Introduction

In an ever-evolving financial landscape, businesses must navigate complexities with precision and strategic foresight. Accounting advisory services offer a transformative suite of solutions designed to optimize financial processes and bolster operational efficiency. From financial reporting and compliance management to risk assessment and strategic guidance, these services are tailored to meet the unique needs of each organization.

The tangible benefits of such advisory services are exemplified by entities like the Department of Defense, which has achieved significant financial gains through rigorous audits, and firms leveraging cloud technology to enhance revenue and client service. This article delves into the critical role of accounting advisory services, explores the key offerings of advisory firms, and underscores the importance of Financial Planning and Analysis (FP&A) in driving business success. By embracing these expert insights, businesses can make informed decisions, manage finances effectively, and achieve sustainable growth.

What are Accounting Advisory Services?

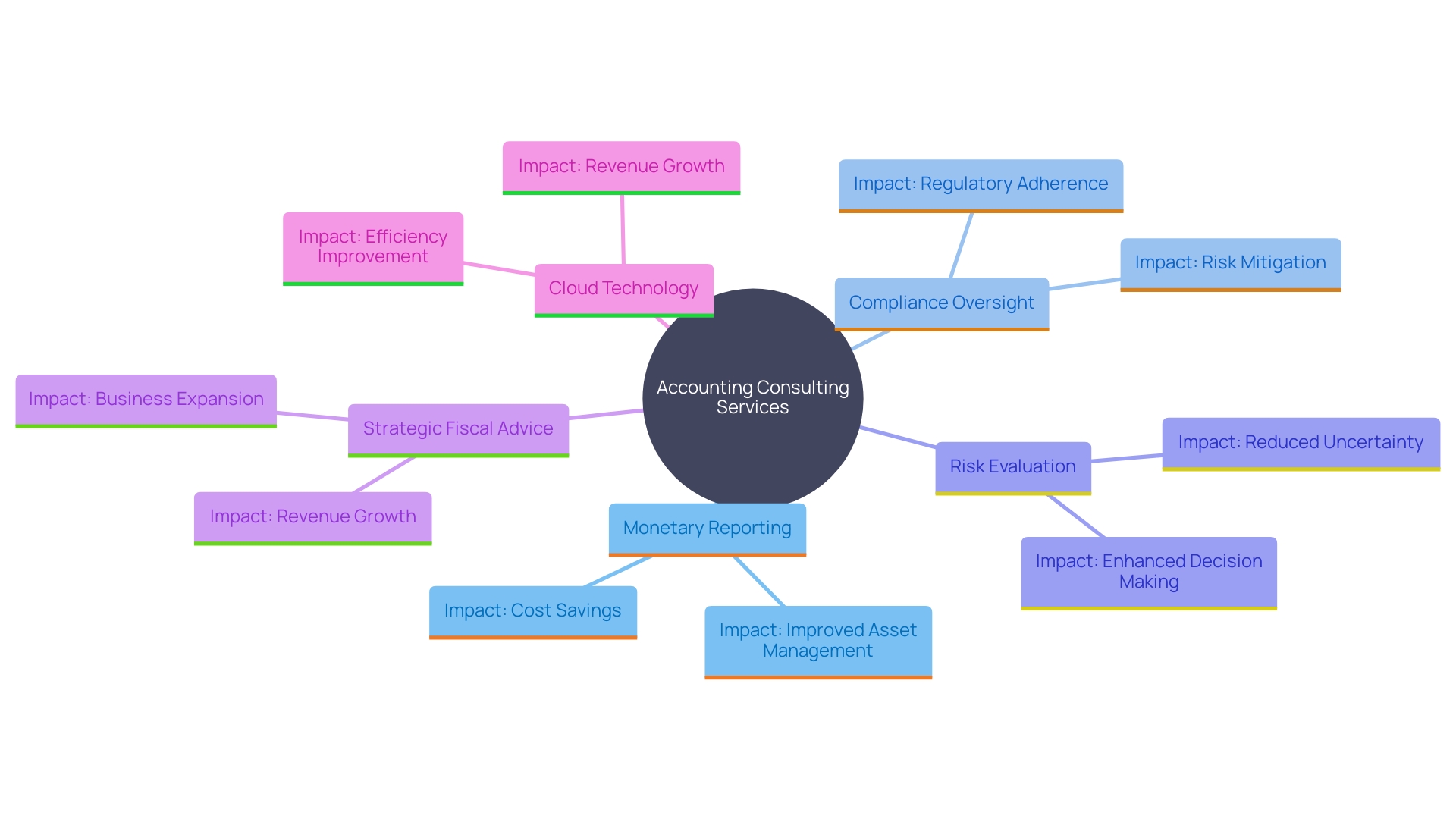

Accounting consulting offerings deliver a complete range of expert solutions designed to improve monetary processes and boost operational effectiveness for companies. Essential offerings encompass monetary reporting, compliance oversight, risk evaluation, and strategic fiscal advice. 'These offerings are meticulously tailored to address the unique needs of each organization, ensuring that insights are actionable and beneficial for decision-making.'.

A notable example is the Department of Defense (DOD), which has achieved substantial monetary advantages through rigorous audit processes. These include cost savings, improved asset management, and heightened efficiency. While the DOD tracks some outcomes, expanding this practice could yield even more comprehensive insights department-wide.

Similarly, the transformative impact of cloud-based technology in accounting is highlighted by Xero's 2023 State of the Industry Report. It indicates that 75% of companies utilizing cloud technology reported increased revenue and enhanced client support, highlighting the significance of technological adoption in the sector. Practices that have integrated Client Advisory Services (CAS) into their offerings have seen substantial client growth, demonstrating the value of providing strategic financial advisory services.

Accounting is not solely focused on bookkeeping; it is a vital instrument for growth in enterprises. Financial statements offer vital insights into an organization's performance, guiding stakeholders in making informed investment decisions. Efficient cash flow management and precise monetary tracking are essential to ongoing enterprise success, highlighting the significance of thorough accounting systems in forecasting cash requirements and recognizing possible risks or opportunities. By utilizing these consulting offerings, companies can more effectively manage monetary intricacies and promote sustained expansion.

