Overview

Best practices for stakeholder management and communication for CFOs involve:

- Identifying interested parties

- Analyzing their interests

- Engaging them effectively to foster trust and collaboration

These strategies not only enhance relationships but also lead to improved financial performance. Organizations with strong stakeholder engagement practices report significantly better outcomes. Therefore, it is essential for CFOs to prioritize these practices to achieve both relational and financial success.

Introduction

In today's complex and interconnected business landscape, effective stakeholder management stands as a critical competency for CFOs aiming for financial success. By identifying, analyzing, and engaging with a diverse array of stakeholders—from investors and employees to customers and regulatory bodies—CFOs can align their financial strategies with the expectations of those who have a vested interest in their organizations. This proactive approach not only fosters trust and collaboration but also enhances decision-making and resource allocation, ultimately driving improved financial performance.

As organizations navigate the challenges posed by conflicting interests and communication barriers, understanding the unique needs of each stakeholder group becomes essential. Crafting tailored engagement strategies that resonate yields tangible benefits, making this an imperative focus for CFOs.

Understanding Stakeholder Management: A CFO's Guide

Stakeholder management and communication represent a vital process for financial executives, necessitating the identification, analysis, and involvement of individuals or groups with vested interests in the organization's activities. This process encompasses a diverse array of parties, including investors, employees, customers, and regulatory bodies. By effectively overseeing stakeholder management and communication, financial leaders can align monetary strategies with the expectations of these involved parties, nurturing trust and collaboration that are essential for enduring success.

Understanding the distinct interests of each group enables financial leaders to refine their stakeholder management and communication approaches, ultimately enhancing relationships and boosting financial performance. Research indicates that organizations with robust engagement practices witness significant improvements in their financial outcomes, underscoring the importance of this approach in today's dynamic business environment.

A compelling case study titled 'Addressing Conflicting Objectives' illustrates how CFOs must navigate conflicting sentiments from interested parties regarding capital allocation strategies, such as debt levels, dividend policies, and reinvestment decisions. Engaging in ongoing dialogue with interested parties is crucial for effective stakeholder management and communication, fostering a better understanding of the organization’s strategy and objectives, which ultimately benefits the capital allocation process.

Key steps in the effective management of involved parties include:

- Identifying Interested Parties: Recognize who your involved parties are and assess their influence on financial decisions. This foundational step in stakeholder management and communication ensures that all relevant voices are considered during the decision-making process.

- Analyzing Interests: Gain insights into what each participant values and how these interests align with the organization's goals. This understanding is essential for formulating strategies that resonate with interested parties.

- Engaging Effectively: Develop tailored strategies for stakeholder management and communication to effectively interact and collaborate with involved individuals, addressing their needs while achieving financial objectives. Continuous dialogue is vital for stakeholder management and communication, as it fosters a clearer comprehension of the organization’s strategy and goals, ultimately aiding capital allocation processes. Integrating these approaches not only enhances stakeholder management and communication with involved parties but also equips financial leaders to navigate intricate financial environments, particularly when addressing divisive issues related to debt levels, dividends, and reinvestment plans. Leveraging technology for immediate insights, such as those provided by the client dashboard from Transform Your Small/ Medium Business, can further assist financial leaders in structuring optimal interaction strategies. This ensures that participant management remains a cornerstone of effective financial leadership. Furthermore, as highlighted by PwC's 2024 Trust Survey, executives often overestimate the level of trust they receive from employees and consumers, emphasizing the necessity for CFOs to understand perceptions from various groups to promote effective stakeholder management and communication.

The Importance of Stakeholder Management for Financial Success

Effective stakeholder management and communication are essential for achieving financial success, as they cultivate robust relationships that enhance decision-making and resource allocation. Transform Your Small/ Medium Business facilitates a shortened decision-making cycle throughout the turnaround process, enabling your organization to take decisive action to preserve business health. When participants feel appreciated and involved, they are more likely to support organizational efforts, which can significantly enhance financial results.

For instance, transparent communication with investors not only boosts their confidence but also encourages increased investment. Similarly, actively engaging employees can elevate morale and productivity, leading to improved overall performance.

Studies indicate that firms focusing on stakeholder management and communication achieve 20% greater customer satisfaction and 35% improved employee involvement, underscoring the tangible advantages of these methods. This information is supported by a study examining 251 UK multinational companies and 4,676 subsidiaries, which emphasizes the correlation between effective involvement of interested parties and enhanced financial performance. Moreover, we continuously monitor the success of our plans through our client dashboard, which provides real-time business analytics to assess your business health.

