Overview

The article centers on a structured approach to effective financial continuity planning through nine essential steps. These steps encompass:

- Conducting thorough financial assessments

- Identifying critical business functions

- Developing a robust business continuity plan

Evidence underscores the significance of proactive strategies and real-time analytics, ensuring organizational resilience during disruptions. This comprehensive framework not only highlights the necessity of preparedness but also guides organizations toward actionable insights that can fortify their operational stability.

Introduction

In an increasingly unpredictable business landscape, small and medium enterprises must prioritize financial continuity to navigate disruptions effectively. A comprehensive financial assessment serves as the cornerstone for identifying vulnerabilities and optimizing operational efficiency. By leveraging real-time analytics and engaging in proactive planning, organizations can better prepare for unforeseen challenges while ensuring their critical functions remain intact.

This article delves into essential strategies for creating a robust continuity plan:

- Conducting thorough risk assessments

- Fostering strong communication channels with stakeholders and external partners

By implementing these best practices, businesses can not only survive crises but emerge stronger and more resilient.

Transform Your Small/ Medium Business: Comprehensive Financial Assessment for Continuity Planning

Conducting a thorough financial assessment is essential for any organization. This process involves analyzing cash flow, liabilities, and operational costs. The evaluation should not only pinpoint underlying organizational issues but also emphasize areas where expenses can be minimized and cash conserved. This focus on financial continuity planning ensures that the entity can continue its operations during disruptions.

Moreover, by utilizing real-time commercial analytics through a client dashboard, organizations can consistently track their financial health and make informed decisions swiftly. It is crucial to test every hypothesis related to financial modeling to project future scenarios and prepare for potential challenges.

This proactive method, paired with an efficient decision-making cycle, establishes the foundation for a robust strategy that incorporates financial continuity planning and aligns with the organization's financial capacities.

Identify Critical Business Functions: The Foundation of Financial Continuity

To effectively identify vital organizational functions, conducting a Business Impact Analysis (BIA) is essential. This analysis evaluates the potential consequences of disruptions on various operations and prioritizes functions critical for revenue generation and customer satisfaction. Engaging with department leaders is crucial; their insights on dependencies and workflows ensure that the continuity strategy encompasses the most essential elements of the organization. Our team facilitates a shortened decision-making cycle throughout the turnaround process, empowering your team to take decisive actions that preserve your business.

Notably, statistics reveal that:

- 77% of respondents are based in North America

- 8% in EMEA

- 14% in Asia Pacific

This highlights the widespread application of BIA in enhancing financial stability across different regions. Furthermore, case studies demonstrate that organizations invoking their Business Continuity Plans (BCPs) have gained invaluable insights into the necessity of communication and collaboration during crises. These studies particularly emphasize the importance of plans that address long-term event durations, employee health and safety, and the regular updating and testing of these plans.

As organizations increasingly turn to commercial software for managing their BCPs, the BIA process is simplified through cloud-based solutions for Business Continuity as a Service (BCaaS). These solutions provide real-time analytics capabilities that bolster resilience against disruptions. By prioritizing BIA and continuously testing hypotheses, organizations can better prepare for long-term event durations, ensuring employee health and safety while safeguarding their financial continuity planning.

A practical suggestion for CFOs is to frequently assess and revise the BIA process. This ensures that any alterations in operational activities or external factors are captured, keeping the analysis relevant and efficient.

Conduct Risk Assessment: Recognize and Mitigate Potential Threats

To ensure financial stability, small enterprises must conduct a thorough risk evaluation that incorporates financial continuity planning and identifies both internal and external threats, including financial instability, supply chain disruptions, and cybersecurity risks. According to Kroll's cybersecurity incident response assessments, preparing for cybersecurity incidents is crucial in today's digital landscape. Employing a mix of qualitative and quantitative methods enables organizations to assess the probability and possible effect of each risk efficiently. A risk matrix can be developed to prioritize these risks, guiding the creation of targeted mitigation strategies. For instance, diversifying suppliers can reduce dependency on single sources, while enhancing cybersecurity measures can protect against increasing digital threats.

