Overview

Business restructuring consulting in Coral Springs is crucial for CFOs aiming to enhance organizational efficiency and profitability, particularly during financial distress. These consulting services offer tailored strategies and expert insights that empower companies to navigate complex economic challenges. Moreover, they facilitate the implementation of effective turnaround plans, ultimately leading to sustainable growth.

Introduction

In the dynamic realm of business, restructuring consulting has emerged as an essential lifeline for organizations grappling with financial distress or operational inefficiencies. As companies endeavor to bolster their efficiency and profitability, the expertise of seasoned consultants becomes indispensable.

With the surge of private equity firms investing in distressed assets and the growing complexity of market dynamics, businesses must embrace agile methodologies and innovative strategies to navigate these challenging waters. This article explores the multifaceted domain of business restructuring consulting, examining:

- Its significance in 2025

- The hurdles faced by CFOs

- The critical nature of turnaround strategies

- The vital services provided by restructuring consultants

By leveraging industry-specific expertise and harnessing cutting-edge technology, organizations can not only survive but thrive, positioning themselves for sustainable growth in an increasingly competitive environment.

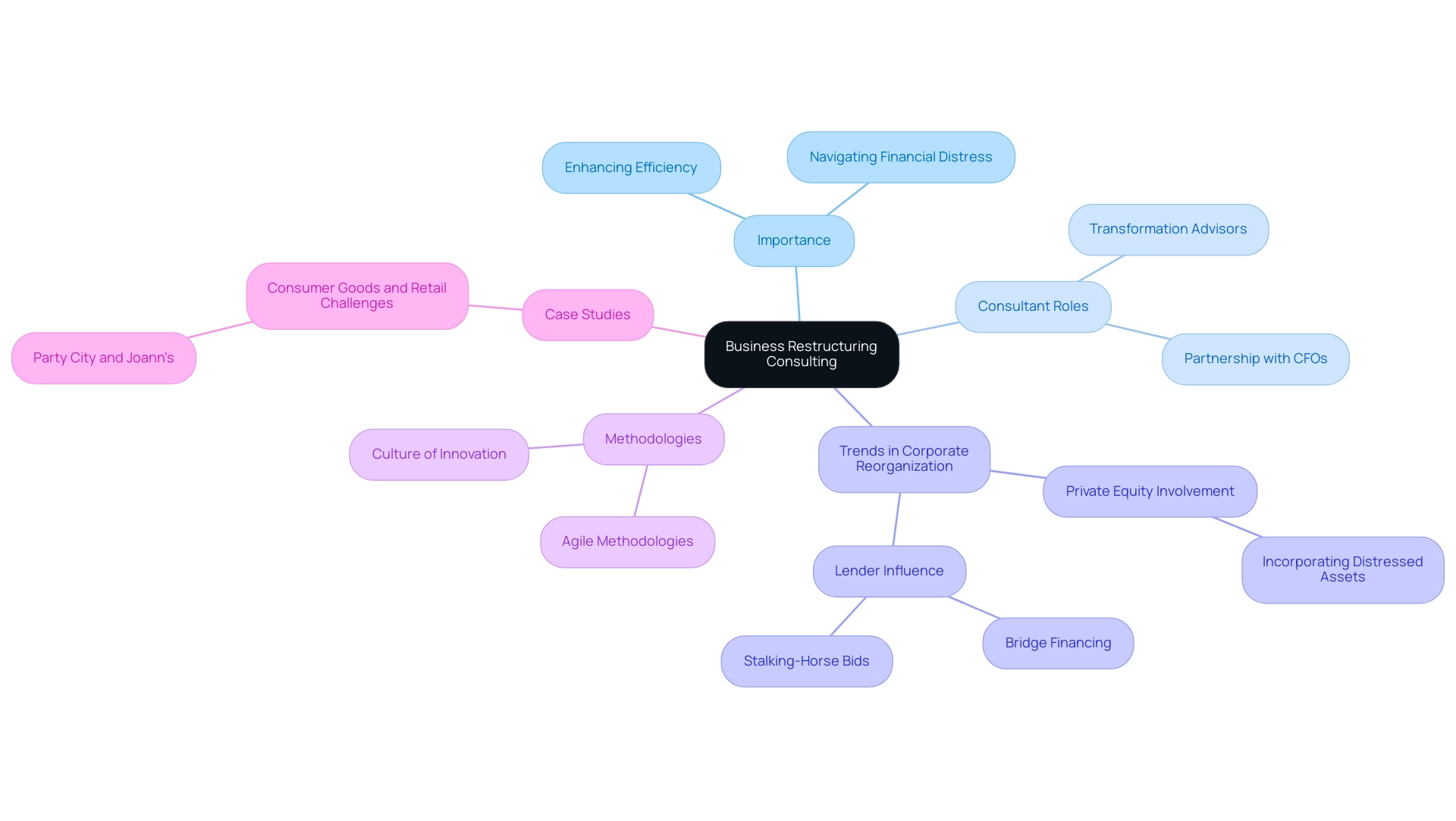

Understanding Business Restructuring Consulting

Business restructuring consulting in Coral Springs represents a tactical process aimed at realigning a company's operations, finances, and overall strategies to enhance efficiency and profitability. This service is particularly vital for organizations facing financial distress or operational inefficiencies, making business restructuring consulting in Coral Springs a sought-after solution. By collaborating with transformation advisors from Transform Your Small/Medium Enterprise, organizations can pinpoint key areas for improvement, streamline processes, and implement effective turnaround plans that foster sustainable growth.

As we look toward 2025, the corporate reorganization landscape is shifting. Private equity firms are increasingly integrating troubled assets into their investment strategies, reflecting a robust trend that shows no signs of abating. This evolution underscores the importance of restructuring consulting as companies strive to navigate these complexities. Lenders are also playing a critical role, leveraging their influence to shape distressed mergers and acquisitions (M&A) outcomes, often providing bridge financing or engaging in stalking-horse bids to protect their interests.

The necessity of business restructuring consulting in Coral Springs is underscored by its ability to guide organizations through these challenges, ensuring they can adeptly respond to lender dynamics.

Consultants advocate for the adoption of agile methodologies and a culture of innovation, equipping organizations to react promptly to market fluctuations. This approach is crucial, especially as companies like Party City and Joann's, which previously emerged from bankruptcy, have recently reentered Chapter 11 due to persistent challenges in the retail sector. This scenario highlights the urgency for effective reorganization strategies. As Michael C. Eisenband, Global Segment Leader of Corporate Finance & Restructuring, aptly states, "Turbulent Waters, Trusted Anchors: The General Counsel’s Evolving Role in Navigating Crises," emphasizing the vital role of trusted advisors during turbulent times.

