Overview

This article highlights seven turnaround financial models that CFOs can implement to drive recovery in small and medium enterprises facing economic distress. It underscores the importance of these models—such as cost efficiency, asset retrenchment, and technology-enabled consulting—as structured strategies for identifying inefficiencies, optimizing resources, and leveraging technology. Such approaches ultimately foster sustainable growth and resilience in challenging market conditions. By adopting these models, organizations can not only navigate through economic turmoil but also position themselves for future success.

Introduction

In the dynamic landscape of small and medium businesses, navigating financial distress presents a daunting challenge. Comprehensive turnaround consulting services offer a lifeline, providing expert guidance to help organizations assess their financial health, streamline operations, and enhance resilience.

By implementing tailored strategies that focus on:

- Cost efficiency

- Asset optimization

- Core activities

businesses can recover from setbacks and emerge stronger, better equipped to thrive in competitive markets.

As the importance of effective leadership and strategic planning becomes increasingly evident, organizations that embrace these transformative models are poised to achieve sustainable growth and long-term success.

This article delves into various frameworks and methodologies that can drive impactful change, showcasing the essential steps CFOs must take to ensure their organizations stabilize and flourish in the face of adversity.

Transform Your Small/ Medium Business: Comprehensive Turnaround Consulting Services

Comprehensive turnaround financial models are essential for small and medium enterprises grappling with economic distress. These services involve a thorough evaluation of a company's financial health, operational efficiency, and market positioning. By leveraging expert insights, organizations can identify critical areas for improvement and implement strategies that promote sustainable growth.

For example, Transform Your Small/Medium Business consultants can assist in streamlining operations, reducing costs, and enhancing revenue generation, ultimately transforming the enterprise into a more resilient entity. Our customized strategy includes detailed evaluations focused on cash preservation and liability reduction, ensuring that companies are well-equipped to face economic challenges.

We also provide interim management services and bankruptcy case management to further support distressed enterprises. Recent trends indicate that businesses engaged in turnaround consulting are better positioned to adapt to market dynamics, with many reporting improved performance and operational efficiency. The emphasis on turnaround consulting has intensified as companies recognize the necessity of adapting to shifts in consumer behavior.

The impact of these services is significant, with research showing that companies adopting comprehensive turnaround financial models experience notable improvements in their economic well-being, which leads to increased stability and growth potential. Furthermore, case studies demonstrate that small and medium enterprises that embrace turnaround consulting not only recover from distress but also emerge stronger, equipped with the tools to thrive in competitive environments.

Our 'Rapid30' plan exemplifies this transformative experience, showcasing client satisfaction and professional success. Specific actions aimed at enhancing economic performance and operational efficiency are crucial for successful turnaround financial models.

David Berliner, Partner & National Leader of Business Restructuring at BDO USA, underscores the importance of restructuring in adapting to market changes, stating, "Retailers are restructuring their footprints to capitalize on smaller spaces." This highlights the necessity of turnaround consulting in today's evolving landscape.

Moreover, statistics reveal that businesses that are recession-ready and engage in turnaround consulting are more likely to succeed, particularly in light of negative perceptions surrounding government ownership in distress-resolution strategies. Understanding these dynamics is vital for chief financial officers aiming to manage economic distress effectively.

Cost Efficiency Model: Streamlining Operations for Financial Stability

The Cost Efficiency Model serves as a crucial tool for identifying and eliminating wasteful expenditures within an organization. Chief Financial Officers can effectively implement this model by conducting a thorough analysis of operational processes to uncover inefficiencies.

For instance, the integration of lean management principles can significantly streamline workflows, reduce overhead costs, and enhance overall productivity. According to a McKinsey study, companies that adopt these principles often achieve cost savings of 15-20% within the first year.

Moreover, mastering the cash conversion cycle through strategic planning and real-time analytics empowers CFOs to make informed decisions that further enhance economic performance. This involves pinpointing key areas for improvement and devising actionable strategies to address them, followed by measuring outcomes to ensure maximum return on investment.

Focusing on cost efficiency not only stabilizes budgets but also enables businesses to allocate resources more effectively, ultimately leading to improved economic outcomes. A notable case study exemplifies this: a manufacturing firm increased its Overall Equipment Effectiveness (OEE) from 68.4% to 85%, resulting in a 50% reduction in unplanned downtime and a 20% boost in production output.

