Overview

Crisis response strategies are crucial for CFOs aiming to adeptly manage unforeseen events and uphold financial stability within their organizations. This article underscores the significance of:

- Proactive planning

- Real-time analytics

- Clear communication

as essential elements that empower CFOs to successfully navigate crises. By implementing these strategies, CFOs can enhance organizational resilience and ensure robust financial management during turbulent times.

Introduction

In an unpredictable world where crises can strike at any moment, the role of CFOs has become increasingly critical. As financial stewards, they are not only responsible for managing the immediate fallout of unexpected events but also for ensuring long-term stability and growth for their organizations. This article explores the essential strategies that CFOs must adopt to navigate crises effectively, highlighting the importance of:

- Robust crisis response frameworks

- Effective communication

- Continuous financial assessments

By embracing proactive measures and learning from past experiences, CFOs can transform challenges into opportunities, fostering resilience and trust among stakeholders. As the landscape of crisis management evolves, understanding these dynamics is crucial for any financial leader aiming to safeguard their organization's future.

Understanding Crisis Response Strategies

Crisis response strategies serve as essential frameworks that empower entities to effectively address unforeseen events threatening their stability. For CFOs, mastering these strategies is crucial, as they play a pivotal role in maintaining financial oversight during turbulent times. Efficient emergency management begins with identifying potential hazards and conducting a thorough evaluation of their possible impact on the organization.

This proactive approach involves developing structured plans that include contingency measures, forming specialized emergency management teams, and ensuring transparent communication of roles and responsibilities to all stakeholders involved.

In 2025, the significance of robust emergency management plans cannot be overstated. Recent trends indicate a growing adoption of technology-enabled solutions by organizations to bolster their crisis response capabilities. For instance, the integration of cloud-based applications equips finance teams with advanced data analytics tools, streamlining essential monetary functions and enhancing decision-making processes.

This aligns with a pragmatic approach to data, where testing hypotheses and leveraging real-time analytics can yield substantial returns on invested capital, both in the short and long term.

Experts emphasize that CFOs must focus not only on immediate economic implications but also consider long-term sustainability. A case study featuring Conlon Construction illustrates the effectiveness of prompt issue resolution assistance, significantly enhancing operational usability and budgetary oversight. Such examples highlight the necessity of agile crisis management strategies capable of adapting to evolving circumstances.

Furthermore, the increasing importance of forensic accounting in uncovering financial manipulations is paramount in today’s landscape, underscoring the need for CFOs to uphold the integrity of their accounting systems.

As Sheng from the China Banking Regulatory Commission aptly remarked, 'Why is an engineer paid four, four times what a real engineer is paid? An engineer constructs bridges, a monetary engineer creates dreams. And you know, when those dreams turn into nightmares, other people pay for it.' This quote underscores the critical role of monetary supervision during emergencies and the potential consequences of neglecting it.

Data indicates that organizations with clearly defined crisis response strategies are better positioned to mitigate risks and recover swiftly from disruptions. By continuously monitoring the effectiveness of their plans through real-time business analytics via the client dashboard, financial executives can operationalize lessons learned and cultivate strong, enduring relationships with stakeholders. As financial executives, chief financial officers must prioritize the formulation and execution of crisis response strategies to protect their entities' financial health and ensure resilience in the face of challenges.

Transform Your Small/ Medium Business is committed to supporting financial executives in these vital efforts.

The Role of Communication in Crisis Management

In moments of emergency, effective communication serves as a crucial lifeline for organizations. CFOs must prioritize timely, transparent, and audience-specific messaging. This encompasses not only the distribution of information regarding the situation but also addressing stakeholder concerns and providing reassurance.

Creating a comprehensive emergency communication strategy is vital; it should clearly outline key messages, preferred communication channels, and designated spokespersons. Regular updates are essential to keep stakeholders informed about developments and the organization's response efforts. By fostering transparent communication, CFOs can build trust and confidence among stakeholders, which are crucial for effectively managing challenging periods.

The significance of communication in managing emergencies cannot be overstated. A case study from the banking sector illustrates this point effectively, highlighting the necessity for proactive and genuine engagement with customers and the media during difficult times. Financial organizations must develop robust emergency communication plans that integrate crisis response strategies, encompassing pre-emergency preparation, active response, and post-emergency evaluation.

