Overview

Best practices for stakeholder management solutions for CFOs begin with prioritizing communication. Engaging stakeholders early and often is crucial, along with tailoring participation strategies to meet the unique needs of different groups. Effective communication fosters trust and collaboration, creating a solid foundation for successful outcomes. Moreover, customized engagement approaches lead to improved project results and enhanced financial performance, particularly in today’s complex and evolving business environment. By adopting these strategies, CFOs can navigate challenges with confidence and drive their organizations toward success.

Introduction

In the intricate landscape of modern business, effective stakeholder management has emerged as a cornerstone of financial strategy, particularly from the vantage point of Chief Financial Officers (CFOs). As organizations grapple with rapid changes and increasing complexity, understanding the diverse needs and expectations of stakeholders—including investors, employees, customers, and suppliers—becomes paramount. The ability to identify, analyze, and engage these individuals or groups not only fosters trust and collaboration but also significantly enhances financial performance.

In 2025, as economic uncertainties loom, the stakes are higher than ever, compelling CFOs to adapt their strategies and cultivate robust relationships that drive sustainable growth. This article delves into the essential practices and insights that empower CFOs to navigate the challenges of stakeholder engagement, ensuring their organizations thrive in a competitive environment.

Understanding Stakeholder Management: A CFO's Perspective

A stakeholder management solution represents a strategic process essential for identifying, analyzing, and engaging with individuals or groups who have a vested interest in an organization's operations and outcomes. For CFOs, this means recognizing that stakeholders—including investors, employees, customers, and suppliers—play a pivotal role in shaping financial strategies. As we approach 2025, the effective management of these involved parties is more crucial than ever, significantly enhancing financial performance by fostering trust and collaboration, particularly during periods of financial uncertainty.

CFOs must prioritize a deep understanding of the unique needs and expectations of each group of interested parties. This alignment of financial objectives with stakeholder interests not only drives sustainable growth but also stabilizes the organization in challenging times. Data indicates that over two-thirds of CFOs are anticipated to seek growth strategies defined by fewer, more focused investments in the next three years, underscoring the importance of strategic engagement with stakeholders.

Moreover, expert opinions reveal that the vast majority of CFOs believe they should take a more prominent role in their company’s planning process, highlighting the necessity for continuous communication with stakeholders. This ongoing dialogue fosters a deeper understanding of the organization’s strategy and objectives, which is essential for navigating conflicting interests, such as those surrounding debt levels, dividends, and mergers and acquisitions.

To facilitate this process, Transform Your Small/Medium Business begins each client engagement with a comprehensive business review. This approach aligns key parties and provides a clearer understanding of beyond mere numbers.

By identifying underlying issues and collaboratively creating a plan to address weaknesses, financial leaders can reinforce their organization’s strengths and operationalize lessons learned from turnaround processes. Additionally, Transform Your Small/Medium Business employs a pragmatic 'Test & Measure' approach, rigorously testing hypotheses to maximize returns on investment in both the short and long term.

A case study titled 'Balancing Short-Term and Long-Term Goals' illustrates the importance of this dialogue. Financial executives who engage in thorough evaluation and conversation can synchronize capital distribution plans with both short-term gains and long-term business goals, effectively managing stakeholder expectations.

By implementing effective strategies as a stakeholder management solution, financial leaders can enhance financial performance and ensure their organizations thrive in a competitive environment.

Identifying Key Stakeholders: Who Matters Most?

To effectively manage interested parties, CFOs at Transform Your Small/Medium Business must begin by employing to identify key individuals both inside and outside the organization. Internal parties encompass board members, executives, and employees, while external groups consist of investors, customers, and suppliers. A systematic approach, such as creating a participant map, is essential.

This map categorizes participants based on their influence and interest levels, enabling financial leaders to prioritize engagement strategies and allocate resources efficiently.

For example, during a financial recovery, initial engagement with key investors can prove crucial. By securing their support, financial officers can alleviate potential resistance to necessary changes, facilitating a smoother transition. The importance of mapping involved parties cannot be overstated; it streamlines communication and reduces costs by ensuring that participants are appropriately engaged at relevant project phases.

Furthermore, leveraging real-time analytics through our client dashboard allows CFOs to continuously monitor participant sentiments and project outcomes, enhancing decision-making processes.

