Overview

This article highlights nine consulting strategies that CFOs can utilize to explore alternatives to bankruptcy, underscoring the necessity of customized approaches in times of financial distress. It elaborates on various strategies, including:

- Interim management

- Creditor negotiation

- Asset sales

These strategies are essential for businesses aiming to sustain liquidity and enhance operational efficiency. By leveraging expert guidance and proactive financial management, these strategies can ultimately help organizations avert bankruptcy. Understanding these options not only provides a pathway to recovery but also instills confidence in navigating complex financial landscapes.

Introduction

In the ever-evolving landscape of small and medium businesses, the threat of financial distress looms larger than ever, with projections indicating a staggering rise in bankruptcy filings. Navigating these turbulent waters requires more than just traditional strategies; it demands tailored consulting services that focus on the unique needs of each organization. By implementing customized approaches to cash flow management, creditor negotiations, and operational restructuring, businesses can not only avoid the pitfalls of bankruptcy but also position themselves for sustainable growth.

As financial experts highlight the urgency of proactive measures, this article delves into the critical strategies that CFOs can employ to safeguard their companies’ futures and enhance their resilience in the face of economic challenges.

Transform Your Small/ Medium Business: Tailored Consulting for Bankruptcy Alternatives

Small and medium enterprises encounter unique challenges that necessitate specialized consulting services. Tailored consulting for bankruptcy alternatives consulting is critical, highlighting the importance of understanding the distinct requirements of each enterprise. This approach enables the development of customized strategies aimed at maintaining financial flow, reducing obligations, and ultimately preventing bankruptcy.

With projections indicating that weekly bankruptcy filings could reach 15,000 by late next year, as analyzed by LendingTree, the urgency for effective solutions is unmistakable. By leveraging sector-specific knowledge and financial expertise, consultants can navigate the complexities of financial distress, equipping organizations with essential resources for recovery through bankruptcy alternatives consulting.

Our comprehensive turnaround and restructuring consulting services include detailed financial evaluations that prioritize cash preservation, operational efficiency, and risk mitigation. We initiate each client engagement with a thorough assessment to align key stakeholders and gain a deeper understanding of your operational landscape beyond mere numbers. This process allows us to identify fundamental issues and collaboratively develop a strategy that minimizes vulnerabilities while reinforcing critical strengths.

For instance, the information sector faces a staggering 25.8% failure rate for new ventures, underscoring the urgent need for strategic support in high-risk areas. Customized strategies not only enhance economic recovery but also empower companies to thrive in challenging environments, making personalized consulting an invaluable asset for financial leaders aiming to steer their organizations toward stability and success. Furthermore, recognizing the regional disparities in bankruptcy statistics can assist CFOs in tailoring their strategies to address specific local challenges, ensuring a more effective approach to financial recovery.

