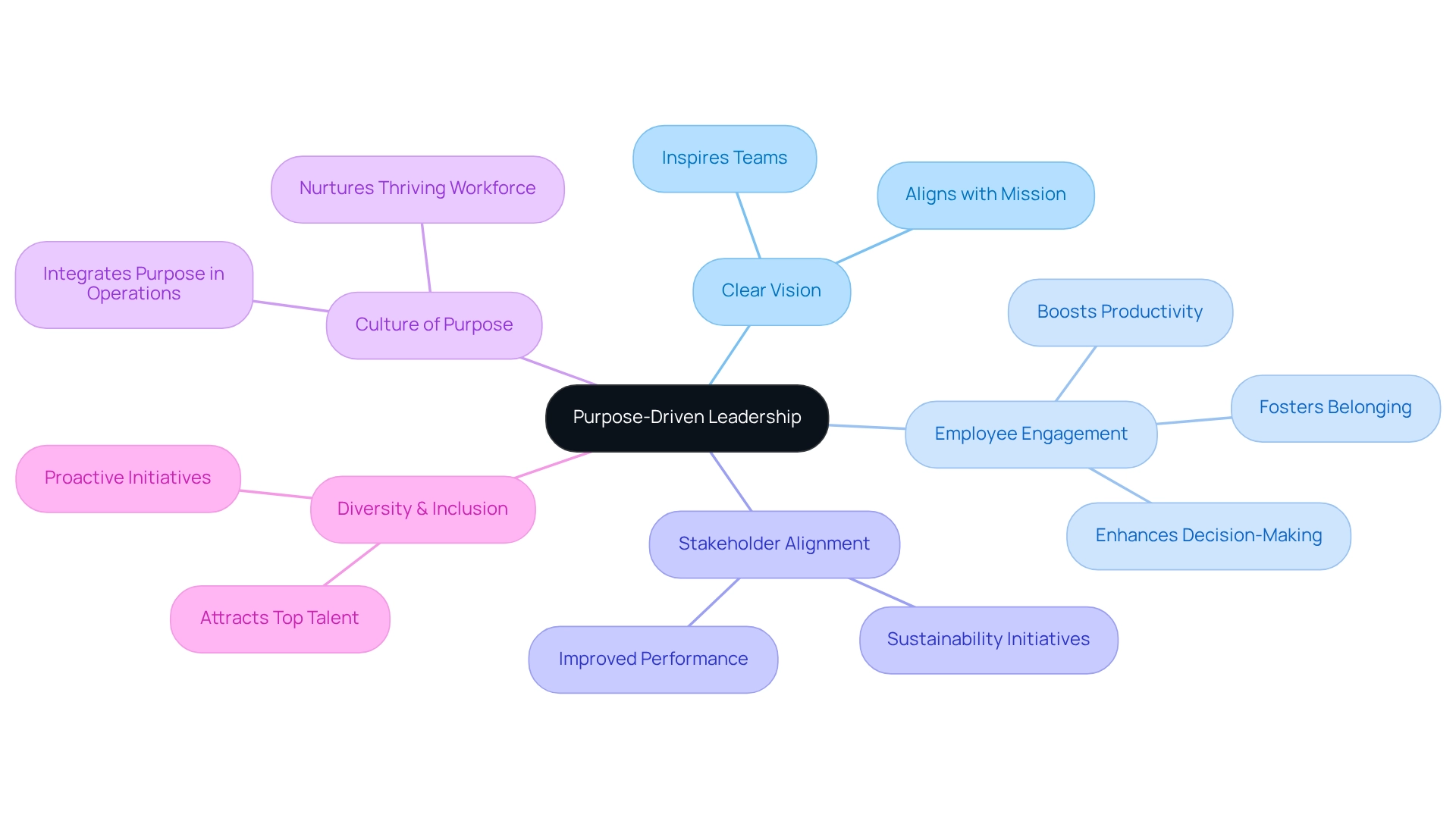

Purpose-Driven Leadership: Guiding Stakeholder Engagement

Purpose-driven leadership is essential for cultivating a clear vision that resonates with both employees and stakeholders. Leaders who articulate a compelling organizational purpose can inspire their teams, fostering a sense of belonging that significantly boosts engagement and productivity. For example, companies that prioritize sustainability not only attract environmentally conscious consumers but also engage employees who align with these values. By embedding purpose into the organizational culture, leaders can align all participants with the company's mission, resulting in enhanced collaboration and sustained success.

