Overview

Business cost reduction strategies are vital for CFOs, as they seek to minimize expenses while enhancing overall efficiency and profitability within organizations. This article underscores that these strategies encompass systematic approaches, including:

- Process optimization

- Supplier negotiation

- Leveraging technology

Each of these elements is crucial for sustaining competitiveness and achieving sustainable growth in today's challenging economic environment. Moreover, adopting these strategies can significantly impact an organization's bottom line, making them an essential focus for financial leaders.

Introduction

In a landscape where financial agility reigns supreme, CFOs confront the critical challenge of navigating cost reduction strategies that not only trim expenses but also bolster long-term profitability. As economic pressures escalate and operational costs rise, a strategic approach to cost management has never been more vital.

This article explores the multifaceted realm of cost reduction, highlighting its significance for financial leaders and outlining actionable strategies that can be implemented to foster efficiency and drive sustainable growth.

From optimizing processes and leveraging technology to monitoring performance metrics, the insights presented here aim to equip CFOs with the essential tools to thrive in an increasingly competitive marketplace.

Define Cost Reduction and Its Importance for CFOs

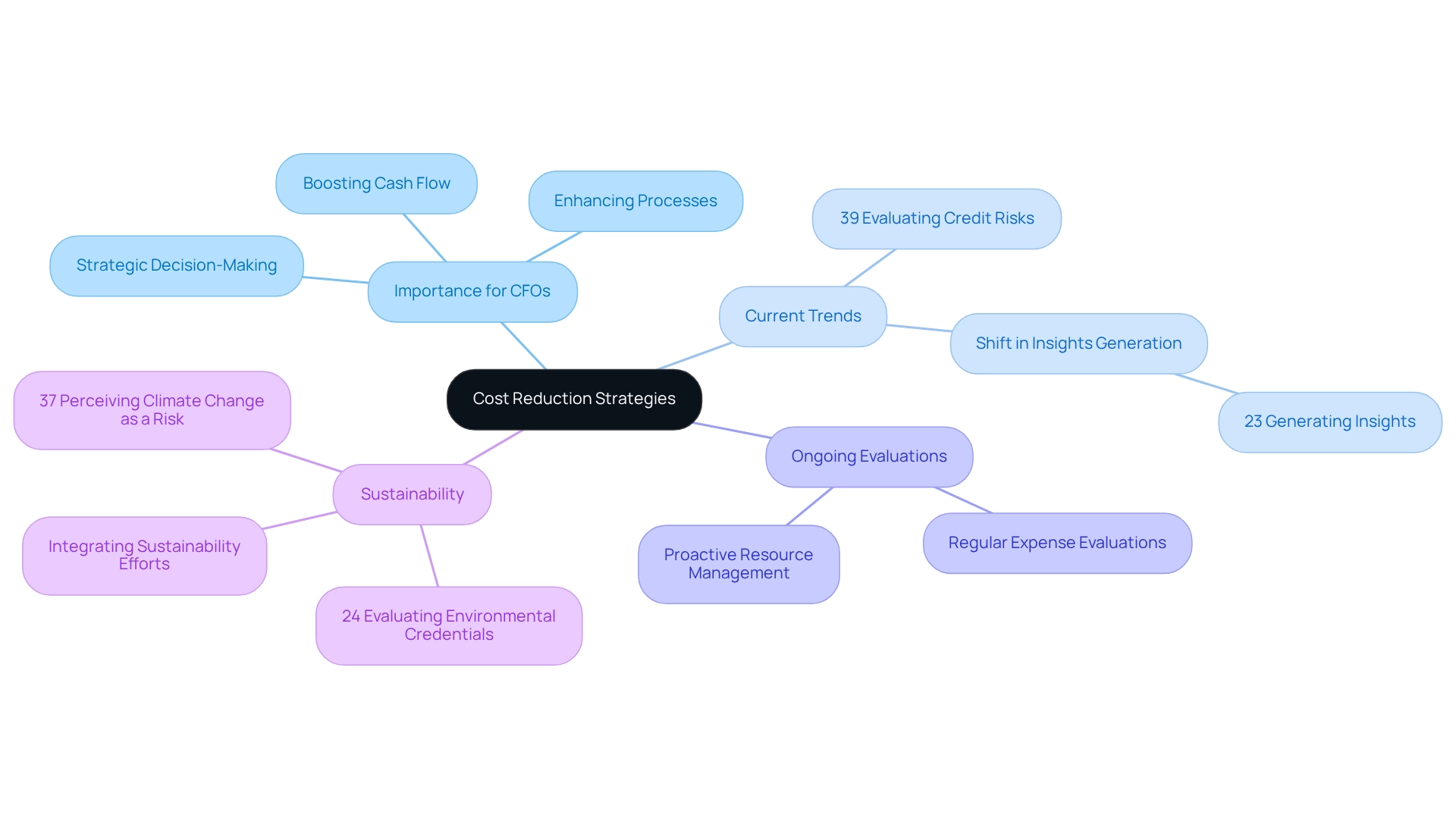

Business cost reduction strategies are systematic approaches designed to decrease a company's expenses and maximize profits. For CFOs, this practice transcends mere budget cuts; it involves strategic decision-making to identify and eliminate unnecessary costs while enhancing processes. Effective expense trimming can significantly boost cash flow, enhance profitability, and strengthen a company's competitive position in the market.

In today's economic climate, characterized by rising operational costs and fluctuating revenues, understanding the intricacies of expense trimming is essential. Notably, 39% of leaders are currently evaluating the credit risk of major clients, which can inform financial management decisions by pinpointing potential revenue threats and enabling proactive adjustments to financial strategies. This reflects a broader trend where financial executives must recognize that cost reduction is not a one-time initiative but an ongoing process that necessitates regular expense evaluations and a proactive approach to resource management. Aligning business cost reduction strategies with overarching organizational goals is vital for ensuring agility and resilience.

