Introduction

In today's complex economic landscape, financial consultants play a crucial role in guiding organizations through intricate financial decisions. Their expertise in areas like cash flow optimization, risk management, and strategic investments is indispensable for businesses aiming to navigate regulatory challenges and market dynamics. By leveraging historical data and advanced financial modeling, these professionals provide predictive insights that are vital for strategic planning.

As businesses face rising costs and evolving regulations, particularly in regions like Australia, the demand for skilled financial consultants continues to grow. These experts not only ensure regulatory compliance but also empower organizations to make data-driven decisions, optimizing resources and identifying lucrative investment opportunities.

Understanding the Role of Financial Consultants

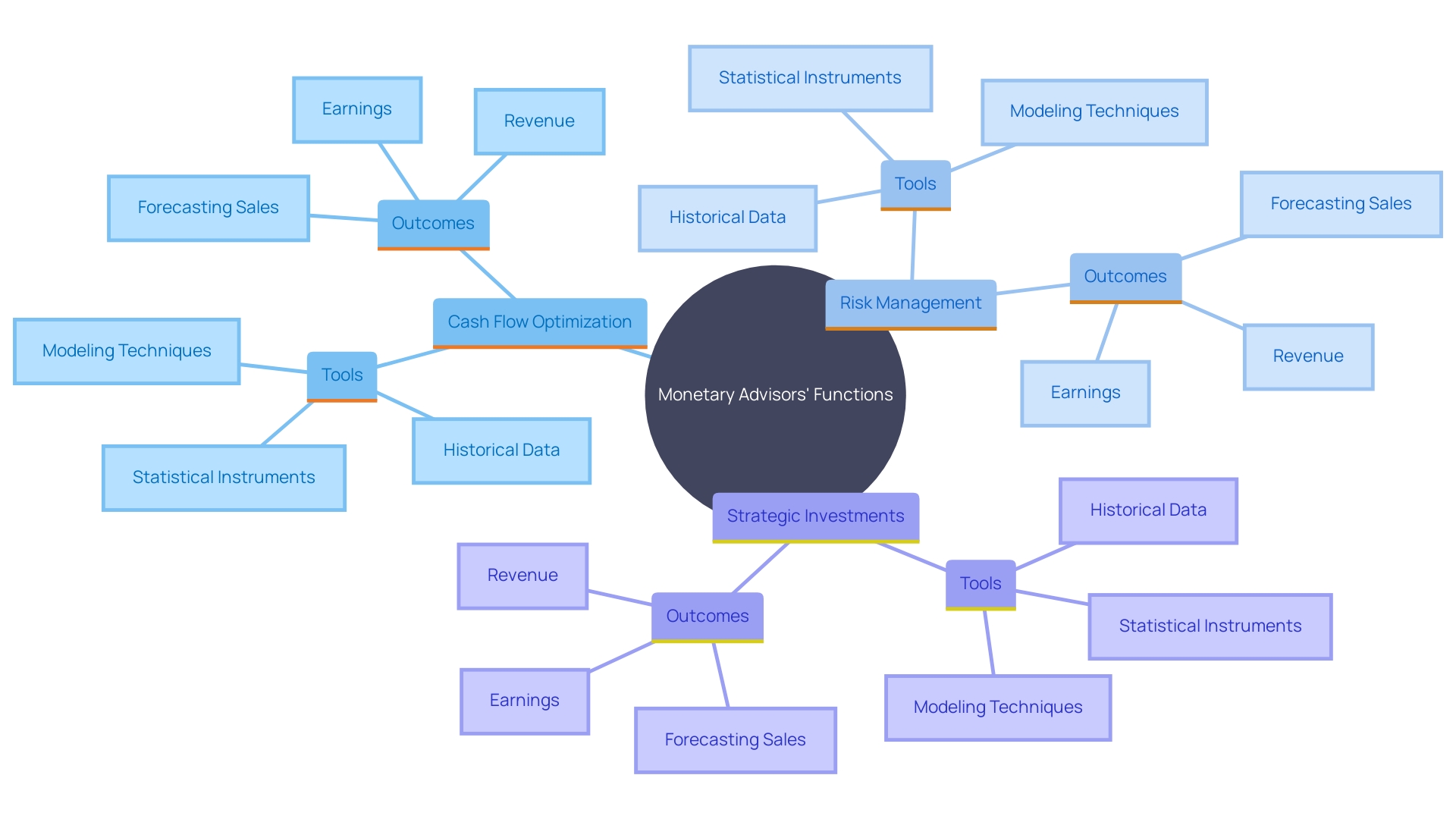

Monetary advisors are crucial in maneuvering through the complex economic terrains encountered by businesses today. They offer specialized expertise in critical areas such as cash flow optimization, risk management, and strategic investments. Employing historical information, statistical instruments, and modeling techniques, these experts can forecast results for sales, revenue, and earnings, thus offering invaluable insights for strategic planning. For example, by examining market trends and monetary reports, advisors can evaluate a company’s economic condition, predict future results, and recognize investment possibilities with potential gains and hazards.

In a progressively challenging atmosphere, advisors assist companies in remaining informed about changing rules and market trends. The demand for quality economic guidance is surging, especially in regions like Australia, where the cost of living and borrowing is on the rise. Financial advisors play a crucial role in ensuring that organizations are compliant with regulatory requirements while also being positioned for growth. Their insights enable businesses to make data-driven decisions, such as adjusting budgets or investment plans to mitigate potential cash flow issues.

A skilled advisor provides companies with the means to assess their activities in an organized manner, recognizing essential value contributors and formulating plans to boost value generation. This comprehensive approach not only aids in managing economic risks but also in capitalizing on investment opportunities, ensuring that resources are allocated efficiently. As predictive analytics gains importance in management of finances, the role of consultants is set to become even more pivotal in helping organizations navigate complex economic conditions and achieve sustainable growth.

