Overview

The best practices for interim CFO leadership focus on leveraging temporary financial executives to navigate organizational transitions, crises, and strategic planning effectively. The article emphasizes that interim CFOs bring diverse experiences and skills that enable them to provide immediate oversight, implement best practices, and prepare organizations for long-term success, thereby ensuring operational continuity during critical periods.

Introduction

In the dynamic landscape of modern business, organizations often find themselves at critical junctures that demand swift and effective financial leadership. Interim CFOs have emerged as essential players during these pivotal moments, providing the expertise and strategic guidance necessary to navigate periods of transition, crisis, or growth.

With a wealth of experience across various industries, these temporary financial leaders are adept at assessing an organization's fiscal health and implementing strategies that ensure operational continuity. From managing financial reporting during mergers and acquisitions to fostering strong succession planning, interim CFOs not only address immediate challenges but also lay the groundwork for long-term stability and success.

As the demand for their unique skill set continues to rise, understanding the multifaceted role of interim CFOs becomes crucial for organizations aiming to thrive in an ever-evolving marketplace.

Understanding the Role of Interim CFOs in Modern Business

Interim CFO leadership plays a vital role as temporary leaders in organizations undergoing phases of transition, crisis, or restructuring. Their responsibilities include overseeing monetary operations, ensuring compliance with regulatory standards, and delivering strategic guidance. Unlike permanent chief financial officers, temporary executives bring a rich tapestry of experience from various sectors, which enables them to swiftly assess an organization’s economic condition and implement effective strategies.

This adaptability enables companies to maintain operational continuity while addressing urgent monetary concerns. For example, during mergers and acquisitions, temporary chief finance officers are crucial in optimizing reporting and unifying separate systems, thereby establishing the foundation for enduring success. Their expertise in testing hypotheses is essential, as it enables them to make informed decisions quickly and effectively.

The use of real-time analytics, facilitated through a client dashboard, ensures that organizations can monitor performance and adjust strategies proactively. Furthermore, effective financial reporting is essential for businesses, as it provides a clear picture of economic health and guides strategic decisions. As Pat Grismer, EY CFO Advisor in Residence, articulates,

My ability to articulate that playbook, coupled with a track record of success, played an instrumental role in landing two compelling, follow-on CFO roles.

This emphasizes how interim CFO leadership not only addresses urgent issues but also prepares organizations for long-term stability and expansion. Significantly, the statistic indicating a 4:1 ratio of executives appointed from controller or treasurer positions compared to those from business unit chief financial officer or Investor Relations roles from 2001-2010 emphasizes the trend toward employing temporary financial leaders who can utilize their varied experiences to manage transitions effectively. Furthermore, effective succession planning, as shown in the case study on CFO transitions, illustrates that interim CFO leadership plays a vital role in identifying potential successors and ensuring a smooth transition, thereby fostering strong, lasting relationships within the organization—a critical factor for maintaining organizational stability.

When to Hire an Interim CFO: Key Considerations

Organizations are increasingly acknowledging the strategic importance of interim CFO leadership during several critical situations, especially in times of economic distress, rapid growth, or major leadership transitions. A temporary CFO not only steps in to provide prompt oversight and strategic direction during cash flow challenges or regulatory scrutiny but also offers the essential time needed to find and onboard the right full-time CFO. Their pragmatic approach to data enables them to test hypotheses and deliver maximum return on invested capital, while real-time analytics from client dashboards help continually monitor business health and inform necessary adjustments.

For instance, in the context of mergers or acquisitions, their expertise is invaluable for navigating the complexities of financial integration while ensuring reliable financial decision-making is maintained. Moreover, temporary financial leaders play a crucial role in operationalizing lessons learned throughout the turnaround process, ensuring that insights gained are effectively integrated into future strategies. Recent data shows a significant 103% rise in demand for temporary financial officers, emphasizing their increasing significance in the market.

As Corey McLellan of Bridgepoint Consulting highlights, Bridgepoint Consulting’s industry-leading chief financial officers comprehend how to enhance performance and generate enterprise value by incorporating economic insights into overall decision-making. By comprehending and utilizing these crucial moments, companies can engage interim CFO leadership to ensure strong financial management is established to efficiently tackle pressing economic requirements. According to the case study titled 'When to Consider Hiring a Temporary CFO,' companies may gain advantages from interim CFO leadership during various situations, including:

- Leadership vacancies

- Mergers and acquisitions

- Economic crises

- IPO preparations

- Rapid growth

- Specialized monetary projects

This operational approach not only enhances decision-making but also strengthens the overall business turnaround strategy.

