Overview

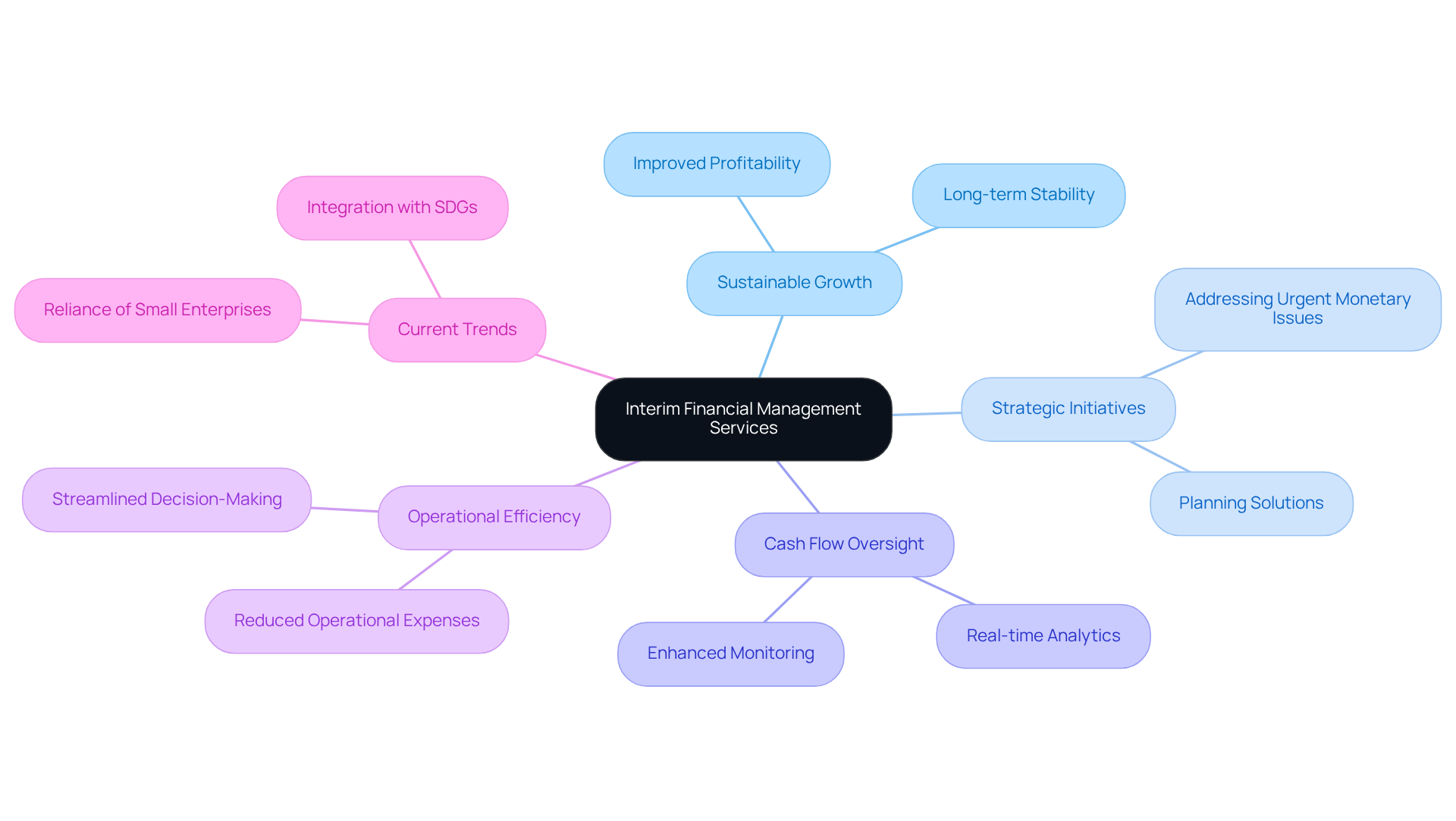

Interim financial management services offer significant advantages to small and medium enterprises by enhancing operational efficiency, improving cash flow management, and ensuring regulatory compliance. These services empower companies to leverage expert guidance for strategic decision-making and risk management. Consequently, they foster sustainable growth and long-term financial stability, making them an essential consideration for businesses aiming to thrive in a competitive landscape.

Introduction

Temporary financial management services have emerged as a transformative solution for small and medium enterprises striving to enhance their financial operations. By integrating experienced professionals into their teams, businesses can streamline processes, improve cash flow management, and ensure regulatory compliance, ultimately paving the way for sustainable growth.

Moreover, as companies navigate the complexities of today's economic landscape, the question arises: how can interim financial management services not only address immediate challenges but also position organizations for long-term success in an ever-evolving market?

Transform Your Small/ Medium Business: Streamline Financial Operations with Interim Management