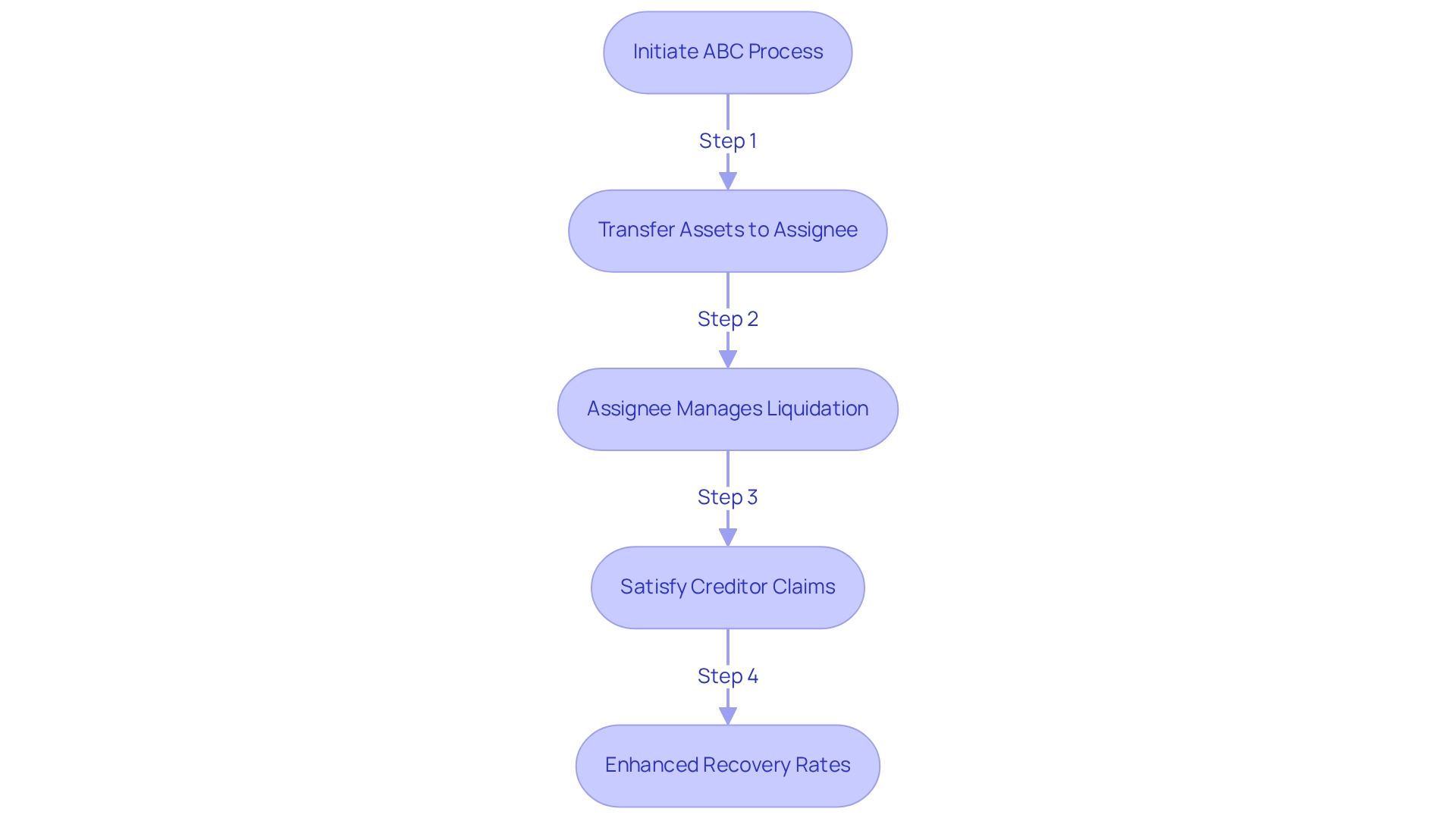

ABC (Assignment for the Benefit of Creditors): A Structured Debt Management Solution

An Assignment for the Benefit of Creditors (ABC) serves as a strategic legal process that allows financially distressed firms to transfer their assets to a third-party assignee. This assignee then manages the liquidation of those assets to satisfy creditor claims. Such a structured approach often proves to be more cost-effective and expedient than traditional bankruptcy proceedings. By opting for an ABC, companies can circumvent the lengthy court procedures typically associated with bankruptcy, thereby retaining greater control over the liquidation process and potentially safeguarding their market reputation.

Statistics reveal that the ABC process can significantly enhance recovery rates for creditors. For example, it has been noted that the assignee sent two additional notices to creditors after the closing, underscoring the structured nature of the ABC process and its implications for creditor communication. Businesses that have successfully navigated the ABC process frequently report higher asset recovery values compared to those that pursued traditional bankruptcy routes.

Real-world examples further illustrate the effectiveness of ABC as a debt management solution. In one notable case, a distressed retail company initiated the ABC process by entering an agreement with a third-party assignee to efficiently liquidate its assets. This structured wind-down maximized value for creditors while minimizing operational disruptions. Such an approach not only preserved the company's brand integrity but also facilitated a smoother transition for stakeholders involved; CFOs should view bankruptcy alternatives consulting as a viable strategy for managing debts, particularly given its advantages in terms of speed, cost, and control. The pragmatic approach to data and hypothesis testing during the ABC process enables quick decision-making, ensuring that organizations can adapt to changing circumstances effectively. As economic specialist David Kupetz emphasizes, 'In numerous instances, the troubled company has already stopped operations before making the assignment or will halt its activities when the ABC is initiated.' This underscores the urgency and adaptability that the ABC process offers, making it an appealing choice for businesses facing monetary difficulties. Continuous monitoring through real-time analytics further enhances the effectiveness of the ABC process, allowing CFOs to operationalize lessons learned and cultivate strong relationships with stakeholders throughout the turnaround.