The impact of organizational consulting on operational efficiency is significant. Statistics reveal that organizations engaging in business restructuring consulting in Coral Springs frequently experience notable enhancements in operational performance and financial health. For CFOs, the role of these consultants transcends mere advice; it embodies a partnership that ensures all facets of the organization are evaluated for a holistic reform strategy.

Expert insights highlight the critical nature of these consulting services, especially in 2025, as businesses maneuver through an increasingly intricate economic landscape. By harnessing the expertise of restructuring consultants, CFOs can steer their organizations toward recovery and long-term success.

Challenges Faced by CFOs in Financial Management

CFOs frequently encounter a myriad of challenges, particularly in managing cash flow, ensuring compliance with evolving economic regulations, and tackling operational inefficiencies. The effect of economic fluctuations in 2025 has intensified these issues, placing additional strain on resource management practices. A recent study reveals that nearly 70% of CFOs report increased pressure to adapt to changing market conditions, underscoring the critical need for flexible monetary approaches.

Navigating the shifting regulatory landscape across jurisdictions demands precision and adaptability, further complicating the CFO's role. Moreover, the dual responsibility of balancing immediate operational demands with long-term strategic objectives can lead to significant stress for CFOs. This balancing act is further complicated by the necessity to anticipate market fluctuations, which enables the development of plans aimed at mitigating financial risk and safeguarding the overall health of the organization. As Steve McNally aptly stated, "During 2025, I encourage you to try a few new hats on for size to drive your organization to even greater success."

Recognizing these challenges is essential for CFOs, as it lays the groundwork for understanding how restructuring consulting can provide vital support. By leveraging expert insights and tailored strategies, CFOs can navigate these turbulent waters more effectively, ensuring that their organizations not only survive but thrive amidst uncertainty. The adoption of AI in contracting emerges as a strategic automation solution to safeguard financial integrity, which is crucial for modern CFOs.

Additionally, continuous business performance monitoring through real-time analytics empowers CFOs to make informed decisions swiftly, operationalizing lessons learned from past experiences to enhance cash flow management and operational efficiency. Case studies indicate that organizations engaged in reorganization consulting often experience improvements in these areas, ultimately resulting in sustainable growth. For instance, the case study titled "Driving Digital Transformation" illustrates how CFOs can effectively manage technology integration and change management to align tech investments with organizational goals.

