Introduction

In the intricate landscape of business finance, effective cash flow management emerges as a cornerstone of organizational success. For small to medium enterprises, the stakes are particularly high; a misstep in cash flow can not only threaten operational stability but can also lead to insolvency. Understanding the dynamics of cash flow is not merely beneficial—it's essential for survival in a competitive marketplace.

With a staggering percentage of business failures attributed to poor cash management, the imperative for CFOs to adopt proactive strategies has never been clearer. This article delves into essential techniques, from leveraging technology to establishing strong relationships with clients and suppliers, that empower organizations to optimize their cash flow, make informed decisions, and ultimately thrive in an ever-evolving economic environment.

Understanding Cash Flow Management: A Key to Business Success

Financial management is a systematic method for overseeing and enhancing the net revenue received versus expenses incurred, a practice essential for the stability and growth of companies, particularly small to medium enterprises (SMEs). These organizations are particularly susceptible, as poor financial management can result in insolvency. Research indicates that inadequate financial management is a major cause of business failures, greatly affecting sustainability and profitability.

For example, the agriculture, forestry, fishing, and hunting sectors have the lowest failure rate after ten years at 49.5%, highlighting the necessity for efficient financial management in these industries. As Brian Sutter, Director of Marketing for Wasp Barcode Technologies, succinctly states, 'Cash issues are almost like death and taxes. You’re never going to escape them.'

This emphasizes the importance of prioritizing strategies for cash flow management in monetary planning. Additionally, the 'new Coke' fiasco acts as a warning regarding the consequences of insufficient market research and planning, which can negatively impact financial management. By cultivating a thorough comprehension of monetary movement dynamics and creating a strong operational strategy that incorporates strategies for cash flow management, market evaluation, and financial forecasts, enterprises can simplify decision-making processes and utilize real-time analytics through a client dashboard.

This proactive approach enables them to take decisive action to preserve their business, make informed strategic decisions that meet immediate obligations while seizing growth opportunities, and ensure long-term success in a competitive landscape.

Essential Strategies for Effective Cash Flow Management

Efficient financial management is essential for organizational resilience and necessitates a multi-dimensional strategy. Here are several key strategies for cash flow management that CFOs should prioritize, as outlined in 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' ($99.00):

-

Forecasting Financial Flow:

Regular financial flow forecasting is essential for anticipating potential shortfalls and surpluses.

By analyzing historical data alongside current market trends, businesses can project their future financial requirements with greater accuracy. Recent statistics reveal that 62% of executives deem real-time financial data vital for their company's survival, underscoring the necessity for precise forecasting.

-

Optimize Cash Conversion Cycle:

Streamlining operations to reduce the monetary conversion cycle is imperative. This entails employing strategies for cash flow management by efficiently managing inventory levels and enhancing accounts receivable collections to accelerate the conversion of inventory into cash. Insights from top consultants highlight that optimizing this cycle through strategies for cash flow management is essential for enhancing liquidity and overall organizational performance.

-

Streamlined Decision-Making:

Implementing a shortened decision-making cycle throughout the turnaround process allows teams to take decisive actions swiftly. This agility is vital in preserving organizational health during challenging times.

-

Real-Time Analytics:

Utilize client dashboards that provide real-time financial analytics to continuously monitor the success of financial strategies. This ongoing assessment enables CFOs to diagnose business health and adjust their strategies for cash flow management as necessary.

-

Maintain Liquidity:

It is vital to ensure adequate financial reserves to meet immediate operational needs. Establishing a line of credit can provide a valuable safety net during challenging periods, enabling organizations to apply strategies for cash flow management and navigate financial uncertainties effectively.

-

Regularly Review Expenses:

Conducting periodic reviews of expenses can reveal opportunities for cost reductions without sacrificing quality. Recognizing non-essential expenses can release funds that can be redirected towards strategies for cash flow management and more strategic investments.

-

Set Up Payment Terms:

Clearly defining payment terms with customers encourages timely payments and reduces outstanding receivables. This proactive approach not only enhances strategies for cash flow management but also strengthens customer relationships.

As Marc Huffman, CEO of BlackLine, states, "There is widespread acknowledgment that better visibility over monetary data, processes, and working capital, as well as effective strategies for cash flow management, is needed if organizations want to weather the storm."

-

Consider Generative AI Lessons:

CFOs should also be aware of the six generative AI lessons outlined by Ed Fitzpatrick and Dr. Alfred Sanders for 2025, which emphasize leveraging technology to enhance financial decision-making and forecasting accuracy.

