Overview

Automated risk assessment for financial crime compliance is essential for CFOs, as it leverages advanced technology to evaluate and manage risks associated with financial offenses. This not only enhances compliance but also reduces manual workloads. Critical components such as data integration and machine learning are outlined, demonstrating how these tools significantly improve detection rates and streamline compliance processes. These aspects are vital for organizations facing increasing regulatory scrutiny.

Moreover, the integration of sophisticated technologies allows CFOs to proactively address compliance challenges, ensuring that their organizations remain ahead of regulatory demands. The use of machine learning algorithms can identify patterns and anomalies that manual processes may overlook, thus increasing the effectiveness of compliance efforts.

Consequently, organizations that adopt automated risk assessment tools position themselves to navigate the complexities of financial crime compliance more effectively. The call to action is clear: CFOs must prioritize these technologies to not only safeguard their organizations but also to enhance operational efficiency and compliance integrity.

Introduction

In an era where financial crimes are becoming increasingly sophisticated, the imperative for robust compliance measures has reached an unprecedented level of urgency. Automated risk assessment stands out as a transformative solution for CFOs, providing a systematic method for identifying and mitigating risks associated with financial offenses such as money laundering and fraud. However, as organizations adopt this innovative technology, they must adeptly navigate the complexities of implementation to ensure their systems can outpace the evolving tactics employed by criminals.

How can CFOs effectively leverage automated risk assessment not only to adhere to regulations but also to fortify their organizations against emerging threats?