As we approach 2025, effective mapping strategies for CFOs will continue to evolve, underscoring the need for adaptability in recognizing key individuals. Statistics reveal that organizations utilizing structured participant identification methods report higher success rates in project outcomes, with a Cronbach's alpha coefficient of 0.82 demonstrating the reliability of these strategies. As emphasized by the Project Management Institute (PMI), 'the project management team must … manage and then influence those expectations to ensure a successful project.'

Moreover, companies that apply lessons learned from previous turnarounds and establish participation strategies for involved parties can achieve improved engagement and project efficiency through a stakeholder management solution, ultimately leading to sustainable success. However, it is essential to recognize the study's limitations, which include its focus on private corporate building projects, potentially limiting applicability to public projects, and the variances in project management practices between developed and developing economies.

Analyzing Stakeholder Interests and Influence

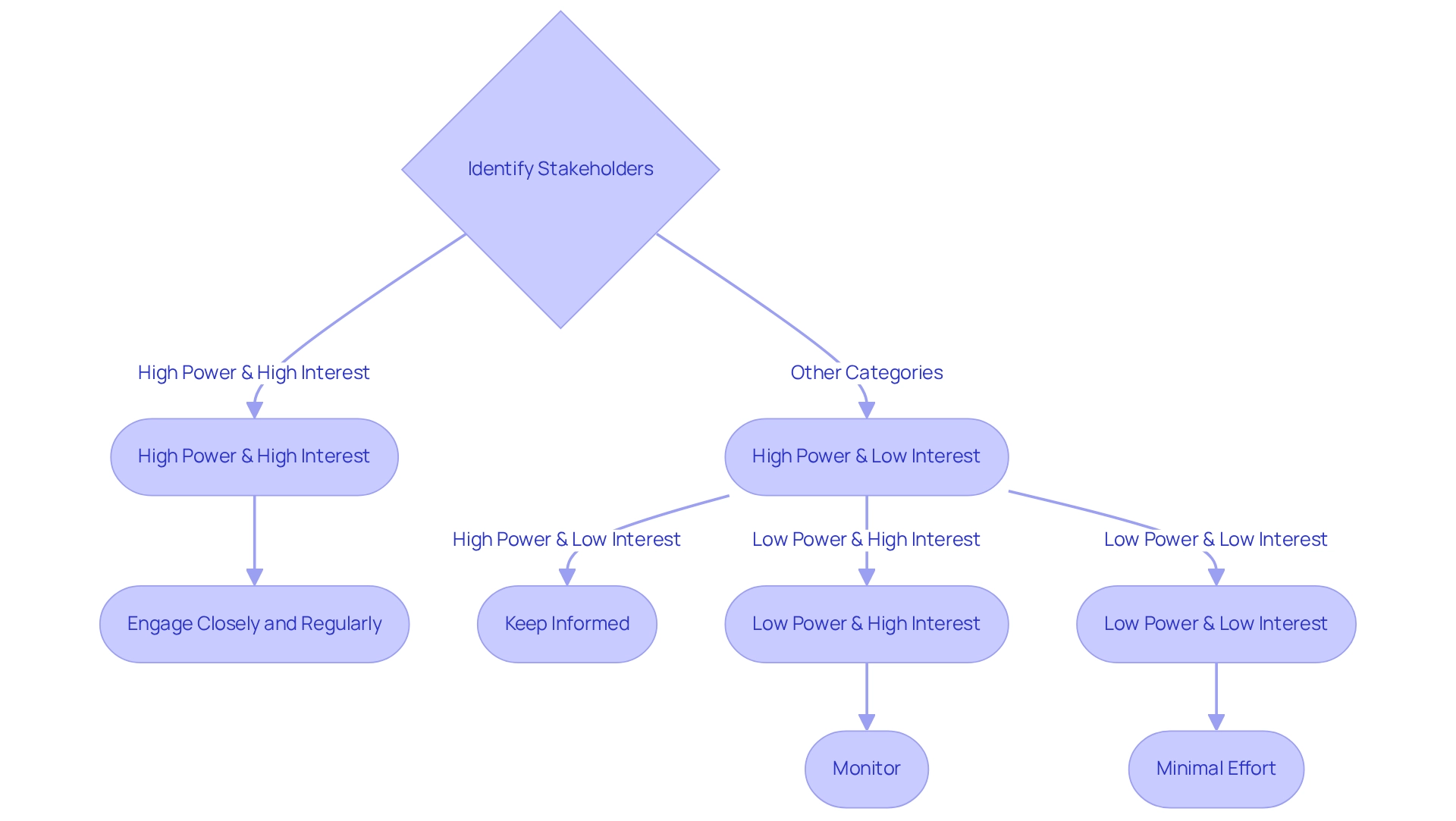

After recognizing important parties, financial officers must explore their interests and impact. This essential evaluation involves understanding what each participant prioritizes—whether it be financial returns, operational efficiency, or (CSR), which can enhance brand and overall growth. Utilizing tools like the Power/Interest Grid allows CFOs to categorize participants based on their influence and interest levels in the organization.

