Overview

Financial survival strategies for CFOs in 2025 are essential for maintaining liquidity, optimizing cash flow, and implementing proactive risk management to navigate economic uncertainties. This article outlines best practices such as:

- Regular financial assessments

- Scenario planning

- Establishment of emergency funds

These measures not only enable organizations to withstand economic shocks but also to seize opportunities for recovery and growth.

Introduction

In a world where economic uncertainties loom large, the role of Chief Financial Officers (CFOs) has never been more critical. As they navigate the complexities of financial management, CFOs are tasked with implementing survival strategies that ensure their organizations remain resilient and competitive.

From maintaining liquidity and optimizing cash flow to fostering a culture of accountability and innovation, these leaders must adopt a multifaceted approach to safeguard their companies against potential financial distress.

With the right tools and strategies, CFOs can not only weather economic storms but also position their organizations for sustainable growth in an ever-evolving market landscape.

Understanding Financial Survival Strategies for CFOs

Financial leaders aiming to ensure their entities remain resilient amid economic challenges recognize the critical importance of financial survival strategies. These strategies encompass a variety of practices, including maintaining liquidity, optimizing cash flow, and implementing stringent cost control measures. By concentrating on economic well-being, chief financial officers can establish a robust framework that not only aids their organizations in weathering economic shocks but also positions them to seize recovery opportunities.

Key components of effective financial survival strategies include:

- Regular Financial Assessments: Conducting frequent evaluations of financial performance enables CFOs to pinpoint potential vulnerabilities and areas for enhancement. Utilizing real-time analytics through client dashboards from Transform Your Small/ Medium Venture can significantly improve this process, delivering immediate insights into organizational health.

- Scenario Planning: Crafting various financial scenarios equips organizations to navigate different economic conditions, facilitating proactive decision-making. This approach is essential for operationalizing lessons learned during turnaround efforts.

- Emergency Funds: Establishing reserves for unexpected expenses ensures organizations can face unforeseen challenges without compromising operational stability.

In 2025, the focus on liquidity and cash flow optimization is more critical than ever. Experts advocate that financial leaders align tax and trade planning with core business priorities to unlock savings and bolster resilience. As highlighted by American Express, financial leaders must 'reimagine their operations, processes, and products to better serve customer needs and keep pace with competitors.' This strategy is vital for sustaining a competitive edge in a rapidly evolving market.

Moreover, with only 2% of global finance and tech leaders having implemented cyber resilience measures, it is imperative for financial executives to prioritize these initiatives to safeguard their entities against potential disruptions. By fostering a culture that promotes informed risk-taking and continuous learning, as demonstrated in the case study titled 'Building Resilience in Finance Functions,' financial leaders can significantly enhance trust and collaboration across departments, ultimately contributing to the overall success of the entity.

In summary, financial survival strategies for executives in 2025 must concentrate on liquidity, cash flow optimization, and a proactive approach to risk management. By mastering the cash conversion cycle and leveraging real-time analytics from Transform Your Small/ Medium Business, entities can not only survive but thrive in challenging economic landscapes.

