Introduction

Navigating the financial landscape of modern business requires more than just basic accounting skills; it demands strategic oversight and expert guidance. An outsourced CFO delivers this elevated level of financial leadership, ensuring that companies align their financial practices with long-term objectives. From comprehensive financial planning and budgeting to effective cash flow management, the role of an outsourced CFO is pivotal in maintaining a clear and actionable financial strategy.

With many small business owners expressing a lack of confidence in their financial decision-making abilities, the expertise of an outsourced CFO becomes indispensable. They bridge this gap by providing informed guidance, enabling businesses to make sound financial decisions and establish a solid foundation for sustainable growth. This article delves into the key functions of an outsourced CFO, the benefits of CFO consulting services, and the critical importance of strategic financial guidance and risk management.

Explore how leveraging these services can transform financial operations and drive business success.

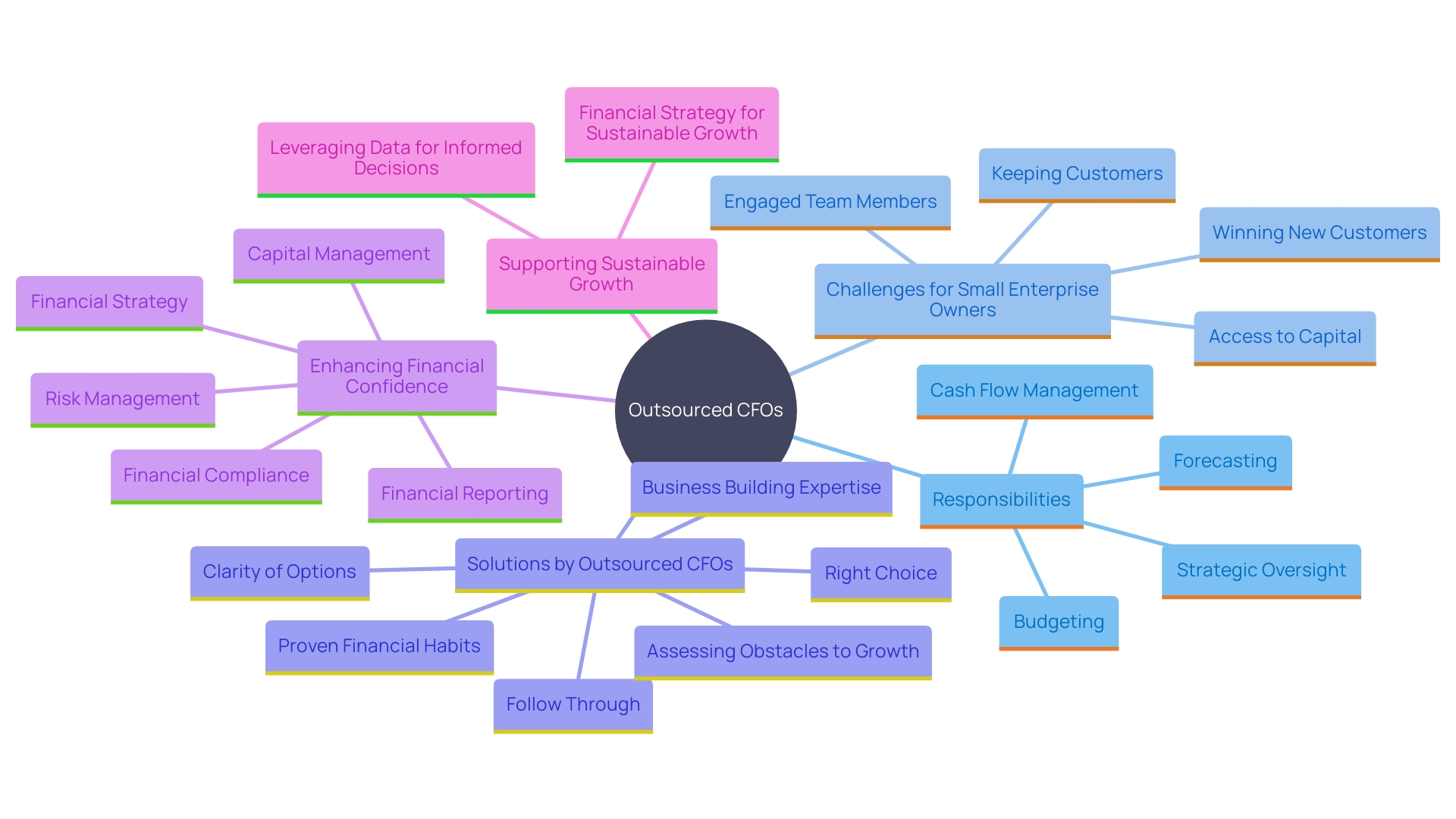

Key Functions of an Outsourced CFO

An outsourced CFO significantly enhances the monetary leadership of an organization by providing strategic oversight and aligning fiscal practices with the company's long-term objectives. This role involves comprehensive monetary planning, budgeting, and forecasting, which are essential for maintaining a clear view of the economic landscape. Effective cash flow management is another crucial responsibility, ensuring liquidity is preserved and operational efficiency is optimized.

A survey by the AICPA emphasized that 69% of small enterprise owners lack confidence in their monetary decision-making abilities. Outsourced CFOs bridge this gap by providing expert guidance, enabling organizations to make informed decisions and create a solid foundation for sustainable growth. For example, Dan Bates, President & CEO of Windstream Technologies, praised their outsourced CFO for being a dependable and proactive ally in economic growth, concentrating on essential operational aspects that propel business success.

Furthermore, outsourced CFOs play a key role in ensuring precise reporting and strong internal controls. They oversee cash flow forecasting and analysis, which assists organizations in fulfilling monetary needs without turning to short-term borrowing. This strategic economic leadership is essential for enterprises aiming to navigate dynamic markets effectively. As demonstrated by the support provided to Aria Systems, outsourced CFOs collaborate closely with executives to manage hyper-growth through meticulous planning, execution, and review processes.