Essential Skills for Successful Interim CFO Leadership

Successful temporary financial executives are defined by a unique array of abilities that enable them to thrive in constantly evolving settings. Among the key competencies required are:

- Strong monetary acumen

- Strategic thinking

- Exceptional communication abilities

Flexibility is a crucial quality; temporary CFOs must quickly assess an organization's economic condition and modify strategies as needed to address changing challenges.

Furthermore, experience in crisis management and change leadership is indispensable, enabling them to navigate organizations through periods of uncertainty. As Ken Frieze, Chairman of the Board at Gordon Brothers, notes, strong leadership is crucial in these transitional times. A prime example of interim CFO leadership is an interim CFO who effectively articulates strategies to stakeholders while utilizing real-time analytics to monitor business health through a client dashboard, fostering collaboration and aligning efforts towards shared objectives.

Notably, Chris O'Brien's contributions to C.H. Robinson's growth from $3.6 billion to $26 billion over his 31-year career exemplifies the impact of strong economic leadership. Additionally, recent data shows that 54% of new finance chiefs in early 2024 were promoted from within, underscoring the importance of cultivating leadership qualities internally.

Proactively addressing CFO turnover through strategic planning and interim CFO leadership, alongside operationalizing lessons learned and committing to a shortened decision-making cycle, can further enhance the effectiveness and continuity of financial management during transitional phases. Furthermore, examining hypotheses enables temporary financial officers to enhance strategies based on real-time information, ensuring that choices are informed and significant.

The Strategic Advantages of Engaging Interim CFOs

Engaging interim CFO leadership presents a multitude of strategic advantages, particularly in driving transformation and managing crises with finesse. The need for temporary financial executives has increased by 103% over the past year, highlighting their rising significance in today's business environment. To attract top talent, organizations may need to refresh their Employee Value Proposition (EVP), ensuring they appeal to skilled temporary financial officers who can bring fresh perspectives and specialized expertise.

Interim CFO leadership allows organizations to swiftly implement best practices across various functions, utilizing real-time analytics to monitor performance and make informed decisions. They excel in cash flow management, cost reduction, and enhancing operational efficiency—critical areas often sidelined during transitional phases. For example, a temporary CFO can identify inefficiencies within budgeting processes and implement streamlined reporting systems, resulting in enhanced performance.

Their temporary role empowers them to make decisive choices without the constraints typically faced by permanent leadership, allowing organizations to adapt rapidly to evolving market conditions. A pertinent case study emphasizes how temporary chief financial executives are adept at handling crises, steering companies through difficult monetary situations such as cash flow emergencies, fraud inquiries, or significant accounting problems. They provide the necessary expertise to address issues quickly, communicate with stakeholders, and help develop recovery plans.

As Jeremy Hanson from Heidrick & Struggles articulates, 'There is a need for financial leaders who are adept at taking customer data and analytics and using that information to improve business and the way they market products and services.' There simply aren’t enough of those executives on the planet right now. This emphasizes the distinctive abilities of interim CFO leadership in leading transformation and tackling intricate economic challenges.

Furthermore, temporary chief financial officers can utilize a 'Test & Measure' method by evaluating different financial strategies to optimize return on invested capital. Organizations must also plan for knowledge transfer from the temporary CFO to the team or the next permanent CFO, ensuring a smooth transition and sustained success while operationalizing the lessons learned throughout the turnaround process. By continually monitoring success through real-time analytics, temporary CFOs can 'Update & Adjust' strategies as necessary to ensure optimal business performance.

Best Practices for Integrating Interim CFOs into Your Organization

The success of interim CFO leadership relies significantly on prioritizing clear communication and collaboration throughout the organization, especially during critical turnaround situations. With over 10,000 top finance executives available, the pool of talent for temporary CFO roles is vast, enabling organizations to select individuals who best fit their needs. It is crucial to delineate the temporary CFO’s roles and responsibilities from the outset, ensuring that existing team members understand their objectives and how these align with broader organizational goals.

As Kirstin Chambers, Managing Consultant for Executive Interim in EMEA, notes, 'When I’m asking these questions, I’m shaping a profile of the kind of temporary CFO services that each client needs, and getting a strong understanding of the skills, traits, and capabilities that the temporary will need to succeed.' Establishing regular meetings fosters an environment of open dialogue, allowing team members to voice concerns and share insights. Moreover, involving the temporary CFO in strategic planning sessions offers them vital exposure to the organization’s culture and operational dynamics, which can facilitate smoother decision-making processes.