Moreover, our group facilitates an efficient decision-making process during the risk evaluation and reduction stages, allowing entities to take decisive action swiftly. By consistently tracking the effectiveness of our plans through our client dashboard, which offers current analytics, we can assess organizational health and modify strategies as required. As Kroll expands its AI risk consulting services, leveraging technology in risk assessments becomes increasingly important.

Additionally, the case study titled 'Sustainability Liabilities Move Up the D&O Watchlist' illustrates the growing scrutiny on corporate sustainability practices and the potential legal implications, emphasizing the need for comprehensive risk management. As the landscape evolves in 2025, staying proactive in risk assessment and utilizing real-time analytics is crucial for effective financial continuity planning and maintaining business resilience.

Develop a Business Continuity Plan: Outline Procedures for Operational Resilience

Establishing a robust financial continuity planning strategy is crucial for sustaining essential functions during a crisis. Start by outlining comprehensive strategies tailored for various scenarios, including natural disasters and economic downturns. Clearly define the roles and responsibilities of team members, ensuring that each individual comprehends their specific tasks in an emergency. This clarity not only enhances response efficiency but also fosters accountability within the organization.

Moreover, to facilitate a streamlined decision-making process, our team underscores the significance of real-time analytics. By continuously monitoring the effectiveness of our plans through a client dashboard, organizations can assess their operational health and make informed decisions swiftly. Regularly reviewing and updating the BCP is vital to adapt to shifts in the organizational environment and operational capabilities. Integrating best practices for operational resilience, such as conducting routine training and simulations, can better prepare businesses for unforeseen challenges.

In addition, effective third-party relationship management is essential; organizations that oversee contracts, documents, and risk assessments related to their third-party relationships can maintain superior oversight and control, thereby reducing associated risks. Furthermore, successful case studies highlight the effectiveness of BCPs in emergency situations. Companies that implemented financial continuity planning as part of their comprehensive strategies were able to pivot quickly, sustaining operations and minimizing disruptions. By prioritizing the development of a BCP, organizations can safeguard their future and ensure sustainable growth even in the face of adversity.

Establish Communication Strategies: Keep Stakeholders Informed and Engaged

Creating a strong communication strategy is vital for efficiently sharing information during an emergency. Begin by identifying key stakeholders, including employees, customers, suppliers, and investors. Determine the most effective channels for communication, such as email, social media, or direct calls, to ensure messages reach the intended audience promptly. Establish protocols for regular updates, which can significantly enhance stakeholder engagement and trust.

Moreover, incorporating real-time analytics into your communication strategy facilitates continuous monitoring of stakeholder sentiment and organizational health, allowing for prompt modifications to your messaging. Feedback mechanisms should also be integrated to address concerns and foster open dialogue. Statistics indicate that organizations with well-defined communication strategies can lead to operational improvements; for instance, Britest helped a custom synthesis manufacturer increase process throughput by at least 50% within three years by optimizing communication processes.

A quote from Britest highlights, "A Britest methodology to support the optimisation of changeover/cleaning processes was used to help FUJIFILM Imaging Colorants address capacity constraints," demonstrating how structured communication can enhance processes during a challenging situation. Case studies show that companies adopting structured communication strategies not only manage crises more effectively but also enhance their financial continuity planning, leading to stronger stakeholder relationships and increased resilience.

Furthermore, the HR team's focus on raising awareness of resolution and Aviva's efforts to embed resolution approaches within their culture highlight the growing importance of proactive communication strategies in today's business environment. By operationalizing lessons learned from the turnaround process and utilizing real-time analytics, organizations can build strong, lasting relationships with stakeholders.

