Introduction

In the competitive landscape of business, organizations often find themselves at a crossroads, grappling with the need for revitalization amidst financial turmoil. Business turnaround consulting emerges as a lifeline, offering tailored strategies that empower small to medium enterprises to not only survive but thrive.

By conducting in-depth financial assessments and implementing customized solutions, consultants play a pivotal role in identifying critical areas for improvement and driving sustainable growth. This article delves into the essence of turnaround consulting, showcasing success stories that highlight the transformative power of expert intervention.

From financial restructuring to operational efficiency, the strategies employed can redefine a company’s trajectory, ensuring resilience in the face of challenges. As organizations increasingly embrace these practices, understanding the nuances of effective turnaround management becomes essential for navigating today's complex business environment.

Understanding Business Turnaround Consulting

Business recovery consulting is a critical strategy for revitalizing struggling organizations, employing a data-driven and customized approach tailored for small to medium enterprises. Professionals in this field conduct thorough financial assessments to preserve cash and reduce liabilities, meticulously evaluating financial health, operational processes, and market positioning to identify key areas for enhancement. Services provided encompass extensive transformation and restructuring consulting, interim management, financial evaluation, and bankruptcy case management.

For example, the Codewave Employee Turnover Challenge illustrates how targeted strategies can effectively tackle employee retention issues, underscoring the importance of adaptable, tailored solutions in real-world scenarios. With an impressive 100% personal success rate and a 95% candidate success rate, Ian Coach exemplifies the efficacy of these consulting engagements. These experts collaborate closely with management teams to develop actionable plans that address immediate challenges while laying a foundation for long-term viability.

Focus areas include:

- Cash flow management

- Cost reduction

- Enhancing [operational efficiency

Cristian](https://businessaiconsulting.com/blog/case-study--successful-business-turnarounds-through-consulting), a highly regarded MBB & McKinsey coach, highlights the necessity for flexibility in this process, stating, 'Don't assume though that this is exactly the case that you should be practicing for. It could be anything.'

This adaptability is crucial as recent trends indicate a growing dependence on consulting for transformation, with organizations increasingly acknowledging the financial turnaround impact that these expert insights have on their recovery and growth trajectories. By utilizing their sector-specific knowledge, recovery consultants apply strategies that are not only effective but also sustainable, enabling companies to navigate crises and emerge stronger than before. Additionally, the Rapid-30 process is utilized to quickly identify underlying organizational issues and initiate transformational change, further enhancing the effectiveness of the consulting services.

