Overview

Best practices for turnaround management strategies for CFOs encompass:

- Conducting thorough assessments

- Developing comprehensive action plans

- Fostering stakeholder engagement to ensure successful recovery

This approach not only highlights the importance of leveraging data-driven methodologies but also underscores the necessity of maintaining open communication. Such practices significantly enhance the likelihood of achieving sustainable growth and effectively overcoming challenges faced by struggling organizations. By implementing these strategies, CFOs can navigate the complexities of financial recovery with confidence and authority.

Introduction

In the dynamic realm of business, organizations frequently encounter formidable challenges that jeopardize their viability and growth. Turnaround management stands out as a crucial strategic framework, meticulously designed to revitalize struggling companies through a series of deliberate actions aimed at stabilizing operations and addressing fundamental issues. This comprehensive approach not only concentrates on immediate recovery but also underscores the significance of data-driven strategies, stakeholder engagement, and continuous performance monitoring. As CFOs navigate the complexities of financial recovery, grasping the essential components of turnaround management is vital for fostering sustainable growth and securing long-term success. Through insightful analysis and practical frameworks, this article explores the intricacies of effective turnaround management, providing invaluable guidance for organizations ready to transform adversity into opportunity.

Understanding Turnaround Management: A Comprehensive Overview

Turnaround management strategies serve as a strategic framework aimed at revitalizing enterprises facing significant challenges. This approach encompasses a series of deliberate actions designed to stabilize the company, address underlying issues, and implement transformative changes that enhance performance. Key components of effective turnaround management strategies include:

- A thorough assessment of the current business state

- Identification of root causes contributing to decline

- The formulation of a comprehensive action plan aimed at restoring profitability

Recent trends indicate that organizations utilizing data-driven strategies achieve 23% greater profitability, underscoring the importance of leveraging analytics in recovery efforts. Transform Your Small/Medium Business is committed to applying lessons learned through the recovery process, ensuring that businesses can continuously monitor their performance via our client dashboard, which provides real-time business analytics. This capability allows for timely adjustments and informed decision-making.

Moreover, addressing common pitfalls—such as lack of management support, outdated processes, and poor communication—can significantly strengthen change management initiatives. Research reveals that approximately 70% of change initiatives fail to meet their objectives, primarily due to employee resistance. As noted by Hen Lotan, principal at Boston Consulting Group, "Still, only about 1 in 4 turnaround programs leads to long-term improvements in performance."

This highlights the critical need for entities to proactively address these challenges, as evidenced by the case study titled 'Pitfalls to Avoid in Change Management,' which illustrates how many change initiatives falter due to these common pitfalls. By tackling these issues, entities can build a robust foundation for successful change, ultimately improving overall effectiveness and employee engagement.

For CFOs, grasping these fundamentals is essential as they navigate the complexities of financial recovery and operational restructuring. The influence of turnaround management strategies on business performance cannot be overstated; they not only help stabilize struggling organizations but also position them for sustainable growth in the long term. As the landscape of recovery management evolves, staying informed about current best practices and success rates will be crucial for driving impactful change.

The Role of Strategic Planning in Successful Turnarounds

Strategic planning is fundamental to the success of any recovery initiative, underpinning effective decision-making and resource allocation in turnaround management strategies. It begins with the establishment of clear objectives and the identification of key performance indicators (KPIs) that will guide progress and measure success. For CFOs, engaging in scenario planning is crucial; it enables entities to foresee potential challenges and create contingency plans that can be activated when necessary.

This proactive approach not only aids in navigating uncertainties but also cultivates a culture of accountability and transparency throughout the organization. It emphasizes the importance of turnaround management strategies in addressing the 71.2% of businesses that cite liquidity and cash flow issues as significant internal challenges. By prioritizing thorough financial assessments, CFOs can identify opportunities to implement turnaround management strategies that preserve cash and reduce liabilities, ensuring that their recovery efforts remain focused and adaptable to evolving circumstances. Additionally, Gartner observes that 58% of entities believe their performance assessment systems are inadequate for tracking the effectiveness of plans, highlighting the difficulties CFOs encounter in efficient strategic planning.