Key Services Offered by Accounting Advisory Firms

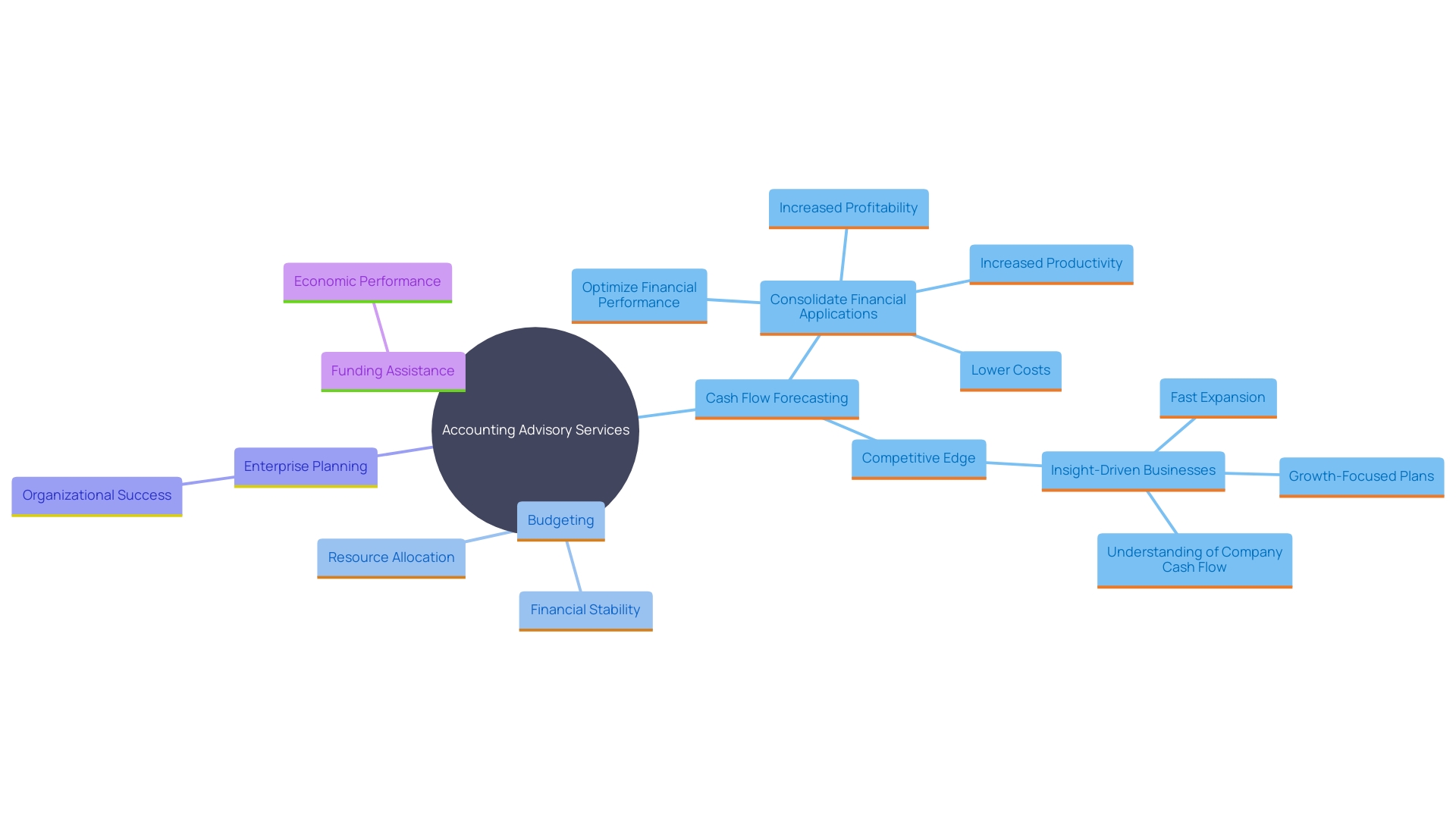

Accounting advisory firms offer a varied array of services aimed at enhancing economic performance and operational efficiency. These include:

-

Cash Flow Forecasting: Regular cash flow analyses are essential for maintaining liquidity and financial stability. They estimate anticipated inflows and outflows, assisting organizations in managing their funds efficiently and avoiding short-term borrowing. A recent survey highlighted that companies using consolidated cash flow tools reported increased profitability (44%), productivity (43%), and reduced costs (42%).

-

Budgeting: Comprehensive budgeting aligns with strategic goals and monitors spending. Effective budgeting aids in planning and ensures that resources are allocated efficiently to meet both short-term and long-term goals.

-

Enterprise Planning: Developing strong plans is essential for outlining operational and monetary strategies. These plans assist organizations in setting clear objectives, identifying potential challenges, and devising actionable steps to achieve growth.

-

Funding and Loan Applications: Advice on obtaining funding through loans and other monetary tools is essential for company growth. Expert advice in this area can significantly enhance a company's ability to access necessary funds and invest in growth opportunities.

These offerings are not only focused on handling funds but also on utilizing monetary insights to propel organizational achievement. As noted in industry reports, adopting advanced monetary tools and strategies can lead to higher revenue and profit margins, especially with the integration of cloud-based technologies, which have shown to improve client services and workforce morale.