Key Elements of a Strong Business Strategy for Financial Consulting

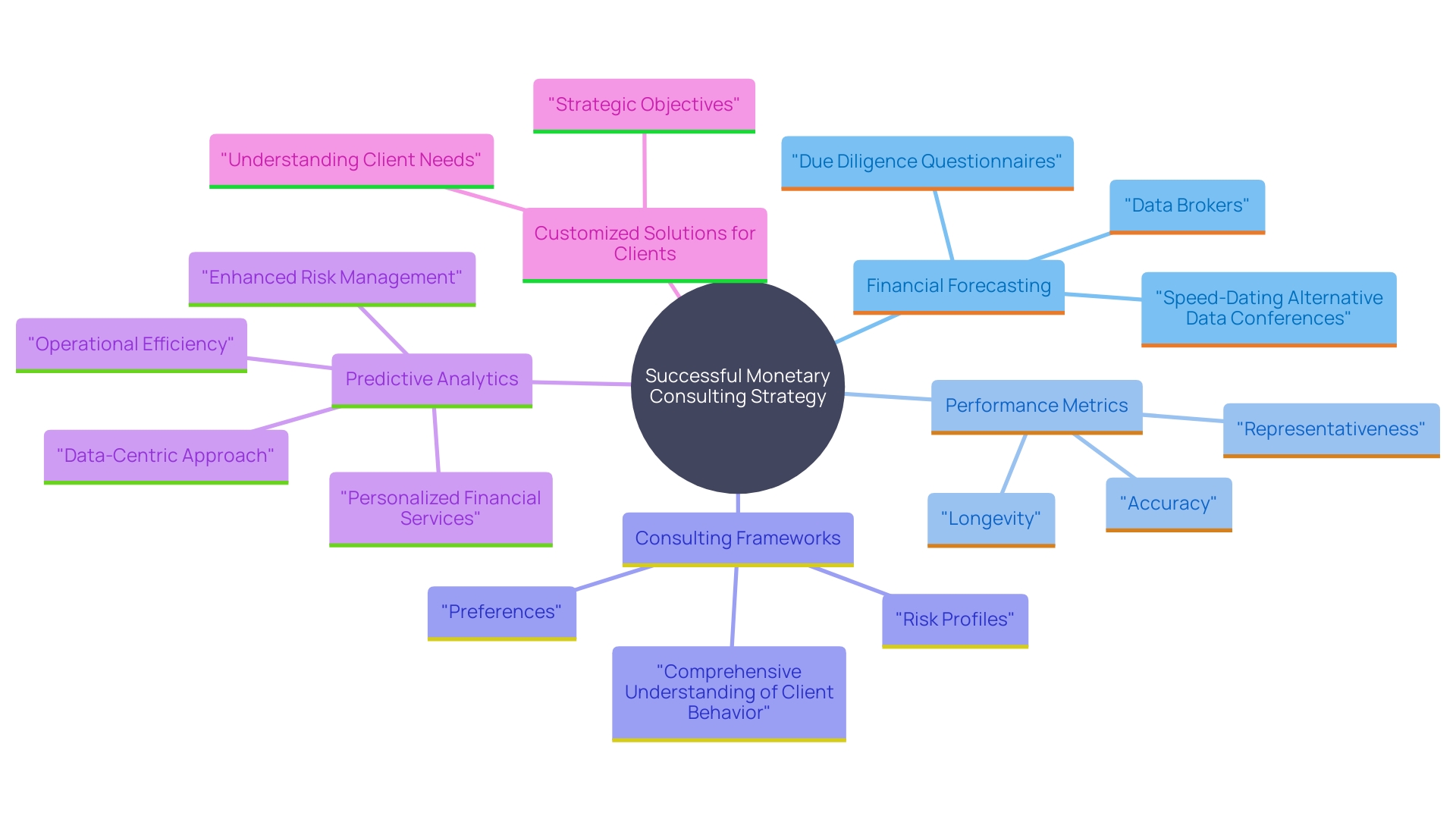

A robust business strategy in monetary consulting demands clear objectives, precise market positioning, and a deep understanding of client needs. This strategy must integrate a comprehensive approach that includes budgeting forecasting, resource allocation, and performance metrics. Adjusting advisory services to the strategic objectives of the organization enables specialists to provide customized solutions that foster lasting success.

Financial forecasting is crucial for predicting sales, revenue, expenses, and earnings. Using historical data and statistical tools, consultants can provide data-driven insights that inform strategic planning, budgeting, and efficient resource allocation. For example, the significance of ongoing education in the monetary sector cannot be overstated. Financial analysts play a pivotal role in navigating the complexities of the financial landscape, shaping the future of businesses through their expertise and insights.

Moreover, addressing core issues and delivering value to clients requires adherence to established principles and guidelines. Consulting frameworks, such as the industry framework, help analyze industry structure, key players, and competitive dynamics. This structured approach ensures that advisors can identify the best solutions for specific problems, driving strategic decisions and fostering business growth.

Performance metrics and reporting are integral to understanding business success. Consistent performance reporting bridges gaps among various departments, providing valuable insights that keep the entire enterprise on course. For example, monthly Budget vs. Actual Reports allow the FP&A team to collaborate with department heads, addressing variances and proactively adjusting strategies. This collaboration is essential for navigating external factors like market conditions or competitor actions.

Furthermore, improvement consulting related to finances has experienced substantial growth, with a 56% rise in performance enhancement projects since 2020. Clients seek to enhance revenue, reduce costs, and optimize labor force, among other services. This trend highlights the growing demand for consultants who can deliver measurable outcomes in financially challenging environments.

Integrating predictive analytics into economic consulting is another key aspect. Predictive analytics interprets economic data to estimate future outcomes, helping decision-makers respond more effectively to complex and unreliable economic conditions. This approach is expected to play a crucial role in driving industry growth during the forecast period.

By combining these elements, advisors can offer thorough, customized solutions that promote long-term success for their clients.

