Introduction

In the high-stakes arena of corporate finance, turnaround management emerges as a lifeline for organizations grappling with financial distress, particularly in the face of bankruptcy. As companies like Red Lobster navigate the turbulent waters of shifting consumer preferences and escalating operational costs, the need for strategic intervention becomes increasingly critical.

This article delves into the multifaceted strategies employed in turnaround management, highlighting the importance of:

- Financial assessments

- Operational efficiencies

- The role of external advisors in steering organizations toward recovery

By examining real-world examples and actionable insights, it becomes clear that a proactive approach not only preserves business health but also positions firms for sustainable growth in an ever-evolving marketplace.

Understanding Turnaround Management in the Context of Bankruptcy

A turnaround management case study includes a comprehensive set of strategies and actions designed to restore a company's economic stability and operational efficacy, especially during crises such as bankruptcy. This process begins with a thorough monetary assessment that identifies opportunities for cash preservation, operational streamlining, and liability reduction. Additionally, our services include bankruptcy case management, which is critical for navigating complex financial situations.

As the healthcare sector braces for a challenging landscape in 2024—marked by high interest rates and regulatory pressures—these strategies become essential. Stan Prokop, founder of 7 Park Avenue Financial, emphasizes that 'to navigate these turbulent times, organizations must not only focus on immediate cash flow but also advocate for improved reimbursement rates and lower interest rates to achieve long-term stability.' For instance, amend-and-extend transactions illustrate the complexities companies face when negotiating with patient lenders for more manageable debt terms.

Such negotiations often involve high fees, elevated interest rates, and stringent covenants, underscoring the need for a meticulous approach in management of recovery. Furthermore, our comprehensive restructuring consulting services provide hands-on executive leadership through interim management, fostering transformational change via our Rapid-30 process. By executing firm measures and cooperative approaches, organizations can stabilize their monetary situations and improve operations during recovery scenarios.

Statistics indicate that organizations utilizing a turnaround management case study in bankruptcy see a success rate of over 60%, highlighting the importance of tailored solutions. By leveraging streamlined decision-making and real-time analytics, which are operationalized through our client dashboard for continuous monitoring and adjustment, organizations can navigate through financial distress effectively, ultimately emerging stronger and more resilient in the face of adversity.

A Closer Look at Red Lobster's Bankruptcy: Causes and Consequences

Red Lobster's bankruptcy can be attributed to a confluence of factors, prominently featuring shifting consumer preferences, escalating competition, and rising operational costs. The trend toward healthier dining options has notably diverted patronage away from traditional seafood establishments, indicating a fundamental change in consumer tastes. Over the last decade, the restaurant industry has witnessed a staggering increase in bankruptcies, with over 10,000 establishments failing to adapt to evolving market demands.

Economic downturns have worsened these challenges, resulting in reduced revenues and increasing debt burdens for establishments like Red Lobster. This illustrates the critical need for streamlined decision-making and real-time analytics in a turnaround management case study, as CFOs must act swiftly to preserve business health. For instance, Toms King, a Burger King franchisee, sold for $33 million after going bankrupt in January 2023, auctioning 90 stores by March, reflecting a broader trend of economic distress in the sector.

This highlights the urgency of implementing lessons learned from economic crises to build strong, lasting relationships with stakeholders. As emphasized by Aaron Allen, founder and CEO, 'We assist executive teams in connecting what’s occurring internally and externally so they can identify, evaluate, and capture the greatest opportunities for their organizations.' This declaration highlights the significance of a strong recovery plan, particularly as illustrated in a turnaround management case study, since the consequences of bankruptcy reach beyond simple economic indicators, impacting employees, suppliers, and stakeholders as well.

The case of Louisiana Apple further exemplifies the risks tied to creditor relationships, as it went bankrupt after a creditor lawsuit and subsequent loss of operational control, illustrating how financial distress can lead to diminished influence over operations. To effectively navigate these challenges, it is essential to adopt a 'Test & Measure' approach, rigorously testing hypotheses to maximize returns on invested capital. Executing a 'Decide & Execute' approach will facilitate a shortened decision-making cycle, enabling swift actions that maintain organizational health.