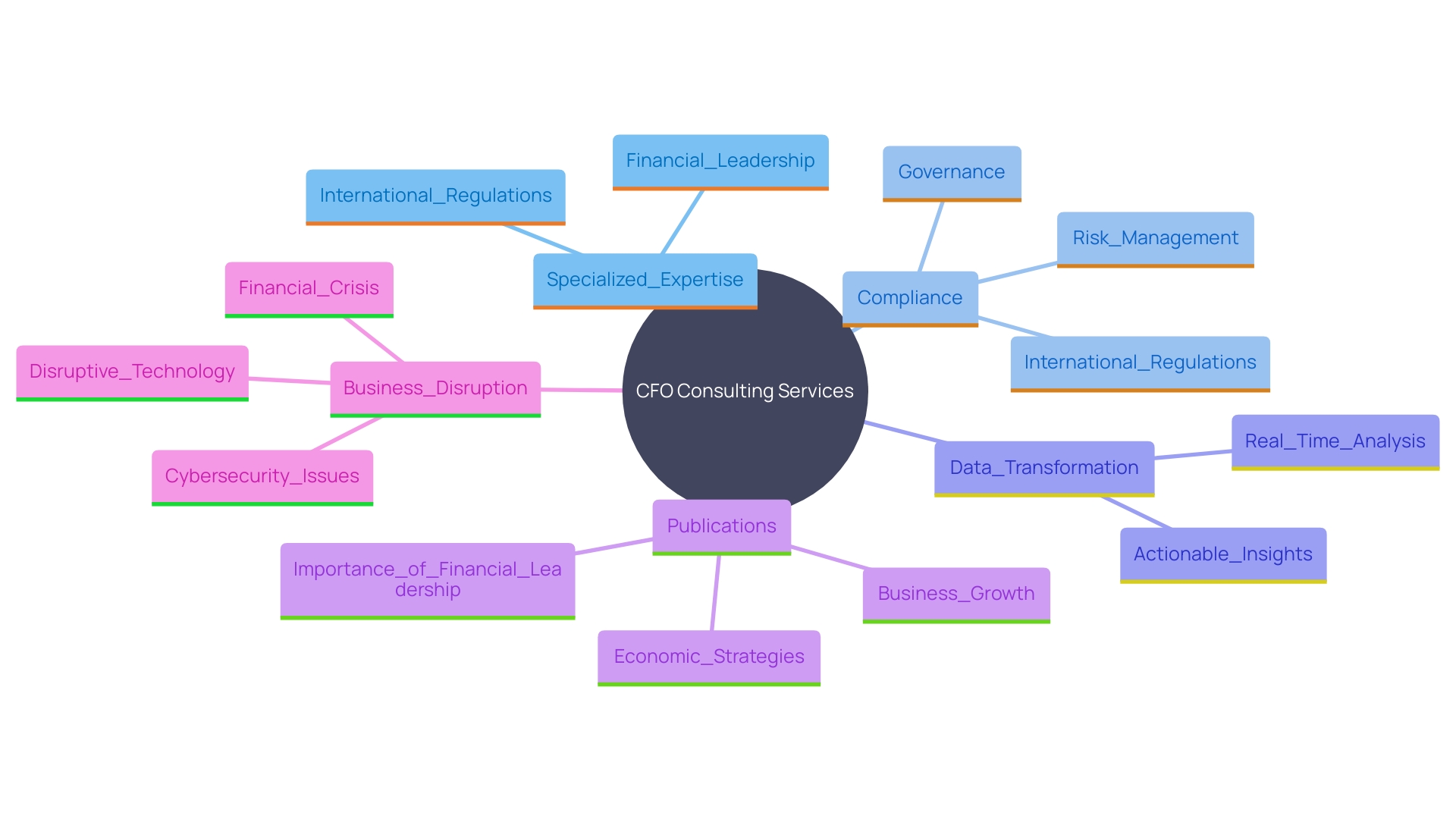

Benefits of CFO Consulting Services

'CFO consulting services offer a strategic advantage for businesses aiming to enhance their leadership in finance.'. These services provide access to specialized expertise without the overhead of a full-time CFO, enabling organizations to improve their economic strategies and drive growth. By leveraging the insights of experienced CFO consultants, companies can navigate complex monetary challenges more effectively, ensuring compliance with international regulations and optimizing decision-making capabilities.

For instance, companies functioning within the monetary sector, such as those in Denmark serving clients across Europe, often face the mandate of adhering to strict international regulations like Anti-Money Laundering and Know-Your-Customer requirements. "CFO consultants play a crucial role in transforming intricate monetary data into actionable insights, much like the instructional design strategies employed by eWyse Agency to simplify technical data presentation.".

Furthermore, publications such as The Economist and The CEO Magazine emphasize the significance of strong monetary leadership in their examination of business trends and executive strategies. These insights are invaluable for CFO consultants aiming to provide tailored solutions that align with both global and local market demands.

In a setting of economic unpredictability, as observed in the Grant Thornton CFO survey, the assurance of finance leaders in navigating their enterprises through turmoil highlights the essential significance of expert monetary advice. CFO advisory services are crucial in strengthening economic resilience and preparing entities for long-term success.