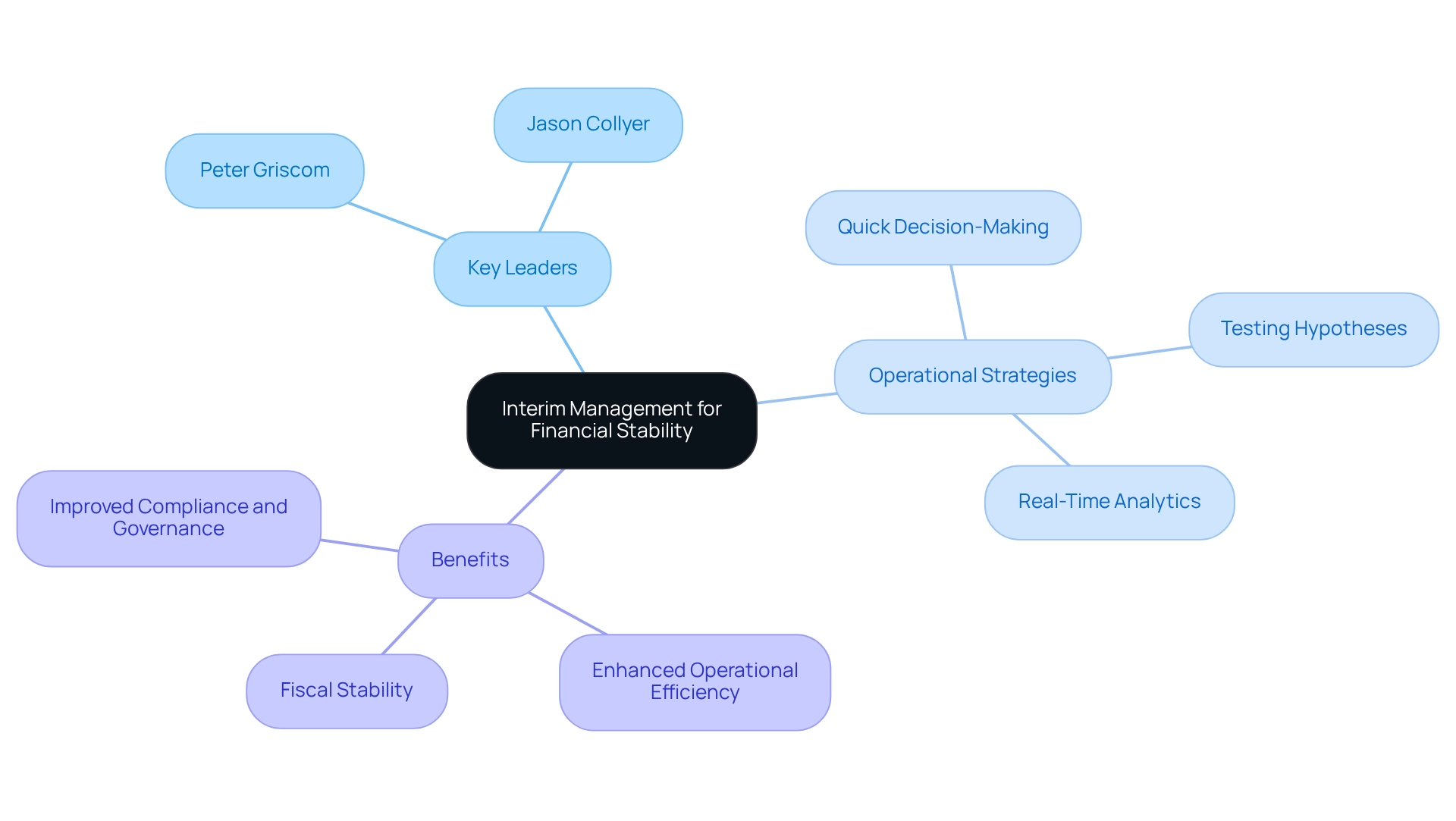

Interim Management: Immediate Leadership for Financial Stability

Interim management plays a pivotal role in delivering experienced leadership during periods of economic distress. By placing skilled executives such as Peter Griscom, M.S., who has integrated over 15 enterprises and received the Turnaround of the Year award in 2018 and 2022, organizations secure immediate guidance and stability—essential for navigating crises effectively. Alongside him, Jason Collyer, a Top 100 COO with expertise in defense, aviation entrepreneurship, and supply chain transformation, further fortifies the leadership team. These leaders excel at swiftly assessing situations, implementing necessary changes, and steering organizations toward recovery. The infusion of fresh perspectives and specialized skills from interim executives can be transformative, particularly when internal resources are stretched thin.

Data from Frederickson Partners suggest that companies employing interim executives during economic recovery frequently witness superior results, with many noting enhanced operational efficiency and fiscal stability. For instance, organizations led by interim executives have demonstrated a marked increase in compliance and governance, as these leaders are typically well-versed in regulatory requirements and best practices.

Key operational strategies—such as testing hypotheses, quick decision-making, and real-time analytics—are essential during the turnaround process. Case studies illustrate the effectiveness of interim management in real-world scenarios. Many Chief Restructuring Officers (CROs) hold the Certified Turnaround Professional (CTP) certification, underscoring their expertise in crisis management. This specialized knowledge equips them to lead organizations through challenging transitions, ensuring that stakeholders' interests are protected while minimizing disruption.

