Introduction

The financial landscape is constantly evolving, with increased scrutiny on regulatory compliance and financial integrity. To navigate these challenges, organizations must be well-prepared for financial audits. In this article, we will explore the importance of audit preparation and provide practical advice and solutions for CFOs.

From implementing ISO 27001 to safeguard sensitive data to learning from case studies and expert insights, we will delve into the key steps and strategies for successful audit preparation. By embracing a comprehensive approach and understanding regulatory standards, businesses can confidently navigate the intricate audit process with integrity.

Understanding the Importance of Audit Preparation

The financial landscape is continually evolving, and the recent $220 million settlement by SAP over bribery charges underscores the heightened scrutiny on regulatory compliance. To meet these challenges, it's imperative for organizations to be well-prepared for financial audits, adopting a holistic approach to ensure thorough evaluation and reinforcement of their financial integrity.

Implementing ISO 27001: To safeguard sensitive data, an ISO 27001 framework is pivotal. This set of guidelines evaluates and enhances the security of Information Management Systems, addressing all facets—personnel, policies, and technology. It's a systematic method to identify risks, secure data confidentiality, integrity, and availability, and fortify cyber resilience.

Preparing for Your Audit: Assessing your financial reporting needs and establishing a clear timeline is critical. Comprehend the deadline for your financial statements and determine whether they adhere to GAAP or another comprehensive basis of accounting. Such foresight not only streamlines the process but also aligns with the strategic goals of the organization.

Learning from Case Studies: M&T Bank's initiative to establish Clean Code standards exemplifies how industry leaders prioritize regulatory compliance and risk management. Similarly, forensic experts play a crucial role in preserving and analyzing data, ensuring organizations meet the high standards of reputation and regulatory enforcement.

Expert Insights: As one expert puts it, success criteria for audits should be comprehensive, minimal, written, and falsifiable. This aligns with the IPPF's relook, which aims to be fluid, responsive, and assistive to all stakeholders involved in the audit process.

Statistical Backing: With the average cost of data breaches reaching a record high, the role of the Chief Information Security Officer (CISO) has never been more critical. Their leadership in security strategy and execution is vital to the overall success and protection of the business.

In conclusion, a successful audit is not just about checking boxes but about embracing a comprehensive strategy that includes understanding regulatory standards like ISO 27001, being aware of the financial reporting landscape, and learning from both successes and missteps within the industry. By doing so, businesses can navigate the intricate audit process with confidence and integrity.

Establishing Clear Audit Goals

Commencing a financial audit pivots on setting clear, concrete success criteria that guide the entire process. These criteria must encompass all aspects of the audit's objectives, be minimal yet sufficient to achieve the desired outcome, and be documented as a single source of truth. For instance, an audit may aim to detect financial anomalies, uphold statutory compliance, or assess the robustness of internal controls. Involving key stakeholders in defining these criteria ensures they are comprehensive and measurable, which is crucial for the audit's success. This approach not only narrows the focus to the most critical areas but also aligns the audit with the company's overarching goals, such as those highlighted by recent initiatives to reinforce auditor responsibilities and improve the management of audit quality.

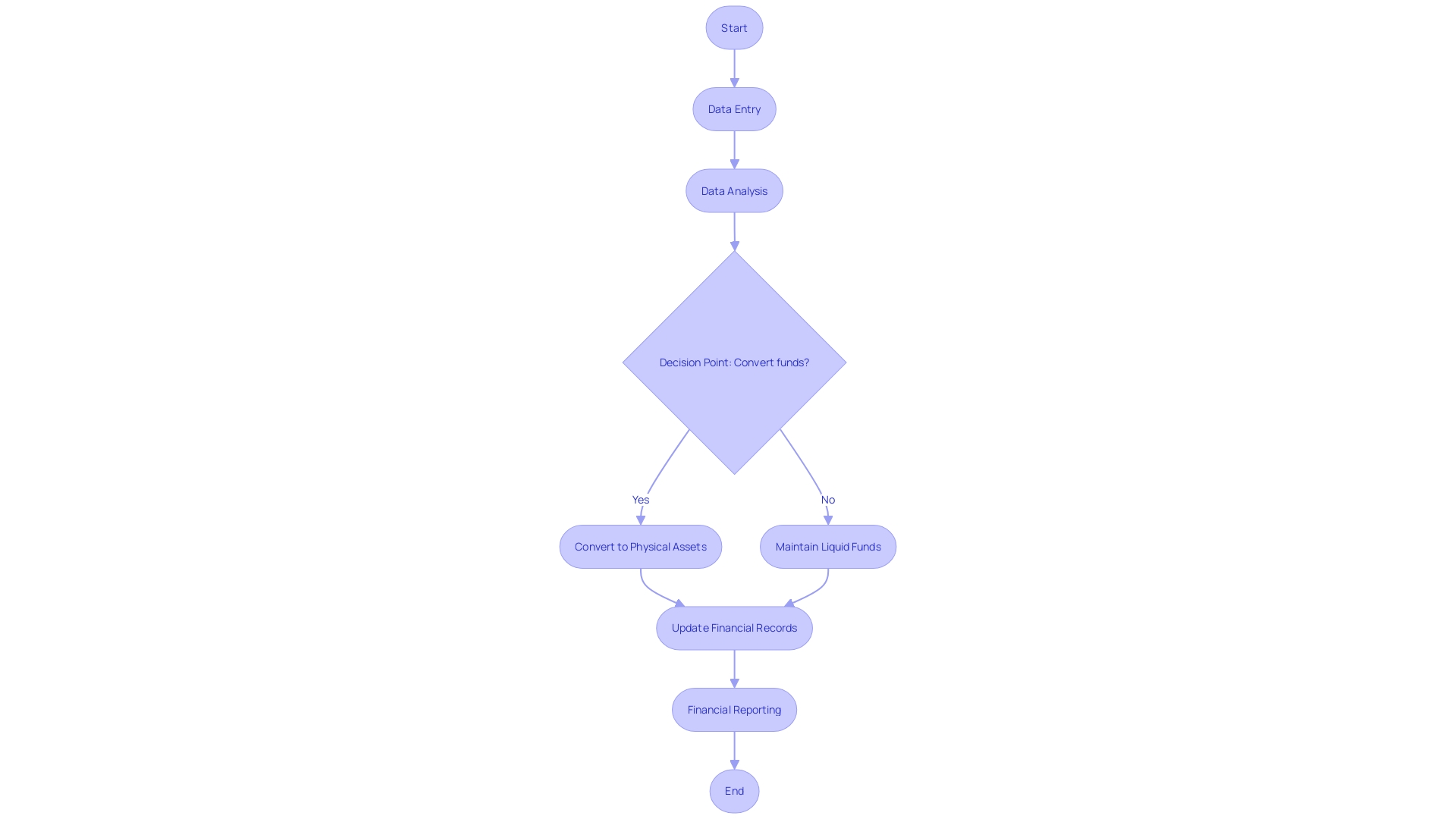

Organizing Financial Records and Documentation

Assembling and maintaining an organized framework of financial records is a foundational step in audit preparation. This process involves meticulous management of all financial transactions within an organization, which can be likened to an intricate web of transfers between various accounts. For instance, when a company purchases a significant asset like a computer, it's not just an expenditure but rather a conversion of liquid funds into a physical asset that still holds value on the books.

