Overview

This article presents a systematic approach to mastering the financial risk assessment matrix, focusing on the critical processes of identifying, evaluating, and prioritizing financial risks according to their likelihood and potential impact.

By detailing eight essential steps—such as defining risk scales, calculating risk ratings, and customizing the matrix to align with an organization's unique context—it ensures effective risk management and informed decision-making.

This structured methodology not only enhances understanding but also empowers organizations to take decisive action in mitigating financial risks.

Introduction

Understanding financial risk is crucial for organizations navigating the complexities of today's economic landscape. The financial risk assessment matrix is a vital tool that enables businesses to categorize and prioritize risks based on their likelihood and potential impact. By mastering this matrix, organizations can enhance their decision-making processes and safeguard their financial stability. However, with various uncertainties lurking in the shadows, how can businesses effectively identify, evaluate, and mitigate these risks to ensure long-term success?

Understand the Financial Risk Assessment Matrix

The financial risk assessment matrix acts as a crucial visual tool that enables organizations to categorize and prioritize risks according to their likelihood and potential impacts. Typically, it consists of a grid where one axis represents the likelihood of a hazard occurring, while the other axis signifies the severity of its impact. Understanding the financial risk assessment matrix is essential for businesses aiming to effectively navigate financial uncertainties and make informed decisions. It is imperative to become familiar with key terms such as:

- likelihood

- impact

- rating

as these concepts will be integral throughout the assessment process.

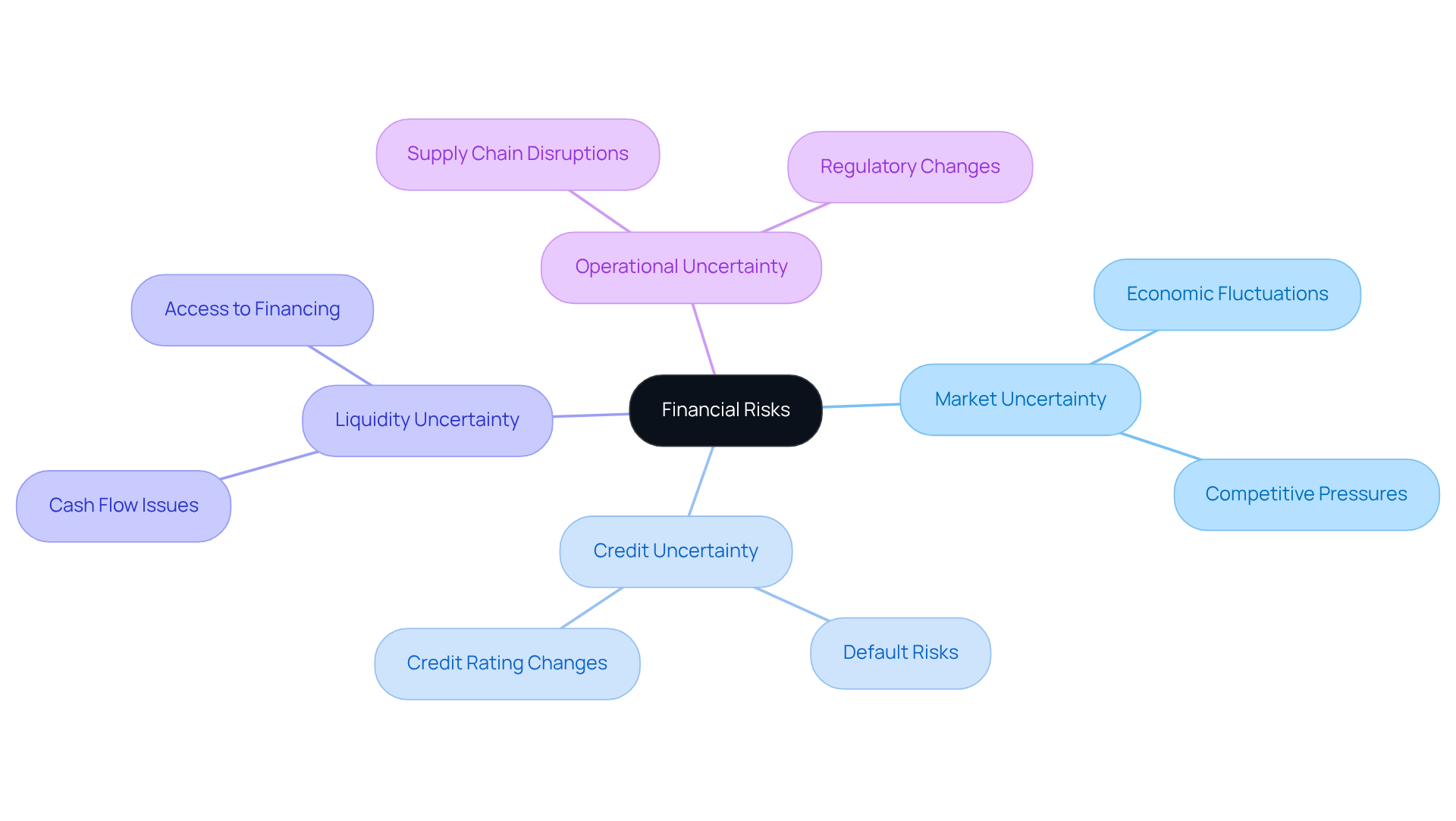

Identify Financial Risks

Commence with a comprehensive assessment of your business activities and financial records. Involve key stakeholders in collaborative brainstorming sessions to pinpoint potential challenges. Organizations frequently encounter various financial uncertainties, including:

- Market uncertainty

- Credit uncertainty

- Liquidity uncertainty

- Operational uncertainty

To foster in-depth discussions and guarantee that all uncertainties are acknowledged, employ analytical tools such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats). It is crucial to document all identified risks for future evaluation, as this will provide a solid foundation for your financial risk assessment matrix.