Such transformations underscore the essential role of operational efficiency and ongoing performance monitoring in achieving economic stability and recovery. Institutions that excel will systematically identify, measure, and optimize their operational capabilities. This systematic approach is a fundamental driver of comprehensive economic performance in the banking sector.

Asset Retrenchment Model: Maximizing Value from Existing Resources

The Asset Retrenchment Model serves as a strategic framework aimed at optimizing the value of existing resources within an organization. CFOs must conduct a thorough assessment of their current assets—such as inventory, equipment, and real estate—to uncover optimization opportunities. For instance, selling underutilized assets can significantly enhance cash flow, while renegotiating leases may lead to reduced overhead costs. Implementing robust asset management practices not only boosts operational efficiency but also contributes to a more resilient economic position. However, it is crucial to recognize that investing carries inherent risks, including the potential loss of invested capital, underscoring the need for careful decision-making.

A significant case study is that of Allison Dunn, who established Idaho’s premier coaching firm, Deliberate Directions. Through her coaching, she has guided numerous small businesses in uncovering hidden opportunities and implementing tailored approaches for growth, demonstrating the effectiveness of asset retrenchment in driving economic recovery.

Statistics indicate that effective asset optimization strategies can lead to substantial improvements in cash flow for small to medium enterprises (SMEs). As Ana Gonzalez-Ribeiro wisely noted, "Wealth is seldom a sprint. 'Rushed choices can result in debt and catastrophe,'" emphasizing the significance of meticulous asset management in economic recovery. By focusing on maximizing the value derived from existing resources, businesses can navigate financial distress more effectively.

Expert opinions suggest that financial leaders should prioritize turnaround financial models, which include streamlined decision-making and real-time analytics, to ensure sustainable growth and recovery in 2025 and beyond. This approach not only mitigates risks but also positions organizations to capitalize on their strengths during challenging times. As Warren Buffett indicates, investors ought to approach stock choices with the perspective of making only a finite number of lifetime decisions, reinforcing the strategic approach financial leaders should adopt when making choices regarding asset retrenchment.

Core Activities Focus Model: Enhancing Business Resilience

The Core Activities Focus Model compels organizations to prioritize their essential functions that yield the highest value. CFOs must undertake a comprehensive evaluation of their operations to pinpoint activities critical for driving revenue and ensuring customer satisfaction. By reallocating resources to these vital areas, organizations can significantly bolster their resilience against market fluctuations.

For example, a restaurant may focus on its most popular menu items while optimizing less profitable offerings, resulting in improved overall profitability. This strategic emphasis not only boosts financial performance but also aligns with findings that 62% of small enterprise owners report their ventures are in 'good health,' signaling a robust foundation for growth.

Additionally, harnessing technology can further amplify efficiency; AI has demonstrated the ability to enhance productivity by 40% and reduce operating costs by up to 30% (Gartner, 2024; PwC, 2024). Consistent monitoring of Key Performance Indicators (KPIs) is crucial, as evidenced by a case study emphasizing the significance of KPIs in aiding small businesses to assess growth, efficiency, and customer engagement, ultimately facilitating more informed decision-making.

In 2025, underscoring core activities transcends mere planning; it becomes a fundamental element for sustainable success. Furthermore, implementing streamlined decision-making processes and real-time analytics can substantially enhance turnaround financial models, enabling financial executives to make rapid, informed choices. As Luca Maestri articulates, the shift towards in-house development fosters better control over innovation, further highlighting the necessity of concentrating on core functions.