Historically, the significance of reliable record-keeping is underscored by ancient civilizations who etched their transactions into stone, ensuring their permanence and resistance to alteration. This methodology, though antiquated, highlights the enduring importance of accurate and immutable records, a principle that resonates with modern financial documentation practices.

In the realm of accounting, which encompasses the analysis and reporting of financial health, accuracy is paramount. Accounting goes beyond simply recording transactions; it involves synthesizing financial data to offer insights into business performance and projections. The line between bookkeeping and accounting may blur, but the distinction is clear: bookkeeping lays the foundation with data entry, while accounting builds upon this to provide a comprehensive financial narrative.

The Government Accountability Office (GAO) embodies this dedication to precision and accountability. It scrutinizes public fund usage and federal programs, delivering objective and balanced information to aid in Congressional decision-making.

Moreover, audit fees, a concern for any CFO, are influenced by the complexity and potential risks involved in auditing a company's financials, as highlighted by analysis of the S&P 500's audit expenditures. A well-prepared audit, informed by diligent record-keeping and accounting practices, mitigates these risks and can lead to a more cost-effective and efficient audit process.

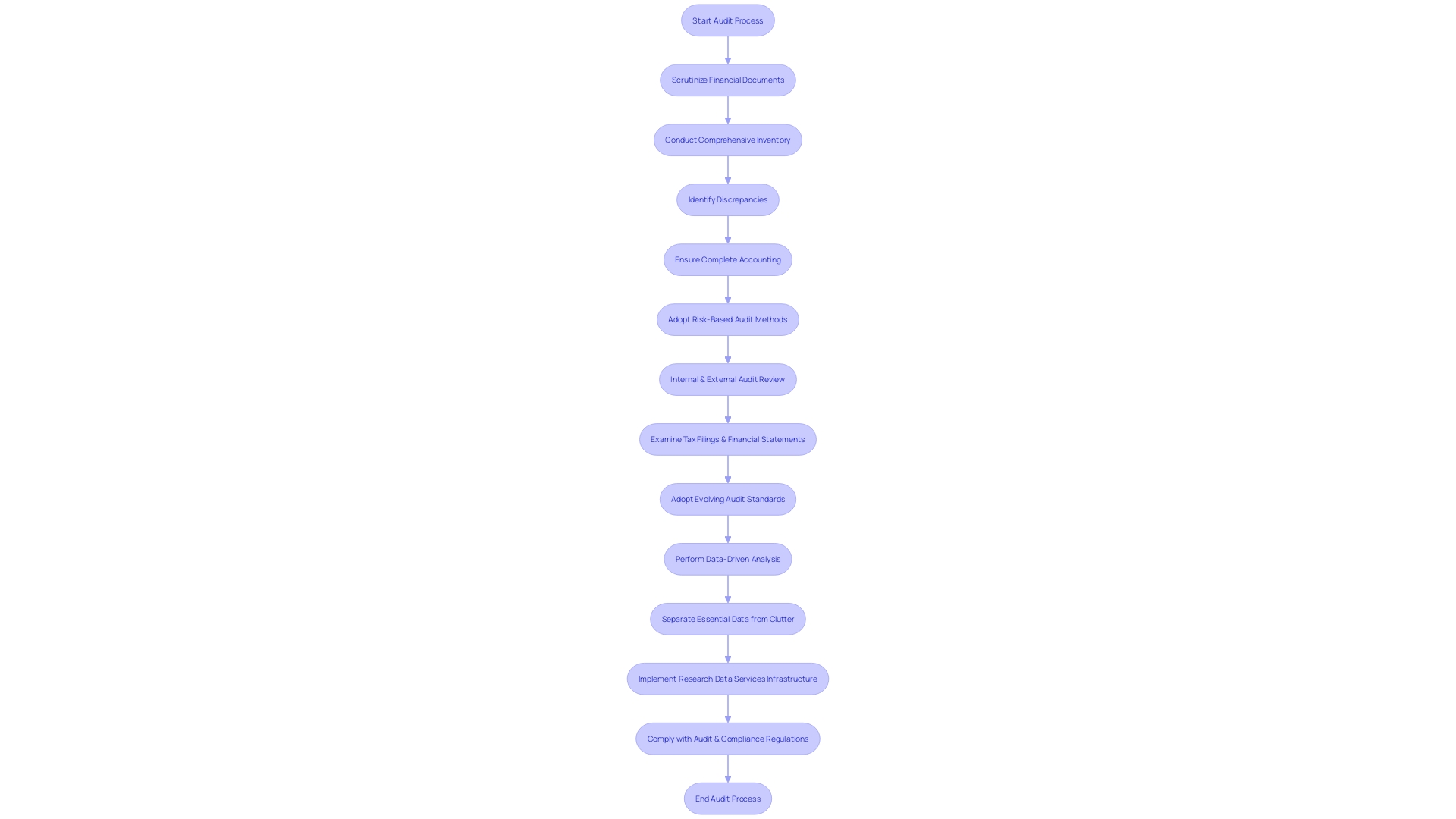

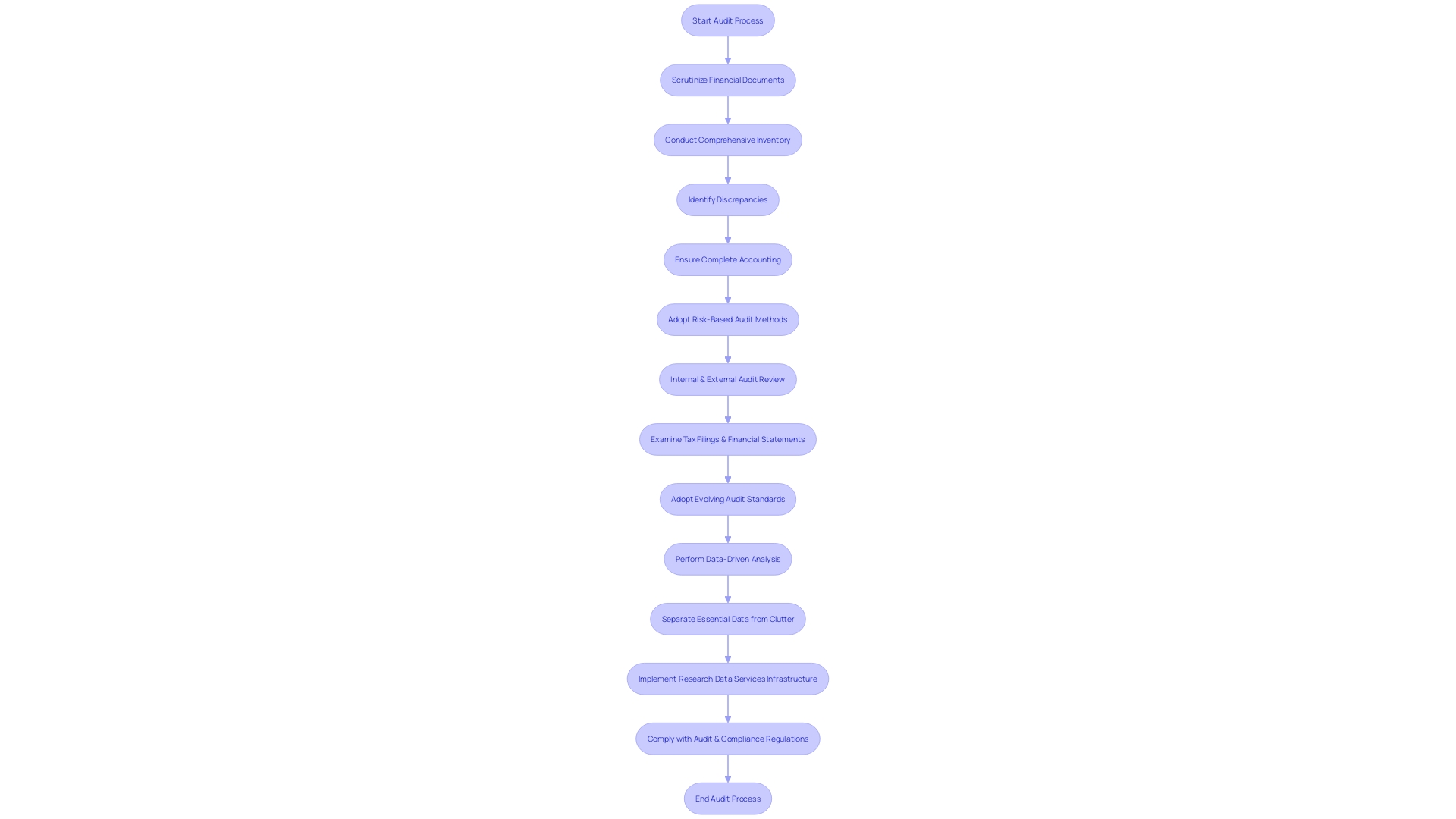

Conducting a Comprehensive Content Inventory

A meticulous evaluation of financial documents and data is pivotal for audit preparedness. This process scrutinizes the precision, relevance, and integrity of all financial materials. A comprehensive inventory ensures no detail is missed, revealing discrepancies or missing elements in the financial records, paving the way for a complete and accurate accounting.

