Overview

Best practices for turnaround management in practice require a comprehensive assessment, clear recovery strategies, stakeholder engagement, and continuous monitoring. These elements are essential for effectively navigating organizational crises and achieving sustainable growth.

Successful turnaround efforts are underpinned by:

- Transparent communication

- Targeted financial assessments

- The integration of technology

Collectively, these strategies empower organizations to address underlying issues and foster resilience during challenging times.

Introduction

In the dynamic landscape of modern business, the ability to adapt and recover from financial distress is more crucial than ever. Turnaround management emerges as a lifeline for organizations facing significant challenges, offering a structured approach to restore profitability and operational efficiency. This strategic process not only addresses immediate issues but also paves the way for sustainable growth by fostering a culture of accountability and engagement among employees.

As businesses grapple with common obstacles such as cash flow problems and market volatility, understanding the intricacies of effective turnaround strategies becomes paramount. This article delves into the essential elements of turnaround management, exploring:

- Best practices

- The role of technology

- Real-world case studies that highlight successful transformations

Through a comprehensive examination of these strategies, organizations can equip themselves with the tools needed to navigate crises and emerge stronger in an ever-evolving marketplace.

Understanding Turnaround Management: Definition and Importance

Turnaround management in der praxis represents a strategic initiative aimed at transforming struggling organizations into profitable entities through meticulous planning and execution. This multifaceted approach encompasses diagnosing underlying issues, implementing targeted solutions, and restoring economic health. The significance of turnaround management in der praxis is profound; it serves as a vital lifeline for companies grappling with financial difficulties, empowering them to confront challenges and enhance resilience.

In 2025, the importance of efficient recovery oversight is underscored by the imperative for organizations to adapt swiftly to changing market conditions. Statistics reveal that with top-down strategies, only 20% of the workforce comprehends the changes they face, whereas open-source communication boosts this understanding to 54%. This underscores the necessity of transparent communication during the change process, fostering a culture of engagement and collaboration.

Moreover, effective turnaround management in der praxis addresses not only urgent monetary concerns but also lays a robust foundation for sustainable development and operational effectiveness. A thorough financial assessment can pinpoint opportunities to preserve cash and reduce liabilities, which is essential for stabilizing financial positions. High employee turnover can significantly impact both finances and morale, with studies indicating that turnover rates correlate with a 28% decrease in employee morale.

The costs associated with replacing an employee can range from 50% to 200% of their annual salary, averaging around $15,000 per employee. Retaining talent during a transition presents an opportunity to cultivate stronger, more resilient teams, ultimately enhancing organizational performance.

As Dmitry Saprykin aptly states, "First impressions are everything. That's why it's important to have the proper plan and employee development training in place to maximize employees' potentials." This highlights the essential role of employee development in recovery strategies.

The 'Rapid30' plan exemplifies a hands-on approach to turnaround management in der praxis, enabling businesses to swiftly identify issues and implement effective solutions. Furthermore, Transform Your Small/Medium Business offers temporary oversight services and bankruptcy case coordination, ensuring comprehensive assistance throughout the recovery process. Case studies illustrate the efficacy of recovery strategies.

Companies that have successfully navigated financial distress frequently report improved financial health and operational performance as a direct result of turnaround management in der praxis. Therefore, recovery management is not merely a reactive approach; it is a proactive strategy crucial for the survival and growth of struggling enterprises.