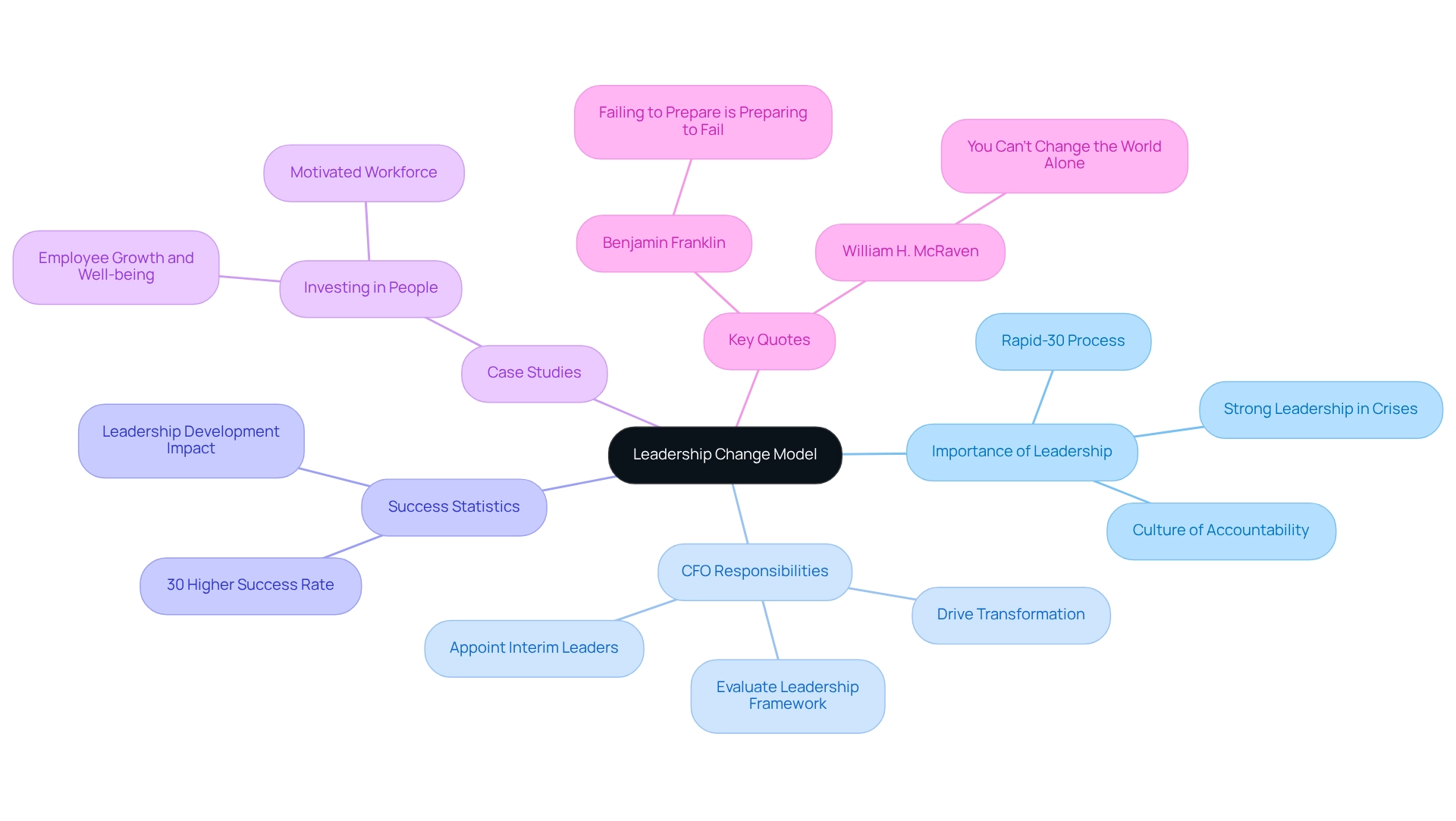

Leadership Change Model: Driving Transformation Through Effective Management

The Leadership Change Model highlights the critical importance of strong leadership in navigating crises. Chief Financial Officers must rigorously evaluate their existing leadership framework and remain open to necessary adjustments. This could involve appointing interim leaders with proven expertise in turnaround financial models, capable of introducing innovative perspectives and driving transformation through structured processes like the Rapid-30. Effective leaders not only inspire their teams but also foster a culture of accountability, ensuring that the organization stays aligned with its recovery objectives.

Statistics indicate that organizations implementing proactive leadership changes during economic downturns achieve a 30% higher success rate in their turnaround financial models. For example, companies that emphasize leadership development and invest in their teams often experience enhanced morale and engagement, both vital for recovery.

Case studies, such as 'Investing in People,' demonstrate that by prioritizing the growth and well-being of employees, leaders can cultivate a motivated workforce that propels organizational success. As Benjamin Franklin wisely stated, failing to prepare is preparing to fail; therefore, strategic leadership changes are essential for guiding organizations toward sustainable recovery.

Furthermore, as William H. McRaven remarked, 'You can’t change the world alone – you will need some help,' underscoring the significance of collaboration in effective leadership during crises. By embracing these leadership changes and leveraging the insights from the Rapid-30 process, finance leaders can profoundly impact their organizations' economic recovery and the development of turnaround financial models.

