Introduction

In a landscape where businesses frequently face financial turmoil, turnaround management emerges as a vital strategy for revitalizing struggling organizations. This comprehensive approach begins with a meticulous assessment of financial health and operational capabilities, setting the stage for targeted interventions that can reverse decline and foster growth.

By leveraging real-time analytics and tailored solutions, CFOs can not only identify weaknesses but also capitalize on strengths, driving sustainable transformation. As the stakes rise—with alarming failure rates in various sectors—mastering the nuances of turnaround management becomes imperative for financial leaders seeking to navigate challenges and enhance profitability.

This article delves into the strategic frameworks and technological tools essential for executing effective turnaround initiatives, equipping CFOs with the insights needed to lead their organizations toward a more resilient future.

Understanding Turnaround Management: A Key to Business Transformation

Turnaround management represents a strategic initiative aimed at rejuvenating struggling enterprises by implementing to steer them back toward profitability. This process begins with a thorough evaluation of the organization's financial condition, operational effectiveness, and competitive standing, which falls under the 'Identify & Plan' phase. By identifying underlying organizational issues, our team collaborates to create tailored turnaround management solutions that mitigate weaknesses and reinvest in key strengths.

Utilizing real-time analytics, our method allows CFOs to make informed decisions quickly, significantly enhancing the cycle. The 'Test & Measure' phase is integral to our methodology; we pragmatically test every hypothesis to ensure maximum return on invested capital in both the short and long term. Insights from the McKinsey global survey, which collected responses from 1,527 executives, underscore that targeted strategies can effectively address inefficiencies and harness growth opportunities.

With a ten-year failure rate at 65.3%, the necessity for effective recovery strategies is undeniable. Furthermore, approximately 23.2% of private sector businesses in the U.S. fail within their first year, particularly in the transportation and warehousing industry, which faces a staggering 24.8% failure rate. For CFOs, mastering the principles of recovery oversight is essential, allowing them to implement tailored turnaround management solutions that drive sustainable transformation through strategic financial restructuring and operational improvements.

Our commitment to continuous performance monitoring fosters strong relationships, allowing for the implementation of lessons learned during the recovery process. As one expert aptly notes,

Performing diagnostics can also help to uncover many quick hits; capture and pursue these.

Additionally, recovery acquisitions make up about half of all M&A transactions, a number expected to increase during economic declines, further emphasizing the importance of recovery strategies in today's economic environment.

By understanding and implementing these facets, CFOs can navigate challenges effectively while enhancing overall profitability in an increasingly competitive environment.

Tailored Solutions for Effective Turnaround Management

Effective turnaround management requires tailored turnaround management solutions that consider the unique circumstances of each organization, as it is not a one-size-fits-all endeavor. Our approach starts with Identify & Plan, where we evaluate underlying organizational issues and collaboratively develop actionable strategies for enhancement. Here are several strategies that can significantly enhance recovery efforts:

- Financial Restructuring: This involves a thorough assessment and renegotiation of debts to improve cash flow. Given the 68% increase in bankruptcies reported last year according to Reorg, companies must prioritize this strategy to mitigate financial strain.

- Operational Efficiency: Streamlining processes is essential for reducing costs and enhancing productivity. Applying best practices in operational efficiency can lead to substantial improvements, enabling struggling enterprises to operate more effectively while continuously monitoring performance through real-time analytics.

- Market Repositioning: Identifying new market opportunities is crucial. Modifying product offerings in reaction to market demands can assist businesses in reclaiming competitiveness and market share, implementing lessons from recovery experiences to establish strong, enduring relationships with stakeholders.

- Leadership Changes: Introducing interim management can provide fresh perspectives and drive necessary change. This approach has proven effective, especially in cases where existing leadership is resistant to change, facilitating streamlined decision-making processes.

- Employee Engagement: Fostering a culture of accountability and innovation is vital for improving morale and performance. Engaged employees are more likely to contribute to recovery efforts, making this an essential focus area.

- Test & Measure: We adopt a pragmatic approach to data, rigorously testing every hypothesis to maximize returns on investment. By leveraging tailored turnaround management solutions, organizations can effectively navigate the complexities of financial restructuring.

continues to debate whether sponsor-owned companies face higher failure rates than their corporate counterparts, underscoring the need for proactive recovery strategies. Companies should aim to plan for the next 18 months, ensuring they have ample runway to address potential challenges and capitalize on value creation levers. Additionally, mastering the cash conversion cycle through targeted strategies can further enhance organizational performance.

