Overview

The article highlights best practices for CFOs in leveraging stakeholder management tools and techniques to enhance financial outcomes and bolster organizational resilience. It underscores that effective engagement with stakeholders—achieved through tailored communication, continuous monitoring, and strategic involvement—can significantly align financial strategies with stakeholder expectations. This alignment fosters trust and ultimately improves overall economic performance. By implementing these practices, CFOs can not only navigate complex financial landscapes but also drive their organizations toward sustainable growth.

Introduction

In the dynamic world of finance, stakeholder management emerges as a pivotal strategy for Chief Financial Officers (CFOs) aiming to navigate complex relationships and drive organizational success. As CFOs engage with a diverse array of stakeholders—from investors and employees to customers and suppliers—they must skillfully align financial strategies with varying interests and expectations. This nuanced approach not only enhances financial performance but also fosters trust and collaboration, especially during challenging times.

Moreover, with robust stakeholder engagement practices, organizations can mitigate risks, adapt to market fluctuations, and ultimately achieve sustainable growth. As the financial landscape continues to evolve, the significance of effective stakeholder management becomes increasingly clear, positioning CFOs as key players in steering their organizations toward resilience and success.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder management tools and techniques are essential processes that involve identifying, analyzing, and engaging with individuals or groups capable of influencing or being influenced by an organization's objectives. For financial executives, this necessitates a comprehensive understanding of the diverse interests of stakeholders, including investors, employees, customers, and suppliers. By effectively managing these relationships, CFOs can align financial strategies with stakeholder expectations, fostering an environment of trust and collaboration.

Focusing on the needs of stakeholders enables CFOs to make informed decisions that not only enhance economic performance but also drive sustainable growth. This alignment becomes particularly critical during challenging times, as effective stakeholder management can significantly influence recovery efforts and long-term success. Organizations that excel in engaging relevant parties often report improved financial outcomes, with studies indicating that effective communication with stakeholders can mitigate setbacks and ensure that all parties are informed about changes and associated costs.

As highlighted by EY's report of a global revenue of US$51.2 billion for fiscal year 2024, the financial landscape underscores the importance of robust stakeholder management practices.

As financial leaders navigate the complexities of fiscal strategies in 2025, leveraging stakeholder management tools and techniques will be vital for implementing best practices in stakeholder engagement. This entails actively involving stakeholders, utilizing management tools for effective communication, and continuously assessing stakeholder sentiment to adapt strategies accordingly. For example, financial leaders must serve as strategic partners to the CEO, providing insights on potential disruptions and recommending strategic actions.

By harnessing technology-driven turnaround consulting from Transform Your Small/ Medium Business, financial leaders can enhance collaboration and transparency, ensuring that the interests of all stakeholders are prioritized. This approach not only safeguards business value but also optimizes balance sheets and cultivates long-term partnerships, positioning organizations for superior performance and resilience in the face of disruption. Furthermore, our team facilitates a streamlined decision-making process throughout the turnaround, empowering your team to take decisive actions to protect your business.

We consistently monitor the effectiveness of our strategies and teams through our client dashboard, which offers real-time business analytics to continuously assess your business health.

The Importance of Stakeholder Analysis in Financial Management

Interest analysis functions as a systematic framework for identifying and evaluating the concerns and influence of various parties within an organization. For chief financial officers, this process is vital in understanding who holds influence and how their interests correspond with the organization's monetary goals. By employing stakeholder management tools and techniques to group involved parties based on their impact and interest levels, finance executives can prioritize engagement activities and tailor communication tactics to promote collaboration and support.

This evaluation not only helps in reducing risks linked to dissatisfaction among involved parties but also improves the finance executive's ability to advocate for crucial monetary decisions that align with the organization's objectives. For example, using stakeholder management tools and techniques such as the Power-Interest Grid allows CFOs to visualize the dynamics of interested parties efficiently, promoting a more strategic method to managing these groups.

