Overview

Financial efficiency audits significantly enhance business performance by pinpointing inefficiencies, optimizing resource allocation, and improving decision-making. These elements collectively contribute to heightened operational effectiveness and lower costs. Furthermore, these audits deliver actionable insights and cultivate a culture of continuous improvement. Consequently, they position companies for sustainable growth and a competitive edge in the market.

Introduction

In a competitive landscape where every dollar counts, small and medium businesses are increasingly turning to financial efficiency audits as a strategic lifeline. These audits not only uncover hidden inefficiencies but also empower organizations to streamline their financial operations, optimize resource allocation, and bolster compliance with regulations. By focusing on critical areas such as:

- Budgeting

- Forecasting

- Expense management

Businesses can transform their financial practices, enhance cash flow, and ultimately position themselves for sustainable growth. Moreover, as the landscape evolves, the insights gained from these audits become invaluable, enabling companies to make informed decisions that drive operational excellence and foster a culture of continuous improvement.

Transform Your Small/ Medium Business: Streamline Financial Operations with Efficiency Audits

Monetary performance assessments play a crucial role in helping companies identify shortcomings within their monetary operations, leading to streamlined procedures and reduced expenses. By concentrating on essential aspects such as budgeting, forecasting, and expense management, these evaluations empower organizations to enhance operational performance and optimize resource allocation. This transformation not only bolsters cash flow but also lays the groundwork for sustainable growth.

Recent data indicates that companies engaged in resource management reviews experience a significant improvement in operational performance, with many reporting enhanced decision-making capabilities and lower overhead costs. For instance, a case study on employee benefit plan evaluations revealed that companies leveraging assessment results could refine their processes, resulting in decreased expenses and improved management of their plans. This case study illustrates how economic performance assessments can yield substantial operational enhancements.

Expert opinions underscore the importance of these assessments; CFOs have noted that insights derived from economic performance evaluations can catalyze transformative changes in corporate operations. As Chan Li, a prominent scholar in business productivity, emphasizes, the regulatory landscape surrounding assessments, including the Department of Labor's role in ensuring the accuracy of Form 5500 submissions, can profoundly influence operational productivity.

In 2025, the benefits of economic productivity evaluations for small and medium enterprises are more apparent than ever. These evaluations not only facilitate compliance with regulations, such as the timely submission of Form 5500, but also provide actionable insights that drive operational improvements. By embracing financial efficiency audits, SMEs can position themselves for enhanced performance and enduring success. Furthermore, the integration of real-time analytics allows organizations to continuously monitor their performance, ensuring they can swiftly adapt and respond to challenges, thereby effectively operationalizing turnaround lessons.

Identify Cost-Saving Opportunities: Uncover Hidden Savings Through Financial Efficiency Audits

Financial efficiency audits uncover hidden savings by analyzing spending patterns and identifying unnecessary expenditures. Companies often discover they are overpaying for services or supplies, or they may find opportunities to negotiate improved terms with vendors. Our team is dedicated to identifying underlying business issues and collaborating to create a plan that mitigates weaknesses. This approach allows companies to reinvest those savings into growth initiatives.

We apply rigorous testing and measurement processes to validate the outcomes of our financial efficiency audits, ensuring that the implemented strategies yield maximum returns. Furthermore, by utilizing methodologies such as benchmarking and variance analysis, we provide a clearer picture of the performance landscape.

Moreover, implementing these findings and continuously monitoring performance through real-time analytics enables organizations to enhance their profitability and operationalize turnaround lessons effectively. This method aligns with our plans for mastering the cash conversion cycle, ensuring that companies not only save but also enhance their economic performance.

Enhance Compliance: Ensure Adherence to Financial Regulations with Efficiency Audits

Economic performance evaluations are essential for companies striving to comply with fiscal regulations and criteria. By conducting financial efficiency audits, organizations can thoroughly review financial practices to identify compliance gaps and take necessary corrective actions. This proactive approach not only mitigates risks but also enhances the organization's reputation with clients and regulators.

In 2025, companies engaging in financial optimization evaluations are expected to see a significant rise in compliance rates. Research indicates that organizations leveraging technology in their evaluations can avert financial restatements and enhance overall compliance effectiveness by conducting financial efficiency audits.

Furthermore, expert opinions underscore the importance of financial efficiency audits in achieving operational excellence, which leads to more informed decision-making and sustained organizational success. As one specialist noted, "By doing so, you can attain a degree of operational excellence that results in improved effectiveness, more informed decision-making, and ultimately, sustained business success."