The Role of Turnaround Strategies in Restructuring

Turnaround approaches are essential components of the business restructuring consulting process in Coral Springs, aimed at reversing negative trends and reinstating profitability. These methods encompass a variety of strategies, including cost-cutting measures, operational enhancements, and initiatives designed to boost revenue. A clearly outlined turnaround plan not only stabilizes an organization's economic position but also provides a clear roadmap for future development.

In 2025, the effectiveness of these approaches is underscored by the fact that organizations implementing comprehensive turnaround plans experience significant improvements in profitability, with many reporting a return to pre-crisis revenue levels within 12 to 18 months.

CFOs play a pivotal role in this transformative journey, ensuring that financial plans align closely with operational changes. Such alignment is essential for fostering a unified strategy for business restructuring consulting in Coral Springs, which can greatly influence overall organizational performance. Research indicates that effective turnaround approaches can lead to a 30% increase in operational efficiency, highlighting their importance in the restructuring landscape.

Moreover, the significance of turnaround methods in business restructuring consulting is further emphasized by case studies from 2025, revealing that organizations proactively addressing common pitfalls—such as lack of management support and poor communication—are more likely to achieve their restructuring goals. In fact, studies show that 70% of change initiatives fail primarily due to employee resistance, underscoring the need for CFOs to engage their teams and cultivate a culture of adaptability. As Bryan Philips from In Motion Marketing states, 'We turn B2B marketing challenges into growth opportunities,' which resonates with the necessity for CFOs to transform challenges into strategic advantages.

In addition, mastering the cash conversion cycle through streamlined decision-making and real-time analytics is crucial for effective turnaround and performance monitoring. By continually testing hypotheses and adjusting approaches based on real-time data, CFOs can operationalize lessons learned and ensure their organizations remain agile and responsive to market changes. As the business environment evolves, CFOs must stay vigilant and informed about the latest trends in turnaround approaches.

By doing so, they can navigate their organizations through challenging times while positioning them for sustainable growth and success in the future. Furthermore, assessing change management via employee feedback, adoption rates, project timelines, and ROI on change initiatives can provide valuable insights into the effectiveness of turnaround approaches, ensuring continuous improvement and adaptation.

At Transform Your Small/Medium Business, we offer a comprehensive guide on 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' for just $99.00, equipping CFOs with the necessary tools to implement these strategies effectively.

Key Services Offered by Restructuring Consultants

Business restructuring consulting in Coral Springs serves a crucial function in guiding businesses through crises by providing a comprehensive suite of services tailored to their specific challenges. Transform Your Small/Medium Business offers key services, including:

- Business restructuring consulting in Coral Springs

- Full-service turnaround and reorganization consulting

- Interim management

- Economic assessments

- Strategic planning

These advisors collaborate closely with CFOs to identify inefficiencies, develop practical strategies, and implement transformative changes that enhance economic health.

In 2025, the consulting landscape for reorganization is notably dynamic, with 77% of U.S. respondents anticipating increased regulatory focus on sustainability, underscoring the importance of adaptable approaches in crisis management. The healthcare sector has encountered significant hurdles, as illustrated by recent bankruptcy filings, including those of Steward Health Care and Prospect Medical in January 2025. This situation highlights the urgent need for effective business restructuring consulting in Coral Springs amid economic challenges.

Moreover, reorganization advisors have demonstrated their value through case studies, such as a retail chain that utilized data analytics to enhance customer experiences, resulting in a 20% increase in sales and a 10% boost in customer loyalty. This success was facilitated by consultants who assisted in establishing data infrastructure and training marketing teams, showcasing how their services directly contributed to these positive outcomes.

By leveraging these specialized services, which include thorough assessments focused on cash preservation and efficiency, organizations can address immediate financial challenges while laying the groundwork for sustainable growth and resilience during adversity. The expertise of transformation consultants is indispensable for CFOs seeking to navigate their organizations through turbulent times and emerge stronger on the other side.