As underscored by the 2024 Yellow Book revisions, audit quality has moved from a focus on quality control to a more dynamic quality management approach. Organizations are encouraged to adopt risk-based methods to manage quality objectives effectively, aligning with the diverse needs of different audit environments.

Moreover, in the realm of small business audits, both internal and external auditors play a crucial role in examining tax filings and financial statements. This rigor is not just about compliance but also about honing in on areas like foreign account reporting to the IRS, ensuring thoroughness in every aspect of financial reporting.

The evolution of the International Professional Practices Framework (IPPF) further emphasizes the necessity for fluid, adaptive standards that cater to the varying demands of practitioners across business sectors. This comprehensive approach aims to support internal auditors in their mission to be valuable to stakeholders, encompassing organizational leadership to service end-users.

In the context of modern content management, organizations must ask critical questions about their content's necessity and utility. Data-driven analysis, using metrics such as page views, content validity, and user engagement, is indispensable for distinguishing between essential content and expendable clutter.

The Ford Foundation's experience illustrates the significant change when scaling content production. As their content output increased, so did the need for a robust system to manage the escalating volume and complexity. Similarly, organizations must adapt their audit preparation to the scale and scope of their operations, ensuring that their financial documentation is comprehensive and in order.

The urgency for an efficient research data services infrastructure is another testament to the importance of comprehensive financial audits. Universities and research institutions face the challenge of siloed and informal data services, which can lead to inefficiencies and confusion. A well-structured audit process can help these entities streamline their data services, making them more accessible and adaptable to the evolving needs of researchers.