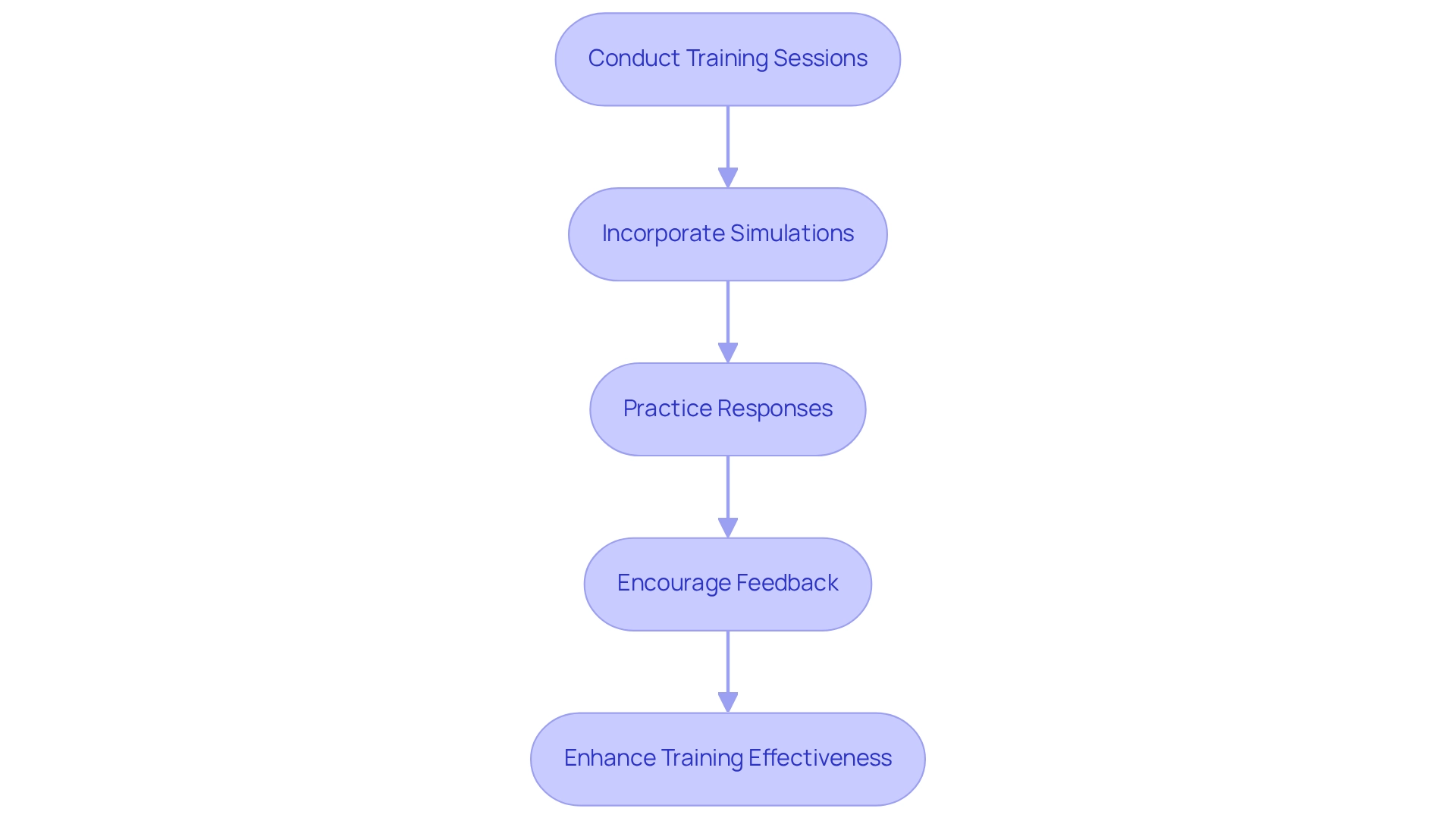

Train Staff on Continuity Procedures: Empower Employees for Effective Response

Conduct regular training sessions to familiarize employees with the continuity strategy and their specific roles within it. These sessions should incorporate simulations and drills to practice responses to various scenarios, allowing staff to gain hands-on experience. Moreover, encouraging feedback is essential to enhance training effectiveness and ensure that employees feel confident in their ability to respond during a crisis.