-

Case Study on Debtor Financing:

Implementing debtor financing enables owners to access funds tied up in accounts receivable by selling unpaid invoices to a factoring company, thus avoiding the need for unsecured loans. This approach assists companies in steering clear of debt while enhancing liquidity.

As conversations regarding optimizing the ROI of talent occur on October 31, 2024, effective financial management will be a crucial subject for CFOs aiming to guide their organizations toward sustainable growth.

Leveraging Technology for Enhanced Cash Flow Management

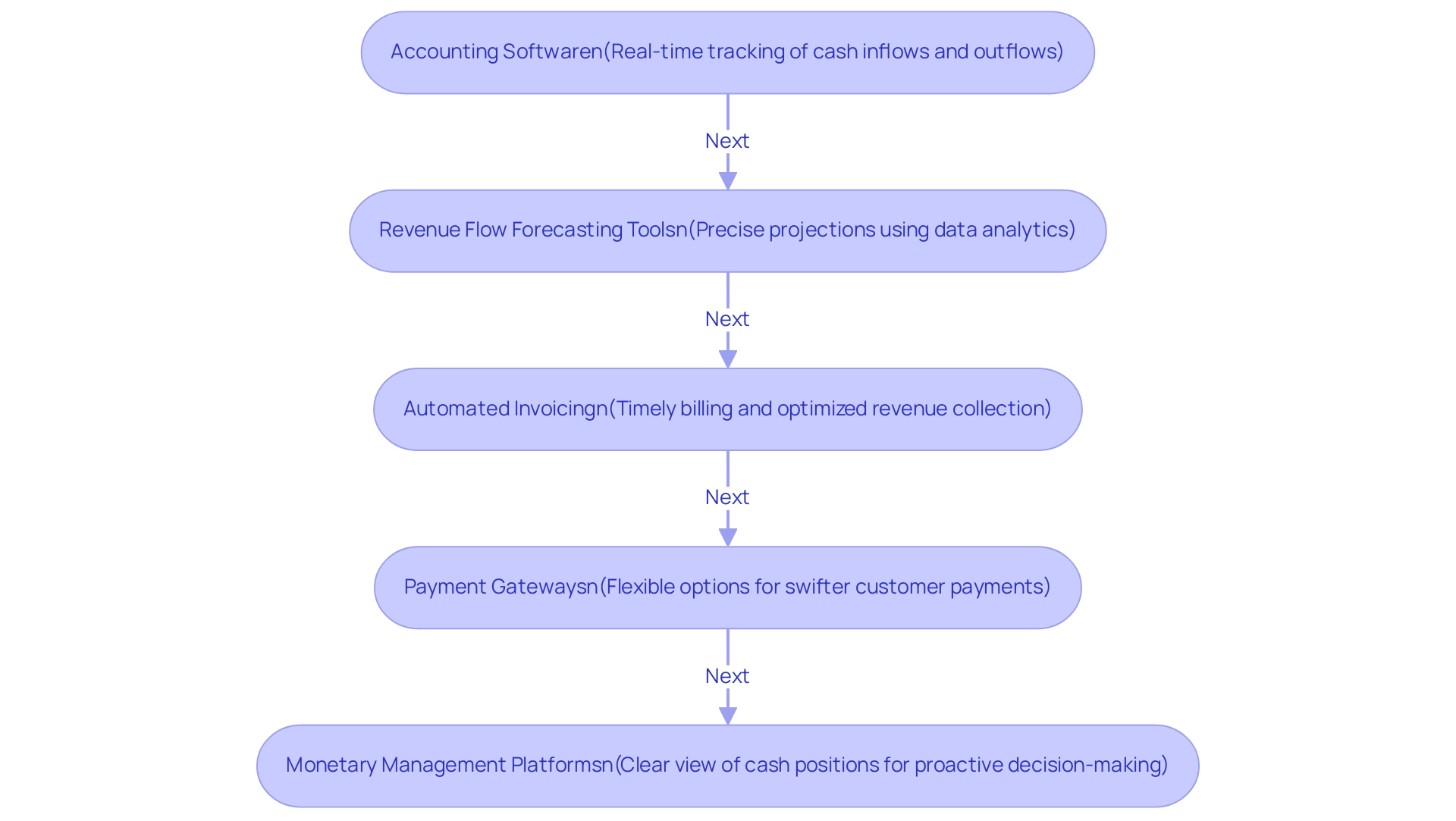

Technology is integral to optimizing strategies for cash flow management, enabling businesses to automate and streamline essential processes effectively.

- Accounting Software: Implementing sophisticated accounting software, such as QuickBooks or Xero, allows for real-time tracking of cash inflows and outflows.