Financial Assessment Model: Identifying Opportunities for Cash Preservation

The Financial Assessment Model is indispensable for chief financial officers seeking to enhance cash preservation within their organizations. This model involves a thorough examination of monetary statements, cash flow, and operational costs. By meticulously reviewing these elements, CFOs can identify opportunities for cash preservation, such as minimizing discretionary spending and renegotiating payment terms with suppliers.

Moreover, a comprehensive understanding of the company's liabilities enables the prioritization of debt repayments and the exploration of refinancing options. This proactive resource management approach is essential for stabilizing the organization during recovery. Effective forecasting, as discussed in the case study 'Most importantly of all: Forecast,' can eliminate guesswork and guide strategic advancements in cash flow management.

Significantly, the statistic that 54% of U.S. small enterprises sought loans or lines of credit in 2018 underscores the critical need for thorough financial evaluations to navigate difficult periods. By applying disciplined reinvestment strategies, as highlighted by industry leaders such as Cathie Lesjak, organizations can significantly improve their future worth. Lesjak states, 'If you save a dollar and you reinvest that back into the business in a disciplined way, that dollar is actually worth a lot more in the future.'

This underscores that strategic financial management, including the testing of hypotheses and operationalizing lessons learned, is crucial for sustainable growth and the development of effective turnaround financial models.