Moreover, nearly a fourth of organizations assess their plans' executions merely once annually, underscoring the significance of ongoing evaluation in tactical planning. Case studies, such as the analysis of stakeholder influence on recovery approaches in small and medium enterprises, demonstrate the positive relationship between effective leadership changes and successful turnaround management strategies. This emphasizes the significance of informed decision-making during the recovery process, ultimately resulting in enhanced performance and sustainable growth.

Our extensive consulting services for restructuring at Transform Your Small/Medium Business—including temporary leadership and operational efficiency strategies—are designed to assist companies in overcoming challenges and attaining sustainable growth through strategic planning, ongoing performance monitoring, and real-time analytics.

Key Steps in the Turnaround Management Process

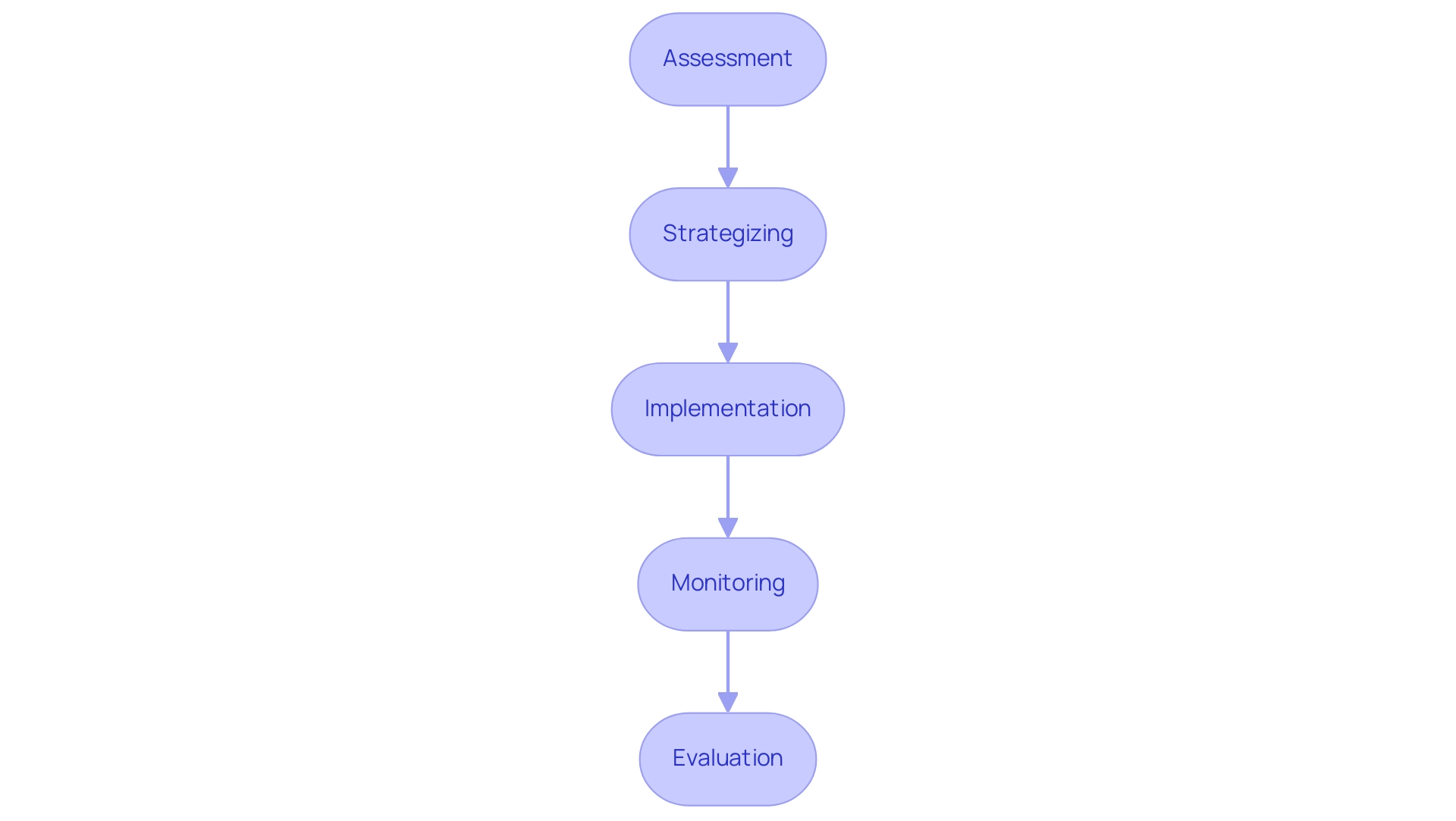

The turnaround management process represents a structured approach that encompasses several critical steps, each meticulously designed to facilitate recovery and growth within an organization:

- Assessment - This initial phase involves a detailed analysis of the organization's financial health and operational performance. CFOs should utilize quantitative metrics and qualitative insights to identify weaknesses and opportunities for improvement. Notably, research indicates that 40% of employees rank managers as the group that has the most impact on recognition, highlighting the importance of effective leadership during this phase. Moreover, gathering employee insights is crucial; a questionnaire administered to 240 employees across 30 enterprises in Ogun State, Nigeria, underscores the value of understanding employee perspectives.

- Strategizing - Following the assessment, a comprehensive recovery plan must be developed. This plan should utilize turnaround management strategies to not only address the identified issues but also leverage innovative thinking to create sustainable solutions. The connection between recovery approaches and the entrepreneurial process is important, necessitating CFOs to participate in innovative problem-solving during crises. Engaging key stakeholders in this process can enhance buy-in and foster a collaborative environment.

- Implementation - Executing the recovery plan requires a focused approach on critical areas such as cash flow management and operational efficiency. It is essential to prioritize initiatives that can yield quick wins while laying the groundwork for long-term success. The operationalization of lessons learned during this phase is crucial, as it helps in building strong, lasting relationships that can support ongoing improvements.