The client dashboard enables tracking key performance indicators and adjusting strategies in real-time, ensuring that your organization remains agile and responsive to changes in the business environment. During periods of financial hardship, stakeholder management and communication with interested parties are crucial. This proactive engagement in stakeholder management helps mitigate panic and fosters a collaborative approach to problem-solving, often resulting in innovative solutions that benefit both the organization and its partners.

The significance of corporate governance mechanisms cannot be overstated, as they align the interests of management and shareholders, ultimately driving firm value and profitability. A case study titled 'Corporate Governance and Equity Prices' reveals that organizations with stronger shareholder rights enjoy higher firm value, illustrating the economic benefits of effective management of interested parties. As David I. Cleland aptly noted, understanding the needs and influence of project advocates and opponents is vital for aligning projects with the interests of involved parties, further emphasizing the role of stakeholder management and communication in achieving financial success.

Furthermore, implementing insights gained from the turnaround process is vital for establishing strong, enduring connections with interested parties, ensuring that the organization not only survives but flourishes in the long term.

Essential Skills for Effective Stakeholder Management

To effectively manage interested parties, financial executives must cultivate a diverse set of essential skills, including:

- Communication: The ability to convey financial information clearly and persuasively is paramount. Chief financial officers should excel at customizing their messages for different audiences, ensuring that intricate financial information is both accessible and understandable. Effective dialogue not only improves understanding but also cultivates trust among participants, which is essential for successful stakeholder management and communication in collaboration. Statistics reveal that organizations with strong stakeholder management and communication practices see 47% greater returns to shareholders, highlighting the importance of these skills specifically for financial leaders in attaining financial success.

- Relationship Management: Establishing and nurturing strong connections with interested parties requires empathy, active listening, and a proactive method to addressing concerns. A strong relationship between financial and marketing leaders, for instance, can significantly enhance customer profiling and strategic predictive modeling, which are vital for informed decision-making at the executive level. Moreover, utilizing real-time analytics via client dashboards enables financial leaders to consistently oversee business performance, allowing for prompt adjustments and nurturing stronger relationships with interested parties. The shortened decision-making cycle supported by these analytics enables teams to take decisive actions swiftly, preserving the business's health.

- Negotiation: Chief Financial Officers frequently engage in negotiations with interested parties, whether securing funding from investors or aligning interests with department heads. Mastering negotiation skills can lead to results that benefit all parties involved, thereby enhancing stakeholder management and communication and reinforcing the CFO's role as a strategic partner within the organization.

- Analytical Thinking: The ability to analyze relevant data and feedback is crucial for making informed decisions that align with both financial objectives and expectations of interested parties. This analytical prowess enables financial executives to identify trends and insights that can drive strategic initiatives and improve overall business performance. Ongoing assessment of business vitality via real-time analytics not only aids decision-making but also implements insights gained during turnaround procedures, thus improving the chief financial officer's efficiency in stakeholder management and communication with interested parties.

In a case study emphasizing the role of chief financial officer leadership within finance teams, it was observed that capable chief financial officers not only concentrate on compliance but also enable junior team members, nurturing a collaborative atmosphere. This approach enhances the overall health of the business and reduces financial crises, highlighting the significance of strong leadership in managing interests. By refining these crucial abilities, financial leaders can improve their stakeholder management and communication, ultimately fostering sustainable growth for their organizations.

Transform Your Small/ Medium Business is committed to operationalizing lessons from the turnaround process to build strong, lasting relationships.