Research shows that 92% of employees encounter mental health challenges affecting their work, highlighting the necessity for a supportive, purpose-driven environment. A case study on developing a purpose-driven culture illustrates how integrating purpose into every aspect of an organization can nurture a thriving workforce. When employees comprehend how their roles contribute to the larger mission, it enhances decision-making, innovation, and customer relationships, ultimately driving productivity and engagement.

Furthermore, strong leadership is vital for boosting employee engagement and retention, as well as attracting top talent. Proactive diversity and inclusion initiatives position companies as leaders in fostering an inclusive workplace, which is crucial for engaging with stakeholders. As Rosey Rhyne, Senior Research Manager, observes, "HR can help improve engagement and also allow leaders to recognize their valuable contributions."

As organizations navigate the complexities of modern commerce, redefining the corporation: stakeholder management and organizational wealth becomes increasingly critical for purpose-driven leadership in aligning corporate purpose with stakeholder interests, leading to improved performance. By emphasizing the advantages of purpose-driven leadership, companies can gain a deeper understanding of its importance in achieving sustainable growth.

Financial Assessments: Preserving Cash and Reducing Liabilities

Regular monetary evaluations are essential for organizations aiming to conserve cash and reduce liabilities. By meticulously analyzing cash flow statements, balance sheets, and income statements, businesses can pinpoint inefficiencies and uncover significant cost-saving opportunities. For instance, renegotiating supplier agreements can lead to substantial savings, especially when considering customer concentration risks that may impact cash flow if a few major clients face economic difficulties. Diversifying suppliers not only mitigates this risk but also enhances economic stability. Furthermore, implementing stricter credit regulations can effectively minimize bad debts, thereby improving cash flow and overall financial health.

In 2025, organizations that prioritize these assessments, bolstered by real-time analytics and streamlined decision-making processes, are poised to enhance their cash management systems—an essential factor for maintaining a competitive edge. Statistics show that businesses engaged in regular financial evaluations can significantly strengthen their cash preservation efforts, resulting in a more resilient financial position. A notable case study illustrates that transparent communication regarding cost-saving initiatives, supported by metrics and regular updates, can elevate employee engagement by 83%, fostering a culture of accountability and trust.

This proactive strategy not only bolsters stakeholder confidence but also contributes to increased profitability and retention rates. Moreover, organizations that integrate cash excellence into their operations will further solidify their competitive positions. As highlighted by McKinsey, automation can yield a productivity increase of 20-30%, underscoring the benefits of economic evaluations and operational efficiency in today's corporate landscape.