Statistics show that these parties greatly affect corporate decision-making, with over 70% of executives recognizing that engagement with them directly influences economic performance. Indeed, with all the market fluctuations, it’s wonderful to witness our team exceeding Q1 objectives in bookings at 130% growth, highlighting the tangible advantages of using stakeholder management tools and techniques. Thus, grasping the viewpoints of interested parties is not just a best practice; it is a crucial component of monetary management that can foster sustainable growth and operational efficiency by utilizing stakeholder management tools and techniques.

Additionally, our team stresses a practical approach to data, testing every hypothesis to provide maximum return on invested capital in both the short and long term. Ongoing business performance assessment via real-time analytics enables chief financial officers to adaptively modify strategies, utilizing stakeholder management tools and techniques to ensure that the interests of involved parties are regularly aligned with organizational goals. Case studies demonstrate the effectiveness of stakeholder management tools and techniques in resource management.

For instance, organizations that actively involve participants in budgeting processes through stakeholder management tools and techniques often report better results, including increased revenue sources and decreased operational risks. One such case involved David's mentorship focused on developing team members by providing guidance and encouraging ownership, which led to a more effective revenue funnel and a positive work environment. By utilizing insights from involved parties and implementing turnaround lessons through stakeholder management tools and techniques, financial leaders can make informed decisions that resonate with both internal and external groups, ultimately leading to a more resilient and adaptive organization.

Moreover, upholding a clear division between sales teams and authors is crucial to safeguard the integrity of communication with interested parties, ensuring that financial management practices stay transparent and effective.

Essential Tools for Effective Stakeholder Management

Chief financial officers possess the opportunity to significantly enhance stakeholder management tools and techniques by leveraging a diverse array of resources designed to foster communication and engagement. Mapping tools, such as Simply Stakeholders and Stakeholder Map.com, empower CFOs to visualize connections and manage interactions, ensuring that all parties involved are effectively engaged. Furthermore, project management platforms like Asana and Trello facilitate seamless collaboration, enabling teams to align their efforts with the organization’s financial objectives.

Looking ahead to 2025, the most effective tools for managing interests will not only clarify processes but also cultivate a culture of teamwork, essential for achieving superior financial outcomes. Research reveals that organizations prioritizing human sustainability outperform their peers, realizing a 2.2% higher five-year return on equity. This underscores the importance of integrating stakeholder management tools and techniques into financial strategies.

Moreover, case studies, such as the insights derived from the baggage handling system at Denver International Airport, highlight the necessity of de-escalating challenging projects through effective stakeholder engagement. By identifying issues early, reviewing past actions, and exploring alternatives, financial leaders can implement effective exit strategies that mitigate risks and enhance project success. This aligns with Kim Pope’s perspective on the vital role of innovative leadership in navigating complex stakeholder environments.

As HR and talent leaders are urged to adopt a skills-oriented approach and harness AI technology, financial executives must consider how these trends can refine their stakeholder management tools and techniques. It is critical for CFOs to understand and address internal conflicts that impede early project management efforts, thereby effectively managing stakeholder relationships.

To bolster these initiatives, CFOs at Transform Your Small/Medium Business can embrace a pragmatic approach to data by testing hypotheses and employing real-time analytics to track business health. This ongoing performance monitoring facilitates timely adjustments and operationalizes lessons learned from past experiences, ultimately ensuring that organizations not only endure but also prosper in challenging financial landscapes.

Additionally, a streamlined decision-making cycle can empower teams to take decisive actions that safeguard the business and cultivate robust partnerships.

Best Practices for Implementing Stakeholder Management Techniques

To effectively implement management techniques for involved parties, CFOs should adopt several best practices:

- Engage Early and Often: Involving interested parties from the outset of financial planning processes ensures their insights and concerns are addressed, fostering a sense of ownership and commitment.

- Tailor Communication: Customizing communication approaches based on the preferences and interests of relevant parties is essential for fostering engagement. This approach not only enhances understanding but also builds trust.

- Establish Clear Objectives: Defining clear goals for participant engagement allows CFOs to measure success and adjust strategies as needed. As PMI indicates, effective sponsorship is regarded as extremely vital for change success, which highlights the significance of aligning participant expectations with project results.