By emphasizing genuineness and openness, entities can cultivate trust and bolster their position as reliable advisors during challenging times. Furthermore, post-event assessments are essential for extracting insights from past errors and enhancing future crisis response strategies. These evaluations assist organizations in identifying what was effective and what was not, facilitating continuous improvement in emergency management.

Statistics reveal that organizations with clearly defined communication strategies are significantly more efficient in handling emergencies, resulting in improved stakeholder relations and institutional resilience. Moreover, addressing challenges such as semantic noise and adopting strategies to enhance clarity can further boost communication effectiveness during emergencies. For financial executives, understanding the impact of communication on emergency management is crucial, as it directly influences the organization's ability to recover and thrive in the aftermath of a disruption.

Challenges CFOs Face in Crisis Situations

Chief Financial Officers confront a multifaceted array of challenges during crises, with crisis response strategies rendering liquidity management a paramount concern. The pressure to sustain operational continuity while navigating uncertain market conditions and fluctuating revenues can be formidable. In 2025, the landscape for CFOs is particularly daunting, as they must reconcile urgent monetary needs with long-term strategic objectives.

This often necessitates difficult compromises that can impact the entity's future viability.

In these turbulent times, implementing effective crisis response strategies for liquidity management is essential. Adopting stricter credit policies and offering early payment discounts can significantly incentivize quicker payments, thereby bolstering cash flow. For instance, during the 2008 economic downturn, recognized as the most severe economic crisis in global history, numerous organizations learned the hard way that maintaining a disciplined approach to spending is crucial.

Matthias Heiden, CFO at Industrial and Financial Systems (IFS), emphasizes that treating spending as both a profit and loss item and a liquidity expense is vital for sustaining economic stability.

Moreover, the challenges faced by CFOs during economic crises underscore the necessity of effective crisis response strategies and are not merely theoretical. Statistics reveal that many organizations grapple with cash shortfalls, underscoring the significance of proactive liquidity management and crisis response strategies. As Sheng from the China Banking Regulatory Commission aptly articulates, "Why engineer paid four, four times what a real engineer is paid? A true engineer constructs bridges, while a monetary engineer creates dreams," illustrating the crucial role of financial management and crisis response strategies in adeptly navigating crises.

To effectively tackle these challenges, CFOs can leverage real-time analytics through the client dashboard provided by Transform Your Small/Medium Business, utilizing crisis response strategies to continuously monitor business health. This allows for swift decision-making that preserves liquidity. By testing hypotheses and operationalizing lessons learned from previous experiences, organizations can adapt their strategies to meet current demands. Additionally, interim financial executives must facilitate the search for a permanent CFO, ensuring a seamless transition and ongoing success during turbulent times.

By comprehending these challenges and employing effective strategies, financial leaders can not only address immediate concerns but also position their organizations for sustainable growth in the future.

Practical Steps for Effective Crisis Response

To effectively navigate crises, CFOs should implement the following practical steps:

- Establish an Emergency Management Team: Form a dedicated group tasked with emergency planning and response, ensuring representation from key departments such as finance, operations, and communications. This diversity promotes a thorough method to managing emergencies.

- Develop Crisis Response Strategies: Create a detailed plan that outlines procedures for various emergency scenarios, including financial contingencies. This plan should be adaptable to different situations, ensuring that the organization can respond swiftly and effectively.

- Conduct Regular Training and Simulations: Participate in emergency simulations to prepare the team for real-life scenarios. Regular training enhances readiness and response capabilities, allowing the team to act decisively under pressure.

- Monitor Financial Health Continuously: Implement real-time financial monitoring systems to track cash flow, expenses, and revenue fluctuations. This proactive approach enables quick decision-making and helps identify potential issues before they escalate. Utilizing a client dashboard for real-time business analytics can significantly enhance this monitoring process, allowing for continual diagnosis of business health.

- Engage Stakeholders: Maintain open lines of communication with stakeholders, providing regular updates and addressing concerns. This transparency fosters trust and collaboration, which are essential during challenging times. Building strong relationships through consistent engagement can operationalize the lessons learned during the turnaround process, further strengthening stakeholder confidence.

The significance of possessing a strong emergency management plan, which includes effective crisis response strategies, cannot be exaggerated. Organizations that have well-defined crisis response strategies are better positioned to mitigate risks and recover from setbacks. For example, a recent study showed that organizations with well-established emergency management teams had a 30% quicker recovery rate than those lacking such teams.