Define Automated Risk Assessment in Financial Crime Compliance

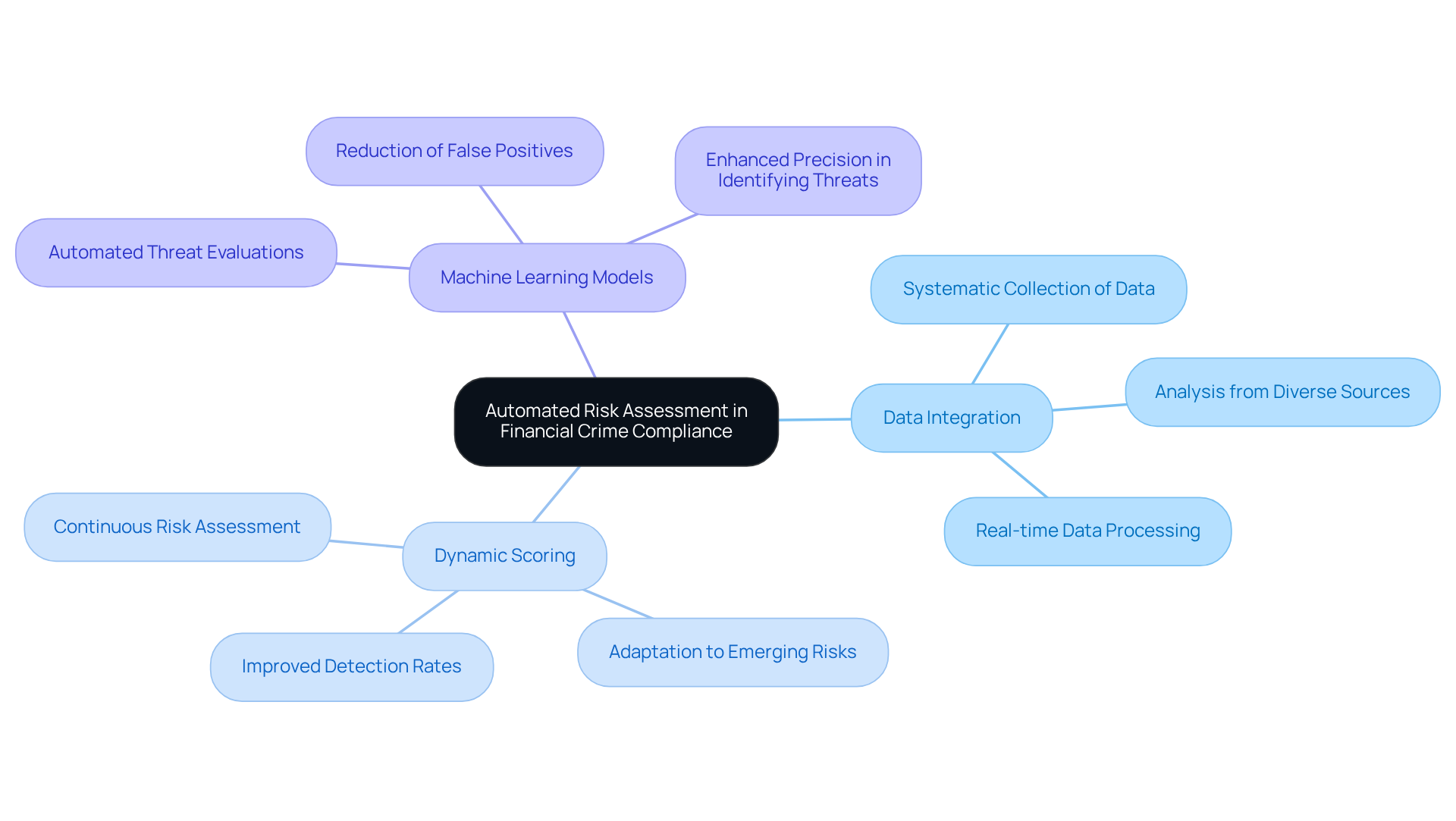

The automated risk assessment for financial crime compliance leverages advanced technology and algorithms to evaluate and manage risks associated with financial offenses, including money laundering and fraud. This process involves the systematic collection and analysis of data from diverse sources to identify potential threats and vulnerabilities within an organization. By automating threat evaluations, businesses significantly enhance their capacity to perform an automated risk assessment for financial crime compliance, streamline compliance procedures, and alleviate the manual workload on compliance teams.

Key components of automated risk assessment for financial crime compliance include:

- Data integration

- Dynamic scoring

- Deployment of machine learning models that adapt to emerging risks

As noted by Tookitaki, their Dynamic Risk Scoring solution is a 'game-changer' for financial institutions navigating uncertainties. For CFOs, grasping this concept is vital, as it directly influences their organization's ability to uphold compliance and effectively mitigate financial risks.

The integration of mechanized systems has demonstrated improvements in detection rates, with AI-driven solutions capable of conducting automated risk assessment for financial crime compliance by analyzing vast datasets in real-time, thereby identifying genuine threats with enhanced precision and decreasing false positives by up to 45%. Furthermore, with 90% of financial institutions projected to adopt AI and ML for automated risk assessment for financial crime compliance by 2025, the shift towards automation is unmistakable.

The recent penalty imposed on Deutsche Bank by the Federal Reserve for failing to address AML deficiencies serves as a stark reminder of the consequences of inadequate evaluation. Nevertheless, it is crucial to acknowledge the challenges posed by AI in this domain; 69% of respondents believe that criminals are more adept at utilizing AI for financial crime than banks are at detecting it.