The Advantages of Outsourcing Turnaround Management

Outsourcing tailored turnaround management solutions presents a wealth of advantages that can significantly influence an organization's recovery trajectory. The key benefits include:

-

Access to Expertise: Engaging external consultants like the SMB team offers specialized knowledge and innovative approaches crucial for navigating complex recovery scenarios.

Their 'Rapid30' plan, praised by clients for its clarity and effectiveness, illustrates their ability to diagnose issues and craft actionable strategies swiftly. One client remarked, 'Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years.'

-

Cost Efficiency: In crisis situations, outsourcing can prove more cost-effective than hiring full-time staff, as it allows businesses to utilize skilled professionals without the long-term financial commitment.

-

Objective Perspective: External consultants provide unbiased insights essential for identifying hidden issues and uncovering new opportunities that may not be visible to internal teams.

-

Rapid Implementation: With extensive experience, these consultants can quickly assess situations and implement necessary changes, avoiding the delays that often accompany internal procedures. Clients benefit from a 60% quicker completion time for their marketing campaigns, reflecting the effectiveness of outsourcing in enhancing operational efficiency.

As Gartner notes, 60% of won’t be renewed by 2025, highlighting the evolving landscape of outsourcing and the need for CFOs to adapt. Additionally, case studies indicate that digital outsourcing methods like cloud computing and RPA are cost-efficient and scalable, enhancing productivity and strategic focus.

By embracing outsourcing and leveraging the transformative support of the SMB team, including the operationalization of lessons learned throughout the recovery process, CFOs can orchestrate tailored turnaround management solutions that lead to a successful revival, positioning businesses to maintain competitiveness in an increasingly challenging landscape.

Leveraging Technology for Successful Turnaround Management

Technology is vital for facilitating successful recovery efforts, providing CFOs with essential tools to improve analysis and informed decision-making while maximizing return on invested capital. Key areas where technology can be effectively leveraged include:

-

Data Analytics: Advanced analytics allow organizations to identify emerging trends and forecast financial performance, which is vital for proactive management and testing hypotheses.

By 2027, more than 50% of enterprises are expected to adopt industry cloud platforms, indicating a shift toward more data-driven strategies.

-

Project Management Software: These solutions enable teams to meticulously track progress and manage resources efficiently throughout the turnaround phase, ensuring that all initiatives remain on schedule and within budget.

-

Financial Management Systems: Implementing software that provides real-time tracking of cash flow and key financial metrics empowers CFOs to make timely adjustments as needed, enhancing responsiveness.

-

Communication Platforms: These tools facilitate seamless communication among all stakeholders, fostering alignment and accountability, which are crucial during transitions. A relevant example is Empresas CMPC, Chile's largest paper manufacturer, which integrated digital methods across their production chain to enhance visibility. This transformation not only enhanced employee motivation but also improved service delivery by allowing operators to understand the complete value delivery system.

By integrating these technological solutions and applying lessons learned through the recovery process, businesses can significantly streamline their efforts using tailored turnaround management solutions, leading to improved outcomes and enhanced financial performance. The increasing demand for expertise in this area is reflected in the significant growth of roles, with approximately 4 million digitally enabled positions forecasted across various industries. As Iva Krasteva, an agile practitioner and content creator expert, notes, 'Digital transformation specialist is one of the jobs with the largest growth over the last 5 years,' underscoring the importance of technology in navigating complex recovery scenarios.

