Introduction

Understanding Your Business Loan: A Comprehensive Guide to Refinancing

If you're a CFO or a finance professional in a high-pressure role, you know how vital it is to have a deep understanding of your business loan. Refinancing can be a strategic move to improve your financial health and streamline debt management.

But before considering refinancing, it's crucial to fully comprehend the nuances of your current loan. In this article, we'll explore the importance of scrutinizing the specific terms, interest rates, and payment schedules that bind you to your lender.

We'll also provide practical steps to navigate the refinancing process with confidence and explore the types of business loans available for refinancing. Whether you're looking to bolster day-to-day operations, purchase essential equipment, or fund expansion strategies, this comprehensive guide will equip you with the knowledge you need to make informed decisions. So, let's dive in and unleash the power of strategic refinancing for your business loan.

Understanding Your Business Loan

Understanding the nuances of your current business loan is a crucial first step before considering refinancing. Scrutinize the specific terms, interest rates, and payment schedules that bind you to your lender.

It's imperative to fully comprehend the existing loan's structure, including any covenants or stipulations, as a way to measure up potential refinancing options. Whether it's to buttress day-to-day operations, purchase vital equipment, or fund expansion strategies, refining your knowledge of your loan lays the groundwork for making informed decisions. A thorough evaluation of these details will arm you with the insight to navigate through the refinancing process with a sharp business acumen and strategic foresight.

Why Refinance Your Business Loan

Refinancing your business loan could be a strategic move to improve financial health and streamline debt management. As you navigate the loan landscape, keep in mind the terminology that will guide you through the process. Understanding the principal, interest, maturity, and amortization is crucial to evaluating whether refinancing offers more beneficial terms.

For example, obtaining a lower interest rate through refinancing can reduce the cost of borrowing over time. Additionally, by consolidating multiple loans into a single monthly payment, you can simplify your business's financial management. With various lending options available, from banks and credit unions to online lenders and peer-to-peer platforms, it's imperative to consider the competitive landscape.

As of 2023, non-banking financial institutions are offering rates that challenge traditional banks, making it a ripe time for reassessment of loan agreements. A well-constructed business plan that outlines your company's revenue streams, target customers, market analysis, and financial forecasts can bolster your position when applying for refinancing. Remember, securing a loan that aligns with your strategic goals can significantly impact your ability to invest in growth or manage operational costs.

Steps to Refinance Your Business Loan

Securing a favorable business loan for expansion or to cover startup costs necessitates understanding the loan's structure and choosing the right lender for your needs. A small business loan is a potent tool that allows companies to manage daily operations, cover initial expenses, or grow their footprint. With diverse financial products on the market, each with unique terms and conditions, navigating through the loan process involves several strategic steps:

1.

Analyze your company's financial health and needs. 2. Compare the available lending institutions—banks, credit unions, and increasingly competitive non-bank lenders.

- Collect necessary financial documents, emphasizing stability and potential for growth, which lenders scrutinize. 4.

Prepare a robust business plan detailing your business model, market analysis, and financial projections. 5. Submit your refined loan application, highlighting your ability to meet the repayment terms.

- Review and evaluate loan offers based on interest rates and repayment terms that align with your business's financial strategy. 7. Finalize the loan by undergoing the closing process, ensuring you meet all set conditions.

Understanding the common terms—principal, interest, maturity, amortization—and the types of loans available is critical. Recognize that securing a loan isn't merely about the immediate capital injection but about securing your business's long-term viability and ensuring alignment with your overall vision. A meticulous approach can vastly improve your prospects for gaining a loan that will bolster your business's success.

Types of Business Loans Available for Refinancing

Refinancing your business loan demands a keen understanding of various loan types, as these shape the trajectory of your funding strategy. A traditional term loan is the first port of call for many business owners; it's a straight path to a fixed amount of capital repaid over a set term. To secure this, prepare to present a robust business plan and a credit history that demonstrates reliability.

SBA loans are a different beast, often presenting more favorable terms due to government backing; they require a comprehensive assessment of your company's financial health and strategic foresight. Equipment financing is more narrow in scope; tailored for purchasing the machinery that keeps your company operational. This option can be optimal if your business hinges on high-value hardware that needs regular upgrades.

Invoice financing is the wildcard of loan types, converting unpaid invoices into immediate capital—a crucial cash flow remedy that can unchain your operational capabilities from the whims of client payment schedules. While exploring these options, familiarize yourself with business loan terminology—understanding terms such as principal, interest, and amortization will illuminate the borrowing landscape. This foundational knowledge, coupled with a clear business plan outlining goals, market strategies, and financial projections, is indispensable when deciding on a business loan suited to your company's objectives and financial state.