Moreover, the count of qualified leads produced in the 1st Quarter of 2024 surpassed the overall leads for the entirety of 2023, highlighting the favorable results of efficient management during challenging times.

As Professor Randall S. Peterson, Academic Director of the London Business School Leadership Institute, states, "It’s time to acknowledge this trait as a key factor in achieving sustainable success for both employees and businesses." By prioritizing these strategies, financial leaders can guide their organizations through challenging times more effectively, ensuring long-term sustainability and growth. Furthermore, creative methods, such as employing green walls to cool urban areas, emphasize the significance of incorporating sustainability into emergency management strategies, which can connect with stakeholders and improve organizational resilience.

Financial Assessment: A Key Component of Crisis Response

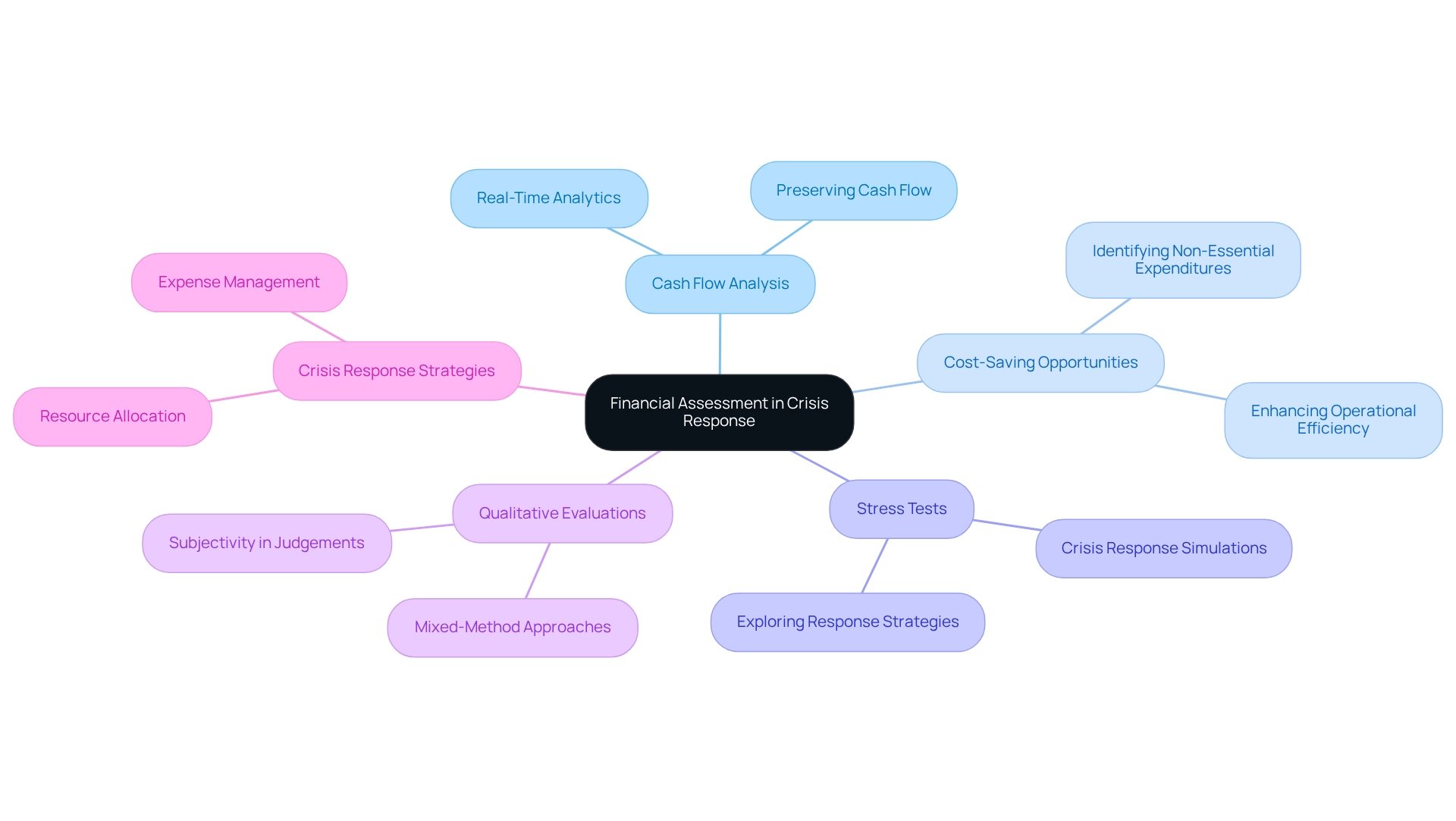

A thorough economic evaluation is essential for chief financial officers maneuvering through challenges, particularly when employing advanced techniques such as AI and machine learning. This process requires a meticulous examination of cash flow, identification of cost-saving opportunities, and assessment of the organization's overall economic health through a business valuation report. Conducting stress tests is crucial; these simulations allow financial leaders to explore various crisis response strategies and their potential impacts on the business.

By comprehending the economic consequences of different scenarios, finance executives can make informed decisions regarding resource allocation, expense management, and strategic investments. Furthermore, this evaluation should encompass a comprehensive review of current monetary controls and compliance measures, ensuring that the organization maintains stability during turbulent times.

