Overview

This article delves into best practices for cost management strategies that CFOs can implement to oversee expenses effectively and enhance financial performance. It highlights essential techniques such as:

- Identifying expense drivers

- Fostering employee engagement

- Leveraging technology

Supported by evidence, these strategies not only lead to sustainable savings but also improve organizational efficiency.

Introduction

In the competitive landscape of modern business, effective cost management stands as a cornerstone for financial stability and growth. As organizations grapple with the pressures of economic fluctuations and evolving market demands, CFOs are entrusted with the pivotal role of steering their companies toward sustainable financial practices. This article delves into the essential components of cost management, offering insights on strategies that can help organizations:

- Identify cost drivers

- Implement efficient budgeting practices

- Leverage technology for enhanced oversight

By understanding the significance of fostering employee engagement and continuously improving processes, CFOs can not only navigate the complexities of cost management but also position their organizations for long-term success in an ever-changing economic environment.

Understanding Cost Management: A CFO's Guide

Cost oversight is a critical discipline that requires meticulous planning and control of a business's budget, focusing on strategies designed to reduce expenses while preserving quality and operational efficiency. For financial executives, a thorough comprehension of expense management is crucial, as it directly influences the organization's financial well-being.

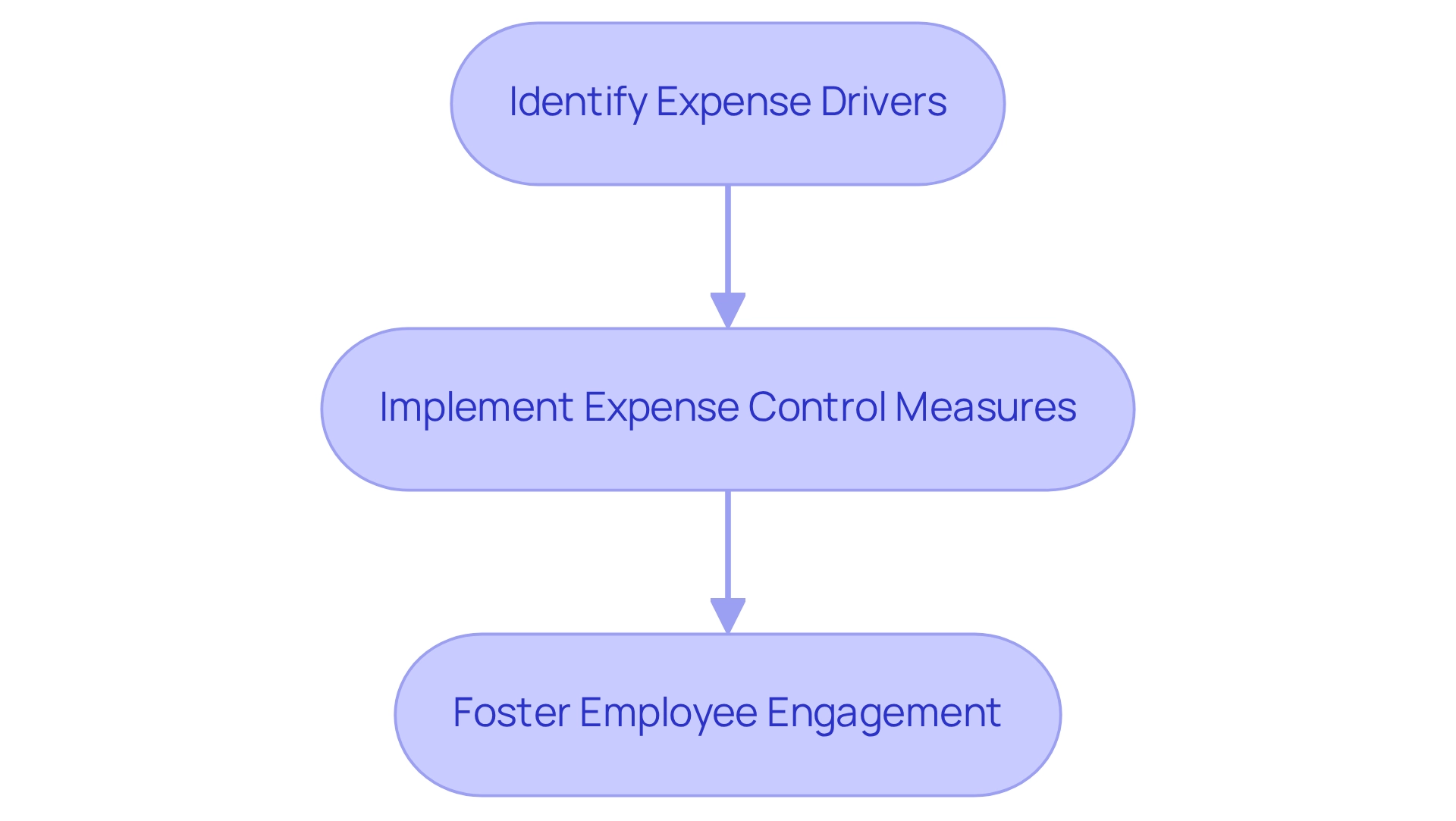

Key elements of successful expense management include:

