Overview

Best practices for developing stakeholder management skills for CFOs encompass:

- Effective communication

- Strategic thinking

- A commitment to continuous improvement through regular assessments and training

These skills are not merely beneficial; they are essential for aligning stakeholder interests with organizational goals. This alignment enhances financial performance and fosters sustainable growth. Research substantiates this, demonstrating that effective engagement strategies lead to superior project outcomes and heightened stakeholder trust. Therefore, it is imperative for CFOs to prioritize the development of these skills, ensuring they are equipped to navigate the complexities of stakeholder relationships.

Introduction

In the dynamic landscape of financial leadership, stakeholder management emerges as a pivotal element for Chief Financial Officers (CFOs) aiming to steer their organizations toward success. Beyond merely addressing shareholder interests, effective stakeholder management involves a nuanced understanding of the diverse individuals and groups that influence an organization’s financial performance, including:

- Employees

- Customers

- Suppliers

- Regulatory bodies

By cultivating strong relationships and engaging proactively with these stakeholders, CFOs can align expectations, mitigate risks, and drive sustainable growth. As the complexities of modern finance evolve, the importance of strategic stakeholder engagement becomes increasingly clear. This underscores the need for CFOs to equip themselves with the skills and tools necessary to thrive in this critical aspect of their role.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder management skills are a vital aspect of fiscal leadership, encompassing the identification, analysis, and engagement of individuals or groups with a vested interest in the organization's economic performance. For chief financial officers, this extends beyond shareholders to include employees, customers, suppliers, and regulatory bodies. These skills are crucial for managing parties involved, as they help in comprehending their requirements, anticipations, and the possible influence they exert on the organization.

Cultivating strong connections with these parties can greatly boost cooperation and attract backing for monetary initiatives, ultimately resulting in better business results. Our commitment to your success ensures that we work closely with your team to find collaborative solutions that drive success. Research suggests that new chief financial officers who adopt a structured approach to relationship building can enhance their chances of a successful transition by up to 50%.

This highlights the significance of efficient stakeholder management skills in achieving performance objectives. Moreover, a recent study by Gartner disclosed that successful transitions of chief financial officers possess crucial similarities, emphasizing the importance of these skills in handling these shifts.

In practice, financial leaders can organize regular meetings with important contributors to discuss budget strategies, performance indicators, and forthcoming challenges. Employing instruments like mapping of involved parties allows CFOs to develop their stakeholder management skills by prioritizing engagement initiatives based on the influence and interest levels of different participants. Our team supports a streamlined decision-making process, enabling decisive actions that preserve business value.

This proactive involvement not only reduces risks but also aligns the interests of parties involved with the organization's economic goals, paving the way for sustainable growth and resilience in an ever-evolving business landscape. Continuous business performance monitoring through our client dashboard allows for real-time analytics and the operationalization of lessons learned, fostering strong, lasting relationships.

However, it is crucial to recognize that executives often overestimate how much they are trusted by employees and consumers, as highlighted by PwC. This critical viewpoint on participant relationships reinforces the need for genuine engagement.

Furthermore, the growing need for improved cybersecurity introduces an important element that chief financial officers must consider in their management strategies, connecting it to the wider context of economic leadership.

The Importance of Stakeholder Management for Financial Success

The efficient management of interested parties necessitates strong stakeholder management skills, which are crucial for chief financial executives, as they significantly impact the organization's economic stability. Involving interested parties ensures that their expectations align with the company's monetary goals, potentially leading to increased investment, improved credit ratings, and a stronger market reputation. For instance, transparent communication with investors builds trust and confidence, essential during capital-raising efforts.

Moreover, a profound understanding of interests allows CFOs to anticipate potential challenges and address them proactively. This strategy not only safeguards the organization from financial pitfalls but also positions it for sustainable growth. Research indicates that businesses with effective engagement strategies are 40% more likely to complete projects on time and within budget, underscoring the economic advantages of robust involvement.

Since 2018, the Financial Health Pulse research initiative has underscored the importance of assessing economic well-being, a critical factor in the effective management of interested parties. As Robert C. Merton articulated, "The primary function of the economic system is to facilitate the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment." This perspective emphasizes the necessity for financial leaders to engage with interested parties to manage uncertainties adeptly.