- Foster Relationships: Creating strong connections through regular interactions and feedback loops ensures individuals feel valued and heard. This ongoing dialogue is crucial for maintaining engagement and support. Efficient communication approaches are essential for utilizing stakeholder management tools and techniques to gain support from interested parties and realize project success, as emphasized in the case study 'Building Strong Partnerships for 2025 and Beyond.' When involved parties are aligned with the project's purpose, they become advocates for its success.

- Monitor and Adapt: Continuously assessing stakeholder dynamics and adapting strategies to meet evolving needs and expectations is vital. The integration of local and scientific knowledge, along with ongoing engagement processes, is essential for addressing these changes. Transform Your Small/ Medium Business supports a shortened decision-making cycle throughout the turnaround process, enabling financial leaders to take decisive action to preserve their business. Furthermore, the ongoing assessment of business performance via our client dashboard, which offers real-time analytics, allows financial executives to evaluate business health effectively. Individuals who believe their input is appreciated are twice as inclined to stay involved in a project, highlighting the significance of being responsive.

By adopting stakeholder management tools and techniques, financial leaders can improve their management efforts, ultimately fostering better financial outcomes and guaranteeing project success in 2025 and beyond. Transform Your Small/ Medium Business's services aim to assist companies in overcoming challenges and attaining sustainable growth, reinforcing the overarching theme of resilience and development in management.