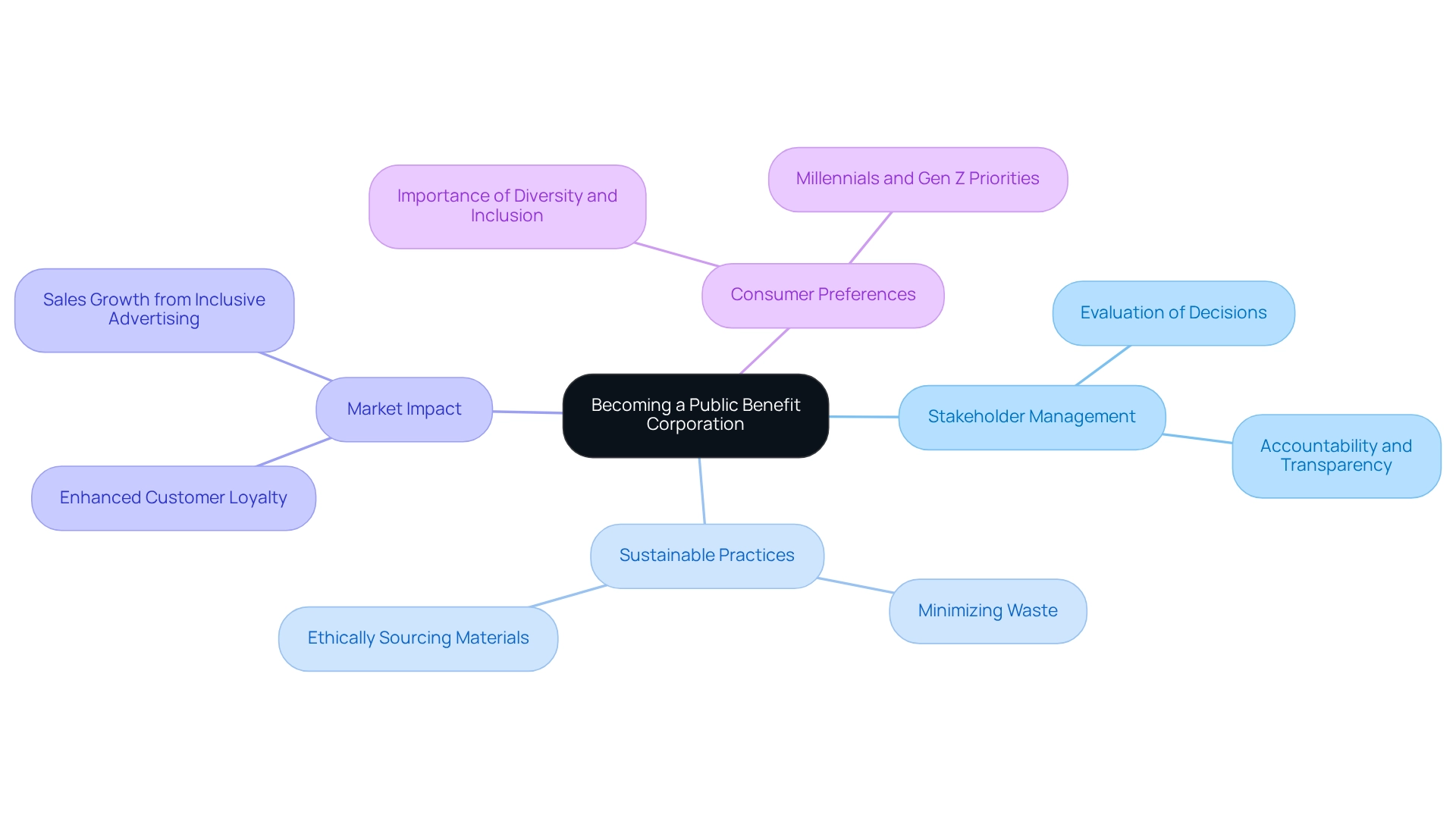

Becoming a Public Benefit Corporation: Embracing Corporate Responsibility

Transitioning to a public benefit corporation (PBC) is crucial for redefining the corporation: stakeholder management and organizational wealth, as it allows organizations to align their operations with social and environmental objectives alongside financial goals. This legal framework mandates that companies evaluate the effects of their decisions on all stakeholders, which is essential for redefining the corporation: stakeholder management and organizational wealth. For instance, a PBC may adopt sustainable practices such as minimizing waste and ethically sourcing materials. Such initiatives not only bolster the company's reputation but also resonate with consumers who prioritize corporate responsibility.

Research from Kantar indicates that diversity, fairness, and inclusion are more important to millennials and Gen Z than other groups, highlighting the market impact of adopting PBC status. Additionally, Esi Eggleston Bracey, Chief Growth and Marketing Officer at Unilever, states, "This report emphasizes the undeniable case for more diverse and inclusive marketing and will serve as a powerful tool as the industry aims for even more progressive, impactful work in the future."

Companies that commit to PBC status often see enhanced customer loyalty and increased sales, positioning themselves favorably in a competitive market. The case study titled "Impact of Inclusive Advertising on Brand Performance" demonstrates that brands embracing inclusive practices experience significant sales growth, particularly among younger consumers.

As a result, the advantages of becoming a PBC extend beyond compliance; they foster a culture of accountability and transparency that is essential for redefining the corporation: stakeholder management and organizational wealth, ultimately leading to long-term success and sustainability. Richard Branson's call for collective responsibility in business further emphasizes the importance of aligning corporate practices with societal values, reinforcing the strategic benefits of PBC status.

Stakeholder Politics: Navigating Corporate Governance Dynamics

Navigating the politics of involved parties is essential for redefining the corporation: stakeholder management and organizational wealth, as it necessitates a nuanced understanding of the diverse interests and influences they contribute to the decision-making process. Effective corporate governance is essential for redefining the corporation: stakeholder management and organizational wealth, as it hinges on leaders' ability to balance these interests while aligning decisions with the entity's overarching goals. For instance, a board of directors must consider the perspectives of shareholders, employees, and community members when redefining the corporation: stakeholder management and organizational wealth in their strategic initiatives.

