Overview

Corporate turnaround plans represent a strategic framework that CFOs can leverage to revitalize struggling businesses. This process emphasizes the assessment of the current situation, the establishment of clear objectives, and the engagement of stakeholders. Essential steps include:

- Conducting a comprehensive financial assessment

- Developing a strategic recovery plan

Together, these elements guide CFOs in transforming challenges into opportunities for sustainable growth.

Moreover, by utilizing data-driven insights and expert opinions, CFOs can navigate the complexities of corporate recovery effectively. This approach not only addresses immediate financial concerns but also positions the organization for long-term success. The commitment to professionalism and reliability in these strategies ensures that stakeholders remain engaged and informed throughout the turnaround process.

Consequently, it is imperative for CFOs to take decisive action by implementing these strategies. By doing so, they can foster an environment conducive to growth and resilience, ultimately leading to a revitalized business landscape.

Introduction

In the dynamic landscape of business, organizations often find themselves at a crossroads, facing the daunting task of revitalizing their operations amid financial distress. A corporate turnaround plan emerges as a beacon of hope, offering a structured approach to navigate these turbulent waters. This article delves into the essential components of crafting an effective turnaround strategy, from conducting a thorough financial assessment to engaging stakeholders and implementing key initiatives. By mastering these fundamentals, CFOs can transform challenges into opportunities, ensuring not only survival but also sustainable growth in an ever-evolving market.

Understand the Fundamentals of Corporate Turnaround Plans

Corporate turnaround plans serve as a strategic framework designed to revitalize a struggling business. It encompasses several essential components:

- Assessment of Current Situation: A thorough evaluation of the economic and operational health of the business is crucial. This involves pinpointing the underlying causes of distress, such as declining sales, excessive operational costs, or shifts in market dynamics. A comprehensive financial review can help identify opportunities to preserve cash and reduce liabilities, which is vital for stabilizing the business.

- Setting Clear Objectives: Establish specific, measurable goals that the recovery plan seeks to achieve, such as enhancing cash flow, reducing debt, or expanding market share.

- Stakeholder Engagement: Actively involve key stakeholders—including employees, investors, and creditors—to secure their support and commitment to the recovery initiatives. Engaging stakeholders fosters a collaborative environment that can drive successful outcomes. As highlighted in the case study titled "The Role of CFOs in Corporate Citizenship," prioritizing corporate citizenship can enhance a company's reputation and foster trust among stakeholders.

- Strategic Focus: Concentrate on the organization’s core competencies and identify areas where it can regain a competitive edge. This strategic focus is vital for sustainable growth and operational efficiency. Employing extensive transformation and restructuring consulting services can streamline operations and enhance financial performance.

- Implementation Framework: Create a comprehensive structure for executing the recovery plan, outlining timelines and designating responsibilities to ensure accountability. Interim management services play a crucial role in providing hands-on executive leadership for crisis resolution and transformational change through structured processes like the Rapid-30.

By mastering these fundamentals, CFOs can adeptly navigate the complexities of the recovery process, transforming challenges into opportunities for growth. Recent trends indicate that incorporating employee involvement, fostering open communication, and leveraging technology can significantly enhance the effectiveness of recovery strategies. As Maureen O'Connell, former CFO of Scholastic, noted, "Just as organizations continuously evolve with the ever-changing global business climate, the role of a CFO is bound to change." Successful case studies demonstrate that CFOs who prioritize stakeholder engagement and corporate citizenship not only improve their companies' reputations but also build trust among stakeholders, ultimately leading to more effective corporate turnaround plans.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive financial assessment, follow these steps:

- Gather Fiscal Statements: Collect the last three to five years of fiscal statements, including income statements, balance sheets, and cash flow statements. This historical data is essential for identifying trends and anomalies.

- Analyze Key Financial Ratios: Evaluate liquidity ratios, such as current and quick ratios, alongside profitability ratios like gross and net profit margins. Leverage ratios, including the debt-to-equity ratio, are also critical, especially since companies with high debt-to-total assets ratios face increased risks due to higher principal and interest payments. As Stéphanie Bourret, Senior Manager at BDC, states, "Use them right and you end up with more money in your pocket."