- Monitoring - Regularly reviewing progress against established Key Performance Indicators (KPIs) is vital. This step allows CFOs to track the effectiveness of implemented strategies and make necessary adjustments in real-time, ensuring that the organization remains agile in response to changing circumstances. Utilizing a client dashboard for real-time business analytics can significantly enhance this monitoring process, providing insights that inform decision-making and operational adjustments.

- Evaluation - The final phase involves assessing the overall effectiveness of the recovery efforts. This evaluation should include a thorough analysis of outcomes against initial objectives, as well as a reflection on lessons learned to inform future initiatives. The case study titled 'Organizational Recovery: A Conceptual Framework and Research Agenda' offers a theoretical framework that aids in evaluating recovery efforts, guiding CFOs in understanding the behavioral aspects of senior leadership teams during challenges.

By adhering to these structured steps and integrating real-time analytics and streamlined decision-making, CFOs can systematically tackle challenges and employ turnaround management strategies to drive meaningful change within their organizations. Integrating these elements not only enriches the depth of the content but also offers a more authoritative guide for CFOs on management strategies for recovery.

Financial Assessment: Ensuring Cash Flow and Liquidity

A thorough financial assessment is essential during turnaround management strategies, serving as the foundation for effective decision-making. CFOs at Transform Your Small/ Medium Business must prioritize the evaluation of cash flow, liquidity, and overall financial health by meticulously analyzing historical financial data and forecasting future cash flows. This process should involve identifying potential liquidity risks that could threaten the entity’s stability.

Executing a 13-week cash flow projection is a tactical method that allows organizations to foresee cash requirements, thus aiding informed choices about expenses and investments. Moreover, improving cash flow can be accomplished through various techniques, such as renegotiating payment conditions with suppliers and optimizing inventory oversight. For instance, understanding inventory turnover ratios and employing Just-in-Time (JIT) inventory strategies can significantly reduce excess inventory, freeing up cash and improving operational efficiency.