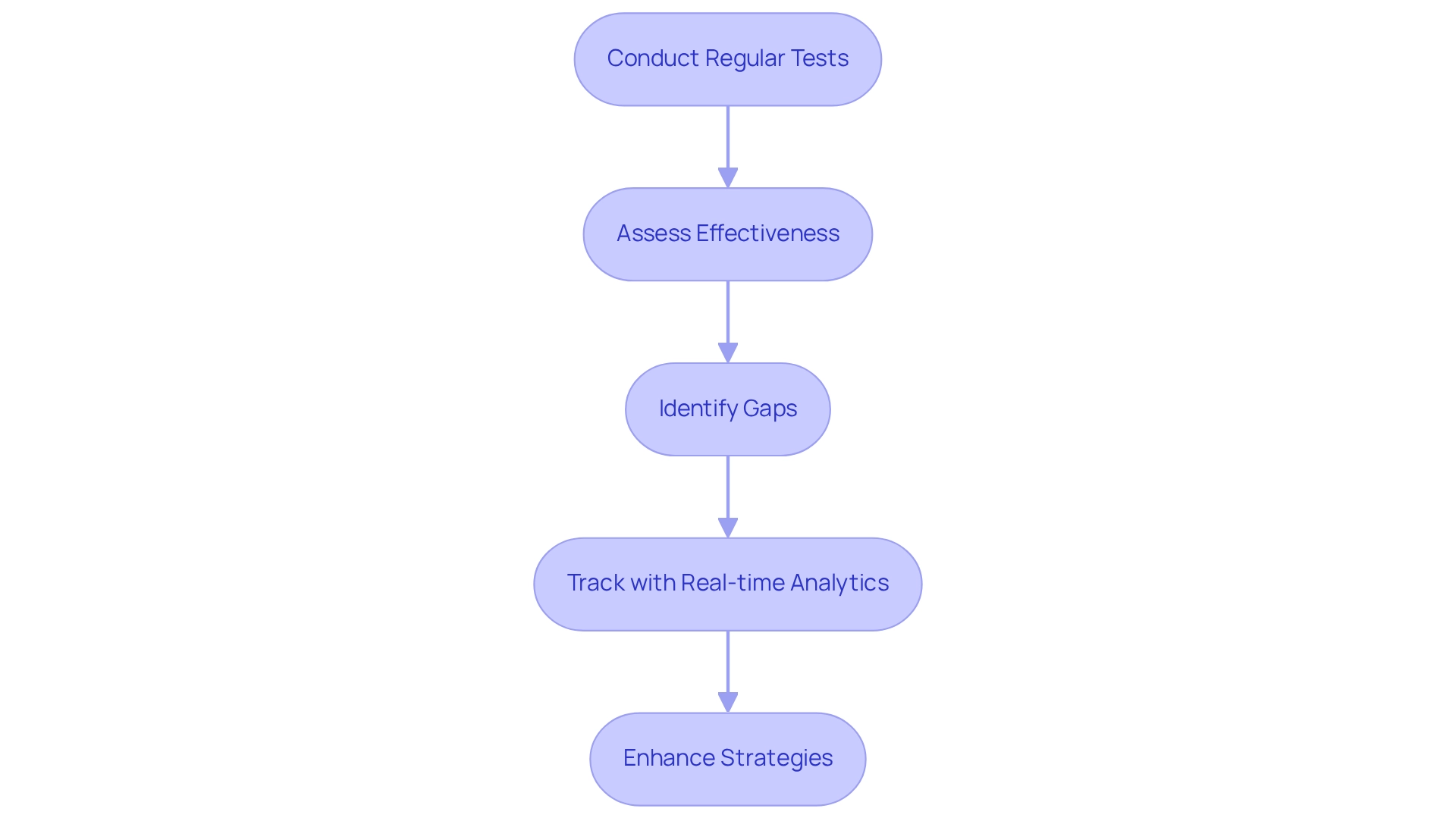

Test and Exercise the Continuity Plan: Identify Weaknesses and Improve Strategies

Conduct regular tests of your continuity strategy through tabletop exercises and real-time simulations. Our team facilitates a shortened decision-making cycle throughout this process, empowering your team to take decisive action to preserve business health.