Current trends indicate that chief financial officers are increasingly focusing on qualitative aspects of health monitoring, extending beyond traditional metrics to incorporate broader operational dynamics. This shift underscores the necessity for CFOs to adopt mixed-method approaches in their assessments, as highlighted by research from Chadwick and Dawson (2018), which emphasizes the importance of integrating qualitative insights with quantitative data. The evolution of CFO research from fiscal management and organizational dynamics in the 1990s to qualitative research and operations management in recent years further supports this trend.

For instance, during a recent crisis, a team implemented a series of cost-reduction strategies that not only preserved cash flow but also enhanced operational efficiency. By prioritizing cash flow analysis and leveraging real-time analytics, the CFO identified non-essential expenditures and redirected resources toward critical areas, ultimately fostering resilience and positioning the company for future growth. Moreover, interim financial leaders play a vital role in guiding organizations through monetary difficulties, ensuring a seamless transition to sustainable management by employing effective crisis response strategies, as illustrated in the case study titled 'The Role of Interim Financial Executives in Crisis Management.'

In summary, the importance of monetary evaluations during crises is paramount for developing effective crisis response strategies. They enable financial leaders to navigate challenges adeptly by implementing crisis response strategies, ensuring that organizations remain agile and prepared for whatever lies ahead. As Pinho et al. noted, the clustering outcomes and their interpretation included qualitative evaluations that demonstrated subjectivity, further emphasizing the necessity for a balanced approach in monetary assessments. By applying lessons learned and continuously monitoring business performance, financial leaders can enhance cash flow and profitability, ultimately mastering the cash conversion cycle. This process is supported by the $3,500.00 Business Valuation Report, which provides critical insights into the financial health of the organization.

The guidance from experts such as Peter Griscom, David Bates, and Chase Hudson further reinforces the strategies for effective turnaround management.