In fact, effective cash forecasting not only aids in managing cash positions but also supports better decision-making regarding financing and operational activities. As highlighted in external sources, cash flow oversight is significantly impacted by creating a detailed forecast and driving a budget.

CFOs should also leverage real-time business analytics through the client dashboard to continuously monitor financial performance and operational health. This approach allows for quick adjustments based on current data, ensuring that decisions are informed and timely. Furthermore, grasping the typical liquidity ratios for companies in recovery scenarios, which generally range from 1.0 to 1.5, signifies the necessity for meticulous liquidity oversight.

Investors and lenders often scrutinize cash flow statements to assess a company’s profitability and viability, as well as the ability to repay loans, as noted by Tom Shemanski. Consequently, poor accounts receivable oversight can lead to tough cash flow decisions, requiring owners to inject additional capital or resort to high-rate financing. By prioritizing financial evaluation and cash flow oversight, along with implementing lessons learned from real-time analytics, CFOs can ensure their organizations maintain adequate liquidity to navigate the complexities of a recovery, ultimately positioning them for turnaround management strategies that support sustainable growth.

Engaging Stakeholders: The Importance of Communication and Buy-In

Involving stakeholders is crucial for the success of turnaround management strategies aimed at recovery. CFOs of small and medium businesses must prioritize transparent communication with all relevant parties, including employees, investors, and creditors. Developing a comprehensive stakeholder engagement plan is essential; it should identify key stakeholders, clarify their interests, and outline tailored communication strategies.

Regular updates on the progress of improvement efforts, along with the implementation of turnaround management strategies and active involvement of stakeholders in decision-making processes, can significantly foster trust and collaboration.

Statistics reveal that companies excelling in stakeholder engagement are 40% more likely to complete projects on time and within budget, underscoring the tangible benefits of effective communication (source: news). Moreover, expert opinions support the continuous and developing participation of stakeholders throughout the project cycle, as highlighted by Reed and colleagues, stressing that this involvement should progress as the changes unfold.

By utilizing real-time analytics via our client dashboard and efficient decision-making, CFOs can enhance buy-in for recovery initiatives by implementing turnaround management strategies that keep stakeholders informed and actively involved. This creates a supportive environment conducive to implementing turnaround management strategies, improving the likelihood of successful outcomes while strengthening relationships vital for long-term organizational resilience. However, it is important to acknowledge the complexities and potential negative impacts of stakeholder engagement, as highlighted in the case study titled "Need for Research on Negative Impacts."

Enhancing stakeholder engagement techniques, such as documentation and prioritization, is crucial for success in stakeholder capitalism and ultimately for management initiatives. Additionally, the 'Test & Measure' approach ensures that all hypotheses are rigorously tested, further supporting effective decision-making and stakeholder involvement.

Best Practices for Implementing Turnaround Strategies

Implementing turnaround management strategies necessitates a disciplined and strategic approach. Key best practices include:

- Establishing Clear Objectives - Defining specific, measurable goals that align with the overall vision for recovery is essential. This clarity aids in tracking progress and maintaining focus.

- Building a Strong Leadership Team - Assembling a diverse team with a range of skills and experiences is crucial. Effective leadership groups significantly influence recovery outcomes by promoting turnaround management strategies that enhance innovation and flexibility.

- Fostering a Culture of Accountability - Encouraging ownership among team members is vital. A culture where individuals are responsible for their tasks enhances commitment and drives performance.

- Regularly Reviewing Progress - Frequent evaluations of the plan's effectiveness allow for timely adjustments. This iterative process ensures that approaches remain relevant and effective in a changing environment. Utilizing real-time business analytics through client dashboards facilitates ongoing evaluation, enabling teams to continually diagnose business health and make informed decisions.