Mastering the cash conversion cycle through strategic planning and ongoing performance monitoring can further amplify these outcomes. For example, innovations in digital auditing, particularly through machine learning and AI, are revolutionizing how industries approach compliance, as demonstrated in the case study titled "Future Trends in Digital Auditing." This case study illustrates the concrete benefits of integrating technology into financial practices, highlighting the shifting regulatory landscapes.

Therefore, the importance of financial efficiency audits in maintaining compliance cannot be overstated.

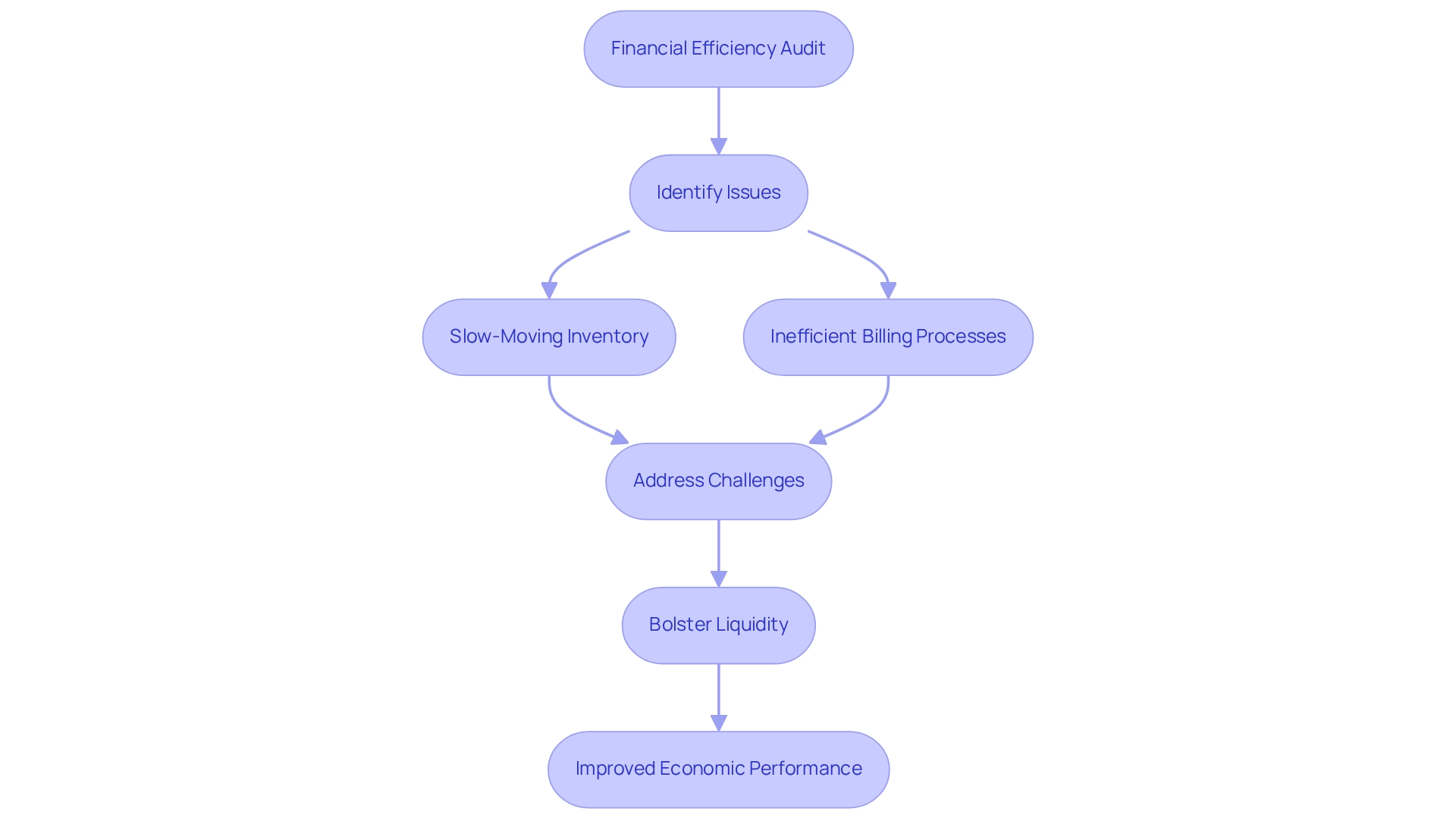

Improve Cash Flow Management: Optimize Liquidity with Financial Efficiency Audits

Financial efficiency audits can significantly enhance cash flow management by identifying areas where funds are unnecessarily constrained. For instance, financial efficiency audits can uncover issues such as:

- Slow-moving inventory

- Inefficient billing processes that delay cash inflows

By addressing these challenges, companies can bolster their liquidity through financial efficiency audits, ensuring they have the necessary funds to operate and expand. Moreover, our approach fosters a streamlined decision-making cycle, enabling your team to take decisive actions based on real-time analytics. This continuous monitoring of operational health through our client dashboard ensures that your cash conversion cycle is optimized, ultimately leading to improved economic performance.

