Overview

This article delves into best practices for effective stakeholder management from the perspective of a CFO. It underscores the critical importance of engaging various interested parties to align financial strategies with organizational goals. By emphasizing the necessity for transparent communication, the utilization of advanced tools such as CRM systems, and the significance of understanding stakeholder dynamics, the article highlights how these elements foster trust and collaboration. Ultimately, these practices enhance economic performance and resilience.

Introduction

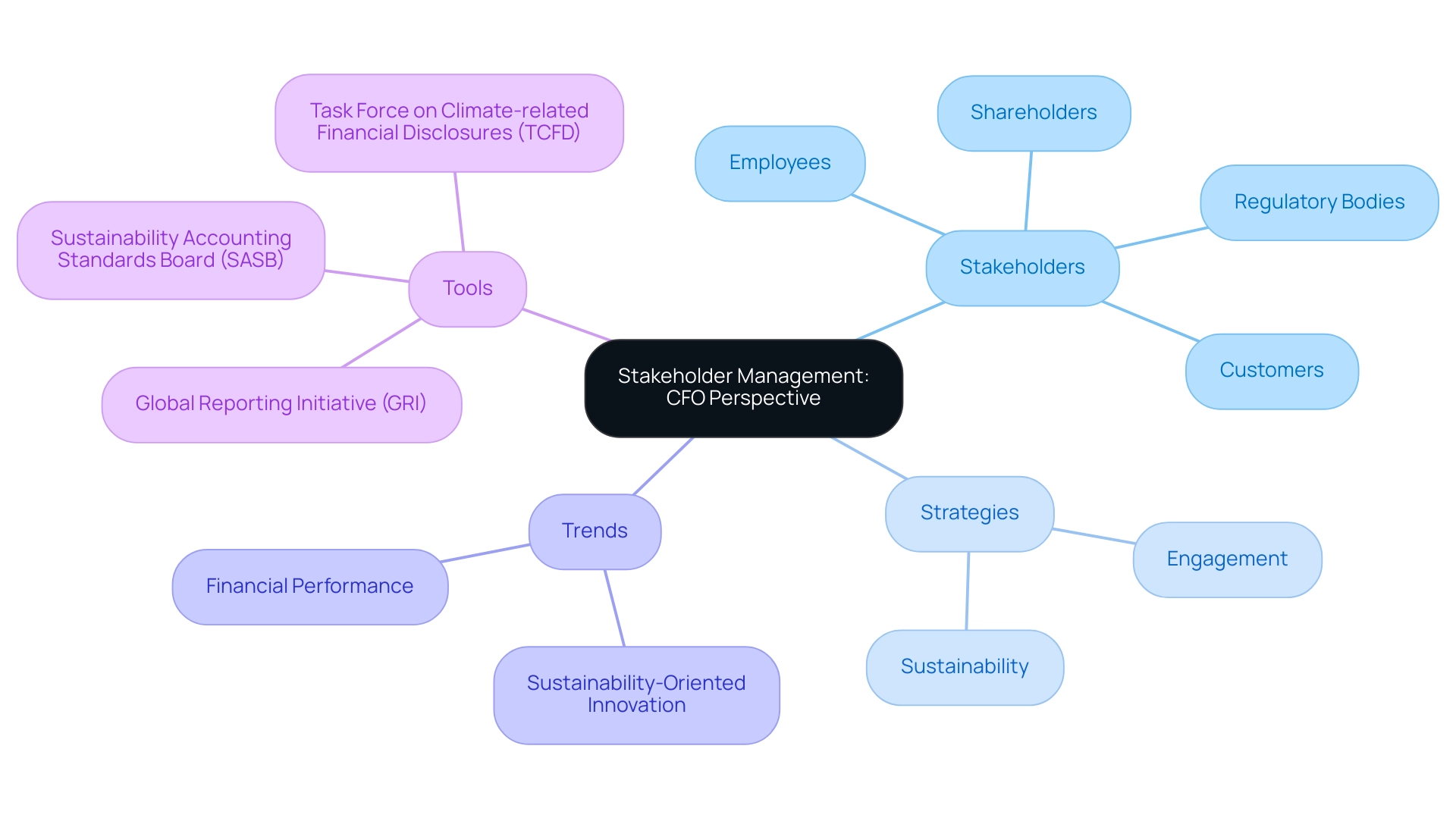

In the intricate world of finance, stakeholder management emerges as a pivotal responsibility for CFOs, shaping the trajectory of organizational success. As the landscape evolves, comprehending the diverse interests of shareholders, employees, customers, and regulatory bodies becomes paramount. By adeptly navigating these relationships, CFOs can align financial strategies with stakeholder expectations, fostering resilience and driving performance.

Moreover, the growing emphasis on sustainability and transparency underscores the need for innovative engagement techniques, ensuring that financial decisions resonate with a broader audience. This article delves into essential practices, tools, and communication strategies that empower CFOs to effectively manage stakeholder dynamics in an ever-changing financial environment.

Understanding Stakeholder Management: A CFO's Perspective

An effective approach to stakeholder management is a vital process that entails identifying, analyzing, and engaging with individuals or groups who have a vested interest in an organization's monetary decisions. For CFOs, their approach to stakeholder management encompasses a diverse range of interested parties, such as shareholders, employees, customers, and regulatory bodies. In 2025, the significance of a robust approach to stakeholder management cannot be overstated, as it directly affects economic performance and organizational resilience.

A successful CFO must skillfully balance the interests of these parties, employing an effective approach to stakeholder management to ensure that economic strategies align with their expectations. This requires a nuanced understanding of each participant's motivations and the approach to stakeholder management that can impact the overall business strategy. Recent trends indicate that sustainability-oriented innovation (SOI) fully mediates the association between engagement (SE) and financial performance (FP), underscoring the need for CFOs to prioritize these interactions.