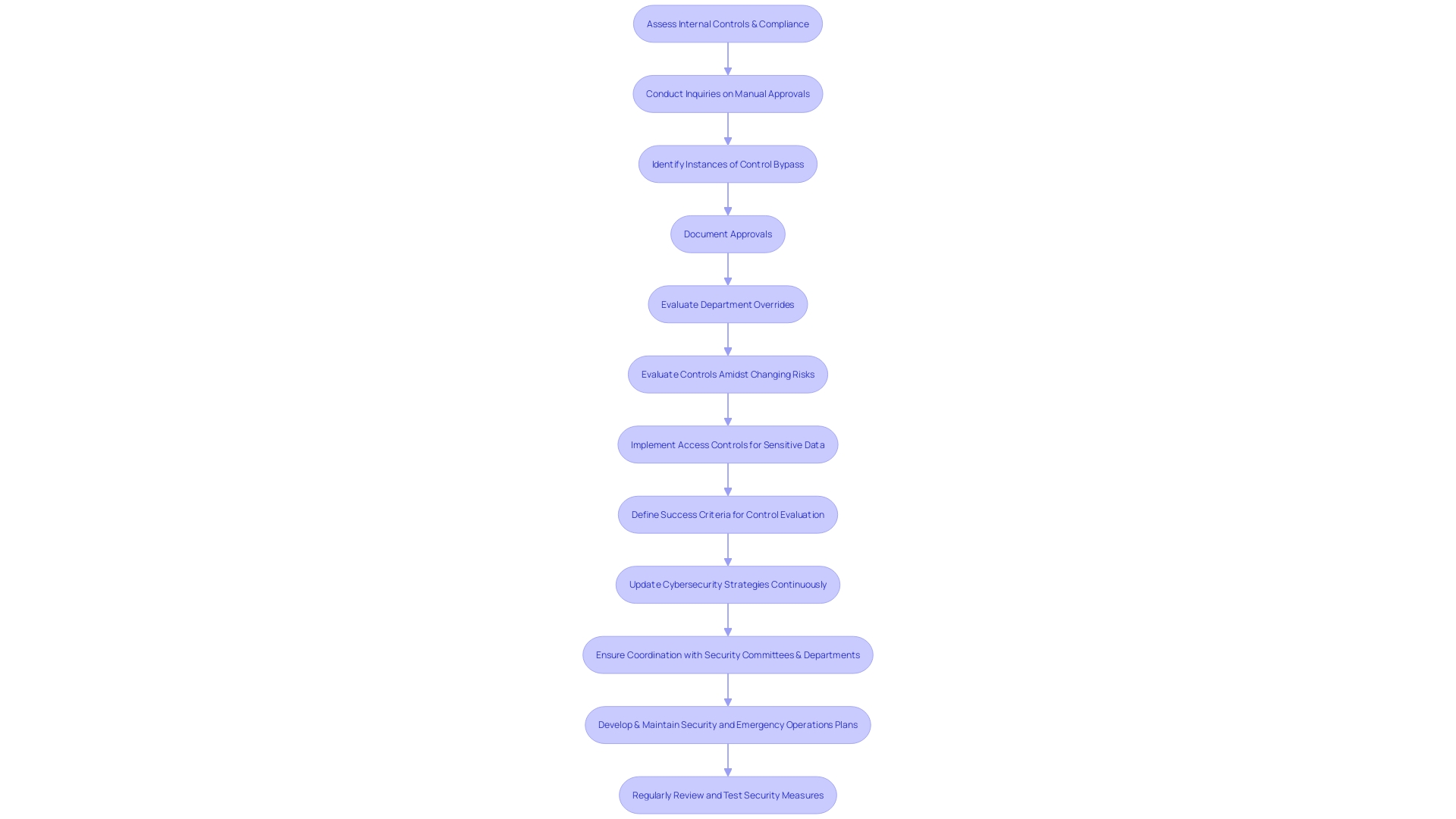

Evaluating Internal Controls and Compliance Procedures

As a preventive measure against potential fiscal discrepancies and fraudulent activities, it is crucial for organizations to rigorously assess and fortify their internal controls and compliance mechanisms. This rigorous evaluation not only ensures adherence to the Foreign Corrupt Practices Act (FCPA) and other regulatory standards but also embeds a robust culture of compliance across the company. Christina Ravelo, an expert in the field, suggests initiating this process with key inquiries: the frequency of manual approvals, instances where controls are bypassed, the levels and documentation of approvals, and the frequency of required overrides by departments. These insights can uncover whether the existing procedures merely reflect a facade of compliance or if they genuinely protect the organization's financial integrity.

Moreover, in the context of risk mitigation, similar to how utility companies in California assess the uncertainty and efficacy of their safety measures against wildfires, organizations must evaluate their internal controls in the face of changing risks and uncertainties. This proactive stance can mitigate reputational risks and avoid the economic repercussions of non-compliance, such as increased operational costs.

Furthermore, the importance of safeguarding sensitive corporate data, as emphasized by Retail Technology Review, underlines the need for stringent access controls. Instituting password-protected systems and regular audits of data access ensures that only authorized personnel handle critical information, which is foundational to maintaining trust with stakeholders.

To establish a starting point for success, organizations should define success criteria that are comprehensive, minimal, written, and falsifiable. Such criteria serve as a single source of truth, ensuring clarity and measurability in evaluating the effectiveness of internal controls, which must include essential elements like delegation of authority, vendor master file maintenance, third-party contracts, and cash flow management.