Furthermore, a systematic approach to assessing economic health, as demonstrated in the case study "Recommendations for Economic Health Measurement," reveals that defining key indicators and establishing a comprehensive data collection system can provide a holistic view of economic performance. This insight enables financial executives to assess progress and develop targeted strategies that enhance their stakeholder management skills, aligning the expectations of involved parties with financial objectives and ultimately improving overall financial success. By operationalizing lessons learned from turnaround processes and leveraging real-time analytics, financial leaders can streamline decision-making and cultivate strong, lasting relationships with stakeholders.

In addition, by committing to the 'Test & Measure' approach, financial executives can ensure that every hypothesis is rigorously tested to maximize returns on investment. This dedication, coupled with a focus on an expedited decision-making process, empowers chief financial officers to take decisive actions that preserve and enhance the financial well-being of their organizations.

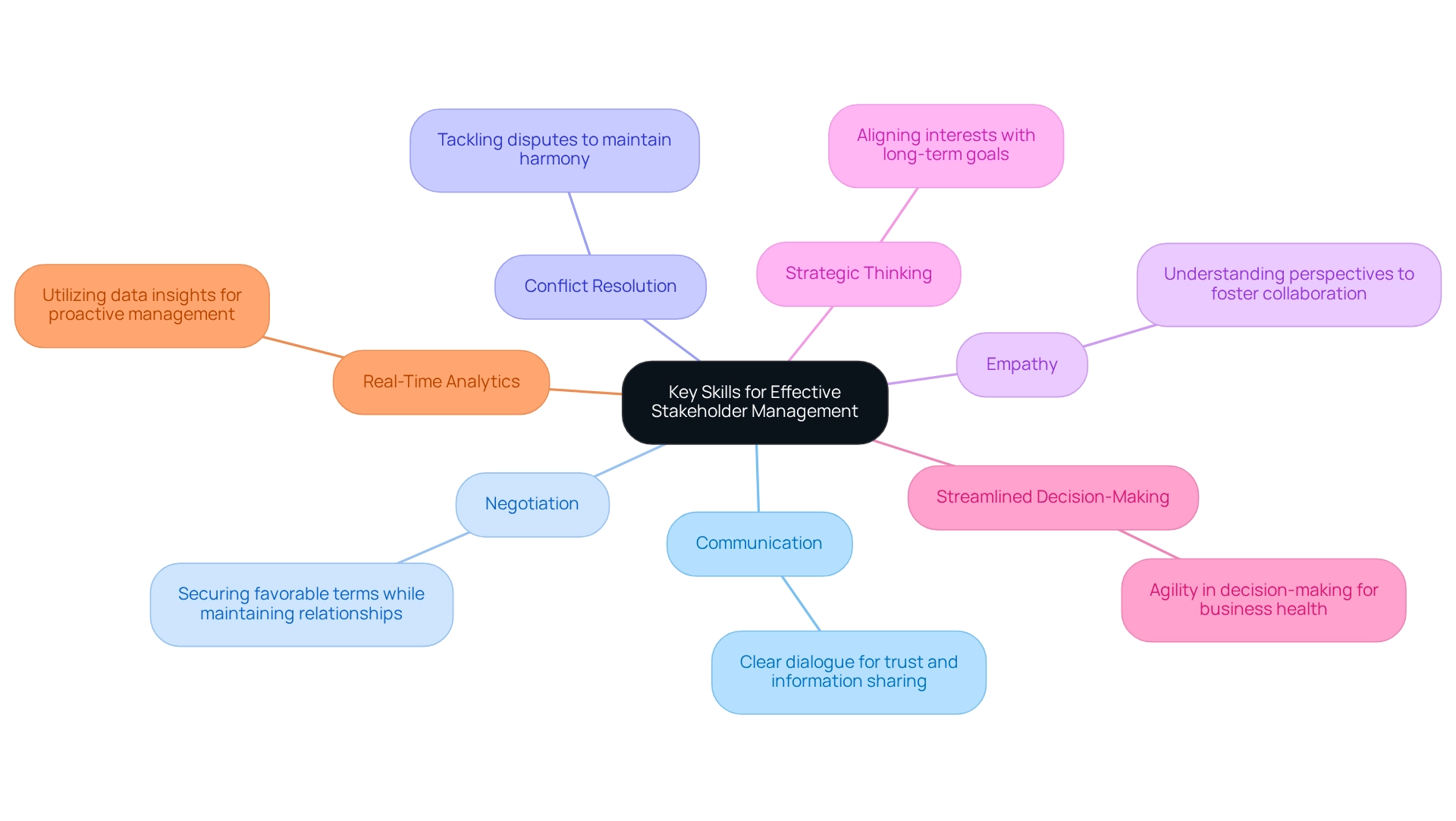

Key Skills for Effective Stakeholder Management

To effectively manage interested parties, CFOs must develop stakeholder management skills that are essential for promoting teamwork and achieving economic success. These skills include:

- Communication: Clear and concise dialogue is crucial for conveying intricate monetary information and involving interested parties in meaningful discussions. Effective communication not only conveys information but also establishes trust, which is essential for relationships with partners. As emphasized in a recent article, grasping yearly revenue is essential for evaluating a company's economic status, which financial executives must convey effectively to stakeholders.