- Identifying Expense Drivers: Acknowledging the factors that contribute to expenses is the first step in managing them effectively. This entails a comprehensive examination of both fixed and variable expenses to identify areas where savings can be achieved. Our group at Transform Your Small/Medium Business will uncover fundamental business challenges and collaborate to formulate a strategy that reduces vulnerabilities, enabling the organization to reinvest in essential strengths.

- Implementing Expense Control Measures: Once expense drivers are identified, CFOs must create and enforce strategies to regulate these expenditures. This may involve renegotiating contracts, optimizing supply chains, or investing in technology that enhances operational efficiency. As noted by Jim Wittmer from Grant Thornton, companies are increasingly attempting to achieve more with fewer resources, demonstrating a readiness to invest in technology for enhanced efficiency during budget optimization. We adopt a pragmatic approach to data, testing every hypothesis to deliver maximum return on invested capital in both the short and long term. Furthermore, we emphasize the significance of the 'Test & Measure' method to ensure that strategies are effective and modifications can be implemented as needed.

- Fostering Employee Engagement: Involving employees in the financial management process is vital. Research shows that entities that share performance data and engage personnel in cost-reduction initiatives tend to achieve more sustainable outcomes. Paul Goydan, managing partner and global head of Boston Consulting Group’s accelerated expense benefit initiative, highlights that it’s about sharing performance information further within the entity than has been traditionally practiced. This participatory method not only enhances morale but also fosters creative solutions from within the workforce.

The impact of efficient expense handling on a company’s financial well-being cannot be overstated. In 2025, CFOs must prioritize transparency in communications and visible leadership commitment to cultivate a culture of participation. By adhering to these principles, they can navigate the complexities of expense oversight and ensure their organizations remain competitive and financially robust in an ever-evolving economic landscape.

Practical instances from small to medium enterprises demonstrate that those who embrace a strategic approach to expense oversight not only achieve their initial savings objectives but also maintain them over the long term, thus securing their financial future. An analysis of sustainable expense oversight shows that numerous firms that initiate expense-reduction initiatives meet their savings targets initially, yet many leaders report that expenses ultimately revert, underscoring the necessity for continual involvement to preserve savings in the long run. Moreover, Jason's experience collaborating with businesses from Fortune 500 companies to small boutique firms highlights the diverse expertise in expense strategies.