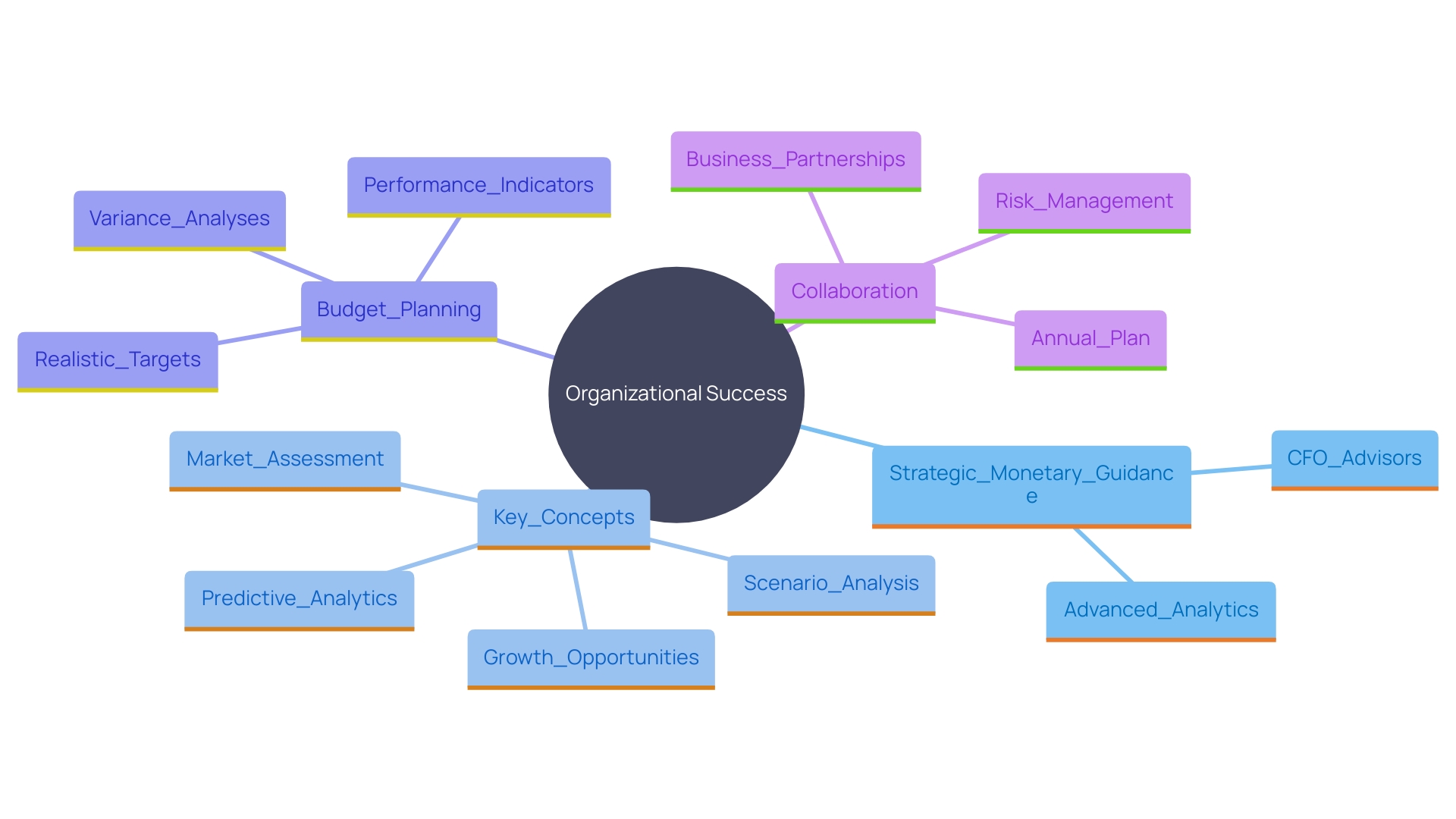

Strategic Financial Guidance and Planning

'Strategic monetary guidance serves as the backbone for any organization aiming to excel in a competitive landscape.'. CFO advisors provide essential knowledge that enables organizations to align their monetary strategies with broader corporate objectives. This synchronization is essential as it involves assessing market conditions, identifying growth opportunities, and developing comprehensive plans that support strategic initiatives.

Advanced data analytics and technology tools play a crucial role in this process. They enable finance teams to identify key indicators and address potential variances proactively. Successful planning practices are intrinsically linked and mutually reinforcing—establishing realistic targets aligned with the corporate strategy ensures the entire planning process remains relevant and effective.

Scenario analysis is another pivotal component, offering finance organizations the chance to drive business agility through enhanced collaboration and business partnerships across various functions. This collaborative approach not only identifies and quantifies potential risks but also uncovers opportunities across the entire value chain, leading to a more integrated and cohesive annual plan.

Furthermore, the incorporation of predictive analytics into budget planning is becoming increasingly significant. As global economic conditions grow more complex, predictive analytics helps decision-makers respond swiftly and effectively to emerging challenges. This capability drives market growth by enhancing the accuracy and reliability of economic forecasts, thereby supporting long-term strategic planning.

In essence, CFO advisors offer the crucial knowledge required to maneuver through monetary complexities, ensuring entities can adjust and flourish amidst dynamic market conditions.