As Resolute, the CRO for Santa Cruz Valley Regional Hospital, states, "Focused crisis management ensures compliance, minimizes disruption, and protects value for all stakeholders during critical transitions." Industry leaders consistently advocate for the strategic use of interim executives during crises, revealing that focused crisis management not only stabilizes operations but also lays the groundwork for sustainable growth. As companies face increasing economic pressures, the role of interim management becomes even more crucial, providing a pathway to recovery and long-term success.

Comprehensive Financial Assessments: Identifying Cash Preservation Opportunities

Thorough economic evaluations are essential for uncovering opportunities to conserve funds and reduce obligations with the help of bankruptcy alternatives consulting. These evaluations involve a comprehensive examination of monetary statements, liquidity projections, and operational efficiencies, enabling CFOs to identify specific areas for expense reduction and income enhancement.

In 2025, with seed costs projected to rise by $1.1 billion and revenue from chicken eggs anticipated to decline by $0.6 billion, understanding the economic landscape becomes increasingly crucial for maintaining solvency during turbulent times. By prioritizing resource preservation through strategic decision-making and leveraging real-time analytics, companies can significantly mitigate the risks associated with economic distress.

Moreover, expert insights indicate that organizations engaging in thorough monetary evaluations are better positioned to navigate challenges, and bankruptcy alternatives consulting can enhance this process, with research showing that effective cash flow management can lead to improved economic outcomes. Bill Schaninger notes that the healthiest organizations generate returns three times greater than those in the bottom quartile, underscoring the importance of comprehensive economic evaluations. This proactive approach not only protects the business but also establishes a foundation for sustainable growth.

Furthermore, as chief financial officers increasingly focus on digital transformation and talent development, integrating budget evaluations into these broader strategic initiatives becomes vital. By operationalizing the lessons learned from these assessments and continuously refining strategies based on real-time analytics, CFOs can enhance decision-making processes, ensuring their organizations remain agile and responsive to evolving market conditions.

Additionally, employing a 'Test & Measure' approach facilitates hypothesis testing that can lead to improved monetary decision-making, guaranteeing that the strategies implemented are effective and aligned with the organization's objectives.

Restructuring Consulting: Realigning Operations for Recovery

Restructuring consulting involves a comprehensive evaluation of a company's operations to identify inefficiencies and opportunities for improvement. By realigning operations, organizations can significantly boost productivity, lower costs, and enhance their financial stability. This transformative process frequently entails revising business models, optimizing supply chains, and embracing innovative technologies.

For financial leaders, engaging in restructuring consulting is not merely a reactive measure; it is a proactive strategy that equips organizations to navigate evolving market dynamics and build resilience. Current trends reveal that effective restructuring can lead to substantial enhancements in operational efficiency, with statistics indicating that small businesses leveraging restructuring consulting see a pronounced increase in performance metrics.

Notably, 22.3% of global time entries are submitted after their due date, highlighting the critical nature of timely restructuring efforts to improve operational efficiency. Furthermore, mastering the cash conversion cycle through strategic planning and real-time analytics can greatly enhance decision-making processes, allowing financial executives to test hypotheses and accurately assess investment returns.

An interactive workshop focused on implementing an effective Corrective & Preventive Action Request Process utilizing the Global 8D Problem Solving Process is available, providing financial executives with essential resources to execute effective strategies. As Norman Foster aptly noted, optimism is crucial in architecture; similarly, a positive outlook is indispensable for financial leaders steering their organizations through restructuring initiatives.

Moreover, industry leaders emphasize that restructuring can significantly impact economic recovery, reinforcing the imperative for CFOs to adopt these strategies. By embracing these approaches, organizations can strategically position themselves for sustainable growth and recovery.

Creditor Negotiation: Securing Favorable Terms to Avoid Bankruptcy

Negotiating with creditors is a crucial tactic for businesses experiencing economic distress. Proactive engagement enables companies to secure more favorable payment terms, such as extended deadlines or reduced interest rates, significantly alleviating immediate financial pressures. This approach not only aids in managing cash flow but also fosters positive relationships with creditors, essential for long-term stability. CFOs must prioritize open communication and transparency during negotiations, as these practices can lead to mutually beneficial agreements that assist in bankruptcy alternatives consulting.

For instance, a workout agreement represents a negotiation where the credit card issuer lowers interest rates or waives fees to assist the debtor in managing payments more effectively. While this can ease the burden of debt, it may also result in account closure, impacting credit scores due to increased credit utilization.

Statistics indicate that businesses that engage in bankruptcy alternatives consulting and effectively negotiate with creditors often experience improved outcomes, with many reporting a significant reduction in overall debt burdens. Recent trends suggest that nurturing strong creditor relationships is becoming increasingly essential during economic hardship, as it can lead to more advantageous terms and foster sustainable growth.