These tools not only provide critical insights into financial health but also enhance overall financial management capabilities through effective strategies for cash flow management. Significantly, accounts payable software can lower expenses by $16 or more per invoice, rendering it a cost-efficient solution for enterprises.

- Revenue Flow Forecasting Tools: Leverage advanced revenue flow forecasting tools that utilize data analytics to deliver precise projections. This capability is essential for organizations to develop strategies for cash flow management, allowing them to anticipate fluctuations and prepare accordingly.

- Automated Invoicing: Automation technology significantly reduces the time required to issue invoices, ensuring timely billing and optimizing revenue collection cycles. This efficiency can lead to improved liquidity through effective strategies for cash flow management for the business.

- Payment Gateways: Integrate flexible payment gateways that accommodate various payment options, thereby facilitating swifter customer payments and enhancing revenue flow. It's crucial that these payment processes adhere to PCI-DSS compliance to ensure secure handling of payment information.

- Monetary Management Platforms: Utilize comprehensive monetary management platforms that provide a clear view of cash positions. This visibility enables proactive decision-making and the implementation of strategies for cash flow management in strategic budget planning. Furthermore, our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your organization.

This 'Decide & Execute' framework ensures that decisions are made quickly and effectively. We consistently track the success of our strategies and teams via our client dashboard, which offers real-time analytics to evaluate and improve your financial health. Furthermore, the cloud sector is anticipated to dominate the financial management market, as shown by case studies indicating that cloud-based financial management solutions provide low operational expenses, simplicity of implementation, scalability, and personalization.

By utilizing these technologies, companies can significantly enhance their financial management processes, aligning with the insights of prominent market entities such as Oracle (NetSuite), Sage Group Plc., Microsoft Corporation, Xero Ltd., and SAP SE, who are investing heavily in advanced technology and SaaS-based solutions. The ACCA indicates that over 50% of accounting executives foresee a transformative impact from automated and intelligent accounting systems over the next 30 years.

