Overview

Best practices for business health improvement for CFOs include conducting regular financial evaluations, leveraging financial analytics, and aligning health initiatives with corporate strategies to foster a resilient and productive organization. The article supports this by emphasizing the importance of data-driven decision-making and continuous improvement, highlighting how these practices can lead to enhanced operational efficiency and employee well-being, which are critical for overall business success.

Introduction

In the ever-evolving landscape of modern business, the role of the Chief Financial Officer (CFO) has transformed into a multifaceted position that extends beyond traditional financial oversight. Today, CFOs are tasked with understanding the intricate interplay between financial health, operational efficiency, and employee well-being. As organizations strive for sustainable growth, the importance of leveraging data analytics, aligning health initiatives with business strategies, and fostering strategic partnerships cannot be overstated.

With a pressing need to navigate complex challenges and capitalize on emerging opportunities, CFOs must adopt a proactive approach to enhance business health. This article delves into essential strategies and insights that empower CFOs to drive organizational success while cultivating a resilient workforce.

Understanding Business Health: A CFO's Perspective

Business health improvement is a composite of various metrics that reflect an organization's overall performance, encompassing financial stability, operational efficiency, and employee engagement. For CFOs, a deep understanding of these metrics is essential for business health improvement, as they reveal potential vulnerabilities and highlight areas that are ripe for improvement. Our strategy facilitates a streamlined decision-making cycle throughout the turnaround process, enabling your team to take decisive action to safeguard your enterprise.

A robust company not only meets its financial targets but also emphasizes business health improvement by cultivating a positive workplace culture that fosters enhanced productivity and employee morale. As we look towards 2024, the growing demand for chronic condition management—projected to increase by 41%—underscores the urgency for CFOs to prioritize initiatives focused on business health improvement and employee wellness. This urgency is further magnified by the complexity of managing vast amounts of data, which necessitates the adoption of the right analytical tools to navigate these challenges effectively.

Our client dashboard offers real-time analytics, facilitating ongoing performance tracking and proactive diagnosis of organizational well-being. This dashboard plays a critical role in tracking the cash conversion cycle, which is essential for optimizing organizational performance. Consistently assessing financial performance indicators enables CFOs to recognize and tackle challenges before they intensify, which is crucial for business health improvement and operational resilience.

Insights from the World Economic Forum reinforce this notion, stating that 'data analytics has become more pervasive and composable,' highlighting the critical role of contemporary analytical tools in business health improvement assessments. Moreover, case studies, such as the discussion surrounding ERISA's 50th anniversary, emphasize the urgency for self-insured employers to maintain consistent benefits structures. This consistency is crucial, as it directly impacts employee engagement and overall business health improvement, aligning with the pressing need for organizations to foster a supportive environment for their workforce.

Leveraging Financial Analytics for Enhanced Decision-Making

Chief Financial Officers can drastically enhance their decision-making capabilities by harnessing advanced financial analytics tools that deliver real-time insights into essential key performance indicators (KPIs). With 58% of financial executives dedicating more time to technology investments this year, leveraging these tools has never been more critical. By meticulously analyzing cash flow patterns, revenue streams, and cost structures, financial leaders can uncover trends that may reveal underlying issues within the organization.

Mastering the cash conversion cycle through 20 targeted strategies enhances overall business performance, including:

- Optimizing inventory management

- Streamlining accounts receivable processes

- Reducing payment cycles

These strategies enable financial leaders to forecast future financial scenarios, preparing them for potential downturns or growth opportunities as they arise. Furthermore, financial leaders should champion enterprise-wide data and analytics governance to ensure that financial insights are accurate and actionable.

The implementation of robust analytics platforms, such as Prophix One Financial Performance Platform, exemplifies how technology can streamline financial processes, promote real-time collaboration, and operationalize turnaround lessons. This platform not only automates repetitive tasks but also enhances accuracy and reduces audit resources. As one CFO noted, 'Accurate data, metrics, and analytics are central to finance’s ability to provide agile planning, budgeting, and forecasting, as well as its ability to pilot AI solutions.'