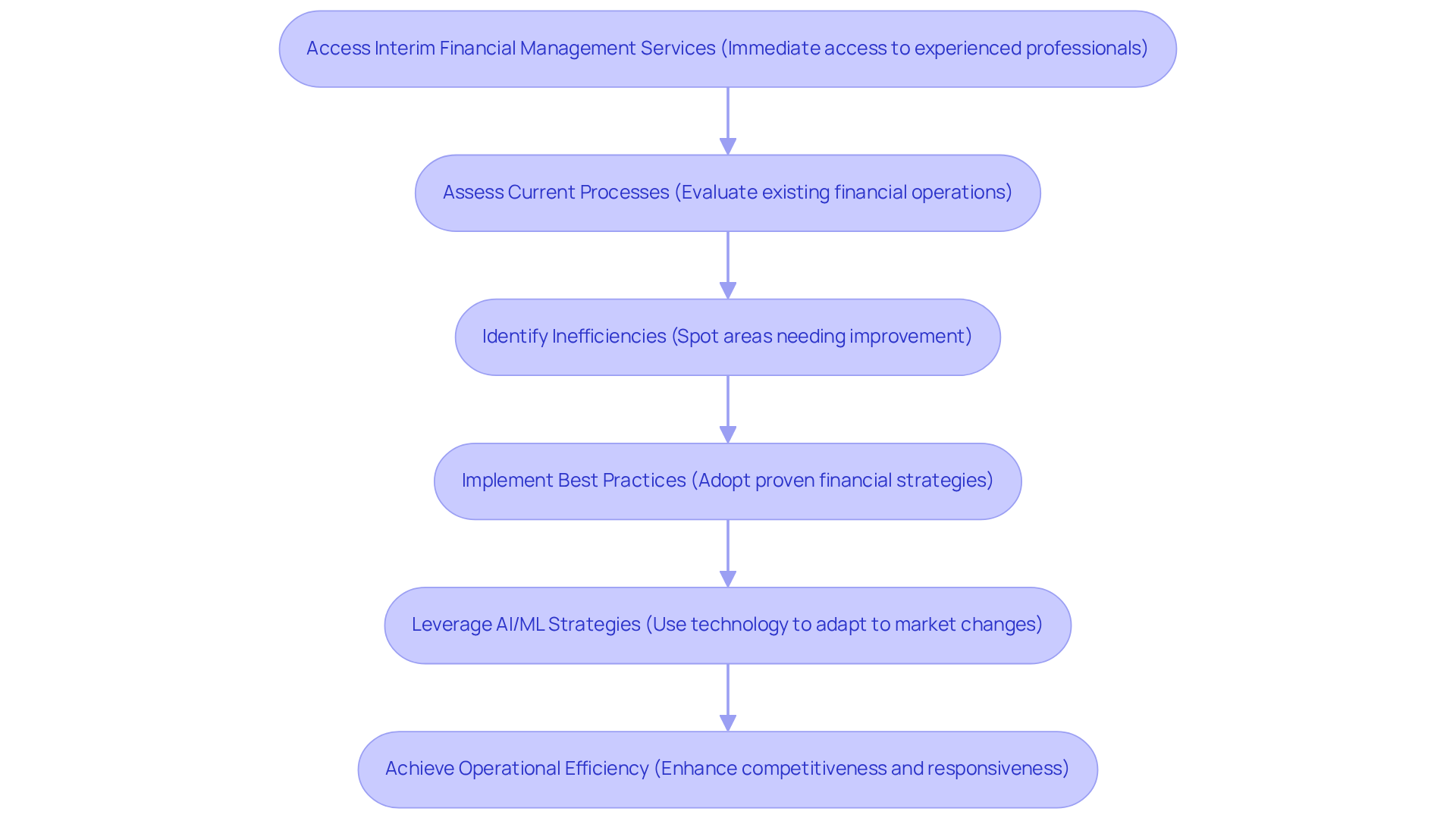

Temporary fiscal oversight services, specifically interim financial management services, can significantly transform small and medium enterprises by optimizing their monetary operations. These interim financial management services provide immediate access to experienced financial professionals who assess current processes, identify inefficiencies, and implement best practices.

Moreover, by leveraging temporary leadership alongside expert guidance from a Valuation Report, companies can utilize AI/ML strategies to swiftly adapt to changing market conditions. This approach not only enhances but also ensures that enterprises remain competitive and responsive to customer demands, ultimately propelling successful turnaround strategies.

Improved Cash Flow Management: Ensure Liquidity and Operational Stability

Interim financial management services are crucial for enhancing cash flow control, which is a fundamental aspect for small enterprises striving for operational stability. Interim financial management services involve interim managers who bring the expertise necessary to quickly assess cash flow patterns, identify bottlenecks, and implement effective strategies to improve liquidity. This proactive approach enables companies to meet operational costs, seize growth opportunities, and maintain stability during challenging periods.

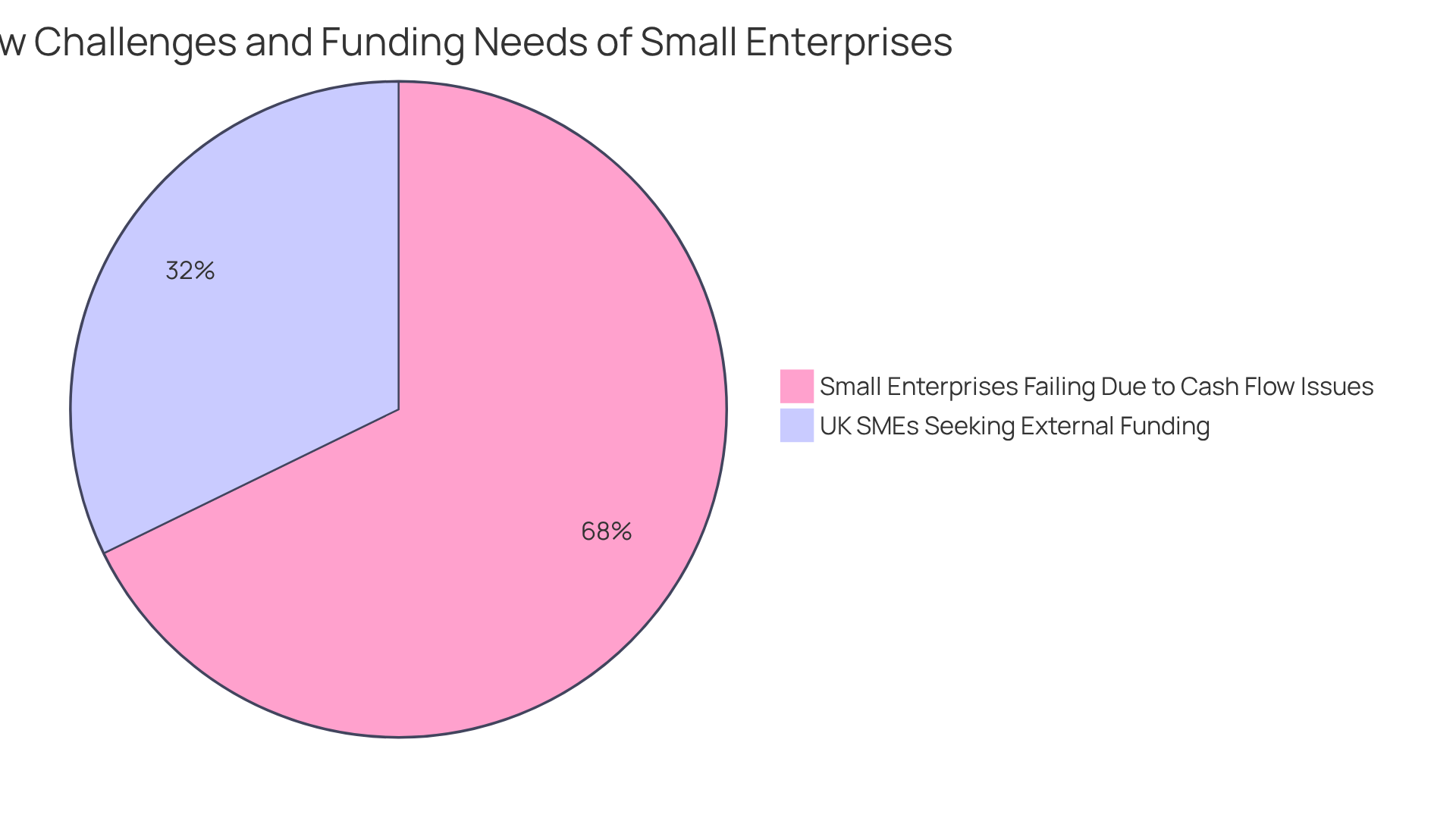

Given that 82% of small enterprises fail due to cash flow issues, effective cash flow oversight is not just beneficial; it is essential for sustaining operations and fostering long-term success. Recent trends indicate that many small enterprises are increasingly focused on liquidity, with 39% of UK SMEs seeking in 2022, highlighting the urgent need for robust cash flow strategies.