- Leveraging External Expertise - Engaging consultants or advisors with specialized experience in management recovery provides valuable insights and support. Their external perspective often uncovers opportunities for improvement that internal teams may overlook.

- Embracing Emerging Technologies - Incorporating new technologies can revolutionize corporate restructuring and recovery strategies, enhancing efficiency and effectiveness. This includes operationalizing lessons learned from previous experiences to improve future decision-making processes.

By adhering to these best practices, CFOs can significantly enhance their chances of achieving successful recovery outcomes through effective turnaround management strategies. Notably, statistics indicate that budgets are typically approved 1.5 years before the implementation of maintenance, underscoring the importance of proactive planning and leadership in managing these complex processes. A case study on a leading aerospace supplier exemplifies how a reorganization approach focused on adapting to market dynamics and enhancing competitiveness can yield successful outcomes.

As Richard, a Business Turnaround Consultant, observed, "It was out of touch with the competitive market environment and, more importantly, with our own customers' changing needs," highlighting the critical necessity for alignment with market demands.

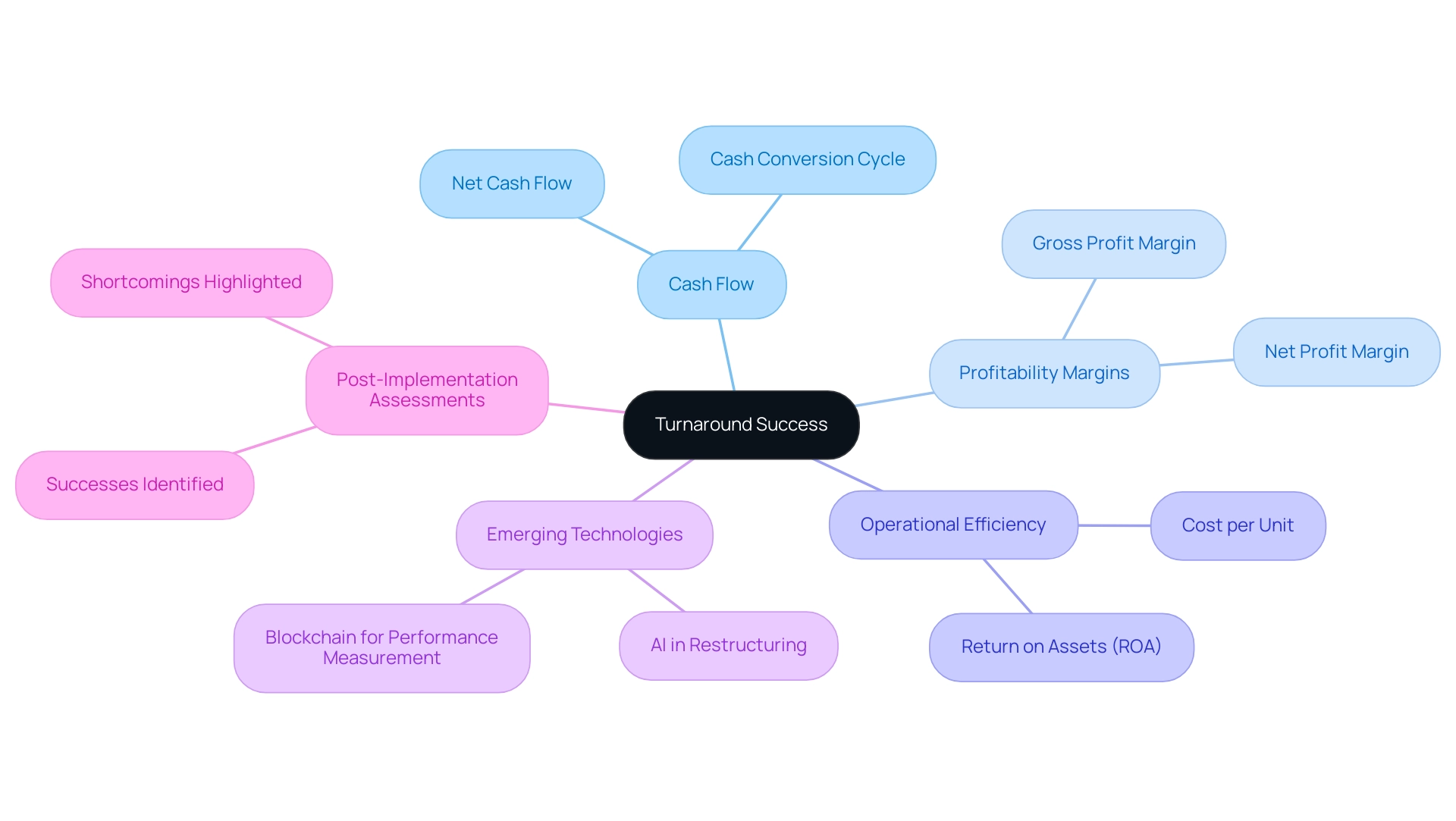

Monitoring and Evaluating Turnaround Success: Metrics and KPIs

Monitoring and evaluating the success of recovery efforts is essential for ensuring that strategies remain effective and aligned with organizational goals. CFOs must establish key performance indicators (KPIs) that directly relate to their recovery objectives. Commonly utilized metrics—such as cash flow, profitability margins, and operational efficiency—serve as critical indicators of a company's health during the recovery process.

Regularly reviewing these metrics enables CFOs to assess progress, identify areas for improvement, and make informed decisions. For instance, a study revealed that organizations actively tracking their KPIs are 30% more likely to achieve their recovery goals compared to those that do not. This underscores the significance of an organized approach to performance measurement, particularly in mastering the cash conversion cycle through efficient techniques.

Furthermore, conducting post-implementation assessments is vital for gaining insights into the efficacy of the approaches employed. These evaluations not only highlight successes but also pinpoint shortcomings, providing valuable lessons for future initiatives. By maintaining a rigorous focus on metrics and KPIs, CFOs can ensure that their entities remain on track toward recovery and sustainable growth.