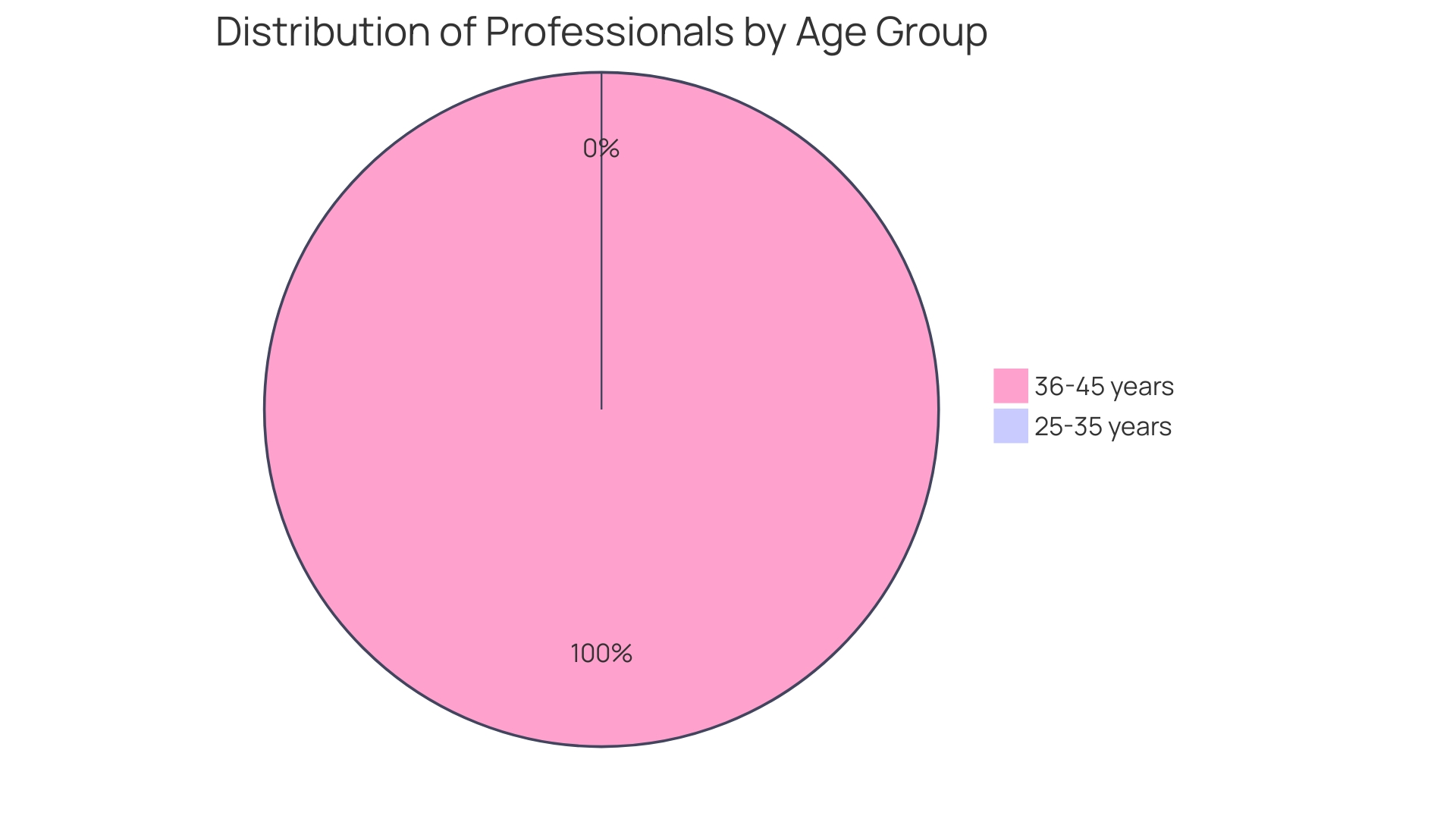

In an era where cybersecurity is paramount, with only 4% of organizations being fully confident in their defenses against cyber threats, the onus is on companies to continuously update and adapt their strategies to safeguard against evolving security vulnerabilities. The cybersecurity workforce, standing at approximately 4.7 million professionals, plays an indispensable role in this ongoing battle to protect the organization's financial and informational assets.

Streamlining and Standardizing Audit Procedures

For organizations aiming to enhance the audit process, embracing a comprehensive, systems-based approach is critical. Take, for example, the International Professional Practices Framework (IPPF) Evolution, a rigorous audit standard overhaul that aimed to be fluid and responsive to the needs of practitioners across diverse business sectors. By clearly defining and documenting necessary actions for each audit task, organizations like M&T Bank have successfully standardized procedures, aligning with stringent regulatory requirements and maintaining high-quality software standards for optimal performance and security.

The implementation of ISO 27001, a globally recognized framework for Information Security Management Systems, further illustrates the importance of a methodical approach to audits. This standard provides a structured methodology for safeguarding information assets, emphasizing the evaluation of personnel, policies, and technology. An ISO 27001 audit rigorously assesses an organization's adherence to these guidelines, highlighting the commitment to managing risks and enhancing cyber resilience.

Moreover, understanding the core processes of a business is fundamental for compliance with any management system. By identifying and managing various types of financial risks—ranging from operational to foreign exchange risks—organizations can leverage regular assessments to gain market advantages and make well-informed financial decisions. Such proactive management is the cornerstone of sustained growth and stakeholder confidence.

In essence, streamlining and standardizing audit procedures not only fosters efficiency and accuracy but also contributes to an organization's ability to meet evolving business demands and regulatory expectations, thereby ensuring long-term success and stability.