By utilizing interim financial management services, companies can tackle these challenges and enhance their economic resilience.

Regulatory Compliance Assurance: Navigate Financial Reporting Standards

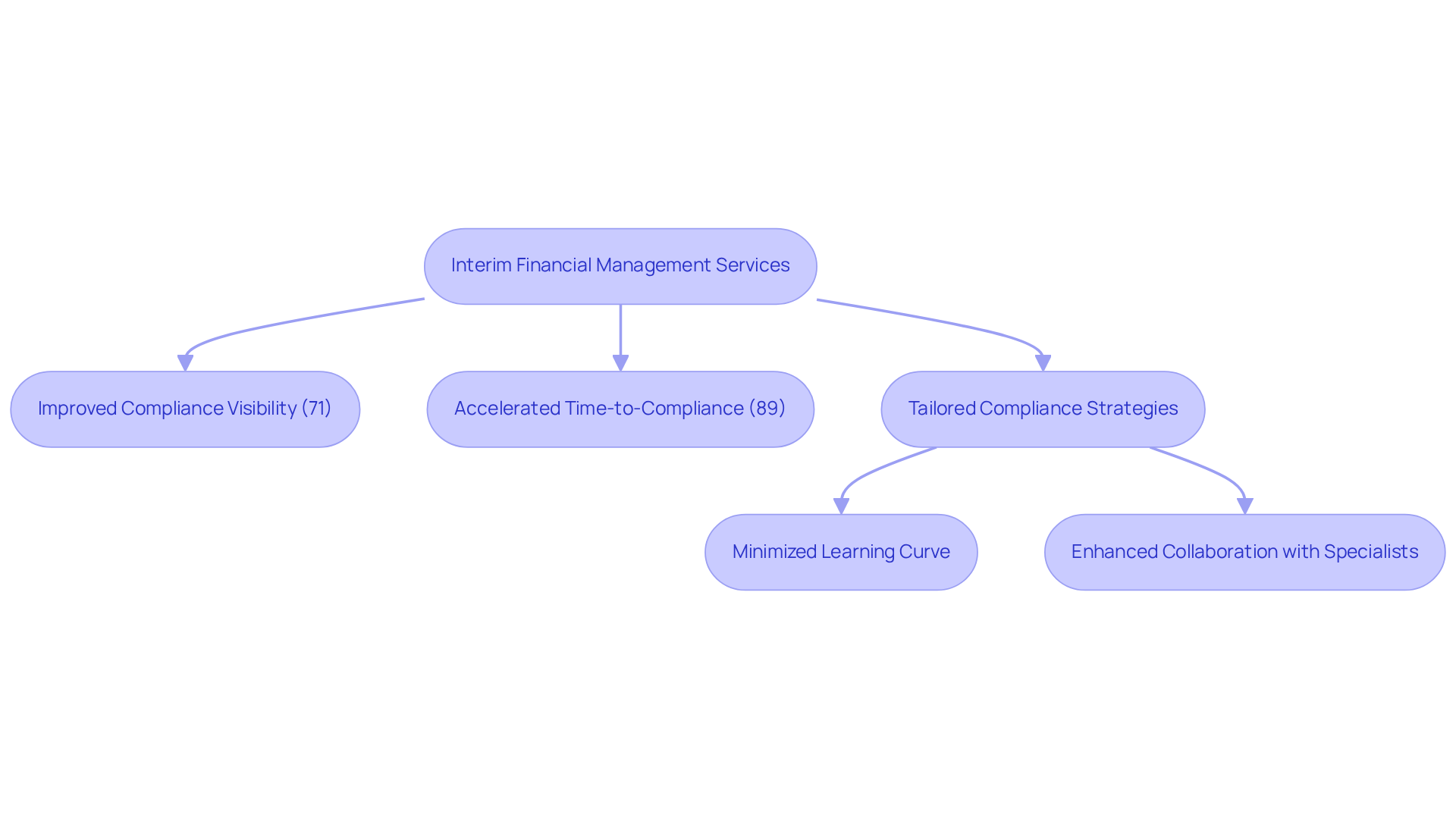

Interim financial management services are essential in ensuring regulatory compliance, particularly in navigating the complexities of financial reporting standards. Their specialized expertise in interim financial management services empowers organizations to effectively adhere to regulations, significantly reducing the risk of penalties while enhancing credibility with stakeholders. Companies employing temporary managers frequently observe improved visibility into their compliance situation, with 71% of organizations indicating such advantages. Moreover, 89% of users have accelerated their time-to-compliance across various frameworks, demonstrating the effectiveness of interim financial management services in optimizing compliance processes. This assurance of compliance enables companies to focus on growth and innovation, free from the distractions of potential legal issues.

Furthermore, interim financial management services provided by temporary managers excel at addressing the current compliance challenges faced by small and medium enterprises (SMEs), such as the increasing complexity of regulatory frameworks. By implementing tailored strategies, they offer interim financial management services to assist organizations in optimizing their monetary processes and ensuring compliance with evolving standards. Their specialized expertise from day one minimizes the learning curve, allowing for an immediate impact on compliance efforts. This proactive approach not only mitigates risks but also that can lead to long-term success. Legal compliance is viewed as an investment in sustainable growth rather than merely a cost. Additionally, temporary managers collaborate with multidisciplinary specialists, providing extensive support that enhances the overall compliance framework.