Leveraging Technology in Financial Consulting

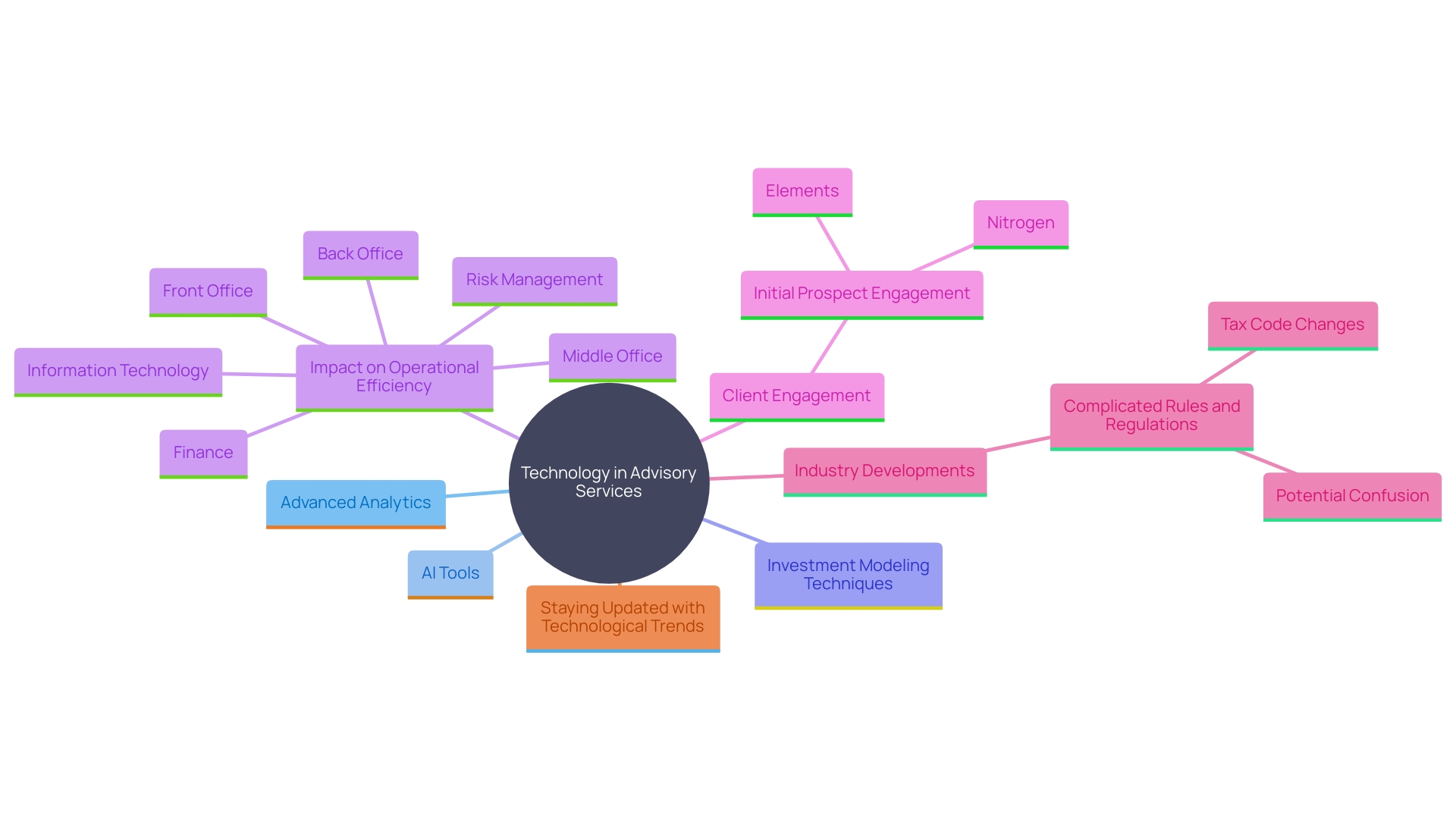

Technology has become a crucial component in contemporary advisory services, enabling advisors to utilize data-driven insights and improve operational efficiency. Leveraging advanced analytics tools, artificial intelligence, and financial modeling software, consultants can deliver precise forecasts and optimize resource management. This technological integration not only boosts efficiency but also significantly improves the quality of advisory services provided to clients.

'A case in point is the use of alternative information and quantitative techniques for investment modeling, particularly in areas like ESG investing.'. By fine-tuning large language models (LLMs) and employing natural language processing (NLP), consultants can unearth inefficiencies and capture investment returns effectively. 'This approach is backed by Karmela Peček from eWyse Agency, who highlights the significance of converting technical information into engaging formats that encourage users to investigate details on their own.'.

Moreover, the consulting industry has seen noteworthy developments such as Alteryx's acquisition by Clearlake and Insight Partners for $4.4 billion, indicating the growing significance and investment in advanced analytics and data science solutions. These advancements are essential for business leaders in finance to navigate the complexities of AI adoption while maintaining a competitive edge.