Furthermore, the use of a client dashboard allows for ongoing monitoring of organizational performance, enabling faster decision-making cycles that are crucial during turnaround processes. Ultimately, these data-driven strategies are essential for aligning organizational objectives with business health improvement and enhancing operational efficiency, especially as 43% of CFOs report being approached for new opportunities more often, indicating a rising demand for skilled financial leadership in analytics.

Aligning Health Services with Business Strategies for Optimal Outcomes

Aligning medical services with business health improvement strategies is crucial for entities aiming to achieve optimal outcomes. A striking statistic reveals that less than half of U.S. workers feel their organization genuinely cares about their wellbeing, highlighting a significant area for improvement. Moreover, thirty-nine percent of companies regard diversity, equity, and inclusion as significantly influential in benefits decisions, which emphasizes the importance of these factors in shaping wellness initiatives.

CFOs should critically evaluate how wellness initiatives can support overarching organizational objectives, particularly in business health improvement by enhancing employee well-being and reducing healthcare expenses. For instance, companies investing in effective wellness programs have reported an impressive average return on investment (ROI) of $2.73 for every dollar spent. A case study of a leading firm that successfully integrated wellness strategies into their business model showed a marked increase in employee productivity and satisfaction, demonstrating the tangible benefits of such initiatives.

Furthermore, Gallup highlights the significance of merging strengths and wellbeing at work as a transformational method to boosting resiliency and mental wellness. By fostering a culture of well-being, organizations can enhance employee satisfaction while positively impacting their financial performance. Frequent evaluations of the coherence between medical services and corporate strategies are crucial to guarantee that these components function collaboratively towards shared objectives, underscoring the significance of business health improvement initiatives in promoting organizational success.