For instance, mastering the cash conversion cycle through strategic improvements can equip financial executives with insights that enhance cash flow and profitability. A recent case study indicated that only 23% of finance executives reported generating insights for , a decrease from 39% in 2021. This decline impacts expense-saving initiatives by indicating a shift away from proactive engagement in strategic decision-making, underscoring the necessity for financial leaders to prioritize savings as a pathway to sustainable growth. Furthermore, as 24% of businesses currently evaluate the environmental qualifications of third-party providers, integrating expense minimization with sustainability efforts can enhance corporate image and operational efficiency. This is particularly relevant as 37% of enterprises perceive climate change as a serious or moderate threat, highlighting the importance of incorporating environmental considerations into expense-saving strategies.

Ultimately, by implementing business cost reduction strategies and leveraging and restructuring services, financial leaders can position their organizations to thrive in the face of challenges, ensuring long-term profitability and success.

Implement Proven Cost Reduction Strategies

CFOs can implement established business to enhance efficiency and boost profitability. Here are some key approaches:

- Process Optimization: Streamlining operations by eliminating redundancies and automating repetitive tasks can yield significant savings in labor costs. For instance, adopting software solutions for invoicing and payroll not only conserves time but also minimizes errors, leading to an estimated 15% reduction in operational expenses. Testing the effectiveness of these optimizations ensures maximum return on investment.

- Supplier Negotiation: Regularly reviewing supplier contracts and negotiating improved terms can result in substantial savings. CFOs should consider consolidating purchases to leverage bulk discounts or exploring alternative suppliers for more competitive pricing. Success stories in supplier negotiations underscore how strategic discussions can lead to considerable savings. Collaborating with procurement teams can further enhance these negotiations.

- Energy Efficiency Initiatives: Investing in energy-efficient technologies can lower utility expenses over time. Transitioning to LED lighting and smart thermostats, for example, can significantly reduce energy consumption and costs, thereby improving overall efficiency. Measuring the return on investment for these initiatives is essential to validate their effectiveness.

- Outsourcing Non-Core Functions: Engaging external services for tasks such as IT support or payroll can effectively decrease overhead costs while allowing internal teams to concentrate on primary business activities. This strategy not only reduces expenses but also provides access to specialized expertise without the commitment of full-time hires. Evaluating the impact of outsourcing on overall performance can yield valuable insights into its effectiveness.

- Regular Financial Reviews: Conducting comprehensive financial assessments quarterly helps identify areas for expense reduction. CFOs should scrutinize spending trends and adjust budgets as necessary to ensure alignment with strategic objectives, promoting a proactive approach to financial management. This aligns with the need to pinpoint underlying business issues and develop cost reduction strategies to address weaknesses, facilitating reinvestment in core strengths.