The Role of Budgeting in Effective Cost Management

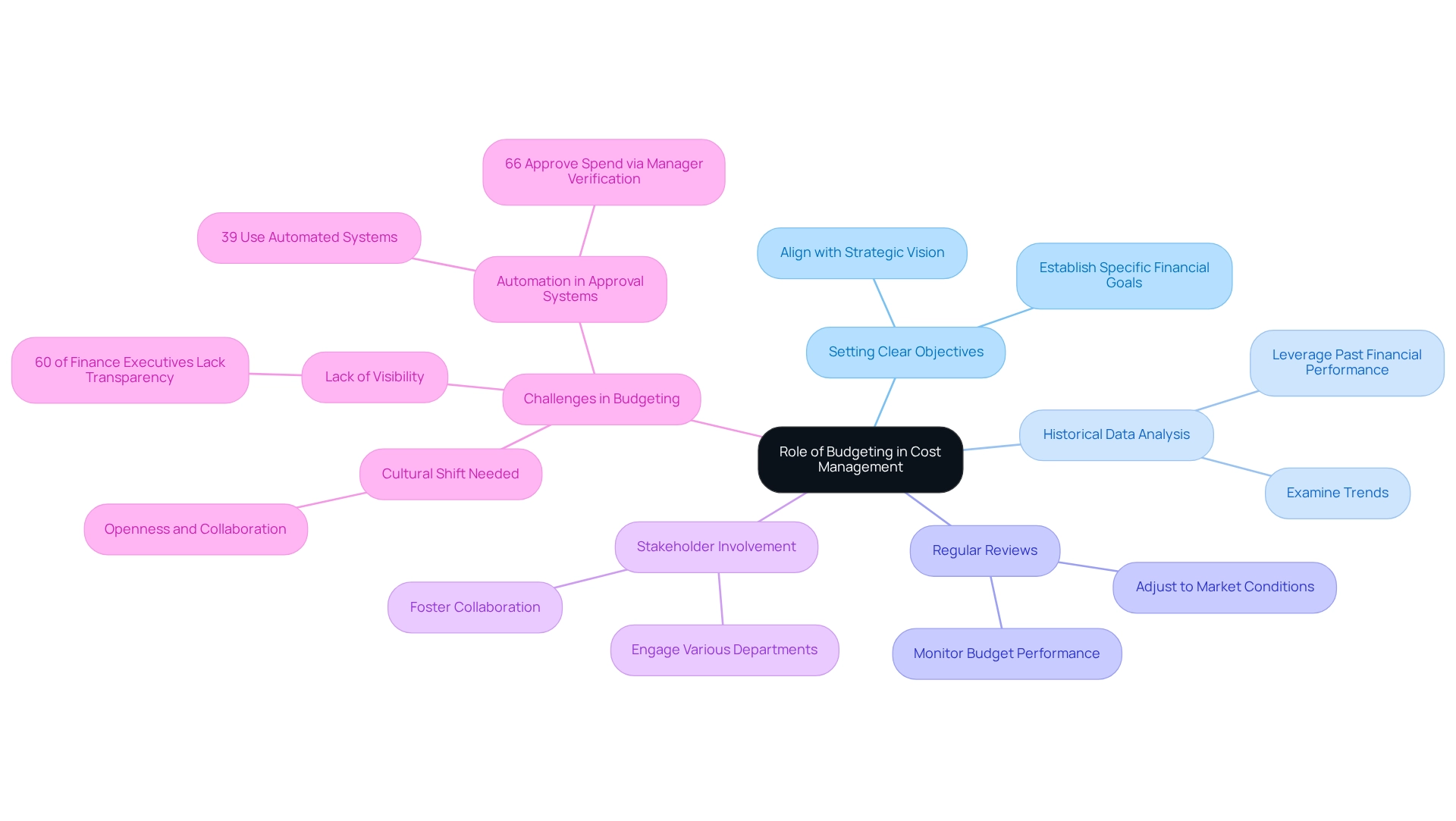

Budgeting is fundamental to effective cost management strategies, serving as the backbone for financial planning and resource allocation. For CFOs, adopting a systematic approach to budgeting is essential, which includes the following best practices:

- Setting Clear Objectives: Establish specific financial goals that align with the entity's strategic vision. This clarity helps in directing resources effectively and measuring success.

- Historical Data Analysis: Leverage past financial performance to inform future budgets. Examining trends enables enterprises to make data-informed choices, reducing the risk of overspending.

- Regular Reviews: Continuously monitor budget performance against set targets. This practice allows entities to adjust to evolving market conditions and operational requirements, ensuring financial agility and facilitating continuous business performance evaluation.

- Stakeholder Involvement: Engage various departments in the budgeting process to gather diverse insights and foster collaboration. This inclusivity not only improves the quality of the budget but also secures buy-in from all tiers of the entity, facilitating relationship-building through real-time analytics.

The significance of budgeting in financial management is emphasized by recent findings from a survey conducted by The Economist Intelligence Unit, which disclosed that 60% of finance executives lack complete visibility into their organizations' transactions. This lack of transparency can lead to overspending and missed opportunities for cost savings. By implementing robust cost management strategies, financial leaders can enhance spend visibility and drive operational efficiency.

As Tetiana Davydiuk notes, "Among the budgets, the most important is the budget of income and expenses, which allows you to plan the target indicators of the company's activity, while forming various business scenarios and predicting financial results for each of them, taking into account possible risks."

Current trends indicate a shift towards automated approval systems, with only 39% of companies currently utilizing such tools. Payhawk's survey found that 66% of companies approve operational spend through pre-approved manager verification, which ensures oversight but can be time-consuming. Automation can streamline the budgeting process, reducing the time spent on approvals while ensuring oversight.

As institutions increasingly acknowledge the need for real-time insights, investing in technology that supports budgeting processes will be crucial for future success. Additionally, achieving greater spend visibility requires a cultural shift towards openness and collaboration, which is essential for effective stakeholder involvement.