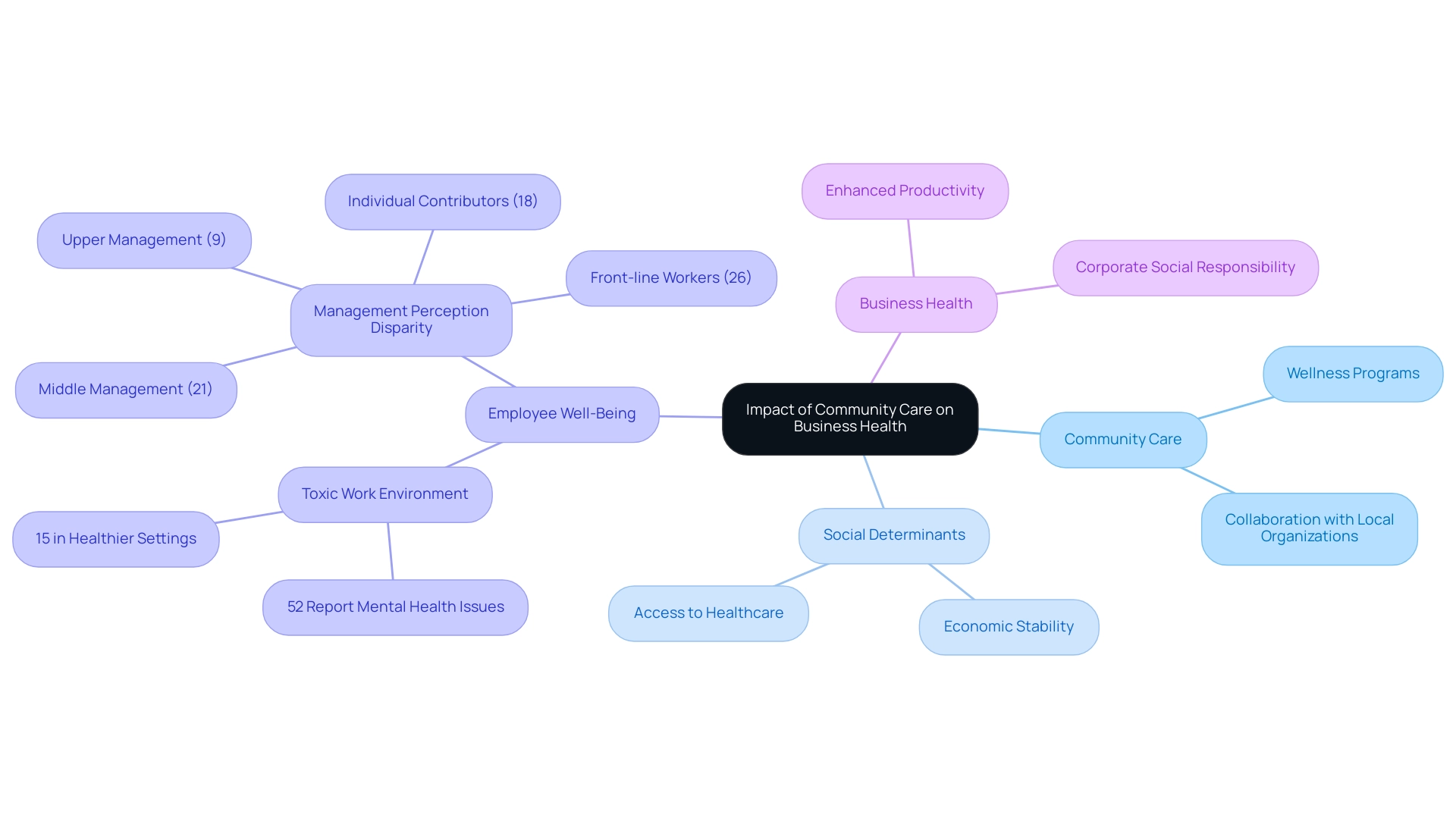

The Impact of Community Care and Social Determinants on Business Health

CFOs must acknowledge that the well-being of a business extends beyond internal operations; it is profoundly influenced by community care and social determinants. Elements like economic stability, access to healthcare, and active community involvement significantly influence employee well-being and productivity. A staggering 52% of individuals in toxic work environments report negative effects on their mental well-being, a stark contrast to just 15% among those in healthier settings.

Dr. Wolff emphasizes that understanding these dynamics is essential for effective management, stating, "Organizations must recognize the broader impact of their community engagement on employee well-being." By strategically investing in community wellness programs, groups can cultivate a more resilient workforce, which supports business health improvement and enhances overall performance. Collaboration with local wellness organizations and active participation in community programs not only bolsters corporate social responsibility but also supports business health improvement by having a direct positive impact on employee productivity.

Notably, a report found that upper management reported workplace toxicity at a much lower rate (9%) compared to middle management (21%), front-line workers (26%), and individual contributors (18%). This disparity indicates a notable gap in viewpoints that financial leaders must tackle by incorporating social factors into their performance evaluations. Such proactive measures can lead to a healthier organizational environment and a more engaged workforce, as highlighted in the case study management Levels and Toxic Workplace Perception, which illustrates the varying experiences of employees at different levels.

Fostering Continuous Improvement and Innovation in Business Practices

Fostering a culture of continuous enhancement and innovation is vital for business health improvement, especially in the role of CFOs who are crucial in motivating their teams to identify inefficiencies and propose innovative solutions. Our approach to business health improvement begins with identifying underlying organizational issues through a series of diagnostic assessments, stakeholder interviews, and data analysis to collaboratively create a strategic plan that mitigates weaknesses and allows enterprises to reinvest in key strengths. Methodologies such as Lean and Six Sigma are instrumental in streamlining operations and minimizing waste; for instance, Lean techniques can help identify non-value-added activities, while Six Sigma focuses on reducing process variation, leading to enhanced operational efficiency.

According to BPM Trends, '72% of executives in Europe credit their enhanced customer satisfaction rates to effective process management efforts.' This statistic underscores the importance of implementing structured approaches to foster business health improvement, as it directly correlates with the identification and planning of enhancements. Furthermore, our pragmatic approach ensures that we test every hypothesis to deliver maximum return on invested capital in both the short and long term.