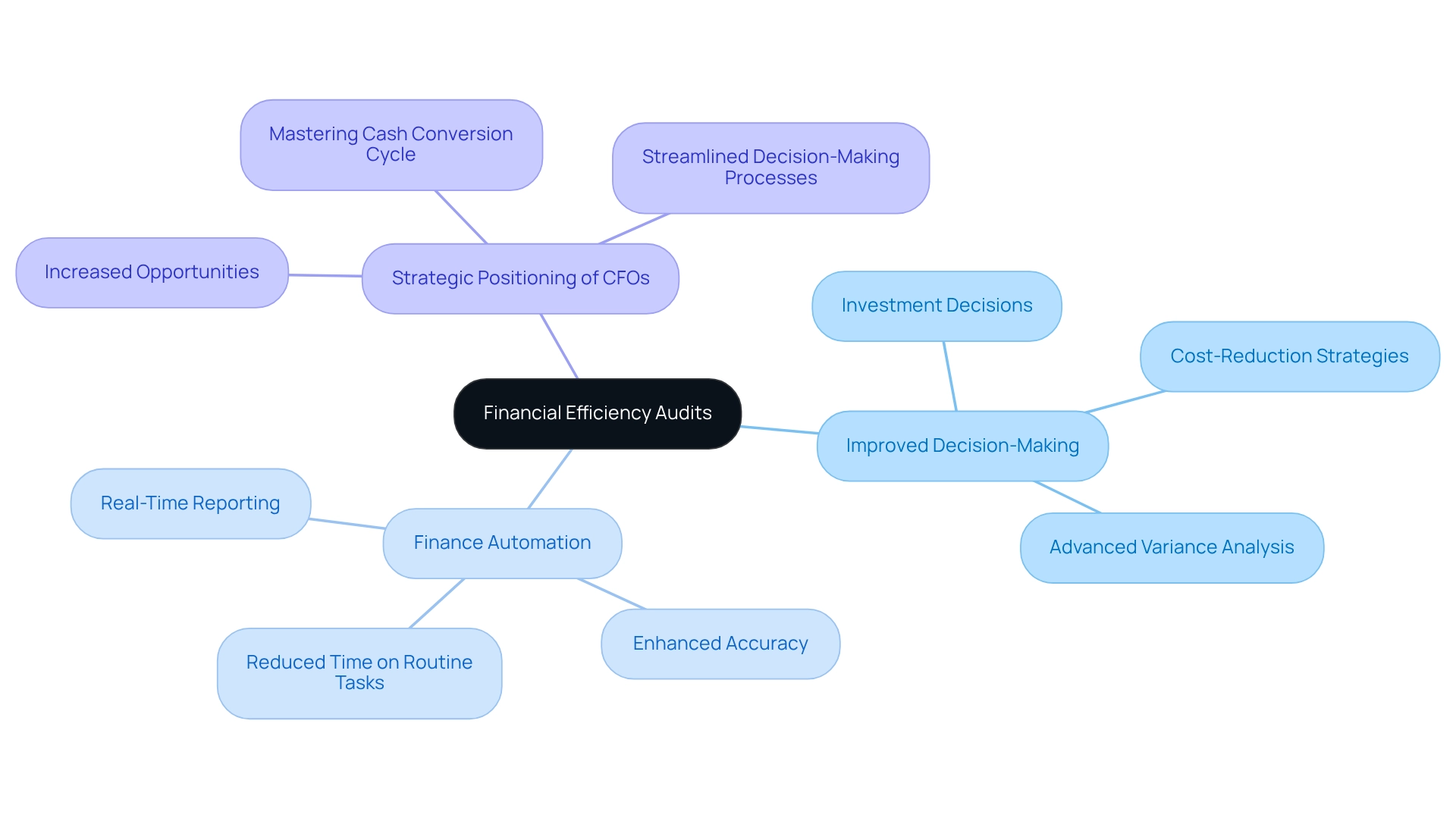

Facilitate Better Decision-Making: Gain Accurate Insights with Financial Efficiency Audits

Economic efficiency evaluations, such as financial efficiency audits, empower enterprises by delivering precise and comprehensive insights into their fiscal condition. By conducting financial efficiency audits and meticulous analyses of monetary data, organizations can make informed decisions regarding investments, cost-reduction strategies, and strategic initiatives. This data-driven approach significantly enhances the effectiveness of management decisions, leading to improved business outcomes.