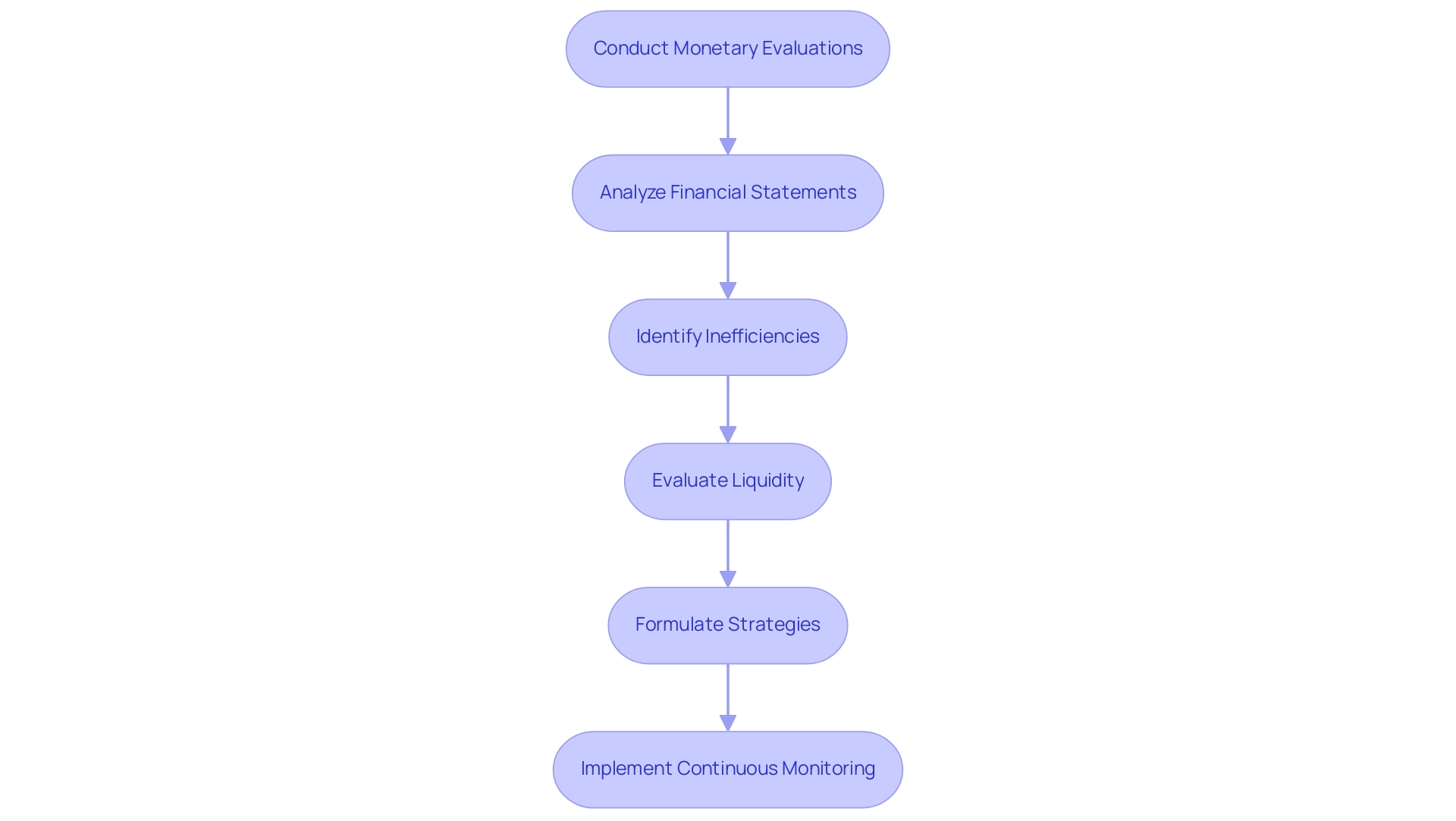

Conducting Financial Assessments for Effective Restructuring

Monetary evaluations are pivotal in the restructuring journey, enabling businesses to gauge their economic health and pinpoint areas ripe for enhancement. This comprehensive evaluation encompasses a detailed analysis of monetary statements, cash flow projections, and operational expenditures. By undertaking a meticulous assessment, CFOs can reveal inefficiencies, evaluate liquidity, and formulate strategies aimed at cash preservation and liability reduction.

In 2025, the significance of these assessments is underscored by the fact that 17% of finance professionals cite investor demands as a top concern, highlighting the need for robust economic health evaluations. Furthermore, a recent statement from AICPA-CIMA reveals that 54% of finance professionals find it easy or very easy to secure a new position, reflecting the competitive landscape that emphasizes the importance for organizations to maintain robust fiscal health.

Moreover, integrating risk and compliance into transformation initiatives can significantly enhance the sustainability of cost reductions, ensuring that companies not only survive but flourish in challenging environments. A report has highlighted five critical questions for bank executives to prioritize in 2025, emphasizing the importance of sustainable growth and strategic actions, which aligns closely with the focus on economic assessments.

At Transform Your Small/ Medium Business, our team identifies underlying business issues and works collaboratively to create a plan to mitigate weaknesses, allowing organizations to reinvest in key strengths. Case studies demonstrate the efficacy of monetary evaluations in reorganization. For instance, organizations that have implemented incremental modernization strategies—such as integrating innovative layers over legacy systems—have successfully transitioned to more agile infrastructures, enabling them to leverage advanced technologies like generative AI. This method not only simplifies operations but also improves overall financial performance.