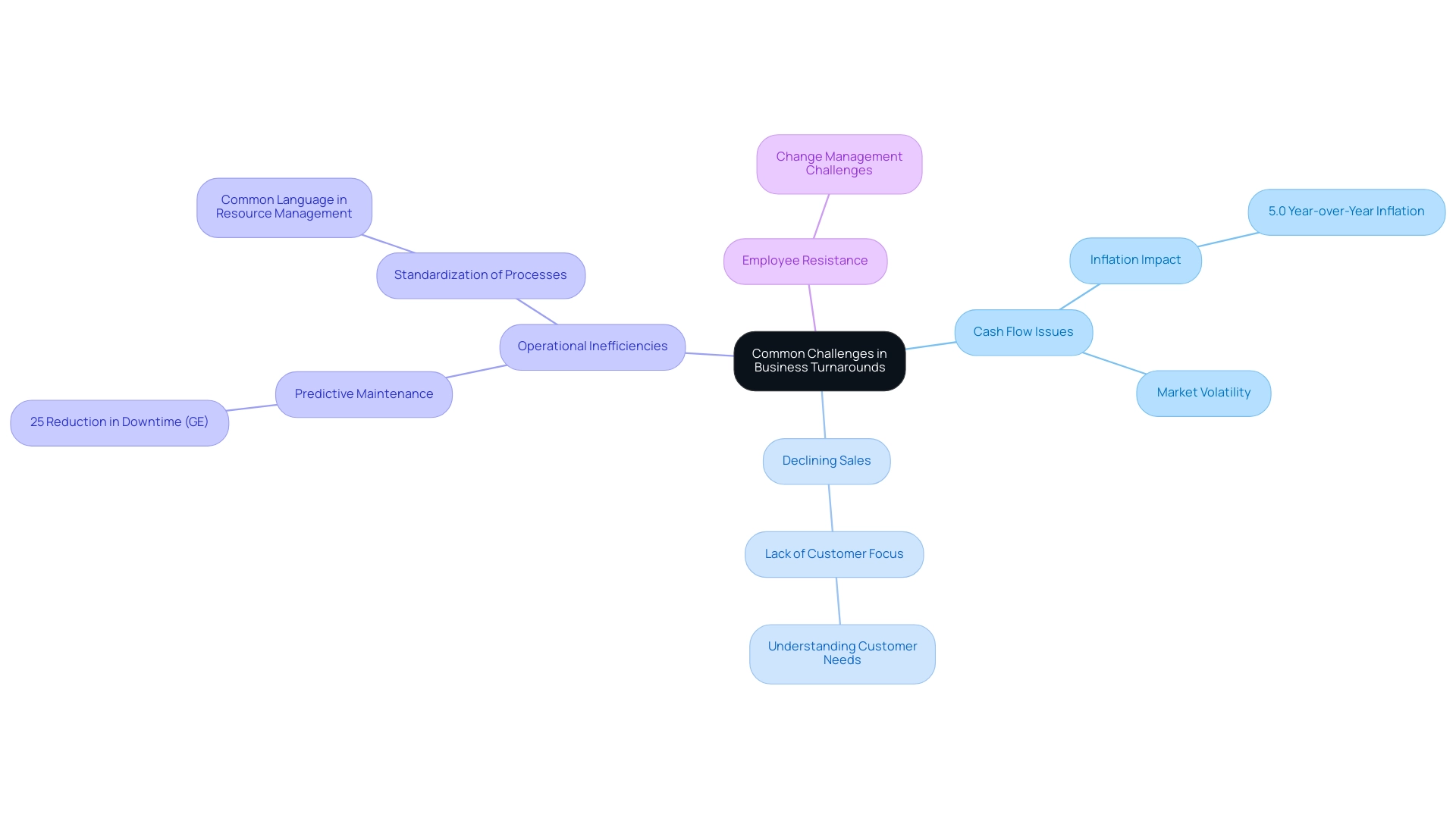

Identifying Common Challenges in Business Turnarounds

Businesses navigating turnaround management in der praxis frequently encounter a range of significant challenges, including cash flow issues, declining sales, operational inefficiencies, and employee resistance to change. In 2025, cash flow problems remain a critical concern, with many organizations reporting that over 60% of struggling businesses cite cash flow as a primary obstacle to recovery. This issue is further exacerbated by inflation, reported at 5.0% year over year during March 2023, impacting the financial stability of many companies.

External factors, such as market volatility and regulatory pressures, complicate these challenges, making it essential for leaders to recognize and address them promptly. Identifying these common obstacles early in turnaround management in der praxis is crucial for the recovery process. By doing so, leaders can develop targeted strategies that tackle the root causes of distress rather than merely addressing superficial symptoms. For instance, a case study on customer focus highlights that companies lacking clarity about their customer base often face significant setbacks.

Aligning operations with customer needs not only reduces risks but also improves overall organizational performance. This is especially pertinent as companies must ensure they are meeting the evolving demands of their customers to avoid pitfalls. Moreover, expert insights reveal that standardizing processes and creating a common language around resource and labor management can significantly improve communication and efficiency during transitions. This approach fosters a collaborative environment, enabling teams to work more effectively towards shared goals. Our team at Transform Your Small/Medium Organization supports a shortened decision-making cycle throughout the recovery process, allowing your entity to take decisive action to preserve organizational health.