By actively engaging with interested parties and leveraging streamlined decision-making processes, CFOs can cultivate trust and collaboration through their approach to stakeholder management, which are vital for navigating financial challenges and achieving organizational goals. Our team supports a shortened decision-making cycle throughout the turnaround process, enabling decisive action to preserve your business. For instance, Starbucks exemplifies this approach by evaluating its Environmental, Social, and Governance (ESG) goals through a comprehensive review process that highlights engagement with interested parties.

This guarantees that their strategies are not only effective but also customized to produce positive results. Furthermore, adopting recognized ESG reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), improves transparency and credibility in communications with interested parties. Our client dashboard provides real-time business analytics to continually monitor the success of our plans and teams, allowing for ongoing diagnosis of your business health. This dashboard not only monitors key performance metrics but also enables modifications to strategies based on real-time insights, thereby improving management of involved parties.

This, in turn, attracts investor interest and reinforces the organization's commitment to sustainability and its approach to stakeholder management. As Saumya Tyagi, a research and writing specialist, observes, 'Google. Org has invested over $1 billion in educational programs and resources since 2012,' illustrating the wider trend of aligning monetary choices with the interests of those involved.

In this changing environment, the capacity to involve interested parties effectively through an approach to stakeholder management, while consistently tracking business performance and modifying strategies, is crucial for financial leaders seeking to promote sustainable growth and manage the intricacies of contemporary finance.

The Importance of Stakeholder Analysis in Financial Management

For CFOs aiming to align monetary strategies with organizational objectives, a comprehensive analysis of interested parties is paramount in their approach to stakeholder management. This process involves mapping participants based on their influence and interest in monetary decisions, which informs our stakeholder management strategy by enabling a nuanced understanding of their potential impact. Stakeholders can be categorized into primary, secondary, and tertiary groups, each necessitating a distinct approach to management.

An effective stakeholder management strategy entails understanding the needs and expectations of these groups. Techniques such as surveys, interviews, and feedback sessions yield valuable insights into participant perspectives. Recent trends indicate that 57% of finance professionals believe that generative AI will enhance efficiency and productivity, underscoring the importance of incorporating innovative tools in engagement with interested parties.