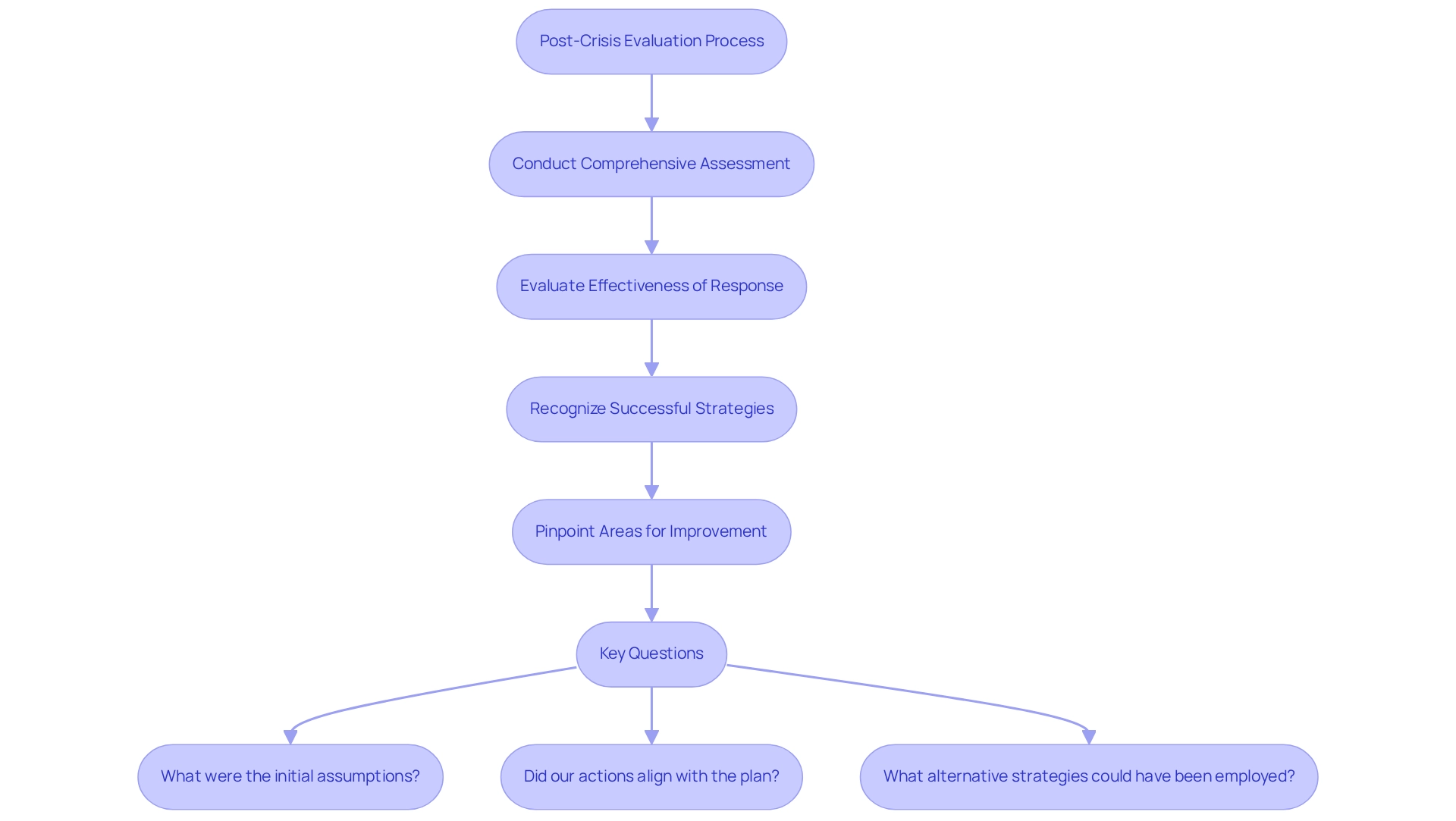

Learning from Crises: Post-Crisis Evaluation and Improvement

Following the resolution of an emergency, it is imperative for CFOs to conduct a comprehensive post-emergency assessment. This critical process encompasses evaluating the effectiveness of the emergency response, recognizing successful crisis response strategies, and pinpointing areas that necessitate enhancement. Engaging the emergency management team in this assessment not only fosters accountability but also cultivates a culture of continuous learning within the organization.

Key questions to guide this evaluation include:

- What were the initial assumptions that shaped our response?

- Did our actions align with the established emergency management plan?

- What alternative strategies could have been employed?

By systematically analyzing these elements, CFOs can refine their management strategies, thereby enhancing their readiness for future challenges. Statistics reveal that in 10% of emergencies, 15 or more specialists are involved, underscoring the complexity of emergency management and the necessity for thorough assessments.

Moreover, organizations that prioritize post-crisis evaluations frequently experience significant enhancements in their crisis response strategies, particularly in financial management practices. For instance, organizations that have effectively evaluated their emergency responses have reported increased stakeholder trust and improved operational resilience. The ongoing pressures on CFOs, as highlighted in the case study "Can Companies Keep Their CFOs?" emphasize the importance of supporting finance leaders during challenging times to mitigate turnover and ensure effective leadership.

The significance of gleaning insights from past challenges cannot be overstated. As the landscape of financial management evolves, financial leaders must adapt by integrating lessons learned into their strategic planning. This proactive approach, bolstered by real-time analytics and a commitment to implementing insights gained during the emergency, not only mitigates risks but also fortifies organizations' crisis response strategies for sustainable growth in the aftermath of a challenging situation.

Expert opinions consistently highlight that the most sought-after skills in emergency management involve crisis response strategies, which prioritize immediate expertise over cultural fit, reinforcing the necessity for CFOs to establish a robust response framework. Patrick Gibbons remarked, "Thanks for this timely and very thorough article. Well done. Valuable insights and a highly detailed strategy for emergency management…thanks!"