- Assess the effectiveness of your response and identify any gaps or shortcomings in your strategy.

- Moreover, we consistently track the effectiveness of our strategies through real-time analytics, utilizing the results to enhance methods and revise the framework accordingly.

- This ensures ongoing improvement and readiness for future disruptions.

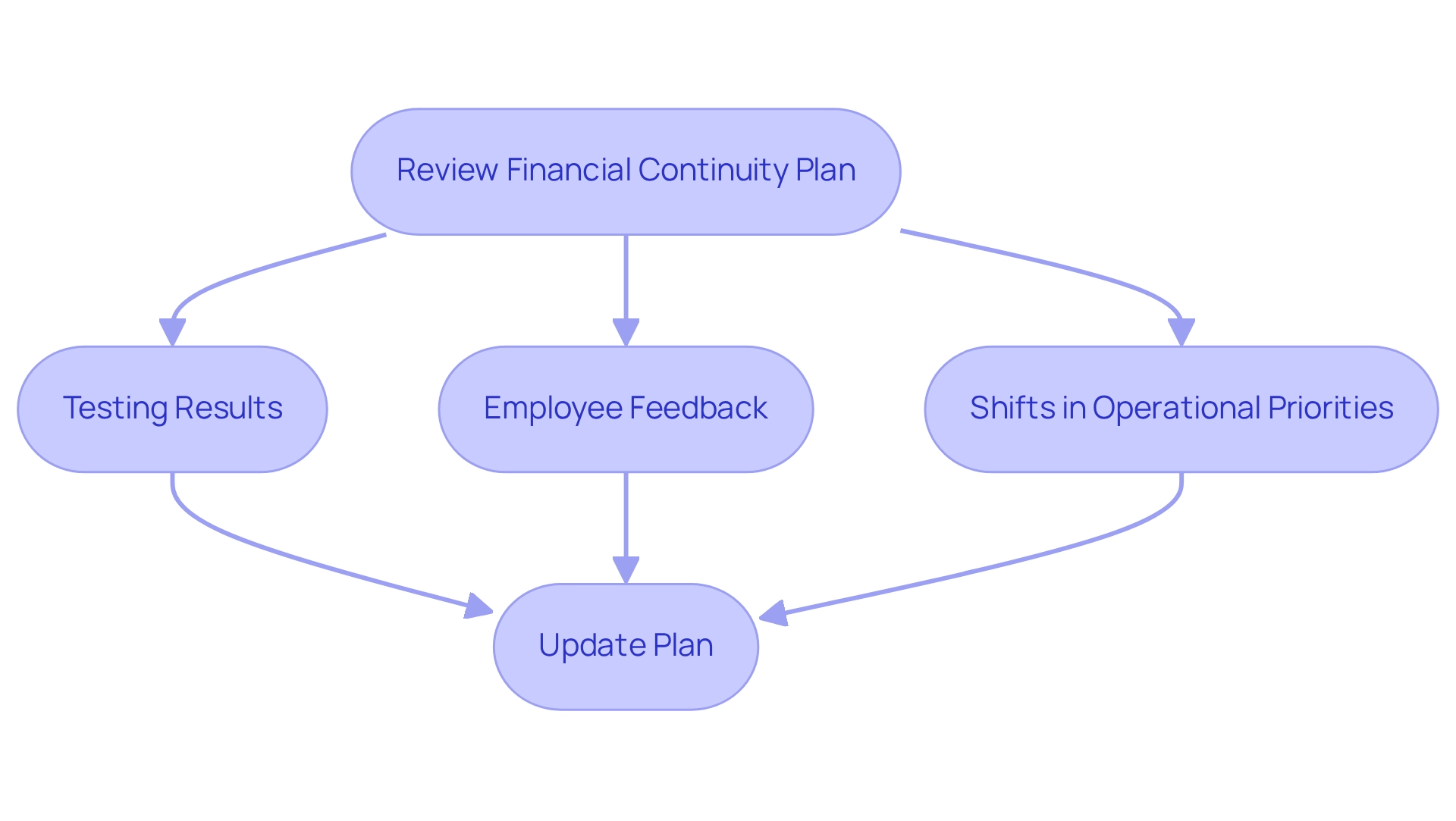

Review and Update the Continuity Plan: Adapt to Changing Circumstances

Conduct regular assessments of the financial continuity planning strategy—at least annually or after significant changes in the business environment. Evaluate the strategy's effectiveness through:

- Testing results

- Employee feedback

- Shifts in operational priorities

Update the financial continuity planning to incorporate emerging risks, technologies, and best practices, thereby ensuring the organization is well-prepared for future challenges.

Leverage Technology: Enhance Communication and Data Management for Continuity

Investing in technology solutions is crucial for effective communication and data management during crises. Businesses must prioritize tools that facilitate remote collaboration, ensure robust data backup, and enable real-time monitoring of operations. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business. Systems designed for rapid information dissemination and seamless coordination among team members are essential. Regular evaluations and upgrades of technology are necessary to adapt to the evolving needs of the business landscape.

In 2025, organizations are increasingly adopting advanced remote collaboration tools, which have proven vital for maintaining operational continuity. For instance, statistics from Amazon's COVID-19 response indicate that their donation of 150,000 face shields was part of a broader strategy that significantly improved their operational response times. Businesses investing in technology for emergency management have observed a substantial enhancement in their response times and overall resilience. Effective applications of technology for emergency communication, such as educational campaigns via social media, demonstrate that timely and clear communication can mitigate risks and enhance decision-making processes.

As Adriana Mangones states, 'Responsible use of social media in disaster management involves acknowledging its limitations and potential pitfalls while leveraging its strengths.' This emphasizes the significance of utilizing technology not only for prompt crisis management but also for establishing the foundation for long-term financial continuity planning and operational stability. Additionally, we consistently track the effectiveness of our strategies via our client dashboard, which offers up-to-the-minute business analytics to evaluate your business health, ensuring that the flow of information from crowdsourcing is effectively managed to assess priorities and deliver emergency assistance. Furthermore, we emphasize the importance of testing hypotheses to ensure that our strategies are data-driven and effective in real-time scenarios.