Recent trends indicate that organizations are redefining the corporation: stakeholder management and organizational wealth by prioritizing open communication and transparency, which can significantly enhance relationships with involved parties, thereby minimizing conflicts and fostering trust. Statistics reveal that improved engagement practices can lead to a 10% increase in employee retention, particularly in the tech sector, underscoring the importance of addressing the needs of involved parties. A notable case study is Interface, a global flooring manufacturer that actively engaged its stakeholders—employees, customers, suppliers, and communities—to address environmental challenges. This commitment to sustainability has resulted in an impressive 96% reduction in greenhouse gas emissions since 1996, alongside considerable energy cost savings.

Such examples illustrate the financial and environmental benefits of effective participant engagement, emphasizing the crucial role of redefining the corporation: stakeholder management and organizational wealth in balancing diverse interests. As Satya Nadella aptly stated, "Many companies aspire to change the world. But very few have all the elements required: talent, resources, and perseverance." This underscores the necessity of possessing the right elements for effective participant engagement. Moreover, entities in 2025 face recent challenges in balancing stakeholder interests, highlighting the importance of redefining the corporation: stakeholder management and organizational wealth, and necessitating a proactive approach to navigate the complexities of stakeholder politics.

Operational Efficiency: Streamlining Processes for Better Results

Streamlining operational processes is crucial for enhancing efficiency and achieving superior results. By embracing lean management principles, such as just-in-time inventory systems, organizations can significantly reduce waste and boost production efficiency in manufacturing.

As we approach 2025, small enterprises are increasingly adopting these principles to remain competitive, with operational efficiency recognized as a key driver of financial success and innovation. Moreover, utilizing customer information is essential for fostering growth in this data-centric environment, enabling companies to customize their strategies effectively.

For instance, entities that adopt optimized workflows have reported a reduction in customer complaints by as much as 45%, highlighting the tangible advantages of process streamlining. Continuous evaluation and refinement of processes not only enhance responsiveness to market changes but also lead to improved overall performance.

Our pragmatic approach to data emphasizes testing every hypothesis to deliver maximum return on invested capital, which is vital for effective decision-making. By utilizing real-time enterprise analytics through client dashboards, organizations can continually monitor their performance and operationalize lessons learned from turnaround processes.

Expert opinions indicate that companies focusing on operational agility are better positioned to outperform their counterparts. As noted by ING, 'The enhanced operational agility contributed to ING’s consistent outperformance of European banking peers in return on equity metrics.' This underscores the importance of systematic optimization of operational capabilities, as illustrated in the case study titled 'Foundation for Innovation and Digital Transformation,' which emphasizes operational efficiency as a fundamental driver of financial performance in the banking sector.

By leveraging these strategies, CFOs can foster sustainable growth and navigate the complexities of today's business environment.