For instance, General Electric (GE) applied predictive maintenance throughout its manufacturing plants and noted a 25% decrease in equipment-related downtime, highlighting the advantages of operational efficiency. Furthermore, we consistently track the success of our plans and teams via a client dashboard that offers real-time analytics, allowing proactive adjustments and implementing lessons learned. This dashboard is essential for testing hypotheses and ensuring that strategies are effective. In summary, proactive acknowledgment of these challenges provides organizations with the tools necessary for effective turnaround management in der praxis, ultimately paving the way for sustainable growth and resurgence.

The primary objective of these services is to assist businesses in overcoming obstacles and attaining sustainable growth, which underscores the importance of turnaround management in der praxis for effective recovery strategies.

Strategic Approaches to Effective Turnaround Management

Effective turnaround management necessitates a systematic approach that encompasses several critical strategies:

- Comprehensive Assessment: Begin with a detailed evaluation of the organization's financial and operational health. This step is crucial, laying the groundwork for understanding the severity of the crisis and management's awareness of the situation, often categorized through cluster analysis.

- Clear Recovery Strategy: Develop a clear and actionable recovery plan that delineates specific goals and timelines. Research indicates that budgets for maintenance are typically approved 1.5 years prior to implementation, emphasizing the need for foresight in planning.

- Stakeholder Engagement: Actively engage stakeholders, including employees and investors, to cultivate buy-in and support. This collaborative method is essential for fostering a unified direction during the recovery process.

- Cost-Cutting and Revenue Growth: Implement strategic cost-cutting measures while simultaneously identifying avenues for revenue growth. This dual focus can stabilize the organization financially while positioning it for future success.

- Continuous Monitoring and Adjustment: Regularly monitor progress through real-time analytics provided by the client dashboard from Transform Your Small/ Medium Business, and be prepared to adjust strategies as necessary. The most agreed-upon initial step in a recovery process is situation analysis, with 47.6% of experts advocating for its importance, while changing top management is often viewed as a lower priority (4.1%). As Guillaume Coiraton noted, "The significance of maintenance to plant safety and uptime has insulated it to some extent from normal reengineering and budgeting efforts," highlighting the critical nature of this phase. This ongoing performance monitoring not only facilitates timely adjustments but also fosters strong relationships by implementing lessons learned throughout the recovery process.

By following these strategic methods, companies can enhance their turnaround management in der praxis to navigate the complexities of recovery processes with increased confidence and clarity. Case studies, such as those highlighting the impact of emerging technologies like AI and blockchain in corporate restructuring, demonstrate how these innovations can optimize operational excellence and strategy development, further reinforcing the effectiveness of a well-structured recovery plan. For a comprehensive guide on mastering the cash conversion cycle, consider our offering at $99.00.

The Role of Financial Assessment in Turnaround Strategies

A comprehensive fiscal assessment is fundamental to effective turnaround management in der praxis. This process entails a meticulous analysis of essential economic metrics, including cash flow, profitability, and debt levels, to pinpoint areas of concern and identify opportunities for enhancement. By conducting a thorough monetary assessment, companies can uncover concealed obligations, assess their liquidity status, and prioritize measures that will protect cash and enhance economic stability.

Such evaluations not only direct the development of the recovery strategy but also set a standard for monitoring progress throughout the recovery process.

Key economic metrics, such as the Current Ratio—dividing total assets by liabilities—offer insights into an organization's solvency and its ability to consistently meet monetary obligations. This metric is crucial for maintaining a credit rating that supports growth and expansion. Additionally, the Accounts Receivable Turnover ratio, calculated by dividing total sales by average accounts receivable, reflects the efficiency of collecting payments from customers, further informing the financial health of the organization.

In 2025, the significance of financial reviews in turnaround management in der praxis for business recoveries cannot be overstated. They serve as a vital tool for identifying underlying issues and initiating changes relevant to turnaround management in der praxis. Successful recovery strategies are often built on qualitative data from seasoned practitioners, emphasizing the need for tailored strategies, effective execution, and agile decision-making.

Utilizing AI and ML technologies can streamline decision-making processes and enhance real-time analytics, allowing CFOs to monitor performance continuously and operationalize lessons learned. As Howard Schultz pointed out, after addressing underperforming stores and reworking its growth, he aims to lead Starbucks back to its glorious youth, demonstrating the potential for revitalization through strategic oversight. Moreover, promoting accountability and ownership among team members is vital; celebrating achievements can boost morale and propel the recovery process forward.