Moreover, constant observation of success via a client dashboard can offer real-time business analytics, enabling ongoing evaluation and modification of recovery plans. Considering recent news, including a report on the ten most impactful bankruptcies in the restaurant sector for 2024, it is evident that navigating these challenges requires keen economic leadership and strategic foresight.

Key Elements of Turnaround Management in Red Lobster's Case

The turnaround management case study at Red Lobster included several crucial strategies aimed at revitalizing the brand and ensuring economic recovery. A thorough financial assessment was conducted to pinpoint cost-saving opportunities, particularly focusing on the ten products that constitute a significant portion of food costs. This analysis serves as a turnaround management case study, identifying areas for operational efficiencies and facilitating a streamlined decision-making cycle, which enables prompt action to preserve the business.

Menu innovation emerged as a cornerstone of the strategy, designed to attract a broader customer base. By introducing new offerings that resonate with current dining trends, Red Lobster aimed to reinvigorate customer interest and drive sales. Furthermore, the turnaround management case study highlighted that strategic debt restructuring and the renegotiation of supplier contracts were crucial in stabilizing the company’s financial footing.

Together, these initiatives addressed immediate fiscal challenges and laid a robust foundation, which can serve as a turnaround management case study for sustainable growth. As Steve Easterbrook, former CEO of McDonald's, stated, 'The key to a successful recovery lies in focused initiatives that drive performance.' This perspective underscores the importance of leveraging such initiatives during challenging times.

Furthermore, mastering the cash conversion cycle was crucial in enhancing cash flow, while the incorporation of real-time analytics via a client dashboard facilitated ongoing observation of business health, guaranteeing that plans could be updated and modified based on performance metrics. The pragmatic approach to data, emphasizing testing and measurement, was essential for making informed decisions throughout the recovery process. Employee engagement strategies, such as recognition and fostering a positive work environment, played a vital role in boosting morale and productivity, further supporting the success of the recovery efforts.

The Role of External Advisors in Red Lobster's Turnaround

The turnaround management case study of Red Lobster exemplifies the significant impact external advisors can have in recovery situations. These specialists brought invaluable industry knowledge and resources, conducting thorough economic analyses that underpinned strategic recommendations. Their ability to facilitate negotiations with creditors and suppliers was crucial in navigating economic distress, demonstrating a streamlined decision-making process that allowed for swift actions to preserve the business.

By leveraging real-time analytics, these advisors continuously monitored the success of their plans, ensuring that operational adjustments were made promptly to enhance efficiency. Furthermore, the presence of external advisors instilled confidence among stakeholders, signaling a robust commitment to recovery and sustainable growth. This turnaround management case study aligns with findings from a dataset of 122 observations at the PSF practice level, indicating that firms leveraging external expertise during financial crises experience notably higher success rates in restructuring efforts.

Furthermore, the case study named 'CEO Functional Background and Recovery Approaches' emphasizes how a CEO's functional background affects the execution of recovery methods, reinforcing the notion that those with an output-oriented functional background are especially skilled at developing and implementing market-oriented approaches. As noted by Seema Miglani, 'Market-based recovery strategies enhance the performance of a declining firm, and those with an output-based functional background are particularly skilled at formulating and implementing these strategies.' Consequently, the role of external advisors, particularly in the restaurant sector, is not merely beneficial but essential for revitalizing distressed businesses.

Testing hypotheses throughout this process is crucial to delivering maximum return on invested capital, while the commitment to developing strong, lasting relationships further enhances the effectiveness of these turnaround efforts.