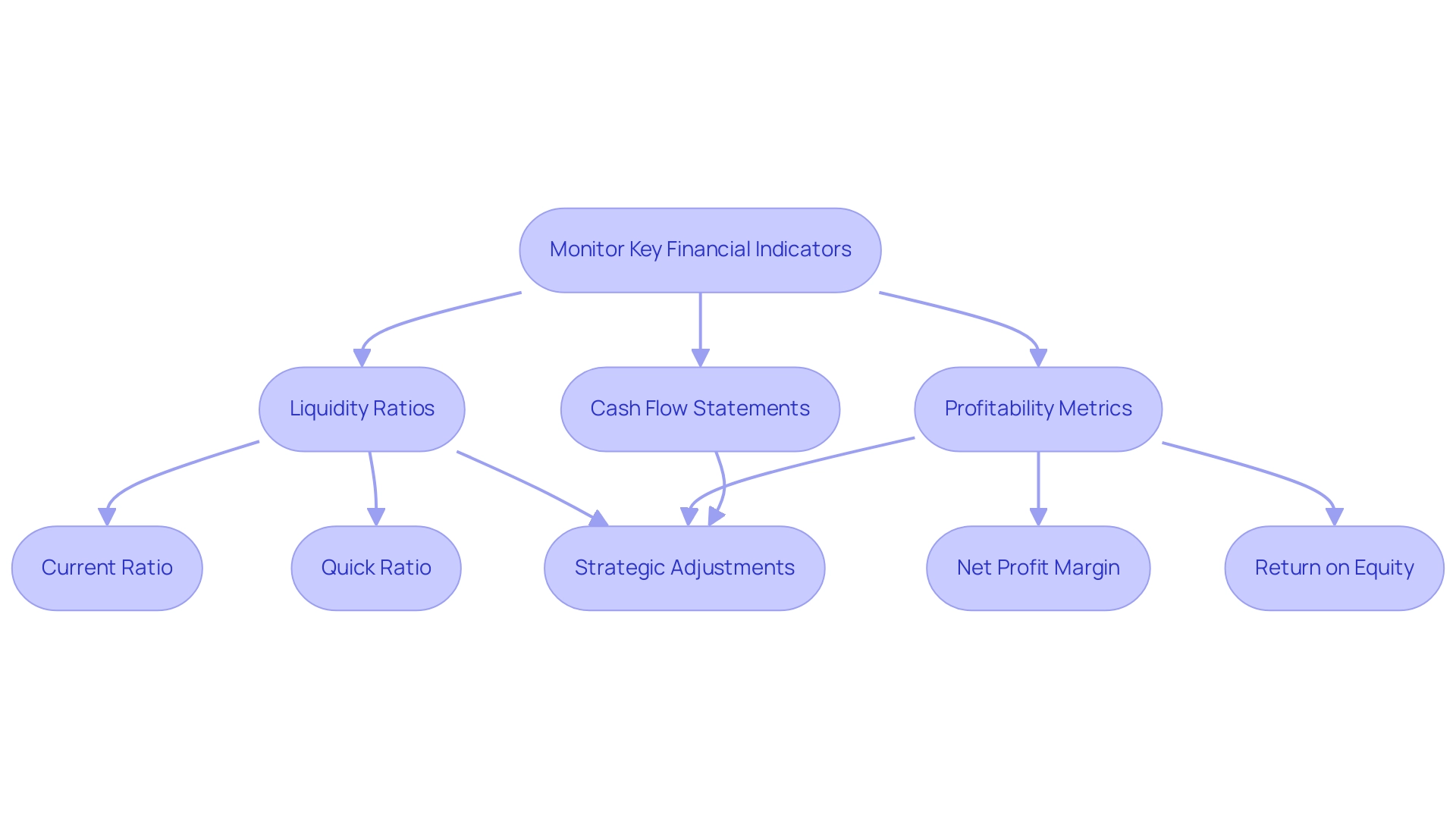

Key Financial Indicators to Monitor for Stability

To sustain organizational stability, executives must prioritize several key metrics while utilizing streamlined decision-making and real-time analytics. Liquidity ratios, including the current ratio and quick ratio, are essential as they assess the organization's ability to meet short-term obligations. These ratios serve as indicators of economic health, enabling executives to determine whether the company can develop financial survival strategies to withstand unforeseen monetary pressures.

Organizations that actively monitor their liquidity ratios through real-time analytics employ effective financial survival strategies, resulting in improved stability that enables them to navigate economic fluctuations more effectively.

Profitability metrics, such as net profit margin and return on equity, are equally important as they provide insights into operational efficiency and overall economic performance. By analyzing these metrics, financial leaders can identify areas for improvement and drive strategic initiatives that enhance profitability. Continuous monitoring of these metrics, facilitated by client dashboards, allows for timely adjustments and informed decision-making.