- Employee Training and Development: Investing in employee training enhances productivity and reduces errors, resulting in long-term savings. A well-trained workforce is more efficient and can significantly contribute to improved operational performance. Assessing the outcomes of training programs is crucial for evaluating their return on investment.

- Monitoring Customer Service Expenses: As highlighted in the case study 'Customer Service Expense Optimization,' scrutinizing customer service expenditures and implementing cost-effective strategies can enhance investment in this area and improve efficiency. By closely monitoring these expenses, companies can identify potential savings that bolster overall financial health. Evaluating various customer support strategies can further enhance financial efficiency.

By adopting these business cost reduction strategies, financial leaders can cultivate a culture of expense awareness that boosts effectiveness and prepares the organization for sustainable growth. As noted by industry experts, including Ryan Thompson, these strategies serve as both inspiration and a roadmap for organizations poised to transform their operations. Furthermore, integrated processes form the foundation of a robust business infrastructure, enhancing efficiency, productivity, quality, and ROI.

Leverage Technology for Cost Reduction

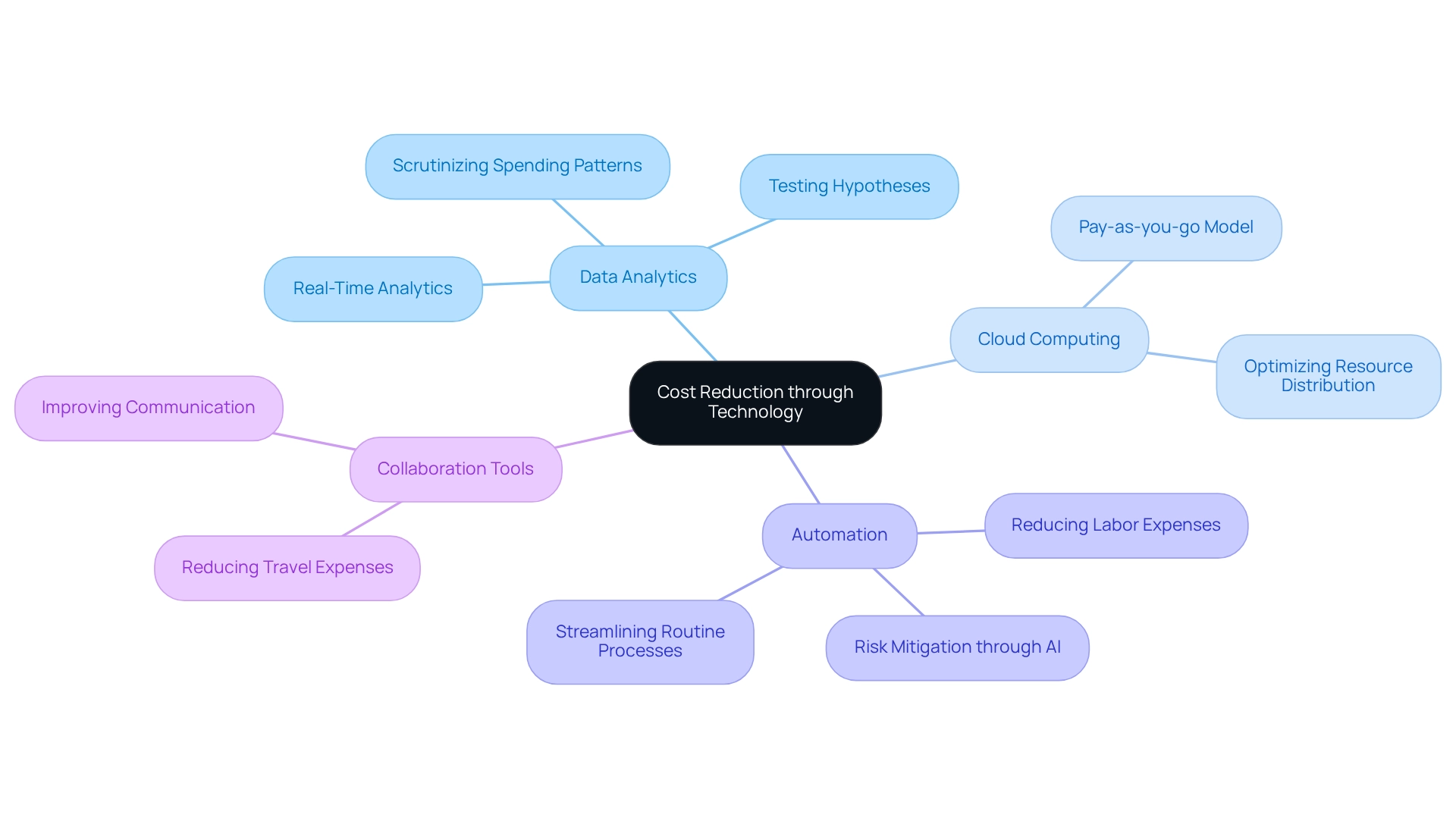

Technology is essential for financial executives aiming to implement effective business cost reduction strategies. By harnessing advanced tools and software, organizations can achieve greater visibility into their financial data and operational processes. Here are several key ways technology facilitates cost reduction:

- Data Analytics: Leveraging data analytics tools enables CFOs to scrutinize spending patterns and pinpoint areas of inefficiency. Understanding expenditure allows organizations to develop business cost reduction strategies, ultimately leading to significant savings. Companies are heavily investing in generative AI, expecting substantial revenue growth and productivity gains within the next three years. Moreover, real-time analytics, observed via a client dashboard, can consistently assess organizational health, enabling prompt modifications to strategies as necessary. This process also involves testing hypotheses to ensure that decisions are data-driven and effective.

- Cloud Computing: Embracing cloud-based solutions can significantly reduce IT infrastructure expenses. With a pay-as-you-go model, cloud services enable organizations to modify their usage based on current demands, thus avoiding unnecessary costs and optimizing resource distribution.