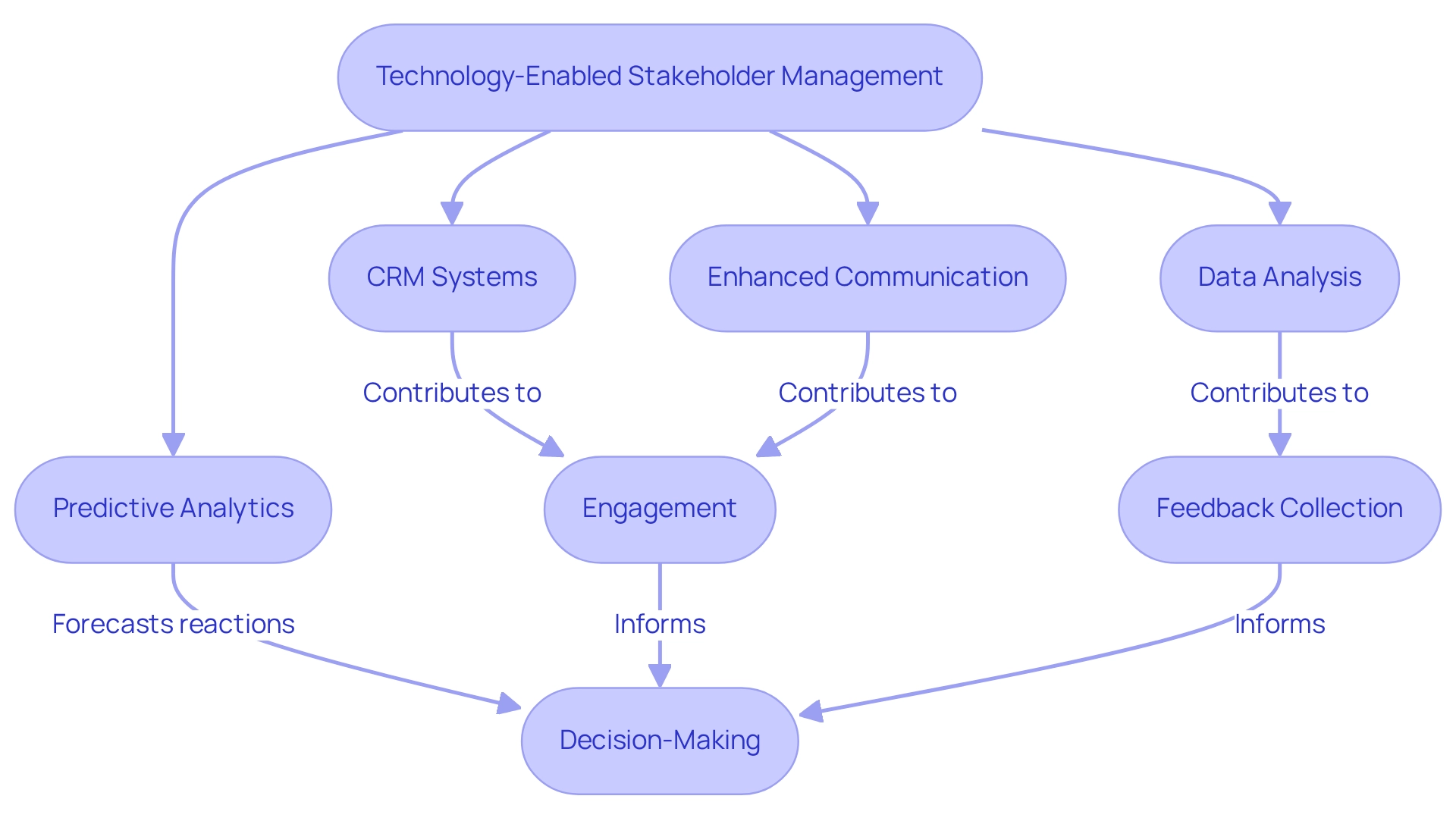

Technology-Enabled Stakeholder Management: Enhancing Organizational Wealth

Technology is essential for enhancing participant management, offering tools that facilitate improved communication and engagement. Customer Relationship Management (CRM) systems allow entities to meticulously monitor interactions with parties involved, collect valuable feedback, and analyze data to inform strategic decision-making. For instance, a nonprofit organization can leverage CRM technology to engage donors through tailored communications and updates on project outcomes, fostering a deeper connection. In 2025, trends indicate that CRM systems are becoming increasingly advanced, integrating predictive analytics to anticipate responses to proposed changes, thus enhancing engagement strategies.

According to the concept of 'Sustainability Satellites,' understanding various aspects of sustainability is crucial for effective participant engagement, as it enhances knowledge and awareness of critical issues. This technology not only strengthens relationships but also plays a crucial role in redefining the corporation: stakeholder management and organizational wealth by aligning stakeholder interests with corporate goals. Moreover, our team promotes a condensed decision-making cycle during the turnaround process, enabling entities to take decisive action to safeguard their operations. By continually monitoring the success of our plans through real-time business analytics, entities can diagnose their health and adjust strategies accordingly.

As one expert noted, "Successful engagement with interested parties is about building relationships, fostering collaboration, and ensuring that all involved feel heard and valued." As entities navigate the intricacies of managing interested parties, utilizing these advancements is essential for achieving successful results and promoting collaboration. Furthermore, participant engagement is a vital element of promoting successful IT change initiatives, underscoring the significance of technology in enabling efficient participant management.