Moreover, cash flow statements are critical for understanding the dynamics of cash inflows and outflows. Consistent oversight of cash flow allows chief financial officers to make proactive modifications to budgetary strategies, ensuring that the entity remains adaptable in response to shifting market circumstances. In 2025, chief financial officers are encouraged to concentrate on these indicators not only to monitor results but also to foresee potential challenges. By regularly reviewing liquidity ratios and profitability metrics, chief financial officers can identify trends and address issues before they escalate, ultimately fostering a culture of resilience through effective financial survival strategies within their organizations.

This proactive approach is vital, especially in an environment where organizations have experienced a 50% decline in employees' ability to absorb changes without fatigue, highlighting the need for effective continuity planning. Additionally, financial leaders should be aware of the five finance initiatives prioritized in 2025, which include enhancing data governance and fostering cross-departmental alignment. Tackling these initiatives can assist executives in connecting technology with human expertise, ultimately enhancing stability.

The case study titled 'CFO Challenges in FP&A Transformation' illustrates the significant challenges chief financial officers encounter in transforming budget planning and analysis, emphasizing the importance of effective training and collaboration to ensure trustworthy data. Moreover, understanding how abilities, facilitating technologies, data accessibility, and personnel acceptance influence the viability of various AI initiatives is essential for executives overseeing finances as they manage the intricacies of budget planning.

Operational Indicators Essential for Financial Health

CFOs must prioritize monitoring operational indicators that significantly influence economic health, alongside traditional monetary metrics. Key operational metrics include:

- Inventory turnover

- Accounts receivable turnover

- Employee productivity rates

These indicators are essential for assessing resource utilization efficiency and pinpointing areas ripe for improvement.

For example, a low inventory turnover ratio can signal issues such as overstocking or declining sales, necessitating a thorough review of inventory management practices. In 2025, understanding these operational indicators is crucial, as they directly correlate with financial outcomes. Effective inventory management not only enhances cash flow but also supports strategic decision-making.

Statistics reveal that small businesses often struggle with inventory turnover, with many reporting turnover rates below the industry average. By implementing best practices in inventory management, organizations can achieve significant improvements. For instance, companies that have adopted automated inventory systems have seen turnover rates increase by up to 30%, leading to enhanced cash flow and reduced holding costs. Moreover, the potential industry savings of $16.4 billion from fully electronic processing highlight the importance of process automation in finance, which ties into operational efficiency.

In the healthcare sector, where year-over-year average hourly earnings growth for hospitals was consistently below 4% through the first 10 months of 2024, managing operational indicators becomes even more critical. Moody's emphasizes that operating cash flow growth will be fueled by stronger revenue growth and stricter cost controls, underscoring the need for financial leaders to focus on these metrics. Moreover, the capacity to make rapid decisions based on real-time analytics can greatly improve a company's turnaround efforts, permitting timely adjustments that maintain organizational health.

In addition, case studies demonstrate the effect of operational indicators on economic stability. One notable example involves a mid-sized retail company that revamped its inventory processes, resulting in a 25% increase in turnover within a year. This transformation not only improved liquidity but also allowed the company to reinvest in growth initiatives.

Moreover, the transition towards value-oriented care in healthcare delivery frameworks illustrates how operational metrics can greatly influence economic well-being, as numerous hospitals have adopted value-based care initiatives, yet merely 29% of leaders indicate significant cost reductions.

As Chief Financial Officers maneuver through the intricacies of monetary management in 2025, aligning operational performance with economic results will be essential for implementing financial survival strategies and improving overall organizational efficiency. The integration of real-time business analytics into decision-making processes, supported by the client dashboard from Transform Your Small/ Medium Business, will further empower financial leaders to monitor performance continuously and operationalize lessons learned during turnaround efforts.

Identifying Red Flags: Warning Signs for CFOs

CFOs must maintain a keen awareness of red flags that indicate potential economic distress. Key warning signs include:

- Declining revenue trends, which correlate with broader economic shifts.