For instance, individuals classified as high-power and high-interest should be engaged closely and regularly to ensure their needs are met. Conversely, those with low power and low interest may require less frequent communication. This organized assessment acts as a stakeholder management solution that not only simplifies engagement efforts but also helps in predicting possible challenges, thus aligning financial plans with participant expectations. In 2025, the effectiveness of the Power/Interest Grid as a stakeholder management solution in analyzing interested parties remains evident, as it provides a clear framework for CFOs to navigate complex relationships, ultimately enhancing financial decision-making and operational efficiency.

Moreover, with 68% of CSR experts anticipating their budgets to stay unchanged, utilizing a stakeholder management solution to comprehend the interests of involved parties becomes increasingly vital in adjusting financial approaches. The robustness test estimate for ownership structure (OWNSTR) on ROE, which is 23.507, highlights the quantitative effect of effective participant involvement on financial performance. As pointed out by Jason Sturgess, multinational companies' investments have increased four times quicker than global GDP, underscoring the importance of a stakeholder management solution in shaping financial strategies.

Furthermore, the incorporation of real-time business analytics, backed by our team at Transform Your Small/Medium Business, enables financial leaders to consistently track the effectiveness of their client interaction approaches via our client dashboard, guaranteeing that they can make informed decisions rapidly. The case study on 'Competition Intensity and Resource Management' demonstrates how the analysis of interested parties affects resource management approaches in competitive settings, further increasing the significance of this discussion for financial executives.

Crafting Effective Engagement Strategies for Stakeholders

Developing effective engagement strategies necessitates a well-organized communication plan, serving as a stakeholder management solution that delineates how and when to connect with interested parties. CFOs must leverage a variety of communication methods—including meetings, comprehensive reports, and digital platforms—to ensure that stakeholders receive timely and relevant information. Involving these parties in financial decision-making processes is a pivotal stakeholder management solution, fostering their commitment and amplifying support for initiatives.

For example, during a restructuring period, engaging essential participants in discussions about financial plans can lead to more informed choices and enhanced backing. Regular updates and feedback mechanisms are crucial for sustaining participant engagement as part of a stakeholder management solution throughout the process. Organizations that prioritize effective communication report on their communications, underscoring the impact of well-executed strategies.

As CFOs navigate the complexities of 2025, employing a stakeholder management solution to craft customized communication strategies that address the concerns and expectations of stakeholders will be vital. This approach not only aligns with strategic goals but also highlights the importance of transparency and collaboration in achieving sustainable development.

Furthermore, utilizing a stakeholder management solution, such as those provided by Transform Your Small/Medium Business, can significantly enhance decision-making and engagement with involved parties. Their technology-driven transformation and reorganization consulting services offer a stakeholder management solution by enabling real-time analytics and ongoing performance assessments, which are essential for implementing turnaround insights and cultivating robust connections with stakeholders. As CFOs contemplate these advancements, they must remain vigilant regarding cybersecurity concerns, as only 2% of finance and tech leaders have enacted cyber resilience measures, emphasizing the necessity for secure communication channels.

Moreover, leveraging a stakeholder management solution can foster cross-departmental collaboration, aligning budgets with strategic objectives and further enhancing involvement.

Monitoring and Adapting Stakeholder Management Strategies

Tracking participant involvement is essential for guaranteeing effective communication strategies and high levels of participant satisfaction. CFOs should establish essential performance metrics (KPIs) that specifically assess involvement levels and utilize a stakeholder management solution to collect extensive input from interested parties. For instance, KPIs such as satisfaction scores from participants, frequency of communication, and response rates provide valuable insights into the effectiveness of involvement.

This data is crucial for making informed adjustments to engagement strategies.

In 2025, it is particularly important to focus on KPIs that evaluate satisfaction levels, including the Net Promoter Score (NPS) and (CSAT), which can indicate how individuals perceive the organization’s transparency and responsiveness. If involved parties express concerns regarding financial transparency, the CFO may need to enhance reporting practices or increase the frequency of updates to address these issues.