The Road Ahead: Future Strategies for Red Lobster's Recovery

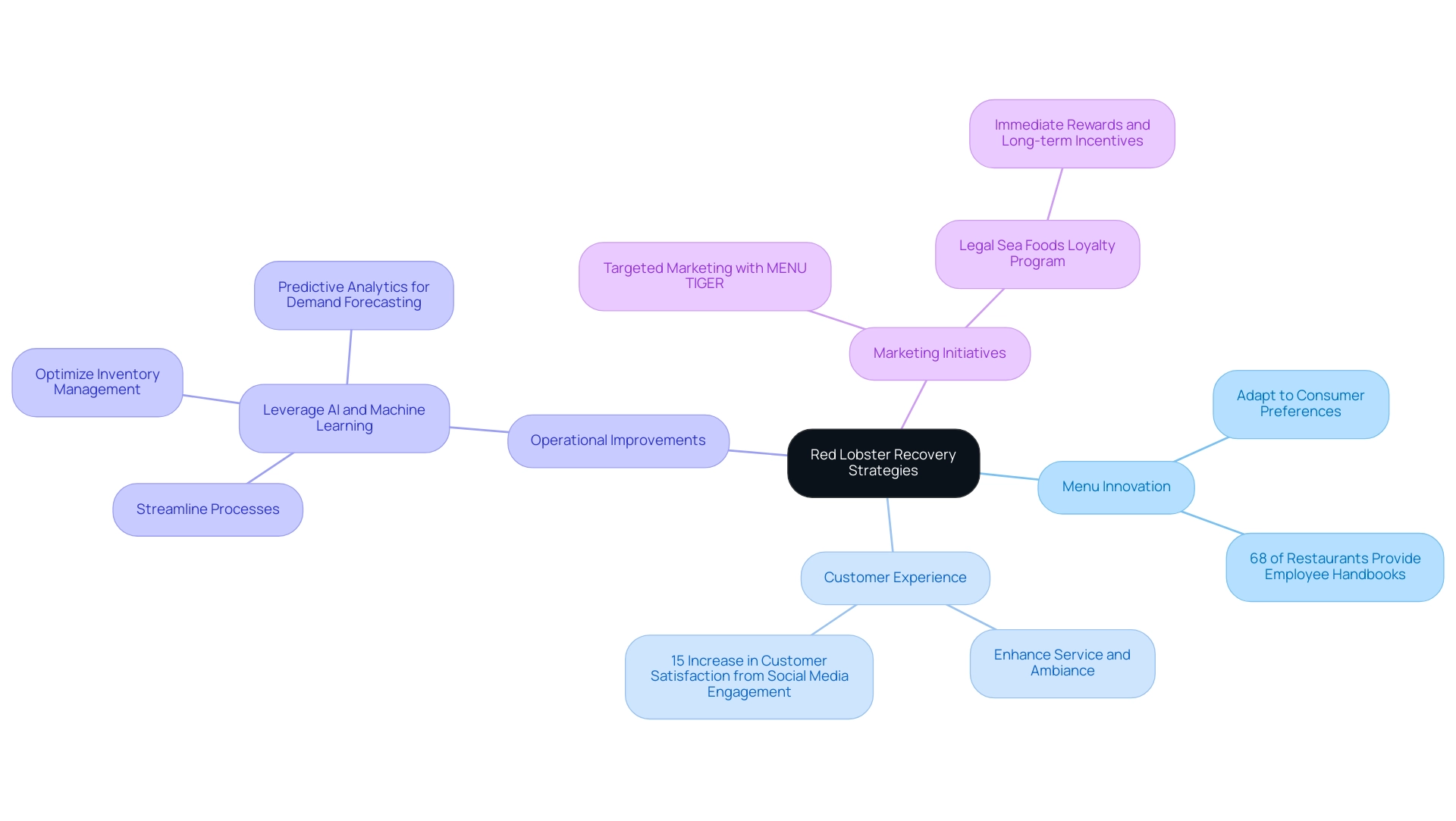

For Red Lobster to achieve a sustainable recovery, it is imperative to concentrate on several pivotal strategies. Menu innovation remains paramount; adapting to evolving consumer preferences is crucial as 68% of restaurants now provide an employee handbook, indicating a shift towards structured management practices that can enhance service quality. Notably, 53% of restaurants also offer food safety and alcohol certification training, emphasizing the importance of these structured practices.

Furthermore, enhancing the dining experience through improved service and ambiance will set Red Lobster apart, particularly as restaurants that actively engage with customer feedback on social media experience a 15% increase in customer satisfaction, reinforcing the need for Red Lobster to respond to customer reviews. To revolutionize operations, leveraging AI and Machine Learning technologies will play a significant role in streamlining processes, optimizing inventory management, and reducing costs. These technologies can provide predictive analytics to forecast demand, automate supply chain management, and enhance customer personalization.