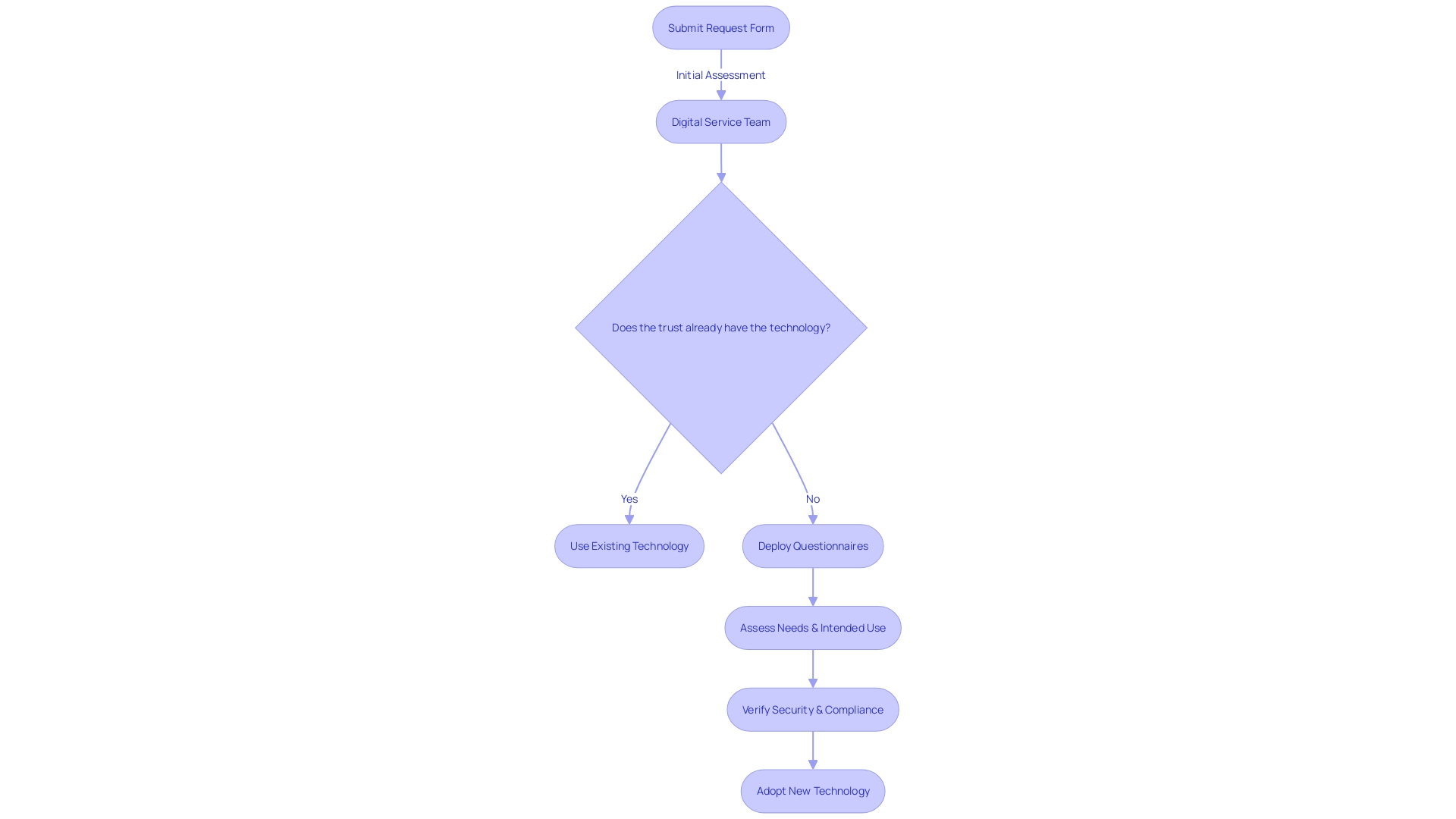

Implementing Technology Solutions for Audit Efficiency

Innovative digital solutions are revolutionizing the way audits are conducted, streamlining processes that were once manual and time-consuming. Take, for instance, the transformative approach of the NHS's Digital Service Team, which scrutinizes new technology requests through a meticulous digital assurance process. By deploying questionnaires that delve into the requester's needs and intended use, the team ensures that only secure, appropriate, and compliant technology is adopted. This proactive measure often reveals that the requested technology or its functionalities are already in place, enhancing efficiency and preventing unnecessary expenditure.

Similarly, adopting advanced audit software is pivotal in combating sophisticated financial statement fraud. With fraudsters mastering the art of concealment within intricate financial reporting systems, and the vast volumes of complex financial data overwhelming traditional analysis methods, the need for technology that can offer real-time insights and automate tasks such as risk assessment is undeniable.

The benefits of such technological integration are echoed in the corporate world, where firms experience substantial growth and heightened customer satisfaction when they adapt their technology capabilities to meet evolving business demands. A strong alignment between business needs and technology capabilities is not just a strategic move; it's an imperative for high-performance IT that fosters deep trust within the organization.

Moreover, technology not only automates mundane tasks, freeing up valuable time for strategic decision-making, but it also provides a clearer view into areas ripe for improvement. For example, during a tech stack audit, compiling a comprehensive list of software and expanding the data set for each tool can reveal usage patterns and integration efficiencies that are essential for informed decision-making.

In essence, the strategic implementation of audit technology is a game-changer. It ensures secure and compliant practices, facilitates the detection of financial fraud, fosters trustworthy IT environments, and aligns technological capabilities with business objectives for stellar performance and growth.

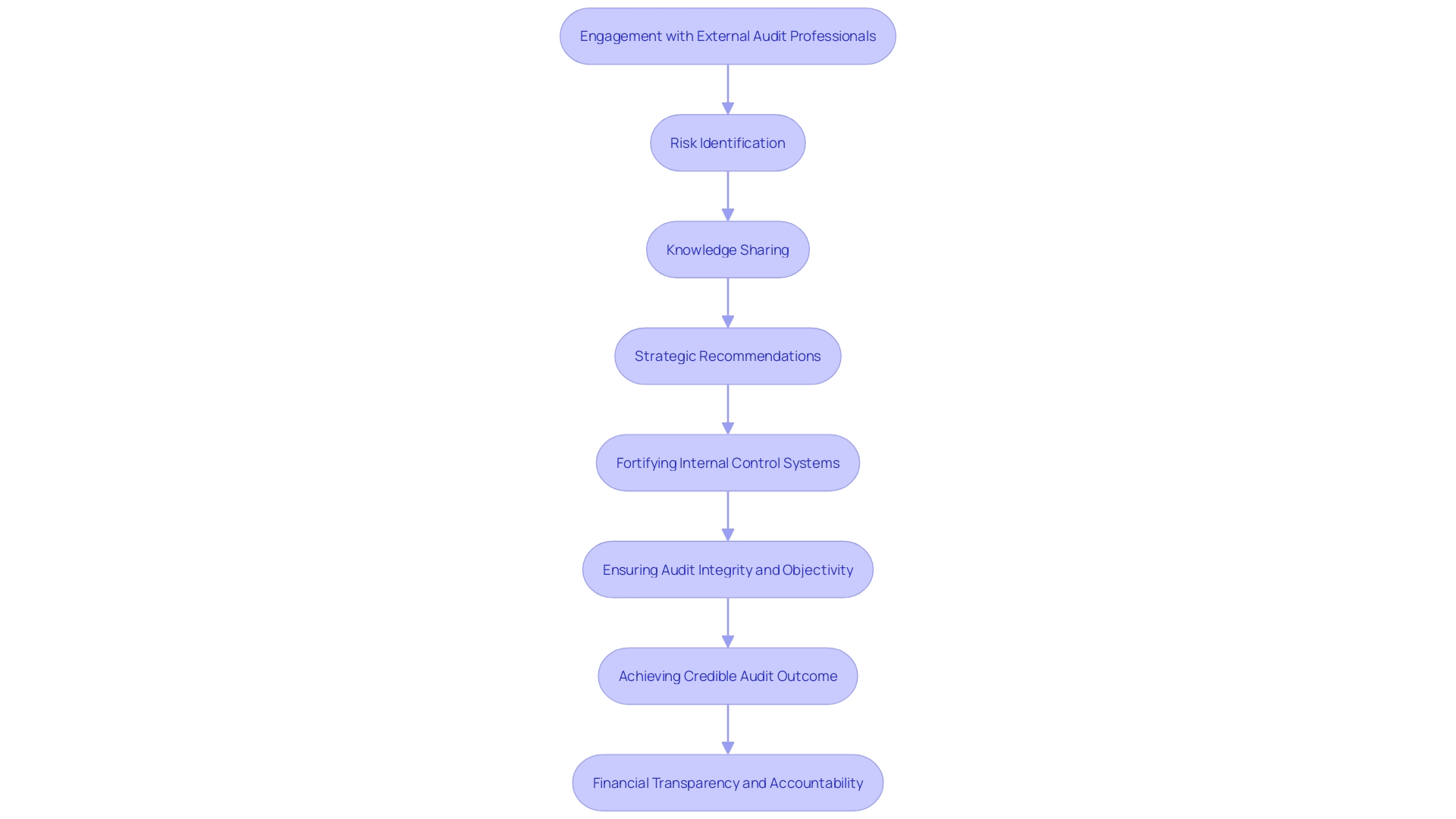

Engaging with External Audit Professionals

Effective collaboration with external audit professionals can significantly enrich the financial audit preparation process. These experts contribute their specialized knowledge and perspectives, guiding organizations through the intricacies of best practices and risk identification. Moreover, they provide strategic recommendations to fortify internal control systems. By facilitating an impartial evaluation, external auditors not only bolster the integrity of the audit results but also its perceived objectivity, which is paramount in maintaining stakeholder confidence. In essence, their involvement is a cornerstone for achieving a thorough and credible audit outcome that underscores a company's commitment to financial transparency and accountability.