Factors to Consider Before Refinancing

When contemplating a strategic move such as refinancing, it's essential for business leaders to scrutinize several key facets thoroughly. Begin by assessing the prevailing interest rates; a judicious review may unveil opportunities for decreasing expenses through lower rates.

Next, consider the loan repayment terms closely. This could allow for more rapid debt reduction, echoing the benefits depicted in 'How Big Things Get Done,' where effective planning equates to achieving significant initiatives.

Additionally, be attentive to fees and closing costs. As described in timeless business planning advice, every financial projection must account for such expenditures to ensure a solid foundation for decisions.

Another critical aspect is the presence of any prepayment penalties that might restrict flexibility in managing finances. It is also imperative to evaluate the potential effects on your credit score, for which a seasoned loan and a consistent record of on-time payments, as emphasized in narratives of those with government-backed loans, are advantageous. By meticulously examining these factors, business leaders can reach an informed and strategic verdict on whether refinancing aligns with their objectives and economic prospects. It’s a decision that weighs immediate financial outlays against long-term fiscal health and should be approached with the same level of rigor as crafting a detailed business plan or executing a pivotal project.

How to Choose the Right Lender

Identifying a suitable lending partner is more than just shopping for the lowest interest rates; it necessitates a comprehensive evaluation of what each lender brings to the table. Probe into the credibility and expertise of the lender—this is non-negotiable. Are they experienced in funding businesses within your niche?

Do they have a sterling reputation for reliability and sound financial dealings? The competitive nature of loan terms cannot be overlooked either. Interest rates are paramount, but so are the specifics of the loan agreement such as principal, maturity, and amortization conditions, all of which govern the long-term affordability and feasibility of the refinancing.

Customer satisfaction stories can offer valuable insights into the lender's operability and service quality. Assess customer feedback, which often reflects the lender's capacity to tailor services to individual business requirements and their agility in responding to customer needs. Additionally, flexibility, a key attribute to look for in a lender, can prove crucial during unforeseen economic shifts.

How responsive are they when the economic climate for your business changes, or when an investment opportunity arises during peak season? Lastly, consider the supplementary support you might require—does the lender offer additional resources or advisory services that could aid in your business's growth? These could be in the form of consultations, financial planning, or legal document assistance.

In 2023, even non-bank lenders are starting to rival traditional banks in terms of competitive rates, so it's worth considering a broad spectrum of lenders. Remember, the decision to take on a loan is critical for your business's financial health. Be meticulous in your research, and prioritize your business's unique needs to find the most compatible financial partner for your refinancing goals.