In 2025, the landscape of management transformation continues to evolve, with emerging technologies like AI and blockchain playing a pivotal role in optimizing operational excellence and strategy development. These technologies revolutionize corporate restructuring, offering new avenues for enhancing performance measurement and analysis, thereby supporting streamlined decision-making and real-time analytics.

Ultimately, the strategic application of KPIs in assessing success transcends mere number tracking; it fosters a culture of accountability and ongoing enhancement within the entity. As Jim Schoen, Principal at FRC Group, aptly noted, "This is truly a service that benefits the consulting industry and associated clients." By leveraging these insights, CFOs can drive transformational change and position their companies for long-term success, aligning with the organization's aim to help businesses overcome challenges and achieve sustainable growth.

Leveraging Technology: Tools for Effective Turnaround Management

Technology is essential in optimizing turnaround operations, enabling CFOs to implement effective strategies that drive financial recovery. A variety of tools are available that enhance data analysis, project coordination, and communication, which are crucial for navigating challenging times. For instance, financial oversight software can significantly streamline budgeting and forecasting processes, allowing for more accurate financial planning and resource allocation.

Project management tools further support these efforts by tracking progress and ensuring that resources are allocated efficiently.

Moreover, the integration of data analytics into recovery strategies offers profound insights into operational performance, helping to pinpoint areas that require improvement. At Transform Your Small/ Medium Business, our technology-enabled restructuring consulting services are customized specifically for small to medium enterprises, emphasizing collaboration and core values of transparency, results, and innovation. This approach not only aids in cash preservation and efficiency but also mitigates risks to uncover value and reduce costs.

However, organizations encounter various challenges in implementing digital transformation, such as high costs, economic uncertainty, and technological barriers. As they face growing pressure to adjust to digital processes, it is significant that 54% of all employees will require substantial reskilling by 2025, highlighting the importance of technology adoption in recovery strategies. In fact, around 75% of companies have already embarked on their digital transformation journeys, with 24% still in the planning stages, showcasing the ongoing need for strategic planning in technology adoption.