A high engagement ROI indicates that the resources allocated to engaging interested parties yield significant benefits, underscoring the necessity for CFOs to prioritize these efforts. Adjusting approaches based on feedback from interested parties not only cultivates stronger connections but also enhances the organization’s resilience during financial challenges. As Justin Lagac, Account Manager and Business Development Team Leader, notes, "Building and maintaining connections with interested parties is essential, and having the right tools ensures productive meetings."

Integrating real-time business analytics through a stakeholder management solution via a client dashboard can further support this process, enabling CFOs to continuously track the effectiveness of participant involvement and modify strategies as required. A notable example is the Beachside Beautification Project, where monitoring participant sentiment through communication software led to increased support for the initiative. Following an event, the council observed a 30% increase in visitors after dark, demonstrating the positive impact of effective participant engagement.

Ultimately, by leveraging efficient decision-making and real-time analytics, including insights from the client dashboard, financial leaders can ensure that their organizations remain agile and responsive to the needs of their constituents, thereby fostering sustainable growth.

Overcoming Challenges in Stakeholder Management

CFOs often face significant challenges in management, including conflicting interests, communication barriers, and resistance to change. They must also efficiently manage inventory levels and adapt to rapidly changing consumer behaviors, adding complexity to their roles. To effectively navigate these obstacles, it is essential to establish a stakeholder management solution, along with clear communication channels and set expectations from the outset.

A culture of transparency and inclusivity can markedly reduce resistance. For instance, when implementing financial adjustments, articulating a clear rationale and actively engaging interested parties in discussions can diminish pushback. Consistently seeking input and promptly addressing issues fosters trust and strengthens connections.

Data indicates that communication obstacles can profoundly impact relationships, leading to misunderstandings and diminished involvement. In 2025, as CFOs adapt to fluctuating market conditions and closely monitor company debt due to rising interest rates, overcoming these barriers will be crucial for effective engagement with stakeholders. Strategies such as holding regular meetings with involved parties and leveraging technology for real-time updates can enhance transparency and inclusivity—vital components of a stakeholder management solution that enable streamlined decision-making and continuous performance monitoring.

Moreover, addressing conflicting interests among parties necessitates a nuanced approach. Involving stakeholders in a stakeholder management solution can help align diverse interests and cultivate a sense of ownership during collaborative decision-making processes. Expert guidance suggests that CFOs should prioritize understanding the motivations and concerns of different parties to navigate these complexities successfully.

The application of real-time analytics through a stakeholder management solution, supported by the client dashboard from Transform Your Small/Medium Business, can enhance this process by providing insights into participant sentiments and business performance.

Case studies underscore the effectiveness of these approaches. For example, organizations that have embraced Environmental, Social, and Governance (ESG) reporting have witnessed positive outcomes by engaging stakeholders in discussions regarding the impacts of climate change. are increasingly evaluating the financial implications of climate change; while this strategy attracts responsible investors and bolsters brand reputation, it also demands extensive data collection and analysis, highlighting the importance of clear communication and stakeholder involvement.

As Jennifer Hemmerdinger noted, entrepreneurs anticipate a stronger economy in 2025, which may positively influence engagement strategies with stakeholders. In summary, overcoming challenges in managing stakeholders can be addressed through a stakeholder management solution that emphasizes proactive communication, transparency, and collaboration. By implementing these best practices, including operationalizing lessons learned and utilizing real-time analytics through the client dashboard, financial leaders can foster stronger connections with stakeholders, ultimately driving organizational success.

Best Practices for Effective Stakeholder Management

To enhance stakeholder management, CFOs must adopt several best practices:

- Prioritize Communication: Establishing open lines of communication with involved parties is essential for building trust and transparency. Effective communication promotes a collaborative atmosphere where participants feel appreciated and informed.

- Engage Early and Often: Involving participants in the decision-making process from the outset encourages collaboration and ensures that their insights are considered. This proactive approach can lead to more successful project outcomes.

- Tailor Participation Strategies: Customizing communication and involvement techniques based on the specific interests and influence of each participant is crucial. Customized approaches not only boost participation but also synchronize contributor expectations with organizational objectives. Companies such as Bentley and Rolls-Royce demonstrate that focused interaction strategies can yield organizational success.

- Observe and Adjust: Frequently evaluating the success of participant involvement initiatives enables financial leaders to pinpoint areas for enhancement. Employing real-time analytics via instruments such as client dashboards can provide insights into , allowing CFOs to make well-informed modifications. Being open to adjusting strategies according to feedback and performance metrics is essential for sustaining strong relationships with interested parties. The case study titled 'Measuring Involvement Effectiveness' highlights that companies that actively listen to their constituents perform 15% better in achieving their strategic plans, underscoring the importance of effective interaction.