In summary, effective budgeting techniques and cost management strategies not only support strategic decision-making but also play a pivotal role in achieving sustainable financial performance. By concentrating on these optimal strategies, financial leaders can maneuver through the intricacies of expense oversight and prepare their organizations for expansion, while consistently recognizing problems, devising solutions, and assessing investment yields.

Proven Cost Management Strategies for CFOs

CFOs can implement several proven strategies to enhance cost management effectively:

- Conduct Regular Cost Audits: Regularly reviewing expenses is crucial for identifying areas ripe for reduction. Statistics indicate that efficient financial audits can lead to substantial savings, with companies reporting an average of $520,000 conserved through organized compliance strategies. A notable case study highlights that implementing a formal compliance charter has been beneficial in achieving these savings. This practice not only uncovers inefficiencies but also promotes a culture of financial accountability. As Paul Munter, Acting Chief Accountant, states, "The independent audit overseen by an active and effective audit committee is a critical step in providing that information to the capital markets."

- Implement Zero-Based Budgeting: This approach requires justifying all expenses from the ground up, rather than relying on historical budgets. Case studies indicate that organizations adopting zero-based budgeting have observed significant enhancements in financial performance, as it promotes a detailed review of every expense and aligns spending with present organizational objectives. By integrating real-time analytics, CFOs can continuously monitor the impact of these budgets and adjust as necessary. Testing hypotheses related to budget allocations can further maximize returns on invested capital.

- Negotiate with Suppliers: Actively seeking better terms and pricing from vendors can significantly lower procurement expenses. Engaging in strategic negotiations not only lowers expenses but also strengthens supplier relationships, fostering collaboration that can lead to further savings. Utilizing real-time data can enhance negotiation strategies by providing insights into market trends and supplier performance.

- Embrace Automation: Utilizing technology to automate repetitive tasks can significantly lower labor expenses and enhance operational efficiency. Notably, 36% of financial leaders intend to integrate artificial intelligence into their financial reporting procedures within the next five years, emphasizing automation as a crucial factor in expense oversight in the upcoming years. This shift allows for more streamlined decision-making and frees up resources for strategic initiatives.

- Monitor Key Performance Indicators (KPIs): Tracking financial metrics is crucial for evaluating the efficiency of expense strategies. By setting clear KPIs, financial leaders can make informed choices that promote ongoing enhancement and ensure that expenditure strategies align with overall business goals. Real-time analytics tools, including a client dashboard, can facilitate this monitoring, providing immediate insights into business health and performance.

These cost management strategies not only assist in managing expenses but also foster a culture of financial responsibility within the organization, positioning businesses for sustainable growth.

Key Performance Indicators: Measuring Cost Management Success

To effectively gauge the success of cost management strategies, CFOs must prioritize the following key performance indicators (KPIs):

- Cost of Goods Sold (COGS): This metric represents the direct expenses related to the production of goods sold, acting as a vital indicator of operational efficiency and pricing strategies.

- Operating Margin: This KPI assesses the percentage of revenue left after addressing variable production expenses, providing insights into the profitability of primary business activities across different sectors.

- Return on Investment (ROI): By evaluating the profitability of investments in cost management strategies, CFOs can determine the effectiveness of their approaches and make data-driven decisions to enhance financial performance.

- Expense Ratio: This ratio compares total expenses to total revenue, offering a clear picture of operational efficiency and helping identify areas for potential cost reductions.

- Cash Flow: Monitoring cash flow is essential for ensuring that the organization can meet its financial obligations while simultaneously investing in growth opportunities.

Regularly reviewing these KPIs enables CFOs to make informed decisions that not only enhance financial performance but also drive sustainable growth. For instance, effective inventory oversight has been shown to yield significant cost savings and improved cash flow, as highlighted in a case study titled "The Power of Effective Inventory Oversight." This study underscores the strategic benefits of maintaining effective inventory oversight, including its role in optimizing production and procurement processes.

Moreover, the American Hospital Association (AHA) reports an average inventory turnover ratio of 5.2 for hospitals, illustrating the importance of operational efficiency in managing inventory. By focusing on these metrics and employing a strategic approach to identify underlying business issues and collaboratively plan solutions, organizations can better navigate financial challenges and improve their overall return on investment.

Leveraging Technology for Enhanced Cost Management

Chief financial officers can significantly enhance their expense management strategies by leveraging advanced technology in the following ways:

- Cloud-Based Solutions: Embracing cloud technology not only reduces IT expenses but also enhances scalability. With over half of surveyed businesses migrating to the cloud for disaster recovery, as highlighted in recent industry reports, this shift is becoming essential for financial services, driving security, efficiency, and innovation. Notably, Microsoft Azure Stack's usage surged to 37% in 2022, indicating a strong preference for cloud solutions that support financial operations.