Best Practices for Engaging Stakeholders Effectively

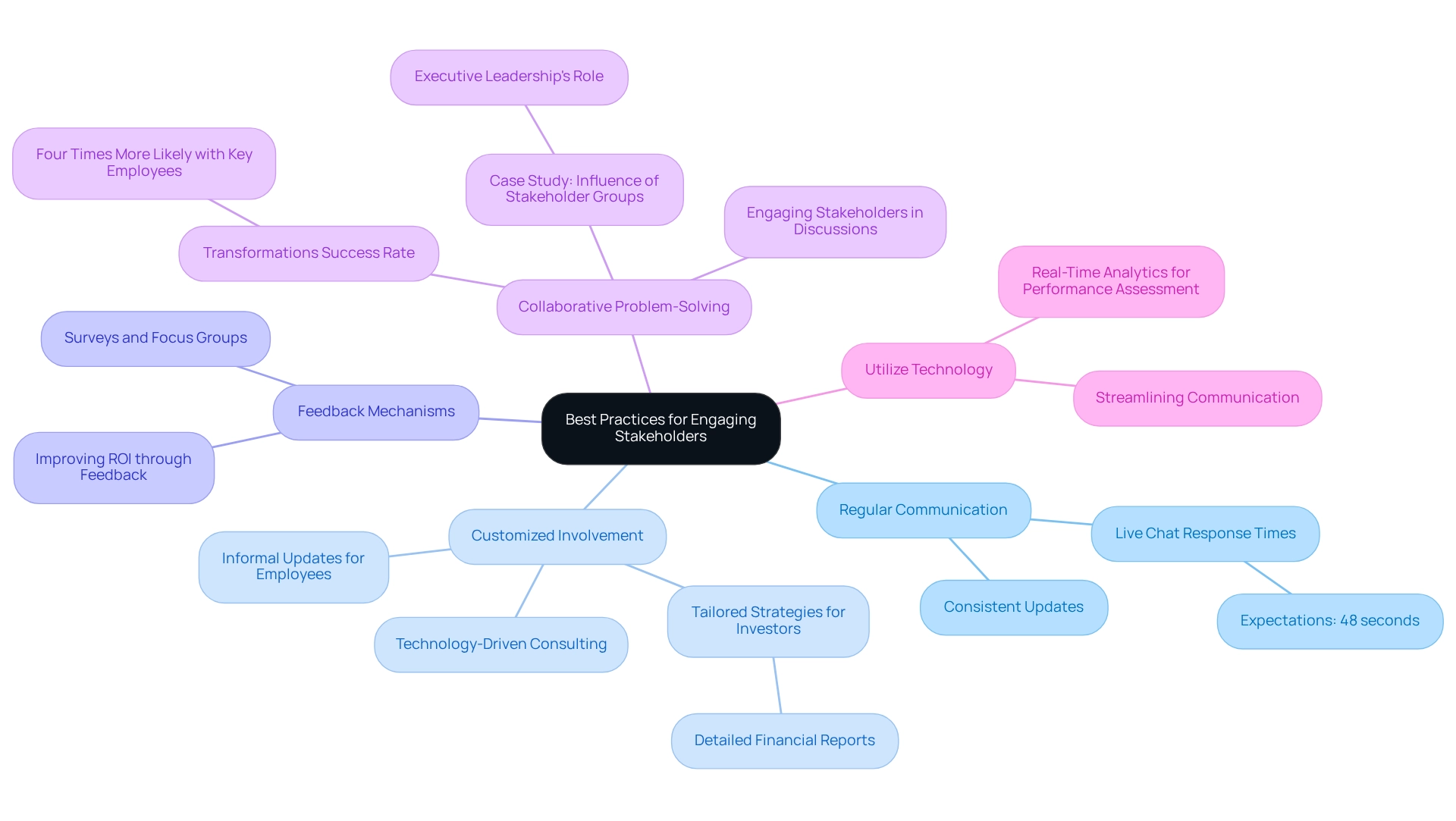

To effectively engage interested parties, CFOs should implement the following best practices:

-

Regular Communication: Establish a consistent schedule for updating involved individuals on financial performance and strategic initiatives. This openness fosters trust and enhances stakeholder management by keeping interested parties informed about the organization's direction and health. In today's fast-paced environment, prompt interaction is essential; for instance, customers expect companies to respond via live chat within 48 seconds.

-

Customized Involvement: Tailor involvement strategies to meet the specific needs and interests of diverse groups. For example, investors may require detailed financial reports, while employees might benefit from informal updates that promote a sense of inclusion and engagement. Leveraging technology-driven consulting services can enhance these customized approaches, ensuring that stakeholder management and communication are both effective and efficient.

-

Additionally, implement robust feedback mechanisms to gather input from involved parties, which are crucial for effective stakeholder management. Utilizing surveys or focus groups can provide invaluable insights for guiding decision-making processes, demonstrating that contributors' opinions are genuinely valued. Research indicates that organizations actively seeking feedback can improve their return on investment by refining strategies based on insights from interested parties.