As monetary regulations become increasingly complex, the role of technology in ensuring compliance and providing sophisticated advisory services cannot be overstated. 'The shift towards more client-centric services, facilitated by innovative technology tools, is shaping the future of advisory services, much like the evolution seen in the medical field.'. This transformation highlights the necessity for monetary advisors to remain at the forefront of technological trends to provide outstanding value to their clients.

Data-Driven Strategies for Financial Success

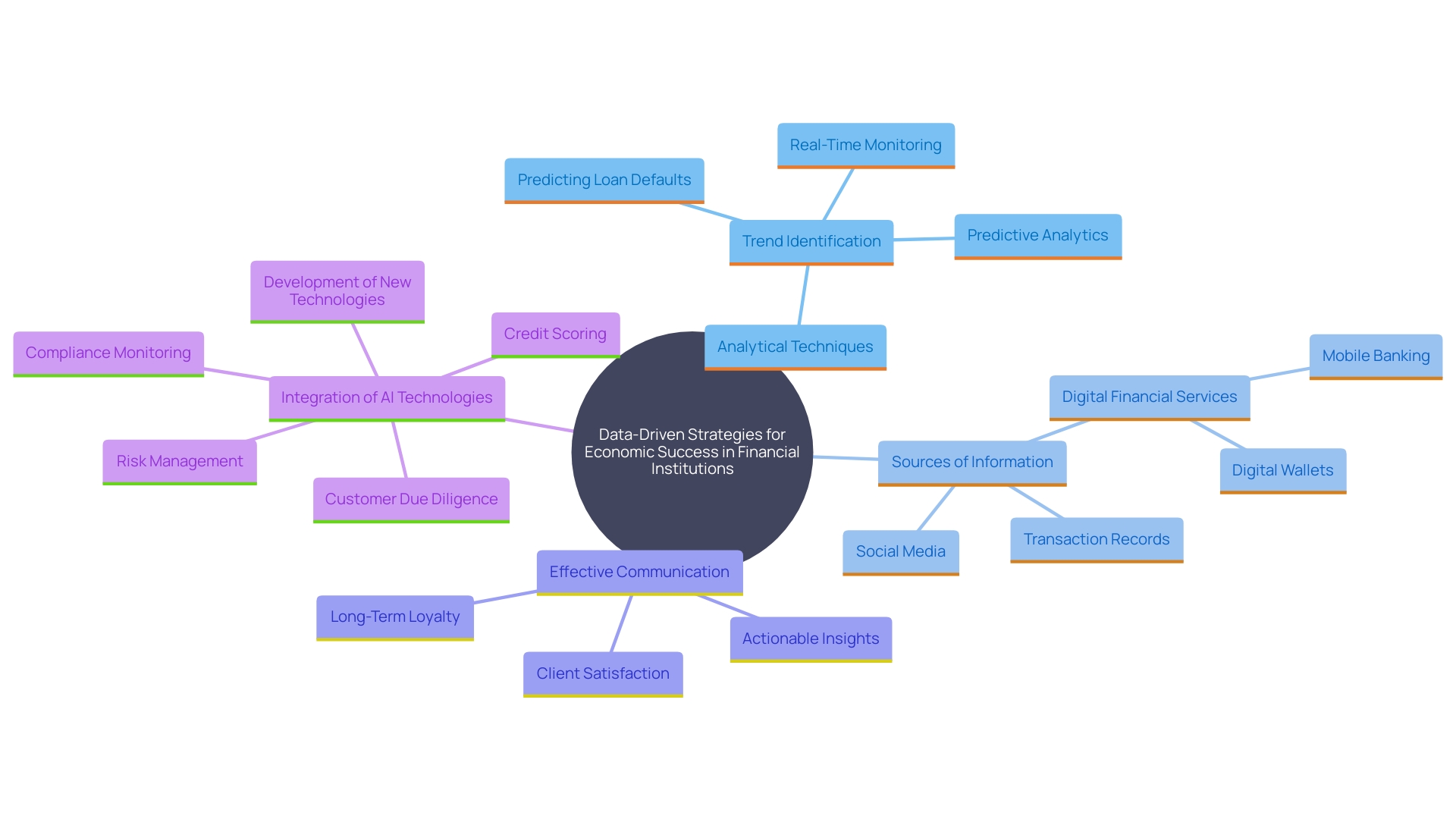

'Implementing data-driven strategies is pivotal for achieving economic success.'. By utilizing extensive analytical techniques, financial consultants can identify trends, uncover hidden opportunities, and make informed decisions. With expenditures on information infrastructure anticipated to exceed $36 billion, the focus on information-centric strategies has never been greater. Financial institutions, traditionally reliant on information, now face an unprecedented volume and complexity of information, necessitating robust analytics to maintain a competitive edge.