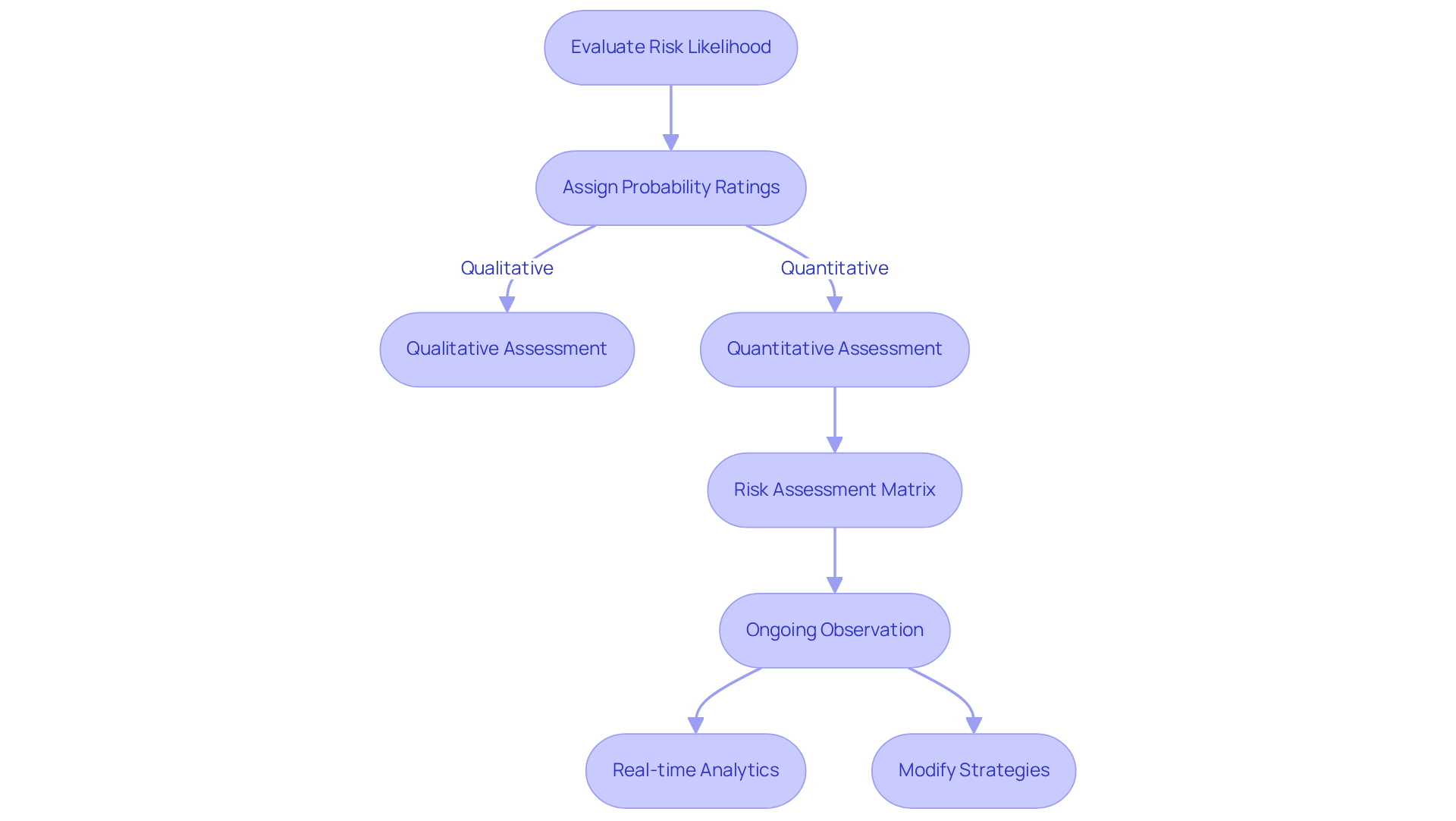

Evaluate Risk Likelihood

To effectively assess the likelihood of each identified financial threat, it is essential to assign a probability rating based on historical data, expert judgment, and industry benchmarks. Utilizing a scale—such as low, medium, and high—can help categorize the likelihood of occurrence. Factors to consider include market trends, economic conditions, and internal business processes. For instance, historical data indicates that the annual loss expectancy (ALE) for software can reach up to $25,000, while hardware losses can amount to $100,000.