-

Collaborative Problem-Solving: Engage interested parties in discussions about challenges and opportunities through collaborative problem-solving. This approach not only leads to innovative solutions but also strengthens relationships. A case study on the influence of interest groups in data and analytics initiatives reveals that involving executive leadership and other key participants is vital for successful project approvals and implementations. As Bill Schaninger notes, studies show that transformations are four times more likely to succeed when key employees are included.

-

Utilize Technology: Leverage technology-enabled consulting services to streamline communication and participation efforts. Efficient software solutions can optimize resource utilization and improve stakeholder management for the overall success of participant involvement initiatives. Continuous business performance assessment through real-time analytics can enhance these initiatives, empowering financial leaders to apply turnaround insights and foster enduring collaborations.

By adopting these optimal strategies, financial executives can forge stronger connections with partners, ultimately leading to improved financial outcomes and organizational success.

Crafting a Stakeholder Communication Plan: Strategies for Success

Developing a robust engagement strategy is crucial for CFOs aiming to enhance interaction through effective stakeholder management and communication, thereby driving organizational success. This process encompasses several essential steps:

- Identify Participants: Begin by compiling a comprehensive list of all relevant participants. Categorize them according to their influence and interest levels to customize your outreach strategies efficiently.

- Set Objectives: Clearly define the objectives of your outreach efforts. Whether the aim is to boost transparency, encourage collaboration, or improve trust among involved parties, having specific targets will direct your messaging and approach.

- Choose Interaction Channels: Select the most effective interaction channels for each group of interested parties. Options may include email updates, newsletters, webinars, or face-to-face meetings. Understanding the preferred methods of various interest groups can significantly enhance engagement.

- Establish a Schedule: Consistency is essential in interactions with involved parties. Create a consistent timetable for updates and interactions, ensuring that participants remain informed and engaged over time.

- Evaluate and Adjust: Regular assessments of your outreach plan's effectiveness are vital. Gather feedback from involved parties to identify areas for improvement and adapt your strategies accordingly. This iterative process not only enhances interaction but can also lead to a 50% reduction in attrition rates, as organizations that prioritize stakeholder management and communication often experience better retention. Furthermore, utilizing tools like Simply Stakeholders can streamline stakeholder management by offering features such as contact records and sentiment analysis, further bolstering your outreach efforts.

Integrating insights from experts can further elevate your strategy. For instance, Sabrinthia Donnelly from Finance Alliance underscores the importance of creating successful deals through efficient dialogue, suggesting that clearly defined goals can transform potential challenges into opportunities for growth. Additionally, our team advocates for a reduced decision-making cycle during the turnaround process, enabling your organization to act decisively based on real-time business analytics.

This ongoing assessment of performance not only assists in evaluating business wellness but also highlights the importance of implementing lessons learned from the turnaround process to establish robust, enduring relationships.

Moreover, case studies illustrate the impact of effective interaction methods on employee engagement and productivity. Research from McKinsey indicates that organizations that assess internal communications effectively can enhance morale and achieve improved business results.

By adhering to these essential steps and leveraging expert insights, CFOs can craft a communication strategy that emphasizes stakeholder management and communication, fulfilling organizational objectives while fostering a culture of collaboration and transparency.

Monitoring Stakeholder Relationships: Ensuring Long-Term Engagement

Overseeing stakeholder management and communication is essential for guaranteeing project success and promoting lasting involvement. To achieve this, consider implementing the following essential practices:

- Regular Check-Ins: Arrange periodic meetings or calls with key participants to discuss their concerns and gather feedback on your engagement efforts. This proactive method not only addresses issues swiftly but also underscores the significance of stakeholder management and communication in decision-making processes. Such an approach facilitates a shortened decision-making cycle that can sustain business health.

- Performance Metrics: Establish clear metrics to evaluate the effectiveness of your participant engagement strategies. Metrics such as participant satisfaction scores, benchmarked against industry standards—like Adobe's impressive 85+ NPS score—provide valuable insights into how well individuals perceive their involvement and the project's progress. By utilizing real-time business analytics from the client dashboard at Transform Your Small/ Medium Business, you can continuously assess business health, ensuring that the project management team effectively integrates stakeholder management and communication to meet the expectations of involved parties, as highlighted by the Project Management Institute (PMI).