Furthermore, leveraging real-time analytics can enhance the negotiation process, enabling CFOs to make informed decisions swiftly and adjust strategies based on ongoing performance monitoring. Moreover, debt consolidation might be advantageous if one qualifies for a low interest rate and makes timely payments, further enhancing the economic stability of the business.

As Michelle Black from Bankrate emphasizes, "Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first," underscoring the importance of informed negotiation strategies.

Cash Flow Management: Ensuring Liquidity During Financial Distress

Efficient financial flow management is crucial for preserving liquidity during economic hardship. CFOs must adopt thorough liquidity flow forecasting methods to accurately predict funding needs and identify potential deficits. Approaches such as tightening credit terms can directly address the concerning statistic that 37% of small enterprise owners considered closing due to late payment issues, underscoring the essential need for proactive financial management. Furthermore, monitoring inventory levels and enhancing payment cycles can significantly bolster liquidity. By maintaining a comprehensive understanding of revenue and expenditures, companies can navigate economic challenges more effectively and mitigate the risk of insolvency.

Current trends indicate a shift towards user-friendly access to funding, which can further support effective flow management strategies. For instance, lending organizations are increasingly offering simplified loan applications and flexible repayment options, facilitating access for small enterprises to secure necessary funding. Successful case studies demonstrate that small enterprises implementing robust liquidity forecasting methods have improved their financial resilience, enabling them to thrive even in challenging conditions. Additionally, findings from a case study on microenterprises reveal that these entities often face substantial barriers to obtaining bank loans, such as heightened rejection rates and stringent collateral requirements. This highlights the importance of effective financial flow management techniques in overcoming funding challenges. As Forbes notes, most firms carry fewer than $100,000 in liabilities, while the average small enterprise loan amount is approximately $663,000, indicating a significant gap in financing availability.

To enhance liquidity, CFOs should consider employing flow forecasting methods that allow for regular evaluations and adjustments based on real-time data. This proactive approach, supported by efficient decision-making processes, can help identify potential funding shortfalls before they escalate, ensuring that companies remain agile and prepared to address financial challenges. Moreover, leveraging real-time business analytics can provide insights into operational performance, further aiding in the effective management of financial flow and overall business health.

Asset Sales: Generating Immediate Cash to Reduce Liabilities

Liquidating non-essential assets serves as a robust strategy for generating immediate cash flow and reducing liabilities. CFOs must conduct a thorough inventory assessment to identify assets that can be sold without compromising core operations. This may include:

- Surplus equipment

- Underutilized real estate

- Excess inventory that fails to align with the business's primary objectives

By executing strategic asset sales, companies can swiftly enhance their funds, thereby securing the liquidity necessary to address financial challenges and seek bankruptcy alternatives consulting.

Incorporating real-time analytics into this process enables CFOs to make informed decisions promptly, ensuring asset sales align with current market conditions. Statistics indicate that successful asset sales can boost cash flow by up to 30%, with many enterprises reporting a substantial increase in liquidity following liquidation. Advisors consistently highlight the importance of identifying non-essential assets, as this can lead to significant tax savings and improved financial health. For instance, timely asset sales can leverage prevailing market conditions, allowing companies to maximize returns before potential depreciation impacts future sales.

Successful case studies demonstrate that companies proactively liquidating non-essential assets not only reduce liabilities but also benefit from bankruptcy alternatives consulting to position themselves for sustainable growth. One notable example is the case study titled "Strategic Timing for Asset Purchases," which underscores the necessity for timely action to secure tax benefits linked to asset sales. By collaborating with experienced accounting professionals and utilizing real-time analytics, CFOs can formulate tailored asset sales strategies that align with their unique financial situations, ensuring effective navigation through challenging times. As one advisor aptly noted, "Recognizing and selling non-essential assets can be a game changer for businesses aiming to enhance their cash flow and overall economic well-being.