Understanding Financial Planning and Analysis (FP&A)

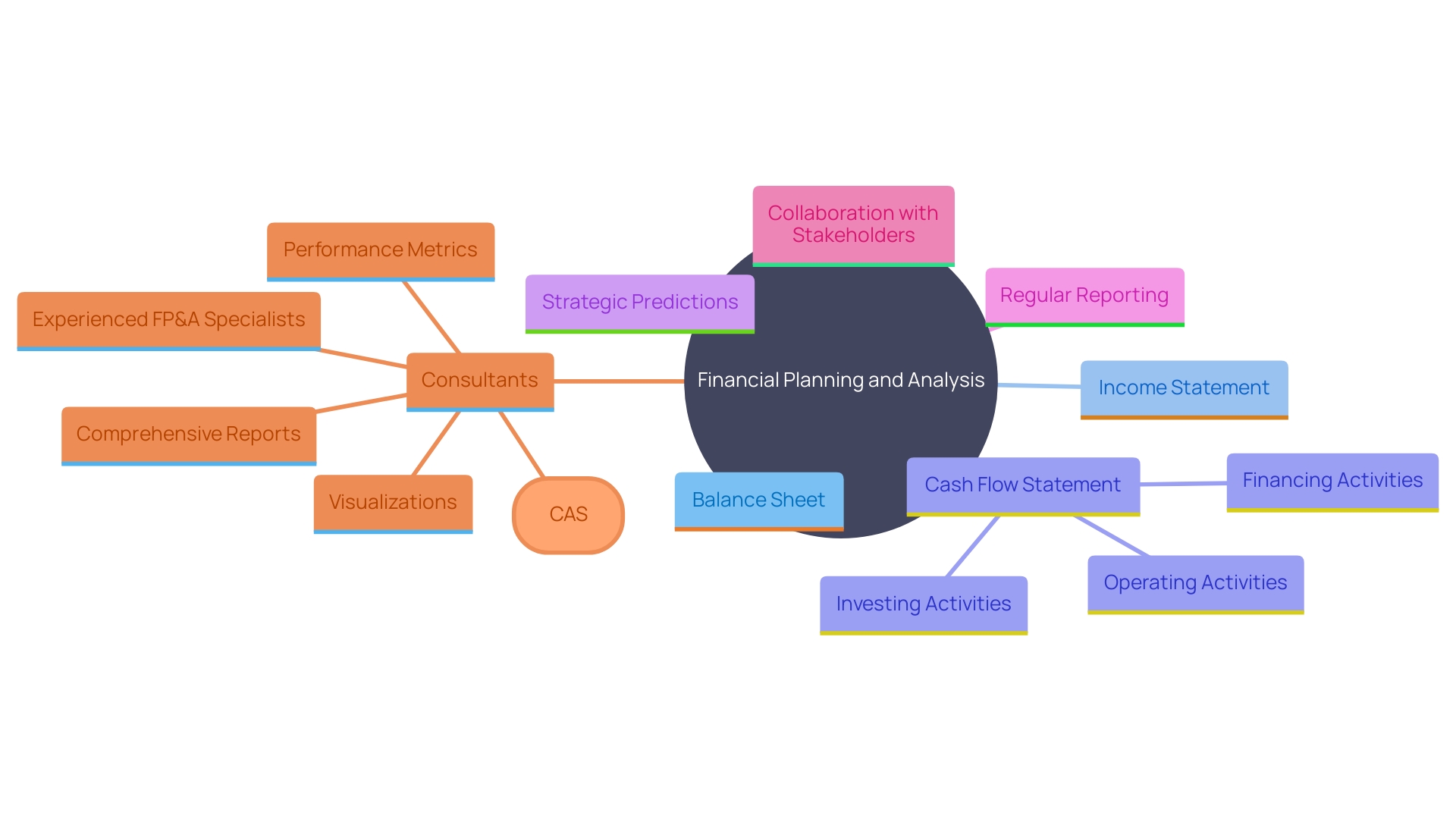

Financial Planning and Analysis (FP&A) is indispensable for driving strategic decision-making and business planning. This function includes evaluating monetary results, conducting variance analysis, and preparing forecasts that guide the organization's strategy. FP&A teams diligently analyze data from the balance sheet, income statement, and cash flow statement to provide a comprehensive view of the company’s economic health.

