Overview

Best practices for utilizing stakeholder management tools underscore the critical role of effective engagement strategies for CFOs. Emphasizing clear communication, active listening, and tailored interactions with stakeholders, this approach is essential. Structured stakeholder management not only enhances relationships but also drives improved financial outcomes and facilitates successful transitions for new CFOs. Ultimately, this alignment of financial strategies with stakeholder interests is vital for achieving organizational success.

Introduction

Navigating the intricate world of stakeholder management is essential for CFOs seeking to enhance their organization’s financial performance. This multifaceted approach involves:

- Identifying stakeholders

- Analyzing stakeholders

- Engaging a diverse array of stakeholders, from investors to regulatory bodies, all of whom play a vital role in shaping financial outcomes.

Moreover, as the landscape shifts towards concentrated growth strategies and heightened cybersecurity demands, CFOs must align their financial strategies with stakeholder interests to foster trust and drive success. Through effective relationship management, comprehensive financial reviews, and strategic communication, financial leaders can not only mitigate risks but also unlock hidden value. Consequently, this ensures their organizations thrive amidst evolving challenges.

Understanding Stakeholder Management: A CFO's Perspective

Stakeholder management tools represent an essential process for financial executives, encompassing the identification, analysis, and engagement of individuals or groups that influence the organization's financial performance. This includes a diverse array of stakeholders such as investors, employees, customers, and regulatory bodies. By effectively utilizing stakeholder management tools to manage these relationships, financial leaders can significantly enhance communication, build trust, and drive improved financial outcomes.

Research indicates that over two-thirds of CFOs are anticipated to seek growth approaches defined by fewer, more concentrated investments in the coming three years. This shift underscores the importance of aligning financial strategies with the interests and concerns of involved parties through the use of stakeholder management tools. Moreover, the rising need for improved cybersecurity is transforming the CFO's responsibilities, as they must tackle these challenges while employing stakeholder management tools to manage relationships with interested parties.

A structured approach to relationship building utilizing stakeholder management tools can enhance the likelihood of a successful transition for new Chief Financial Officers by up to 50%, as emphasized by Gartner research. This study highlights that poorly managed transitions can lead to knowledge transfer gaps and employee disengagement, adversely affecting financial performance.

To improve relationships with interested parties, financial leaders should prioritize thorough financial assessments through stakeholder management tools that focus on cash preservation, efficiency, and risk reduction. By uncovering hidden value and reducing costs, CFOs can foster long-term partnerships and optimize balance sheets. Furthermore, collaborative communication and the implementation of stakeholder management tools to actively involve participants in the decision-making process are essential.

This approach not only ensures that all parties are informed but also promotes a sense of ownership and dedication among involved individuals. As Ajit Kambil, Global Research Director, states, "The margin of error that financial leaders have in making capital allocation choices is narrow," emphasizing the critical nature of informed participant engagement in financial decision-making.

In 2025, the significance of managing interested parties for financial executives cannot be overstated. Effective strategies using stakeholder management tools involve regular updates, clear communication, and seeking feedback to comprehend the viewpoints of involved parties more effectively. By embracing these practices, alongside efficient decision-making and real-time analytics for business turnaround and performance assessment, financial leaders can leverage stakeholder management tools to navigate the intricacies of relationships with interested parties and ultimately improve their organization's financial results, especially in light of emerging challenges like cybersecurity.

Transform Your Small/ Medium Business supports this process by providing quick examinations of finances, focusing on cash preservation, and uncovering hidden value, which are essential for effective management of interested parties. Our strategy highlights a shortened decision-making cycle, allowing financial leaders to take decisive action during the turnaround process.