Establish a Framework for Implementation

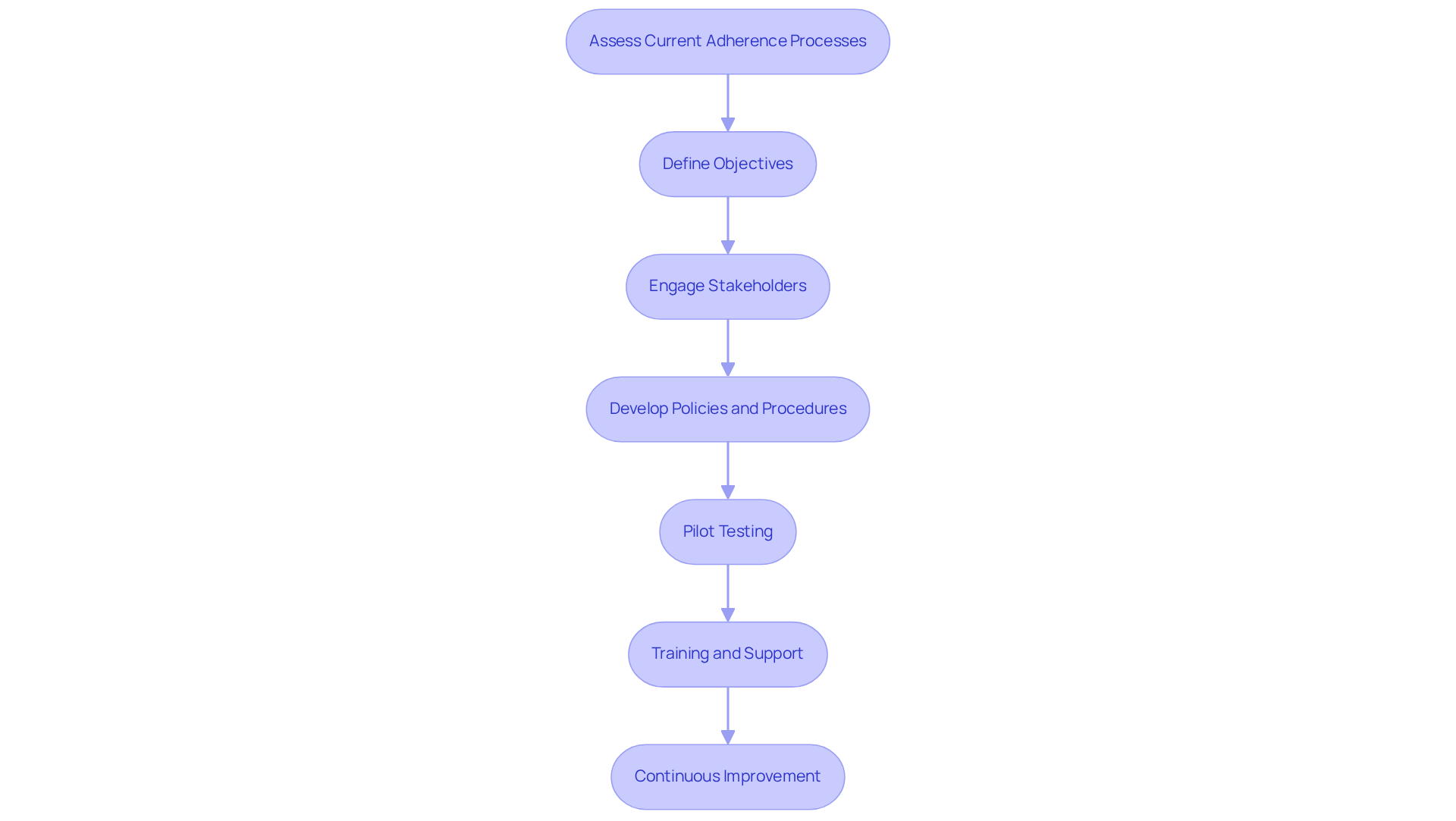

To establish a robust framework for implementing automated risk assessment, CFOs should adhere to the following steps:

- Assess Current Adherence Processes: Conduct a thorough evaluation of existing protocols to pinpoint gaps and areas needing enhancement. Statistics show that 75% of organizations find it challenging to adapt to changing regulatory demands, emphasizing the need for this preliminary evaluation.

- Define Objectives: Clearly articulate the goals of the automated risk assessment, such as minimizing false positives or enhancing detection rates. This clarity will guide the implementation process and align it with organizational priorities.

- Engage Stakeholders: Involve key stakeholders, including regulatory officers and IT teams, to ensure alignment and garner support. Involving these groups early can enable smoother transitions and promote a culture of adherence.

- Develop Policies and Procedures: Formulate comprehensive policies that delineate the operational framework of the systematized evaluation of potential issues, including data handling and reporting protocols. This step is crucial for adhering to regulations such as GDPR and PCI DSS.

- Pilot Testing: Launch a pilot program to test the automated risk assessment tools in a controlled environment. This allows for necessary adjustments before full-scale deployment, ensuring the tools function effectively in real-world scenarios.

- Training and Support: Offer comprehensive training for personnel on the new procedures and tools to guarantee smooth adoption and adherence. Entities that allocate resources for training frequently observe better adherence results, with 85% indicating cost reductions through improved training programs.

- Continuous Improvement: Create a feedback loop to frequently evaluate and enhance the self-operating evaluation framework based on performance metrics and regulatory changes. This iterative approach ensures that the framework remains effective and responsive to the dynamic regulatory landscape.

By adhering to these steps, CFOs can efficiently establish self-operating evaluation procedures that improve compliance and reduce financial crime threats.