- Negotiation: Chief Financial Officers often discuss terms with investors, suppliers, and other important parties. Mastering negotiation skills is critical, as it enables CFOs to secure favorable terms that align with the organization’s financial objectives while maintaining positive relationships. Given that software is the second biggest budget expense after payroll for most companies, effective negotiation can lead to significant cost savings.

- Conflict Resolution: The capability to tackle and settle disputes among participants is essential. Proficient conflict resolution skills can prevent disruptions and help maintain a harmonious working environment, which is essential for long-term collaboration.

- Empathy: Understanding the perspectives and concerns of involved parties fosters trust and collaboration. By demonstrating empathy, financial leaders can create a more inclusive atmosphere that encourages open dialogue and strengthens partnerships.

- Strategic Thinking: Aligning the interests of involved parties with the organization’s long-term financial goals requires a strategic mindset. Chief financial officers must be skilled at recognizing possible disruptions and proposing proactive steps, guaranteeing that management of interested parties is incorporated into the wider business strategy. An excellent CFO serves as a strategic ally to the CEO, balancing innovative leadership with team responsibility, which is essential for efficient management of interested parties.

- Streamlined Decision-Making: In the context of business turnaround, financial executives at Transform Your Small/Medium Business should support a shortened decision-making cycle that allows for decisive actions. This agility is essential for preserving business health and responding to challenges effectively.

- Real-Time Analytics: Utilizing real-time business analytics through our client dashboard can enhance continuous performance monitoring and relationship-building. By utilizing data insights, financial leaders can assess business health and modify approaches accordingly, promoting a proactive method to managing relationships.

By refining their stakeholder management skills, financial leaders can greatly improve their efficiency in managing connections, ultimately aiding the organization’s financial well-being and sustainable growth. The alliance between financial officers and marketing officers can further improve business plans and customer profiling, demonstrating the significance of teamwork in achieving organizational objectives.

Practical Strategies for Enhancing Stakeholder Management Skills

Chief Financial Officers can significantly enhance their management capabilities through the application of targeted strategies.

- Regular Training: Engaging in workshops and training sessions that focus on essential skills such as communication, negotiation, and conflict resolution is crucial. Notably, 39% of small businesses currently offer classroom-led training, while 17% utilize virtual classrooms for employee training, highlighting the value placed on continuous learning in this area. Organizations are expected to concentrate more on employee training and development in 2022, making it essential for financial leaders to prioritize these initiatives.

- Participant Mapping: Creating a comprehensive participant map to recognize key players and their interests is a strategic tool that allows CFOs to customize engagement strategies efficiently. This approach improves stakeholder management skills, ensuring that the requirements and expectations of interested parties are fulfilled.

- Feedback Mechanisms: Establishing regular feedback loops with involved parties is essential for gaining insights into their concerns and expectations. This proactive approach fosters transparency and trust, both of which are crucial for effective collaboration and enhancing stakeholder management skills.

- Cross-Functional Collaboration: Working closely with other departments facilitates a unified approach to engaging interested parties. By utilizing varied viewpoints, financial leaders can enhance their stakeholder management skills, improving the efficacy of their approaches and ensuring coherence throughout the organization.

- Utilize Technology: Implementing management software streamlines interactions, manages communications, and analyzes participant sentiment. This technology-enabled method not only enhances efficiency but also provides valuable information to guide decision-making.

By implementing these strategies, CFOs can develop their stakeholder management skills to nurture stronger connections with interested parties, ultimately resulting in better collaboration and improved financial performance. The effectiveness of training programs, such as those highlighted in Brinkerhoff's Success Case Method, underscores the importance of understanding both successful and unsuccessful training outcomes. This understanding enables organizations to enhance their strategies and improve their stakeholder management skills to achieve better outcomes with interested parties.

As Devlin Peck emphasizes, developing instructional design abilities is crucial for entering the industry, further reinforcing the necessity for focused training in the management of involved parties.

