Introduction

A Corporate Controller plays a crucial role in ensuring financial integrity and guiding strategic decision-making within a company. This article dives into the responsibilities, qualifications, and career development path of a Corporate Controller.

It highlights the multifaceted role of financial reporting and analysis, the establishment of internal controls, and the strategic financial decision-making undertaken by Controllers. Furthermore, it emphasizes the fusion of technical expertise, industry insights, communication skills, and analytical prowess required for success in this role. Lastly, the article explores the career progression from Corporate Controller to CFO or COO, emphasizing the importance of continuous learning, advanced certifications, industry knowledge, and networking.

What is a Corporate Controller?

A Corporate Controller is the linchpin of financial integrity in any thriving venture, meticulously overseeing the financial tapestry - weaving through the essentials of financial planning, budget management, reporting, and discerning analysis. Tasked with the guardianship of financial accuracy, this role underpins the financial health of the company, furnishing pivotal insights and guidance that steer senior management's monetary decisions.

Controllers are the sentinels of financial oversight, assuring that financial records and statements accurately reflect the company's fiscal activities. They embrace the complexity of financial management, addressing not just mere accounting tasks, but imparting strategic advisement, ensuring regulatory compliance, and wielding financial reporting as a vital instrument for strategic decision-making.

Their contributions are essential in creating monthly and annual reports that form the backbone of sound strategic decisions. Through this prism, the Corporate Controller emerges as a vital asset in any business structure, especially in the small business realm, where their responsibilities burgeon to include managing accounting operations comprehensively.

Their role extends from financial reporting and ledger management to developing financial policies and fostering an internal control environment to safeguard assets. Furthermore, in a small business, where fluid cash flow is the lifeblood, a Corporate Controller deftly manages the budgeting and forecasting processes, underpinning business planning and strategic foresight. These formidable challenges call for a Controller with a breadth of skills: analytical prowess, proficiency in financial software, and a leadership temperament that resonates with both the team and the organization's ethos. Carving a path towards the epitome of financial leadership—the CFO—entails not only these competencies but a deeper dive into financial intricacies, strategic financial planning, and risk management to secure the financial helm of an organization.

Key Responsibilities of a Corporate Controller

A Corporate Controller's role is multifaceted and critical for the operational success and strategic direction of a company. At the core of their duties is financial reporting and analysis, wherein a controller ensures the creation of precise financial statements. By dissecting financial data and delineating trends, they furnish key insights to senior management and spearhead critical decision-making.

They perform a balancing act, weaving through budgeting and financial planning, marrying the aspirations of department heads with realistic budget frameworks, and overseeing financial projections and liquidity management, hence shaping the financial forecast of the enterprise. Controllers also establish a fortress of internal controls to protect corporate assets while ensuring adherence to financial regulations, an increasingly complex task given contemporary compliance requirements. They serve as the bedrock of their finance teams, cultivating a culture of excellence, peer learning, and leadership to bolster overall team performance.

Moreover, strategic financial decision-making is within their purview, working shoulder-to-shoulder with top executives to conduct cost-benefit analysis, scrutinizing investment opportunities and steering the company towards a trajectory of growth and enhanced profitability. Their significance in the organization is underscored by a cash flow statement's revelations on operational funding versus external financing needs, and by a statement of change in equity which highlights decisions affecting shareholder value. A Corporate Controller's contribution to a firm's financial clarity and regulatory compliance is an indispensable asset to any forward-thinking business.

Qualifications and Skills Required

Achieving excellence as a Corporate Controller demands a fusion of qualifications and abilities attuned to financial oversight and strategic leadership. Technical expertise is the cornerstone, where a nuanced grasp of financial concepts, like accounting standards and analytical methods, meets the practical knowhow of regulatory landscapes. Industry insights elevate this role, empowering the Controller to inform key business decisions through real-time market trends and competitor analyses.

The role transcends numbers; it requires an orchestrator of cross-departmental harmony, an effective communicator translating complex data into actionable intelligence. This clarity in conveying financial narratives impacts stakeholders, driving organizational alignment around fiscal strategies and performance drivers. Analytical and problem-solving prowess allow Corporate Controllers to delve into financial intricacies, discern patterns, and formulate solutions ensuring financial robustness.

In keeping with the ever-evolving business scape, technological adeptness – particularly in financial software and advanced data manipulation tools – stands as an indispensable skill. Amidst the tactical competencies, personal integrity and an unwavering ethical framework are paramount. This moral compass ensures confidentiality, underscores compliance, and fosters trust – elements that, when woven into the fabric of a company's culture, can yield substantial dividends for both financial success and corporate reputation.