To assist your recovery efforts, consider our Business Valuation Report, available for $3,500.00, which offers expert guidance from Peter Griscom, M.S., David Bates, CFP, CPA, and Chase Hudson, MBA, Lean Six Sigma Black Belt. For more information, visit SMBdistress.com.

Leveraging Interim Management for Successful Turnarounds

Temporary leadership is crucial for accomplishing successful recoveries, particularly during periods of crisis. By providing experienced leadership, interim managers bring specialized skills and an objective viewpoint that enables organizations to implement necessary changes swiftly and effectively. Their ability to focus on executing the recovery plan allows them to sidestep the distractions often associated with existing organizational politics and long-term commitments.

The benefits of turnaround management in der praxis during interim situations are significant. For instance, organizations that engage interim managers can stabilize operations and return to profitability more rapidly, often with a more resilient model. This approach not only preserves cash flow but also reduces liabilities, positioning the organization for sustainable growth.

As stated by SierraConstellation Partners, "We’ll assist in stabilizing the company and restoring it to profitability with a more resilient model or prepare it for a sale for the best outcome."

A compelling testimonial from a satisfied client illustrates this process: "My company was in a challenging situation. I was referred to the SMB team, and we were quickly impressed with their knowledge, experience, and innovative approach. Within a week, the SMB team had diagnosed several issues in my company and created an easy-to-understand 'Rapid30' plan.

Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years, which highlights the transformative impact of turnaround management in der praxis on family business growth and customer focus through effective support.

Moreover, the cost-effectiveness of interim oversight is noteworthy. For example, hiring an interim Chief Restructuring Officer (CRO) for eight months can cost approximately $150,000 less than recruiting a full-time CRO, demonstrating the financial advantages of this approach. This statistic reinforces the overall theme of how interim management can provide significant cost savings while fostering successful transformations.

In summary, turnaround management in der praxis illustrates the crucial role of interim managers in driving change during crises, helping teams view challenges as opportunities for innovation and growth. Their expertise not only stabilizes the organization but also fosters an environment conducive to transformation, ultimately leading to improved outcomes in both the short and long term. With the backing of the SMB team, companies can utilize real-time analytics and implement lessons learned to ensure ongoing performance monitoring and relationship-building throughout the recovery process.