CFOs should prioritize the adoption of these technology tools to enhance their recovery strategies. By leveraging financial management software and data analytics, they can make informed decisions that not only address immediate challenges but also lay the groundwork for sustainable growth. The influence of these technologies on success cannot be overstated, as they facilitate a more agile response to market dynamics and operational hurdles, ensuring that businesses can effectively test hypotheses, make quick decisions, and operationalize lessons learned.

Our services are available for $99.00, providing exceptional value for the comprehensive support we offer.

Industry-Specific Strategies: Tailoring Turnaround Approaches

Different industries encounter distinct challenges during turnaround efforts, necessitating the development of tailored strategies. In the retail sector, for instance, a strong emphasis on inventory management and customer engagement is crucial to mitigate the impacts of fluctuating consumer preferences and economic pressures. Conversely, the hospitality sector often prioritizes operational efficiency and service quality to enhance guest experiences and drive repeat business.

CFOs must undertake comprehensive, industry-specific analyses to pinpoint key trends and challenges that directly impact their entities. For instance, the average churn rate in consumer packaged goods (CPG) stands at 9.62%, emphasizing the significance of employee retention approaches in sustaining operational stability. It costs U.S. businesses approximately $1 trillion per year to replace employees who voluntarily leave, underscoring the financial impact of turnover.

In contrast, government agencies report a notably lower turnover rate of 8.4%, indicating that job security and benefits contribute significantly to employee retention compared to other sectors.

By tailoring turnaround plans to address these industry nuances, CFOs can greatly improve the effectiveness of their initiatives. This approach not only fosters a more resilient organizational structure but also drives sustainable growth. For instance, companies that invest in employee recognition have been shown to enhance retention rates, which is critical in high-turnover environments like retail and hospitality.

Gallup discovered that entities with high engagement faced 21% lower turnover for those with high turnover and 51% lower turnover for those with low turnover, further highlighting the significance of engagement in decreasing turnover.

Moreover, the incorporation of real-time analytics via the client dashboard offered by Transform Your Small/Medium Business enables CFOs to consistently track the effectiveness of their approaches, facilitating swift decision-making that can adjust to evolving situations. By implementing the insights gained during the recovery process, companies can establish robust, enduring connections with their employees, ultimately resulting in enhanced performance and recovery results.

Ultimately, a strategic emphasis on these customized methods, backed by efficient decision-making and ongoing performance evaluation, can lead to more successful recovery results.

Future Trends in Turnaround Management: Preparing for Tomorrow

In a constantly changing business environment, CFOs must be proactive in identifying emerging trends that significantly impact turnaround management strategies. Notably, digital transformation has become a cornerstone of effective recovery efforts, enabling entities to streamline operations and enhance decision-making processes. Companies leveraging digital tools exhibit greater agility and report a remarkable 30% revenue growth, as highlighted by McKinsey (2023), underscoring the critical role of technology in driving financial recovery.

Sustainability initiatives are gaining momentum as businesses increasingly acknowledge the importance of environmentally responsible practices. This shift not only meets consumer demand but also strategically positions companies in the market, contributing to long-term viability. Furthermore, data-driven decision-making is becoming essential; entities employing robust performance management practices are 4.2 times more likely to outperform their rivals, emphasizing the necessity of incorporating analytics into turnaround management strategies.

At Transform Your Small/Medium Business, our commitment to operationalizing the lessons learned through turnaround management strategies ensures that these insights are effectively utilized to enhance business performance.

To navigate these trends effectively, CFOs should cultivate a culture of innovation and agility within their organizations. This entails not only adopting new technologies but also ensuring that employees are engaged and involved in the transformation process. Research indicates that companies with highly engaged workforces achieve 23% higher profitability compared to their competitors.