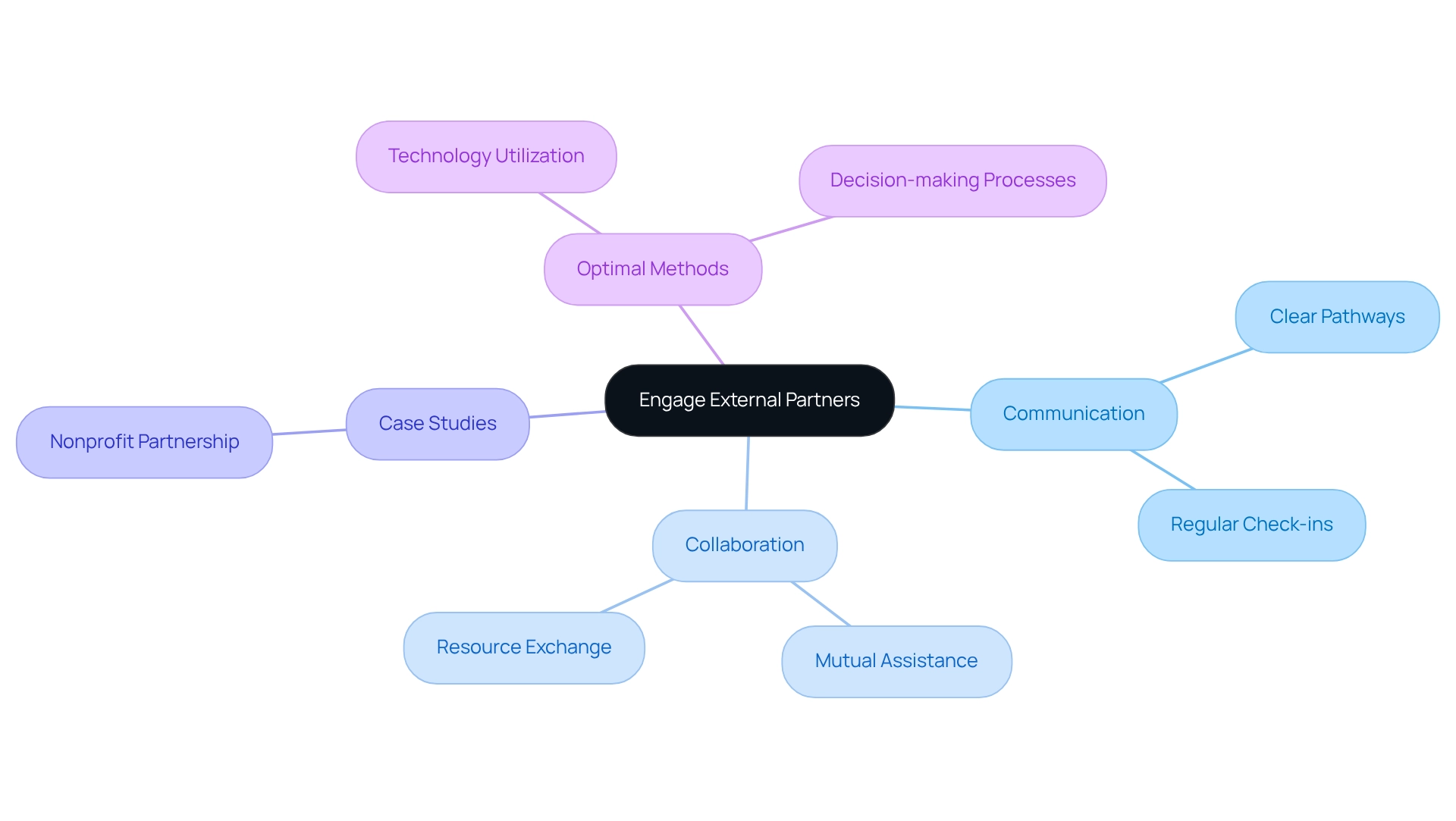

Engage External Partners: Strengthen Financial Continuity Through Collaboration

Identifying key external partners—such as suppliers, service providers, and industry associations—is crucial for bolstering your financial continuity planning efforts. Clear communication pathways and cooperative arrangements guarantee mutual assistance during emergencies. Consistent interaction with these partners promotes the exchange of best practices, resources, and insights, ultimately enhancing the resilience of your ecosystem.

Statistics indicate that organizations actively collaborating with external partners are better positioned to navigate crises, with a significant percentage reporting enhanced operational stability. A recent study underscores that flexibility and preparation are essential for managing ongoing uncertainties, highlighting the necessity for organizations to adapt proactively.

Integrating efficient decision-making processes and immediate analytics into these partnerships can further improve operational effectiveness. Our team supports a shortened decision-making cycle throughout the turnaround process, empowering your team to take decisive action to preserve your business. This is facilitated by our client dashboard, which offers current analytics to continually assess your company's health and modify strategies as necessary.

As noted by a Nonprofit Manager, "I think [what it is], fundamentally, is having a corporate social responsibility program be kind of embedded in the DNA of the company. It's not checking a box." This perspective reinforces the importance of integrating social responsibility into partnerships to enhance financial continuity.

Case studies illustrate successful collaborations during challenging times. One notable example involved a nonprofit that maintained a supportive relationship with its business partner even after gaining independence, demonstrating that partnerships can evolve while still providing mutual benefits. This case illustrates how effective teamwork, backed by real-time analytics, can result in ongoing assistance during emergencies, emphasizing the significance of preserving robust connections with external partners.