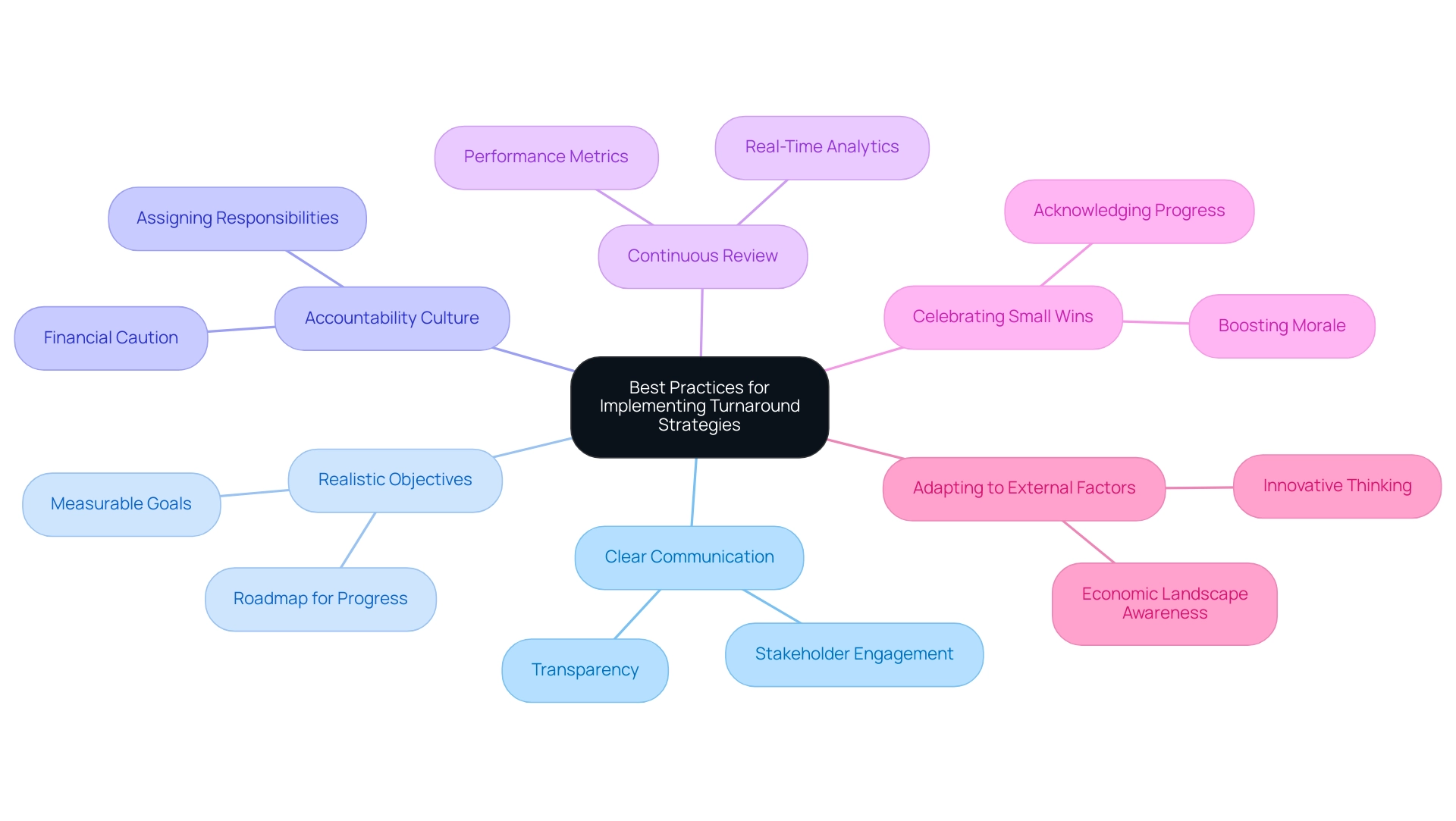

Best Practices for Implementing Turnaround Strategies

Implementing turnaround management in der praxis effectively hinges on several best practices that can significantly enhance the likelihood of success. First and foremost, establishing clear communication channels is essential to keep all stakeholders informed and engaged throughout the process. This transparency fosters trust and collaboration, which are critical during challenging times.

Establishing realistic and measurable objectives is another cornerstone of effective turnaround management in der praxis. These goals not only provide a roadmap for progress but also enable teams to track their achievements and make necessary adjustments. A statistical analysis revealed that 70.4% of companies faced critical situations requiring extraordinary measures between 2010 and 2016, underscoring the need for precise goal-setting in times of crisis.

Furthermore, external factors such as GDP reduction have been shown to negatively impact strategic planning and turnover, highlighting the importance of adapting goals to the current economic landscape.

Fostering a culture of accountability is equally important. By assigning specific responsibilities to team members, organizations can ensure that everyone is aligned with the recovery objectives and understands their role in achieving them. As one expert noted, "Whatever the size of your business I can tell you this; you can always cut costs."

This viewpoint emphasizes the necessity for financial caution during recovery efforts. Consistently reviewing and adjusting the action plan based on performance metrics and feedback is essential for sustaining momentum and tackling emerging challenges in turnaround management in der praxis. The use of real-time analytics, as highlighted in Transform Your Small/ Medium Enterprise's approach, allows for continual diagnosis of organizational health, ensuring that decisions are data-driven and timely.

Moreover, celebrating small wins can significantly boost morale and motivation among employees. Acknowledging progress, regardless of how small, aids in maintaining enthusiasm and dedication to the improvement efforts. Incorporating a pragmatic approach to testing hypotheses ensures that strategies are effective and aligned with the business's evolving needs.

Integrating these best practices not only establishes a structured and supportive environment but also improves communication strategies, which are essential for successful turnaround management in der praxis. As demonstrated by various case studies, effective communication can lead to higher success rates in recovery initiatives, reinforcing the importance of accountability and engagement in achieving sustainable growth. Additionally, the connection between recovery strategy and the entrepreneurial process necessitates innovative thinking, which can be a game-changer in navigating crises.