Training and Educating Internal Stakeholders

Elevating the expertise of internal stakeholders through targeted education is a cornerstone for executing a seamless audit. As evidenced by Nets, a seasoned player in the digital payment arena, innovative training methodologies can revolutionize the presentation of complex data, making it more digestible and engaging. Embracing this approach, organizations can effectively demystify audit objectives, procedures, and delineate team member responsibilities, fostering an environment where each participant is well-prepared to contribute meaningfully. Moreover, as internal audit functions evolve to address a broader spectrum of risks—including information security and continuous monitoring—companies can no longer sideline the development of a robust, well-informed internal team. The stakes are high, with non-compliance penalties averaging $14M per event and third-party risk incidents costing around $1B each. Therefore, cultivating a proactive and knowledgeable internal audit culture not only meets regulatory expectations but also fortifies organizational resilience against the unpredictable currents of economic, geopolitical, and cyber threats.

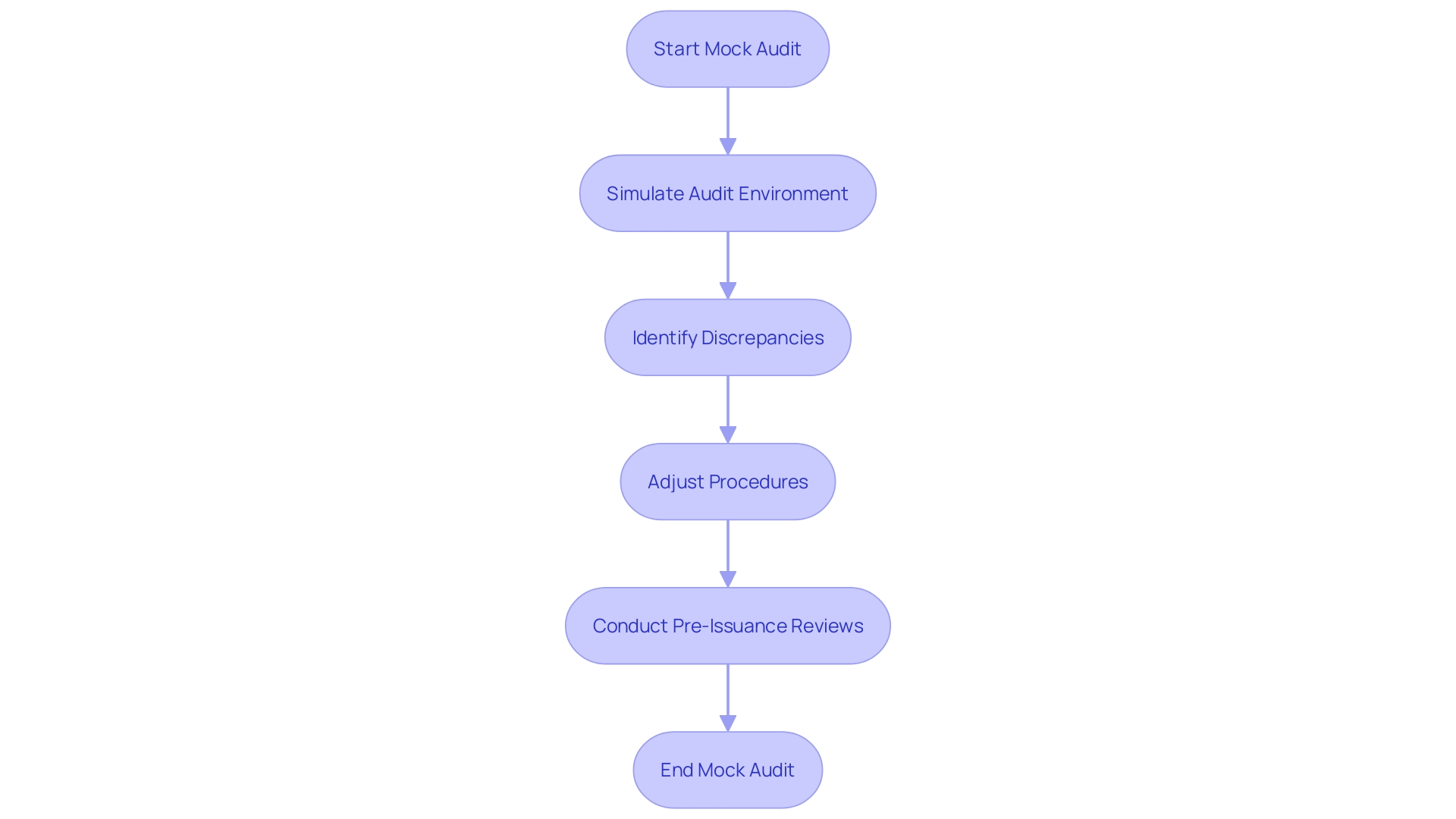

Conducting Mock Audits for Preparedness

Implementing mock audits is a proactive approach that echoes the complexities of actual financial audits, reflecting best practices in audit preparation. By simulating the audit environment, organizations can uncover discrepancies and streamline their processes. This exercise is akin to conducting a thorough self-examination, ensuring that all financial statements align with the generally accepted accounting principles (GAAP) or other relevant accounting frameworks.

The benefits of mock audits have been illustrated by various organizations, such as Allianz India, which faced the challenge of adhering to dynamic compliance and legal standards. Through internal simulations, they could adjust their procedures to meet evolving regulations, thus avoiding potential compliance breaches.

Moreover, as the e-commerce landscape rapidly evolves with new strategies and technologies emerging, such as the business dynamics on Amazon, the importance of staying ahead through continuous audits is paramount. The agility afforded by mock audits allows businesses to remain competitive and responsive to market changes.

Industry statistics reinforce the value of mock audits, highlighting a trend towards more rigorous pre-issuance reviews. For instance, in the 2023 audit cycle, firms have achieved a remarkable milestone where 100% of public audits were subject to extensive pre-issuance scrutiny. This shift towards early-stage review underscores the importance of mock audits in enhancing audit quality.