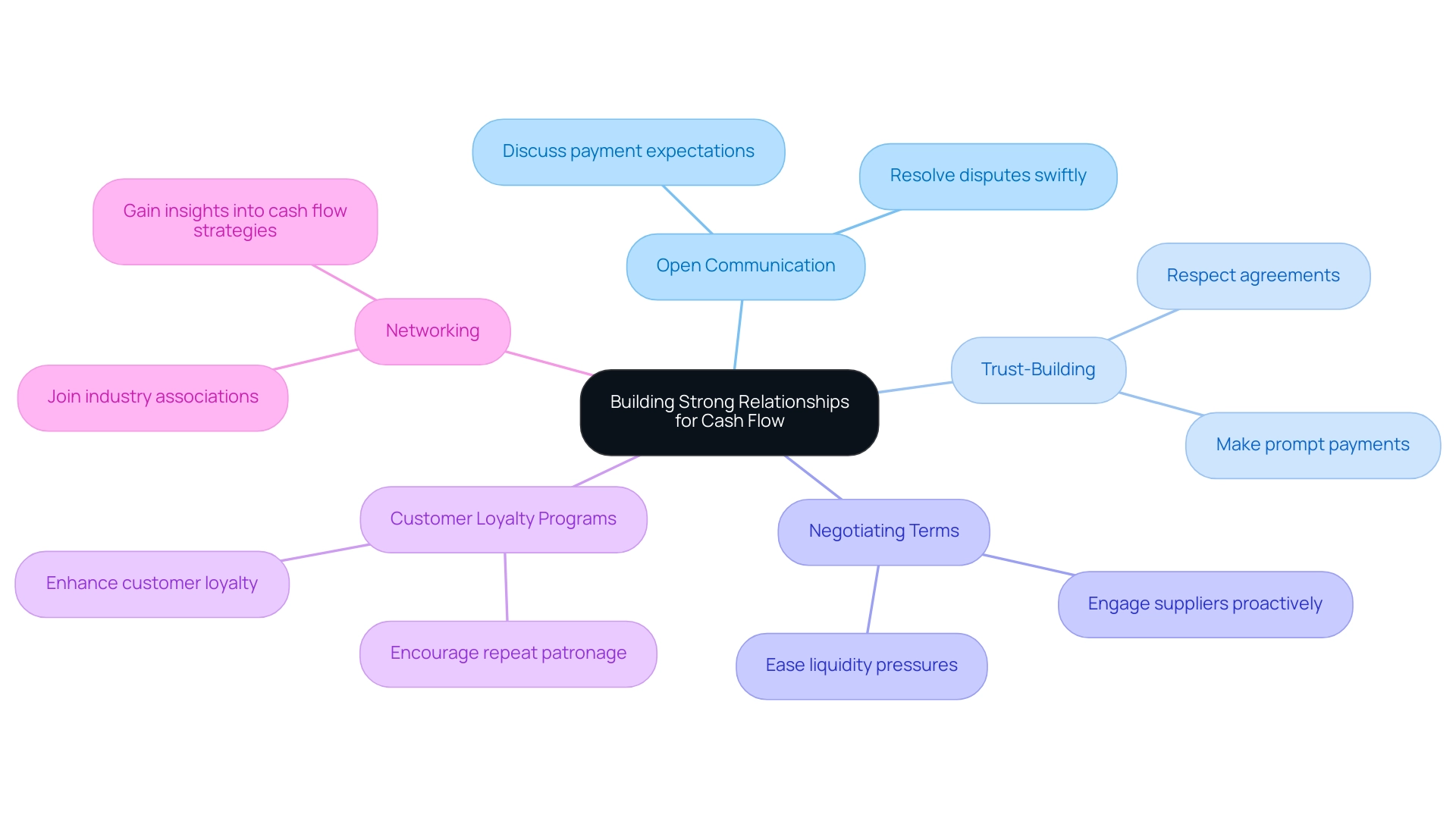

Building Strong Relationships to Improve Cash Flow

Robust connections with clients and vendors are vital for effective strategies for cash flow management, especially in today's rapid business landscape. As evidenced by Interac eTransfer's record of over 103 million transactions in October 2023, the significance of efficient payment processes cannot be overstated. Here are several actionable strategies that leverage streamlined decision-making and real-time analytics for optimal performance:

- Open Communication: Establishing clear lines of communication with clients is crucial. Discuss payment expectations transparently to resolve disputes swiftly, thereby sustaining a healthy financial situation and enabling prompt decision-making.

- Trust-Building: Fostering trust with suppliers by respecting agreements and making prompt payments can result in more advantageous terms and credit options, directly influencing financial movement positively and improving operational agility.

- Negotiating Terms: Proactively engage suppliers in discussions to negotiate improved payment terms. Such negotiations can ease liquidity pressures and improve financial flexibility, which supports the development of strategies for cash flow management.

- Customer Loyalty Programs: Implement loyalty programs that encourage repeat patronage and prompt payments. This method not only ensures a dependable revenue stream but also enhances customer loyalty, nurturing long-lasting connections that are essential for operational sustainability.

- Networking: Active involvement in industry associations can assist in establishing a strong network, offering support and valuable insights into strategies for cash flow management, which can be instrumental during turnaround situations.

To support these strategies, utilizing a client dashboard that provides real-time analytics can enhance continuous monitoring of organizational health, allowing for timely adjustments and informed decision-making. For instance, ActivTrak, an American SaaS company, transformed its revenue collection process by automating 85% of follow-up emails, achieving a Days Sales Outstanding (DSO) of just 23 days on net 30 payment terms. As noted by ActivTrak, "Fast forward two years, ActivTrak has not only won back countless hours for their finance team but also eliminated the need for an extra hire to oversee collections."

By fostering client and vendor relationships and utilizing real-time analytics, companies can establish a more stable financial environment, ultimately resulting in enhanced financial health. Moreover, comprehending the influence of age and income on payment habits can enhance financial strategies, guaranteeing that enterprises are prepared to address the varied requirements of their clientele.

Advanced Techniques for Cash Flow Optimization

To enhance liquidity management, CFOs should consider adopting the following advanced strategies:

- Dynamic Revenue Modeling: By utilizing dynamic modeling, companies can simulate a range of financial scenarios. This allows for better preparation against unexpected market changes and supports informed decision-making during financial uncertainty. Lior Ronen, Founder and CEO of Finro Financial Consulting, emphasizes that understanding these dynamics is crucial for maintaining liquidity. For example, a business with $100,000 in reserves and a burn rate of $20,000 monthly has a runway of five months, emphasizing the significance of financial management in maintaining operations.

- Proactive Debt Management: Regular assessments of debt levels and the creation of organized repayment strategies can significantly lower interest expenses, thereby enhancing liquidity. This proactive approach not only enhances financial flexibility but also mitigates risks associated with high debt levels.

- Inventory Management Techniques: Implementing just-in-time inventory systems minimizes the funds tied up in stock, ensuring that product availability aligns with demand without overextending resources. This technique effectively frees up capital for other necessary expenses.