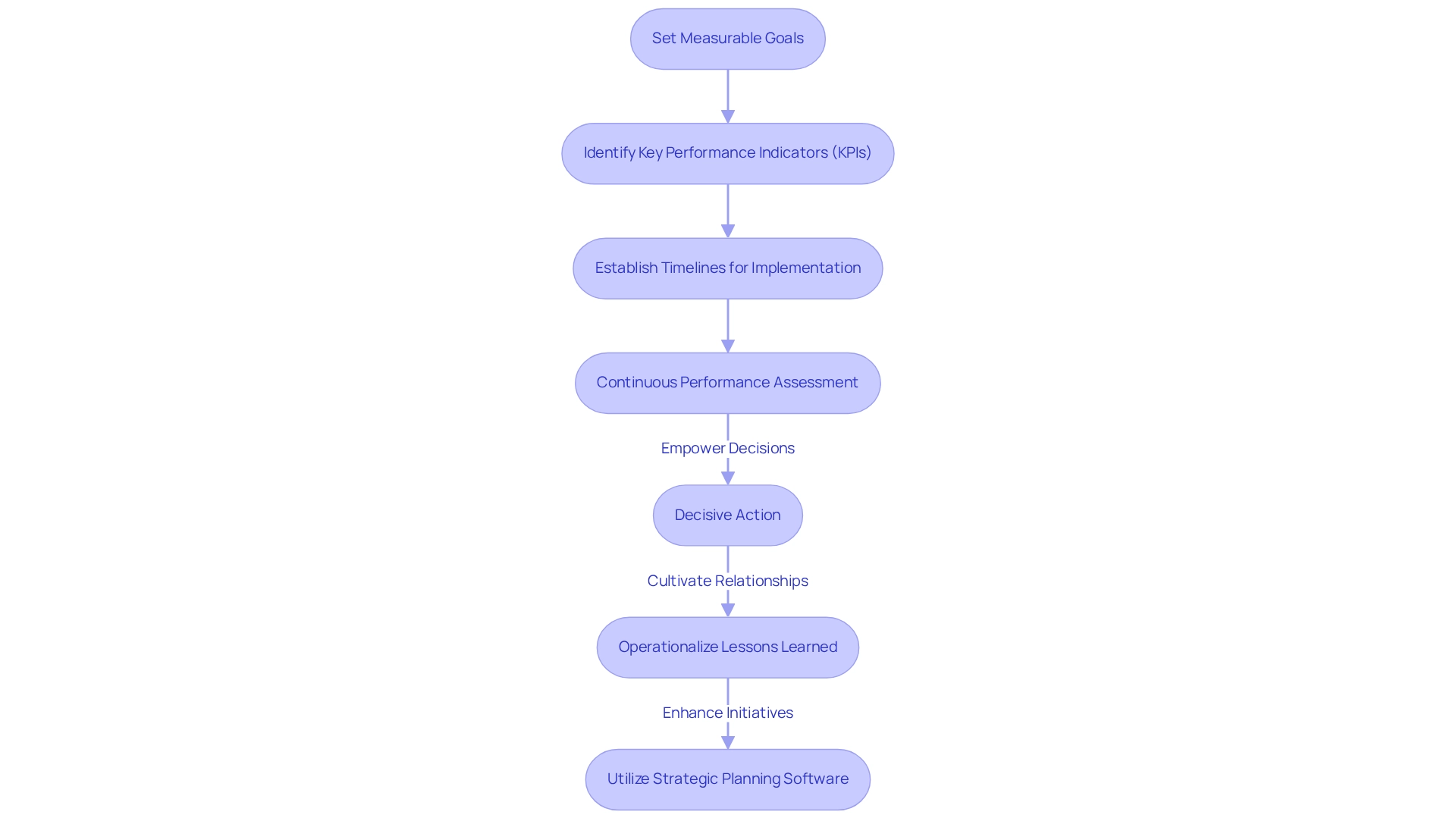

Strategic Planning Model: Crafting and Executing Effective Turnaround Strategies

The Strategic Planning Model emphasizes the critical need for a systematic approach in developing and implementing turnaround strategies. CFOs are urged to engage in scenario planning, which enables them to anticipate potential challenges and develop turnaround financial models that outline clear recovery objectives. This process entails:

- Setting measurable goals

- Identifying key performance indicators (KPIs)

- Establishing timelines for implementation

By formulating a comprehensive strategic plan, companies can adeptly navigate the complexities of recovery, ensuring alignment among all stakeholders with the organization's vision.

Notably, 98% of leaders acknowledge that strategy implementation frequently demands more time than the formulation phase, as highlighted in Bridges Business Consulting's Strategy Implementation Survey Results. This underscores the essential nature of effective planning in achieving successful outcomes. Furthermore, the integration of real-time analytics through client dashboards allows for continuous performance assessment, empowering financial leaders to make informed decisions swiftly.

The case study titled 'The Power of Decisive Action' illustrates the importance of taking action, even if imperfect, reinforcing the notion that progress is achieved through decisive steps. Additionally, operationalizing the lessons learned during the turnaround process cultivates strong, enduring relationships and enhances overall business resilience. Employing strategic planning software can revolutionize the planning and execution process for organizations, equipping financial leaders with the necessary tools to enhance their strategic initiatives.