The case study titled 'Agile Methodology for Flexible Improvements' highlights how Agile promotes flexibility, collaboration, and rapid iteration in process enhancement. By integrating Agile principles into our strategic planning and measurement framework, organizations can encourage small, frequent changes and solicit constant feedback, remaining agile and responsive in today's dynamic market landscape, increasingly influenced by rapid shifts in digital marketing strategies. By emphasizing innovation and ongoing enhancement alongside strategic planning and assessment, organizations can navigate these shifting circumstances and strengthen their competitiveness, ultimately ensuring long-term success and business health improvement.

Building Strategic Partnerships for Sustainable Business Health

Establishing strategic partnerships is integral to fostering business health improvement within the organization. For CFOs, seeking collaborations with organizations that not only complement existing services but also introduce new market opportunities can be transformative. Significantly, collaborations with technology companies can enhance operational efficiency by utilizing innovative solutions customized to particular organizational needs.

Our team's approach emphasizes a shortened decision-making cycle throughout the turnaround process, enabling decisive action that supports business health improvement. As Robin Dimond, CEO of Fifth & Cor, aptly states,

It’s important to have partners that fill in your gaps, and that is what we have created.

This sentiment is echoed in the digital media industry, where approximately 15% of revenue now comes from affiliate marketing, highlighting the financial benefits of effective partnerships.

Moreover, our client dashboard plays a crucial role in providing real-time business analytics to continually monitor the success of our plans, ensuring that performance is consistently assessed. This dashboard enables entities to quickly adapt their strategies based on real-time data, enhancing the decision-making cycle. Collaboration with industry associations also opens doors to invaluable insights and networking opportunities essential for navigating today’s complex market landscape.

However, it’s critical to address the challenges of partnership, as 38% of managers cite trust and communication breakdowns as reasons for failed collaborations. By utilizing our client dashboard, entities can foster transparency and communication, mitigating these challenges. A case study on failures in joint ventures reveals that trust and communication are essential factors in the success of these partnerships.

By nurturing connections founded on trust and shared advantage and implementing insights from the turnaround process, entities can efficiently combine resources and expertise, ultimately driving growth and contributing to business health improvement.

Expert Tips and Best Practices for CFOs to Enhance Business Health

To enhance business performance effectively, financial leaders should implement several best practices:

- Conduct regular financial evaluations, with statistics showing that entities performing these assessments experience a 15% increase in operational efficiency. This proactive approach is essential in today's complex financial landscape, where evaluations can reveal hidden risks.

- Leverage financial analytics to facilitate data-driven decision-making and streamline operations, enabling CFOs to base their strategies on solid evidence rather than assumptions.

- Ensure that health initiatives align with overarching corporate strategies, creating synergies that yield mutual benefits across the entity.

- Invest in community engagement initiatives that promote employee well-being, recognizing that a healthy workforce is integral to organizational success.

- Cultivate a culture of continuous improvement and innovation within the finance team, encouraging proactive problem-solving and adaptability.

- Build strategic partnerships that provide access to new resources and expertise, enriching the organization’s capabilities. For instance, Amazon Advertising's practice of resetting cookie durations and utilizing various identifiers showcases how data-driven strategies can enhance customer engagement and operational efficiency.

- Encourage teamwork among groups when recognizing organizational challenges and devising solutions, ensuring varied perspectives enhance effective strategies.

- Regularly review and adapt strategies based on performance metrics and real-time analytics, allowing for responsive adjustments that enhance overall effectiveness.

Additionally, testing hypotheses is crucial for maximizing returns on investment, as it allows financial executives to validate assumptions and make informed decisions. By adopting these practices, CFOs can drive business health improvement in organizational health, addressing the challenges highlighted by Sabrinthia Donnelly, who emphasizes that

Keeping finances afloat is one of the biggest CFO challenges of 2024.