- Liquidity Stress Testing: Performing stress evaluations offers understanding of how different external elements might affect financial movement. By identifying potential vulnerabilities, businesses can implement measures to mitigate risks, ensuring financial resilience in challenging times.

- External Financing Options: Exploring alternative financing sources, such as crowdfunding or peer-to-peer lending, can enhance liquidity without relying solely on traditional bank loans. This diversification of funding sources can be especially advantageous during restricted liquidity periods.

- Accounts Receivable Automation: Utilizing A/R automation solutions such as Gravity can enhance performance metrics by optimizing monetary processes. For instance, Gravity has shown its importance in enhancing revenue by assisting businesses in attaining economies of scale while preserving customer service quality.

By integrating these advanced techniques into their financial strategy, businesses can develop strategies for cash flow management and strengthen their overall financial position. Additionally, implementing a streamlined decision-making cycle and utilizing real-time analytics through client dashboards not only aids in monitoring the success of these strategies but also supports ongoing adjustments to ensure that CFOs can adapt swiftly to changing circumstances.

Conclusion

Effective cash flow management stands as a pivotal element for the success of small to medium enterprises. By understanding the intricacies of cash flow dynamics and implementing robust strategies, businesses can not only avert the pitfalls of insolvency but also position themselves for sustainable growth. The emphasis on:

- Forecasting

- Optimizing the cash conversion cycle

- Leveraging technology

underscores the necessity of proactive financial planning.

Furthermore, cultivating strong relationships with clients and suppliers enhances cash flow stability, creating a more resilient operational framework. By fostering open communication and negotiating favorable terms, organizations can improve their liquidity and financial flexibility. The incorporation of advanced techniques, such as:

- Dynamic cash flow modeling

- Proactive debt management

equips CFOs with the tools needed to navigate uncertainties and adapt to market changes.

In conclusion, prioritizing effective cash flow management is not just a strategic advantage; it is essential for survival in today’s competitive landscape. By embracing these practices, CFOs can ensure their organizations thrive, making informed decisions that lead to long-term success and operational resilience. Taking decisive action today will pave the way for a financially sound tomorrow.

Frequently Asked Questions

What is financial management and why is it important for SMEs?

Financial management is a systematic method for overseeing and enhancing net revenue against expenses. It is crucial for the stability and growth of companies, especially small to medium enterprises (SMEs), as poor financial management can lead to insolvency and is a major cause of business failures.

What industries are particularly affected by financial management practices?

The agriculture, forestry, fishing, and hunting sectors have a notably low failure rate after ten years (49.5%), indicating that efficient financial management is vital in these industries.

What is the significance of cash flow management in financial planning?

Cash flow management is essential for maintaining business operations and making informed strategic decisions. It allows enterprises to meet immediate obligations, seize growth opportunities, and ensure long-term success in a competitive landscape.

What are some key strategies for effective cash flow management?

Key strategies include: 1. Forecasting Financial Flow: Anticipating potential financial shortfalls and surpluses through historical data analysis. 2. Optimize Cash Conversion Cycle: Streamlining operations to enhance liquidity by managing inventory and accounts receivable. 3. Streamlined Decision-Making: Shortening decision-making cycles to act swiftly during challenging times. 4. Real-Time Analytics: Using client dashboards for continuous monitoring of financial strategies. 5. Maintain Liquidity: Ensuring adequate financial reserves and establishing lines of credit for emergencies. 6. Regularly Review Expenses: Identifying non-essential expenses for potential cost reductions. 7. Set Up Payment Terms: Defining clear payment terms to encourage timely payments from customers. 8. Consider Generative AI Lessons: Leveraging technology to improve financial decision-making and forecasting. 9. Case Study on Debtor Financing: Accessing funds tied up in accounts receivable by selling unpaid invoices to improve liquidity.

Why is regular financial flow forecasting important?

Regular financial flow forecasting helps businesses anticipate potential shortfalls and surpluses, allowing for more accurate future financial planning. Statistics show that 62% of executives consider real-time financial data vital for their company's survival.

How can organizations maintain liquidity?

Organizations can maintain liquidity by ensuring they have adequate financial reserves and establishing a line of credit, which provides a safety net during challenging periods.

What role does technology play in financial management?

Technology, particularly generative AI, can enhance financial decision-making and improve forecasting accuracy, making it a valuable tool for CFOs in managing financial strategies.

How can debtor financing benefit a company?

Debtor financing allows companies to access funds tied up in accounts receivable by selling unpaid invoices to a factoring company, helping to avoid unsecured loans and enhancing liquidity.