Essential Stakeholder Management Tools for Financial Leaders

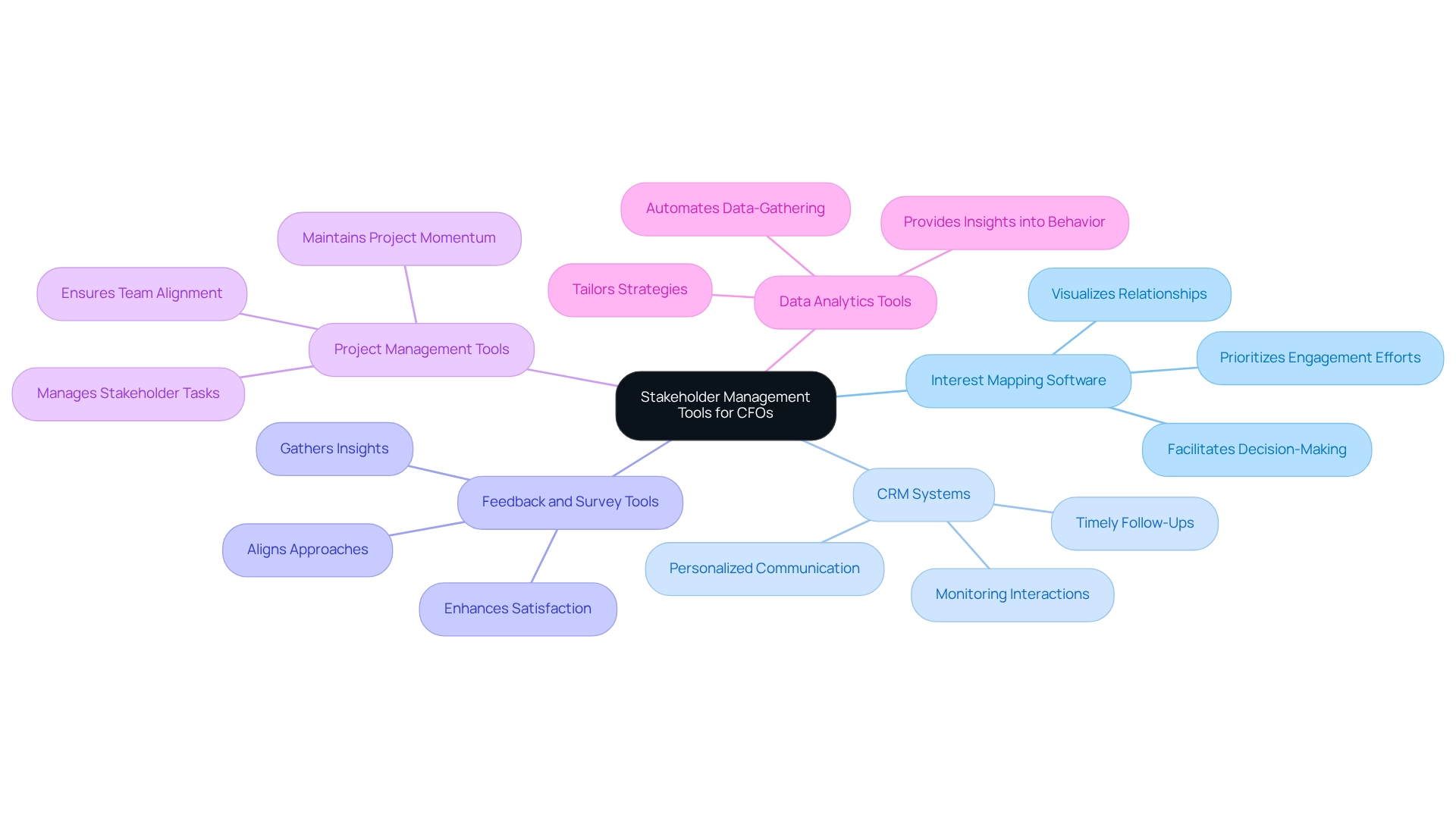

Chief Financial Officers can leverage a variety of management tools to enhance their interaction strategies and drive project success. Key tools include:

- Interest Mapping Software: Solutions like StakeholderMap.com empower CFOs to visualize relationships, enabling them to prioritize engagement efforts based on influence and interest. This strategic approach ensures that resources are allocated efficiently to the most influential parties, facilitating a streamlined decision-making process vital for business recovery.

- Customer Relationship Management (CRM) Systems: CRMs such as Salesforce play a crucial role in monitoring interactions with contacts, ensuring timely follow-ups and personalized communication. This not only strengthens relationships but also fosters trust and collaboration, essential for operationalizing lessons learned during the turnaround process.

- Feedback and Survey Tools: Platforms like SurveyMonkey allow CFOs to gather valuable insights from stakeholders, aiding in a better understanding of needs and expectations. This feedback loop is critical for aligning approaches with interested parties and enhancing overall satisfaction, thus supporting ongoing business performance evaluation.

- Project Management Tools: Tools like Asana or Trello facilitate the management of stakeholder-related tasks, ensuring all team members are aligned on engagement strategies. This coordination is vital for maintaining momentum and achieving project objectives, particularly in a dynamic turnaround environment.

- Data Analytics Tools: Utilizing advanced analytics platforms provides insights into participant behavior and preferences, enabling financial executives to tailor their strategies effectively. As the finance function evolves, the integration of AI-powered analytics is becoming central to developing sophisticated financial reporting mechanisms, automating data-gathering processes, and enhancing accuracy. Transform Your Small/Medium Business's AI-supported solution can simulate thousands of scenarios quickly, showcasing the efficiency of these advanced tools in managing involved parties.