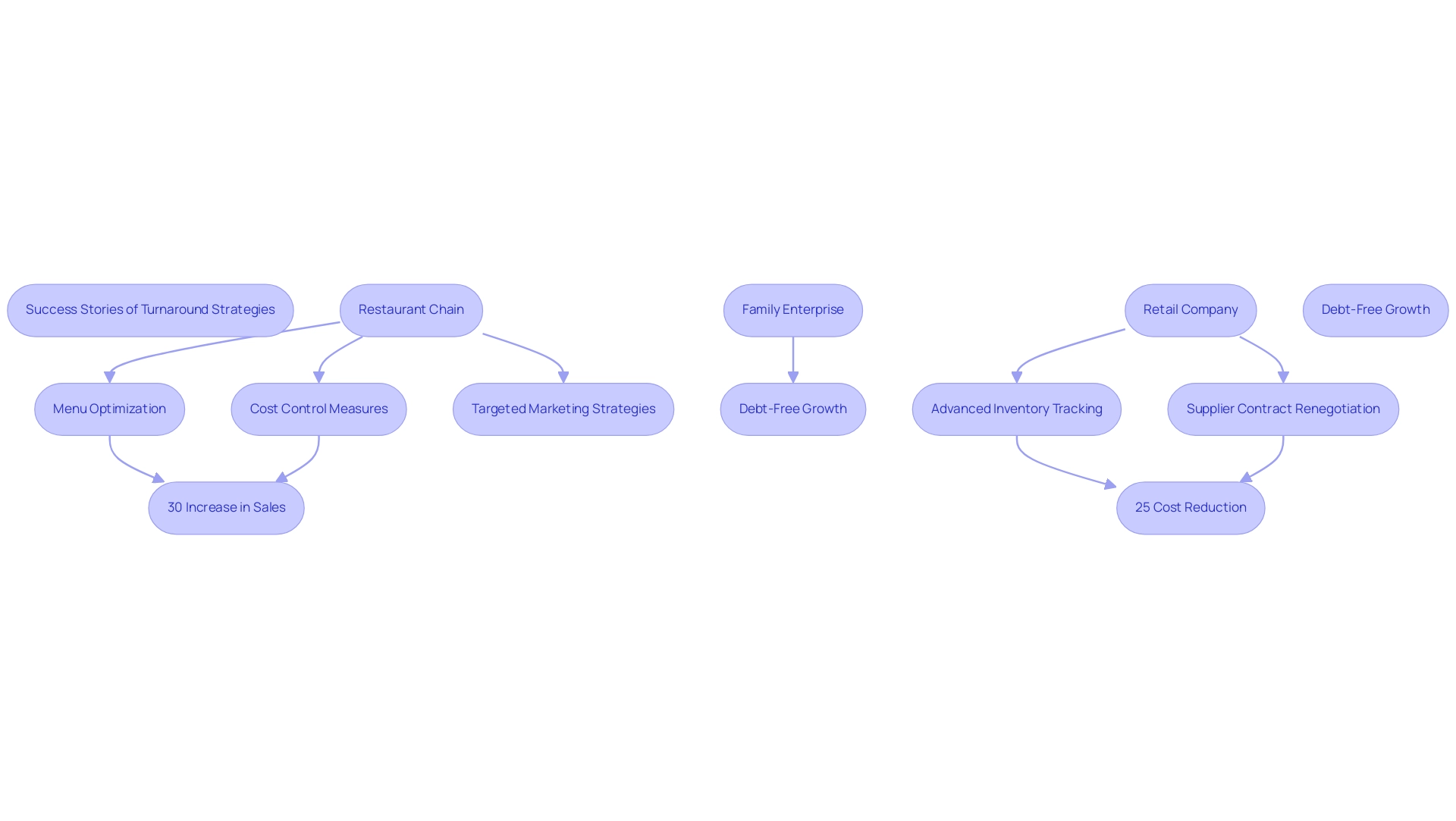

Success Stories: The Impact of Effective Turnaround Strategies

Many businesses have adeptly navigated financial crises through strategic management changes, illustrating the financial turnaround impact of experienced consultants. For instance, a beleaguered restaurant chain that faced declining sales and rising operational costs engaged a recovery consultant, leading to transformative changes through a tailored 'Rapid30' plan. This included:

- Menu optimization

- Rigorous cost control measures

- Targeted marketing strategies

Remarkably, within just one year, the chain achieved a 30% increase in sales while significantly slashing overhead expenses. Likewise, a family enterprise that faced difficulties sought assistance from the SMB team, leading to a debt-free growth path centered on customer service after effectively implementing insights gained from the recovery phase. One client remarked, 'SMB assisted my family enterprise during our most difficult period.'

Since finalizing SMB's recovery process, we were able to expand our operations debt free and concentrate on what we excel at: serving our customers. Another retail company teetering on the edge of bankruptcy due to ineffective inventory management benefitted from consultant intervention. By implementing an advanced inventory tracking system and renegotiating supplier contracts, they realized a 25% reduction in costs, ultimately returning to profitability within 18 months. These success stories emphasize the essential role that customized recovery plans have in revitalizing businesses, showcasing the financial turnaround impact that expert consultants can have in fostering sustainable growth and stability.

Kevin Vasconi’s exit from Domino's, where he aided in a $16 billion recovery, further illustrates the effectiveness of strategic leadership in fostering organizational resilience. As Vasconi transitions to his new role as chief information officer at The Wendy's Company, he stated, 'The company’s IT division has taken code and used it to redefine how people get to eat their favorite slices.' His insights on utilizing technology to improve operational efficiency remain crucial in the discussion about successful recovery plans, highlighting the significance of innovative methods in corporate restructuring.

Moreover, the SMB team consistently observes the effectiveness of their plans via a client dashboard, offering real-time analytics that enable companies to modify approaches as required, ensuring continuous health and performance.

Key Strategies for Successful Turnarounds

Successful business recoveries often depend on a comprehensive method that includes several essential tactics:

- Financial Restructuring: A rigorous financial assessment is paramount in identifying cash flow challenges and potential cost-saving opportunities. This procedure often entails renegotiating debts and contracts, thereby enhancing liquidity. According to Ray Anderson, EY US Value Creation TMT Leader, 'A seasoned executive combines extensive operational, M&A, finance, turnaround, and strategy experience, making them a trusted advisor.' His insights emphasize the importance of having expertise in these scenarios, particularly when testing hypotheses to achieve optimal financial outcomes.