Additionally, investing in targeted marketing initiatives, such as those offered by MENU TIGER's affordable digital services, is essential to rebuild brand loyalty and attract new patrons. The 'Legal Net Rewards' program from Legal Sea Foods serves as a prime example of effectively transforming one-time diners into loyal customers through immediate rewards and long-term incentives. By embracing a proactive stance and remaining attuned to market trends, including the integration of AI-driven analytics, Red Lobster can position itself for enduring success and resilience in an increasingly competitive landscape.

Don’t miss out on our comprehensive guide, 'Revolutionizing Operations With AI & Machine Learning,' available now for just $399, down from $999. Click the button below to secure your copy and start transforming your operations today!

Conclusion

The path to recovery for organizations facing financial distress is fraught with challenges, yet turnaround management offers a structured approach to rejuvenate operations and ensure sustainability. By conducting thorough financial assessments and implementing operational efficiencies, companies can identify critical areas for improvement and take decisive action. The case of Red Lobster illustrates how strategic debt restructuring and menu innovation can not only stabilize a brand but also reinvigorate customer interest in a competitive market.

External advisors play a pivotal role in this process, bringing specialized knowledge and experience that can guide companies through complex negotiations and facilitate effective restructuring. Their contributions enhance stakeholder confidence and provide the necessary support for implementing robust turnaround strategies. The evidence suggests that organizations that leverage external expertise during crises are more likely to emerge successful, highlighting the importance of collaboration in navigating financial turbulence.

Looking ahead, it is essential for companies like Red Lobster to remain agile and responsive to evolving consumer trends. By embracing innovative technologies, enhancing customer engagement, and refining operational practices, businesses can position themselves for long-term success. The insights drawn from turnaround management not only serve as a roadmap for recovery but also lay the groundwork for sustainable growth in an ever-changing marketplace. Taking proactive steps today will ensure that organizations are not just surviving but thriving in the future.

Frequently Asked Questions

What is a turnaround management case study?

A turnaround management case study includes a comprehensive set of strategies and actions aimed at restoring a company's economic stability and operational efficacy, particularly during crises like bankruptcy. It begins with a monetary assessment to identify opportunities for cash preservation, operational streamlining, and liability reduction.

Why are turnaround strategies important in the healthcare sector for 2024?

In 2024, the healthcare sector faces high interest rates and regulatory pressures, making turnaround strategies essential for organizations to navigate financial challenges. These strategies help focus on immediate cash flow and advocate for improved reimbursement rates and lower interest rates for long-term stability.

What role does bankruptcy case management play in turnaround management?

Bankruptcy case management is critical for navigating complex financial situations during a turnaround. It helps organizations manage their recovery process effectively and addresses the intricacies involved in negotiating with lenders and restructuring debt.

How do organizations benefit from using turnaround management strategies?

Organizations utilizing turnaround management strategies during bankruptcy have a success rate of over 60%. Tailored solutions, streamlined decision-making, and real-time analytics enhance their ability to navigate financial distress and emerge stronger.

What are some challenges faced by companies like Red Lobster leading to bankruptcy?

Red Lobster's bankruptcy resulted from shifting consumer preferences towards healthier dining options, escalating competition, and rising operational costs. Economic downturns further exacerbated these challenges, leading to reduced revenues and increased debt burdens.

What is the significance of a strong recovery plan?

A strong recovery plan is crucial as it impacts not just economic indicators but also employees, suppliers, and stakeholders. It helps organizations identify, evaluate, and capture opportunities during recovery.

What lessons can be learned from the bankruptcy cases mentioned?

The bankruptcy cases highlight the importance of maintaining strong relationships with stakeholders and the need for swift action through streamlined decision-making. Implementing a 'Test & Measure' approach can maximize returns on invested capital, while a 'Decide & Execute' approach facilitates quick responses to maintain organizational health.

How does a client dashboard assist in turnaround management?

A client dashboard provides real-time business analytics, allowing organizations to continuously monitor their recovery plans and make necessary adjustments based on ongoing evaluation of success.