The effectiveness of these instruments is underscored by recent trends, with an increasing number of financial executives recognizing the importance of managing interests in enhancing decision-making and boosting operational efficiency. As Andrew W. Butt, Founder, noted, "By addressing what is an often overlooked financial process and aspect of the CFO stack, we were able to deliver immediate value, carve out our niche, and then expand our platform." The successful implementation of stakeholder management tools has been demonstrated to enhance decision-making capabilities, leading to improved business performance and strategic excellence.

As financial leaders adopt these tools in 2025, they position themselves as strategic advisors, prepared to navigate the complexities of modern financial management. The case study titled "The Role of Chief Financial Officers in Embracing AI-Powered Analytics" illustrates how these financial leaders can transition to strategic advisors through the adoption of AI-powered analytics, further linking these tools to their evolving roles.

Techniques for Effective Stakeholder Engagement in Financial Management

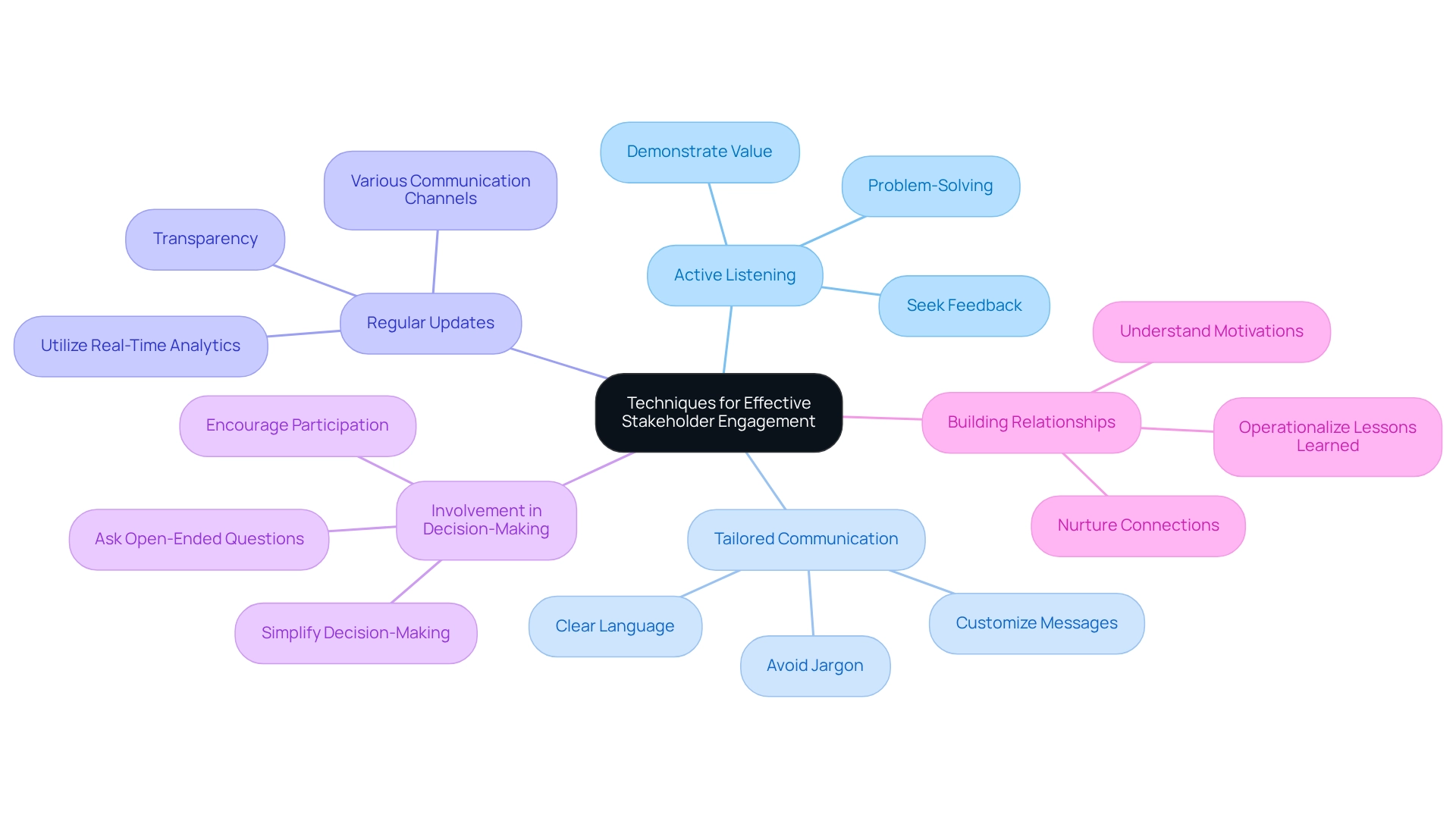

To effectively involve interested parties, CFOs should implement the following strategies:

- Active Listening: Actively seek feedback from involved parties and demonstrate that their input is valued. This practice not only builds trust but also fosters an environment of open communication. Research indicates that 44% of project professionals link project failures to ineffective communication, underscoring the essential role of listening in engaging with interested parties. Moreover, active listening facilitates problem-solving by uncovering underlying issues that may affect the project, particularly when utilizing stakeholder management tools.

- Tailored Communication: Customize messages to align with the interests and concerns of each party involved. Employing clear and concise language while avoiding jargon ensures that all parties fully comprehend the information being conveyed. This tailored approach significantly enhances participant satisfaction and engagement.

- Regular Updates: Keep interested parties informed about financial performance and strategic initiatives through various channels such as newsletters, reports, or meetings. Consistent transparency is key to fostering trust and maintaining engagement over time in stakeholder management tools. Utilizing real-time analytics as stakeholder management tools can further enhance these updates, allowing involved parties to observe the immediate effects of decisions and strategies.

- Involvement in Decision-Making: Encourage interested parties to participate in discussions regarding financial strategies. This collaborative approach not only leads to improved outcomes but also enhances support from interested parties by utilizing stakeholder management tools, making them feel appreciated and engaged in the process. Asking open-ended questions can further stimulate discussion and gather more insights from participants. Simplifying the decision-making procedure can assist in making prompt adjustments based on input from involved parties.

- Building Relationships: Allocate time to nurture personal connections with key individuals. Understanding their motivations and concerns enables CFOs to effectively use stakeholder management tools to align financial strategies with the interests of those involved. As noted by industry experts, listening extends beyond words; it involves observing actions and behaviors, which can reveal underlying issues that may impact the project. Operationalizing lessons learned from past interactions can strengthen these relationships and improve future engagements.

A practical example of these techniques in action can be seen in a recent case involving a tech startup that needed to present its new product to potential investors. By creating a relaxed meeting environment and actively listening to the lead investor's concerns about market competition, the startup was able to reassure the investor, leading to follow-up meetings and ultimately securing the necessary funding. This case highlights the significance of active listening and customized communication in managing interests, particularly in the finance sector.

Identifying and Categorizing Stakeholders: A Key Step for CFOs

Recognizing and classifying involved parties is essential for efficient management in financial leadership. CFOs should consider the following strategies:

- Create a Party List: Begin by compiling a comprehensive list of all involved parties, encompassing both internal groups such as employees and management, as well as external entities like investors, customers, and suppliers. This foundational step ensures that no important participant is overlooked.

- Assess Influence and Interest: Utilize tools like the Power vs. Interest Grid to categorize individuals according to their level of influence and interest in financial decisions. This method enables CFOs to visualize participant dynamics and prioritize engagement efforts effectively. A study surveying 320 respondents from the Ghanaian mining sector highlights the significance of interest analysis in project management, demonstrating how understanding various parties' interests can uncover and remove barriers to project success.

- Prioritize Engagement: Focus on individuals who possess high influence and high interest first. Addressing their needs and concerns promptly can significantly enhance project success and foster stronger relationships. Streamlined decision-making processes can facilitate quicker responses to inquiries, ensuring that concerns are addressed in a timely manner.

- Develop Key Contributor Profiles: Create detailed profiles for important contributors that outline their interests, concerns, and preferred communication methods. This customized method will guide participation plans and enable more effective interactions. By putting into practice the lessons learned from past interactions, financial leaders can cultivate stronger, enduring connections with interested parties.

- Regularly Review and Update: Stakeholder dynamics are not static; they can evolve over time. Consistently examining and refreshing contact lists and profiles is crucial to represent any shifts in influence or interest, guaranteeing that engagement approaches stay pertinent and efficient. Ongoing observation via real-time analytics, enabled by the client dashboard from Transform Your Small/ Medium Business, can assist CFOs in assessing the health of relationships with involved parties and modifying strategies as needed.

Integrating these practices can lead to the effective use of stakeholder management tools, ultimately promoting better financial results and project success. For instance, the Directions of Influence chart categorizes participants into upward, downward, outward, and sideward groups to visualize their relationships and influence dynamics within an organization. While it provides insights into participant relationships, alternative methods like relationship network mapping may offer better classification.