Ultimately, performing comprehensive financial evaluations is not just a procedural step; it is a strategic necessity that establishes the foundation for a focused adjustment plan. This is where business restructuring consulting in Coral Springs plays a crucial role in addressing the specific challenges and opportunities confronting the organization. As businesses navigate through crises, business restructuring consulting in Coral Springs becomes an essential tool for achieving sustainable growth and long-term success, supported by continuous performance monitoring and real-time analytics. We emphasize a pragmatic approach to testing hypotheses and measuring investment returns, ensuring that our clients achieve maximum return on invested capital.

Industry-Specific Expertise in Restructuring Consulting

In the realm of business restructuring consulting in Coral Springs, having industry-specific expertise is essential, particularly in sectors like retail, hospitality, and leisure. These industries frequently encounter unique challenges during economic downturns, necessitating a nuanced understanding of their operational landscapes. Consultants equipped with specialized knowledge can swiftly pinpoint underlying issues characteristic of these sectors, enabling them to propose tailored solutions that effectively address distinct needs.

For instance, in the retail sector, a focused strategy for reorganization can lead to significant improvements in customer loyalty. This is evidenced by a 10% increase following the implementation of promotions based on purchasing patterns. Such data underscores the significance of aligning organizational changes with consumer behavior and market trends, while also testing hypotheses to ensure maximum return on invested capital. Furthermore, the 2025 statistics reveal that firms concentrating on industry-specific challenges in consulting on organizational changes are better positioned to navigate complexities.

Those with a deep understanding of the retail and hospitality landscapes can leverage their insights through business restructuring consulting in Coral Springs to enhance restructuring success rates. This ensures that approaches are not only effective but also in line with industry best practices. According to a Bloomberg report, over the past two years, more than 60 companies have filed for bankruptcy for a second or even a third time. This underscores the urgency for businesses to seek business restructuring consulting in Coral Springs with specialized knowledge. Additionally, Deloitte's 2025 Manufacturing Industry Outlook highlights trends such as talent management and supply chain agility, which are crucial for firms in these sectors. The ability to make quick decisions and monitor performance through real-time analytics is essential for effective turnaround strategies.

Case studies from 2025 illustrate the impact of specialized knowledge in restructuring efforts. For example, firms that have embraced flexible work options and prioritized talent development in a hybrid workforce have seen improved retention rates and overall success. This underscores the necessity for CFOs to engage business restructuring consulting professionals in Coral Springs who can provide insights tailored to specific industry challenges. Ultimately, this fosters sustainable growth and resilience in turbulent times.

The services provided are intended to assist organizations in overcoming challenges and attaining sustainable growth. Furthermore, the operationalization of lessons learned through the turnaround process is critical, as is the use of a client dashboard to monitor organizational health in real-time.