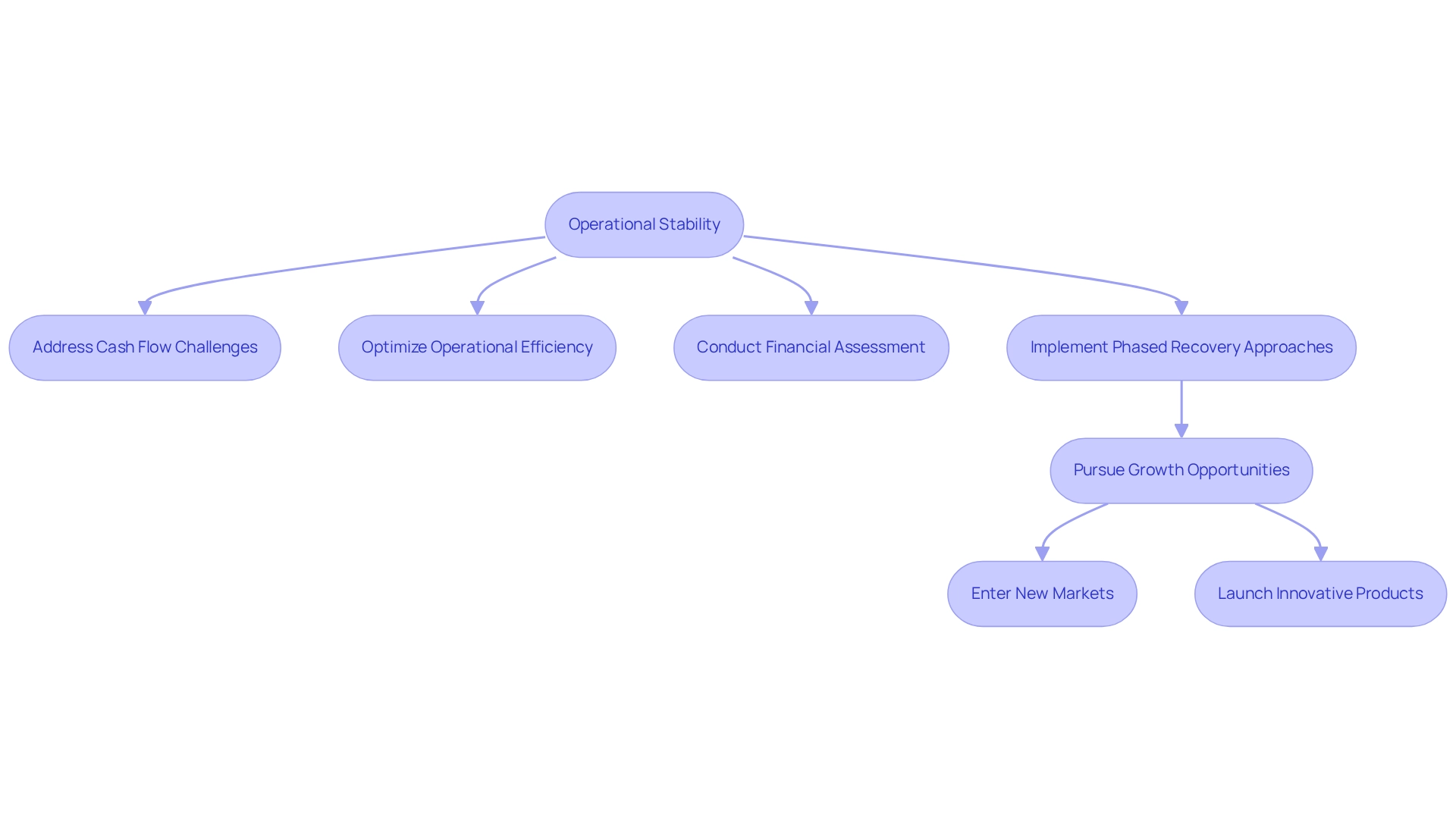

Stabilization and Growth Model: Ensuring Long-Term Financial Recovery

The Stabilization and Growth Model emphasizes the critical necessity for operational stability as a foundation for pursuing aggressive growth strategies. CFOs must prioritize the restoration of economic health by addressing immediate cash flow challenges and optimizing operational efficiency. A comprehensive financial assessment can uncover opportunities to preserve cash and reduce liabilities, which is vital for stabilizing the organization. For example, organizations that adopt phased recovery approaches frequently witness significant improvements in long-term success, as demonstrated by case studies such as EisnerAmper Financial Advisory Services, which has adeptly guided companies through restructuring to enhance their operational performance.

Once stability is firmly established, firms can confidently pursue growth opportunities, such as entering new markets or launching innovative products. This systematic approach, closely aligned with staged recovery plans, not only ensures that recovery efforts are sustainable but also positions the organization advantageously for future growth. Statistics indicate that small enterprises focusing on operational stability prior to expansion are more likely to succeed, with initiatives directed at improving livelihoods through efficient monetary strategies benefiting over 100,000 individuals. By addressing cash flow issues and implementing robust turnaround financial models, financial leaders can establish a resilient and prosperous future. This future is supported by comprehensive turnaround and restructuring consulting services, including bankruptcy case management, that emphasize decisive action and collaborative strategies.

Interim Management Model: Navigating Transitions During Financial Distress

The Interim Management Model is crucial for organizations navigating financial distress, as it involves enlisting seasoned leaders to guide recovery efforts. CFOs must prioritize the appointment of interim executives with a proven track record in turnaround financial models; these leaders provide immediate stability and strategic insight.

Transform Your Small/ Medium Business recognizes industry-specific challenges and delivers tailored solutions for leadership transitions, which is vital in this context. Their expertise enables the swift implementation of necessary changes while mentoring existing staff, fostering a culture of resilience and adaptability.

With a strong emphasis on extensive turnaround financial models and restructuring consulting services, they assist organizations in saving money, streamlining operations, reducing overhead, and increasing revenues. Statistics indicate that key benefits of hiring an interim manager include cost efficiency and rapid results, reinforcing the advantages of this approach.

For instance, through the 'Rapid30' plan, interim leaders have identified critical organizational challenges and executed effective strategies, significantly enhancing operational performance.

By leveraging this model, organizations can adeptly navigate challenging periods, ensuring continuity in operations and positioning themselves for sustainable growth. As noted by Consultport, 'This rapid and efficient response from Consultport highlighted their capability to address client needs swiftly and effectively,' further underscoring the effectiveness of interim management.