By continuously assessing classification methods for interested parties, financial leaders can improve their strategies and promote sustainable growth through the use of stakeholder management tools. As Professor Edward Freeman from the University of Virginia aptly noted, "We thank Professor Edward Freeman for his valuable suggestions and perceptive ideas," emphasizing the importance of expert insights in managing interests.

Common Challenges in Stakeholder Management and How to Overcome Them

CFOs frequently navigate a complex landscape of stakeholder management, facing several key challenges that can significantly impact project success:

- Conflicting Interests: Stakeholders often have divergent priorities, complicating decision-making. To address this, CFOs should promote open discussions that encourage participants to express their concerns and aspirations. Ultimately, this approach works towards a shared vision that aligns interests. Streamlined decision-making processes can facilitate quicker resolutions and improve participant satisfaction.

- Communication Breakdowns: Ineffective communication can lead to significant misunderstandings and eroded trust. As highlighted in PwC's 2024 Trust Survey, "Executives continue to overestimate how much they are trusted by employees and consumers." Establishing clear communication channels and protocols is essential to ensure that all parties utilize stakeholder management tools to receive consistent and accurate information, thereby enhancing transparency and collaboration. Moreover, utilizing real-time analytics can further support this effort by providing interested parties with up-to-date information on project status and performance.

- Resistance to Change: Implementing new financial strategies can encounter skepticism from invested parties. Engaging them early in the process is crucial; by addressing their concerns and clearly demonstrating the benefits of proposed changes, CFOs can utilize stakeholder management tools to mitigate resistance and foster a more receptive environment. Testing hypotheses and measuring investment returns can assist in presenting data-driven justifications for changes, thereby easing concerns of involved parties.

- Lack of Engagement: Stakeholders who feel disconnected from financial decisions may become disengaged, hindering project momentum. Regular updates and inclusive decision-making processes serve as vital stakeholder management tools for improving participant engagement, ensuring that all voices are heard and appreciated. Ongoing performance observation via Transform Your Small/ Medium Business's client dashboard can offer participants insights into business health, strengthening their link to the project.

- Resource Constraints: Limited resources can pose significant challenges to effective management of interested parties. The ongoing labor shortages in finance and IT sectors necessitate that chief financial officers carefully evaluate investments and workforce plans to maintain operational continuity while driving growth. Financial leaders should prioritize engagement initiatives by utilizing stakeholder management tools to assess the influence and interest of interested parties, concentrating efforts where they can attain the most significant effect.

In 2025, as the demand for improved cybersecurity and digital transformation increases, CFOs must also be aware of the changing environment of expectations from interested parties. With 90% of senior finance leaders acknowledging the significance of getting ready for unexpected occurrences, proactive management of involved parties will be essential in addressing these challenges. Furthermore, generative AI offers possibilities for digital transformation in company operations, which can enhance management of interested parties by streamlining processes and improving communication.

Leveraging Technology for Enhanced Stakeholder Management

Chief financial officers can significantly enhance their management of interested parties by leveraging stakeholder management tools alongside advanced technology and innovative solutions, particularly in light of recent workforce reductions and shifting priorities. Here are some effective strategies:

- Utilizing stakeholder management tools such as Simply Stakeholders or StakeTracker enables financial executives to systematically organize and monitor interactions with interested parties. These tools ensure timely follow-ups and foster effective communication, which is crucial for maintaining strong relationships, especially as organizations confront challenges in productivity and strategic planning due to reduced headcounts.

- Data Analytics: The incorporation of analytics tools provides valuable insights into participant behavior and preferences. By analyzing this data, financial leaders can tailor their engagement strategies to better meet the needs and expectations of stakeholders, ultimately fostering more effective interactions. As highlighted by a Deloitte study, 85% of CEOs prioritized digital transformation during the Covid-19 pandemic, underscoring the importance of technology in management. Furthermore, continuous monitoring through real-time business analytics, facilitated by the client dashboard from Transform Your Small/ Medium Business, allows CFOs to assess business health and adjust strategies accordingly.

- Collaboration Platforms: Tools like Slack and Microsoft Teams enhance real-time communication and collaboration among participants. These platforms not only boost engagement but also increase responsiveness, enabling teams to swiftly address issues and opportunities, which is essential for a streamlined decision-making process during turnaround efforts.

- Automated Reporting: Implementing automated reporting solutions simplifies the process of disseminating financial updates to interested parties. This ensures that stakeholders receive timely and relevant information, which is crucial for informed decision-making and maintaining transparency. Regular updates also aid in tracking the effectiveness of turnaround plans and implementing lessons learned.