Incorporating both qualitative and quantitative assessment techniques is essential for a thorough evaluation. Qualitative threat assessment offers a scenario-based method to identify uncertainties needing detailed examination, while quantitative threat evaluation assigns objective numerical values to gauge potential loss and results. As Volkan Evrin states, "The purpose of a quantitative threat analysis is to translate the probability and impact of a danger into a measurable quantity." This evaluation procedure not only helps in prioritizing dangers based on their potential frequency but also enables a more strategic emphasis on the most urgent threats. By combining qualitative evaluations with quantitative information, organizations can improve their management strategies and utilize a financial risk assessment matrix to make informed choices that reduce monetary exposure.

Moreover, it is vital to support a streamlined decision-making cycle throughout this process. Ongoing observation of these threats via real-time analytics, supported by our client dashboard, allows organizations to modify strategies as needed, thereby ensuring continual financial stability through the use of a financial risk assessment matrix. Employing instruments that offer immediate business analytics can assist in assessing the condition of the business and enable prompt modifications to management strategies.

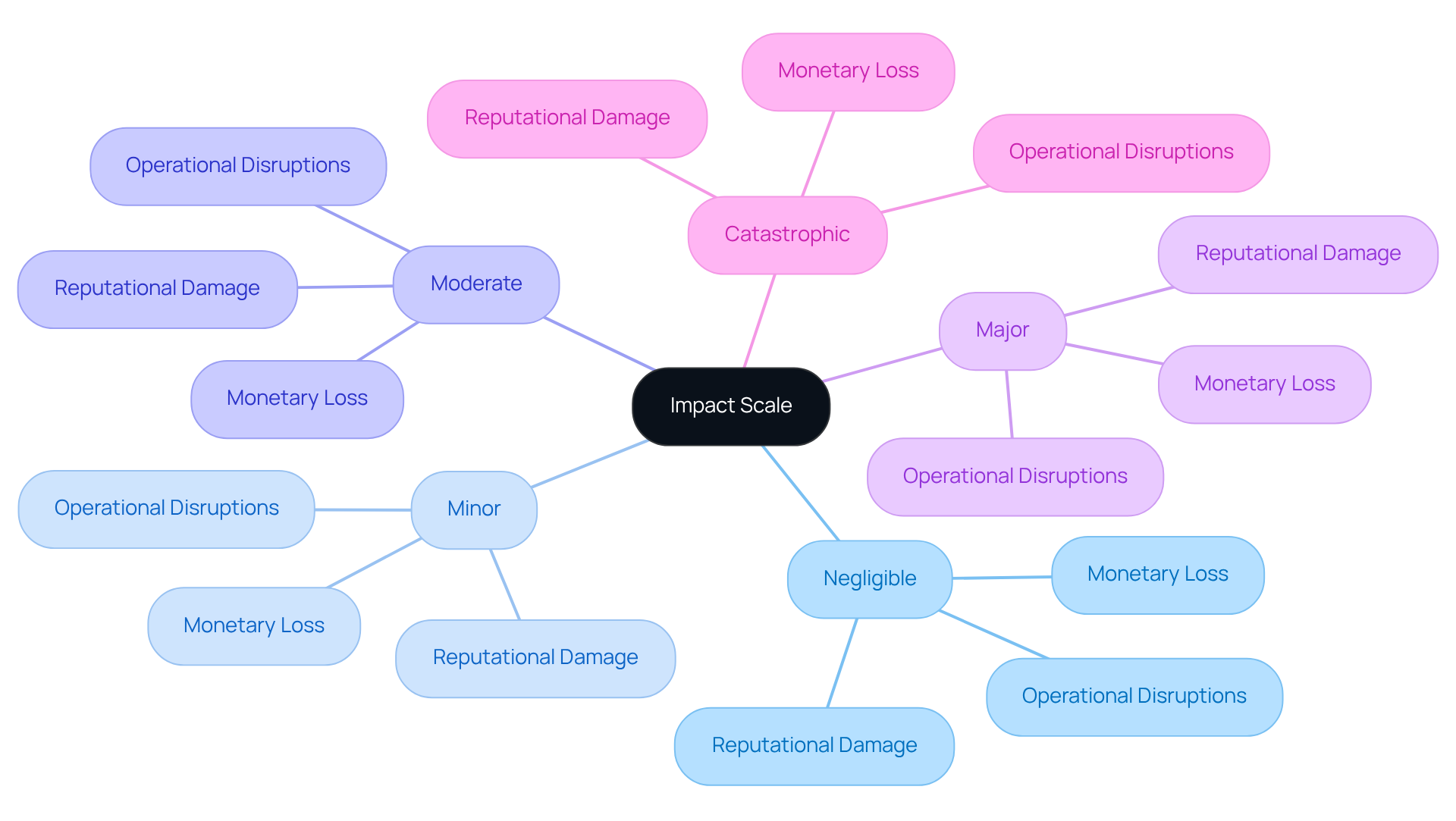

Define Impact Scale

Creating a consequence scale is essential for classifying the potential results of identified risks within a financial risk assessment matrix. This scale should encompass a range from negligible to catastrophic, reflecting the severity of impacts on your business. Key factors to consider include monetary loss, reputational damage, and operational disruptions. For instance, a study showed that companies that do not evaluate uncertainties properly can face financial losses averaging 20% of their yearly income due to unexpected occurrences. Clearly specifying each tier of influence guarantees uniformity in evaluations, facilitating a more organized method of managing uncertainties. This influence scale will operate alongside likelihood ratings and the financial risk assessment matrix to derive overall risk ratings, thereby facilitating informed decision-making. Categories of impact may include:

- Negligible: Minimal impact, no significant financial loss or operational disruption.

