Overview

The article focuses on best practices for developing business metrics, highlighting their importance for CFOs in evaluating performance and aligning with strategic objectives. It emphasizes that effective metrics should be actionable and regularly reviewed, leveraging technology and data analytics to adapt to changing market conditions and enhance decision-making processes.

Introduction

In the ever-evolving landscape of business management, CFOs are tasked with the critical responsibility of navigating financial complexities while driving organizational success. At the heart of this endeavor lies the effective use of business metrics—quantifiable measures that provide insights into profitability, cash flow, and operational efficiency.

As organizations prepare for the future, the emphasis on strategic metrics becomes increasingly vital, especially in light of emerging trends such as enhanced cash management and proactive risk mitigation. By aligning these metrics with overarching business objectives, CFOs can not only assess performance but also seize opportunities for growth and resilience.

This article delves into the essential types of metrics, practical steps for establishing them, and best practices for continuous monitoring, equipping financial leaders with the tools necessary to thrive in a dynamic market.

Understanding Business Metrics: A Foundation for CFOs

Business metrics development is crucial as it provides financial leaders with quantifiable measures to evaluate the performance of different aspects of their organization. These measurements encompass:

- Profitability ratios

- Cash flow indicators

- Operational efficiency measures

In where streamlined decision-making is critical, our team supports a shortened decision-making cycle throughout the turnaround process, empowering financial leaders to take decisive actions that preserve business integrity.

A recent survey revealed that 46% of financial executives plan to prioritize holding more cash in their capital reserves for 2025, underscoring the need for as part of their metrics strategy. Additionally, predictions for 2025 indicate a greater focus on financial planning and analysis (FP&A) reporting and an expected increase in mergers and acquisitions (M&A) activity, which further underscores the evolving landscape that financial leaders must navigate. With our client dashboard providing real-time business analytics, financial executives can continually monitor the success of their plans, diagnosing business health effectively.

This ongoing update and adjustment process allows for timely responses to emerging challenges. By grasping these foundational concepts, financial executives can align their decisions with the company's strategic objectives. As expressed by Bill Klein, President of Consero Global, comprehending these measurements is vital for traversing economic environments.

Furthermore, examining key performance indicators (KPIs) enables executives to identify trends that may suggest economic distress or reveal growth opportunities, aiding in proactive management of resources and investments. In light of potential risks identified by CFOs—such as technology deployment and lack of agility as internal risks, and geopolitics and economic conditions as external concerns—42% have prioritized enterprise risk management for 2025. This highlights the significance of business metrics development for not only performance assessment but also for reducing risks and ensuring financial resilience.

The emphasis on enterprise risk management underscores how measurements can assist in tackling these recognized risks, making it essential for financial leaders to integrate these approaches into their strategic frameworks.