Research indicates that firms conducting fiscal effectiveness evaluations experience a notable increase in decision-making precision, with 70% of finance experts acknowledging the challenges posed by economic fluctuations, such as inflation and the potential for recession. Financial efficiency audits can alleviate these pressures by providing reliable information that supports informed decision-making.

Furthermore, organizations that embrace finance automation report substantial advantages, including reduced time spent on routine tasks and enhanced accuracy, as illustrated in the case study titled 'Benefits of Finance Automation.' This case study demonstrates that finance automation contributes to strategic value creation and improved risk management. Moreover, automation facilitates advanced variance analysis and real-time reporting features, further underscoring the benefits of economic assessments in decision-making processes.

By leveraging these insights, businesses can navigate challenges more effectively and position themselves for sustainable growth. Significantly, with 43% of CFOs indicating they are approached for new CFO roles more frequently, financial assessments can aid CFOs in enhancing their strategic standing within a competitive landscape. By mastering the cash conversion cycle and implementing streamlined decision-making processes, organizations can optimize their performance and ensure they are well-equipped to respond to market changes.

Enhance Operational Performance: Drive Growth Through Financial Efficiency Audits

Financial efficiency audits are crucial in identifying inefficiencies and recommending targeted enhancements that significantly improve operational performance. By streamlining processes, minimizing waste, and optimizing resource allocation, organizations can achieve substantial productivity gains. A recent study emphasized that companies investing in automation as part of their efficiency strategies experienced not only cost savings but also improved employee satisfaction and retention. Juan Perez, EVP and CIO of Salesforce, stated, 'Those that invest in automation are poised to reap significant cost savings and productivity benefits.' This aligns with specialist perspectives indicating that streamlining procedures via automation is transformative for both employee and customer experiences. Moreover, our strategy encompasses mastering the cash conversion cycle, essential for improving operational performance. By identifying underlying organizational issues and collaboratively creating a plan to mitigate weaknesses, we enable enterprises to reinvest in key strengths. Ongoing performance monitoring through real-time analytics facilitates streamlined decision-making and the application of turnaround lessons, ensuring that organizations remain agile and responsive to market changes.

Case studies demonstrate the concrete advantages of resource management assessments. One significant instance involved a mid-sized manufacturing company that, after performing a comprehensive review of its finances, managed to lower operational expenses by 20% while concurrently boosting production. Such results illustrate how financial efficiency audits can promote company growth by nurturing a culture of ongoing enhancement and flexibility. In summary, the influence of financial efficiency audits extends beyond short-term cost reductions; they are essential in improving operational performance, boosting productivity, and ultimately aiding in sustainable company growth.

Gain Competitive Advantage: Leverage Financial Efficiency Audits for Strategic Growth

Harnessing insights from financial efficiency audits can give companies a significant competitive advantage. By mastering the cash conversion cycle and implementing strategies like optimizing inventory management and enhancing receivables collection, organizations can streamline decision-making processes and leverage real-time analytics for effective turnaround management. This strategic approach not only reduces expenses but also empowers companies to offer more competitive pricing or invest in marketing and innovation.

Our services, priced at $99.00, focus on identifying underlying organizational issues and collaboratively developing a plan to address these weaknesses. Continuous performance assessments and relationship development through these analytics facilitate the application of insights gained, ultimately aiding organizations in capturing market share and enhancing their brand reputation. Furthermore, we stress the importance of rigorously testing every hypothesis to ensure maximum return on invested capital in both the short and long term.

Mitigate Financial Risks: Strengthen Risk Management with Efficiency Audits

Financial efficiency audits serve as a vital tool for companies aiming to identify and mitigate financial risks through a thorough evaluation of their fiscal practices. By revealing vulnerabilities such as insufficient internal controls and compliance issues, financial efficiency audits empower organizations to implement targeted strategies that enhance their risk management frameworks. This proactive approach not only diminishes the likelihood of financial losses but also bolsters overall organizational stability.