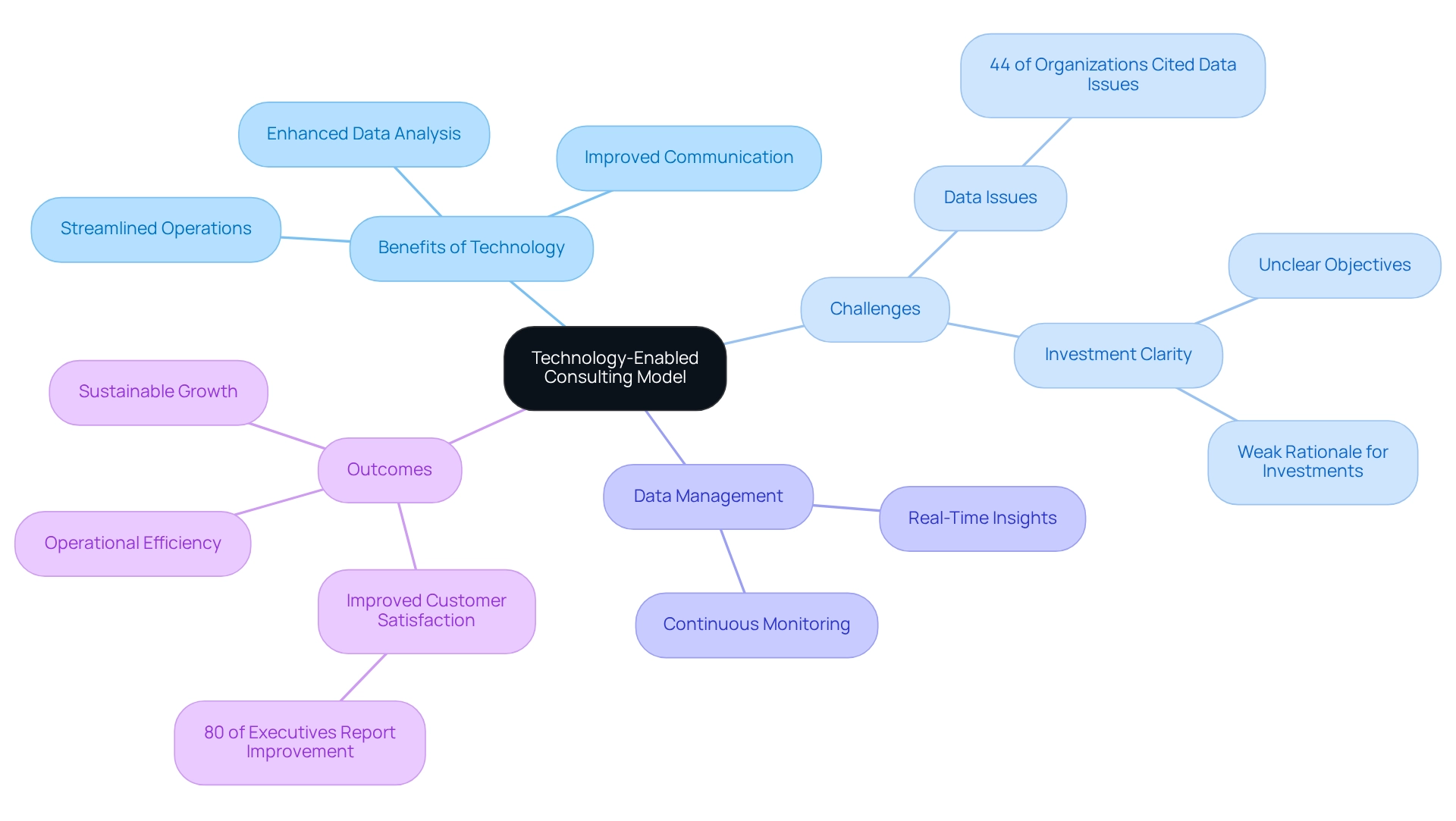

Technology-Enabled Consulting Model: Enhancing Turnaround Strategies with Innovation

The Technology-Enabled Consulting Model underscores the imperative of integrating innovative technologies into turnaround strategies, a vital step for CFOs striving to drive recovery. Digital tools significantly streamline operations, enhance data analysis, and improve internal communication. For instance, the adoption of cloud-based financial management systems empowers organizations to gain real-time insights into cash flow and operational performance, which are essential for informed decision-making.