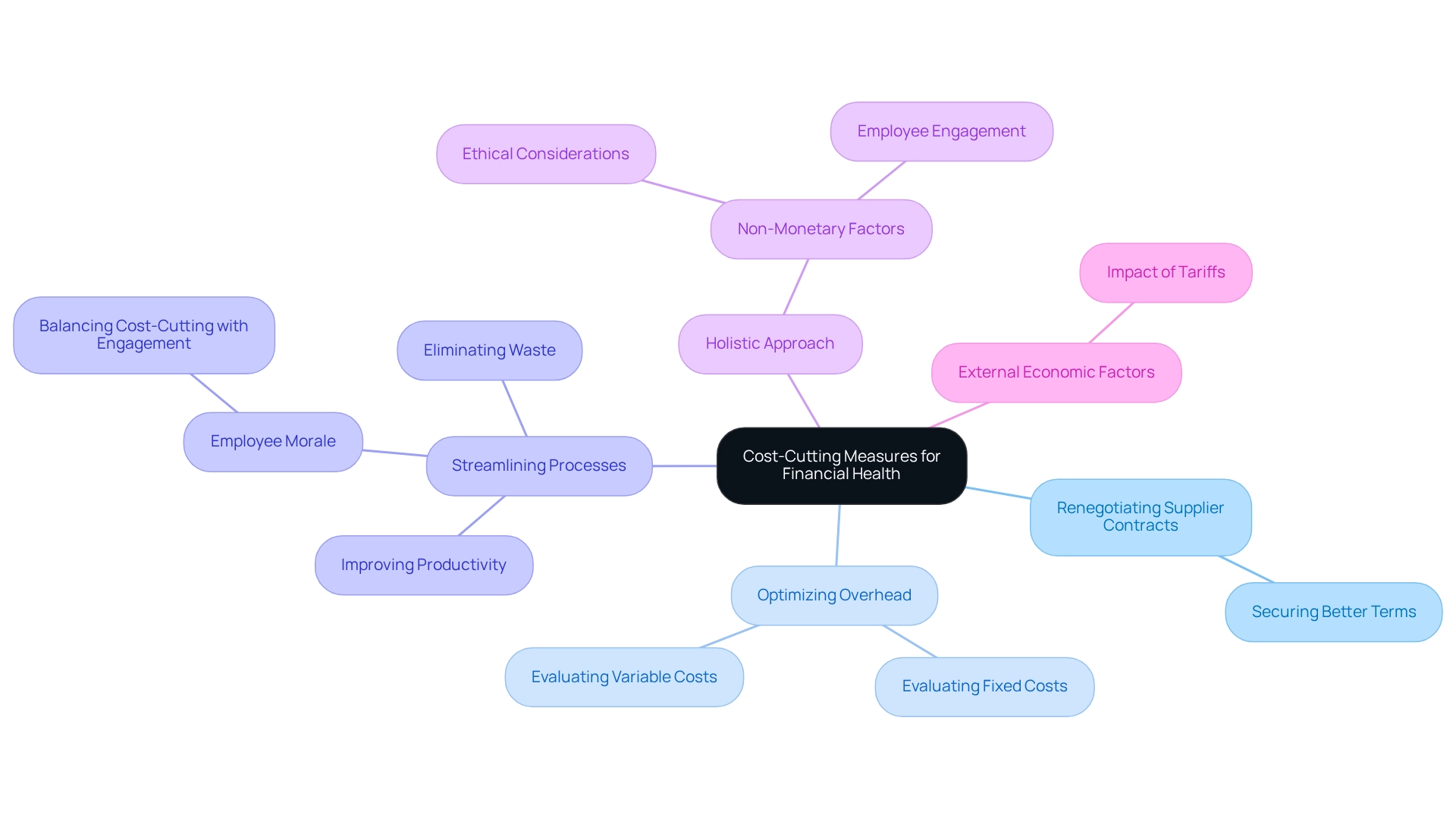

Cost-Cutting Measures: Enhancing Efficiency to Improve Financial Health

Cost-Cutting Measures: Enhancing Efficiency to Improve Financial Health

Implementing cost-cutting measures is crucial for enhancing operational efficiency and bolstering financial health. CFOs should undertake a thorough review of all expenses to pinpoint areas where costs can be trimmed without compromising quality or service. Effective strategies may include:

- Renegotiating supplier contracts to secure better terms.

- Optimizing overhead by evaluating fixed and variable costs.

- Streamlining operational processes to eliminate waste and improve productivity.

By prioritizing efficiency and mastering the cash conversion cycle, companies can significantly enhance their bottom line and establish a more sustainable economic framework, ultimately positioning themselves for recovery and growth.

Vincent Price, President, emphasizes that "the campaign is perfectly timed to address these needs," highlighting the urgency of implementing these strategies. Industry leaders also stress that a holistic approach to cost reduction should consider non-monetary factors, such as employee morale and ethical considerations, which can influence long-term success. For instance, organizations that balance cost-cutting with these factors often see improved employee engagement and productivity, further enhancing operational efficiency. A case study titled 'Non-Monetary Considerations' demonstrates that organizations pursuing projects for reasons beyond profit can achieve better outcomes when they consider employee morale alongside economic metrics.

Statistics indicate that small enterprises adopting focused cost-reduction strategies can attain significant enhancements in financial well-being, with many noting higher revenues and decreased liabilities. For example, businesses that have adopted comprehensive expense reviews and innovative cost-cutting strategies have seen revenue increases of up to 20%. As trends in operational efficiency continue to evolve in 2025, financial leaders are encouraged to explore innovative solutions that not only reduce costs but also foster a culture of continuous improvement and adaptability. Additionally, with the recent agreements between South Korea and the United States to address tariffs, financial executives should remain vigilant about external economic factors that may impact their cost-cutting strategies.