- Identify Cash Flow Issues: Examine cash flow statements to pinpoint periods of negative cash flow and understand the underlying causes. This analysis is essential for maintaining cash and minimizing liabilities, which is critical for any corporate turnaround plans.

- Review Operational Costs: Break down operational expenses to identify areas where costs can be reduced without sacrificing quality or service. Efficient cost management can greatly improve economic well-being and assist in the overall recovery process, particularly through corporate turnaround plans.

- Benchmark Against Industry Standards: Compare metrics with industry benchmarks to identify performance gaps. For instance, the average return on equity (ROE) for engineering and construction companies hovers just above 6%, providing a reference point for assessing performance.

- Engage with Stakeholders: Discuss findings with key stakeholders to gain insights and validate assumptions about economic performance. Interacting with monetary specialists can clarify which ratios are most pertinent, leading to more informed decisions. This step is essential as it assists in guaranteeing that the assessment represents a thorough understanding of the business's economic landscape.

- Consider Duration of Assessment: Be aware that conducting a thorough evaluation for small businesses may take several weeks, depending on the complexity of the data and the availability of resources.

- Utilize Bookkeeping Services: Consider leveraging the assessment services offered by Transform Your Small/ Medium Business to help track performance and calculate ratios effectively.

This comprehensive evaluation will offer a clear view of the organization's financial status and guide the creation of corporate turnaround plans, ultimately improving the prospects for recovery and sustainable growth. Furthermore, integrating expert advice and employing AI/ML strategies can enhance the efficiency of the process, ensuring that businesses not only survive but flourish in a competitive environment.