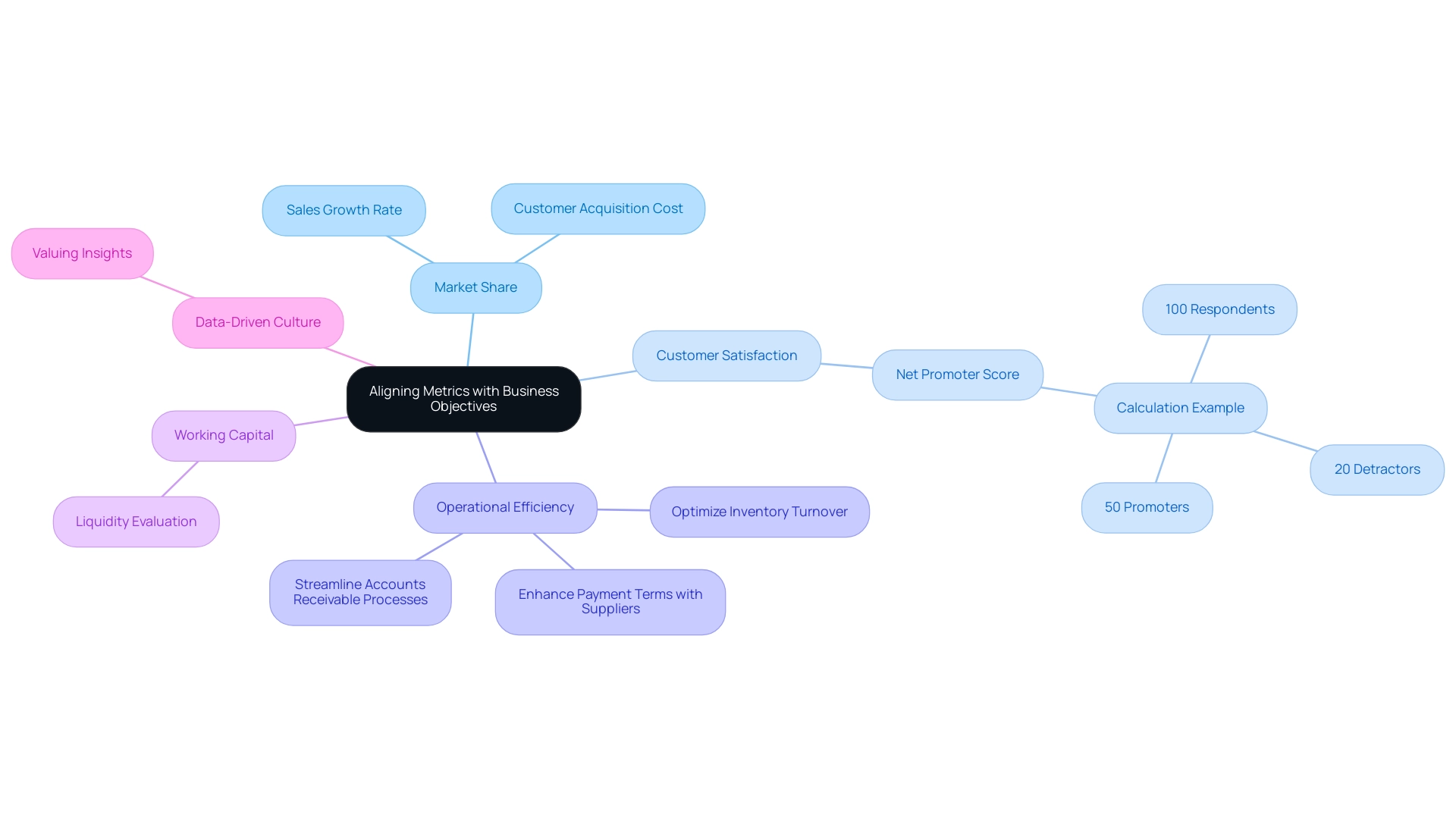

Aligning Metrics with Business Objectives: Key Considerations

For measurements to effectively drive performance, CFOs must ensure they are directly aligned with the organization's overarching business objectives. This alignment begins with clearly identifying specific goals that may include:

- Increasing market share

- Enhancing customer satisfaction

- Improving operational efficiency

For instance, if a company’s goal is to elevate revenue, relevant indicators such as sales growth rate and customer acquisition cost should be closely monitored.

A practical illustration of this is the net promoter score: in a scenario where a company receives feedback from 100 survey respondents, with 20 detractors and 50 promoters, the resulting net promoter score would be 30. This measurement not only highlights customer loyalty but also serves as a predictive indicator of revenue growth. Additionally, comparing actual revenue to forecasted revenue helps executives assess company performance against expectations and identify discrepancies, allowing for proactive measures to address performance issues.

Consistently reviewing these objectives and adjusting business metrics development in response to evolving market conditions promotes agility and ensures that the organization remains aligned with its strategic goals. Streamlined decision-making processes, supported by real-time analytics through a client dashboard, enable CFOs to monitor organizational health continuously and make informed decisions swiftly. Moreover, nurturing a data-driven culture within the organization is vital; it promotes the appreciation of insights that measurements provide.

As David Luther, a Digital Content Strategist, aptly observes, 'Selecting the appropriate indicators, and determining the suitable quantity of indicators, is crucial for the long-term success of any expanding enterprise.' By adopting a proactive strategy for alignment of measurements, including overseeing working capital for liquidity evaluation and implementing turnaround insights, financial leaders can improve business metrics development to navigate the intricacies of the corporate environment more efficiently. Specific strategies for mastering , such as:

- Optimizing inventory turnover

- Streamlining accounts receivable processes

- Enhancing payment terms with suppliers

are crucial for improving cash flow.

Additionally, understanding the pricing context can further illuminate how these strategies contribute to cost savings and increased revenue, ultimately supporting the organization's economic health.

Essential Types of Metrics for Effective Business Management

To navigate the complexities of organizational management, CFOs must prioritize business metrics development that offers a multidimensional perspective of their operations. Financial measures, including gross profit margin and return on equity, act as critical indicators of profitability and overall financial health. In tandem, operational measures such as inventory turnover and production efficiency provide valuable insights into internal processes, enabling businesses to optimize resource allocation and enhance efficiency.

Moreover, customer measurements such as Net Promoter Score (NPS) and customer lifetime value (CLV) are vital for evaluating customer satisfaction and loyalty, which directly affect revenue stability. By incorporating these varied measures into a balanced scorecard, financial leaders can guide strategic choices that enhance operational efficiencies and support business metrics development in alignment with organizational objectives. Bill Klein, President of Consero Global, highlights the significance of this integration:

'Utilizing a comprehensive approach to metrics enables to not only comprehend their current economic position but also to foresee future trends and challenges.'