- Minor: Limited monetary loss, slight reputational damage, manageable operational disruptions.

- Moderate: Noticeable monetary loss, moderate reputational damage, and some operational challenges.

- Major: Significant monetary loss, serious reputational damage, and substantial operational disruptions.

- Catastrophic: Severe monetary loss, critical reputational damage, and complete operational failure.

Practical examples demonstrate the significance of the financial risk assessment matrix; for instance, during the 2008 financial crisis, firms that utilized strong evaluation frameworks were better prepared to manage the turmoil, emphasizing the need for proactive management strategies. By establishing a clear evaluation scale, organizations can improve their assessment procedures and better prepare for possible challenges.

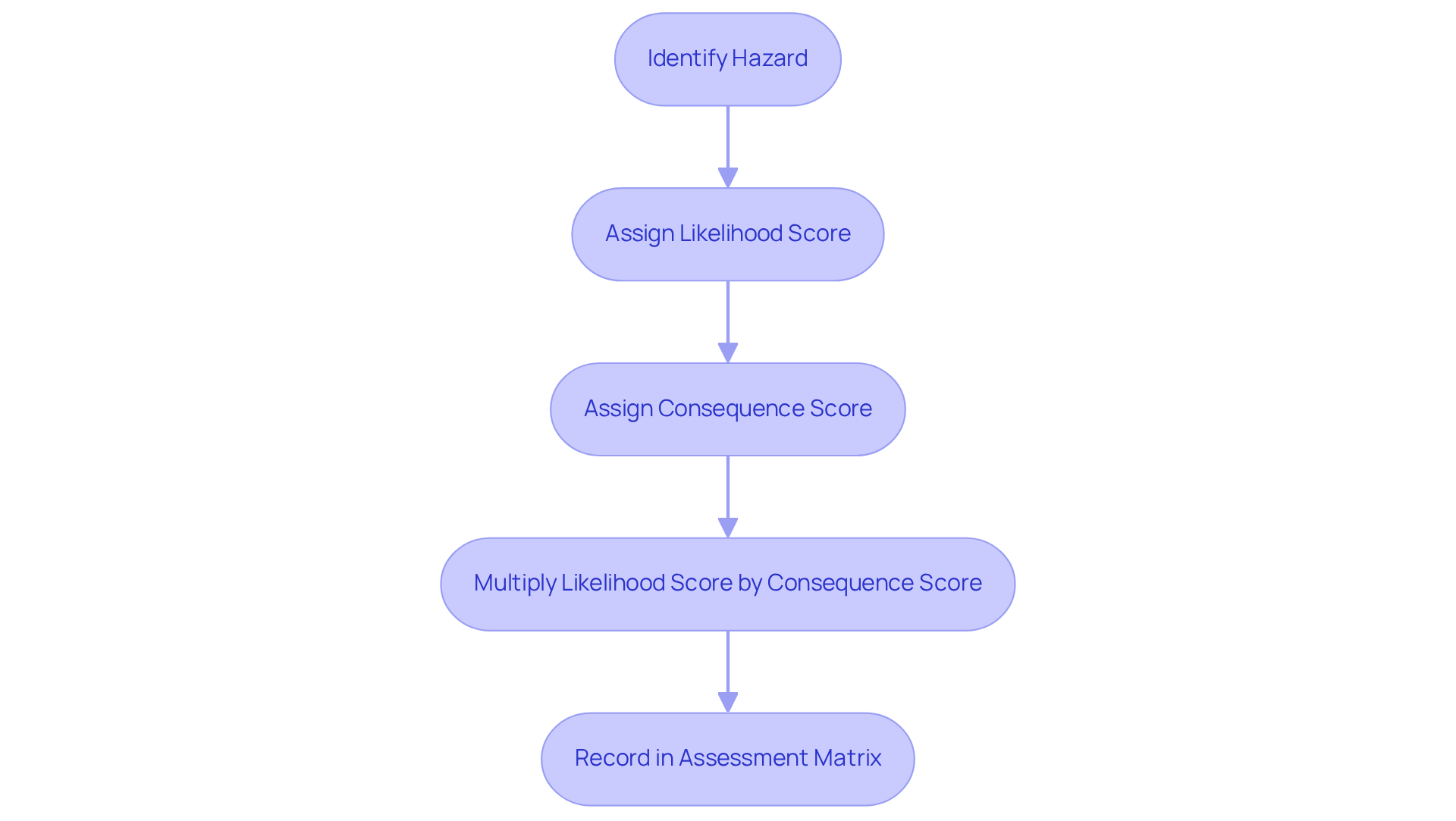

Calculate Risk Ratings

To determine risk scores, multiply the likelihood score by the consequence score for each identified hazard. For example, if a threat has a probability score of 3 (medium) and a consequence score of 4 (high), the resulting threat assessment would be 12. This numerical value is crucial for prioritizing hazards, as higher scores indicate more critical threats. Moreover, it is essential to record these evaluations in your assessment matrix for convenient reference.