In the post-emergency phase, it is crucial for entities to follow up on promises made during the emergency, provide updates on recovery efforts, and analyze the management process for valuable lessons learned. This reflective practice, combined with ongoing business performance tracking through real-time analytics, not only enhances the entity's emergency response capabilities but also elevates overall fiscal management.

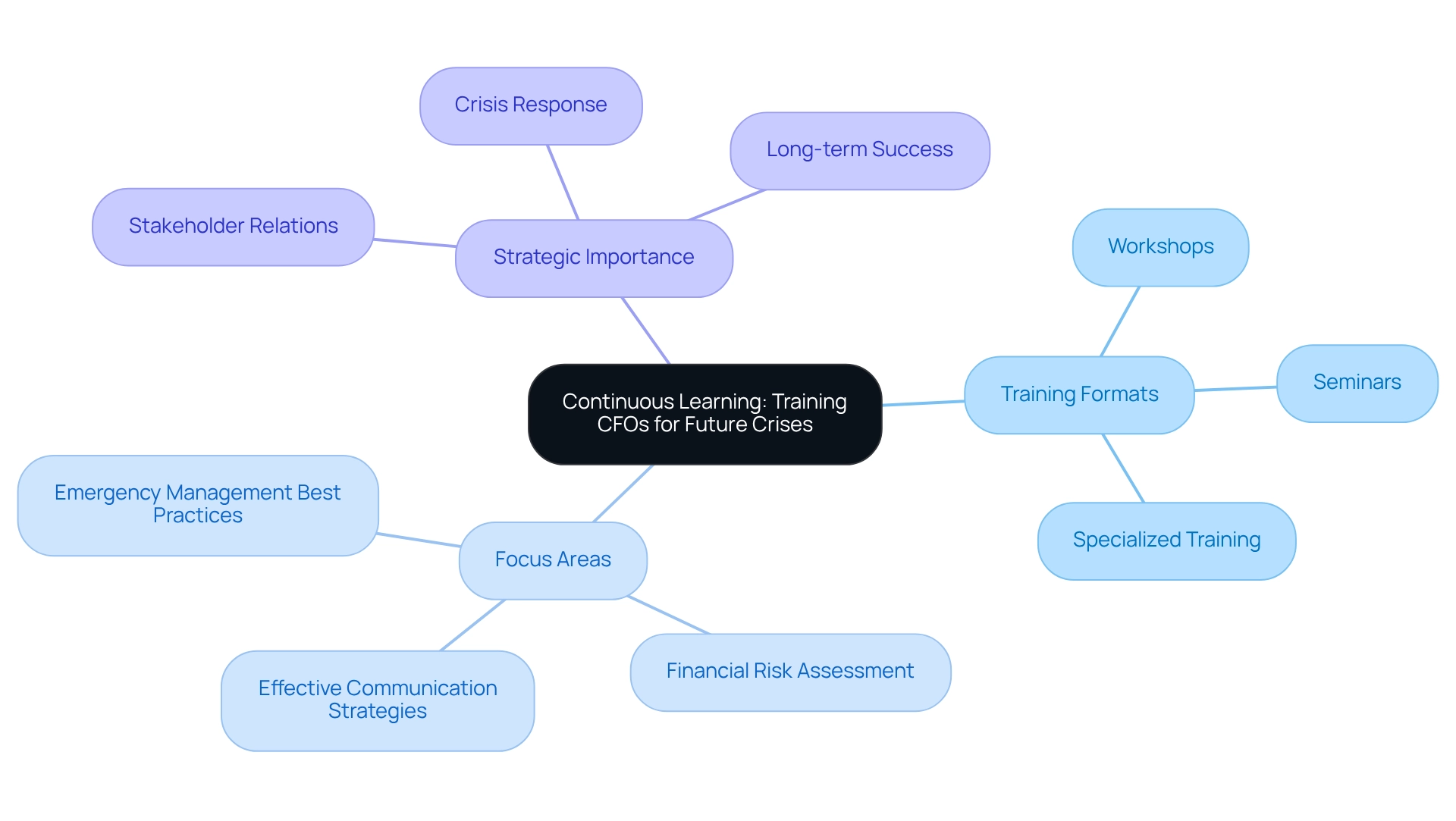

Continuous Learning: Training CFOs for Future Crises

To prepare financial leaders for upcoming challenges, organizations must prioritize ongoing learning and development initiatives. This encompasses a variety of formats, including workshops, seminars, and specialized training sessions focusing on:

- Emergency management best practices

- Financial risk assessment

- Effective communication strategies

A critical component of these strategies is the ability of CFOs to articulate company policies to investors clearly, particularly during challenging times.