Select Appropriate Tools and Technologies

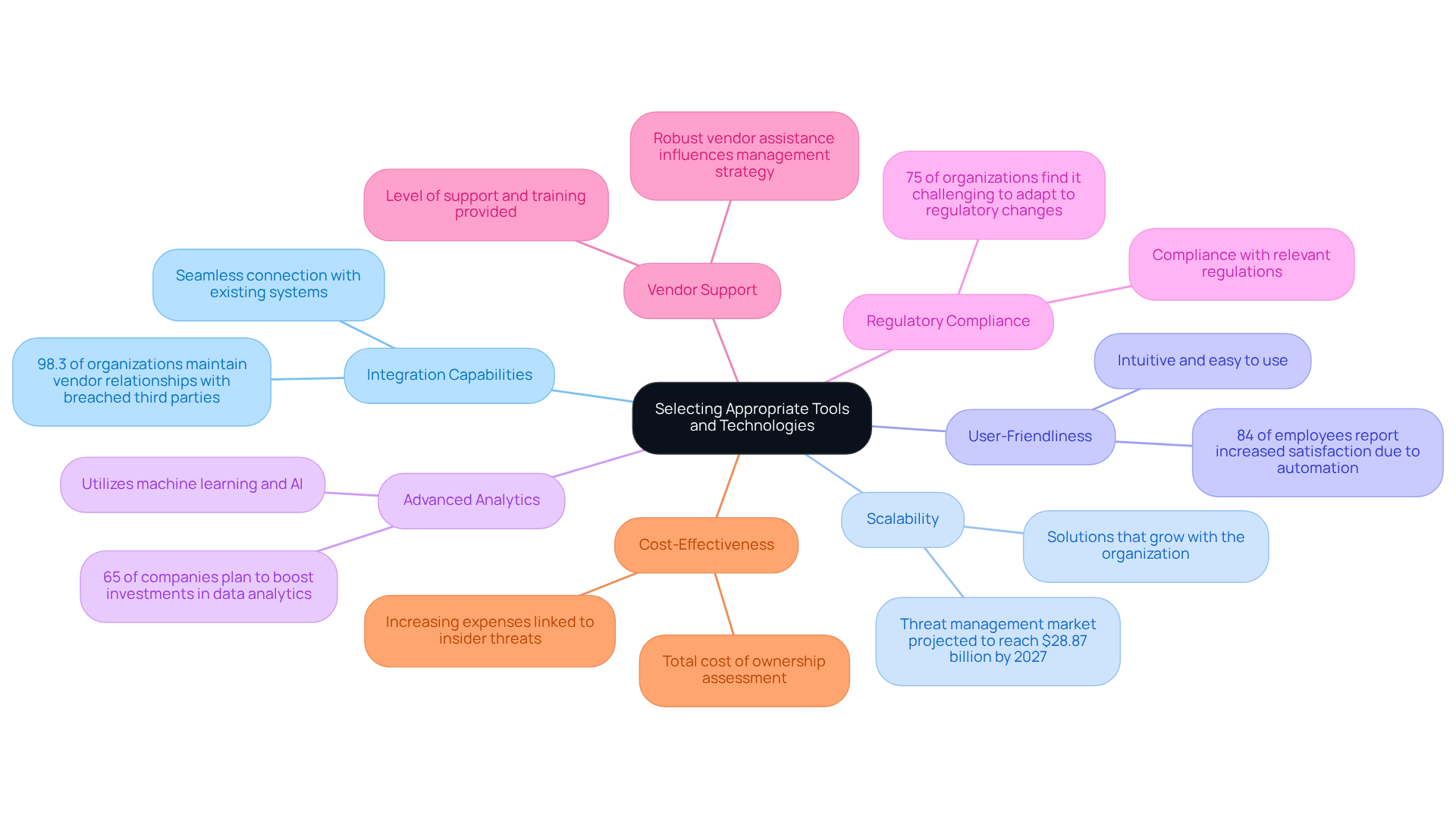

When selecting tools and technologies for automated risk assessment, CFOs should consider the following criteria:

-

Integration Capabilities: Ensure that the tools can seamlessly connect with existing systems and data sources, providing a comprehensive view of potential issues. This is essential as 98.3% of organizations uphold vendor connections with third parties that have encountered breaches, underscoring the necessity for unified management of vulnerabilities.

-

Scalability: Choose solutions that can grow with the organization, accommodating increasing data volumes and complexity. As the threat management market is anticipated to reach $28.87 billion by 2027, scalable solutions will be crucial for long-term success.

-

User-Friendliness: Opt for tools that are intuitive and easy to use, minimizing the learning curve for staff. With 84% of employees reporting increased satisfaction due to automation, user-friendly interfaces can enhance overall productivity.

-

Advanced Analytics: Seek technologies that employ machine learning and AI to improve threat detection and adjust to new challenges. As 65% of companies intend to boost investments in data analytics, utilizing advanced analytics will be essential for efficient management of uncertainties.