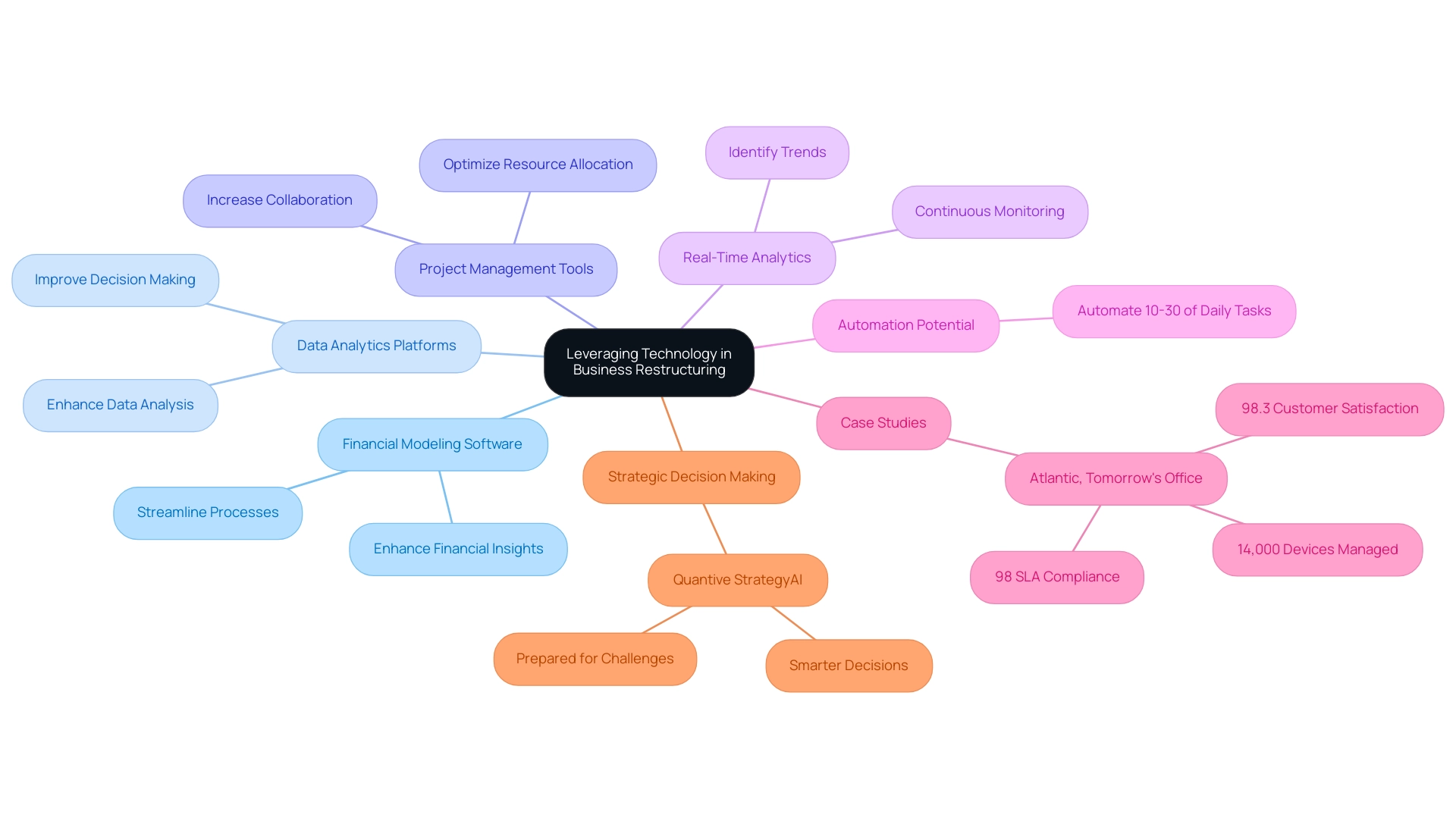

Leveraging Technology in Business Restructuring

In today's swiftly changing corporate environment, technology is crucial in promoting successful transformation efforts. Financial modeling software, data analytics platforms, and advanced project management tools empower organizations to streamline their processes, enhance data analysis, and improve decision-making capabilities. A significant 52% of business leaders recognize the potential to automate 10-30% of daily tasks, illustrating the efficiency gains that technology can provide during organizational changes.

As Derek E. Brink, Vice President and Research Fellow at Aberdeen Strategy & Research, notes, "Today’s IT and Cybersecurity professionals are feeling the pressure of managing and supporting dynamic, complex computing infrastructures, relentless cybersecurity- and compliance-related risks, higher end-user expectations, and the pinch of limited resources." This emphasizes the essential role that technology plays in alleviating some of these pressures during business restructuring consulting in Coral Springs.

By harnessing these technological advancements, CFOs can achieve deeper insights into their organization's financial health, enabling them to monitor progress in real-time and make informed, data-driven decisions. This proactive strategy not only facilitates immediate goals through business restructuring consulting in Coral Springs but also positions organizations for sustainable growth and adaptability in the face of future challenges.

Moreover, mastering the cash conversion cycle is essential for enhancing organizational performance, with features priced at $99.00 designed to optimize this process. The integration of real-time analytics allows organizations to continuously monitor their financial health, identify trends, and assess the impact of various strategies on their performance. As we advance deeper into 2025, the incorporation of technology in organizational transformation will keep developing, with case studies showcasing successful applications illustrating notable enhancements in operational efficiency and stakeholder satisfaction.

For instance, Atlantic, Tomorrow's Office oversees more than 14,000 devices and has attained 98% SLA compliance, with 98.3% customer satisfaction noted in 2024, highlighting the tangible advantages of adopting innovation in process improvements.

Furthermore, Quantive StrategyAI assists companies in making wiser choices and remaining ready for unforeseen challenges, further highlighting the significance of technology in the context of business restructuring consulting in Coral Springs to manage the intricacies of reorganization. By operationalizing lessons learned and fostering strong relationships through continuous performance monitoring, organizations can effectively implement turnaround approaches that drive long-term success.