Expert Financial Oversight: Leverage Professional Experience for Better Decision-Making

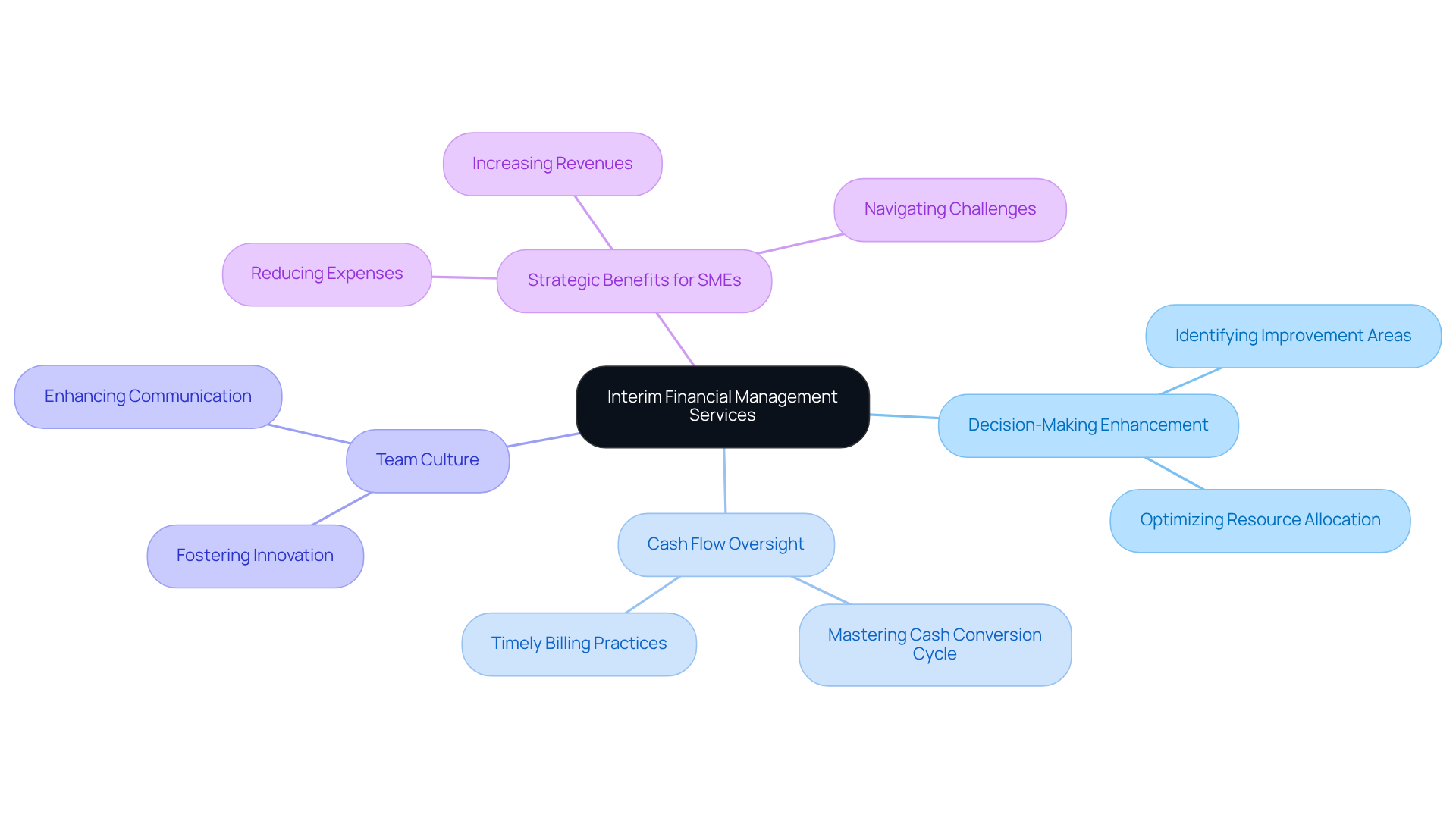

Interim financial management services offer companies essential access to specialized economic guidance during critical times through temporary fiscal oversight. These professionals, equipped with extensive experience and specialized knowledge, significantly enhance decision-making capabilities. Their insights empower organizations to identify areas for improvement, optimize resource allocation, and develop strategies that align with long-term objectives, including mastering the cash conversion cycle.

By implementing effective cash flow oversight strategies, temporary leaders play a crucial role in enhancing overall performance. Moreover, they foster a finance team culture that embraces change and innovation, which is vital for success in today’s dynamic environment. They also improve communication and collaboration among teams during transitions, ensuring that all departments work cohesively towards common goals. This approach not only promotes better decision-making but also ensures that remain robust and adaptable to evolving circumstances.

Customized specifically for small to medium enterprises, interim financial management services assist organizations in reducing expenses, optimizing operations, and increasing revenues. By swiftly identifying fundamental organizational issues and initiating transformative change, temporary leaders enable entities to navigate challenges and seize opportunities effectively.

Effective Risk Management: Mitigate Financial Risks and Enhance Stability

Interim financial management services are essential for crafting effective risk control strategies that empower companies to mitigate monetary risks. Through comprehensive financial evaluations, temporary managers can identify opportunities to , which is vital for maintaining economic stability. This proactive approach not only protects assets but also fosters a culture of risk awareness within the organization, crucial for long-term sustainability.