- Operational Efficiency: Streamlining operations is crucial for eliminating waste and boosting productivity, which can lead to significant enhancements in profitability. Companies should consider adopting advanced technologies and optimizing their supply chain processes to achieve these efficiencies. Utilizing real-time analytics through a client dashboard enables organizations to continually monitor their operational performance and swiftly adjust to changing market conditions.

- Market Repositioning: A deep understanding of market dynamics allows organizations to reposition their products or services effectively, aligning them with evolving customer needs. This may entail rebranding efforts, recalibrating pricing strategies, or exploring new market opportunities to revitalize sales. Continuous monitoring of market trends ensures that businesses remain agile and responsive.

- Leadership and Culture Change: Cultivating a culture of accountability and agility within the organization is imperative. Leadership must be unified in its vision for the recovery and communicate changes effectively to all stakeholders to inspire confidence and commitment. By implementing lessons learned during the recovery process, organizations can build stronger relationships with their teams and stakeholders, enhancing overall morale and engagement.

These approaches, when executed thoughtfully, create a solid framework for sustainable recovery. Notably, organizations like Accord, which boasts a senior management team with extensive experience in restructuring financing and a strong involvement in the Turnaround Management Association (TMA), exemplify successful implementation of these principles. Their notable achievements in turnaround financing further reinforce their relevance in this field.

The recent case study of Milwaukee illustrates the tangible advantages of these approaches, where EY-Parthenon aided the city in discovering new revenue sources and cutting costs to tackle its budget gap. Such initiatives underscore the critical role of strategic financial restructuring and the effective use of real-time analytics in achieving a significant financial turnaround impact on long-term organizational health. By integrating pricing strategies into these efforts, businesses can further enhance their performance and resilience.

Challenges Faced During Turnaround Efforts

During turnaround efforts, organizations encounter several critical challenges that can significantly affect the financial turnaround impact on their success.

-

Resistance to Change: Employees often oppose new initiatives or methods, driven by fears of job loss or increased workloads.

Cem Karabal of Beykent University aptly notes,

If the change that will take place is against their own interests, they can adopt a course of action, a resistance decision, to create protection against it.

To mitigate this resistance, it is essential to foster effective communication and involve employees in the change process from the outset. Additionally, fostering a culture of organizational citizenship can help align employee interests with those of the organization, promoting a more supportive environment for change.

-

Limited Resources: Struggling enterprises frequently face constraints in financial and human resources, complicating the implementation of necessary changes. Prioritizing initiatives and leveraging technology can maximize the impact of limited resources, ensuring that even minimal investments yield significant results.

Our commitment to testing hypotheses and utilizing real-time business analytics through client dashboards allows for continuous monitoring of performance, ensuring that adjustments can be made swiftly. This aligns with our 'Update & Adjust' strategy, which emphasizes the importance of adapting plans based on real-time data.

-

Stakeholder Management: Balancing the interests of various stakeholders—including employees, creditors, and investors—requires careful navigation. Clear communication and proactive stakeholder involvement are crucial to sustaining support during the recovery process. Our 'Decide & Execute' approach aids in shortening decision-making cycles, allowing for swift and informed actions that address stakeholder concerns effectively.

-

Short-Term Focus: The intense pressure to achieve quick results can lead organizations to make decisions that compromise their long-term viability. It is crucial to maintain a balanced perspective that considers immediate needs alongside future growth objectives.

Our group's assistance in shortening decision-making cycles enables decisive actions that preserve organizational integrity while keeping an eye on sustainable growth. A case study involving Victor, a long-serving head of a division, exemplifies these challenges as he struggles to adapt to significant changes, reflecting how cultural assumptions can hinder progress. This case underscores the importance of enhancing cultural intelligence to facilitate smoother transitions.

Notably, insights from Chapter 3 by Oludele Mayowa Solaja, which has garnered 1,983 downloads, emphasize the relevance of these challenges in contemporary organizational contexts. By implementing the insights gained from our recovery approaches and continuously tracking business performance through our client dashboards, organizations can prepare themselves for successful recoveries that positively influence their financial turnaround impact in 2024 and beyond.