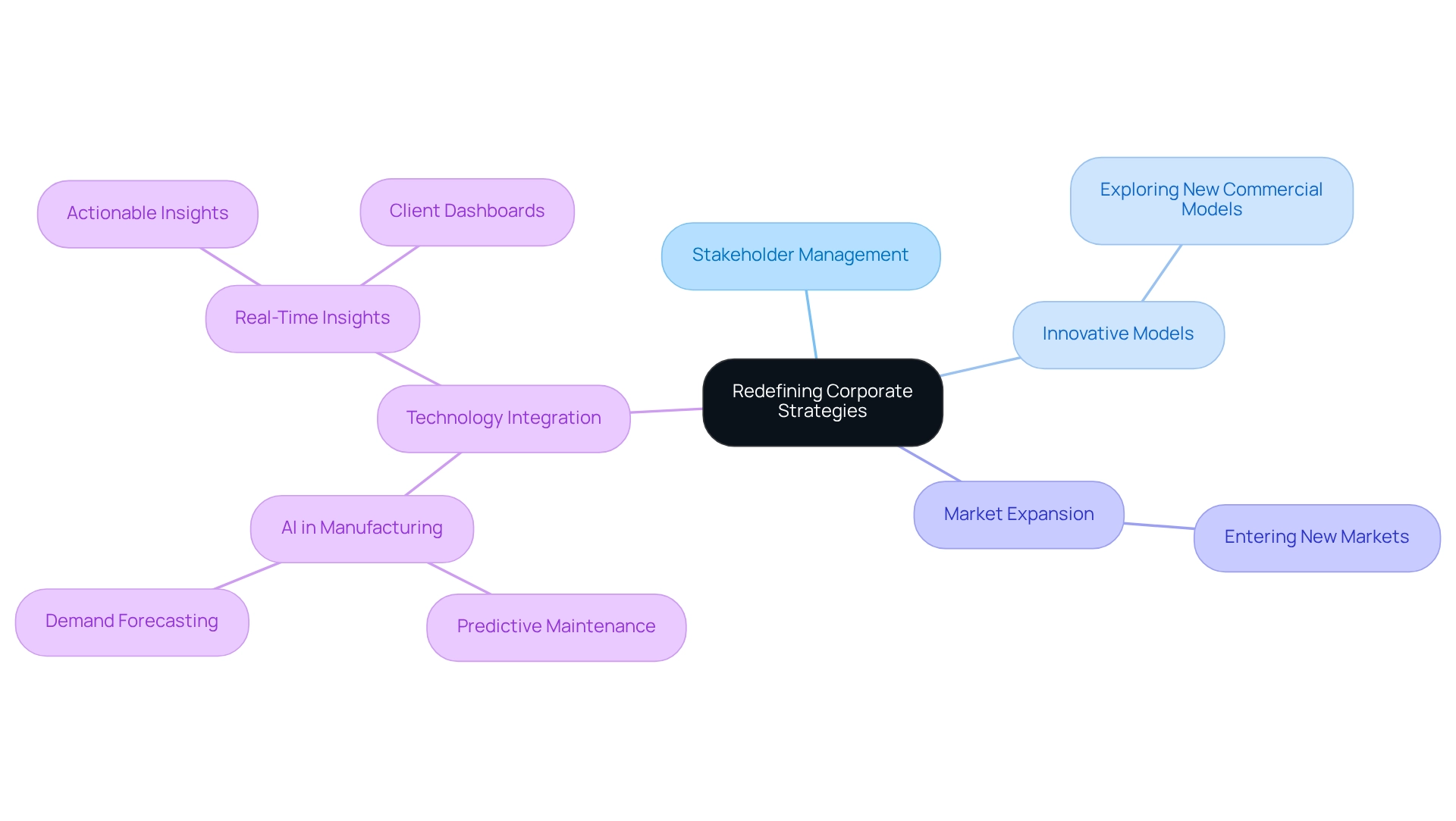

Redefining Corporate Strategies: Ensuring Long-Term Success

Redefining the corporation: stakeholder management and organizational wealth requires a thorough reassessment of a firm's mission, vision, and objectives in response to shifting market dynamics and stakeholder expectations. This strategic evolution may involve exploring innovative commercial models, expanding into new markets, or enhancing product offerings.

For instance, a technology firm might pivot towards sustainable solutions, reflecting the increasing consumer demand for environmentally responsible products. In 2025, companies are prioritizing investments in tools that provide real-time insights, moving beyond mere data collection to generating actionable insights that drive operational excellence. This trend is underscored by the involvement of 440 clients from 99 entities across 61 countries at PwC’s Global Centre for Transformative Leadership, highlighting the global commitment to strategic redefinition.