- Automation: Streamlining routine processes like invoicing, payroll, and inventory management can significantly lower labor expenses and minimize human error. Automation tools streamline workflows, freeing up employees to concentrate on higher-value tasks that drive growth. A case study titled "Risk Mitigation through AI and Machine Learning" illustrates how AI and machine learning algorithms are utilized to detect patterns indicative of fraud or financial risks, allowing businesses to address potential risks before they impact financial performance. This approach aligns with the need for testing hypotheses and operationalizing lessons learned during the turnaround process.

- Collaboration Tools: Utilizing collaboration platforms improves communication and project management, reducing the necessity for in-person meetings and related travel expenses. Tools like Slack and Microsoft Teams support remote work, fostering productivity and teamwork.

By adopting these technological innovations, financial leaders can enhance , realizing savings while also improving overall operational efficiency, which positions their organizations for sustainable success. The integration of AI and machine learning further supports these efforts by identifying patterns that mitigate financial risks, ensuring that businesses remain agile and responsive to changing market conditions. As noted, "AI and machine learning algorithms can detect patterns indicative of fraud or financial risks before they impact the bottom line," underscoring the critical role of technology in financial management.

Monitor and Measure Cost Reduction Efforts

To ensure the success of business cost reduction strategies, CFOs must establish a robust framework for monitoring and measuring their effectiveness. Consider these key practices:

- Set Clear KPIs: Establish (KPIs) that align with expense minimization objectives. Metrics such as cost savings achieved, percentage reduction in overhead, and improvements in operational efficiency are essential for tracking progress. As Scott Beaver, Senior Product Marketing Manager, notes, "Determining the most useful and meaningful KPIs for your business can be challenging."

- Regular Reporting: Implement a systematic reporting process to monitor progress against KPIs. Monthly or quarterly reports enable CFOs to assess the effectiveness of their strategies and make necessary adjustments, ensuring alignment with organizational objectives. Companies that track the percentage of orders delivered on time have seen significant improvements in customer satisfaction, illustrating the broader impact of effective monitoring.

- Feedback Mechanisms: Establish avenues for employee input on expense-saving initiatives. Engaging staff in the process not only provides valuable insights but also fosters a culture of continuous improvement, which is vital for long-term success. This aligns with the need to identify underlying operational issues and collaboratively create plans that allow for reinvestment in key strengths.