These strategies not only position organizations for long-term success but also ensure they remain resilient in an ever-evolving business environment.

Conclusion

In the dynamic landscape of modern business, the role of the CFO has evolved to encompass a broader focus on enhancing overall business health. By understanding key metrics that reflect financial stability, operational efficiency, and employee engagement, CFOs can identify vulnerabilities and areas for improvement. As organizations face increasing demands for chronic condition management and data-driven decision-making, the integration of advanced financial analytics and health initiatives has become paramount.

Strategically aligning health services with business goals is crucial for fostering a productive workforce while managing healthcare costs effectively. Successful wellness programs exemplify the tangible benefits of such initiatives, showcasing a strong return on investment. Furthermore, recognizing the influence of community care and social determinants on employee well-being reinforces the need for a holistic approach to business health.

Continuous improvement and innovation are essential for sustaining operational efficiency. By implementing structured methodologies and fostering a culture of adaptability, organizations can navigate the complexities of today's market. Building strategic partnerships further enhances business resilience, providing access to new resources and expertise that drive growth.

Ultimately, CFOs who adopt these best practices not only position their organizations for sustainable success but also cultivate a resilient workforce. By prioritizing the interconnectedness of financial health, employee well-being, and community engagement, CFOs can effectively steer their organizations toward a prosperous future. Embracing this multifaceted approach is critical for thriving in an ever-evolving business environment, ensuring that organizations remain agile and responsive to emerging challenges and opportunities.

Frequently Asked Questions

What is business health improvement?

Business health improvement is a composite of various metrics that reflect an organization's overall performance, including financial stability, operational efficiency, and employee engagement.

Why is understanding metrics important for CFOs?

A deep understanding of metrics is essential for CFOs as it reveals potential vulnerabilities and highlights areas for improvement, facilitating a streamlined decision-making cycle during the turnaround process.

How does a positive workplace culture contribute to business health improvement?

A robust company not only meets financial targets but also emphasizes business health improvement by cultivating a positive workplace culture, which enhances productivity and employee morale.

What is the significance of chronic condition management for CFOs in 2024?

The growing demand for chronic condition management, projected to increase by 41%, underscores the urgency for CFOs to prioritize initiatives focused on business health improvement and employee wellness.

How can analytical tools assist in business health improvement?

The complexity of managing vast amounts of data necessitates the adoption of the right analytical tools, which can help CFOs navigate challenges effectively and improve organizational performance.

What role does the client dashboard play in organizational well-being?

The client dashboard offers real-time analytics, facilitating ongoing performance tracking and proactive diagnosis of organizational well-being, including tracking the cash conversion cycle.

Why is consistently assessing financial performance indicators important?

Consistently assessing financial performance indicators enables CFOs to recognize and tackle challenges before they intensify, which is crucial for business health improvement and operational resilience.

What insights does the World Economic Forum provide regarding data analytics?

Insights from the World Economic Forum state that 'data analytics has become more pervasive and composable,' highlighting the critical role of contemporary analytical tools in business health improvement assessments.

How can financial leaders enhance their decision-making capabilities?

Financial leaders can enhance their decision-making capabilities by harnessing advanced financial analytics tools that deliver real-time insights into essential key performance indicators (KPIs).

What are some strategies for mastering the cash conversion cycle?

Strategies for mastering the cash conversion cycle include optimizing inventory management, streamlining accounts receivable processes, and reducing payment cycles.

What technology can support financial processes and operational efficiency?

Robust analytics platforms, such as Prophix One Financial Performance Platform, can streamline financial processes, promote real-time collaboration, and operationalize turnaround lessons.

Why is data governance important for financial insights?

Championing enterprise-wide data and analytics governance ensures that financial insights are accurate and actionable, which is essential for effective decision-making.

How does the use of a client dashboard benefit financial leaders?

A client dashboard allows for ongoing monitoring of organizational performance, enabling faster decision-making cycles that are crucial during turnaround processes.