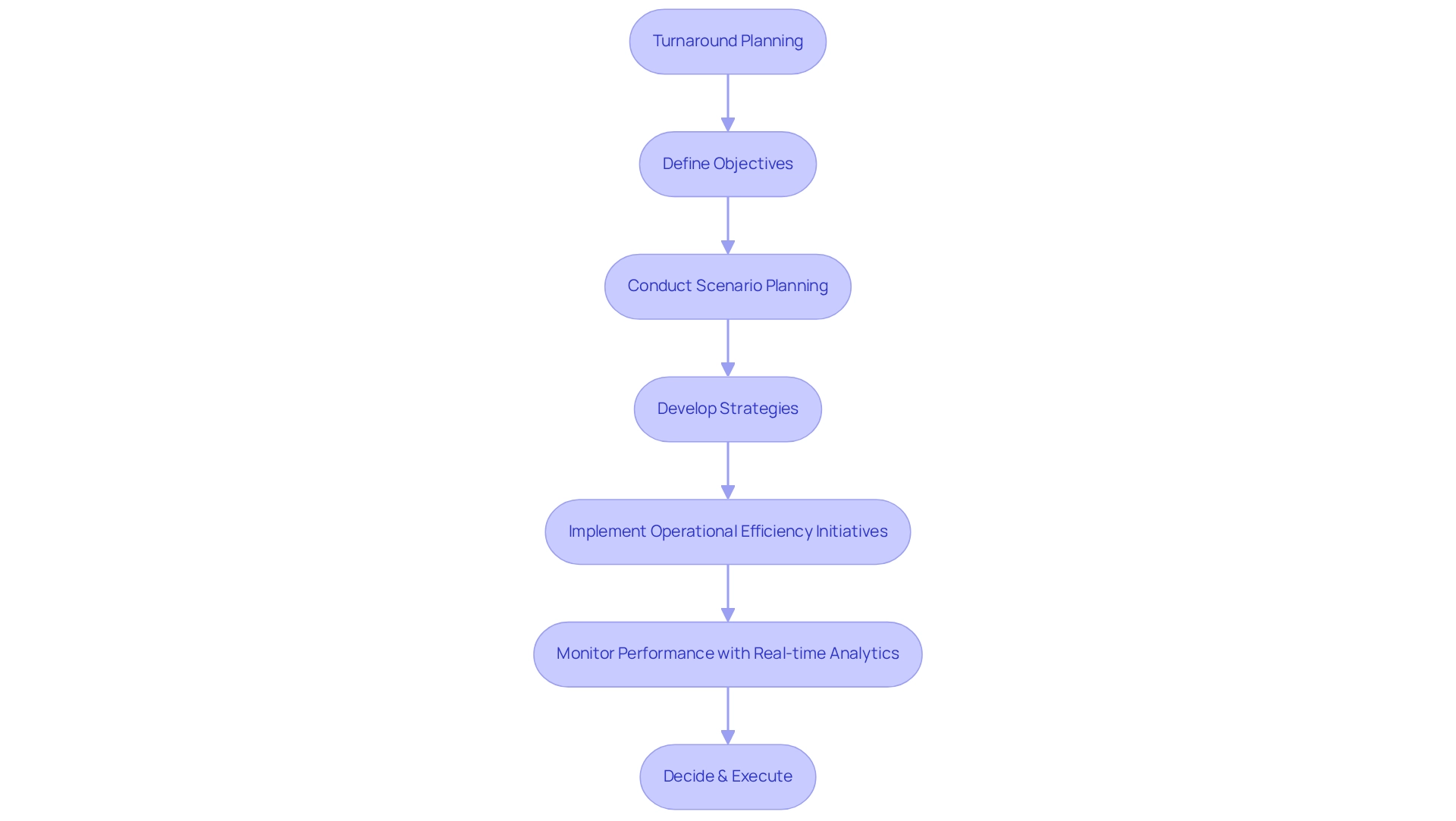

Turnaround Planning: Strategic Guidance to Navigate Financial Challenges

For businesses grappling with economic challenges, a comprehensive turnaround strategy that includes bankruptcy alternatives consulting is essential. This plan must delineate specific objectives, strategies, and timelines for recovery, incorporating a pragmatic approach to data that rigorously tests every hypothesis to maximize return on invested capital. CFOs are encouraged to engage in scenario planning, allowing them to foresee potential challenges and devise contingency measures.

For instance, Webster University faced significant monetary hurdles due to its reliance on in-person learning, which was severely impacted by the Covid pandemic. By executing an operational efficiency initiative and boosting enrollment, the university achieved a favorable financial flow for the first time in over a decade, demonstrating the effectiveness of a structured turnaround strategy.