- Data Analytics: Implementing robust analytics tools enables financial executives to gain critical insights into spending patterns, facilitating the identification of effective cost management strategies. Organizations that utilize data analytics can consistently track their business performance through real-time dashboards, resulting in improved decision-making abilities and more efficient financial management strategies. Transform Your Small/Medium Business offers a client dashboard that provides real-time business analytics to continually assess your business health.

- Automated Reporting: Streamlining financial reporting processes through automation not only saves time but also minimizes errors. This efficiency is vital for financial executives striving to maintain accuracy in financial statements while alleviating the workload on their teams.

- Expense Management Software: Utilizing specialized software for real-time expense tracking empowers financial executives to proactively manage costs. This technology enhances oversight and control over expenditures, ensuring that cost management strategies are effectively implemented and that lessons learned are operationalized for future improvements.

- Collaboration Tools: Enhancing communication and collaboration across departments is crucial for improving operational efficiency. By leveraging modern collaboration tools, financial leaders can reduce redundancies and foster a more integrated approach to financial management.

- Real-World Application: A notable example is BILL's partnership with AWS, which strengthened its cloud capabilities, focusing on scalability to manage fluctuating transaction volumes. This collaboration enabled BILL to swiftly scale resources during peak transaction periods, ensuring seamless customer experiences and preventing downtime.

- Industry Trends: Furthermore, a recent report from American Banker reveals that over 80% of executives from banks, fintechs, and credit unions plan to increase their technology expenditure in 2025, underscoring the growing recognition of technology's role in enhancing financial efficiency.

By adopting these technological innovations, financial leaders can cultivate a more agile and responsive financial environment, utilizing real-time analytics to continuously evaluate performance and prepare their organizations for sustainable growth and resilience amid challenges. The integration of these technologies supports a shortened decision-making cycle throughout the turnaround process, enabling financial leaders to take decisive action to safeguard their business.