In 2025, the impact of financial efficiency audits on risk management structures has become increasingly significant, with data indicating that companies employing these evaluations have seen a marked reduction in financial risks, particularly in relation to application-to-application credential usage through advanced automation. Moreover, mastering the cash conversion cycle via strategic planning and real-time analytics has proven crucial for business turnaround and performance monitoring.

Organizations that have integrated performance evaluations into their operations report improved financial health and resilience against market fluctuations, which can be further enhanced by conducting financial efficiency audits. Additionally, case studies illustrate that companies utilizing financial efficiency audits can achieve considerable cost savings while simultaneously supporting sustainability efforts. A notable example is Certero's PowerStudio, which focuses on reducing energy costs and carbon emissions, showcasing how economic assessments can yield both financial and environmental benefits.

As Sam Peters remarked, 'As the company was seeking the most cost-effective method to tackle the issue and transition into a state of sustained control, this was clearly accomplished and done swiftly and effortlessly in under 3 months.' By prioritizing financial efficiency audits and employing strategies for optimal organizational performance, companies can refine their risk management practices and position themselves for sustainable growth. Furthermore, Venminder offers tailored solution presentations to assist organizations in assessing the applicability of financial performance evaluations for their specific needs.

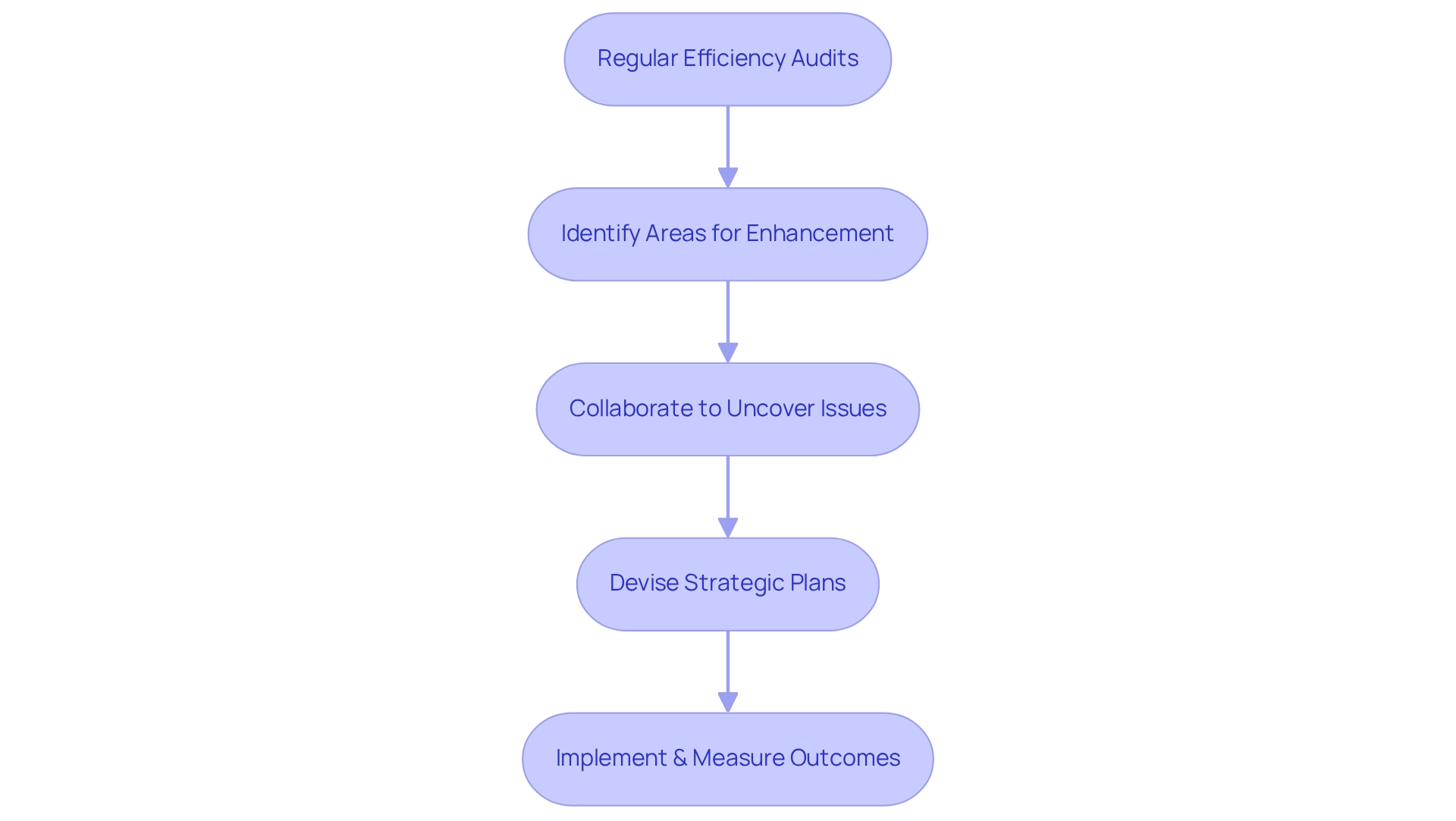

Promote Continuous Improvement: Enhance Financial Processes with Regular Efficiency Audits

Regular efficiency audits serve as a catalyst for fostering a culture of continuous improvement within organizations. By consistently performing financial efficiency audits and identifying areas ripe for enhancement, organizations can adeptly adapt to evolving market conditions and significantly boost their operational efficiency.

Our team collaborates effectively to uncover underlying issues and devise strategic plans that not only elevate performance but also streamline decision-making and facilitate real-time analytics. We implement a pragmatic 'Test & Measure' approach, rigorously validating hypotheses to ensure maximum returns on invested capital. This unwavering commitment to improvement positions businesses for sustainable growth.

Consequently, CFOs are strongly encouraged to implement regular efficiency audits to drive these essential enhancements.

Conclusion

Financial efficiency audits emerge as a vital strategy for small and medium businesses aiming to thrive in a competitive environment. By focusing on key areas such as budgeting, forecasting, and expense management, these audits unveil hidden inefficiencies, enabling organizations to streamline their financial operations and optimize resource allocation. The insights gained from these assessments not only enhance cash flow but also lay a robust foundation for sustainable growth.