By prioritizing participants according to their influence and significance, CFOs can formulate a stakeholder management approach that fosters customized engagement strategies, ensuring that essential voices are heard in budget planning and resource distribution. This strategic approach not only cultivates stronger relationships but also enhances decision-making processes, ultimately leading to improved economic outcomes. The importance of participant analysis is further emphasized by the fact that the use of Monte Carlo simulations in budget modeling has surged by 50% since 2021, reflecting a growing recognition of advanced analytical methods in fiscal management.

As noted by the Financial Times, this increase highlights the necessity for CFOs to adopt advanced techniques in their fiscal strategies.

Moreover, case studies such as the Advent of Virtual Reality in Financial Modeling demonstrate how an innovative approach to stakeholder management can revolutionize participant engagement. According to Oculus Research, 15% of banking institutions are experimenting with VR for immersive presentations, indicating a significant shift in how monetary data is represented and discussed. This trend emphasizes the need for financial leaders to embrace contemporary mapping and analysis techniques to remain competitive in a rapidly evolving financial environment.

Furthermore, as the wealth management sector prioritizes customer-focused innovation and digital transformation in 2025, understanding participant dynamics becomes increasingly essential for achieving sustainable growth.

Best Practices for Engaging Stakeholders Effectively

To effectively engage interested parties, CFOs must adopt a proactive approach to stakeholder management that emphasizes transparency and regular updates. This includes sharing insights on financial performance, strategic initiatives, and any relevant changes that could impact stakeholders. By utilizing a variety of channels—such as emails, newsletters, and town hall meetings—CFOs can ensure that diverse audiences are reached and informed.

Moreover, cultivating an environment that promotes feedback and open dialogue enables participants to express their concerns and suggestions, fostering a more inclusive atmosphere.

Creating a participant engagement calendar is another best practice that supports ongoing interaction, keeping involved parties informed about key developments and milestones. By aligning the interests of stakeholders with organizational goals, finance leaders can enhance their approach to stakeholder management, resulting in improved collaboration and boosted overall economic performance. As we look to 2025, with companies increasingly relying on AI-driven insights for decision-making, effective messaging strategies will be crucial for CFOs to maintain trust and engagement among partners, ultimately leading to more agile and informed business operations.

Notably, 58% of CFOs report spending more time on tech investment and implementation compared to the previous year, underscoring the growing significance of technology in engaging with partners. As Howard noted, 'Payhawk has done a great job of ensuring that we can get that custom field (categorization) from NetSuite and the project code into Payhawk,' highlighting the role of technology in enhancing financial management and engagement with stakeholders. Furthermore, the case study of GDS Group's Digital Finance Transformation illustrates how effective communication and technology can streamline processes; after adopting Payhawk, GDS Group saved over 15 hours a month for their finance team, allowing them to focus on strategic activities rather than administrative tasks.

This integration of technology, streamlined decision-making, and continuous performance monitoring aligns with the shift towards operationalizing turnaround lessons, which are essential for agility in today's business environment. Want more information? Let's talk!

© 2024 SMB Turnaround

+1 (239) 428-9074

3200 Bailey Ln

Naples, FL 34105

Tools and Techniques for Effective Stakeholder Management

In 2025, CFOs can significantly enhance their stakeholder management strategies by utilizing a variety of advanced tools and techniques. Instant access to financial performance metrics will be a necessity, making Customer Relationship Management (CRM) systems pivotal in this process. These systems empower financial executives to meticulously monitor participant interactions, preferences, and feedback, facilitating customized engagement, which is increasingly vital in today's competitive environment.

Moreover, our team supports a shortened decision-making cycle throughout the turnaround process, empowering financial executives to take decisive action that preserves business health. Project management software acts as an essential tool for coordinating communication among interested parties, ensuring that everyone stays updated on project timelines and milestones.

The incorporation of analytics tools is also important, as they offer financial executives the capability to assess participant sentiment and engagement levels in real-time. This data-driven method provides valuable insights into areas that may need extra attention, thereby improving responsiveness to the needs of involved parties. Notably, a recent survey indicated that 78% of financial executives recognize 'quiet quitting' as a significant issue within their organizations, underscoring the necessity for proactive engagement strategies to combat this trend.