Measuring the Impact of Turnaround Strategies

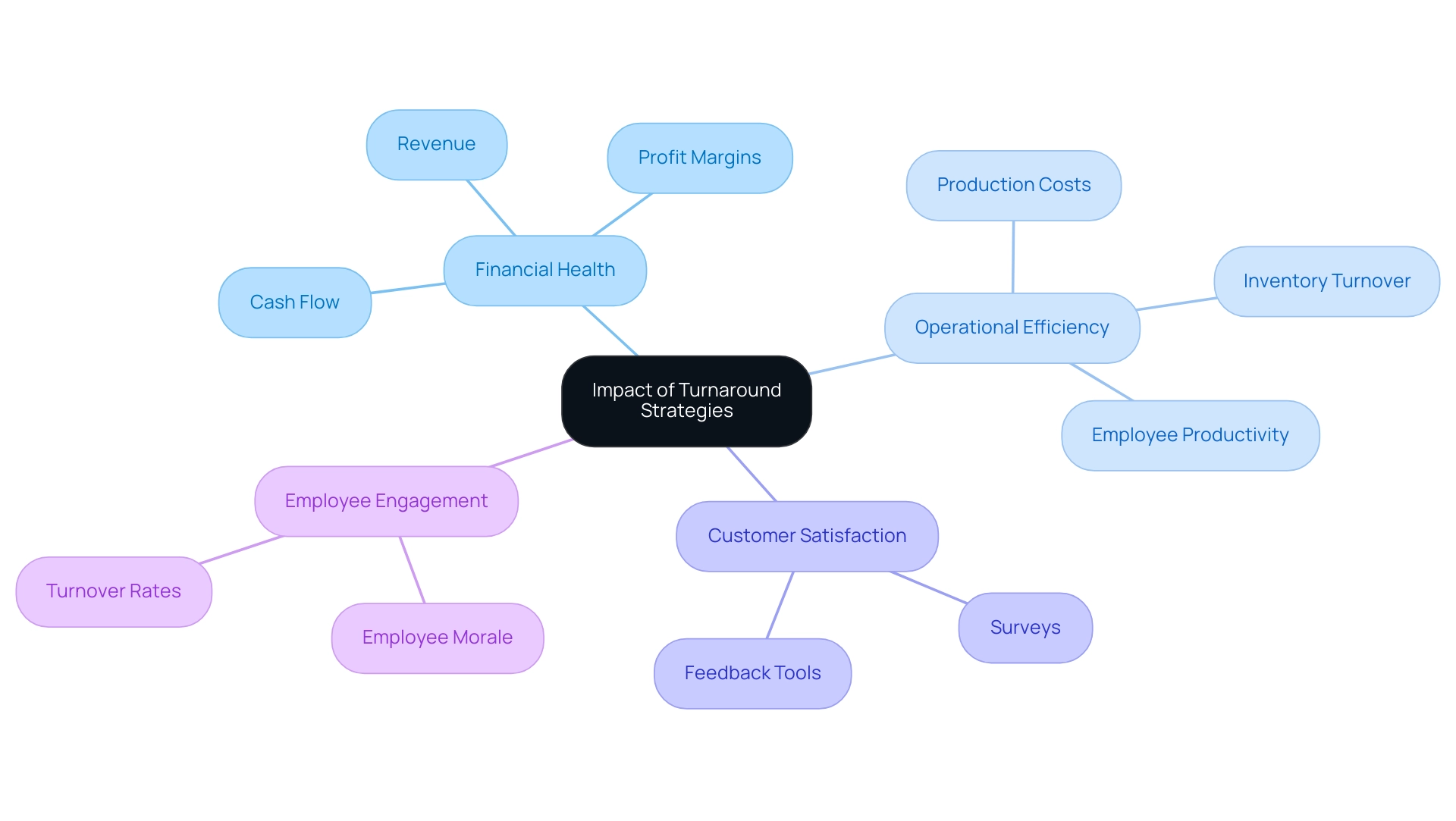

To accurately gauge the impact of recovery strategies, organizations must concentrate on critical key performance indicators (KPIs), which can include:

- Observing shifts in revenue, profit margins, and cash flow provides a tangible assessment of financial health after the recovery, reflecting the financial turnaround impact.