Moreover, the benefits of financial efficiency audits extend beyond immediate cost savings. They empower businesses to improve compliance with regulations, mitigate financial risks, and enhance decision-making through accurate data analysis. With the integration of real-time analytics, organizations can continuously monitor their performance and adapt swiftly to market changes, fostering a culture of continuous improvement.

In conclusion, embracing financial efficiency audits positions businesses for long-term success. By identifying cost-saving opportunities, enhancing operational performance, and driving strategic growth, these audits become essential tools for navigating the complexities of the modern business landscape. As organizations prioritize financial efficiency, they not only improve their operational health but also enhance their competitive edge, ultimately paving the way for sustained prosperity.

Frequently Asked Questions

What is the role of monetary performance assessments in companies?

Monetary performance assessments help companies identify shortcomings in their monetary operations, leading to streamlined procedures, reduced expenses, improved operational performance, and optimized resource allocation.

How do monetary performance assessments impact budgeting and forecasting?

These assessments concentrate on essential aspects such as budgeting, forecasting, and expense management, empowering organizations to enhance operational performance and improve cash flow.

What benefits do companies experience from resource management reviews?

Companies engaged in resource management reviews report significant improvements in operational performance, enhanced decision-making capabilities, and lower overhead costs.

Can you provide an example of the effectiveness of economic performance assessments?

A case study on employee benefit plan evaluations showed that companies leveraging assessment results refined their processes, leading to decreased expenses and improved management of their plans.

What insights do CFOs have regarding economic performance evaluations?

CFOs emphasize that insights derived from these evaluations can catalyze transformative changes in corporate operations, highlighting the importance of accurate assessments.

How do financial efficiency audits help companies uncover savings?

Financial efficiency audits analyze spending patterns to identify unnecessary expenditures, overpayments, and opportunities to negotiate better terms with vendors, allowing companies to reinvest savings into growth initiatives.

What methodologies are used in financial efficiency audits?

Methodologies such as benchmarking and variance analysis are applied to provide a clearer picture of the performance landscape during financial efficiency audits.

Why are economic performance evaluations important for compliance?

These evaluations help organizations identify compliance gaps and take corrective actions, mitigating risks and enhancing the organization's reputation with clients and regulators.

What is the expected impact of financial optimization evaluations in 2025?

Companies engaging in financial optimization evaluations are expected to see a significant rise in compliance rates, especially when leveraging technology to avert financial restatements.

How do innovations in digital auditing affect compliance?

Innovations in digital auditing, particularly through machine learning and AI, are revolutionizing compliance approaches, enhancing overall effectiveness in meeting regulatory requirements.