- Feedback Mechanisms: Digital feedback tools facilitate the effective collection of participant input. By actively seeking and integrating feedback, financial leaders can make informed decisions that reflect insights from stakeholders, thereby enhancing overall engagement and satisfaction.

As organizations navigate the complexities of managing interested parties, especially in the aftermath of workforce reductions and changing priorities, stakeholder management tools will be essential for achieving project success and fostering sustainable growth. Additionally, with a slight uptick in interest and investment in climate technologies beyond electrification and renewables, the importance of efficient management of involved parties becomes even more pronounced in sectors focused on sustainability and innovation. The decisive actions supported by Transform Your Small/ Medium Business during the turnaround process will be critical in this context.

Best Practices for Optimizing Stakeholder Management in Finance

To optimize stakeholder management, CFOs should implement the following best practices:

- Establish Clear Objectives: Defining specific aims for participant involvement that align directly with the organization’s financial goals is essential. This clarity aids in prioritizing interactions with interested parties, ensuring that all efforts contribute to the overall plan.

- Regularly Review Engagement Strategies: Continuous assessment and refinement of engagement approaches are crucial. By integrating feedback and adjusting to evolving dynamics, organizations can enhance their responsiveness and effectiveness. Utilizing stakeholder management tools to manage relationships with interested parties aligns with the commitment to operationalizing lessons from turnaround processes, thereby building strong, lasting relationships.

- Foster a Culture of Transparency: Building trust with involved parties hinges on open communication and transparency. Promoting a culture where information is exchanged freely can significantly improve participant confidence and involvement, ultimately resulting in better collaboration. This is particularly important as organizations utilize real-time analytics to monitor business health and performance.

- Train Teams on Partner Interaction: Providing targeted training for finance teams on effective collaborator involvement techniques is vital. This investment in skill development not only enhances team capabilities but also ensures that stakeholder management tools are applied with utmost professionalism and insight.

- Measure Interaction Effectiveness: Implementing metrics to assess the effectiveness of participant involvement efforts allows organizations to make data-driven improvements. By analyzing engagement outcomes, CFOs can identify successful strategies and areas needing improvement, ensuring that the use of stakeholder management tools remains a dynamic and impactful process. Utilizing real-time business analytics can aid in this continuous performance monitoring.

- Selective Participant Involvement: Not all participants need to be involved in every aspect of the project. By selectively involving interested parties, organizations can enhance communication and reporting, making the process more efficient.

In a notable case study titled "Planned Alignment," a four-year project involving both an international technical sponsor and a remote financial sponsor highlighted the importance of clearly defined roles and responsibilities. The project manager's emphasis on involving customers and vendors from the outset facilitated effective communication strategies, crucial in identifying and addressing potential barriers before they escalated. This proactive approach not only helped in overcoming challenges but also reinforced the significance of maintaining open lines of communication throughout the project.

As organizations navigate the complexities of financial management in 2025, establishing clear objectives for participant involvement and fostering transparency will be essential. Furthermore, setting achievable engagement objectives and employing reporting to illustrate the effect of participant involvement will improve overall effectiveness. These practices not only enhance trust among interested parties but also contribute to the overall effectiveness of financial plans.