The balance sheet offers a snapshot of the company’s net worth, detailing assets, liabilities, and shareholders' equity. The income statement reveals profitability by showing income, expenses, and profits over a specific period. The cash flow statement tracks how cash is generated and spent, derived from operating, investing, and financing activities. These documents together inform FP&A's strategic predictions and reporting of results.

Regular reporting of results is essential for conveying economic metrics to stakeholders, including executives and board members. Through monthly budget vs. actual reports, FP&A teams collaborate with department heads to understand variances and adjust strategies proactively. Cash flow forecasting reports are essential for predicting future monetary liquidity, enabling the organization to maintain stability and capitalize on opportunities.

For organizations lacking dedicated FP&A teams, engaging experienced consultants can be highly beneficial. These specialists not only track metrics but also create comprehensive reports and visualizations, ensuring that all departments are well-informed and actively involved in evaluating the company's overall effectiveness. This progressive strategy, illustrated by companies such as Anchin’s Client Accounting Advisory Services (CAS), assists organizations in reaching their strategic objectives by offering practical insights and keeping a close eye on economic outcomes.

Key Activities in FP&A

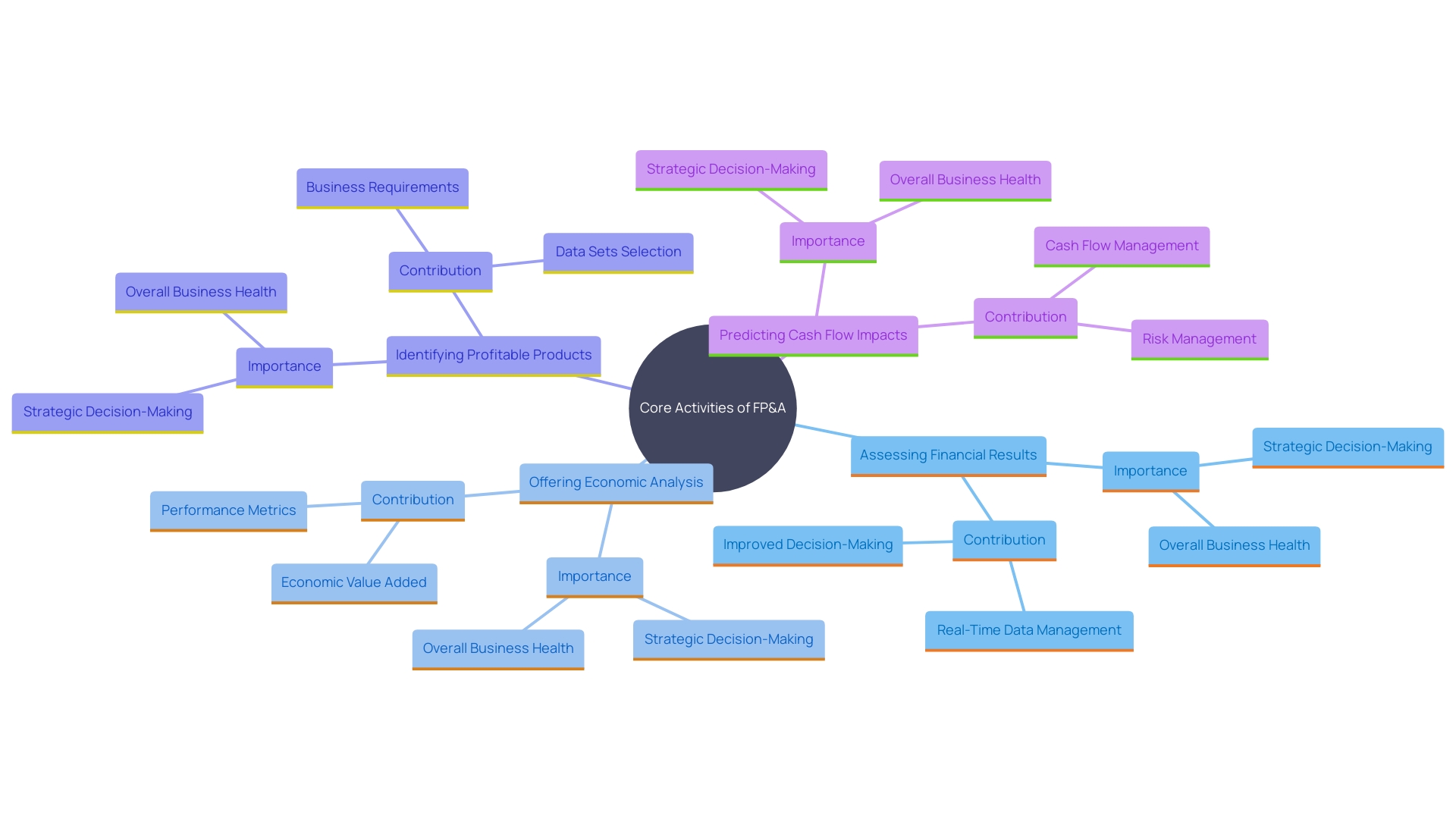

Key activities in FP&A encompass: - Assessing and Monitoring Financial Results: Through reporting on outcomes, which is essential for understanding business success. FP&A teams regularly assess economic metrics, such as income statements and balance sheets, offering a comprehensive view of the organization's health. Consistent performance reporting aids in communicating these metrics to stakeholders, from executives to board members, ensuring everyone is aligned and informed. - Offering Economic Analysis and Advice: By providing insights on monetary data and trends, FP&A specialists enable strategic decision-making. Their analyses, including budget vs. actual reports, help department heads understand variances and adjust strategies proactively. This process is crucial for navigating market conditions and competitor actions effectively. - Identifying Profitable