- Increasing debt levels that can strain cash flow.

- Delayed payments from customers, which may indicate deeper issues within the sales cycle.

Moreover, frequent alterations in monetary forecasts or unexpected cash flow fluctuations are critical signals that should not be overlooked. Notably, missing payroll serves as a final wake-up call to a problem ignored for months, underscoring the urgency of these indicators.

Establishing a robust monitoring system for these indicators is essential. For instance, operational signals that may indicate impending monetary trouble include:

- A shrinking sales funnel.

- A rise in refund requests.

- Aggressive vendor collections.

- The inability to meet payroll.

By proactively addressing these issues—such as adjusting budgets, renegotiating payment terms, or tightening credit controls—CFOs can employ financial survival strategies to mitigate risks effectively.

Utilizing real-time analytics through the client dashboard offered by Transform Your Small/Medium Organization can enhance this process, allowing for continuous monitoring of operational health and timely adjustments based on data-driven insights. Fractional CFO services provide an external viewpoint to swiftly identify monetary issues in a company, offering valuable insights that internal teams may overlook.

Case studies illustrate the importance of responding to competitor signals, such as earnings downgrades or workforce reductions, which can validate market assumptions and prompt timely strategic adjustments. Organizations that monitor these trends can make informed decisions, whether it involves investing in areas of unmet need or scaling back in declining sectors. As one expert noted, "Our fractional CFO services offer an outside perspective to quickly identify business monetary trouble."

Ultimately, early detection of these warning signs, supported by streamlined decision-making, testing hypotheses, and operationalizing lessons learned, is crucial for preserving economic health and ensuring long-term stability.

Actionable Strategies for Financial Resilience

To bolster economic resilience in 2025, CFOs must adopt several essential financial survival strategies for navigating economic uncertainties. Establishing a robust cash flow management system is paramount; this involves not only forecasting cash flow needs but also proactively identifying potential shortfalls. Effective cash flow management enables companies to maintain liquidity and swiftly respond to financial challenges.

For instance, USA Properties experienced a 4x increase in the number of projects under construction due to enhanced operational planning efficiency, underscoring the critical importance of effective cash flow management and operational efficiency.

Diversifying revenue streams stands as another vital financial survival strategy. By reducing reliance on a single source of income, businesses can better withstand market fluctuations and enhance overall stability. Statistics indicate that entities with diversified revenue models are more resilient and adaptable to changing market conditions, utilizing financial survival strategies effectively.

Moreover, fostering a culture of financial survival strategies within the organization is essential. Encouraging employees to identify and eliminate wasteful spending can lead to significant savings and improved operational efficiency. This cultural shift not only enhances economic health but also empowers teams to contribute to the organization’s resilience.

Investing in technology that improves monetary reporting and analysis is crucial for developing effective financial survival strategies. Advanced tools provide executives with real-time insights into monetary performance, aiding in informed decision-making. Notably, 28% of finance departments are already using AI in forecasting, highlighting the growing importance of technology investment in financial reporting and analysis.

For example, predictive analytics can optimize stock levels across various locations, enhancing supply chain agility and improving inventory management—essential for informed decision-making. Furthermore, the incorporation of real-time business analytics enables financial leaders to consistently observe performance and rapidly adapt their financial survival strategies, ensuring companies remain adaptable in the face of challenges.

Case studies illustrate the effectiveness of these strategies. The case study titled 'Building Resilience in Finance Functions' demonstrates that entities prioritizing agility and transparency in their finance functions have seen improved outcomes. By promoting a culture of accountability and trust, financial leaders can create an environment that encourages informed risk-taking and continuous learning, operationalizing the lessons learned throughout the turnaround process.

In summary, implementing these best practices—robust cash flow management, revenue diversification, cost consciousness, and technology investment—will empower financial leaders to navigate challenges and develop effective financial survival strategies within their firms.