Navigating Challenges in Cost Management: Solutions for CFOs

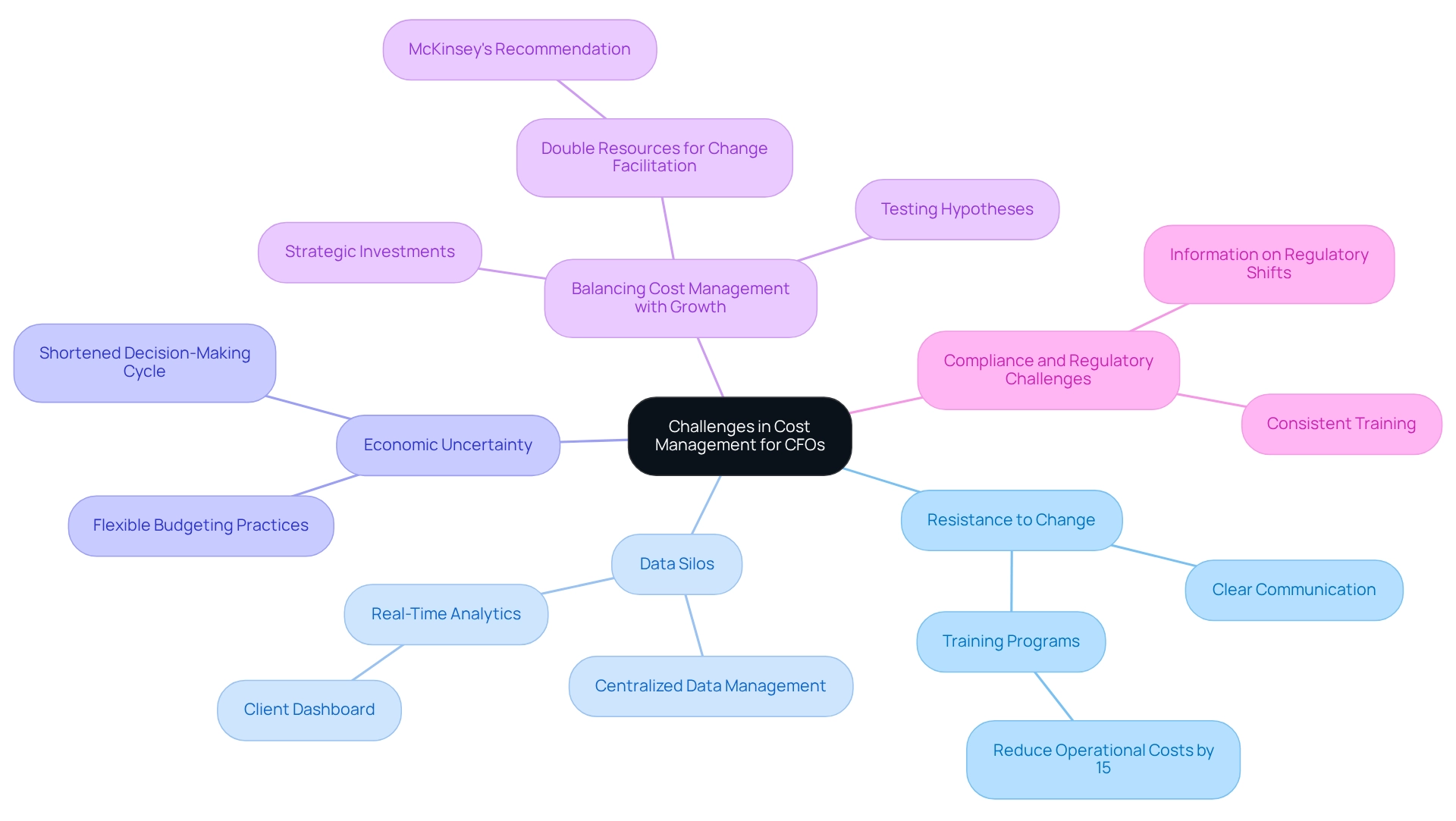

CFOs frequently navigate a complex landscape of challenges in budget oversight, underscoring the vital role of effective cost management strategies that can significantly impact their organizations. Key challenges include:

- Resistance to Change: Employees often demonstrate reluctance towards new cost-saving measures, which can undermine initiatives. In fact, 42% of companies reported that a lack of user buy-in contributed to change failure. To combat this, clear communication regarding the benefits of changes and comprehensive training programs are essential. Investing in employee training can lead to a reduction in operational expenses by up to 15%, while also enhancing project outcomes.

Moreover, a substantial 83% of employees believed they lacked sufficient tools to manage change, emphasizing the critical need for improved communication and support from leadership during cost control initiatives.

- Data Silos: The existence of isolated data systems can severely hinder effective decision-making. Organizations that implement centralized data management systems can enhance visibility and streamline financial analysis, resulting in more informed strategic decisions.

By leveraging real-time analytics through the client dashboard offered by Transform Your Small/Medium Business, financial executives can continuously monitor business performance and make timely adjustments to their strategies, ensuring agility in a fast-paced environment.

- Economic Uncertainty: The volatility of markets complicates budgeting processes. CFOs are encouraged to adopt flexible budgeting practices that allow for swift adjustments in response to economic shifts, ensuring that financial plans remain relevant and actionable. This approach aligns with the necessity for a shortened decision-making cycle, enabling organizations to respond decisively to changing market conditions.

- Balancing cost management strategies with growth: Achieving a balance between stringent cost management strategies and essential investments in growth initiatives is crucial. CFOs should prioritize strategic investments that promise long-term benefits, ensuring that cost-cutting measures do not stifle innovation or market competitiveness. As McKinsey indicates, organizations ought to allocate double the resources for change facilitation and adoption compared to developing the solution to ensure effective implementation of cost management strategies. Operationalizing lessons learned from past initiatives can further enhance this balance, fostering a culture of continuous improvement. Additionally, testing hypotheses during the decision-making process can provide valuable insights that guide effective resource management strategies.

- Compliance and Regulatory Challenges: Navigating adherence while managing expenses presents a significant hurdle. Consistent training and information on regulatory shifts can aid in reducing risks and ensuring that organizations remain compliant without incurring substantial expenses.

By actively addressing these challenges and fostering a culture that embraces change and flexibility, financial leaders can enhance their cost management strategies, ultimately driving organizational success.