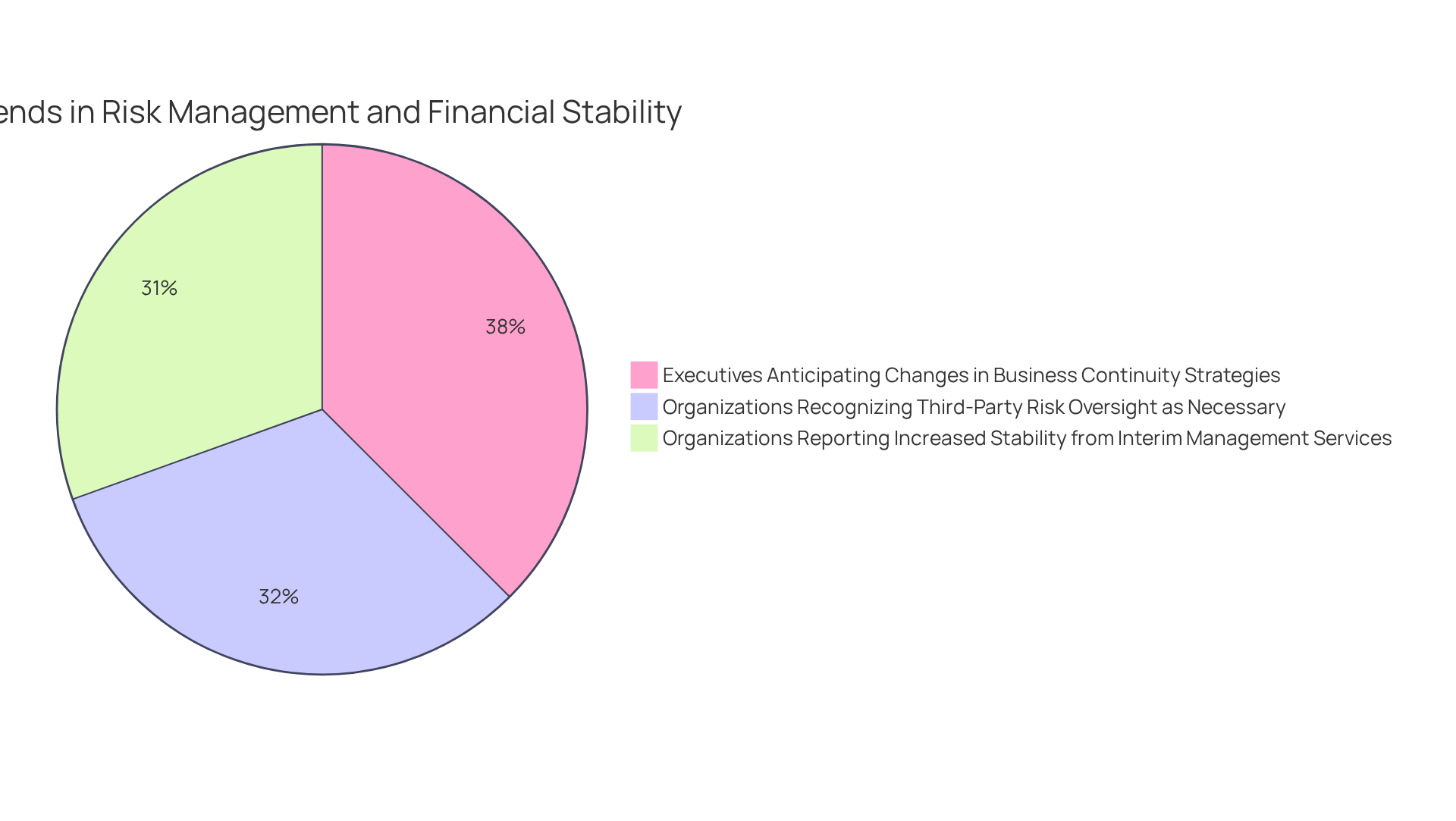

Current trends indicate that:

- 75% of executives anticipate significant changes in business continuity strategies and crisis response, underscoring the need to adapt risk management practices to emerging challenges.

- Organizations that have embraced interim financial management services report increased economic stability and improved decision-making capabilities, which highlights the tangible benefits of these services in navigating complex economic landscapes.

- 64% of organizations recognize third-party risk oversight as a strategic necessity, leading to temporary managers being increasingly tasked with overseeing these relationships to effectively mitigate associated risks.

By leveraging their expertise, temporary managers address urgent financial issues while laying the groundwork for sustainable growth and operational excellence.

Agility in Financial Strategy: Adapt to Market Changes with Interim Services

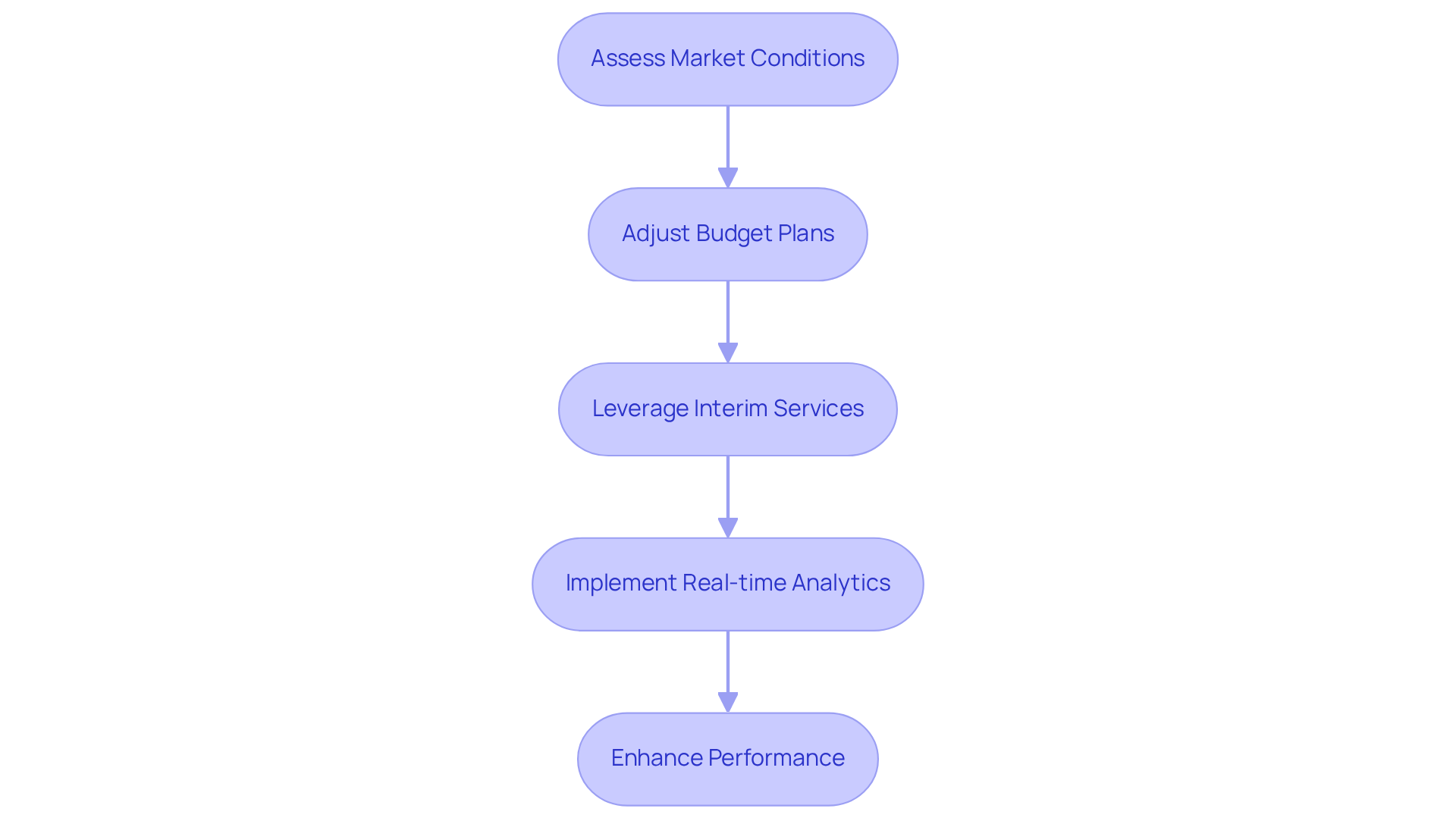

Temporary fiscal management significantly enhances an organization's flexibility in navigating monetary strategies. By swiftly assessing market conditions and adjusting budget plans, temporary managers empower organizations to effectively respond to fluctuations in demand, competition, and economic influences. This adaptability is crucial for sustaining a and achieving long-term success in an increasingly dynamic marketplace.