The Role of Leadership in Financial Survival

Chief financial officers are pivotal in ensuring organizational survival by providing strategic guidance and implementing financial survival strategies, all while fostering a culture of responsibility within their companies. Effective communication with stakeholders—including the board of directors, employees, and external partners—is essential for aligning monetary strategies with overarching organizational goals. By leading with transparency and demonstrating a commitment to financial discipline, financial leaders can inspire confidence and trust among stakeholders.

As Mallory Bulman, CFO Advisory Leader in the Gartner Finance practice, aptly notes, "owning and anchoring strategic D&A to the overall business system will underscore finance leaders’ ability to create a streamlined, measurable approach to tracking metrics and boosting overall enterprise performance."

Moreover, cultivating a robust leadership team and promoting collaboration across departments are essential strategies for financial executives. This collaborative environment not only supports innovation but also enhances resilience in the face of challenges. For instance, a recent case study on sustainability highlights that financial leaders are uniquely positioned to spearhead initiatives related to ESG reporting and climate risk mitigation, leveraging their technical expertise to drive compliance and contribute to organizational growth.

The diverse backgrounds and experiences of team members at Transform Your Small/ Medium Business, particularly those with extensive expertise in manufacturing, technology, and finance, can significantly enhance decision-making processes and operational efficiency.

Looking ahead to 2025, the role of chief financial officers in economic sustainability will be increasingly vital, especially as they navigate intricate economic environments. With 28% of finance divisions already utilizing AI in forecasting, finance executives have access to technological advancements that can bolster economic stability. According to industry experts, effective communication strategies are crucial for financial leaders to engage stakeholders meaningfully.

This engagement includes regular updates on economic performance, proactive discussions about risks, and transparent sharing of strategic objectives. By employing financial survival strategies, alongside the specialized services provided by Transform Your Small/ Medium Organization designed to help enterprises overcome challenges and achieve sustainable growth, financial leaders can enhance financial stability and position their organizations for long-term success. Ongoing performance evaluation and the implementation of turnaround insights will further enable financial leaders to make informed choices that foster improvement.

Innovative Revenue Strategies for Sustainable Growth

CFOs are increasingly tasked with exploring innovative revenue strategies to secure sustainable growth in a rapidly evolving market. Mastering the cash conversion cycle is essential; implementing strategies that optimize cash flow can significantly enhance organizational performance. Moreover, leveraging technology is paramount; for instance, adopting subscription services or digital platforms can enhance customer engagement and create recurring revenue streams.

Notably, AI-driven invoice processing can cut costs by up to 80%, showcasing the potential of technology to streamline operations and improve financial outcomes. Expanding into new markets or targeting different customer segments also presents fresh opportunities for revenue generation.

Collaboration plays a crucial role in this landscape. Forming joint ventures or partnerships can lead to innovative solutions that drive growth and enhance competitive advantage. As the demand for improved cybersecurity increases—yet only 2% of finance and tech leaders have executed cyber resilience measures—CFOs must prioritize secure technology adoption to safeguard their entities while pursuing new business models.

Collaborating with specialists such as Transform Your Small/ Medium Business will guarantee that entities are well-prepared to maneuver through these emerging trends and thrive in a swiftly evolving market.

Continuous assessment of market trends and customer needs is essential. By remaining attuned to these dynamics, financial executives can identify and implement revenue strategies that not only align with their entity’s long-term objectives but also position them as leaders in sustainability and accountability. For example, the case study titled 'Sustainability and the CFO's Role' illustrates how integrating sustainability into financial strategies allows chief financial officers to enhance their organization’s ESG reporting and climate risk mitigation efforts, ultimately aligning capital allocation with broader strategic goals.

Additionally, employing real-time analytics can facilitate ongoing performance monitoring and relationship-building, ensuring that financial executives can operationalize turnaround lessons effectively.