The Future of Stakeholder Management: Trends and Insights for CFOs

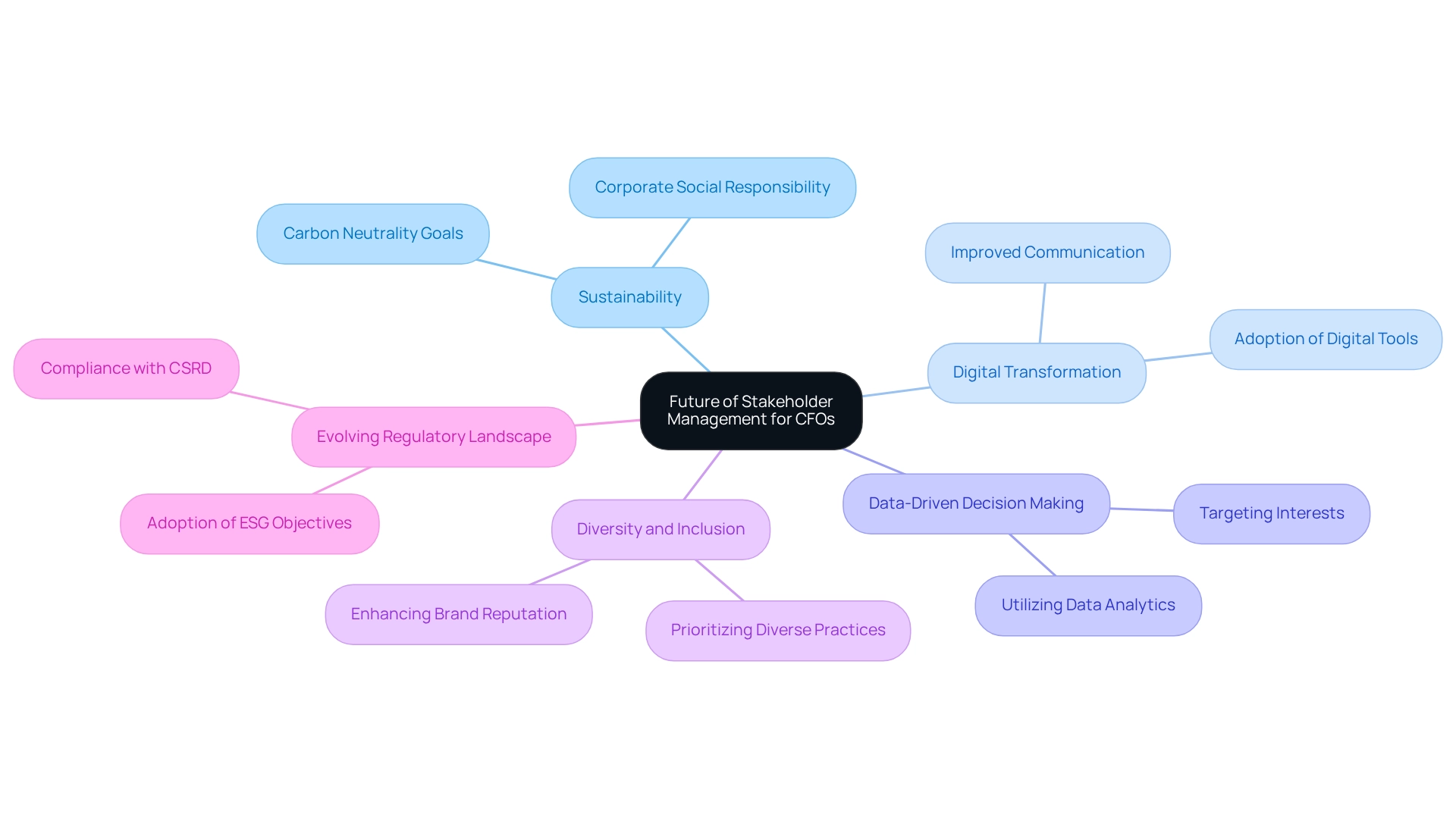

As stakeholder management evolves, CFOs must stay attuned to several key trends shaping the landscape:

- Increased Focus on Sustainability: Stakeholders are placing a heightened emphasis on sustainability and corporate social responsibility. This shift necessitates that CFOs incorporate sustainability considerations into their financial plans, aligning business objectives with environmental goals. With 61% of worldwide consumers suggesting that sustainable purchases are viewed as excessively costly, comprehending the balance between price and sustainability is essential for effective involvement. Businesses are setting ambitious goals for carbon neutrality, implementing strategies such as carbon offsets and renewable energy adoption, which are becoming standard expectations for companies.

- Digital Transformation: The proliferation of digital tools and platforms is revolutionizing participant engagement. CFOs must adopt technology to improve communication and cooperation with parties involved, ensuring that their organizations stay competitive and responsive to their needs. The continuous digital transformation is not merely a trend; it is becoming a crucial element of how companies function and interact with their partners.

- Data-Driven Decision Making: Utilizing data analytics is becoming increasingly vital for understanding the preferences and behaviors of involved parties. By leveraging data, financial executives can create more impactful interaction strategies that resonate with interested parties, ultimately resulting in enhanced relationships and results. As Rebecca Lawson, Sustainability Manager at Aesop, states, "On our journey to Net Zero, precise, granular emissions data is really helpful to Aesop — because before we can act, we need to know what to focus on." This data-focused method enables accurate targeting of interests, improving overall involvement effectiveness.

- Greater Emphasis on Diversity and Inclusion: Stakeholders expect organizations to prioritize diversity and inclusion within their practices. CFOs should ensure that these values are not only recognized but actively reflected in engagement efforts with interested parties. This commitment can enhance brand reputation and foster stronger connections with various interest groups.

- Evolving Regulatory Landscape: The regulatory environment is continuously changing, influencing the expectations of interested parties. CFOs must stay alert to these changes and adjust their plans accordingly. As companies prepare to report under the EU’s Corporate Sustainability Reporting Directive (CSRD) for the first time in 2025, understanding and adhering to these regulations will be crucial for maintaining trust among interested parties and fulfilling their expectations. Moreover, government regulations are increasingly mandating companies to adopt ESG objectives, further highlighting the significance of adherence in managing interests.