-

Regulatory Compliance: Ensure that the selected tools comply with relevant regulations and standards in financial crime prevention. Considering that 75% of organizations find it challenging to adapt to regulatory changes, adherence to regulations should be a top priority.

-

Vendor Support: Evaluate the level of support and training provided by the vendor to facilitate successful implementation and ongoing use. Robust vendor assistance can greatly influence the efficiency of the management strategy.

-

Cost-Effectiveness: Assess the total cost of ownership, including licensing, maintenance, and potential ROI from improved compliance outcomes. With organizations encountering increasing expenses linked to insider threats, economical solutions are crucial for sustainable operations.

Monitor and Evaluate the Automated Risk Assessment Process

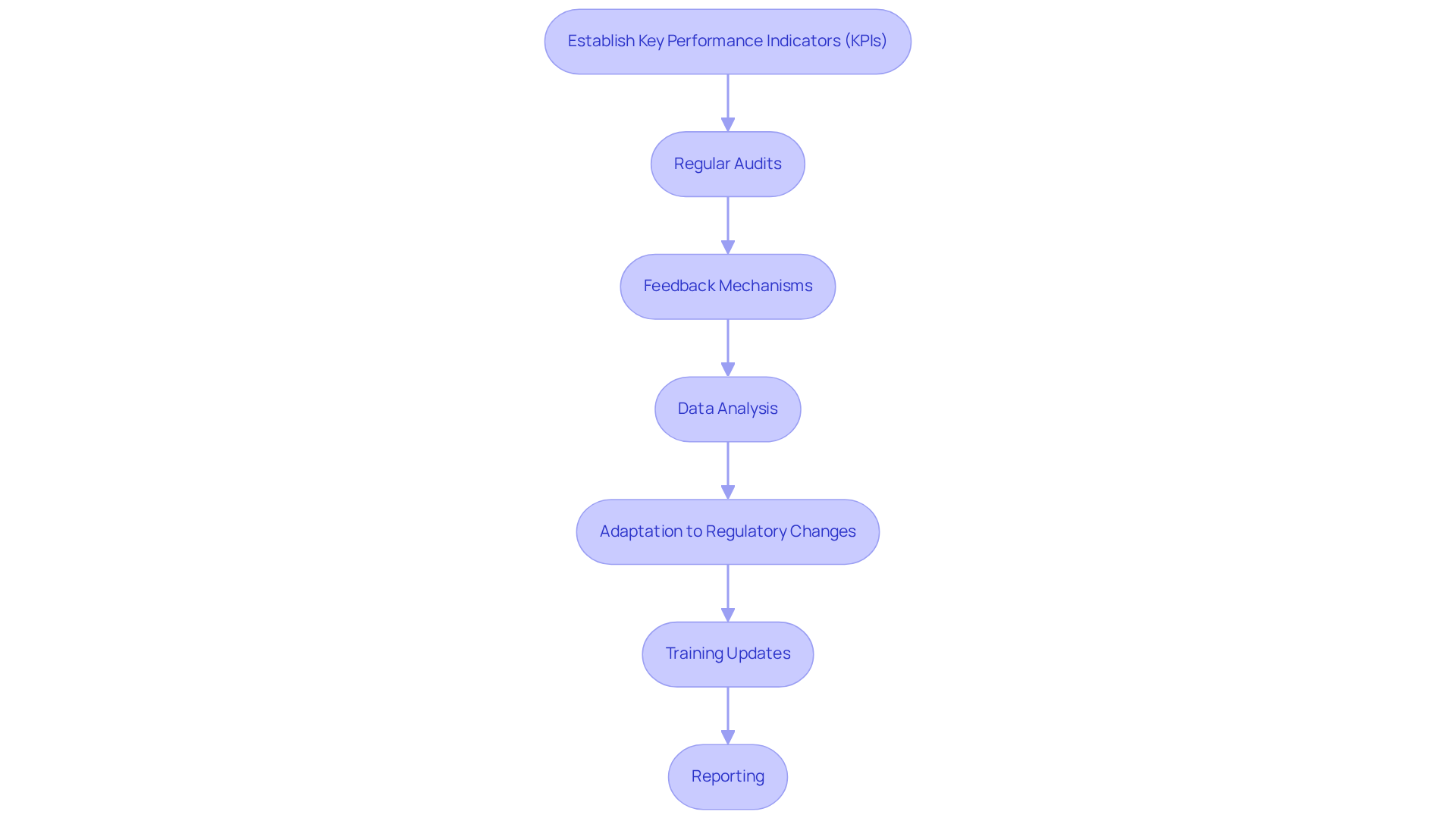

To effectively monitor and evaluate the automated risk assessment process, CFOs must implement the following practices:

-

Establish Key Performance Indicators (KPIs): Define KPIs that evaluate the efficiency of the automated process, including detection rates, false positive rates, and cost of adherence. The average expense of a regulatory issue is determined by dividing total penalties received by the quantity of matters handled by the regulatory department, emphasizing the significance of these metrics in evaluating overall performance and efficiency.