- Operational Efficiency: Evaluating metrics such as production costs, inventory turnover, and employee productivity is vital for understanding the effectiveness of implemented operational changes.

- Customer Satisfaction: Utilizing surveys and feedback tools enables organizations to assess customer perceptions and satisfaction, reflecting the success of market repositioning efforts.

- Employee Engagement: Tracking employee morale and turnover rates acts as a sign of the cultural changes initiated during recovery efforts.

As part of a streamlined decision-making process, real-time analytics, facilitated by our client dashboard, play a crucial role in continuously diagnosing organizational health.

A specific case study of a large European refinery illustrates these principles. The refinery encountered difficulties because of ineffective communication and poorly defined roles during preparation, which hindered scope definition. By creating a structured scope definition approach and utilizing real-time business analytics via the client dashboard, the refinery not only improved scope accuracy but also enhanced contractor coordination and overall governance.

As Jerry Wanichko of T.A. Cook Consultants noted,

A formal, structured scope definition and management methodology was developed and introduced, which helped increase scope accuracy.

This structured approach not only facilitates better measurement of KPIs but also ensures the longevity and sustainability of turnaround initiatives, thereby maximizing their financial turnaround impact.

The comprehensive analysis documented in the 67-page report underscores the importance of these strategies in achieving successful outcomes.

Conclusion

In the dynamic world of business, turnaround consulting stands out as a crucial strategy for revitalizing struggling organizations. By leveraging tailored approaches, financial assessments, and operational improvements, businesses can navigate through crises and emerge stronger. The success stories highlighted throughout this article serve as powerful testaments to the impact that expert consultants can have on transforming financial distress into sustainable growth.

Key strategies such as financial restructuring, operational efficiency, market repositioning, and fostering a supportive culture are essential for any turnaround initiative. Each of these elements plays a significant role in creating a robust framework that not only addresses immediate challenges but also ensures long-term viability. As demonstrated in the various case studies, organizations that embrace these strategies can effectively overcome obstacles and achieve remarkable results.

However, the journey of turnaround management is not without its challenges. Resistance to change, limited resources, and the need for stakeholder engagement can complicate the process. Organizations must remain vigilant and adaptable, utilizing real-time analytics and maintaining a balanced focus on both short-term needs and long-term goals. By doing so, they can ensure that the turnaround efforts are not just momentary fixes but foundational changes that promote resilience and sustained success.

Ultimately, the insights shared in this article reinforce the critical importance of turnaround consulting in today’s business landscape. As organizations face increasing pressures and uncertainties, the ability to implement effective turnaround strategies will be paramount. Embracing expert guidance and prioritizing strategic initiatives will empower businesses to not only survive but thrive in an ever-evolving marketplace.

Frequently Asked Questions

What is business recovery consulting?

Business recovery consulting is a strategy aimed at revitalizing struggling organizations, particularly small to medium enterprises, through a data-driven and customized approach. It involves thorough financial assessments to preserve cash, reduce liabilities, and enhance financial health, operational processes, and market positioning.

What services do business recovery consultants provide?

Services provided by business recovery consultants include transformation and restructuring consulting, interim management, financial evaluation, and bankruptcy case management.

Can you provide an example of successful business recovery consulting?

The Codewave Employee Turnover Challenge is an example where targeted strategies were implemented to tackle employee retention issues, showcasing the importance of adaptable solutions. Ian Coach, a consultant with a 100% personal success rate, exemplifies the effectiveness of these engagements.

What focus areas are emphasized in business recovery consulting?

Key focus areas in business recovery consulting include cash flow management, cost reduction, and enhancing operational efficiency.

What is the Rapid-30 process?

The Rapid-30 process is utilized to quickly identify underlying organizational issues and initiate transformational change, enhancing the effectiveness of consulting services.

What are some common challenges faced during business recovery efforts?

Common challenges include resistance to change, limited resources, stakeholder management, and a short-term focus, which can all significantly affect the success of recovery initiatives.

How do organizations measure the impact of recovery strategies?

Organizations measure the impact of recovery strategies by tracking key performance indicators (KPIs) such as shifts in revenue, profit margins, cash flow, operational efficiency, customer satisfaction, and employee engagement.

What role does technology play in business recovery consulting?

Technology plays a crucial role in business recovery consulting by enabling real-time analytics through client dashboards, allowing organizations to continuously monitor performance and make necessary adjustments to their strategies.