Overcoming Challenges in Stakeholder Management

CFOs frequently navigate a complex landscape of stakeholder management, facing several key challenges that can impact their effectiveness:

- Diverse Interests: Stakeholders often possess conflicting priorities, complicating efforts to achieve consensus. To effectively manage this, CFOs should utilize their stakeholder management skills to prioritize engagement based on each party's influence and the potential impact of their interests on the organization. This strategic method enables more focused discussions and customized solutions, especially when leveraging real-time analytics from Transform Your Small/ Medium Business's client dashboard to evaluate participant needs and align them with business objectives.

- Communication Barriers: Ineffective communication can foster misunderstandings and undermine trust among involved parties. Establishing clear communication channels and protocols is essential for fostering transparency. Regular updates and open forums for feedback can help bridge gaps and ensure all parties feel heard and valued. Utilizing real-time business analytics from the client dashboard can significantly improve these communications, offering interested parties timely insights into organizational performance and decision-making processes.

- Resistance to Change: Stakeholders may exhibit reluctance toward changes proposed by the CFO, particularly if they perceive these changes as threatening. To lessen this resistance, it is essential to engage interested parties early in the decision-making process. By soliciting their input and addressing concerns proactively, financial leaders can enhance their stakeholder management skills while cultivating a sense of ownership and commitment to the proposed changes. As David Akers, an analyst and senior principal at Gartner, notes, "A new-to-role CFO doesn’t have the capacity to meet with everyone and operating by ‘gut feel’ is a good way to miss opportunities to strengthen critical relationships." Efficient decision-making procedures can assist finance leaders in acting decisively while enhancing their stakeholder management skills and sustaining engagement with interested parties.

- Limited Resources: Time and resource constraints often hinder effective management of involved parties. To overcome these limitations, financial executives can leverage technology to streamline processes and enhance efficiency. Implementing tools that facilitate collaboration and data sharing, such as those offered by Transform Your Small/ Medium Business, can significantly enhance participant engagement and decision-making. For instance, utilizing generative AI and real-time analytics can unlock value and transform business operations, offering financial leaders innovative solutions to manage relationships with interested parties more effectively.

By recognizing and tackling these challenges, financial leaders can enhance their stakeholder management skills, ultimately fostering stronger connections that contribute to the organization's success. Furthermore, as the need for improved cybersecurity grows, financial leaders must adjust their strategies to manage the intricacies of contemporary finance and guarantee strong involvement from interested parties.