Grace Smith from Performance Management states, "Companies implementing regular feedback mechanisms achieve 40% higher employee engagement rates alongside 26% better performance outcomes." This emphasizes the necessity for effective performance systems that support employee involvement and continuous monitoring of business health through real-time analytics, facilitated by our client dashboard.

Moreover, effective change oversight necessitates clear communication, employee involvement, and a strategic focus rather than merely relying on technological solutions. The case study titled "Engagement and Profitability Correlation" illustrates this point, demonstrating a strong correlation between employee engagement and organizational success.

As we look toward 2025, the intersection of these trends will shape the future of turnaround management strategies. By staying informed and adapting strategies accordingly, CFOs can position their organizations for sustainable growth and resilience in the face of challenges, supported by our 'Test & Measure' approach to ensure ongoing success.

Conclusion

Transforming a struggling organization through effective turnaround management necessitates a multifaceted approach that encompasses:

- Strategic planning

- Financial assessment

- Stakeholder engagement

- The utilization of technology

The core components of a successful turnaround include:

- A thorough assessment of the current state

- The formulation of clear objectives

- The implementation of a robust action plan

By leveraging data-driven strategies and real-time analytics, organizations can enhance decision-making and adapt to the ever-changing business landscape.

Engaging stakeholders is equally vital; transparent communication fosters trust and collaboration, ultimately contributing to the success of turnaround initiatives. Best practices such as:

- Establishing accountability

- Regularly reviewing progress

- Embracing emerging technologies

are essential for driving meaningful change. Moreover, tailoring strategies to specific industry challenges ensures that organizations can effectively navigate their unique hurdles.

Looking ahead, the integration of digital transformation and sustainability initiatives will play a significant role in shaping the future of turnaround management. As organizations adapt to these trends, fostering a culture of innovation and employee engagement will be crucial for achieving long-term success. By embracing these strategies, CFOs can position their organizations not only to recover from adversity but also to thrive in an increasingly competitive environment. The journey of turnaround management is not merely about overcoming challenges; it is about transforming them into opportunities for sustainable growth and resilience.

Frequently Asked Questions

What are turnaround management strategies?

Turnaround management strategies are a strategic framework aimed at revitalizing enterprises facing significant challenges. They involve deliberate actions to stabilize the company, address underlying issues, and implement transformative changes to enhance performance.

What are the key components of effective turnaround management strategies?

The key components include a thorough assessment of the current business state, identification of root causes contributing to decline, and the formulation of a comprehensive action plan aimed at restoring profitability.

How does data-driven strategy impact profitability in turnaround management?

Organizations utilizing data-driven strategies achieve 23% greater profitability, highlighting the importance of leveraging analytics in recovery efforts.

What common pitfalls can affect change management initiatives?

Common pitfalls include lack of management support, outdated processes, and poor communication, which can significantly weaken change management efforts.

What is the success rate of turnaround programs based on research?

Research indicates that only about 1 in 4 turnaround programs leads to long-term improvements in performance, emphasizing the need for proactive management of challenges.

Why is strategic planning important in turnaround management?

Strategic planning is fundamental for effective decision-making and resource allocation, helping organizations set clear objectives and identify key performance indicators (KPIs) to measure success.

What role does scenario planning play for CFOs during recovery?

Scenario planning enables CFOs to foresee potential challenges and create contingency plans, aiding in navigating uncertainties and fostering a culture of accountability and transparency.

What steps are involved in the turnaround management process?

The steps include Assessment, Strategizing, Implementation, Monitoring, and Evaluation, each designed to facilitate recovery and growth within an organization.

How can CFOs effectively monitor the progress of turnaround strategies?

CFOs can regularly review progress against established KPIs and utilize real-time business analytics through a client dashboard to track the effectiveness of implemented strategies and make necessary adjustments.

What is the significance of employee insights during the assessment phase?

Gathering employee insights is crucial for understanding perspectives and identifying weaknesses and opportunities for improvement, as effective leadership significantly impacts recognition and engagement.