Navigating Challenges in Stakeholder Management

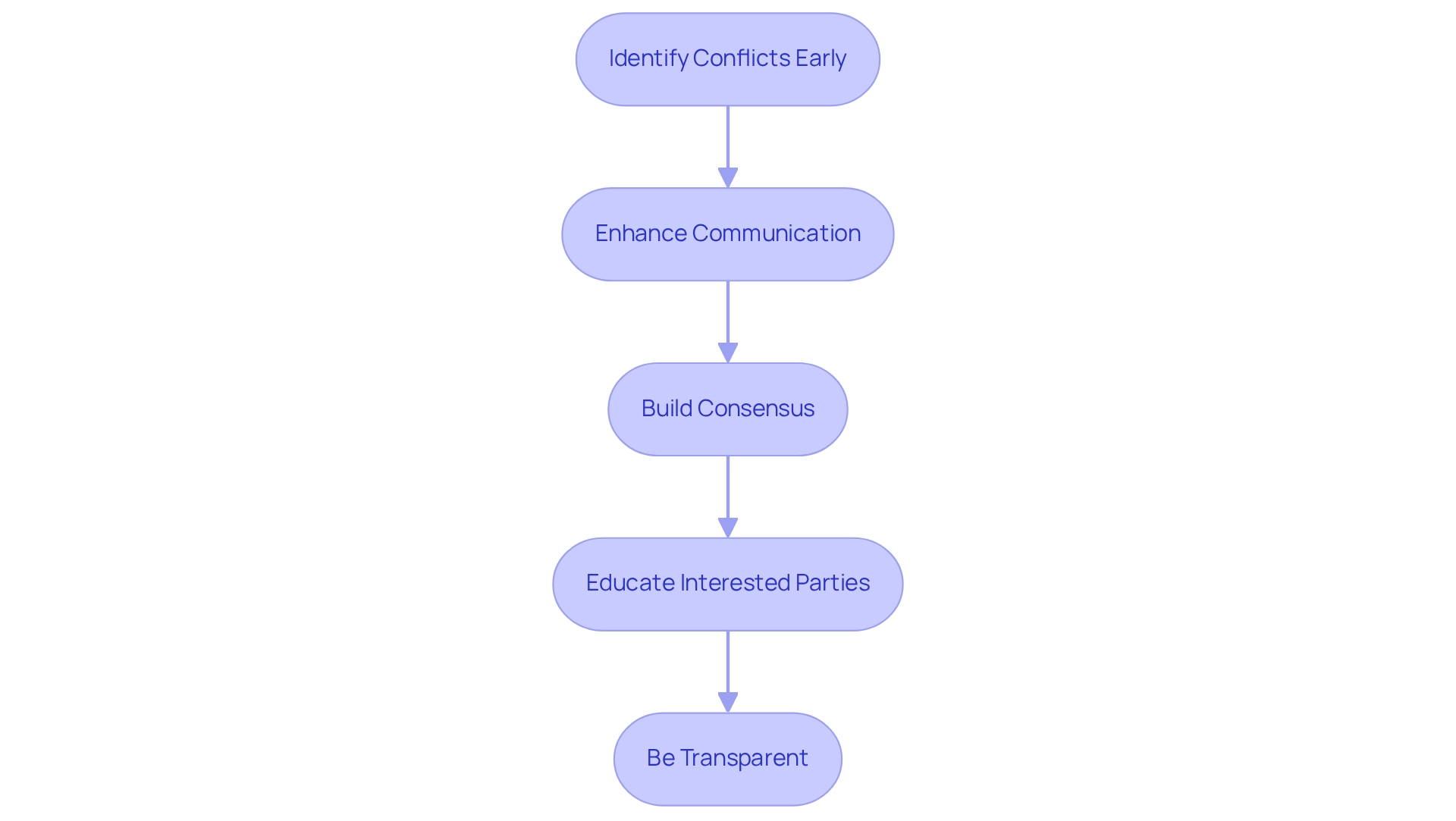

CFOs frequently face a myriad of challenges in managing involved parties, including conflicting interests, communication barriers, and resistance to change. To effectively navigate these complexities, several expert strategies can be employed:

- Identify Conflicts Early: Conduct a thorough analysis of involved parties to pinpoint potential conflicts before they escalate. This proactive approach allows for timely interventions, ensuring that decision-making cycles are shortened and more effective.

- Enhance Communication: Establish open lines of communication to clarify expectations and minimize misunderstandings. As Jonathan Cant notes, "It’s inevitable that there will be misunderstandings and mismatches between Japan and APAC, so for a CFO, it’s necessary to understand and communicate effectively." Effective communication is essential in aligning the interests of involved parties and fostering collaboration, particularly when employing real-time analytics from Transform Your Small/ Medium Business's client dashboard to monitor business health.

- Build Consensus: Involve interested parties in collaborative decision-making processes. By including them in conversations, CFOs can establish agreement, which aids in reducing opposition and fosters support for economic plans. Statistics show that efficient conflict resolution approaches can result in enhanced relationships with involved parties, with methods that generate precise predictions attaining success 90% of the time.

- Educate Interested Parties: Provide interested parties with comprehensive information regarding financial strategies and their implications. This education fosters understanding and support, making it easier to navigate complex decisions and operationalize lessons learned from previous experiences.

- Be Transparent: Maintain transparency throughout the decision-making process. By being transparent about the reasoning behind choices, financial leaders can foster trust and credibility among involved parties, which is crucial for long-term relationship development.

A case study of an American city illustrates the importance of participant engagement; the city successfully closed a significant budget gap through strategic planning and community involvement, demonstrating how involving contributors can lead to fiscal responsibility and effective outcomes. By applying these strategies, financial executives can enhance their stakeholder management tools and techniques with interested parties, ultimately resulting in more successful project outcomes. Furthermore, by embracing the 'Test & Measure' strategy, financial executives can ensure that their decisions are based on data, optimizing the return on invested capital.