In 2025, a notable 44% of organizations identified data issues as a barrier to tech investments, underscoring the necessity for clarity in objectives and the rationale behind these investments. Moreover, our pragmatic approach to data involves rigorously testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

Companies that have embraced digital transformation, particularly during the COVID-19 pandemic, have reported substantial improvements in customer satisfaction and operational efficiency. By leveraging technology, such as advanced analytics platforms and automated reporting tools, organizations not only enhance their recovery efforts but also create turnaround financial models to position themselves for sustainable growth in an increasingly digital marketplace.

Continuous monitoring through client dashboards facilitates real-time business analytics, ensuring that companies can effectively diagnose their health and operationalize the lessons learned throughout the turnaround process.

Conclusion

Navigating financial distress presents a significant challenge for small and medium businesses; however, comprehensive turnaround consulting services offer the necessary framework for recovery and growth. By concentrating on cost efficiency, asset optimization, and core activities, organizations can pinpoint critical areas for improvement and implement targeted strategies that stabilize their operations. Insights drawn from various models—such as the Cost Efficiency Model and the Asset Retrenchment Model—underscore the importance of eliminating wasteful expenditures and maximizing the value of existing resources.

Moreover, prioritizing leadership changes and strategic planning can drive transformation and enhance resilience. Effective leadership is essential in guiding businesses through crises, ensuring that teams remain motivated and aligned with recovery objectives. The integration of technology into consulting practices further amplifies the impact of these strategies, facilitating real-time analytics and informed decision-making.

Ultimately, the journey from financial distress to stability transcends mere survival; it represents an opportunity for businesses to emerge stronger and more competitive. By adopting a systematic approach that includes robust financial assessments and a focus on operational efficiency, CFOs can lay the groundwork for sustainable growth. Embracing these comprehensive turnaround methodologies not only prepares organizations for immediate recovery but also positions them favorably for long-term success in an ever-evolving market landscape.

Frequently Asked Questions

What are comprehensive turnaround financial models?

Comprehensive turnaround financial models are essential tools for small and medium enterprises facing economic distress. They involve a thorough evaluation of a company's financial health, operational efficiency, and market positioning to identify areas for improvement and implement strategies for sustainable growth.

How can consultants assist businesses in economic distress?

Consultants can help streamline operations, reduce costs, and enhance revenue generation. They provide customized strategies focused on cash preservation and liability reduction, enabling companies to better face economic challenges.

What additional services are offered to support distressed enterprises?

Additional services include interim management and bankruptcy case management, which further support businesses in distress by providing expert guidance and management during challenging times.

What evidence supports the effectiveness of turnaround consulting?

Research shows that companies engaging in turnaround consulting often report improved performance and operational efficiency, leading to increased stability and growth potential. Case studies demonstrate that such businesses not only recover from distress but also emerge stronger.

What is the 'Rapid30' plan?

The 'Rapid30' plan is a transformative experience offered by consultants that showcases client satisfaction and professional success through specific actions aimed at enhancing economic performance and operational efficiency.

Why is restructuring important for businesses?

Restructuring is crucial for adapting to market changes, as highlighted by industry experts who emphasize the need for businesses to capitalize on evolving consumer behaviors and operational strategies.

How does the Cost Efficiency Model help organizations?

The Cost Efficiency Model identifies and eliminates wasteful expenditures by analyzing operational processes. It helps CFOs streamline workflows and reduce overhead costs, leading to improved productivity and economic performance.

What are the benefits of mastering the cash conversion cycle?

Mastering the cash conversion cycle through strategic planning and real-time analytics enables CFOs to make informed decisions that enhance economic performance by identifying key improvement areas and measuring outcomes for maximum return on investment.

What is the Asset Retrenchment Model?

The Asset Retrenchment Model is a strategic framework aimed at optimizing the value of existing resources. It involves assessing current assets to uncover optimization opportunities, such as selling underutilized assets or renegotiating leases.

What are the risks associated with asset management?

Investing in asset management carries inherent risks, including the potential loss of invested capital, which underscores the importance of careful decision-making in optimizing asset value.

How can effective asset optimization strategies impact SMEs?

Effective asset optimization strategies can lead to significant improvements in cash flow for small and medium enterprises, helping them navigate financial distress more effectively.

What should financial leaders prioritize for sustainable growth?

Financial leaders should prioritize turnaround financial models that include streamlined decision-making and real-time analytics to ensure sustainable growth and recovery in challenging economic conditions.