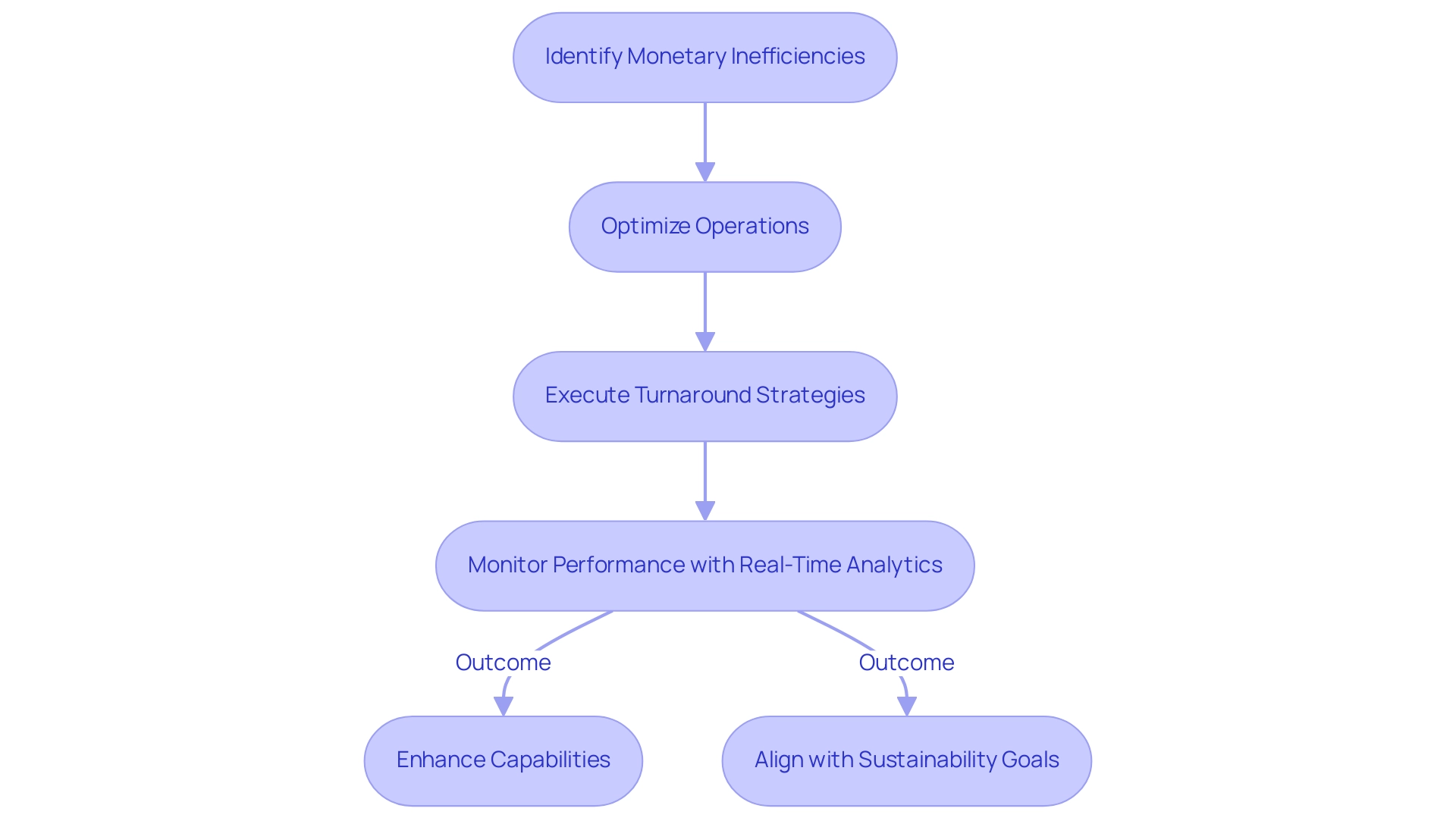

Achieving Sustainable Growth Through Restructuring

The primary objective of business restructuring consulting in Coral Springs is to foster sustainable growth. By leveraging business restructuring consulting in Coral Springs to identify and rectify monetary inefficiencies, optimize operations, and execute robust turnaround strategies, organizations can lay the groundwork for enduring success. In this context, CFOs play a pivotal role; they must ensure that the business restructuring consulting initiatives align with the organization's broader strategic vision.

This alignment is essential, as it enables organizations not only to recover from financial challenges but also to excel in a competitive environment with the aid of business restructuring consulting in Coral Springs.

To achieve this, a pragmatic approach to data is vital. By rigorously testing every hypothesis, organizations can maximize return on invested capital in both the short and long term. Streamlined decision-making processes, supported by business restructuring consulting in Coral Springs, facilitate a shortened decision-making cycle throughout the turnaround process, empowering CFOs to take decisive action to safeguard their organizations.