In the context of Transform Your Small/ Medium Business, the phases of 'Decide & Execute' and 'Update & Adjust' are integral to operationalizing lessons learned and developing strong relationships throughout the recovery process.

Harnessing Technology for Enhanced Turnaround Management

In the current digital landscape, the integration of technology is paramount for the successful management of change. Businesses can utilize advanced data analytics and financial modeling software to extract valuable insights from their operations, enabling informed decisions that drive recovery. The influence of technology on success in recovery is underscored by the increasing demand for digitally enabled roles, with approximately 4 million positions expected to arise, including e-commerce and digital transformation specialists.

This shift emphasizes the necessity for organizations to adapt and leverage technology effectively.

Moreover, the rise of omnichannel shopping—where 77.4% of consumers engage across multiple platforms—demonstrates the importance of a cohesive strategy that enhances brand perception and loyalty. As noted by IDC, omnichannel shoppers spend 15-30% more than single-channel shoppers, significantly boosting brand perception and loyalty. Companies that embrace technology not only enhance operational efficiency but also promote better communication across teams, ultimately resulting in more favorable outcomes in turnaround management.

To optimize performance, mastering the cash conversion cycle is essential. This involves implementing strategies that enhance decision-making processes and operationalize lessons learned from past experiences. Continuous performance monitoring through real-time analytics allows organizations to test hypotheses and make quick decisions, ensuring they can pivot effectively in response to market changes.

Case studies from the technology sector illustrate that the credibility of management teams, particularly the CEO and CFO, is crucial during challenging times. Successful recoveries rely on their capacity to concentrate on essential company fundamentals while still investing in innovation. By leveraging technology, businesses can navigate crises more effectively, ensuring sustainable growth and resilience in the face of adversity.

Case Studies: Successful Turnarounds in Practice

Analyzing successful turnaround case studies reveals critical insights into effective strategies that can be implemented in times of crisis. A notable example involves a prominent retail chain that faced severe economic challenges stemming from declining sales and heightened competition. Through a meticulous fiscal assessment, the company pinpointed essential areas for cost reduction, which led to the execution of a strategic plan.

This plan involved renegotiating supplier agreements and enhancing inventory management, leading to a significant improvement. Within just two years, the company not only stabilized its finances but also achieved profitability.

The experiences of other well-known companies, such as Apple and LEGO, further illustrate the power of decisive action and strategic clarity. For instance, during its financial crisis, Marvel's stock plummeted to $0.96 per share, prompting significant workforce reductions to 250 employees. However, through a focused recovery strategy, Marvel managed to recover and thrive, showcasing the potential for businesses to rebound from adversity.

Recent insights from industry leaders emphasize the necessity of a proactive approach to turnaround management in der praxis. J.C. Penney's CEO, Jill Soltau, highlighted the urgency of improving profits and cash flow, which recently turned positive, despite the company's leveraged balance sheet limiting reinvestment capabilities. Dennis Cantalupo, President of Pulse Ratings, noted that "their balance sheet is leveraged, so they have that strike against them, and their cash flow just turned positive."

This underscores the importance of tailored strategies that address specific financial challenges.

A transformative experience can also be observed through the SMB team's 'Rapid30' plan, which has been instrumental in assisting organizations navigate their challenges. One client shared, "Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years." This emphasizes the effectiveness of the SMB team's strategy, which merges streamlined decision-making and real-time analytics to continuously monitor performance and operationalize lessons learned.

Ultimately, these case studies and expert insights reinforce the notion that with a comprehensive financial assessment and a commitment to turnaround management in der praxis, businesses can navigate through crises and emerge stronger, ready to seize new opportunities for growth. Transform Your Small/Medium Business emphasizes the importance of testing hypotheses and operationalizing lessons learned as part of their management strategy.

Sustaining Success: Long-Term Strategies Post-Turnaround

Maintaining success after a transformation hinges on an unwavering commitment to continuous improvement and strategic planning. Organizations must prioritize the establishment of robust operational processes while fostering a culture of innovation that encourages adaptability. At Transform Your Small/ Medium Enterprise, we identify underlying organizational issues and collaborate to create a plan that mitigates weaknesses, empowering the entity to reinvest in key strengths.

We offer an extensive array of services, including interim management and financial evaluation, to assist organizations in their recovery efforts. Developing a vision and roadmap for both short-term and long-term objectives is crucial for leaders, as it provides direction and clarity in overcoming challenges. Regularly reviewing performance metrics is essential for pinpointing areas ripe for enhancement, ensuring that the organization remains agile in a dynamic market landscape.