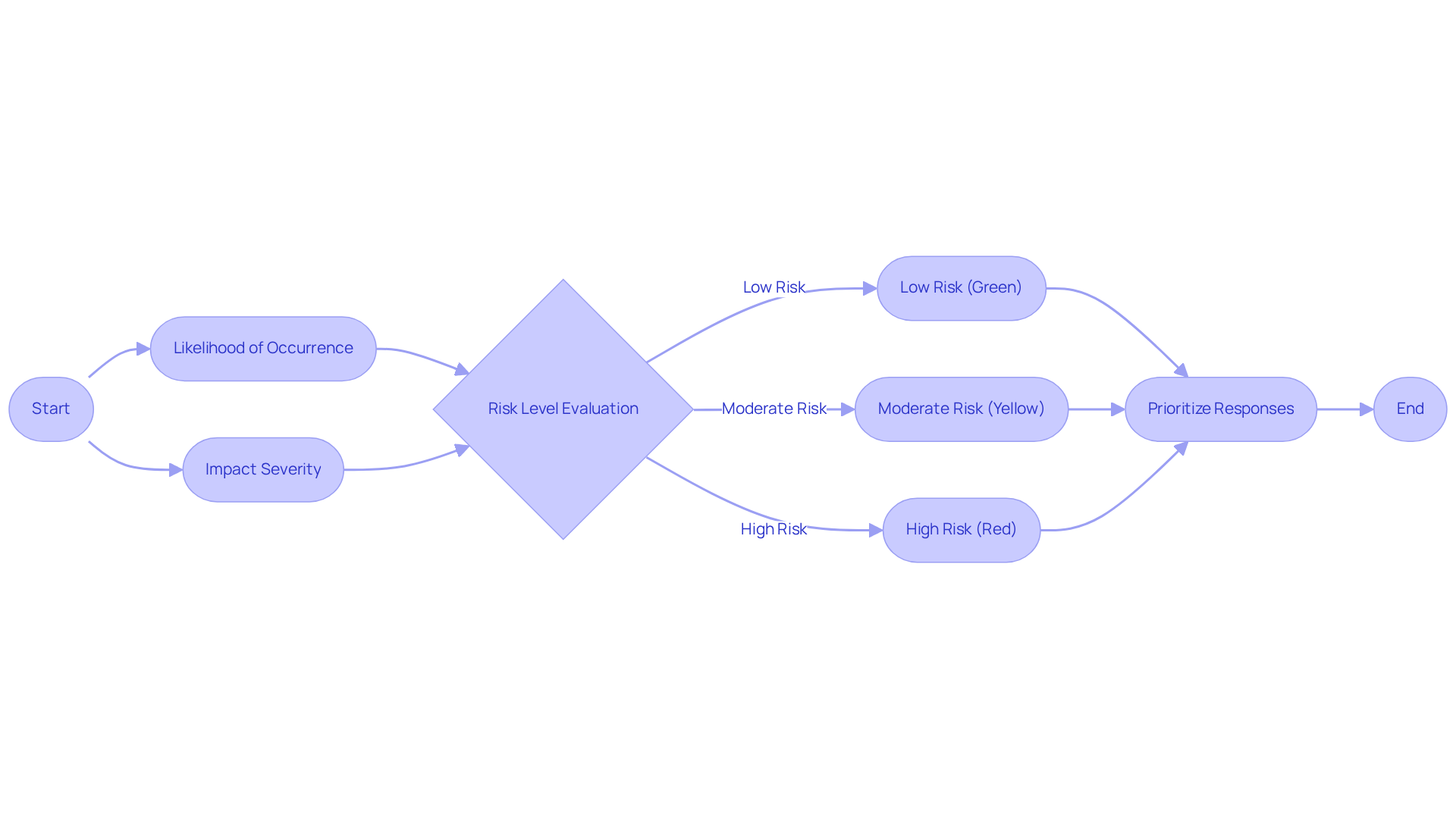

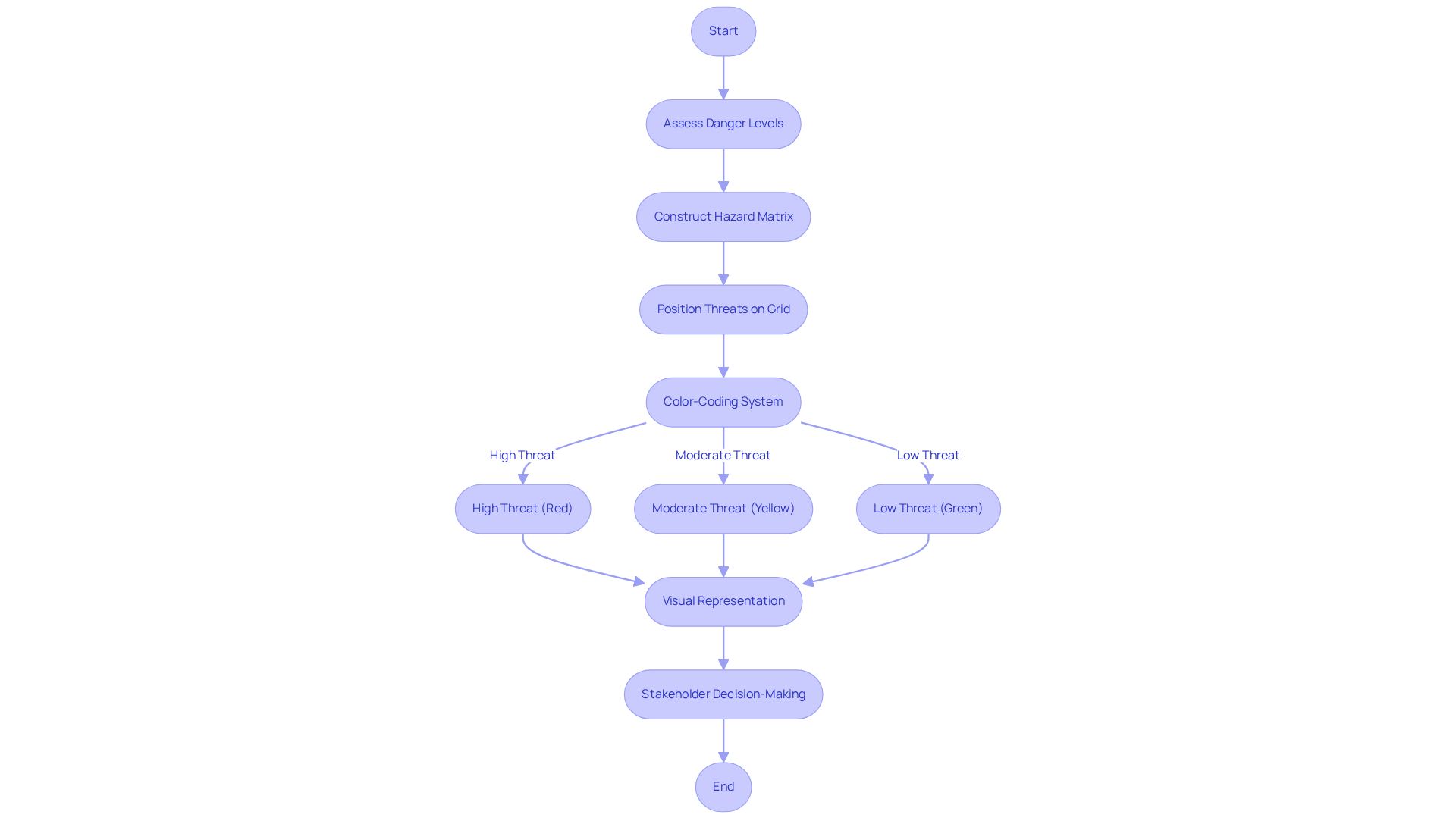

Draw Your Risk Matrix

Utilizing the assessed danger levels, construct your hazard matrix by positioning the identified threats on a grid. The x-axis should denote the likelihood of occurrence, while the y-axis reflects the potential impact. Place each threat in the appropriate quadrant according to its ratings.

To enhance clarity, implement a color-coding system:

- Red for high-threat areas

- Yellow for moderate dangers

- Green for low dangers

This visual representation elucidates the threat landscape, enabling stakeholders to swiftly comprehend the seriousness and distribution of dangers, thereby facilitating informed decision-making.

Furthermore, our client dashboard offers real-time business analytics, which supports a shortened decision-making cycle throughout the turnaround process. As Warren Buffett wisely noted, 'Risk comes from not knowing what you're doing.' By visualizing these challenges and leveraging real-time analytics, stakeholders are empowered to make bold decisions that can lead to both personal and organizational growth.