For instance, GPV reported a 13% decline in sales for Q3 2024, highlighting the challenges companies face in a rebalancing market. In this context, organizations can leverage interim services to streamline operations and boost economic performance through rigorous hypothesis testing and real-time analytics. Such proactive measures not only conserve cash but also mitigate liabilities, positioning companies for recovery and growth amid challenging circumstances.

As Bo Lybæk, CEO of GPV, noted, "We are in a unique situation where the market is rebalancing," underscoring the need for companies to recalibrate their strategies accordingly. By operationalizing lessons learned throughout the turnaround process, organizations can make swifter decisions that enhance their overall performance.

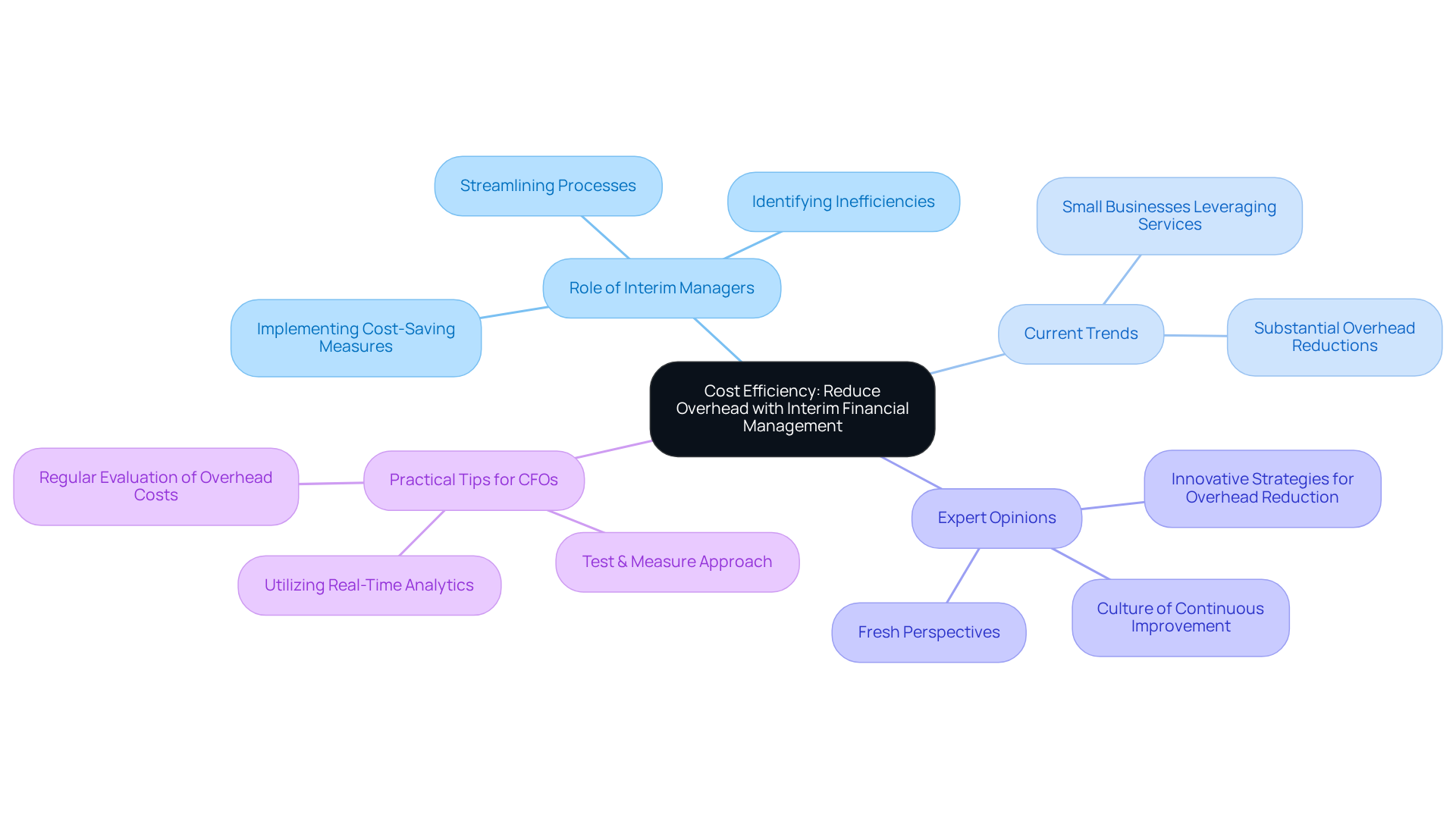

Cost Efficiency: Reduce Overhead with Interim Financial Management

Achieving significant cost efficiency by reducing overhead expenses is crucially supported by interim financial management services. By streamlining processes and eliminating unnecessary expenditures, companies can reallocate resources to areas that drive growth. Our team will identify underlying operational issues and collaboratively develop a plan to mitigate weaknesses, enabling reinvestment in key strengths. Interim managers excel at pinpointing inefficiencies and implementing cost-saving measures that enhance both the bottom line and operational efficiency. This dual focus empowers organizations to thrive even in challenging economic climates.

Current trends indicate that small businesses increasingly leverage interim financial management services to navigate financial uncertainties, with many reporting substantial overhead reductions through targeted interventions. Expert opinions suggest that temporary managers offer a fresh perspective, fostering innovative strategies for overhead reduction while cultivating a culture of continuous improvement and adaptability. To enhance returns on investment, CFOs should consistently , utilize real-time analytics for performance tracking, and consider temporary leadership as a viable solution for ongoing enhancements.

A practical tip for CFOs is to adopt a 'Test & Measure' approach, regularly testing hypotheses related to cost-saving initiatives to ensure maximum effectiveness.