For example, a retail firm that involved its temporary CFO in weekly management meetings reported better oversight of finances and improved alignment across departments. This case highlights the importance of incorporating temporary chief financial officers into regular discussions, thereby improving stakeholder communication through prompt updates—crucial components in advancing organizational growth strategies. By utilizing decisive action and cooperative strategies, organizations can stabilize their monetary positions and enhance operations, maximizing the CFO's expertise in turnaround consulting.

With over 75 successful engagements, our approach, including the Rapid-30 process, ensures both immediate and long-term performance improvements.

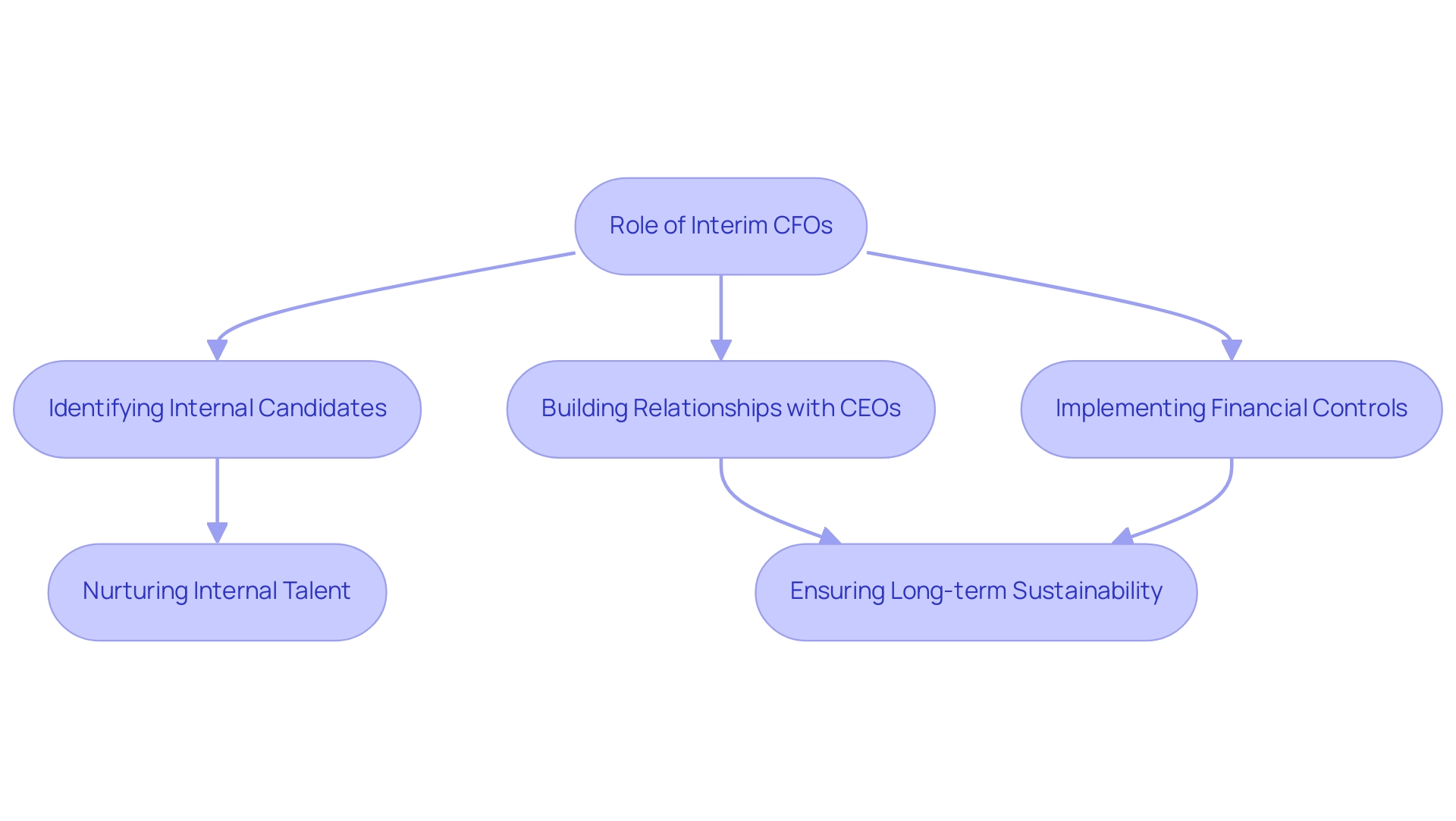

The Role of Interim CFOs in Succession Planning and Leadership Transition

Interim CFO leadership is instrumental in succession planning and facilitating leadership transitions within organizations. They play a vital role in identifying potential internal candidates for the permanent CFO role, offering mentorship and guidance throughout the transition period. By evaluating the organization’s economic condition, temporary chief financial officers can suggest crucial modifications that improve the company’s attractiveness to potential leaders.