- Adaptation: Be prepared to adjust your strategies based on feedback and changing circumstances. Flexibility is crucial for effective stakeholder management and communication, as it demonstrates responsiveness to the needs of involved parties and fosters trust. Ongoing observation of performance enables timely updates and modifications to engagement strategies.

- Documentation: Maintain thorough records of participant interactions, feedback, and any issues that arise. This documentation is invaluable for informing future engagement strategies and identifying patterns over time. A case study on the organizational impact of interested party analysis illustrates how consistent evaluation of these individuals can enhance stakeholder management and communication, thereby improving project management practices and promoting a culture of awareness and engagement.

- Leverage Technology: Utilize AI-powered tools and frameworks like RACI matrices to enhance management practices related to these parties. These technologies can improve interaction and clarify roles, reducing confusion and boosting overall project efficiency. By incorporating real-time analytics into these tools, financial leaders at Transform Your Small/ Medium Business can operationalize turnaround lessons and foster stronger connections with partners.

By applying these best practices, financial leaders can ensure that partner relationships are effectively monitored and managed, ultimately leading to improved project outcomes and sustained organizational success.

Leveraging Technology for Enhanced Stakeholder Management

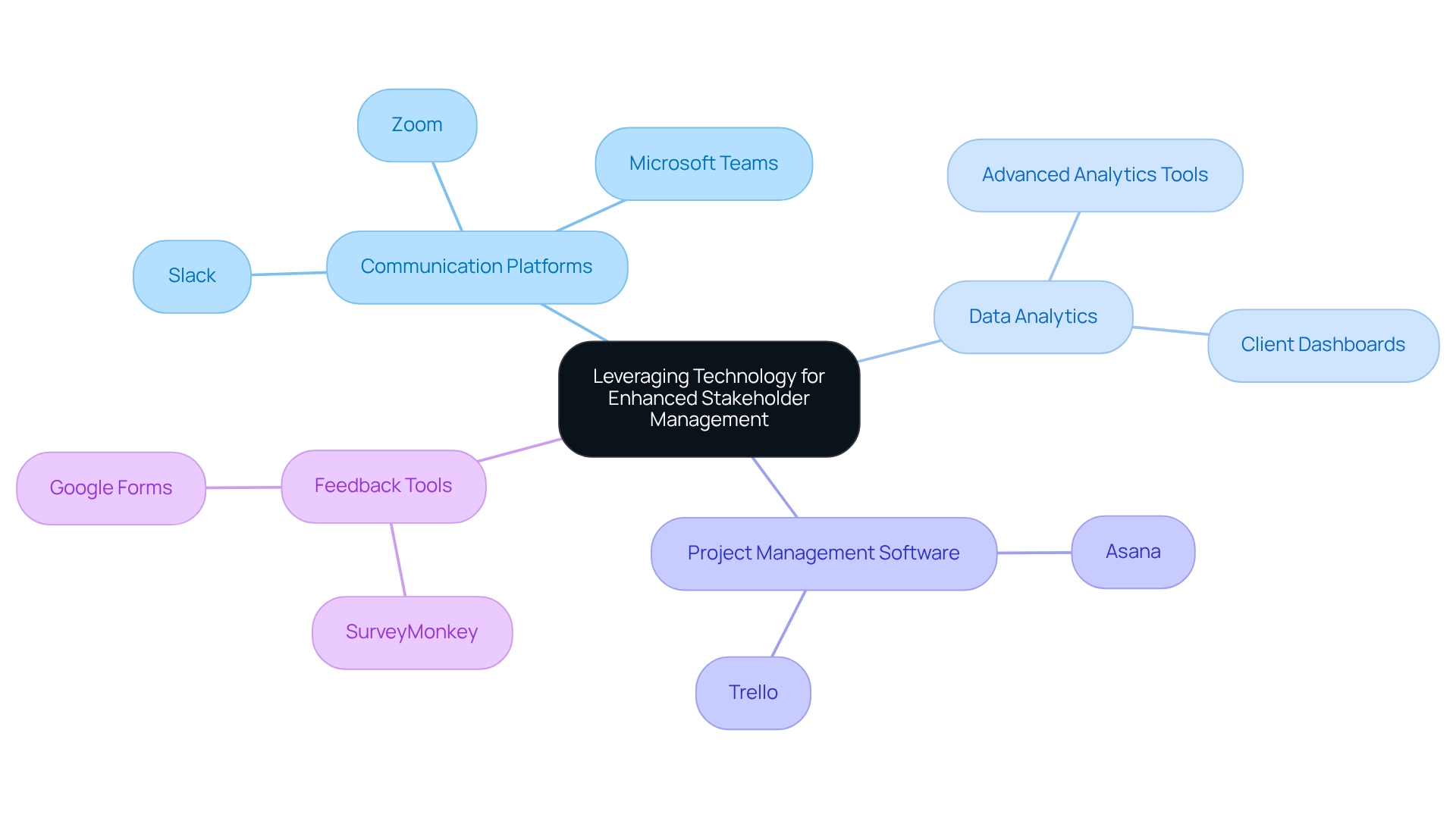

Technology plays a pivotal role in enhancing stakeholder management through several key avenues:

- Communication Platforms: Tools such as Slack, Microsoft Teams, and Zoom facilitate real-time communication and collaboration, allowing CFOs to engage stakeholders effectively. These platforms not only streamline discussions but also foster a culture of transparency and responsiveness, which is crucial for maintaining strong relationships. As noted by ZS, "This article reflects my personal views. 'They do not necessarily represent any official position of ZS,' emphasizing the importance of personal involvement in communication.

- Data Analytics: By leveraging advanced analytics tools, organizations can gain valuable insights into the behavior and preferences of interested parties. This data-focused method allows financial executives to develop focused engagement strategies that connect with interested parties, ultimately resulting in more significant interactions and enhanced outcomes. Continuous monitoring via client dashboards offers real-time business analytics, enabling financial executives to assess business health and modify strategies swiftly.

- Project Management Software: Implementing project management tools like Asana or Trello helps monitor interactions and manage tasks efficiently. These tools guarantee responsibility in stakeholder management and communication initiatives, enabling CFOs to track progress and uphold consistency with the expectations of involved parties. The challenges detailed in the case study on traditional data project methods highlight the necessity for early and thorough involvement from business leaders to avoid project delays, underscoring the significance of cooperation in managing involved parties.