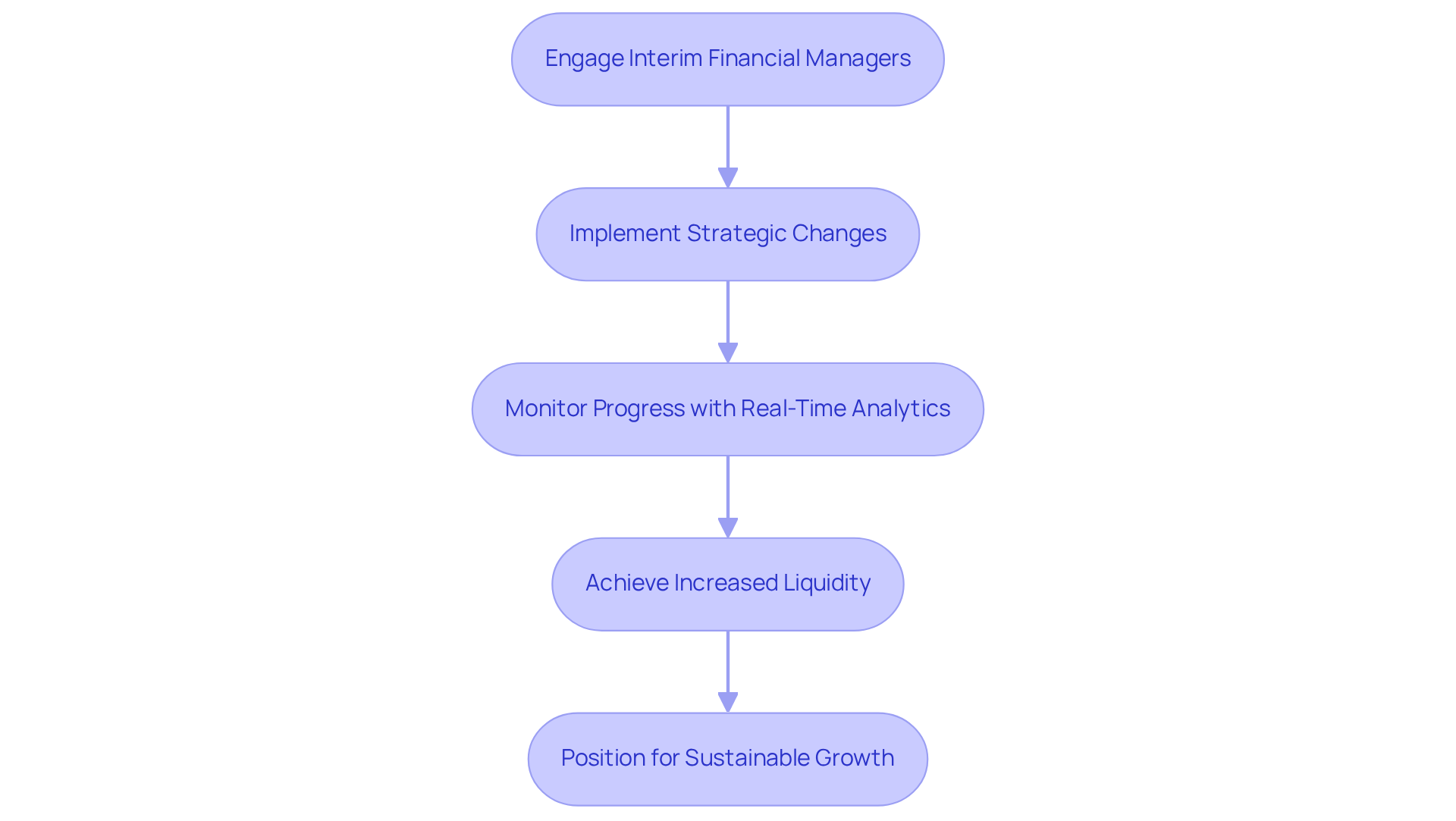

Business Turnaround Support: Drive Transformation with Interim Management

Temporary resource management through interim financial management services is essential for facilitating company turnarounds. Experts in this field excel at spearheading transformation initiatives that tackle fundamental issues and foster recovery. Their strategic approach encompasses not only the implementation of necessary changes but also the vigilant monitoring of progress through to guarantee effectiveness.

For instance, a mid-sized company that engaged temporary financial managers saw a remarkable 40% increase in liquidity within the first year, illustrating the tangible benefits of such expertise. Moreover, current trends indicate that companies facing challenges are increasingly relying on interim financial management services to navigate crises, as these services provide professionals who bring a wealth of experience and a fresh perspective.

By leveraging technology-enabled consulting services, temporary managers can streamline operations and enhance decision-making processes, ultimately positioning organizations for sustainable growth. Their capacity to identify opportunities for cash preservation and liability reduction is vital in today’s volatile market, rendering them indispensable partners for companies striving to emerge stronger from adversity.