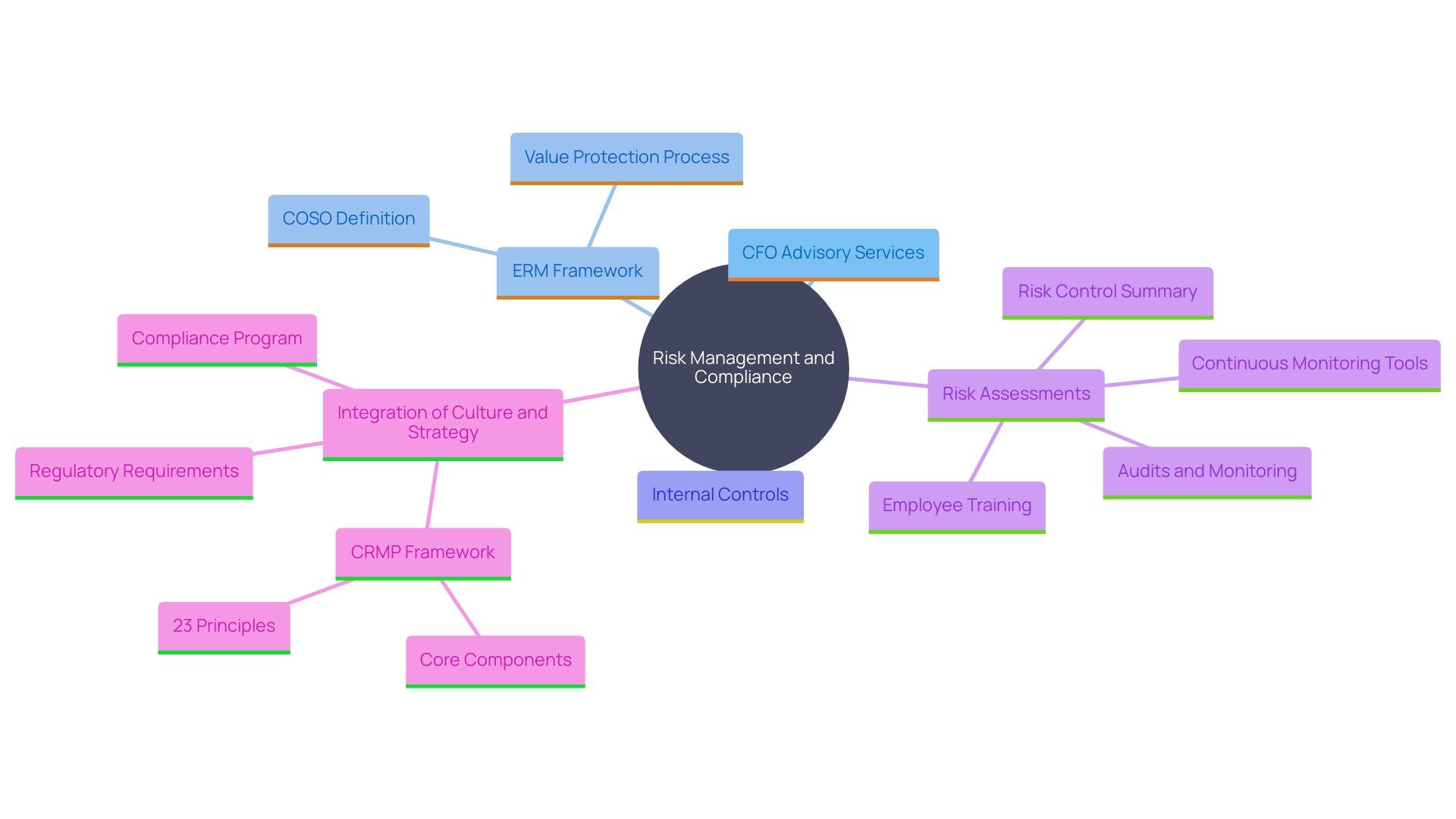

Risk Management and Compliance

In today's complex regulatory environment, effective risk management and compliance are essential for protecting organizational value. CFO advisory services play a critical role in helping organizations identify and mitigate financial risks, ensuring adherence to regulatory requirements and standards. A comprehensive approach to risk management, such as implementing an Enterprise Risk Management (ERM) framework, allows organizations to proactively protect their assets and enhance stakeholder trust. The Committee of Sponsoring Organizations of the Treadway Commission (COSO) defines ERM as integrating culture, capabilities, and practices with strategy-setting and performance to manage risk in creating, preserving, and realizing value. By prioritizing these practices, organizations can maintain robust internal controls, conduct thorough risk assessments, and develop strategies to navigate legal and regulatory challenges effectively. This not only protects existing business value but also positions the organization to seize new opportunities while maintaining financial stability.

Conclusion

Outsourced CFO services are transformative, offering businesses the strategic financial leadership essential for navigating today's complex financial landscape. By providing comprehensive financial planning, effective cash flow management, and robust internal controls, outsourced CFOs empower organizations to make informed decisions and foster sustainable growth. This elevated level of oversight not only enhances financial confidence among business leaders but also ensures alignment with long-term objectives.

The benefits of CFO consulting extend beyond traditional financial management. Access to specialized expertise allows companies to tackle intricate financial challenges while adhering to regulatory requirements. This capability is particularly crucial in dynamic sectors where compliance and strategic agility are paramount.

By leveraging the insights of experienced CFO consultants, businesses can optimize their decision-making processes and enhance their overall financial resilience.

Incorporating strategic financial guidance, advanced analytics, and effective risk management practices further solidifies an organization's ability to thrive. The integration of predictive analytics into financial planning equips decision-makers with the tools necessary to respond proactively to market changes, ensuring that companies remain agile and competitive. As the landscape continues to evolve, the role of outsourced CFOs becomes increasingly indispensable in driving operational excellence and sustainable success.