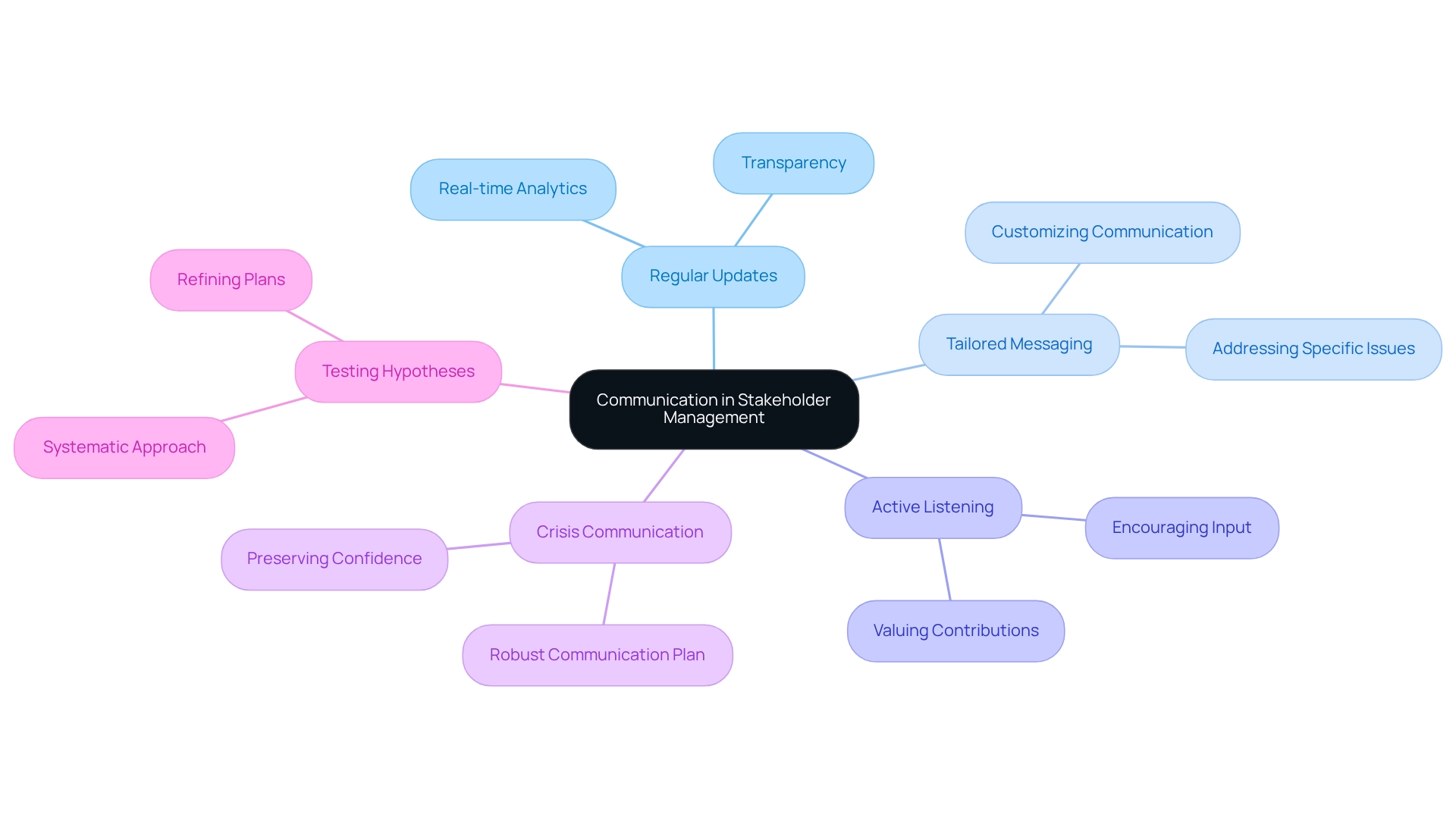

The Role of Communication in Stakeholder Management

Efficient communication is essential for developing stakeholder management skills, particularly for chief financial officers (CFOs) who play a crucial role in navigating their organizations through economic conditions. To promote trust and openness, it is crucial for CFOs to keep stakeholders updated about economic performance, strategic initiatives, and potential challenges. Key communication strategies include:

- Regular Updates: Consistent updates on financial performance and strategic direction are vital. These updates foster trust and improve transparency, enabling participants to feel more connected to the organization's objectives. Utilizing real-time analytics through a client dashboard offers participants immediate insights into business health, reinforcing the importance of data-driven decision-making.

- Tailored Messaging: Customizing communication to align with the interests and influence levels of various parties ensures that messages resonate and engage effectively. This method tackles particular issues and priorities, making participants feel appreciated and understood. By implementing insights gained from past interactions, financial leaders can enhance their communication strategies to better address the needs of involved parties.

- Active Listening: Encouraging input from interested parties is crucial. By demonstrating that their contributions are valued, financial leaders can foster a cooperative atmosphere that enhances participant involvement and commitment. This iterative process of gathering feedback and making informed adjustments is essential for maintaining relevance in communication efforts.

Ongoing observation of participant feedback assists financial leaders in adjusting their strategies efficiently, ensuring that communication remains influential.

- Crisis Communication: Developing a robust crisis communication plan is imperative for addressing potential issues swiftly and effectively. This proactive strategy not only reduces risks but also aids in preserving confidence among interested parties during difficult times.

By leveraging real-time analytics and utilizing a client dashboard, financial executives can quickly evaluate situations and communicate effectively, ensuring that interested parties are kept informed and engaged.

- Testing Hypotheses: Incorporating a systematic approach to testing hypotheses can further enhance decision-making processes. By examining data and results, financial leaders can refine their plans and communication initiatives, ensuring they align with the expectations of interested parties and organizational objectives.

By emphasizing these communication initiatives and incorporating real-time analytics into their methods, financial leaders can significantly enhance their stakeholder management skills, ultimately boosting overall engagement and nurturing a culture of collaboration within their organizations.

Continuous Improvement in Stakeholder Management Practices

Ongoing enhancement in participant management practices is essential for CFOs aiming to excel in a constantly changing business environment. To foster this continuous improvement, several approaches can be implemented:

- Regular Assessments: Periodic evaluations of participant engagement strategies are crucial for identifying areas in need of improvement. This proactive method enables financial executives to stay ahead of potential challenges and adjust their strategies as necessary, leveraging real-time analytics through Transform Your Small/ Medium Business's client dashboard to monitor business health and client satisfaction.