Products and Services: Detailed revenue stream analysis allows FP&A teams to identify the most lucrative offerings. This insight ensures the focus remains on products and services that drive profitability and growth. - Predicting Cash Flow Impacts: Cash flow forecasting is vital for maintaining liquidity. FP&A teams utilize historical data and monetary modeling to forecast future cash flow, ensuring the organization can meet its fiscal obligations and invest in growth opportunities. Cash flow statements provide a detailed account of how cash is generated and spent, pulled from income statements and balance sheets, offering a clear picture of financial liquidity.

Conclusion

The exploration of accounting advisory services reveals their essential role in enhancing financial processes and operational efficiency. By offering tailored solutions such as financial reporting, compliance management, and strategic guidance, these services empower organizations to navigate the complexities of the financial landscape. The successes of entities like the Department of Defense and firms utilizing cloud technology underscore the tangible benefits of robust accounting practices, including improved revenue and asset management.

Key services provided by accounting advisory firms, such as cash flow forecasting, budgeting, and business planning, are vital for aligning financial strategies with organizational goals. These services not only optimize resource allocation but also enhance profitability and productivity, demonstrating that effective financial management is a cornerstone of business success. Furthermore, the integration of advanced financial tools and technology has proven to be a game-changer, enabling businesses to deliver superior client services and improve overall performance.

Financial Planning and Analysis (FP&A) stands out as a crucial component in driving strategic decision-making. The rigorous assessment of financial performance and proactive variance analysis equips organizations with the insights needed to adapt and thrive in a dynamic market. Engaging experienced consultants can augment internal capabilities, ensuring comprehensive performance monitoring and effective communication across departments.

By leveraging these insights, businesses can make informed decisions, manage their finances adeptly, and ultimately achieve sustained growth and success.