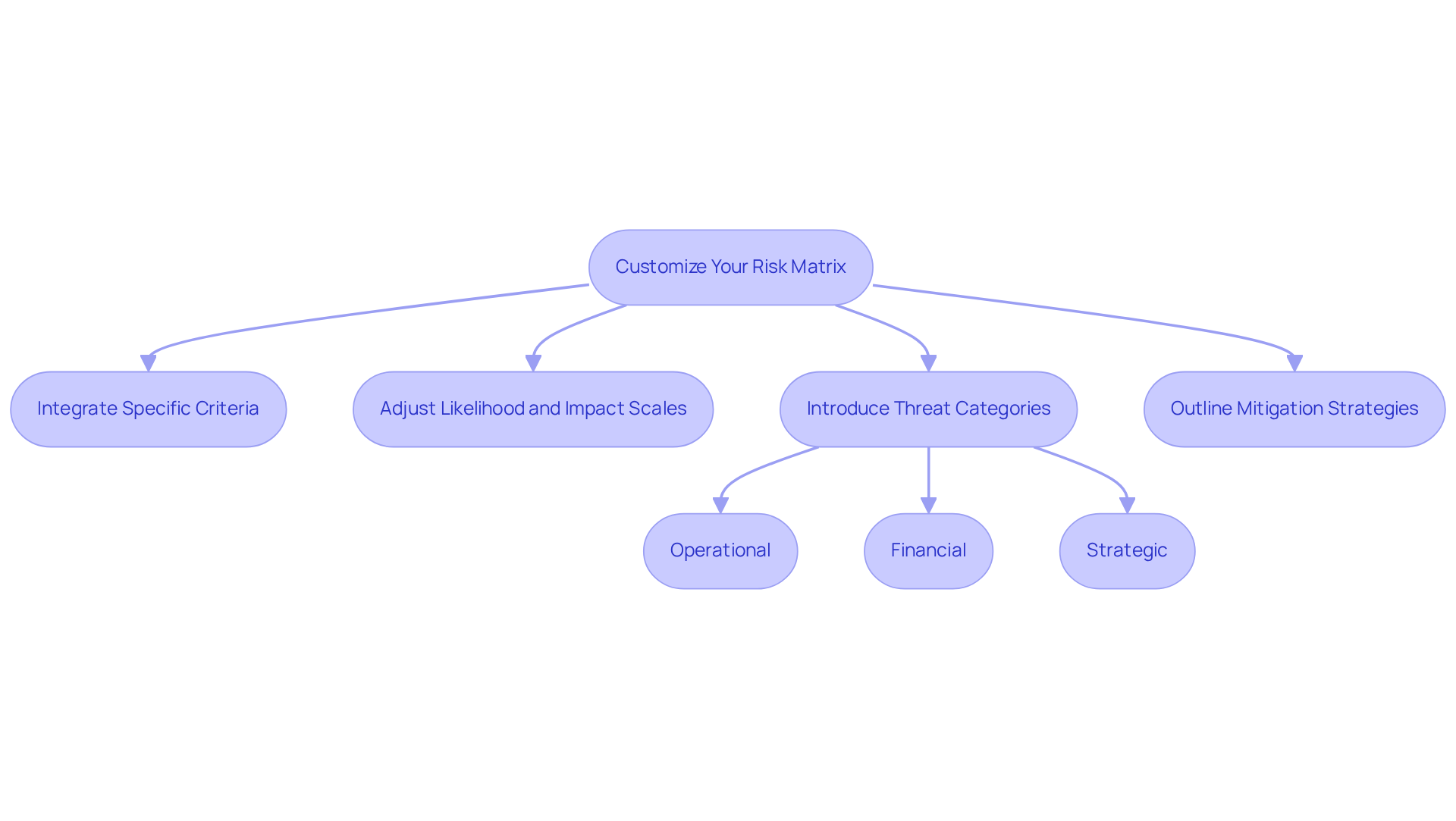

Customize Your Risk Matrix

Tailoring your financial risk assessment matrix is essential for an effective assessment of monetary uncertainties. Start by integrating specific criteria that resonate with your organization’s unique context, underscoring the significance of capital preservation as a primary objective. A thorough monetary assessment can help identify opportunities to retain cash and reduce liabilities, which should be incorporated into your financial risk assessment matrix.

Adjust the likelihood and impact scales to align with the realities of your operational environment, and consider introducing distinct categories for various types of threats, such as:

- Operational

- Financial

- Strategic

This will provide a holistic perspective. Additionally, outline mitigation strategies for each identified threat to bolster preparedness and avert significant losses, which are critical for long-term investment success.

Engaging stakeholders throughout this process is vital; their insights will ensure that the matrix accurately reflects the organization’s tolerance for uncertainty and operational dynamics. Furthermore, leverage technology-enabled consulting services, such as the Financial Assessment offered by Transform Your Small/Medium Business, to effectively tailor your approach.

As Peter Bernstein wisely noted, effective management of uncertainties involves making informed choices that protect against unforeseen challenges, ultimately leading to improved outcomes.