- Benchmarking: By comparing management practices related to the interests of involved parties against industry standards, CFOs can pinpoint best practices and areas ripe for growth. For instance, Adobe's implementation of a three-tier measurement system for participant satisfaction has resulted in an 85+ Net Promoter Score (NPS), underscoring the effectiveness of benchmarking in achieving participant satisfaction. This benchmarking process not only highlights successful strategies but also fosters a culture of excellence within the organization, reinforcing the commitment to operationalizing lessons learned.

- Training and Development: Investing in ongoing training for finance teams ensures they possess the latest skills and knowledge necessary for managing relationships. Educational materials, such as books and training videos available to EEA participants, serve as valuable resources for CFOs looking to enhance their team's capabilities. This commitment to professional growth bolsters the team's stakeholder management skills, enabling them to engage effectively with interested parties and address their needs, ultimately facilitating streamlined decision-making processes.

- Feedback Loops: Establishing systems for collecting input from interested parties is vital for guiding enhancements in engagement strategies. Microsoft's participant feedback implementation program achieved an 87% success rate by forming dedicated 'action teams' that address contributor suggestions within 14 business days. By actively soliciting input, CFOs can gain a deeper understanding of stakeholder expectations and make informed adjustments to their approaches, thereby improving their stakeholder management skills and ensuring continuous business performance monitoring.

By embracing these strategies, CFOs can adapt to the evolving needs of stakeholders, ultimately enhancing their effectiveness in managing relationships and driving organizational success through real-time analytics and operationalizing turnaround lessons.

Conclusion

The role of stakeholder management in financial leadership has reached unprecedented significance for Chief Financial Officers. By engaging effectively with a diverse array of stakeholders—including employees, customers, suppliers, and regulatory bodies—CFOs can align expectations and enhance organizational performance. This article underscores the necessity of a strategic approach to stakeholder engagement, emphasizing that fostering strong relationships can lead to improved collaboration and financial outcomes.

Key skills such as communication, negotiation, and empathy are paramount for CFOs navigating the complexities of stakeholder relationships. By honing these skills and implementing practical strategies like stakeholder mapping and regular feedback loops, CFOs can cultivate trust and transparency, which are vital for sustainable growth. Moreover, overcoming challenges such as diverse interests and communication barriers is essential for successful stakeholder management.

Ultimately, the financial health of an organization is deeply intertwined with effective stakeholder management. Investing in continuous improvement and leveraging real-time analytics will empower CFOs to adapt their strategies and respond to stakeholder needs effectively. As the business landscape continues to evolve, the ability to engage and manage stakeholders will remain a cornerstone of financial leadership, driving both resilience and success in an increasingly competitive environment.

Frequently Asked Questions

What are stakeholder management skills?

Stakeholder management skills involve identifying, analyzing, and engaging individuals or groups with a vested interest in an organization's economic performance, including employees, customers, suppliers, and regulatory bodies.

Why are stakeholder management skills important for chief financial officers (CFOs)?

These skills are crucial for CFOs as they help understand the requirements and expectations of various stakeholders, manage their influence on the organization, and foster strong relationships that can lead to better business outcomes.

How can strong stakeholder relationships benefit an organization?

Strong connections with stakeholders can enhance cooperation, attract support for financial initiatives, and ultimately result in improved business performance.

What does research suggest about new CFOs and stakeholder management?

Research indicates that new CFOs who adopt a structured approach to relationship building can improve their chances of a successful transition by up to 50%.

How can financial leaders effectively engage with stakeholders?

Financial leaders can organize regular meetings with key contributors to discuss budget strategies, performance indicators, and challenges. They can also use stakeholder mapping to prioritize engagement initiatives based on influence and interest levels.

What role does continuous monitoring play in stakeholder management?

Continuous business performance monitoring allows for real-time analytics and operationalization of lessons learned, which fosters strong, lasting relationships with stakeholders.

What common misconception do executives have regarding stakeholder trust?

Executives often overestimate how much they are trusted by employees and consumers, highlighting the need for genuine engagement with stakeholders.

How does cybersecurity factor into stakeholder management for CFOs?

CFOs must consider improved cybersecurity as an important element of their management strategies, connecting it to the broader context of economic leadership.

What are the economic advantages of effective stakeholder engagement?

Businesses with effective engagement strategies are 40% more likely to complete projects on time and within budget, which underscores the economic benefits of robust stakeholder involvement.

What approach can financial executives take to enhance their stakeholder management skills?

Financial executives can adopt a systematic approach to assessing economic health, define key indicators, and establish a comprehensive data collection system to align stakeholder expectations with financial objectives.