A significant illustration is the incorporation of AI in manufacturing, where companies employ predictive maintenance and demand forecasting to improve efficiency and lower expenses, demonstrating how technology can foster innovative commercial models. As entities adopt a pragmatic approach to data, they test hypotheses to ensure maximum return on invested capital, which is crucial for effective decision-making.

By supporting a shortened decision-making cycle, companies can take decisive actions that preserve their operations. Continuous monitoring through client dashboards allows for real-time business analytics, enabling companies to diagnose their health and adjust strategies accordingly.

As Gartner observed in 2019, 'Successful entities find a balance. They give employees the freedom to try new ideas and solutions but also set rules to make sure everything stays on track with the overall change plan.' By continuously adapting and innovating, organizations can achieve long-term success and resilience in a competitive landscape, which is crucial for redefining the corporation: stakeholder management and organizational wealth while meeting the evolving needs of their stakeholders.

Furthermore, assessing the organizational mission and vision is crucial in this process, as it lays the foundation for effective strategic evolution.

Conclusion

Transforming small and medium enterprises through turnaround and restructuring consulting is not merely a choice; it is a necessity in today’s complex business environment. The key elements discussed—strategic planning, purpose-driven leadership, operational efficiency, and effective stakeholder management—are interwoven threads that can significantly enhance an organization's resilience and growth potential. By embracing these principles, businesses can streamline their operations, engage meaningfully with their stakeholders, and foster a culture that prioritizes both financial health and social responsibility.

As organizations navigate the challenges of 2025 and beyond, the emphasis on transparency and inclusivity in stakeholder relationships will prove crucial. The benefits of adopting a holistic approach to stakeholder engagement extend beyond mere compliance; they enhance trust, drive innovation, and ultimately contribute to sustainable financial growth. Companies that actively pursue these strategies are not only better positioned to weather uncertainties but are also likely to thrive in a competitive landscape.

In conclusion, the journey towards sustainable growth and organizational wealth requires a commitment to continuous improvement and adaptation. By redefining corporate strategies and leveraging technology, businesses can unlock new opportunities while ensuring they align their operations with the evolving expectations of their stakeholders. This proactive approach to turnaround and restructuring will empower small and medium enterprises to secure their futures and make a lasting impact on their communities and markets.

Frequently Asked Questions

What is the purpose of turnaround and restructuring consulting for small to medium enterprises?

Turnaround and restructuring consulting helps small to medium enterprises address economic challenges by analyzing their operations and financial status to identify areas for improvement, such as streamlining processes, reducing overhead costs, and implementing effective management strategies.

What specific services does Transform Your Small/Medium Business offer?

Transform Your Small/Medium Business provides comprehensive turnaround and restructuring consulting services, including interim management and financial evaluation, specifically tailored for small to medium enterprises.

What is the 'Rapid30' plan mentioned in the article?

The 'Rapid30' plan is a strategy that enables companies to quickly identify and address key issues, facilitating meaningful enhancements in their operations and financial status.

Why is stakeholder management important during restructuring processes?

Stakeholder management is crucial during restructuring as it helps organizations recognize and address the diverse needs and expectations of all parties involved, including employees, customers, suppliers, and investors, which is essential for maintaining trust and enhancing the overall impact of restructuring on profitability.

What role does feedback play in improving employee engagement and performance?

Regular feedback significantly enhances employee engagement and satisfaction. Statistics indicate that 92% of individuals believe constructive criticism improves performance, while consistent feedback acclimates employees to receiving and responding to feedback, fostering a culture of continuous improvement.

How can organizations enhance their performance and innovation?

Organizations can enhance performance and innovation by actively engaging participants, streamlining decision-making processes, and utilizing real-time analytics to monitor business performance and adjust strategies as needed.

What strategies can businesses adopt to build organizational wealth?

To build organizational wealth, businesses should focus on revenue optimization, cost management, and strategic investments in growth opportunities. Key tactics include diversifying product lines, enhancing customer engagement, and leveraging technology.

What is the significance of mastering the cash conversion cycle for organizations?

Mastering the cash conversion cycle is critical for enhancing cash flow and profitability. It involves implementing streamlined decision-making processes supported by real-time analytics, which align with business ethics and stakeholder management principles.

What trends are influencing the corporate restructuring market?

Recent trends indicate that over 30% of the corporate restructuring market is now led by firms with multiple locations, highlighting the growing importance of strategic consulting in this area.