Staying informed about emerging trends and technologies is essential, as these can significantly enhance crisis response strategies. Conducting comprehensive monetary evaluations through Transform Your Small/Medium Business can help identify opportunities to preserve cash and reduce liabilities, thereby uncovering value and mitigating risks. By fostering a culture of continuous improvement and education, organizations empower their financial leaders to guide effectively during difficult periods, promoting resilience throughout the organization.

This proactive approach not only equips financial leaders for immediate challenges but also positions them to drive long-term success and adaptability. Furthermore, demonstrating care in stakeholder interactions can transform ordinary experiences and cultivate loyalty, which is especially pertinent for CFOs managing stakeholder relations. Ultimately, this focus on empathy and care, coupled with robust performance management practices and real-time analytics, enhances the overall effectiveness of crisis response strategies.

Conclusion

Robust crisis response strategies are essential for CFOs navigating an increasingly unpredictable environment. Establishing well-defined frameworks, prioritizing effective communication, and conducting continuous financial assessments enable CFOs to manage immediate challenges while laying the groundwork for long-term stability and growth. The integration of advanced technologies and real-time analytics further empowers financial leaders to make informed decisions, ensuring organizations remain agile and adaptable in the face of adversity.

Moreover, the importance of post-crisis evaluation cannot be overstated. Engaging in reflective practices allows CFOs to learn from past experiences, refine their strategies, and enhance their crisis management capabilities. This continuous learning approach fosters a culture of resilience, enabling organizations to better withstand future disruptions and emerge stronger.

Ultimately, the role of the CFO has evolved beyond traditional financial stewardship to encompass a holistic approach to crisis management. By embracing proactive measures, fostering open lines of communication, and prioritizing stakeholder trust, CFOs can effectively transform crises into opportunities for growth and innovation. As the landscape of crisis management continues to evolve, financial leaders must remain vigilant and committed to developing the skills and strategies necessary to safeguard their organizations' futures.

Frequently Asked Questions

What are crisis response strategies and why are they important for CFOs?

Crisis response strategies are frameworks that help organizations address unforeseen events that threaten their stability. For CFOs, mastering these strategies is crucial for maintaining financial oversight during turbulent times.

What is the first step in efficient emergency management?

The first step in efficient emergency management is identifying potential hazards and conducting a thorough evaluation of their possible impact on the organization.

What components should be included in structured emergency management plans?

Structured emergency management plans should include contingency measures, the formation of specialized emergency management teams, and clear communication of roles and responsibilities to all stakeholders.

How is technology impacting crisis response capabilities?

Organizations are increasingly adopting technology-enabled solutions, such as cloud-based applications, which equip finance teams with advanced data analytics tools to streamline monetary functions and enhance decision-making processes.

Why is long-term sustainability important for CFOs during a crisis?

CFOs must consider long-term sustainability alongside immediate economic implications to ensure the organization's resilience and financial health during and after crises.

Can you provide an example of effective crisis management?

A case study featuring Conlon Construction illustrates the effectiveness of prompt issue resolution assistance, which significantly enhances operational usability and budgetary oversight.

What role does forensic accounting play in crisis management?

Forensic accounting is crucial for uncovering financial manipulations, highlighting the need for CFOs to maintain the integrity of their accounting systems during emergencies.

How can organizations improve their crisis response strategies?

Organizations can improve their crisis response strategies by continuously monitoring the effectiveness of their plans through real-time business analytics and operationalizing lessons learned.

What is the significance of communication during emergencies?

Effective communication is essential for managing emergencies, as it helps build trust and confidence among stakeholders by providing timely and transparent information.

What should an emergency communication strategy include?

An emergency communication strategy should outline key messages, preferred communication channels, and designated spokespersons, along with regular updates to keep stakeholders informed.

How do organizations benefit from having defined communication strategies during emergencies?

Organizations with clearly defined communication strategies are more efficient in handling emergencies, leading to improved stakeholder relations and institutional resilience.

What is the importance of post-event assessments in crisis management?

Post-event assessments are essential for extracting insights from past errors, enhancing future crisis response strategies, and facilitating continuous improvement in emergency management.