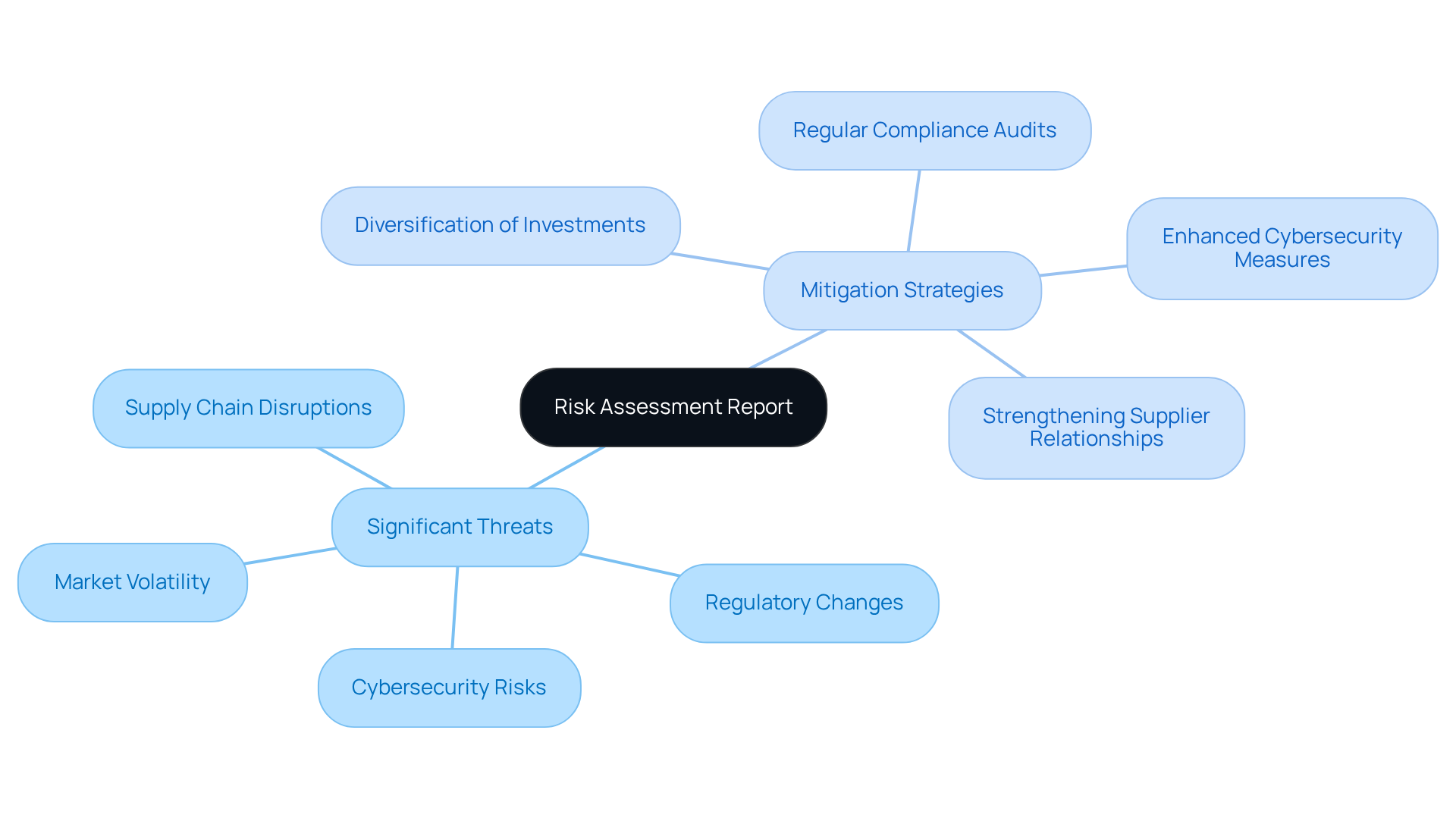

Visualize and Report Risks

Upon completing your assessment matrix, it is imperative to compile a comprehensive report that encapsulates the key findings. This report should feature visual representations of the matrix, highlighting the most significant threats alongside recommended mitigation strategies. Clear and concise language is essential to ensure that all stakeholders, irrespective of their expertise, can comprehend the content effectively. Regular updates to this report are vital to reflect any shifts in the threat landscape, fostering continuous dialogue with stakeholders.

For instance, small to medium enterprises have successfully utilized visual tools such as heat maps and dashboards to present data, simplifying the decision-making process for prioritizing actions. By visualizing risks through real-time analytics, you not only enhance understanding but also promote more informed discussions regarding risk management strategies. This methodology operationalizes the lessons learned during the turnaround process, enabling your team to make swift, data-driven decisions.

As Dianna Booher aptly states, "Clarity in communication comes from careful word choice and structure," underscoring the necessity of precision in your reporting.

Conclusion

Mastering the financial risk assessment matrix is a pivotal step for organizations aiming to navigate the complexities of financial uncertainties. This guide outlines a systematic approach to understanding and implementing this crucial tool, emphasizing the importance of categorizing and prioritizing risks based on their likelihood and potential impacts. By effectively utilizing the financial risk assessment matrix, businesses can enhance their decision-making processes and safeguard their financial health.

Key insights discussed include:

- The necessity of identifying financial risks through comprehensive assessments.

- Evaluating the likelihood of these risks.

- Defining an impact scale that reflects potential consequences.

- Calculating risk ratings.

- Constructing a clear risk matrix.

- Customizing it to meet the unique needs of an organization.

- Engaging stakeholders and leveraging technology to enrich the assessment process.

Ultimately, the financial risk assessment matrix not only serves as a visual representation of risks but also empowers organizations to make informed, data-driven decisions. By embracing this methodology, stakeholders can foster a proactive approach to risk management, paving the way for sustainable growth and resilience in the face of unforeseen challenges. Taking action to implement these strategies today can significantly enhance an organization’s ability to thrive amidst financial uncertainties.

Frequently Asked Questions

What is the financial risk assessment matrix?

The financial risk assessment matrix is a visual tool that helps organizations categorize and prioritize risks based on their likelihood of occurrence and the severity of their potential impacts.

Why is it important to understand the financial risk assessment matrix?

Understanding the financial risk assessment matrix is essential for businesses to navigate financial uncertainties effectively and to make informed decisions.

What key terms should one be familiar with when using the financial risk assessment matrix?

Key terms to understand include likelihood, impact, and rating, as these concepts are integral to the assessment process.

How can organizations identify financial risks?

Organizations can identify financial risks by conducting a comprehensive assessment of their business activities and financial records, and by involving key stakeholders in collaborative brainstorming sessions.

What types of financial uncertainties do organizations commonly encounter?

Common financial uncertainties include market uncertainty, credit uncertainty, liquidity uncertainty, and operational uncertainty.

What analytical tools can be used to facilitate discussions about financial risks?

Analytical tools such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can be employed to foster discussions and ensure all uncertainties are acknowledged.

Why is it important to document identified financial risks?

Documenting identified risks is crucial for future evaluation and provides a solid foundation for creating the financial risk assessment matrix.