Data analysis includes a broad array of methods for examining, cleaning, transforming, and modeling information to extract valuable insights. Comprehending both organized and unorganized information is essential, as it enables organizations to utilize a range of information sources, including social media, sensors, and transaction records. This holistic approach ensures a comprehensive view of market trends, customer behavior, and economic indicators.

A critical aspect of successful data-driven strategies is effective communication. Financial advisors must express their conclusions clearly to stakeholders, ensuring that information insights translate into actionable decisions. For instance, identifying fluctuations in consumer interests can help businesses adjust their marketing strategies, targeting where their audience is most active.

Moreover, the integration of emerging technologies such as artificial intelligence can enhance customer experiences and streamline operations. AI can manage extensive volumes of information, offering real-time insights that facilitate near-instantaneous decision-making. This capability is essential for maintaining a competitive advantage, as it allows organizations to stay ahead of market trends and customer preferences.

As Keith Pitt, CEO of Buildkite, notes, while information is a powerful tool, combining it with developer expertise can lead to innovative solutions beyond mere product improvements. Establishing a culture of data-driven decision-making within the organization is crucial for sustained growth and success. By treating data as a vital business asset, organizations can unlock new value, drive revenue growth, and maintain a competitive edge.

Building and Maintaining Client Relationships

Successful financial consulting is established on a foundation of strong relationships with customers. Building trust and keeping open lines of communication are essential for grasping customer needs and customizing services accordingly. Regular feedback sessions and progress reports are essential tools for fostering collaborative partnerships. This approach ensures that consultants remain aligned with the evolving objectives of those they serve.

A case study of Aria Systems highlights the impact of this approach. The consulting team provided crucial expertise and support, enabling the company to navigate hyper-growth in a dynamic market. The team's proactive and professional style was instrumental in identifying areas needing immediate attention and developing actionable plans.

In the current financially challenging environment, the KLAS 2020 Financial Improvement Consulting report underscores the importance of consulting firms in guiding organizations through obstacles. The report indicates that companies providing extensive assistance and sustaining strong relationships with customers achieve better results, even during challenges like the COVID-19 pandemic.

As monetary services face declining trust and low economic understanding, particularly among younger generations, the need for a client-centric approach becomes even more pronounced. By concentrating on overall economic health and adjusting to industry shifts, advisors can more effectively fulfill customer expectations and restore trust. This client-centric strategy is emphasized by experts who note that understanding clients as individuals with unique financial futures, rather than mere assets, is key to a successful advisory relationship.

Conclusion

In the ever-evolving landscape of financial consulting, the pivotal role of financial consultants cannot be overstated. Their expertise in cash flow optimization, risk management, and strategic investments equips organizations with the necessary tools to navigate complex financial decisions. By employing advanced financial modeling and predictive analytics, these professionals provide insights that help businesses not only comply with regulations but also capitalize on opportunities for growth.

A strong business strategy is essential for financial consultants to deliver tailored solutions that align with client objectives. This includes comprehensive financial forecasting, performance metrics, and the use of established consulting frameworks to address core issues effectively. As the demand for financial improvement consulting rises, the ability to provide measurable outcomes becomes increasingly important.

The integration of technology further enhances the capabilities of financial consultants, allowing for more efficient resource management and improved client advisory services.

Data-driven strategies form the backbone of successful financial consulting. By leveraging big data analytics, consultants can identify trends and make informed decisions that drive financial success. Effective communication of these insights ensures that stakeholders are aligned and can act on recommendations swiftly.

Building and maintaining strong client relationships through trust and open communication is crucial in today's climate, as it fosters collaboration and adaptability in the face of challenges.

Ultimately, the combination of strategic foresight, technological integration, and a client-centric approach positions financial consultants as indispensable partners for organizations seeking sustainable growth in a competitive environment. Embracing these principles will not only enhance service delivery but also ensure long-term success in navigating the complexities of the financial landscape.