-

Regular Audits: Perform regular evaluations of the risk analysis process to ensure compliance with established policies and pinpoint areas for enhancement. Routine audits assist in upholding compliance and improving the dependability of the evaluation results.

-

Feedback Mechanisms: Establish channels for staff to provide input on the mechanized systems and procedures, promoting ongoing enhancement. Engaging employees in the evaluation process can uncover insights that lead to better tool performance and user satisfaction.

-

Data Analysis: Consistently examine information generated by the automatic evaluation to recognize trends, patterns, and possible areas of concern. This proactive method enables organizations to tackle problems before they worsen, ensuring a strong regulatory framework.

-

Adaptation to Regulatory Changes: Stay informed about changes in regulations and modify the risk assessment process accordingly to ensure adherence. This adaptability is crucial in a rapidly evolving regulatory landscape, where non-compliance can lead to significant penalties.

-

Training Updates: Offer continuous education for personnel to keep them informed about updates to the technology tools and any modifications in regulatory requirements. Ongoing education promotes a culture of adherence and ensures that employees are prepared to use the tools effectively.

-

Reporting: Develop a reporting framework to communicate the results of the automated risk assessment to stakeholders, ensuring transparency and accountability. Clear reporting mechanisms enhance trust and facilitate informed decision-making among leadership and compliance teams.

Conclusion

Embracing automated risk assessment in financial crime compliance is essential for organizations striving to enhance their compliance frameworks and mitigate potential threats. By leveraging advanced technologies and data analytics, CFOs can transform their risk management processes, ensuring a more effective and efficient approach to identifying and addressing financial crimes such as money laundering and fraud.

The article outlines critical components and practical steps for implementing an automated risk assessment framework. Key insights include the importance of:

- Data integration

- Dynamic scoring

- Deployment of machine learning models

Establishing a robust implementation plan, selecting appropriate tools, and continuously monitoring the process are vital to achieving compliance and reducing financial crime risks. Moreover, engaging stakeholders and fostering a culture of adherence can significantly improve the outcomes of these initiatives.

As financial institutions increasingly adopt AI and machine learning technologies, the call to action is clear: CFOs must prioritize the implementation of automated risk assessment strategies to stay ahead of evolving threats and regulatory demands. By investing in these advanced systems and fostering a proactive compliance culture, organizations not only enhance their ability to combat financial crime but also contribute to a more secure financial landscape for all.

Frequently Asked Questions

What is automated risk assessment in financial crime compliance?

Automated risk assessment in financial crime compliance involves using advanced technology and algorithms to evaluate and manage risks related to financial offenses, such as money laundering and fraud, through systematic data collection and analysis.

What are the key components of automated risk assessment?

The key components include data integration, dynamic scoring, and the deployment of machine learning models that adapt to emerging risks.

How does automated risk assessment enhance compliance procedures?

By automating threat evaluations, businesses can streamline compliance procedures and reduce the manual workload on compliance teams, thereby improving efficiency and effectiveness.

What improvements have been observed with the integration of mechanized systems in risk assessment?

Mechanized systems have shown improvements in detection rates, with AI-driven solutions analyzing large datasets in real-time to identify genuine threats more accurately and reduce false positives by up to 45%.

What is the projected adoption rate of AI and machine learning in financial institutions for automated risk assessment by 2025?

It is projected that 90% of financial institutions will adopt AI and machine learning for automated risk assessment for financial crime compliance by 2025.

What recent event highlights the importance of adequate risk assessment in financial institutions?

The Federal Reserve imposed a penalty on Deutsche Bank for failing to address anti-money laundering (AML) deficiencies, underscoring the consequences of inadequate evaluation.

What challenges does AI pose in financial crime detection?

A significant challenge is that 69% of respondents believe criminals are better at utilizing AI for financial crime than banks are at detecting it, indicating a gap in the effectiveness of current detection methods.