Lastly, recent advancements in remote desktop access technologies, as showcased in the Remote Incident Manager's free trial period, underscore the innovative methods available for conducting remote audits. This leap in independence and accessibility for audits is a testament to the evolving nature of audit practices and the increasing emphasis on preparation and foresight.

Continuously Improving Audit Processes

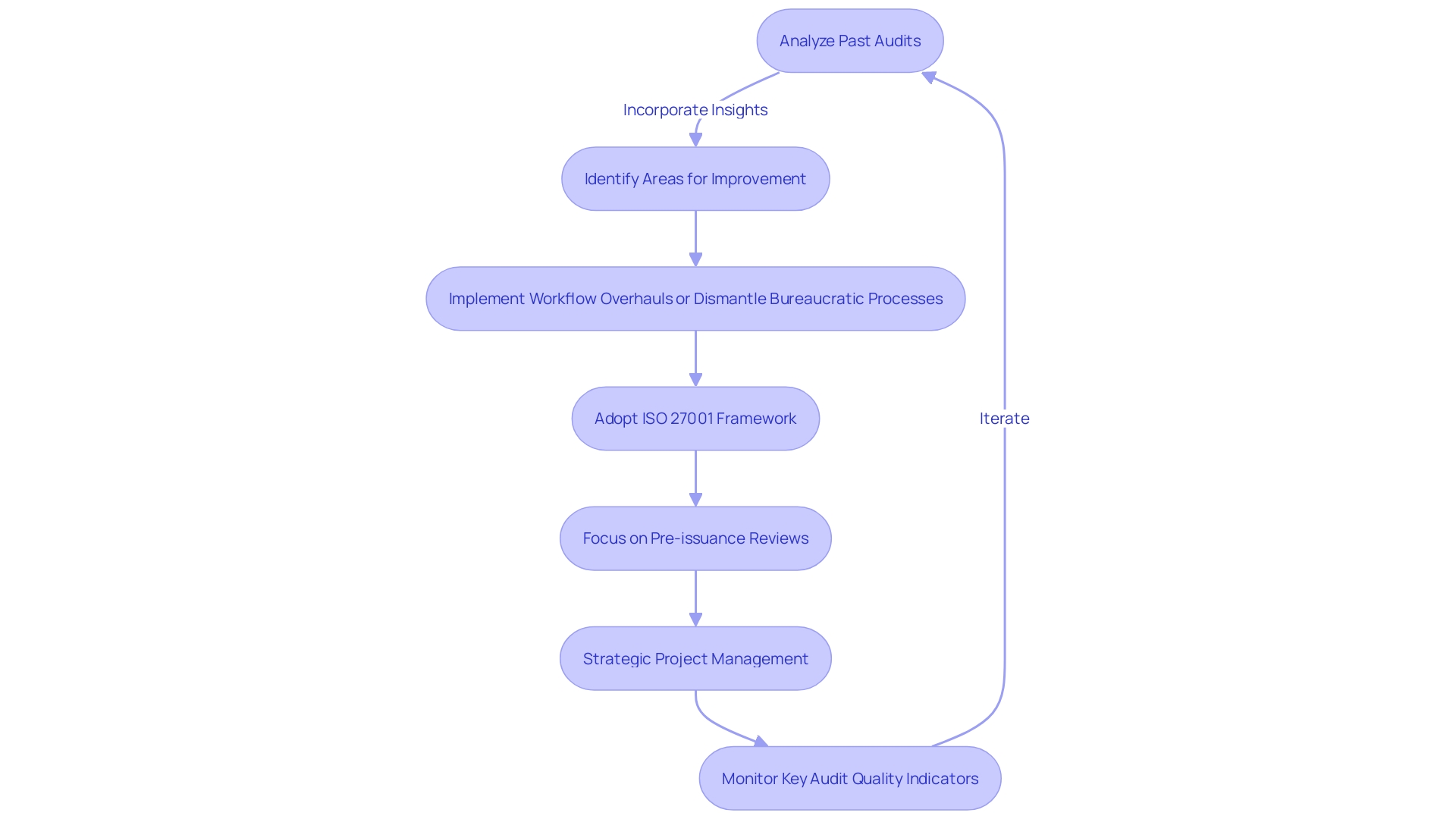

Enhancing the audit process is a dynamic endeavor, shaped by the continuous incorporation of insights gleaned from past audits. It's essential for organizations to systematically analyze and integrate feedback from auditors, pinpointing areas ripe for improvement. This iterative approach not only optimizes current procedures but also paves the way for more streamlined and effective future audits. For example, in the case of the Ford Foundation, a significant workflow overhaul was necessitated when the frequency of content publication escalated, straining the existing content management system. Similarly, AT&T, spurred by employee feedback, recognized the need to dismantle longstanding bureaucratic processes that had become obstacles to efficiency. Adopting a framework such as ISO 27001 can guide organizations through this process, emphasizing a comprehensive review of personnel, policies, and technological systems to bolster information security. A focus on pre-issuance reviews, as seen in recent audit quality reports, supports the drive towards standardization, centralization, and automation, ensuring each phase of the audit cycle contributes to a high-quality outcome. These efforts, when coupled with strategic project management and the monitoring of key audit quality indicators, form the bedrock of a robust and resilient audit process.

Conclusion

In conclusion, effective audit preparation is essential for organizations to navigate the evolving financial landscape with integrity. Implementing ISO 27001 safeguards sensitive data and enhances cybersecurity resilience. Understanding regulatory standards and aligning financial reporting with strategic goals are crucial steps.

Learning from case studies and expert insights prioritizes regulatory compliance and risk management. Organizing accurate financial records and conducting comprehensive content inventories ensure a complete and accurate accounting.

Evaluating internal controls and compliance procedures fortifies the organization against fiscal discrepancies and fraudulent activities. Streamlining and standardizing audit procedures, along with implementing technology solutions, revolutionize the audit process for efficiency and accuracy.

Collaborating with external audit professionals enriches the audit preparation process, providing specialized knowledge and strategic recommendations. Educating internal stakeholders elevates their expertise and ensures a seamless audit.

Mock audits uncover discrepancies, streamline processes, and ensure compliance with accounting frameworks. Continuously improving audit processes through feedback analysis optimizes procedures and strengthens the overall audit process.

In summary, embracing a comprehensive approach, understanding regulatory standards, and learning from industry insights enable organizations to navigate the audit process with integrity. By implementing practical solutions and following best practices, CFOs can confidently prepare for financial audits and ensure the integrity of their financial operations.