Furthermore, with 54% of finance experts finding it easy to secure a new job, effective management of involved parties becomes crucial for retaining talent in a competitive job market.

By incorporating these tools into their management processes, including continuous business performance monitoring through real-time analytics via our client dashboard, financial leaders can foster stronger relationships and drive more effective communication. The dashboard offers real-time business analytics that continually assess business health, enabling financial leaders to make informed decisions swiftly. For instance, the use of Jedox, an enterprise management software, has proven beneficial for users managing large datasets, as its features facilitate improved relationship management, although some aspects may require a learning curve.

As companies increasingly invest in predictive analytics and real-time modeling tools to navigate ongoing economic uncertainties, the effective use of CRM systems and other technologies will be crucial for financial leaders aiming to enhance engagement with their audience in 2025.

Overcoming Challenges in Stakeholder Management for CFOs

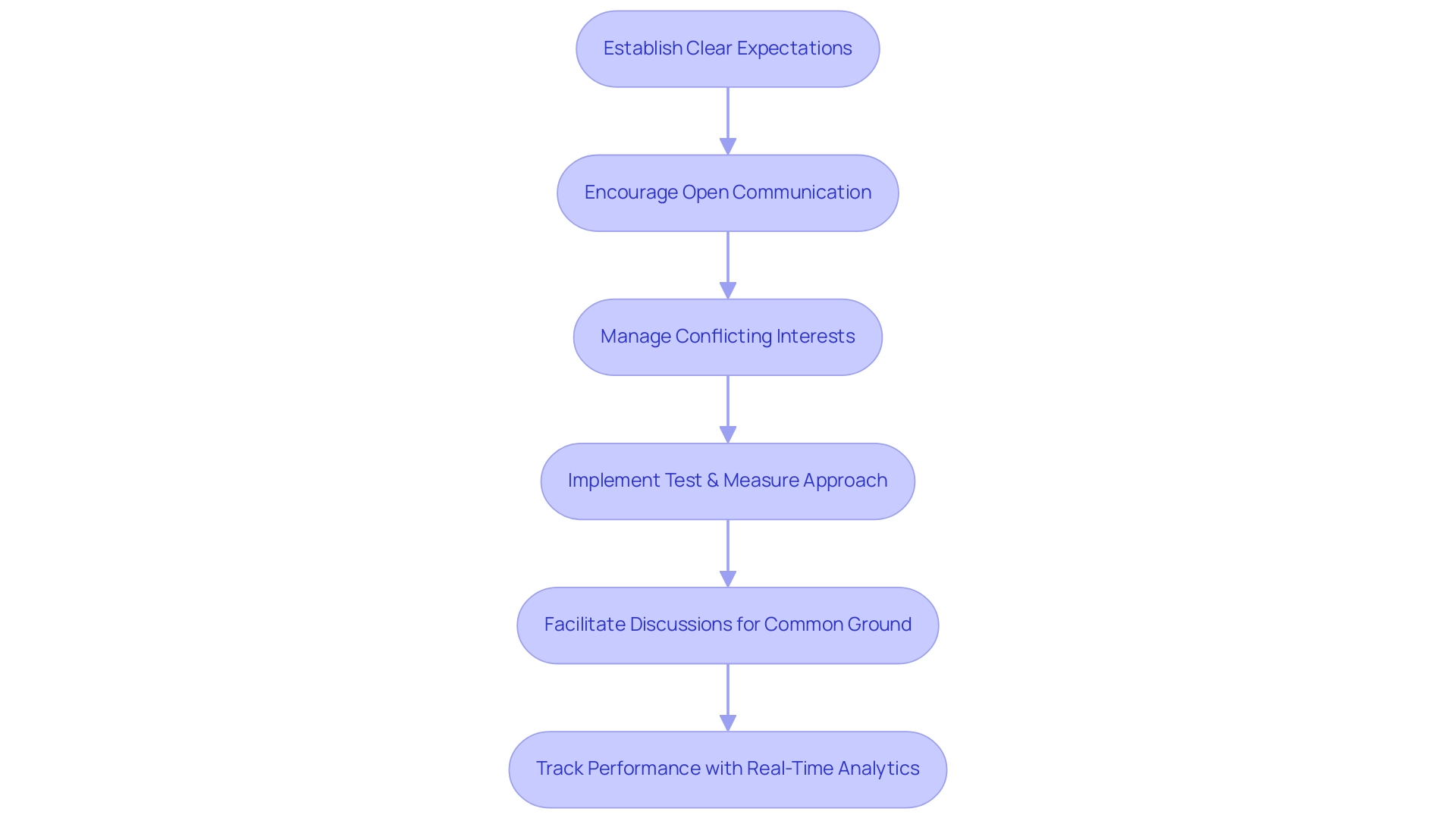

Financial leaders frequently encounter the intricate challenge of reconciling the diverse interests of stakeholders, particularly during periods of economic instability. As we approach 2025, an effective approach to stakeholder management has become increasingly vital. Studies indicate that organizations prioritizing clear dialogue with involved parties are better equipped to navigate challenges. To effectively address these issues, financial leaders must adopt a stakeholder management strategy that emphasizes transparency and fosters open communication. This involves establishing clear expectations and guidelines for interactions with stakeholders, significantly reducing the potential for misunderstandings.