Optimized finance and accounting processes are essential for business metrics development, ensuring timely monthly statements, audit readiness, and effective reporting, which are crucial for maintaining a healthy economic environment. For example, the implementation of reporting tools and accurate cash collection forecasting can significantly enhance cash flow management, allowing CFOs to make informed decisions about resource allocation. As companies get ready for 2024, maintaining a current ratio of 1:1 or higher will be essential for signaling economic robustness.

This benchmark, as emphasized by Klein, reflects a company's capability to meet its short-term obligations and maintain economic health. By strategically applying these measures, financial leaders can improve their effectiveness and maneuver through the changing financial environment.

Steps to Establishing Effective Metrics: A Practical Guide

To establish effective organizational indicators, CFOs should adopt a systematic approach that encompasses the following steps:

- Define Objectives: Articulate clear goals for each measure, ensuring alignment with overarching business objectives.

- Select Measurements: Choose indicators that are not only relevant but also actionable and easy to interpret. As Arpit, VP of Growth Marketing & Analytics, points out,

The appropriate KPIs can provide significant insights into a company's health and performance, but can be deceptive or even harmful to corporate operations.

For instance, Bryan Ye's story, which has garnered 1429 saves, exemplifies the value of choosing significant measures.

- Log Data: Implement a centralized system for consistent tracking and logging of data, supported by real-time analytics to enhance decision-making and performance monitoring.

- Communicate Measurements: Foster a culture where stakeholders comprehend the measurements and their implications, reinforcing their significance in decision-making processes.

- Review Regularly: Establish a schedule for periodic evaluations, allowing for an assessment of the measurements' effectiveness and the opportunity to make necessary adjustments.

Additionally, consider leveraging resources such as Paro, which offers a network of finance professionals to help create tailored KPIs and implement effective KPI dashboards for improved performance. This structured methodology not only enhances accountability but also supports ongoing improvement through business metrics development by identifying underlying business issues and planning solutions, positioning the organization for sustained success in a dynamic market. Moreover, the case study on Healthcare Data-Driven Decision Making demonstrates how hospitals and clinics use electronic health records (EHRs) to examine patient data patterns for improved diagnosis and treatment strategies, highlighting the practical application of a systematic approach to evaluation.

Our team also emphasizes the importance of rapid financial reviews, focusing on cash preservation and efficiency, while employing a 'test and measure' strategy to validate hypotheses and maximize returns on invested capital.

Leveraging Technology for Enhanced Metrics Development

CFOs have the opportunity to significantly elevate metrics development through the strategic use of technology. In today's fast-paced corporate landscape, streamlined decision-making is crucial. Our team advocates for an expedited decision-making cycle during the turnaround process, enabling your team to take decisive action to protect your enterprise.

are crucial for real-time tracking and insightful examination of key indicators, enabling swift identification of trends and anomalies. For example, 42% of companies utilizing blockchain technology have reported enhanced security features, illustrating the growing importance of technological integration. Furthermore, the Internet of Things (IoT) provides data-driven insights that enhance customer experiences and optimize supply chains, making it a critical component in metrics development.

Our client dashboard continually monitors the success of our plans and teams, providing real-time analytics to diagnose your organization's health effectively. This dashboard not only visualizes key performance indicators but also allows for adjustments based on real-time data, ensuring that strategies remain aligned with business goals. Software solutions such as Business Intelligence (BI) platforms provide interactive dashboards that visualize data, facilitating communication of insights throughout the organization.

Moreover, automation plays a pivotal role in streamlining data collection processes, minimizing errors, and saving valuable time. Implementing a cloud-based financial management system not only provides instant access to essential financial data but also facilitates timely decision-making. As emphasized by the McKinsey Technology Council, grasping the possible applications and adoption motivators of these tools is crucial for financial executives seeking to utilize technology for improved performance development in 2024 and beyond.

In light of Deloitte's case study titled 'A Renewed Focus on Innovation,' organizations are encouraged to build talent in AI, RPA, and cybersecurity while balancing globalization with self-reliance to mitigate risks from geopolitical and supply chain disruptions. With the rise of AI, which is set to revolutionize the workforce by merging human creativity with machine efficiency, organizations stand to unlock unprecedented levels of productivity and innovation.

Best Practices for Monitoring and Adapting Business Metrics

To maintain the effectiveness of organizational measurements, CFOs should adopt a set of best practices for ongoing monitoring and adjustment in :

- Regular Reviews: Implement monthly or quarterly evaluations of business metrics development to ensure their continued relevance and effectiveness in achieving business goals. Observability measures are essential tools for enhancing operations and improving customer satisfaction, making these reviews critical.