- Foster Relationships: Establishing strong connections with interested parties through regular interactions and timely replies to their concerns is essential. Strong relationships can lead to increased support and collaboration, ultimately contributing to financial stability and growth. Implementing insights gained from previous interactions can further enhance these relationships.

Moreover, employing a reporting tool for interested parties, such as Simply Stakeholders, can streamline monitoring and reporting on engagement metrics, providing features like custom dashboards and mapping of involved entities.

By implementing these best practices, CFOs can establish that supports organizational objectives and enhances overall financial performance. As noted by the Project Management Institute (PMI), the project management team must manage and then influence the expectations of involved parties to ensure a successful project. Transform Your Small/ Medium Business emphasizes the importance of testing hypotheses and maintaining a shortened decision-making cycle to effectively navigate stakeholder management.

Conclusion

Effective stakeholder management is not merely a strategic advantage; it has evolved into an essential component of financial success for CFOs navigating the complexities of the modern business landscape. By identifying and engaging with key stakeholders—ranging from investors to employees—CFOs can align organizational goals with stakeholder interests, fostering trust and collaboration that ultimately enhances financial performance. The practices outlined in this article, such as stakeholder mapping, tailored engagement strategies, and continuous monitoring, serve as vital tools for CFOs aiming to drive sustainable growth amidst economic uncertainties.

As organizations confront challenges such as conflicting interests and rapid market changes, the significance of transparent communication and inclusivity cannot be overstated. By actively involving stakeholders in decision-making processes and addressing their concerns, CFOs can build stronger relationships that lead to increased support and successful project outcomes. Moreover, leveraging technology and real-time analytics ensures that CFOs remain agile, allowing for informed adjustments to engagement strategies based on stakeholder feedback.

In conclusion, prioritizing effective stakeholder management is crucial for CFOs striving for organizational resilience and success in 2025 and beyond. By adopting best practices such as early engagement, tailored communication, and ongoing adaptation, CFOs can not only enhance stakeholder satisfaction but also secure a competitive edge in an increasingly complex business environment. Embracing these strategies will pave the way for stronger financial performance and a thriving organization.

Frequently Asked Questions

What is a stakeholder management solution?

A stakeholder management solution is a strategic process for identifying, analyzing, and engaging with individuals or groups that have a vested interest in an organization's operations and outcomes.

Why is stakeholder management important for CFOs?

Stakeholder management is crucial for CFOs because stakeholders—such as investors, employees, customers, and suppliers—play a significant role in shaping financial strategies and enhancing financial performance, especially during financial uncertainty.

How should CFOs approach stakeholder engagement?

CFOs must prioritize understanding the unique needs and expectations of each stakeholder group to align financial objectives with their interests, driving sustainable growth and stabilizing the organization during challenging times.

What strategies should CFOs use to engage stakeholders effectively?

CFOs should employ a systematic approach, such as creating a participant map to categorize stakeholders based on their influence and interest levels, which helps prioritize engagement strategies and allocate resources efficiently.

How does Transform Your Small/Medium Business assist in stakeholder management?

Transform Your Small/Medium Business begins client engagements with a comprehensive business review to align key parties and understand the business situation beyond mere numbers, facilitating collaborative planning to address weaknesses.

What is the significance of continuous communication with stakeholders?

Continuous communication fosters a deeper understanding of the organization’s strategy and objectives, which is essential for navigating conflicting interests related to financial decisions such as debt levels, dividends, and mergers and acquisitions.

What role does real-time analytics play in stakeholder management?

Real-time analytics through a client dashboard allows CFOs to monitor participant sentiments and project outcomes continuously, enhancing decision-making processes and improving engagement.

What is the expected trend for CFOs regarding stakeholder engagement by 2025?

It is anticipated that over two-thirds of CFOs will seek growth strategies defined by fewer, more focused investments, highlighting the importance of strategic engagement with stakeholders.

What are the benefits of structured participant identification methods?

Organizations that utilize structured participant identification methods report higher success rates in project outcomes, indicating the effectiveness of these strategies in enhancing engagement and project efficiency.

What limitations should be considered in stakeholder management studies?

Limitations include a focus on private corporate building projects, which may not apply to public projects, and variances in project management practices between developed and developing economies.