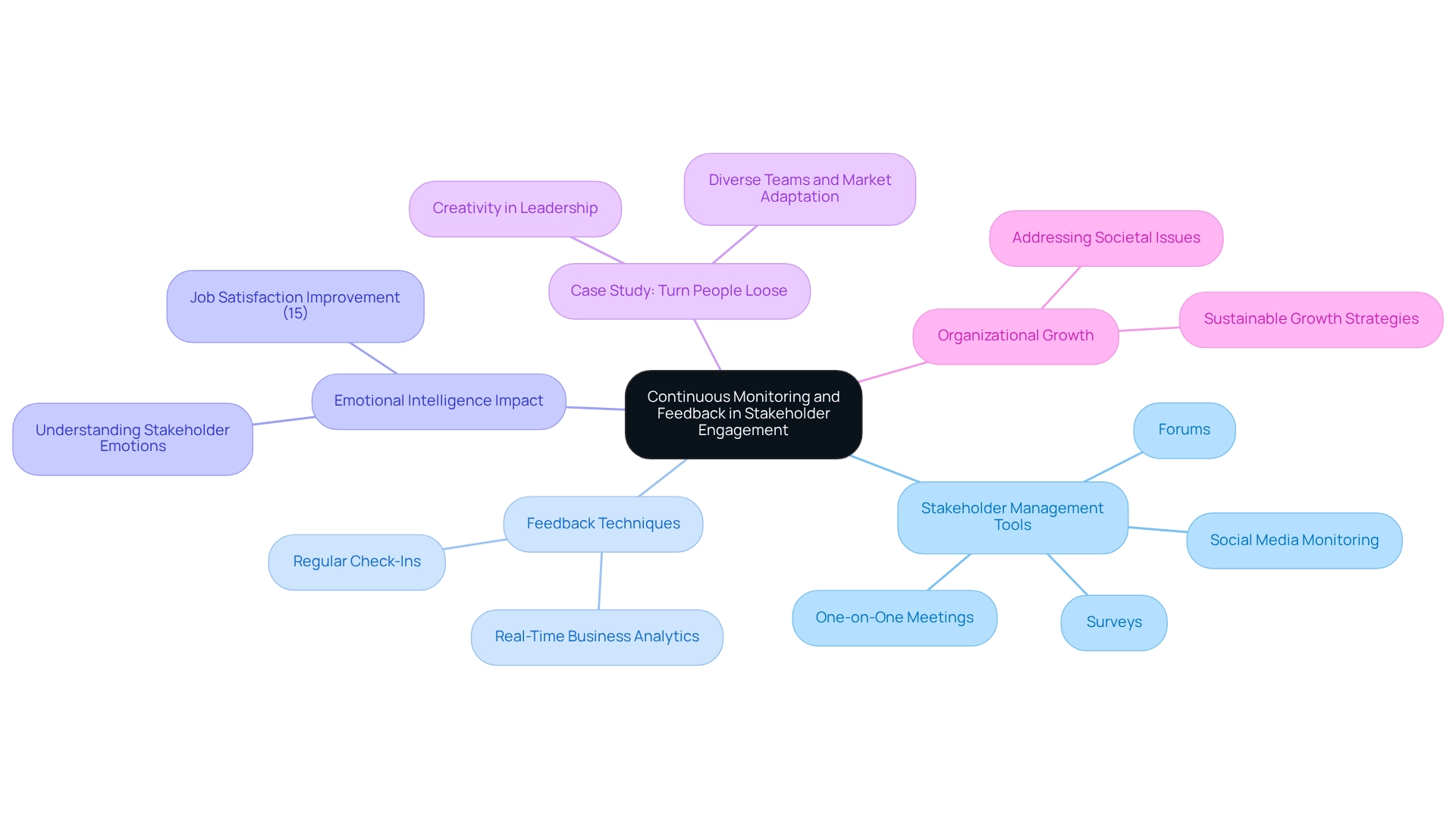

The Role of Continuous Monitoring and Feedback in Stakeholder Engagement

Ongoing observation and input are essential for effective engagement with interested parties, particularly for chief financial officers who utilize stakeholder management tools and techniques to navigate complex financial environments. By employing these tools, establishing regular check-ins with involved parties—through methods such as surveys, one-on-one meetings, or forums—enables CFOs to gather critical insights into their experiences and perceptions. This proactive approach not only identifies areas for improvement but also facilitates the adaptation of engagement strategies to better meet the needs of stakeholders. This process is further supported by real-time business analytics available through the client dashboard provided by Transform Your Small/Medium Business, which continuously assesses organizational health.