- Solicit Feedback: Actively engage team members and stakeholders to gather insights on performance and applicability, fostering a culture of collaboration.

- Adjust to Modifications: Remain flexible by altering measurements in response to shifts in corporate strategy, market dynamics, or operational changes, ensuring alignment with organizational objectives. This adaptability is crucial during turnaround processes, where business metrics development and real-time analytics can guide decisive actions.

- Testing Hypotheses: Regularly test hypotheses related to business metrics development to validate their effectiveness and relevance, allowing for informed adjustments.

- Benchmarking: Assess measurements against industry standards to identify areas for enhancement and leverage competitive advantages.

Notably, 86% of consumers recall podcast ads more than any other channel, underscoring the importance of effective metrics in capturing audience attention. Additionally, the continual monitoring of organizational health is essential; tools such as client dashboards that facilitate business metrics development through real-time analytics allow entities to adjust strategies effectively. By operationalizing lessons learned throughout the turnaround process, CFOs can foster strong relationships and enhance overall business performance.

The case study on 'Spans and Layers Optimization' illustrates how effective management of metrics can lead to improved productivity and collaboration, facilitating better assessment of salary grades and promotion opportunities.

Conclusion

CFOs play a pivotal role in steering organizations through financial complexities, and the effective use of business metrics is crucial in this journey. By focusing on key financial, operational, and customer metrics, CFOs can obtain a holistic view of their organization’s performance. This multidimensional approach not only informs strategic decisions but also enhances the ability to manage risks and seize growth opportunities. As the business landscape evolves, the significance of aligning metrics with organizational goals becomes ever more apparent, empowering CFOs to implement proactive measures that drive success.

Establishing effective metrics requires a systematic approach, beginning with clearly defined objectives and the careful selection of relevant, actionable metrics. Continuous monitoring and adaptation of these metrics ensure they remain aligned with changing market conditions and organizational strategies. Leveraging technology, such as real-time analytics and automation, further enhances the ability to track performance and make informed decisions swiftly. The integration of data-driven insights into daily operations not only streamlines processes but also fosters a culture of agility and responsiveness.

In summary, the strategic application of business metrics equips CFOs with the necessary tools to navigate a dynamic market landscape. By prioritizing the right metrics and fostering a data-driven culture, organizations can enhance their financial resilience and operational efficiency. As CFOs embrace these practices, they position their organizations for sustained success, ultimately driving growth and stability in an increasingly competitive environment.

Frequently Asked Questions

Why is business metrics development important for financial leaders?

Business metrics development is crucial as it provides financial leaders with quantifiable measures to evaluate the performance of various aspects of their organization, including profitability ratios, cash flow indicators, and operational efficiency measures.

What recent trend has been observed among financial executives regarding cash reserves?

A recent survey revealed that 46% of financial executives plan to prioritize holding more cash in their capital reserves for 2025, highlighting the importance of effective cash management in their metrics strategy.

How can financial leaders monitor the success of their plans?

Financial leaders can monitor the success of their plans using a client dashboard that provides real-time business analytics, allowing them to diagnose business health effectively and respond to emerging challenges.

What role do key performance indicators (KPIs) play in business metrics development?

KPIs enable executives to identify trends that may indicate economic distress or growth opportunities, aiding in the proactive management of resources and investments.

What risks have CFOs identified that impact business metrics development?

CFOs have identified internal risks such as technology deployment and lack of agility, as well as external concerns like geopolitics and economic conditions. As a result, 42% have prioritized enterprise risk management for 2025.

How should CFOs align measurements with business objectives?

CFOs must ensure that measurements are directly aligned with the organization’s overarching business objectives, which may include increasing market share, enhancing customer satisfaction, and improving operational efficiency.

Can you give an example of a relevant indicator for measuring customer satisfaction?

The net promoter score (NPS) is an example of a relevant indicator. For instance, if a company receives feedback from 100 survey respondents, with 20 detractors and 50 promoters, the resulting net promoter score would be 30, indicating customer loyalty and serving as a predictive indicator of revenue growth.

What strategies can improve cash flow as part of business metrics development?

Strategies to improve cash flow include optimizing inventory turnover, streamlining accounts receivable processes, and enhancing payment terms with suppliers.

Why is nurturing a data-driven culture important for organizations?

Nurturing a data-driven culture is vital as it promotes the appreciation of insights that measurements provide, enabling informed decision-making and continuous monitoring of organizational health.

How can financial leaders ensure their metrics remain relevant?

Financial leaders can ensure their metrics remain relevant by consistently reviewing objectives and adjusting business metrics development in response to evolving market conditions, which promotes agility and alignment with strategic goals.