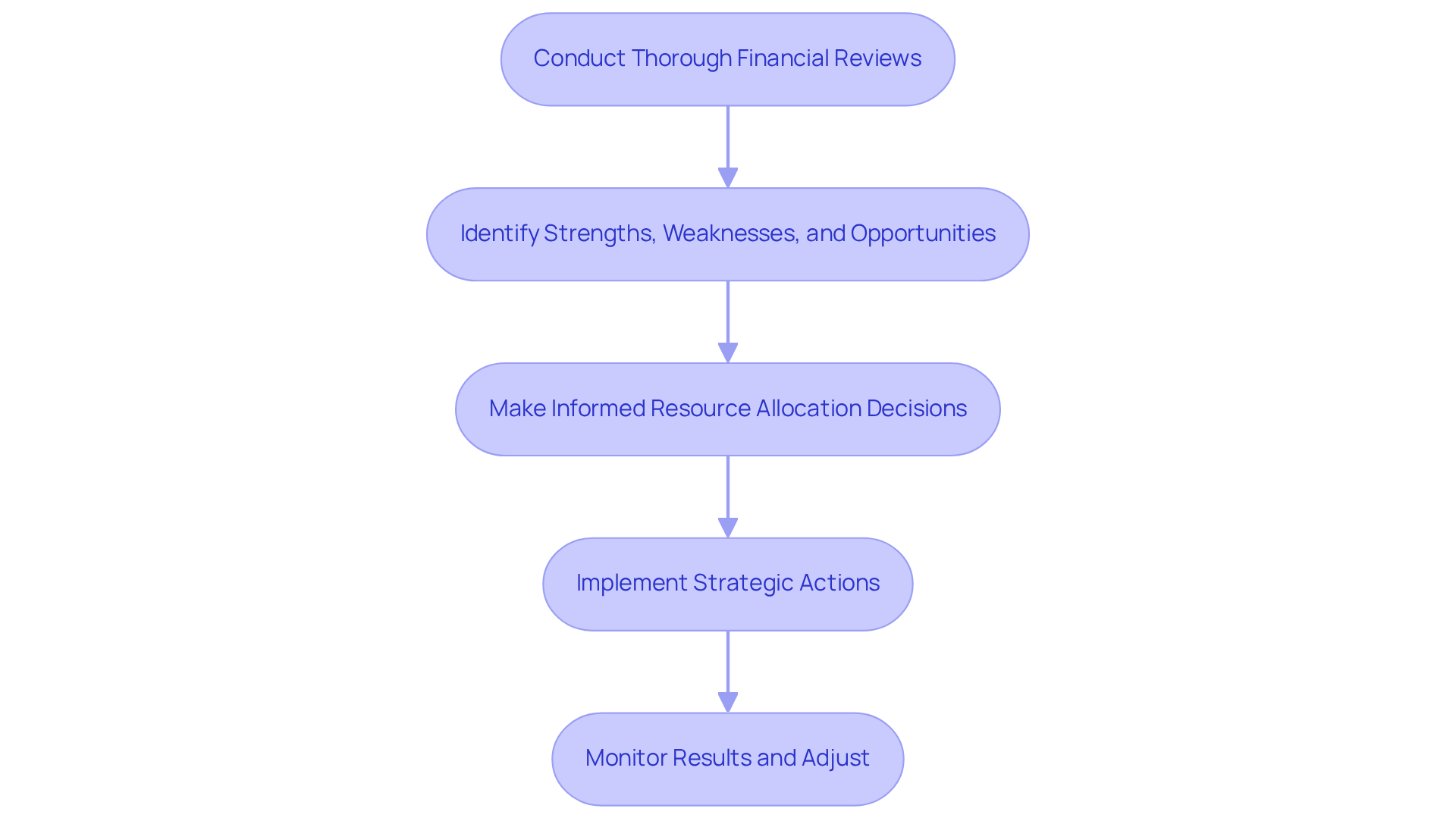

Focused Financial Assessments: Enhance Strategic Planning and Resource Allocation

Interim financial management services deliver targeted evaluations that significantly enhance strategic planning and resource allocation. By conducting thorough reviews of financial data, temporary managers identify strengths, weaknesses, and opportunities for improvement. This focused approach empowers businesses to make , ensuring that investments align with strategic objectives and effectively drive growth.

For instance, a major retail chain successfully avoided bankruptcy and returned to profitability within 18 months by implementing operational changes that optimized resource allocation. Similarly, a global manufacturing firm achieved a 20% increase in production efficiency within six months through strategic actions by temporary managers. These examples underscore the importance of utilizing interim financial management services to enhance resource distribution strategies, ultimately promoting sustainable growth.

Interim managers, often under intense pressure to deliver rapid results, play a crucial role in navigating these challenges. They facilitate a shortened decision-making cycle throughout the turnaround process, enabling teams to take decisive action. As conventional monthly and quarterly reports become outdated, the necessity for real-time assessments in strategic planning becomes paramount.

Christina Ross emphasizes the significance of understanding essential statistics within finance team frameworks, further highlighting the importance of interim financial management services in today’s dynamic business landscape.

Sustainable Growth: Achieve Long-Term Financial Stability with Interim Services

Interim financial management services play a pivotal role in driving sustainable growth and establishing long-term stability. By addressing urgent monetary issues and executing strategic initiatives, temporary managers deliver interim financial management services that lay a solid groundwork for future success. Their expertise in interim financial management services, along with operational efficiency and strategic planning, empowers organizations to effectively navigate obstacles and seize growth opportunities. Organizations that have utilized interim financial management services frequently report improved cash flow oversight and reduced operational expenses, leading to increased profitability.

Current trends indicate that small enterprises increasingly rely on interim financial management services to adapt to the evolving economic landscape, ensuring they remain competitive and resilient. Furthermore, as 53% of income for the top 500 U.S. corporations arises from activities aligned with Sustainable Development Goals (SDGs), the integration of interim financial management services becomes essential for aligning financial strategies with broader sustainability objectives. This proactive approach not only mitigates risks but also positions businesses for in a rapidly changing market by implementing interim financial management services.

By identifying underlying issues and planning solutions, interim financial management services facilitate streamlined decision-making and leverage real-time analytics to continuously monitor performance. This ensures that lessons learned during the turnaround process are operationalized for ongoing improvement in interim financial management services. Additionally, the 'Test & Measure' approach enables organizations to validate their strategies and optimize investment returns, reinforcing the significance of data-driven decision-making in achieving financial stability with the help of interim financial management services.

Conclusion

Interim financial management services stand as a transformative solution for small and medium enterprises, delivering the expertise essential for optimizing financial operations and driving sustainable growth. By integrating temporary fiscal oversight with strategic insights, organizations can enhance their cash flow management, ensure regulatory compliance, and adapt swiftly to market changes, ultimately positioning themselves for long-term success.

Key benefits of these services include:

- Improved cash flow management

- Effective risk mitigation

- Enhanced decision-making capabilities

Interim managers not only bring specialized knowledge but also cultivate a culture of innovation and accountability, empowering businesses to navigate challenges and seize opportunities effectively. Moreover, their role in facilitating business turnarounds and ensuring compliance with evolving regulations is critical and cannot be understated.

Embracing interim financial management services transcends a mere tactical choice; it emerges as a strategic imperative for organizations aspiring to thrive in a competitive landscape. By leveraging the expertise of temporary financial leaders, businesses can achieve operational efficiency, make informed decisions, and ultimately secure a stable financial future. Investing in these services today lays the groundwork for sustainable growth, ensuring that companies are well-equipped to face the uncertainties of tomorrow.

Frequently Asked Questions

What are interim financial management services?

Interim financial management services provide temporary fiscal oversight by experienced financial professionals who assess current processes, identify inefficiencies, and implement best practices to optimize monetary operations for small and medium enterprises.

How can interim financial management services improve cash flow management?

These services enhance cash flow control by allowing interim managers to quickly assess cash flow patterns, identify bottlenecks, and implement effective strategies to improve liquidity, ensuring operational stability and the ability to seize growth opportunities.

Why is cash flow management critical for small enterprises?

Cash flow management is essential as 82% of small enterprises fail due to cash flow issues. Effective oversight enables companies to meet operational costs and maintain stability, particularly during challenging periods.

How do interim financial management services help with regulatory compliance?

They ensure adherence to financial reporting standards, reducing the risk of penalties and enhancing credibility with stakeholders. Their specialized expertise allows for improved visibility into compliance situations and faster time-to-compliance.

What advantages do companies gain from using interim financial management services for compliance?

Companies often observe improved compliance visibility, with 71% indicating advantages in their compliance situation, and 89% accelerating their time-to-compliance, thus allowing them to focus on growth and innovation without legal distractions.

How do interim managers address the complexities of regulatory frameworks?

Interim managers implement tailored strategies to help organizations navigate evolving standards, minimizing the learning curve and allowing for an immediate impact on compliance efforts, which cultivates a culture of compliance for long-term success.

What is the overall impact of utilizing interim financial management services on small and medium enterprises?

These services enhance operational efficiency, improve cash flow management, ensure regulatory compliance, and ultimately help enterprises remain competitive and responsive to customer demands while fostering economic resilience.