Moreover, financial leaders must be adept at managing conflicting interests among stakeholders as part of their stakeholder management strategy. Streamlined decision-making processes, supported by the 'Test & Measure' approach, are essential. This methodology allows teams to act decisively during turnaround efforts, emphasizing hypothesis testing to maximize return on investment.

An effective stakeholder management approach also involves facilitating discussions aimed at finding common ground in challenging situations. Additionally, consistently tracking performance through real-time analytics—such as those provided by client dashboards—enables financial leaders to refine their stakeholder management strategies based on feedback from involved parties, further enhancing relationship management.

For instance, organizations that have successfully implemented dynamic planning and forecasting, as demonstrated in the case study 'Future Trends in FP&A for 2025,' have reported improved relationships with stakeholders by leveraging predictive analytics and real-time modeling tools to inform their business strategies. In today's competitive landscape, it is noteworthy that 43% of financial officers report being approached for new executive opportunities more frequently, which can influence their management strategies concerning investors. By proactively addressing these challenges and applying insights gained from past experiences, financial leaders can enhance their stakeholder management approaches, fostering resilience in their partnerships and ultimately leading to more favorable outcomes.

As Chris Ortega emphasizes, updating monetary planning and analysis methods positions finance as a value-adding function, which is crucial for an effective stakeholder management strategy in today's evolving business environment. Furthermore, Deborshi Dutt from Deloitte underscores the importance of retraining employees and improving AI literacy within organizations to encourage adoption and optimize the benefits of generative AI. This further highlights the evolving competencies required for financial leaders in managing relationships with stakeholders.