Moreover, leveraging stakeholder management tools and techniques, including social media and other digital channels, to monitor participant sentiment can yield valuable insights into perceptions and expectations. Research indicates that leaders with heightened emotional intelligence can enhance job satisfaction by 15%, emphasizing the importance of understanding the emotions of stakeholders in economic decision-making. As noted by Thomas Workman, 'We also acknowledge Shoshanna Sofaer and Thomas Workman for their guidance and review of early drafts of this manuscript,' underscoring the collaborative effort behind this research. The integration of stakeholder management tools and continuous feedback mechanisms fosters a culture of open communication, vital for building trust and strengthening relationships.

For instance, a case study titled 'Turn People Loose' illustrates how encouraging creativity among executives through involvement in the arts can enhance innovative thinking and problem-solving. By cultivating diverse teams that embrace imaginative expression, companies can more effectively respond to market demands, ultimately refining their business models.

As CFOs concentrate on managing interests in 2025, the significance of ongoing evaluation and input cannot be overstated. Adopting efficient feedback techniques not only aligns financial decisions with stakeholder management tools but also prepares organizations for sustainable growth in an ever-evolving business landscape. Furthermore, Transform Your Small/Medium Business invites individuals to join their LinkedIn group, fostering engagement and collaboration on how businesses can address societal issues, further emphasizing the importance of effective management practices.

Case Studies: Successful Stakeholder Management in Action

Many organizations have successfully utilized management approaches to improve their economic performance. A significant case involves a retail company that, faced with decreasing sales, initiated regular feedback sessions and joint planning with its partners. By incorporating these insights into their financial plans, the company not only regained customer confidence but also achieved a substantial rise in sales figures.

Similarly, a manufacturing firm employed influencer mapping to identify key players within its supply chain. By nurturing strong connections with these parties, the firm significantly enhanced its operational efficiency and realized cost savings. This aligns with Ramiro Montealegre's four-phase method of de-escalation, which encompasses:

- Problem recognition

- Re-evaluation of previous actions

- Exploring alternatives

- Executing an exit plan

Such an organized method can assist financial leaders in efficiently managing relationships with stakeholders by utilizing stakeholder management tools and techniques.

Moreover, the case study of Boeing-Rocketdyne illustrates how successful teamwork can lead to innovation and economic achievement, even in a decentralized work environment. The strategies employed by Boeing-Rocketdyne demonstrate that robust engagement with stakeholders can foster radical innovation, ultimately resulting in improved economic outcomes. Integrating streamlined decision-making and real-time analytics into these methods can further enhance their effectiveness.

By supporting a shortened decision-making cycle throughout the turnaround process, Transform Your Small/Medium Business empowers organizations to take decisive actions to safeguard their operations. Ongoing observation via client dashboards provides real-time business analytics, enabling financial executives to assess business health and implement insights gained from the turnaround process. These examples underscore the critical importance of effective stakeholder management tools and techniques in achieving economic success, offering practical approaches that chief financial officers can employ to enhance engagement with participants and improve their organizations' financial results.

Embracing Stakeholder Management for Financial Success

In the intricate landscape of contemporary commerce, effective stakeholder management has evolved from a supplementary task to an essential strategy for leaders pursuing success. By comprehensively understanding participant dynamics and employing stakeholder management tools and techniques, financial leaders can significantly enhance their engagement strategies, leading to improved financial outcomes. Our unwavering commitment to your success ensures a collaborative effort with your team to identify core business challenges and develop actionable plans that safeguard business value and optimize balance sheets.

Ongoing monitoring and feedback systems are vital, as they ensure the needs of stakeholders are addressed through stakeholder management tools and techniques, fostering an environment of trust and collaboration. By leveraging real-time business analytics, CFOs can refine decision-making processes, facilitating decisive actions that bolster business performance and turnaround strategies. Our 'Decide & Execute' approach promotes a streamlined decision-making cycle throughout the turnaround process, empowering your team to act decisively to protect your business.