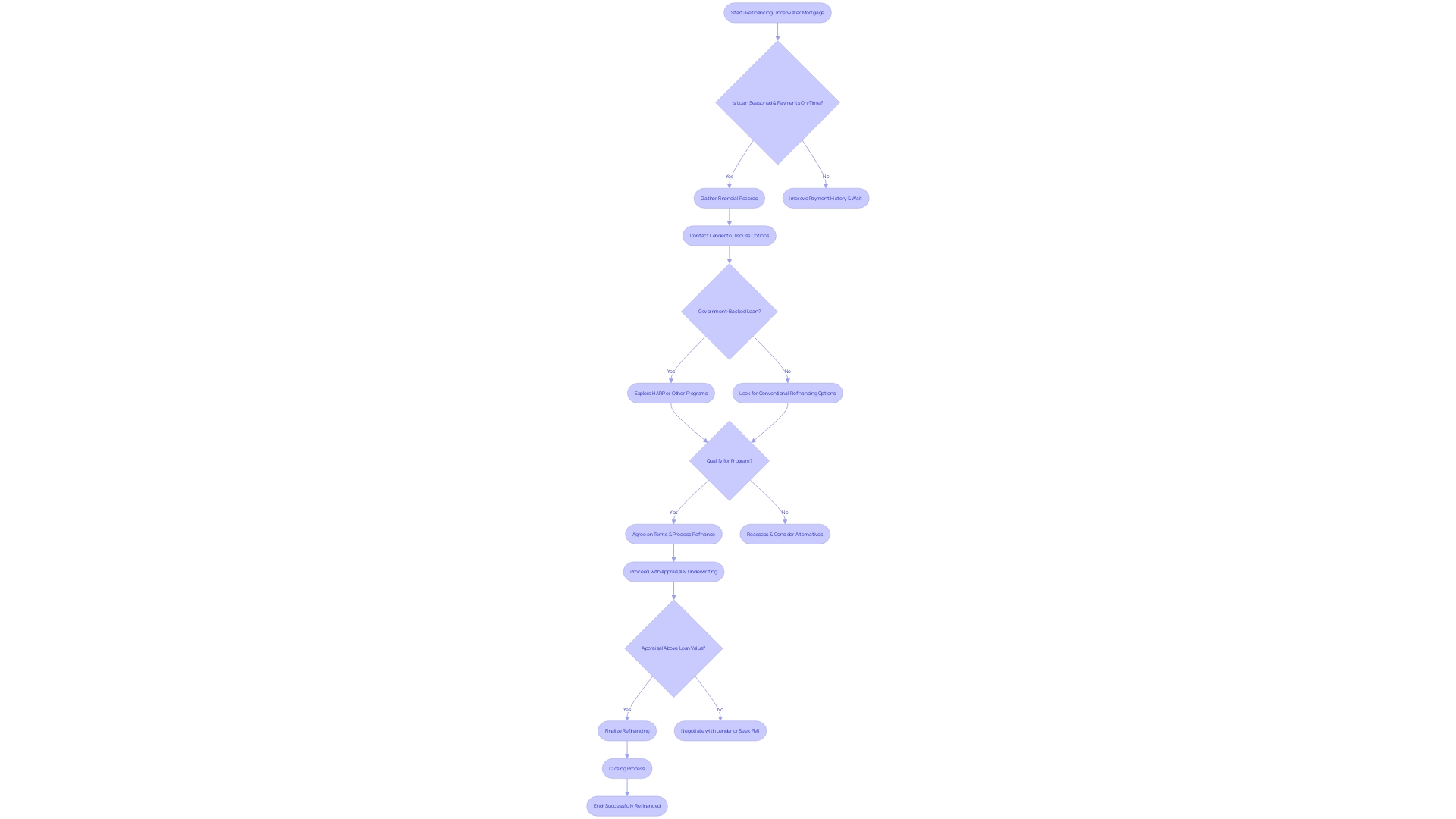

The Refinancing Process: A Step-by-Step Guide

Embarking on the refinancing of an underwater mortgage requires a methodical and strategic approach, given its inherent complexities. Commence with amassing your financial records—a crucial aspect that demonstrates your history of timely mortgage payments and overall loan maturity.

Assessing your present loan is pivotal to ascertain your qualification for refinancing, especially significant for underwater mortgages. Rigorous research and comparison of lenders can expose prospective advantages, such as lower interest rates and the prospect of accelerated loan repayment.

When you submit your refinancing application, it's vital to understand that though closing costs are unavoidable, they should be outweighed by the expected financial benefits, as emphasized by financial experts. Upon receiving multiple loan offers, employ analytical precision to identify the most advantageous option that aligns with your long-term fiscal goals, a decision not to be taken lightly. The culmination of this endeavor is the loan closing process, where due diligence is key to ensuring the decision to refinance bolsters your financial position rather than becoming a monetary encumbrance. These steps, diligently adhered to, form the blueprint for successfully navigating through the refinancing terrain.

Common Mistakes to Avoid When Refinancing

Navigating the refinancing terrain requires a firm grasp of business loan terminology. Understanding key concepts like principal, interest, maturity, and amortization is fundamental. When embarking on refinancing, it's crucial to widen your search beyond traditional banks to include non-bank lenders, as they are now offering competitive rates in 2023.

A robust business plan will not only guide your business's strategic direction but can also bolster your refinancing application. Ensure it encapsulates an in-depth portrayal of your products, target customers, a thorough market analysis, along with marketing strategies and financial projections. Scrutinize the terms and rates of the new loan as they are pivotal elements of the refinancing agreement, influencing your repayment regime.

Capital is the lifeblood of your business; conserving it means being prudent with the associated costs and fees of refinancing. Lastly, don't underestimate the power of your credit score or the insight a financial advisor can bring to this crucial process. By conscientiously considering these elements, you're setting the stage for a successful financial restructuring.

Conclusion

In conclusion, understanding the nuances of your current business loan is crucial before considering refinancing. Scrutinizing specific terms, interest rates, and payment schedules will provide you with the insight needed to make informed decisions. It's important to evaluate whether refinancing offers more favorable terms, such as lower interest rates and simplified debt management.

When refinancing, follow a strategic step-by-step process that includes analyzing your financial health, comparing lenders, and submitting a refined loan application. Familiarize yourself with different loan types and their implications before deciding on a loan that aligns with your business's objectives. Consider factors such as prevailing interest rates, loan repayment terms, fees, and prepayment penalties.

Choose a lender based on their credibility, competitive terms, and customer satisfaction. Lastly, approach the refinancing process with a meticulous and strategic mindset, avoiding common mistakes and seeking guidance from financial advisors. By following these guidelines, you can successfully navigate the refinancing terrain and improve your business's financial position.