The Role of Communication in Successful Stakeholder Management

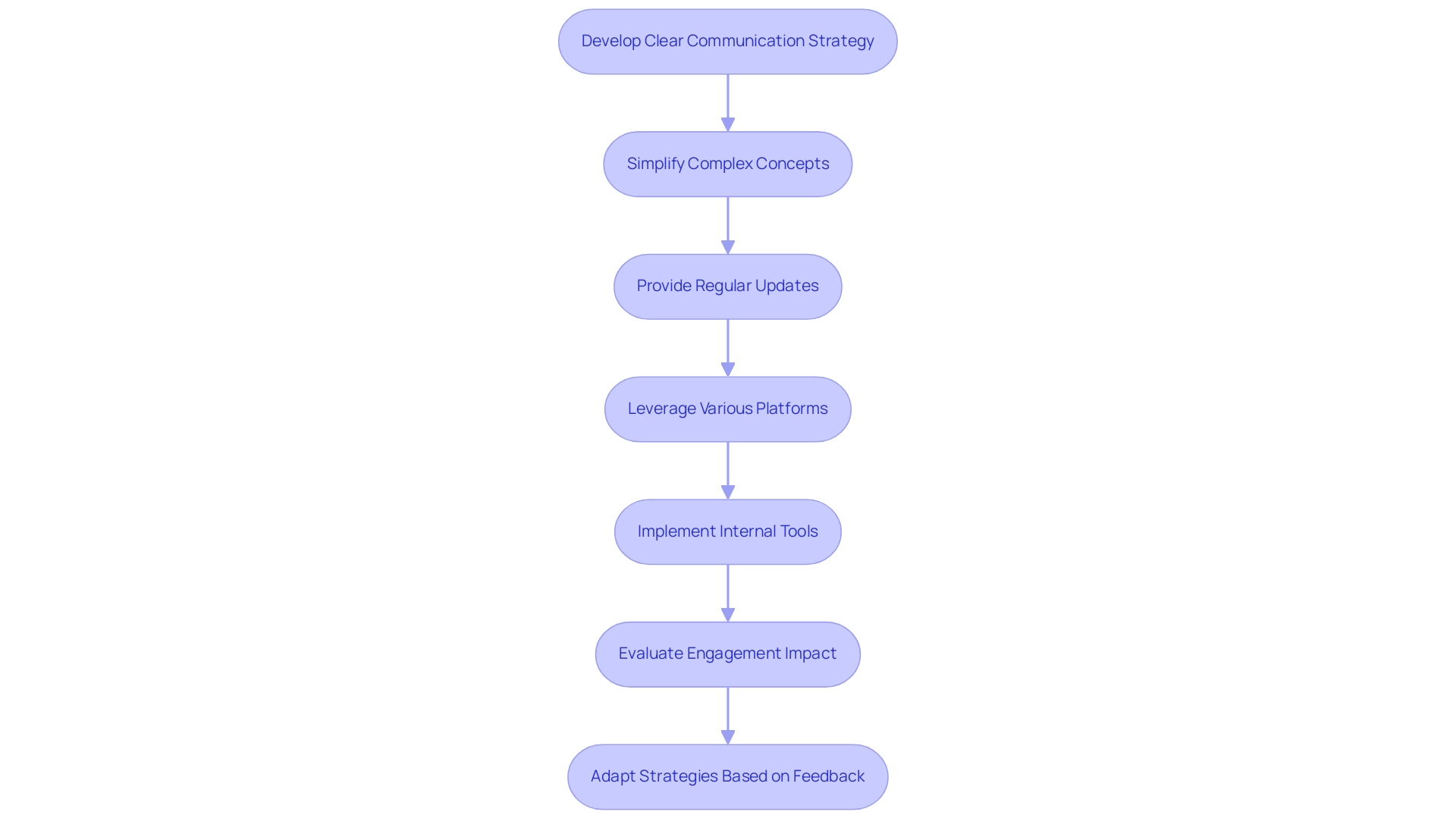

Efficient dialogue serves as the foundation for successful party management, particularly for chief financial officers navigating complex monetary environments. To cultivate robust relationships, CFOs must develop a communication strategy that is not only clear and consistent but also tailored to the diverse needs of their stakeholders. This requires simplifying intricate monetary concepts into layman's terms, ensuring that all parties understand the implications of economic decisions.

Regular updates on financial performance, strategic shifts, and potential risks are vital for building trust and transparency. By proactively sharing this information, CFOs can alleviate uncertainty and bolster confidence among involved parties. Furthermore, leveraging a variety of interaction platforms—such as webinars, newsletters, and in-person meetings—can significantly enhance engagement, ensuring participants are informed and actively involved in the organization's direction.

Effective tools for internal interaction, including intranet platforms and employee engagement software, can further amplify these efforts.

As Julian March notes, "There's lots in the HBR article about over-communicating - I'm a fan. Professor John Kotter found that most leaders under-communicate their vision by a factor of 10 - yup A FACTOR OF TEN!" This underscores the critical need for CFOs to prioritize dialogue in their stakeholder management strategies.

A notable example of effective interaction is the case of Paycor Inc., which confronted the challenge of transitioning to a fully remote workforce during the COVID-19 pandemic. By adopting the Cerkl Broadcast platform, Paycor restructured its internal messaging strategy, resulting in improved open and click-thru rates, as well as increased employee satisfaction. This transformation not only sustained engagement but also positioned Paycor as the first fully virtual-first national technology company.