Ongoing observation of organizational performance through real-time analytics is crucial, allowing CFOs to assess organizational health efficiently and adjust strategies as necessary.

Recent data indicates that firms undertaking successful reorganizations can experience a significant rise in sustainable growth, with many reporting revenue increases of up to 30% within two years following the reorganization. Additionally, initiatives like Transform Your Small/Medium Business enable companies to offset 100% of their travel CO2 emissions, highlighting the potential for sustainability in reorganization efforts. Expert insights suggest that the most successful CFOs in 2025 will be those who adopt a proactive stance towards business restructuring consulting in Coral Springs, focusing on long-term strategies that prioritize both economic health and operational efficiency.

Case studies illustrate this trend: organizations that have effectively utilized business restructuring consulting in Coral Springs often emerge with enhanced capabilities and a clearer strategic direction. For instance, Aesop successfully reduced carbon emissions by as much as 86% on certain routes by switching to rail or CO2-efficient airlines, exemplifying successful sustainability initiatives. Furthermore, the case study on Global Harmonization in Sustainability Reporting underscores the importance of sustainability reporting in the context of restructuring and the evolving regulatory landscape, as the EU’s Corporate Sustainability Reporting Directive will mandate companies to disclose sustainability issues.

The upcoming Nationally Determined Contributions (NDCs) set for 2025 aim to reduce emissions in accordance with the Paris Agreement, and CFOs play a critical role in aligning restructuring efforts with these sustainability goals.

This dual focus on financial and environmental sustainability positions businesses for long-term success, making the role of the CFO more critical than ever in steering these transformative efforts.

Conclusion

The multifaceted realm of business restructuring consulting stands as an invaluable asset for organizations aiming to navigate the intricate challenges of financial distress and operational inefficiencies. The significance of restructuring consulting in 2025 is underscored by the increasing involvement of private equity firms and the pressing challenges faced by CFOs. These professionals are progressively seeking the expertise of restructuring consultants to implement effective turnaround strategies that not only stabilize their organizations but also lay the groundwork for sustainable growth.

CFOs encounter numerous hurdles, from managing cash flow to adapting to regulatory changes, necessitating agile and innovative financial strategies. By engaging with restructuring consultants, CFOs can leverage industry-specific expertise and advanced technology, ensuring that their organizations not only survive but flourish in an ever-evolving market landscape. The successful execution of turnaround strategies can lead to significant enhancements in operational performance and financial health, illustrating the critical role these strategies play in the restructuring process.

Ultimately, the pursuit of sustainable growth through restructuring is a collaborative endeavor between CFOs and restructuring consultants. Through thorough financial assessments and the adoption of technology, organizations can pinpoint inefficiencies and optimize operations. This proactive approach not only improves immediate performance but also positions businesses for long-term success in a competitive environment. As the business landscape continues to evolve, the insights derived from restructuring consulting will be vital in guiding organizations toward resilience and prosperity amidst future challenges.

Frequently Asked Questions

What is business restructuring consulting in Coral Springs?

Business restructuring consulting in Coral Springs is a tactical process aimed at realigning a company's operations, finances, and strategies to enhance efficiency and profitability, particularly for organizations facing financial distress or operational inefficiencies.

Why is business restructuring consulting important?

It is vital for organizations to navigate financial distress and operational inefficiencies, helping them identify areas for improvement, streamline processes, and implement turnaround plans for sustainable growth.

What trends are influencing business restructuring consulting as we approach 2025?

There is a growing trend of private equity firms integrating troubled assets into their investment strategies, and lenders are influencing distressed mergers and acquisitions outcomes, highlighting the need for effective restructuring consulting.

How do consultants support organizations in their restructuring efforts?

Consultants advocate for agile methodologies and a culture of innovation, enabling organizations to respond effectively to market fluctuations and challenges, such as those faced by companies like Party City and Joann's.

What role do CFOs play in business restructuring?

CFOs partner with restructuring consultants to evaluate all facets of the organization, ensuring a holistic reform strategy that enhances operational performance and financial health.

What challenges do CFOs face in 2025?

CFOs encounter challenges such as managing cash flow, ensuring compliance with evolving regulations, tackling operational inefficiencies, and balancing immediate demands with long-term strategic objectives.

How can restructuring consulting help CFOs navigate these challenges?

By leveraging expert insights and tailored strategies, restructuring consulting helps CFOs adapt to changing market conditions, mitigate financial risks, and enhance cash flow management and operational efficiency.

What benefits do organizations experience from engaging in restructuring consulting?

Organizations often see notable enhancements in operational performance and financial health, leading to sustainable growth and improved decision-making through real-time analytics.