To further support financial leaders in these efforts, Transform Your Small/ Medium Business offers the 'Mastering the Cash Conversion Cycle' program, priced at $99. This program includes comprehensive strategies for identifying underlying organizational issues and planning effective solutions, as well as a focus on testing and measuring outcomes to maximize returns on investment.

Proactive Financial Planning and Risk Management

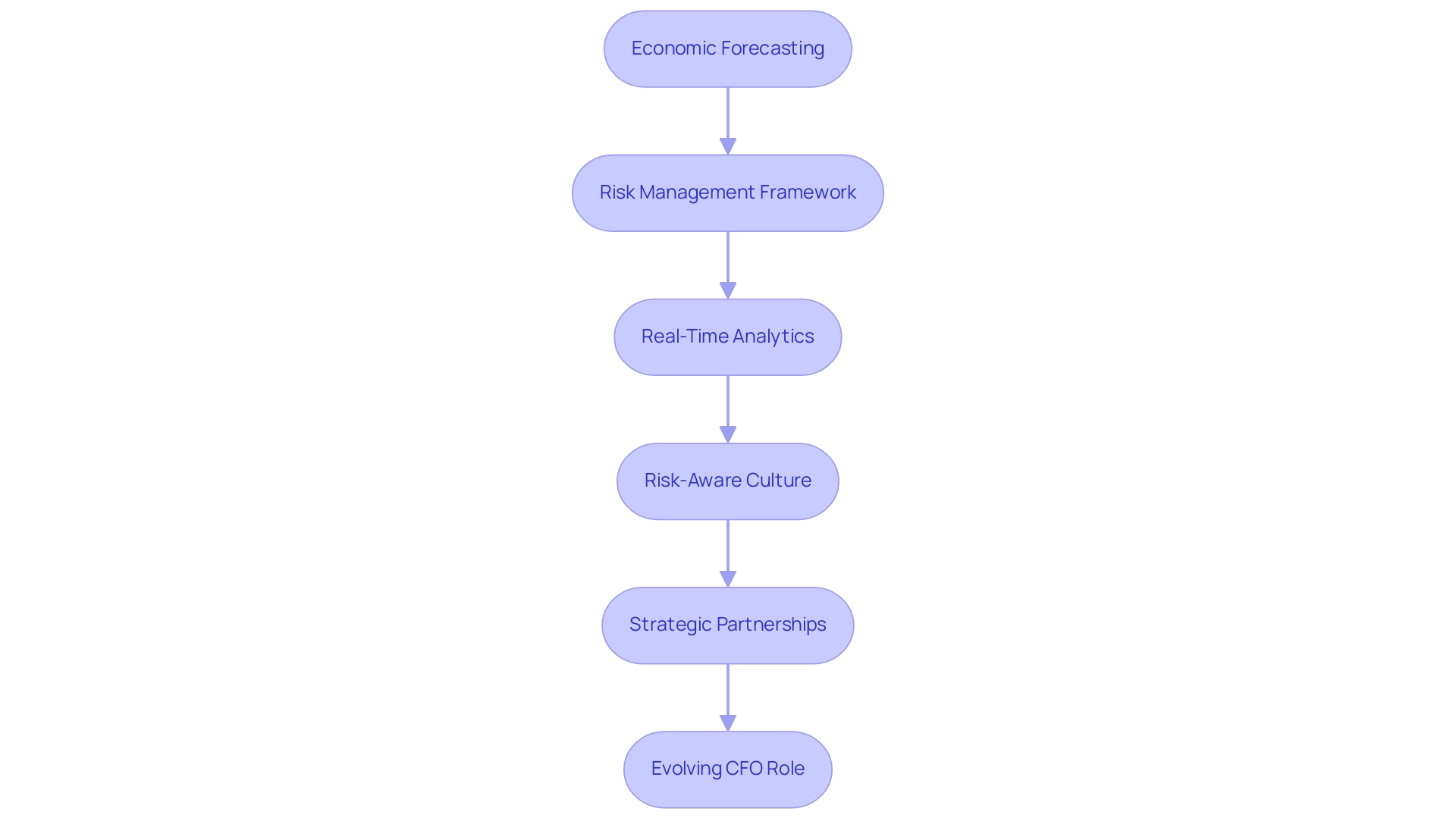

Chief Financial Officers must prioritize proactive monetary planning and risk management to effectively navigate uncertainties in today's dynamic business environment. This involves creating detailed economic forecasts that consider various scenarios, including potential economic downturns and market disruptions. A robust risk management framework is essential, enabling financial leaders to identify potential risks early and formulate effective mitigation strategies.