In 2025, it is imperative for financial executives to recognize that only 47% of communicators assess the impact of their internal messaging. This statistic highlights the necessity for financial leaders to concentrate on engagement strategies that not only involve participants but also evaluate their effects. By embracing these best practices, financial leaders can fortify stakeholder relationships and facilitate smoother financial operations, ultimately driving sustainable growth through their stakeholder management approach.

Additionally, the content calendar for 2024 includes sections that may provide ongoing insights into effective communication strategies pertinent to CFOs.

Conclusion

Stakeholder management transcends mere operational necessity for CFOs; it stands as a strategic imperative that profoundly impacts an organization’s financial performance and resilience. By comprehensively understanding the diverse interests of stakeholders—including shareholders, employees, customers, and regulatory bodies—CFOs can align financial strategies with stakeholder expectations, ultimately driving sustainable growth. The integration of advanced tools, such as CRM systems and real-time analytics, empowers CFOs to engage stakeholders effectively, ensuring their voices are heard and their needs addressed.

Effective communication is pivotal in this process. By adopting proactive communication strategies that prioritize transparency and regular updates, CFOs can build trust and foster collaboration. This entails simplifying complex financial concepts and utilizing various platforms to reach diverse audiences. The emphasis on clear communication not only mitigates uncertainty but also enhances stakeholder confidence in the organization’s trajectory.

In a rapidly evolving financial landscape, the ability to navigate challenges and balance conflicting interests is crucial. By leveraging innovative engagement techniques and continuously monitoring stakeholder sentiment, CFOs can adapt their strategies to foster stronger relationships. As organizations increasingly prioritize sustainability and transparency, the role of the CFO as a stakeholder manager will only grow in importance. Embracing these practices will not only enhance financial performance but also position organizations as leaders in stakeholder engagement, thereby ensuring long-term success in an ever-changing environment.

Frequently Asked Questions

What is stakeholder management and why is it important for CFOs?

Stakeholder management is the process of identifying, analyzing, and engaging with individuals or groups who have a vested interest in an organization's monetary decisions. For CFOs, it is crucial as it directly affects economic performance and organizational resilience, helping them balance the interests of various parties such as shareholders, employees, customers, and regulatory bodies.

How does stakeholder engagement impact financial performance?

Recent trends indicate that sustainability-oriented innovation (SOI) mediates the relationship between stakeholder engagement (SE) and financial performance (FP). This underscores the importance for CFOs to prioritize interactions with stakeholders to enhance financial outcomes.

What strategies can CFOs use to manage stakeholder relationships effectively?

CFOs can employ techniques such as surveys, interviews, and feedback sessions to understand the needs and expectations of stakeholders. Additionally, prioritizing stakeholders based on their influence and significance allows for customized engagement strategies.

How can technology improve stakeholder management for CFOs?

Incorporating innovative tools, such as generative AI, can enhance efficiency and productivity in stakeholder engagement. Moreover, advanced analytical methods like Monte Carlo simulations in budget modeling have gained popularity, reflecting the need for CFOs to adopt modern techniques.

What role do ESG goals play in stakeholder management?

Evaluating Environmental, Social, and Governance (ESG) goals through a comprehensive review process helps organizations like Starbucks ensure their strategies are effective and tailored to produce positive results, thereby fostering trust and collaboration with stakeholders.

How can real-time analytics support stakeholder management?

A client dashboard that provides real-time business analytics allows CFOs to monitor key performance metrics and modify strategies based on current insights, improving the management of stakeholder relationships and attracting investor interest.

What are the different categories of stakeholders and how should they be managed?

Stakeholders can be categorized into primary, secondary, and tertiary groups, each requiring a distinct approach to management. Understanding their influence and interests is essential for formulating effective stakeholder management strategies.

What innovative approaches are being used in stakeholder management?

Recent developments include the use of virtual reality (VR) for immersive presentations in financial modeling, reflecting a shift in how monetary data is engaged with stakeholders. This trend highlights the importance of embracing contemporary mapping and analysis techniques.