Engaging employees in the ongoing improvement process not only boosts morale but also reinforces their commitment to the organization's objectives. By focusing on long-term strategies, businesses can effectively mitigate the risk of future crises and position themselves for sustained growth and success. Notably, turnaround acquisitions currently account for approximately half of all M&A deals, a trend expected to rise during economic downturns, underscoring the importance of strategic foresight in navigating challenges.

Moreover, emerging technologies like AI and blockchain are revolutionizing corporate restructuring, optimizing operational excellence and strategy development. Our pragmatic approach to data ensures that we test every hypothesis to deliver maximum return on invested capital in both the short and long term. Case studies reveal that organizations employing turnaround management in practice and implementing continuous improvement practices post-turnaround experience significantly higher success rates, reinforcing the necessity of these strategies for long-term viability.

As Hen Lotan, a principal in the field, emphasizes, 'The key to thriving post-turnaround lies in not just recovering but continuously evolving to meet market demands.

Conclusion

In the intricate realm of turnaround management, effectively navigating financial distress is paramount for achieving long-term success. This article has underscored the essential components of successful turnaround strategies, highlighting the significance of comprehensive financial assessments, proactive identification of challenges, and the implementation of best practices. By embracing a systematic approach that prioritizes stakeholder engagement and leverages technology, organizations can not only tackle immediate issues but also establish a foundation for sustainable growth.

The case studies presented exemplify how businesses can emerge from crises with enhanced strength and resilience. Companies such as Marvel and the retail chain discussed illustrate that through decisive action, strategic clarity, and a focus on operational efficiency, recovery is not merely feasible but can also lead to renewed profitability and market competitiveness. Furthermore, the role of interim management has been emphasized as a vital asset in driving change and stabilizing operations during turbulent times.

Ultimately, the journey does not conclude with recovery. Sustaining success post-turnaround necessitates a commitment to continuous improvement and innovation. By cultivating a culture that embraces adaptability and regularly reviews performance metrics, organizations can mitigate risks and position themselves for future opportunities. As the business landscape continues to evolve, the insights shared in this article serve as an invaluable resource for leaders striving to navigate the challenges of turnaround management and secure a prosperous future for their organizations.

Frequently Asked Questions

What is turnaround management in der praxis?

Turnaround management in der praxis is a strategic initiative aimed at transforming struggling organizations into profitable entities through meticulous planning and execution, addressing underlying issues, implementing targeted solutions, and restoring economic health.

Why is turnaround management significant for organizations?

It serves as a vital lifeline for companies facing financial difficulties, empowering them to confront challenges, enhance resilience, and lay a robust foundation for sustainable development and operational effectiveness.

What are some common challenges faced during turnaround management?

Common challenges include cash flow issues, declining sales, operational inefficiencies, and employee resistance to change, with cash flow problems being cited as a primary obstacle by over 60% of struggling businesses.

How does effective communication impact turnaround management?

Transparent communication during the change process fosters a culture of engagement and collaboration, improving understanding of changes among the workforce from 20% to 54%.

What is the importance of employee retention in turnaround management?

Retaining talent during a transition can cultivate stronger, more resilient teams, which enhances organizational performance. High employee turnover can lead to a 28% decrease in morale and significant costs associated with replacing employees.

What strategies are essential for effective turnaround management?

Key strategies include comprehensive assessment, clear recovery strategy, stakeholder engagement, cost-cutting and revenue growth, and continuous monitoring and adjustment.

How can organizations monitor their recovery process?

Organizations can use real-time analytics provided by a client dashboard to track progress, make timely adjustments, and implement lessons learned throughout the recovery process.

What role does employee development play in turnaround management?

Employee development is crucial for maximizing employees' potentials and ensuring they are equipped to support the recovery strategies effectively.

Can you provide an example of a successful turnaround management strategy?

The 'Rapid30' plan exemplifies a hands-on approach that enables businesses to swiftly identify issues and implement effective solutions, leading to improved financial health and operational performance.

How does turnaround management contribute to sustainable growth?

By addressing immediate financial concerns and establishing a framework for ongoing operational effectiveness, turnaround management helps pave the way for sustainable growth and resurgence in struggling enterprises.