By recognizing and addressing these trends, CFOs can enhance their stakeholder management tools, ensuring that their organizations are well-positioned for success in an increasingly complex environment.

Conclusion

Navigating the complexities of stakeholder management is indispensable for CFOs aiming to enhance financial performance and drive organizational success. By identifying, analyzing, and engaging a diverse array of stakeholders—ranging from investors to regulatory bodies—CFOs can cultivate trust and optimize financial outcomes. Moreover, the shift towards concentrated growth strategies and heightened cybersecurity demands further underscores the necessity for alignment between financial strategies and stakeholder interests.

Implementing effective stakeholder management practices involves utilizing advanced tools and techniques, such as stakeholder mapping software, CRM systems, and real-time analytics. These resources empower CFOs to tailor their engagement strategies, ensuring that communication is both timely and relevant. By fostering a culture of transparency and active listening, CFOs can mitigate risks associated with conflicting interests and communication breakdowns, ultimately enhancing stakeholder satisfaction and collaboration.

Looking ahead, the evolving landscape of stakeholder expectations highlights the importance of sustainability, digital transformation, and data-driven decision-making. As stakeholders increasingly prioritize corporate social responsibility and diversity, CFOs must adapt their strategies to reflect these values. By embracing these trends and leveraging technology, financial leaders can not only navigate challenges but also unlock significant value for their organizations.

In conclusion, prioritizing stakeholder management is not merely a tactical approach; it is a strategic imperative that can significantly influence an organization's trajectory. By committing to effective engagement and aligning financial strategies with stakeholder interests, CFOs can ensure their organizations not only thrive in the present but are also well-prepared for the future.

Frequently Asked Questions

What are stakeholder management tools, and why are they important for financial executives?

Stakeholder management tools are essential for financial executives as they help identify, analyze, and engage individuals or groups that influence the organization's financial performance. These tools enhance communication, build trust, and drive improved financial outcomes with various stakeholders such as investors, employees, customers, and regulatory bodies.

How are CFOs expected to change their investment strategies in the coming years?

Research indicates that over two-thirds of CFOs are expected to adopt growth strategies characterized by fewer, more concentrated investments in the next three years. This shift emphasizes the importance of aligning financial strategies with the interests and concerns of stakeholders.

What impact does effective stakeholder management have on new Chief Financial Officers?

A structured approach to relationship building using stakeholder management tools can increase the likelihood of a successful transition for new CFOs by up to 50%. Poorly managed transitions can result in knowledge transfer gaps and employee disengagement, negatively affecting financial performance.

What should financial leaders focus on to improve relationships with stakeholders?

Financial leaders should prioritize thorough financial assessments that focus on cash preservation, efficiency, and risk reduction. This approach helps uncover hidden value and reduce costs, fostering long-term partnerships and optimizing balance sheets.

How can stakeholder management tools assist in decision-making processes?

Stakeholder management tools facilitate collaborative communication and actively involve participants in decision-making. This ensures that all parties are informed and promotes a sense of ownership and dedication among stakeholders, which is crucial for effective financial decision-making.

What strategies should CFOs implement to manage stakeholder relationships effectively?

Effective strategies include providing regular updates, maintaining clear communication, and seeking feedback to better understand stakeholder perspectives. These practices, along with efficient decision-making and real-time analytics, help financial leaders navigate complex stakeholder relationships.

What specific tools can CFOs use to enhance their interaction strategies?

CFOs can utilize various tools such as: 1. Interest Mapping Software (e.g., StakeholderMap.com) for visualizing relationships. 2. Customer Relationship Management (CRM) Systems (e.g., Salesforce) for monitoring interactions. 3. Feedback and Survey Tools (e.g., SurveyMonkey) for gathering insights from stakeholders. 4. Project Management Tools (e.g., Asana, Trello) for managing engagement tasks. 5. Data Analytics Tools for gaining insights into participant behavior and preferences.

How do stakeholder management tools contribute to business performance?

The successful implementation of stakeholder management tools enhances decision-making capabilities, leading to improved business performance and strategic excellence. They allow financial executives to recognize the importance of managing interests, which boosts operational efficiency.

What role do AI-powered analytics play in the future of CFOs' responsibilities?

AI-powered analytics are becoming central to the finance function, enabling CFOs to develop sophisticated financial reporting mechanisms, automate data-gathering processes, and enhance accuracy. This transition positions CFOs as strategic advisors, prepared to navigate modern financial management complexities.