- Feedback Tools: Utilizing online survey platforms such as SurveyMonkey or Google Forms allows for the efficient collection of participant feedback. This capability allows organizations to make swift changes to their engagement strategies based on real-time feedback, improving overall participant satisfaction. A comprehensive understanding of the total care cycle nurtures confidence in collaborations and promotes innovative service considerations, which are essential for effective stakeholder management and communication among involved parties.

Integrating these technological resources not only enhances communication but also enables financial leaders to handle relationships with interested parties proactively, ensuring that their organizations stay agile and responsive in a swiftly evolving business landscape. The integration of real-time analytics and a shortened decision-making cycle is crucial for preserving business health and operationalizing turnaround lessons.

Overcoming Challenges in Stakeholder Management: Solutions for CFOs

Chief financial officers frequently encounter various difficulties in stakeholder management and communication, significantly influencing project coordination and overall business success. Key challenges include:

- Conflicting Interests: Stakeholders often have competing priorities that complicate decision-making. To navigate this, CFOs should facilitate open discussions aimed at identifying common ground. By aligning interests through collaborative dialogue, they can foster a more cohesive approach to project goals.

- Communication Barriers: Miscommunication can lead to misunderstandings and project delays. Establishing clear interaction protocols and providing regular updates are essential strategies to mitigate these risks. Utilizing technology to streamline communication can further enhance transparency and involvement among interested parties.

- Resistance to Change: Stakeholders may exhibit resistance to new initiatives, particularly if they feel uninformed or unprepared. Involving interested parties early in the process and actively addressing their concerns can foster buy-in and support. This proactive strategy not only facilitates transitions but also enables involved parties to embrace change.

- Resource Constraints: Restricted resources can present considerable difficulties to effective involvement. Chief financial officers should prioritize important partners and utilize technology to enhance engagement strategies. By concentrating efforts on the most significant relationships, they can enhance the effectiveness of their management initiatives.

Statistics suggest that over two-thirds of chief financial officers intend to pursue growth strategies defined by fewer, yet more concentrated investments in the upcoming three years. This trend underscores the importance of effective stakeholder management and communication, as aligning interests and fostering collaboration will be crucial in navigating complex investment landscapes.