Optimal methods for cooperation during emergencies involve setting up regular check-ins with partners to evaluate needs and resources, in addition to utilizing technology to enhance communication. Engaging external partners not only enhances financial continuity planning but also fosters a culture of shared responsibility and innovation, essential for long-term success. Furthermore, longitudinal data could enhance understanding of the impact of crises on small businesses and their strategies, providing valuable insights for future planning.

Conclusion

In today's unpredictable business environment, small and medium enterprises must prioritize financial continuity to survive and thrive amid disruptions. This article outlines critical strategies such as:

- Conducting thorough risk assessments

- Identifying essential business functions through Business Impact Analysis (BIA)

- Developing comprehensive Business Continuity Plans (BCPs)

By implementing these practices, organizations can pinpoint vulnerabilities, optimize operations, and enhance resilience.

Effective communication with stakeholders and external partners is equally vital. Establishing clear communication channels and engaging in collaborative efforts ensures that businesses can share resources and best practices, ultimately strengthening their operational stability. Moreover, integrating technology into these processes can significantly improve data management and crisis response times, ensuring that organizations remain agile and informed.

Training staff on continuity procedures and regularly testing and updating these plans further fortify an organization's preparedness for unforeseen challenges. By fostering a culture of continuous improvement and adaptability, businesses can not only weather crises but emerge from them stronger and more resilient.

In summary, a proactive approach to financial continuity that encompasses comprehensive assessments, strong communication strategies, and robust training programs is essential for small and medium enterprises. By prioritizing these strategies, businesses can safeguard their operations, enhance stakeholder trust, and position themselves for sustainable growth in an ever-evolving landscape.

Frequently Asked Questions

Why is conducting a financial assessment important for organizations?

Conducting a financial assessment is essential for organizations as it helps analyze cash flow, liabilities, and operational costs, pinpointing underlying issues and emphasizing areas where expenses can be minimized and cash conserved. This process supports financial continuity planning, ensuring operations can continue during disruptions.

How can organizations track their financial health?

Organizations can track their financial health by utilizing real-time commercial analytics through a client dashboard, which allows them to monitor financial status and make informed decisions swiftly.

What is a Business Impact Analysis (BIA)?

A Business Impact Analysis (BIA) evaluates the potential consequences of disruptions on various operations and prioritizes functions critical for revenue generation and customer satisfaction. It involves engaging with department leaders to ensure the continuity strategy covers essential organizational elements.

What role does the BIA play in financial stability?

The BIA plays a significant role in enhancing financial stability by identifying vital functions and ensuring that continuity plans are in place to address long-term disruptions, employee health and safety, and the need for regular updates and testing of these plans.

How does cloud-based Business Continuity as a Service (BCaaS) simplify the BIA process?

Cloud-based BCaaS solutions simplify the BIA process by providing real-time analytics capabilities, which help organizations bolster their resilience against disruptions and maintain effective financial continuity planning.

What should CFOs do regarding the BIA process?

CFOs should frequently assess and revise the BIA process to capture any changes in operational activities or external factors, ensuring the analysis remains relevant and efficient.

What is involved in conducting a thorough risk evaluation for financial stability?

A thorough risk evaluation involves identifying internal and external threats, such as financial instability, supply chain disruptions, and cybersecurity risks. It includes using qualitative and quantitative methods to assess the probability and impact of each risk, and developing a risk matrix to prioritize them.

How can organizations mitigate risks identified in the evaluation process?

Organizations can mitigate risks by implementing targeted strategies, such as diversifying suppliers to reduce dependency on single sources and enhancing cybersecurity measures to protect against digital threats.

Why is it important to leverage technology in risk assessments?

Leveraging technology in risk assessments is important as it allows organizations to utilize real-time analytics for effective financial continuity planning and maintaining business resilience, especially as the landscape evolves.

What does the case study 'Sustainability Liabilities Move Up the D&O Watchlist' highlight?

The case study highlights the growing scrutiny on corporate sustainability practices and their potential legal implications, emphasizing the need for comprehensive risk management in organizations.