Strategic Planning and Execution: The Cornerstones of Turnaround Success

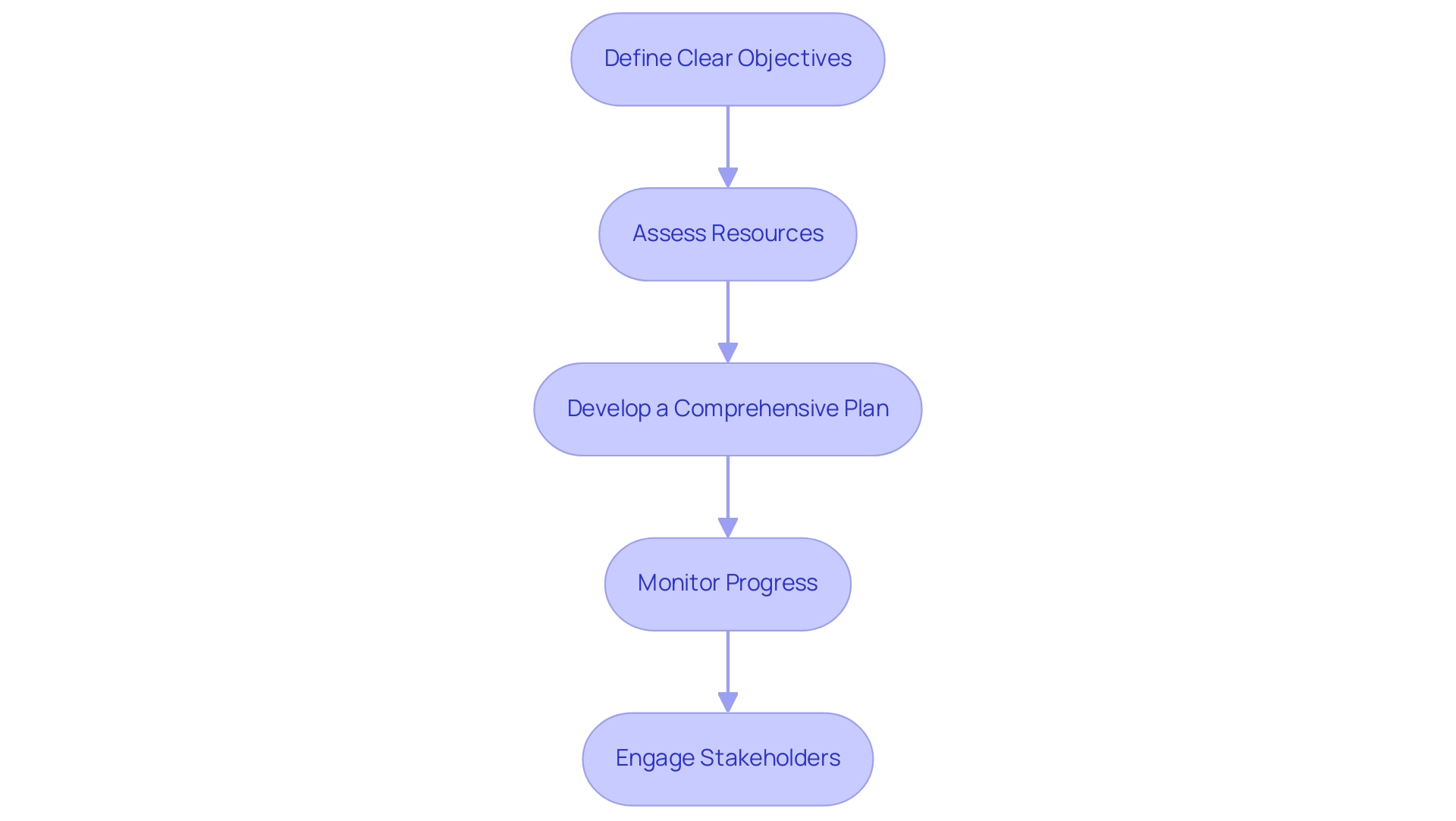

Effective strategic planning and execution are crucial for the successful management of tailored turnaround management solutions. CFOs must prioritize the following steps to navigate challenges and foster organizational transformation:

- Define Clear Objectives: Establish distinct, measurable goals that serve as guiding stars throughout the recovery journey.

These objectives should reflect both short-term recovery and long-term sustainability. - Assess Resources: Conduct a thorough evaluation of available resources and organizational capabilities.

This alignment is crucial to ensuring that the strategic objectives are both realistic and achievable. - Develop a Comprehensive Plan: Craft a detailed roadmap that delineates the necessary steps to achieve recovery goals.

This strategy should include tailored turnaround management solutions through creative model modifications, reflecting insights from recent studies that equate recovery tactics with entrepreneurial processes, and leverage , including bankruptcy case oversight to navigate financial distress effectively. - Monitor Progress: Implement regular performance reviews to gauge progress against the set objectives.