In addition, case studies highlight the importance of adapting business models to remain competitive in evolving markets. For instance, consultants can provide valuable expertise in market analysis and scenario planning, assisting financial leaders in implementing changes that lead to sustainable growth. As Ajit Kambil, Global Research Director of the CFO Program, observes, "The Program utilizes our organization’s extensive capabilities to provide innovative and new insights for every phase of a financial leader’s career—assisting them in navigating the complexities of their roles, addressing their company’s most pressing challenges, and adjusting to strategic changes in the market."

Moreover, the rise of generative AI offers new possibilities for improving management of interested parties and communication approaches, especially as financial leaders navigate digital transformation. The Finance Alliance, launched in 2022, connects finance leaders globally, providing a platform for collaboration and support in addressing these challenges. By addressing these challenges head-on, CFOs can enhance their stakeholder management and communication efforts, ultimately driving better outcomes for their organizations.

To further support these efforts, our team at Transform Your Small/ Medium Business emphasizes a pragmatic approach to data, testing every hypothesis to ensure maximum return on invested capital. We support a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business. Our commitment to operationalizing the lessons learned through the turnaround process fosters strong, lasting relationships, while our client dashboard provides real-time business analytics to continuously monitor performance and diagnose business health.

Conclusion

Effective stakeholder management is not merely an operational necessity; it stands as a strategic imperative for CFOs aiming to drive financial success in an increasingly complex business environment. By identifying, analyzing, and engaging with a diverse range of stakeholders, CFOs can align their financial strategies with stakeholder expectations. This alignment fosters trust and collaboration, essential elements for long-term success.

The article highlights critical skills and best practices necessary for effective stakeholder management, including:

- Communication

- Relationship management

- The strategic use of technology to streamline engagement efforts

Organizations that prioritize robust stakeholder engagement practices can achieve significant improvements in financial performance, employee engagement, and customer satisfaction. Moreover, the ability to navigate challenges such as conflicting interests and resistance to change is crucial for sustaining these relationships.

In conclusion, CFOs must regard stakeholder management as a cornerstone of effective financial leadership. By employing tailored engagement strategies and leveraging technology, they can enhance relationships and drive better outcomes for their organizations. As the business landscape continues to evolve, the proactive management of stakeholder relationships will be key to not only surviving but thriving in the future.

Frequently Asked Questions

What is the importance of stakeholder management and communication for financial executives?

Stakeholder management and communication are crucial for financial executives as they help identify, analyze, and involve individuals or groups with vested interests in the organization. This process fosters trust and collaboration, aligning monetary strategies with stakeholders' expectations, which is essential for long-term success.

Who are considered stakeholders in an organization?

Stakeholders can include a diverse array of parties such as investors, employees, customers, and regulatory bodies, all of whom have vested interests in the organization's activities.

How does understanding stakeholder interests benefit financial leaders?

By understanding the distinct interests of each stakeholder group, financial leaders can refine their management and communication approaches, enhancing relationships and ultimately boosting financial performance.

What evidence supports the effectiveness of stakeholder management practices?

Research indicates that organizations with robust engagement practices see significant improvements in financial outcomes, including 20% greater customer satisfaction and 35% improved employee involvement.

What are the key steps in effective stakeholder management?

The key steps include: Identifying Interested Parties: Recognizing who the involved parties are and assessing their influence on financial decisions. Analyzing Interests: Understanding what each stakeholder values and how their interests align with the organization's goals. Engaging Effectively: Developing tailored strategies for communication and collaboration with stakeholders to address their needs while achieving financial objectives.

How does effective communication with stakeholders impact financial results?

Transparent communication with stakeholders, such as investors and employees, boosts confidence, enhances morale, and encourages support for organizational efforts, leading to improved financial results.

What role does technology play in stakeholder management?

Technology, such as client dashboards, provides real-time business analytics that help financial leaders track key performance indicators and adjust strategies, ensuring agility and responsiveness to changes in the business environment.

Why is stakeholder management particularly important during financial hardship?

Proactive engagement in stakeholder management during financial difficulties helps mitigate panic and fosters collaboration in problem-solving, often resulting in innovative solutions that benefit both the organization and its partners.

How do corporate governance mechanisms relate to stakeholder management?

Corporate governance mechanisms align the interests of management and shareholders, driving firm value and profitability. Effective management of stakeholders can lead to higher firm value, as seen in studies linking stronger shareholder rights to enhanced economic benefits.

What is the long-term significance of stakeholder management?

Implementing insights gained from stakeholder management is vital for establishing strong, enduring connections with interested parties, ensuring that the organization not only survives but flourishes in the long term.