Notably, 87% of chief financial officers cite their relationship with the CEO as a critical factor in their decision to stay with an organization, underscoring the importance of strong leadership dynamics during transitions. Effective temporary financial leaders often implement robust financial controls and reporting mechanisms, which not only stabilize the organization but also signal strong governance to potential candidates. For instance, recent data shows that 54% of new chief financial officers in early 2024 were promoted from within, illustrating the value of nurturing internal talent.

This trend highlights the significance of having temporary financial leaders who concentrate on long-term sustainability, ensuring that organizations are prepared to address immediate challenges while strategically positioning themselves for future success. As Cathleen Beetel, Vice President of Global Client Services, states, the rise of boomerang employees highlights the significance of building a strong alumni talent pipeline. This further validates the role of interim CFO leadership in shaping future leadership, particularly in sectors like manufacturing sales organizations, which face challenges in talent attraction.

By navigating these difficulties, interim CFOs can help organizations maintain a competitive edge in securing and developing top talent.

Conclusion

Interim CFOs have proven to be vital assets in today's complex business environment, particularly during times of transition, crisis, or growth. Their unique blend of experience, adaptability, and strategic insight enables organizations to effectively manage financial operations while ensuring compliance and operational continuity. As highlighted throughout the article, interim CFOs not only address immediate financial challenges but also set the stage for long-term stability and success through effective succession planning and the implementation of robust financial strategies.

The increasing demand for interim CFOs underscores their essential role in various scenarios, such as mergers and acquisitions, financial distress, and rapid organizational growth. Their ability to leverage real-time analytics and drive decisive action allows companies to make informed decisions, optimize performance, and maintain a competitive edge. Moreover, the strategic integration of interim CFOs into organizational frameworks fosters collaboration and enhances financial oversight, ultimately contributing to a more resilient business model.

In conclusion, engaging an interim CFO is a strategic move that can empower organizations to navigate tumultuous periods with confidence. By capitalizing on their expertise, companies can not only overcome immediate financial hurdles but also cultivate a strong foundation for future growth and leadership continuity. As businesses continue to evolve, the value of interim CFOs will remain paramount in steering organizations toward sustainable success in an ever-changing marketplace.

Frequently Asked Questions

What is the role of an interim CFO?

An interim CFO serves as a temporary leader during transitions, crises, or restructuring in organizations. Their responsibilities include overseeing monetary operations, ensuring regulatory compliance, and providing strategic guidance.

How do interim CFOs differ from permanent CFOs?

Unlike permanent CFOs, interim CFOs bring diverse experience from various sectors, allowing them to quickly assess an organization’s economic condition and implement effective strategies.

Why are interim CFOs important during mergers and acquisitions?

Interim CFOs are crucial during mergers and acquisitions as they help optimize reporting and unify separate systems, establishing a foundation for long-term success.

How do interim CFOs use analytics in their role?

They utilize real-time analytics through client dashboards to monitor performance and proactively adjust strategies, ensuring effective financial reporting and informed decision-making.

What are some situations where companies might consider hiring an interim CFO?

Companies may consider hiring an interim CFO during leadership vacancies, mergers and acquisitions, economic crises, IPO preparations, rapid growth, and specialized monetary projects.

What impact does interim CFO leadership have on organizational stability?

Interim CFO leadership addresses urgent financial issues while preparing organizations for long-term stability and expansion, fostering strong relationships within the organization.

What is the trend regarding the appointment of interim CFOs?

There is a trend toward appointing interim CFOs from controller or treasurer positions, with a significant ratio of 4:1 compared to those from business unit CFO or Investor Relations roles from 2001-2010.

How has the demand for interim CFOs changed recently?

There has been a significant 103% rise in demand for temporary financial officers, highlighting their increasing importance in the market.

What skills do interim CFOs bring to organizations?

Interim CFOs possess a pragmatic approach to data, enabling them to test hypotheses and deliver maximum return on invested capital while enhancing overall decision-making.