Career Path and Professional Development

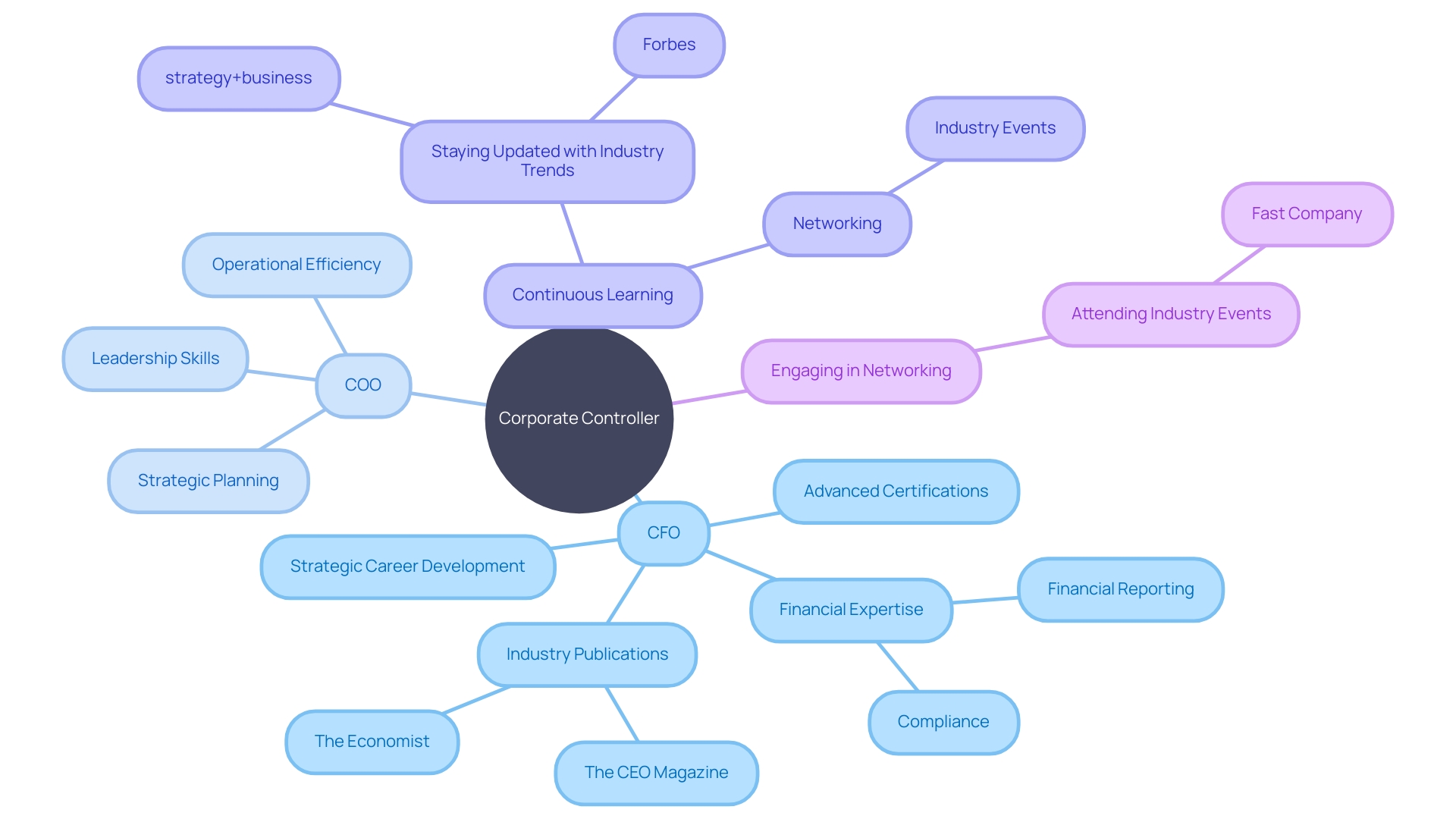

The journey from Corporate Controller to CFO or COO is steeped in continuous learning and strategic career development. By deepening one's financial expertise beyond basic skills, a Corporate Controller can navigate the complexities of financial reporting, strategic planning, risk management, and financial analysis.

To elevate one's career trajectory, it's beneficial to pursue advanced certifications like CPA or CFA. These designations are recognized across the industry and can significantly bolster one's credibility and opportunities for advancement.

Staying abreast of industry trends through premier publications such as The CEO Magazine and The Economist is also instrumental. These resources offer piercing insights into the business landscape, helping ambitious finance professionals shape their strategic thinking.

Additionally, attending industry events and engaging in networking can uncover valuable connections that might open doors to pivotal roles. Financial Controllers, by also mastering the art of financial reporting and compliance, can cement their essential role in the organization—providing the strategic guidance necessary for fiscal responsibility and informed decision-making. According to the Global State of Business Analysis Report, understanding evolving industry trends is crucial. The report, which collates responses from over 4,400 professionals worldwide, reveals a shift in the business analysis landscape, emphasizing the importance of keeping pace with industry developments for those aspiring to executive roles. These insights are pivotal for those looking to navigate the nuances of corporate finance with an eye toward leadership positions.

Conclusion

In conclusion, a Corporate Controller is a vital asset to any organization, overseeing financial integrity and guiding strategic decision-making. They are responsible for financial reporting and analysis, ensuring accurate financial statements and providing key insights for senior management.

Controllers also establish internal controls to protect corporate assets and foster excellence within their finance teams. To excel in this role, a Controller must possess technical expertise in financial concepts and regulatory landscapes, as well as industry insights to inform business decisions.

Effective communication skills are crucial, as they must translate complex data into actionable intelligence and drive organizational alignment. Analytical prowess and problem-solving abilities are necessary to navigate financial intricacies and ensure financial robustness.

Additionally, personal integrity and an unwavering ethical framework are paramount to building trust and maintaining corporate reputation. For career progression from Corporate Controller to CFO or COO, continuous learning and strategic development are key.

Pursuing advanced certifications like CPA or CFA can enhance credibility and opportunities for advancement. Staying informed about industry trends through reputable publications and networking at industry events can also open doors to pivotal roles. By mastering financial reporting, compliance, and strategic thinking, Controllers can provide the necessary guidance for fiscal responsibility and informed decision-making. In a rapidly evolving business landscape, it is essential for aspiring finance professionals to keep pace with industry developments. Understanding evolving trends is crucial for those looking to navigate the nuances of corporate finance and aspire to executive positions. By embracing continuous learning and seeking opportunities for professional growth, Corporate Controllers can position themselves for success in their career journey.