Continuous Improvement: Evolving Cost Management Practices

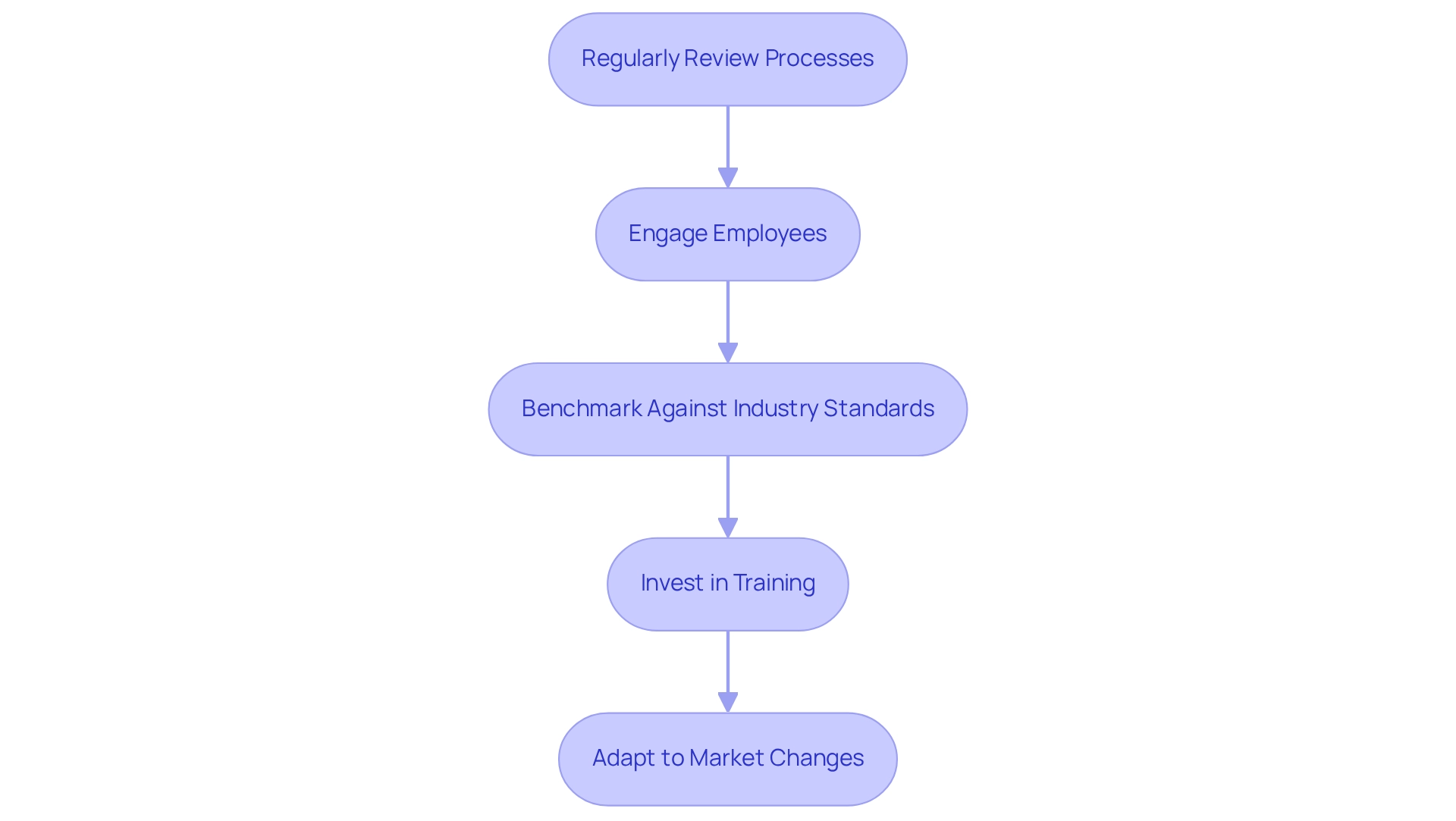

To sustain the effectiveness of financial oversight practices, CFOs should adopt the following strategies:

- Regularly Review Processes: Conducting periodic assessments of cost management strategies is essential. This practice enables entities to identify inefficiencies and apply necessary enhancements, ensuring optimal resource utilization. Techniques such as Process Mapping and Root Cause Analysis are particularly effective in identifying areas for improvement. By continuously monitoring performance, CFOs can operationalize turnaround lessons and make informed decisions based on real-time analytics. Furthermore, this process should focus on reinvesting in key strengths to enhance the entity’s competitive advantage.

- Engage Employees: Cultivating a culture that encourages employee participation in cost-saving initiatives can lead to innovative solutions. When staff members feel appreciated and encouraged to express their ideas, companies can access a wealth of insights that enhance efficiency and lower expenses. The Prosci ADKAR Model emphasizes the importance of awareness, desire, knowledge, ability, and reinforcement in managing change, which is crucial for engaging employees in these initiatives. This engagement fosters a collaborative environment that supports strategic business improvement and enhances the planning process to mitigate weaknesses.