Research indicates that organizations prioritizing stakeholder management tools and techniques are not only better equipped to confront challenges but also achieve sustainable growth. For instance, a recent study involving 50 researchers and 41 partners revealed that effective engagement with stakeholders can take various forms, highlighting the complexity and importance of this practice. This complexity is further illustrated by a researcher who remarked, "We originally anticipated approaching and trying to recruit patients in-person... But what we learned in talking with this clinic was that many of their patients are farmers that live two and three hours away," emphasizing the necessity of understanding the needs of stakeholders in practical contexts.

Chief executives are strongly encouraged to integrate stakeholder management tools and techniques into their budgeting and decision-making processes. Effective leadership hinges on the strategic communication and stakeholder management expertise that allows finance executives to align their financial strategies with stakeholder expectations, ultimately driving successful economic results. Our pragmatic approach to data ensures that we rigorously test every hypothesis to maximize return on invested capital in both the short and long term.

Furthermore, we consistently monitor the effectiveness of our strategies through our client dashboard, which offers real-time business analytics to continually assess your business health. Case studies reveal that firms implementing robust stakeholder management tools and techniques consistently outperform their competitors, underscoring the significance of these practices in today’s competitive environment. The complexities of measuring engagement, as discussed in the case study titled 'Measuring Engagement and Its Impacts,' further reinforce the necessity for CFOs to adopt stakeholder management tools and techniques as a fundamental aspect of their financial strategy for achieving long-term success.

Conclusion

Effective stakeholder management is no longer a peripheral strategy for CFOs; it has become a cornerstone of financial success in today’s complex business environment. By understanding the diverse interests of stakeholders and employing strategic engagement techniques, CFOs can align organizational objectives with stakeholder expectations, fostering the trust and collaboration essential for sustainable growth.

Throughout this article, we have emphasized that proactive stakeholder analysis, clear communication, and the use of modern tools are vital in navigating the intricacies of stakeholder relationships. The case studies shared illustrate the tangible benefits of these practices, showcasing how organizations that prioritize stakeholder engagement can drive financial performance and operational efficiency. Moreover, continuous monitoring and feedback mechanisms have been highlighted as crucial for adapting strategies to meet evolving stakeholder needs, ultimately enhancing decision-making processes.

In conclusion, embracing stakeholder management as an integral part of financial strategy not only prepares organizations to navigate challenges but also positions them for long-term success. As CFOs continue to refine their approaches, the emphasis on collaboration, transparency, and responsiveness will be key in achieving superior financial outcomes. The future of finance lies in the art of stakeholder engagement, and those who master this will lead their organizations to resilience and growth in an ever-evolving landscape.

Frequently Asked Questions

What are stakeholder management tools and techniques?

Stakeholder management tools and techniques are processes that involve identifying, analyzing, and engaging with individuals or groups who can influence or be influenced by an organization's objectives.

Why is stakeholder management important for CFOs?

Effective stakeholder management helps CFOs align financial strategies with stakeholder expectations, fostering trust and collaboration, which is crucial for informed decision-making and sustainable growth.

How does stakeholder management impact financial performance?

Organizations that excel in engaging stakeholders often report improved financial outcomes, as effective communication can mitigate setbacks and ensure all parties are informed about changes and associated costs.

What role does interest analysis play in stakeholder management?

Interest analysis helps CFOs identify and evaluate the concerns and influence of various parties, allowing them to prioritize engagement activities and tailor communication tactics to promote collaboration.

What tools can CFOs use to manage stakeholders effectively?

CFOs can use tools like the Power-Interest Grid to visualize the dynamics of interested parties, which promotes a more strategic approach to managing these groups.

How does stakeholder engagement influence decision-making?

Over 70% of executives recognize that engaging with stakeholders directly influences economic performance, making it a crucial component of monetary management.

What benefits arise from involving stakeholders in budgeting processes?

Actively involving stakeholders in budgeting often leads to better results, such as increased revenue sources and decreased operational risks.

How do financial leaders adapt their strategies over time?

Financial leaders continuously assess stakeholder sentiment and utilize real-time analytics to modify strategies, ensuring alignment with organizational goals.

Why is transparency in communication with stakeholders important?

Maintaining a clear division between sales teams and authors is essential to safeguard the integrity of communication, ensuring financial management practices remain transparent and effective.