Frequent evaluations and revisions of monetary strategies are crucial for ensuring that entities remain adaptable and responsive to changing circumstances.

Integrating real-time analytics into monetary oversight allows CFOs to consistently evaluate operational health and make informed decisions promptly. By operationalizing lessons learned from past experiences, entities can enhance their adaptability and decision-making capabilities. For instance, companies that have effectively adopted extensive economic forecasting alongside real-time performance tracking have demonstrated improved resilience and adaptability to market shifts.

Promoting a risk-aware culture within the organization is vital, as it empowers employees to recognize and report potential risks, thereby enhancing overall resilience. Strategic business partnerships are essential for integrated monetary planning, enabling CFOs to provide insights that drive operational change and align economic strategies with organizational goals.

Moreover, the evolution of the CFO role into that of a Chief Value Officer underscores the necessity of balancing traditional monetary responsibilities with strategic foresight. This shift emphasizes the integration of advanced technologies, such as AI, into finance teams to enhance analysis and drive better results. As highlighted by Washington D.C.'s CFO, a new $1B deficit is approaching, underscoring the urgency for proactive budget planning and risk management.

Additionally, new PwC research confirms that the strategic redeployment of capital can boost profit margins, reinforcing the significance of strategic monetary management. By adopting financial survival strategies, along with proactive financial planning and risk management tactics, as well as streamlined decision-making and real-time analytics, financial leaders can not only safeguard their entities against uncertainties but also position them for sustainable growth. The case study titled 'From Chief Financial Officer to Chief Value Officer: A Strategic Evolution' illustrates this necessity, showcasing how financial leaders are evolving to drive value creation within organizations.

Transform Your Small/ Medium Business utilizes a client dashboard to provide real-time business analytics, enabling financial executives to test hypotheses and make informed decisions that enhance business health.

Implementing Best Practices for Long-Term Financial Survival

To ensure long-term economic survival, CFOs must adopt comprehensive financial survival strategies that address every aspect of management. This begins with establishing clear monetary goals, which serve as a roadmap for organizational success. Regularly monitoring performance against these goals is essential, allowing for timely adjustments to strategies as market conditions evolve.

As Baker from Claris Financial Advisors advises, "Avoid waiting until the last minute," underscoring the importance of timely financial planning and decision-making.

Streamlined decision-making processes are crucial during turnaround situations. Our team at Transform Your Small/ Medium Business supports a shortened decision-making cycle, enabling CFOs to take decisive actions that preserve business health. Coupled with real-time analytics from our client dashboard, entities can continually monitor their performance, allowing for proactive adjustments and fostering a culture of continuous improvement.

Cash flow management is a cornerstone of economic resilience; implementing effective financial survival strategies ensures that entities can meet their obligations while capitalizing on growth opportunities. Moreover, implementing stringent cost control measures and diversifying revenue streams are important financial survival strategies that can significantly enhance a company's ability to withstand economic fluctuations. For instance, the case study on identifying key financial deadlines emphasizes the benefits of planning well in advance, which can lead to more effective financial management and collaboration with advisors.

Fostering a culture of continuous improvement and innovation is equally vital. Encouraging teams to identify efficiencies and explore new avenues for revenue generation not only enhances operational performance but also positions the entity to adapt swiftly to changing circumstances. In the current economic climate, government bonds may be worth reconsidering due to decreasing rates and higher yields, providing another strategic avenue for financial executives.