Furthermore, economic analysts have highlighted that while some companies may appear undervalued, the sustainability of their strategies could be compromised by ongoing negative cash flow margins. This underscores the necessity of developing a comprehensive turnaround plan that incorporates bankruptcy alternatives consulting to address immediate financial concerns and establish a foundation for enduring success.

Continuous monitoring of business performance through real-time analytics is crucial, as it enables organizations to dynamically adjust strategies and operationalize lessons learned throughout the turnaround process. The 'Decide & Execute' approach emphasizes a shortened decision-making cycle, empowering CFOs to take decisive actions swiftly. Current trends in strategic planning for financial recovery stress the need for adaptability and foresight, enabling organizations to optimize resource allocation and focus on achieving sustainable growth.

Conclusion

In the current economic landscape, small and medium businesses confront unprecedented financial challenges that demand a strategic and proactive approach to avert bankruptcy. Tailored consulting services emerge as a vital resource, equipping CFOs with customized strategies that emphasize cash flow management, creditor negotiations, and operational restructuring. By understanding the unique needs of each business, consultants facilitate navigation through financial distress, preserving cash and fostering sustainable growth.

The implementation of structured solutions such as Assignments for the Benefit of Creditors (ABC) and interim management can significantly enhance recovery efforts. These strategies not only expedite the liquidation process but also provide immediate leadership and guidance, essential for stabilizing operations during crises. Comprehensive financial assessments and effective cash flow management are critical components that empower businesses to identify opportunities for cost reduction and improve liquidity, ultimately safeguarding against insolvency.

Moreover, engaging in proactive creditor negotiations and adopting innovative cost-cutting measures can substantially alleviate financial pressures, enabling companies to secure favorable terms and enhance operational efficiency. As businesses prepare for the future, developing a comprehensive turnaround plan that incorporates real-time analytics and scenario planning will be crucial for navigating uncertainties and achieving long-term success.

In conclusion, by embracing these tailored consulting strategies and fostering a culture of adaptability and continuous improvement, CFOs can position their organizations not merely to survive but to thrive in challenging economic conditions. The path to financial stability transcends the mere avoidance of bankruptcy; it is about building resilience and laying the groundwork for future growth and success.

Frequently Asked Questions

What challenges do small and medium enterprises face that require specialized consulting services?

Small and medium enterprises encounter unique challenges that necessitate specialized consulting services, particularly in understanding their distinct requirements to develop customized strategies aimed at maintaining financial flow, reducing obligations, and preventing bankruptcy.

Why is tailored consulting for bankruptcy alternatives important?

Tailored consulting for bankruptcy alternatives is critical as it allows for the development of customized strategies that address the specific needs of each enterprise, ultimately helping to prevent bankruptcy and ensure financial stability.

What are the projected bankruptcy filing statistics, and what do they indicate?

Projections indicate that weekly bankruptcy filings could reach 15,000 by late next year, highlighting the urgency for effective solutions to assist businesses in financial distress.

How do consultants assist organizations facing financial distress?

Consultants leverage sector-specific knowledge and financial expertise to navigate the complexities of financial distress, equipping organizations with essential resources for recovery through tailored bankruptcy alternatives consulting.

What does the comprehensive turnaround and restructuring consulting service include?

This service includes detailed financial evaluations focusing on cash preservation, operational efficiency, and risk mitigation, starting with a thorough assessment to align stakeholders and understand the operational landscape.

What is an Assignment for the Benefit of Creditors (ABC)?

An ABC is a strategic legal process that allows financially distressed firms to transfer their assets to a third-party assignee, who manages the liquidation of those assets to satisfy creditor claims, often more cost-effectively than traditional bankruptcy.

What are the benefits of opting for an ABC over traditional bankruptcy?

The ABC process allows companies to avoid lengthy court procedures, retain greater control over the liquidation process, and potentially safeguard their market reputation while enhancing recovery rates for creditors.

Can you provide an example of the effectiveness of the ABC process?

In one case, a distressed retail company utilized the ABC process to liquidate its assets efficiently, maximizing value for creditors and minimizing operational disruptions while preserving brand integrity.

What role does interim management play during economic distress?

Interim management provides experienced leadership during crises, with skilled executives assessing situations, implementing necessary changes, and steering organizations toward recovery.

How do interim executives contribute to a company's recovery?

Interim executives often lead to superior results, including enhanced operational efficiency and fiscal stability, by applying specialized knowledge in crisis management and regulatory compliance.

What strategies are essential during the turnaround process?

Key operational strategies include testing hypotheses, quick decision-making, and real-time analytics, which are crucial for effective turnaround management.

Why is the role of interim management increasingly important in today's economic climate?

As companies face rising economic pressures, interim management provides a pathway to recovery and long-term success, stabilizing operations and laying the groundwork for sustainable growth.