- Benchmark Against Industry Standards: Comparing performance metrics with industry peers is crucial for identifying best practices. This benchmarking process not only highlights areas for improvement but also fosters a competitive spirit that can motivate teams to excel. By leveraging real-time analytics, CFOs can continuously monitor their entity’s performance against industry standards, ensuring they remain agile and responsive to market changes. Furthermore, this benchmarking should include a focus on measuring investment returns to assess the effectiveness of implemented strategies.

- Invest in Training: Investing in training is vital for staff to stay updated on the latest cost management strategies and technologies. By providing staff with essential skills, companies can improve their overall efficiency and adaptability. Utilizing tools like PRIME BPM Software can facilitate this training by providing a centralized platform for collaboration, ensuring all stakeholders are aligned in improvement projects. This investment in training supports a culture of continuous improvement and strategic planning.

- Adapt to Market Changes: The ability to remain agile in response to economic shifts or changes in consumer behavior is paramount. Chief financial officers should be prepared to modify strategies quickly, ensuring that the company can handle challenges efficiently. By testing every hypothesis and measuring investment returns, CFOs can make data-driven decisions that strengthen their entity’s resilience.

By committing to these continuous improvement practices, CFOs can significantly enhance their entity's resilience and adaptability in an ever-evolving business landscape. Statistics indicate that organizations implementing continuous improvement methodologies, such as Lean and Six Sigma, experience a marked increase in operational efficiency and employee engagement, ultimately leading to sustainable growth.

Conclusion

Effective cost management transcends mere financial necessity; it stands as a strategic imperative for organizations determined to excel in today's competitive landscape. By pinpointing cost drivers, instituting robust budgeting practices, and harnessing technology, CFOs can establish a solid foundation for financial stability and growth. Engaging employees in the cost management process not only fosters innovation but also enhances accountability. Additionally, regular reviews and adaptations of strategies ensure that organizations remain agile amidst economic fluctuations.

The integration of proven cost management strategies, such as zero-based budgeting and automated reporting, further empowers CFOs to optimize resources and drive efficiency. Monitoring key performance indicators facilitates informed decision-making, ensuring that cost management efforts align seamlessly with broader organizational goals. As the business environment continues to evolve, embracing continuous improvement practices becomes essential for sustaining success.

In conclusion, the journey toward effective cost management is an ongoing endeavor that demands a commitment to transparency, collaboration, and adaptability. By prioritizing these elements, CFOs can navigate the complexities of cost management while positioning their organizations for long-term resilience and prosperity. Now is the time to embrace these strategies and lead the charge toward a financially robust future.

Frequently Asked Questions

What is the importance of cost oversight in a business?

Cost oversight is critical for meticulous planning and control of a business's budget, focusing on strategies to reduce expenses while maintaining quality and operational efficiency. It directly influences the organization's financial well-being.

What are the key elements of successful expense management?

The key elements include identifying expense drivers, implementing expense control measures, and fostering employee engagement. Each element plays a role in effectively managing and reducing expenses.

How can businesses identify expense drivers?

Businesses can identify expense drivers by examining both fixed and variable expenses to pinpoint areas where savings can be achieved. This involves a comprehensive analysis of the factors contributing to expenses.

What strategies can CFOs implement to control expenses?

CFOs can implement strategies such as renegotiating contracts, optimizing supply chains, and investing in technology to enhance operational efficiency. The 'Test & Measure' method is also emphasized to ensure strategies are effective.

Why is employee engagement important in expense management?

Involving employees in financial management enhances morale and fosters creative solutions, leading to more sustainable outcomes. Sharing performance data and engaging personnel in cost-reduction initiatives are key to achieving this.

What role does budgeting play in cost management?

Budgeting serves as the backbone for financial planning and resource allocation, helping to set clear objectives, analyze historical data, monitor performance, and involve stakeholders in the budgeting process.

What best practices should CFOs adopt for effective budgeting?

Best practices include setting clear objectives, analyzing historical data, conducting regular reviews, and involving various departments in the budgeting process to gather insights and foster collaboration.

What challenges do finance executives face regarding visibility into transactions?

A significant number of finance executives lack complete visibility into their organizations' transactions, which can lead to overspending and missed opportunities for cost savings.

How can technology improve budgeting processes?

Investing in technology can streamline budgeting processes, reduce time spent on approvals, and enhance spend visibility, which is crucial for effective financial management.

What is the overall impact of effective budgeting and cost management strategies?

Effective budgeting techniques and cost management strategies support strategic decision-making and play a pivotal role in achieving sustainable financial performance, enabling organizations to navigate expense oversight complexities and prepare for growth.