- Benchmarking: Compare performance against industry standards or competitors to identify areas for further enhancement. Benchmarking can reveal best practices and innovative approaches that can be adopted to drive efficiency. For instance, a case study on customer satisfaction in logistics showed that by implementing self-service portals and improving order accuracy, companies significantly enhanced their customer satisfaction scores.

By actively monitoring and measuring business cost reduction strategies, financial leaders can ensure that their initiatives remain effective and aligned with the organization's overall objectives, ultimately driving sustainable growth. Furthermore, manufacturers ought to track inventory levels, while service providers might concentrate on revenue per employee to customize their strategies effectively. This continuous performance monitoring, coupled with real-time analytics, empowers CFOs to operationalize turnaround lessons and make informed decisions that enhance overall business performance.

Conclusion

In today's dynamic economic environment, effective cost reduction stands as a critical imperative for CFOs striving to enhance profitability and secure long-term success. This article underscores the importance of a strategic approach to cost management, highlighting that it transcends mere expense cutting; it involves optimizing processes and aligning cost strategies with overarching business objectives. By employing proven methodologies such as process optimization, supplier negotiation, and energy efficiency initiatives, CFOs can foster a culture of cost consciousness that drives efficiency and positions organizations for sustainable growth.

Moreover, leveraging technology plays a pivotal role in achieving these objectives. Advanced tools like data analytics, cloud computing, and automation provide greater visibility into financial data, empowering CFOs to make informed decisions that lead to substantial savings. The integration of innovative technologies not only reduces costs but also enhances operational efficiency, enabling organizations to remain agile in a competitive marketplace.

Furthermore, monitoring and measuring the effectiveness of cost reduction strategies is equally essential. Establishing clear KPIs, implementing regular reporting, and fostering employee engagement through feedback mechanisms contribute to a robust framework that ensures alignment with organizational objectives. By continuously assessing performance and benchmarking against industry standards, CFOs can identify areas for improvement and drive ongoing success.

Ultimately, the commitment to strategic cost reduction is vital for CFOs as they navigate an increasingly challenging landscape. By embracing these strategies and fostering a proactive approach to financial management, organizations can achieve not only immediate savings but also lay the groundwork for sustained profitability and resilience in the face of future challenges.

Frequently Asked Questions

What are business cost reduction strategies?

Business cost reduction strategies are systematic approaches designed to decrease a company's expenses and maximize profits through strategic decision-making that identifies and eliminates unnecessary costs while enhancing processes.

Why is expense trimming important for CFOs?

Expense trimming is important for CFOs as it can significantly boost cash flow, enhance profitability, and strengthen a company's competitive position in the market. It goes beyond mere budget cuts and involves ongoing evaluations and proactive resource management.

How does the current economic climate affect cost reduction strategies?

The current economic climate, characterized by rising operational costs and fluctuating revenues, necessitates a thorough understanding of expense trimming to inform financial management decisions and address potential revenue threats.

What percentage of leaders are currently evaluating the credit risk of major clients?

39% of leaders are currently evaluating the credit risk of major clients, which helps identify potential revenue threats and enables proactive adjustments to financial strategies.

Is cost reduction a one-time initiative?

No, cost reduction is not a one-time initiative; it is an ongoing process that requires regular expense evaluations and a proactive approach to resource management.

How can mastering the cash conversion cycle benefit financial executives?

Mastering the cash conversion cycle through strategic improvements can provide financial executives with insights that enhance cash flow and profitability.

What trend was observed in finance executives generating insights for broader business applications?

A recent case study indicated that only 23% of finance executives reported generating insights for broader business applications, a decrease from 39% in 2021, highlighting a shift away from proactive engagement in strategic decision-making.

How can integrating expense minimization with sustainability efforts benefit businesses?

Integrating expense minimization with sustainability efforts can enhance a company's corporate image and operational efficiency, particularly as 24% of businesses evaluate the environmental qualifications of third-party providers.

What percentage of enterprises view climate change as a serious or moderate threat?

37% of enterprises perceive climate change as a serious or moderate threat, emphasizing the importance of incorporating environmental considerations into expense-saving strategies.

How can financial leaders ensure long-term profitability and success?

By implementing business cost reduction strategies and leveraging comprehensive crisis management and restructuring services, financial leaders can position their organizations to thrive amidst challenges, ensuring long-term profitability and success.