By adhering to these optimal practices, including the implementation of turnaround lessons and utilizing real-time analytics, organizational leaders can effectively navigate challenges and advance their entities toward sustained success and growth, ensuring they stay competitive in a constantly changing economic environment. With firms like Fidelity employing more than 75,000 associates, the scale and expertise available in the financial advisory sector can further support CFOs in their strategic endeavors.

Conclusion

The multifaceted role of CFOs in navigating financial challenges has never been more crucial. By implementing robust financial survival strategies—such as maintaining liquidity, optimizing cash flow, and fostering a culture of accountability—CFOs can effectively safeguard their organizations against economic uncertainties. Regular financial assessments and scenario planning empower these leaders to anticipate challenges and respond proactively, ensuring operational stability even in turbulent times.

Monitoring key financial and operational indicators is essential for maintaining organizational health. By focusing on liquidity ratios, profitability metrics, and cash flow dynamics, CFOs can identify trends and make informed decisions that promote resilience. Furthermore, recognizing red flags early—such as declining revenues or increasing debt—enables timely interventions that can prevent deeper financial distress.

Adopting actionable strategies like diversifying revenue streams, investing in technology, and encouraging cost-conscious behaviors within teams enhances an organization's ability to adapt and thrive. As CFOs embrace innovative revenue strategies and prioritize proactive financial planning, they position their organizations not just to survive but to flourish in an ever-evolving market landscape.

Ultimately, the effective leadership of CFOs is vital for fostering a culture of financial resilience and strategic foresight. By leveraging real-time analytics and promoting collaboration across departments, they can drive sustainable growth and ensure long-term success. Embracing these best practices will empower CFOs to navigate complexities and seize opportunities, solidifying their role as pivotal architects of their organizations' financial futures.

Frequently Asked Questions

What are financial survival strategies?

Financial survival strategies are practices aimed at ensuring organizations remain resilient amid economic challenges. Key strategies include maintaining liquidity, optimizing cash flow, and implementing stringent cost control measures.

Why are regular financial assessments important?

Regular financial assessments help CFOs identify potential vulnerabilities and areas for improvement. Utilizing real-time analytics, such as client dashboards, enhances the evaluation process by providing immediate insights into organizational health.

What role does scenario planning play in financial survival?

Scenario planning involves crafting various financial scenarios that prepare organizations to navigate different economic conditions, facilitating proactive decision-making and operationalizing lessons learned during turnaround efforts.

How can emergency funds contribute to financial stability?

Establishing emergency funds allows organizations to manage unexpected expenses without compromising operational stability, ensuring they can face unforeseen challenges effectively.

What financial metrics should CFOs prioritize in 2025?

CFOs should focus on liquidity ratios (like current and quick ratios), profitability metrics (such as net profit margin and return on equity), and cash flow statements to monitor economic health and inform decision-making.

How do liquidity ratios affect financial survival strategies?

Liquidity ratios assess an organization’s ability to meet short-term obligations, serving as indicators of economic health. Monitoring these ratios helps executives develop effective financial survival strategies.

What operational indicators should CFOs monitor?

CFOs should monitor operational indicators such as inventory turnover, accounts receivable turnover, and employee productivity rates to assess resource utilization efficiency and identify areas for improvement.

How can effective inventory management impact cash flow?

Effective inventory management enhances cash flow by reducing overstocking and improving turnover rates. Companies that adopt automated inventory systems can see significant increases in turnover, leading to better financial outcomes.

Why is it critical for financial leaders to implement cyber resilience measures?

With only 2% of global finance and tech leaders having implemented cyber resilience measures, it is crucial for financial executives to prioritize these initiatives to protect their organizations from potential disruptions.

How can real-time analytics support financial decision-making?

Real-time analytics enable CFOs to make informed decisions by continuously monitoring performance and allowing for timely adjustments to budgetary strategies in response to shifting market conditions.