Utilizing our real-time business analytics through a client dashboard allows for timely adjustments and ensures momentum is maintained throughout the recovery process. - Engage Stakeholders: Actively involve key stakeholders, including senior leadership and employees, to garner buy-in and support for turnaround initiatives.

The case study titled 'Turnaround Process Awareness Among Managers' reveals a reluctance among managers to acknowledge the need for changes in upper-level leadership, highlighting the emotional attachment to company assets and leadership.

This emphasizes the need for open communication and collaboration to overcome such challenges.

As John O. Whitney aptly states,

Turnarounds are superb management schools. Everything needs fixing. Nothing is sure except the need to recover.

This highlights the intense learning experience inherent in transformation situations. Furthermore, statistical analysis shows a p-value of < 0.001 for the difference in indicators between clusters, reinforcing the significance of strategic planning in achieving successful transformations.

By focusing on strategic planning and execution, organizations can significantly enhance their chances of overcoming obstacles and achieving successful transformations with tailored turnaround management solutions.

The integration of financial assessments and operational efficiency into the turnaround strategy is essential, as these services directly contribute to identifying areas for improvement and optimizing resources for sustainable growth.

Conclusion

Revitalizing struggling businesses through effective turnaround management is not just a necessity but a strategic imperative for CFOs aiming to enhance profitability and ensure long-term success. As outlined, the process begins with a rigorous assessment of financial health and operational capabilities, creating a foundation for targeted interventions that address weaknesses while leveraging strengths. The significance of adopting tailored solutions—ranging from financial restructuring to market repositioning—cannot be overstated, as these strategies provide a roadmap for recovery.

Moreover, the role of technology in facilitating turnaround initiatives is paramount. By utilizing advanced data analytics, project management software, and real-time financial tracking systems, CFOs can make informed decisions that drive efficiency and responsiveness. The integration of these tools not only accelerates the turnaround process but also enhances overall business performance, empowering organizations to navigate the complexities of recovery with confidence.

Ultimately, mastering turnaround management equips financial leaders with the insights and strategies necessary to transform challenges into opportunities. As the landscape becomes increasingly competitive, the ability to implement effective turnaround strategies will distinguish successful organizations from those that falter. Embracing a proactive approach to turnaround management is essential for fostering resilience and securing a prosperous future in today’s volatile business environment.

Frequently Asked Questions

What is turnaround management?

Turnaround management is a strategic initiative aimed at rejuvenating struggling enterprises by implementing tailored solutions to steer them back toward profitability.

What are the key phases in the turnaround management process?

The key phases include 'Identify & Plan', where financial conditions and operational effectiveness are evaluated, and 'Test & Measure', which involves testing hypotheses to ensure maximum return on invested capital.

How does the 'Identify & Plan' phase work?

In the 'Identify & Plan' phase, underlying organizational issues are identified, and a collaborative effort is made to develop actionable strategies for enhancement.

What strategies can enhance recovery efforts in turnaround management?

Strategies include financial restructuring, operational efficiency, market repositioning, leadership changes, employee engagement, and a 'Test & Measure' approach to data.

Why is financial restructuring important?

Financial restructuring is crucial as it involves assessing and renegotiating debts to improve cash flow, especially in light of increasing bankruptcy rates.

How does operational efficiency contribute to recovery?

Streamlining processes reduces costs and enhances productivity, allowing struggling enterprises to operate more effectively while continuously monitoring performance.

What role does market repositioning play in turnaround management?

Market repositioning involves identifying new market opportunities and modifying product offerings to reclaim competitiveness and market share.

Why might leadership changes be necessary during a turnaround?

Introducing interim management can provide fresh perspectives and facilitate necessary changes, especially when existing leadership is resistant to change.

How can employee engagement impact recovery efforts?

Fostering a culture of accountability and innovation improves morale and performance, making engaged employees more likely to contribute to recovery efforts.

What is the significance of the 'Test & Measure' approach?

The 'Test & Measure' approach rigorously tests every hypothesis to maximize returns on investment, enabling organizations to navigate the complexities of financial restructuring effectively.

What is the importance of recovery strategies in the current economic environment?

Recovery strategies are essential as they address high failure rates among businesses, particularly during economic declines, and support sustainable transformation through strategic financial restructuring and operational improvements.