Develop a Strategic Turnaround Plan

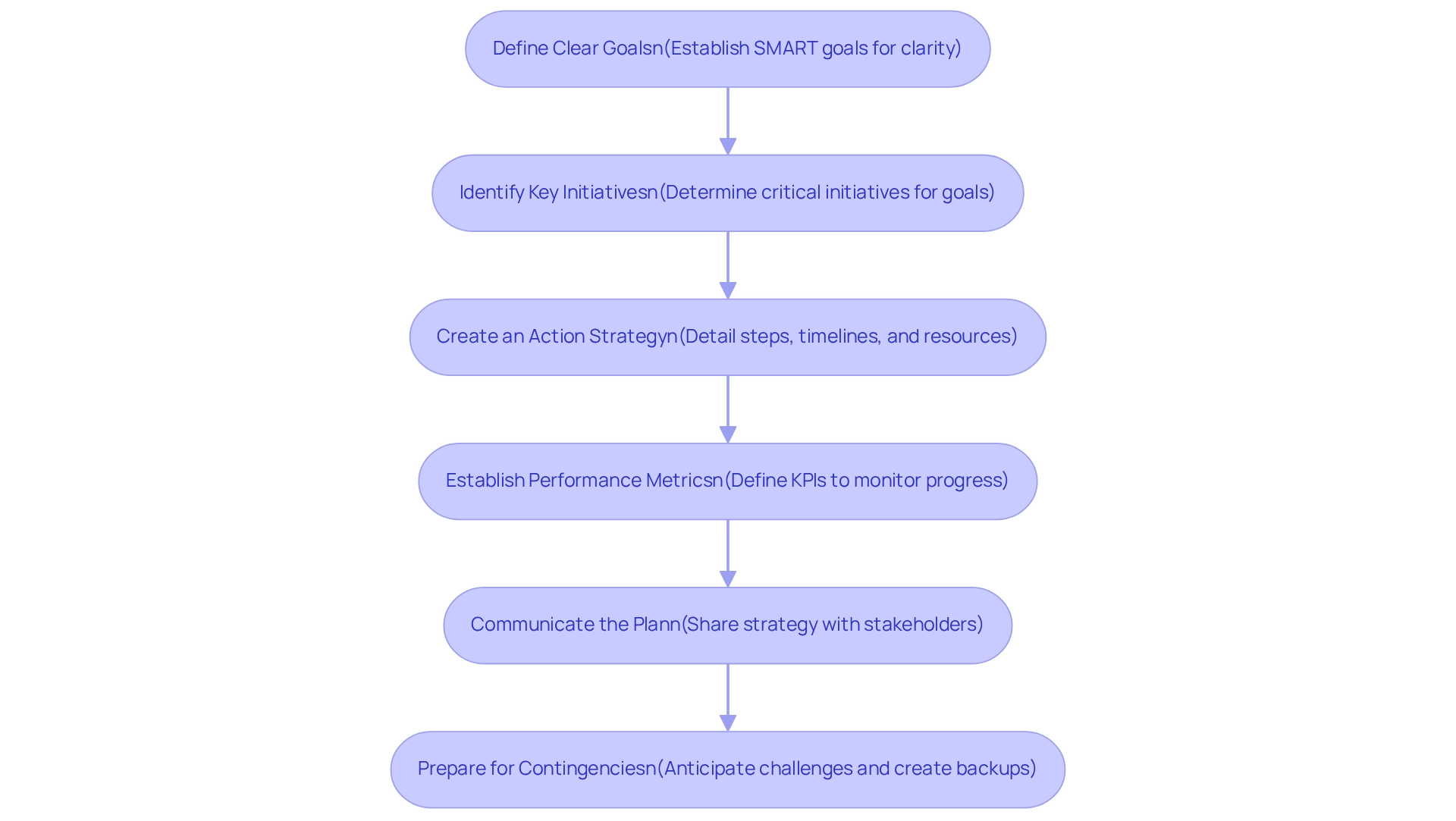

To create a strategic recovery plan, CFOs should follow these essential steps:

- Define Clear Goals: Begin with a thorough financial assessment to establish specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals will serve as the foundation for the corporate turnaround plans, ensuring clarity and focus.

- Identify Key Initiatives: Determine the critical initiatives necessary to achieve the defined goals. This may include implementing cost-cutting measures, enhancing revenue streams, or improving operational efficiencies. Creativity and innovation are vital in identifying these initiatives to stay competitive in a rapidly changing market. As Scott Dylan emphasizes, adapting strategies is crucial for success in today's business landscape.

- Create an Action Strategy: Develop a comprehensive action strategy detailing the steps required to implement each initiative. This strategy should encompass timelines, accountable individuals, and the resources necessary for successful implementation. Integrating SMART goals into this action plan provides structure and clarity, particularly in remote work environments, ensuring that all team members are aligned and accountable.

- Establish Performance Metrics: Define key performance indicators (KPIs) to monitor progress and success throughout the recovery process. For instance, adopting SMART goals can enhance clarity and responsibility, especially in remote work settings, ensuring that all team members understand their roles in achieving performance objectives. Utilizing comprehensive recovery and restructuring consulting services, including interim management and bankruptcy case management, can further refine these metrics, focusing on financial assessment and operational efficiency.

- Communicate the Plan: Share the recovery strategy with all stakeholders to foster alignment and commitment. Transparency is crucial for gaining support and creating a collaborative atmosphere, which is essential for successful implementation.

- Prepare for Contingencies: Anticipate potential challenges and create backup strategies to address them proactively. This foresight can reduce risks and ensure that the organization remains adaptable in the face of unforeseen challenges.

By following these steps, CFOs can create a solid strategic recovery plan that not only directs the organization toward rehabilitation but also includes corporate turnaround plans for sustainable growth. For example, Zoho Corporation successfully implemented KPIs focused on customer acquisition costs and lifetime value, resulting in a remarkable 45% growth rate over two consecutive years. Such case studies underscore the effectiveness of strategic planning in achieving successful recovery. Furthermore, understanding the costs of these services can assist CFOs in making informed decisions about their investments in recovery plans.

Implement and Monitor Turnaround Strategies

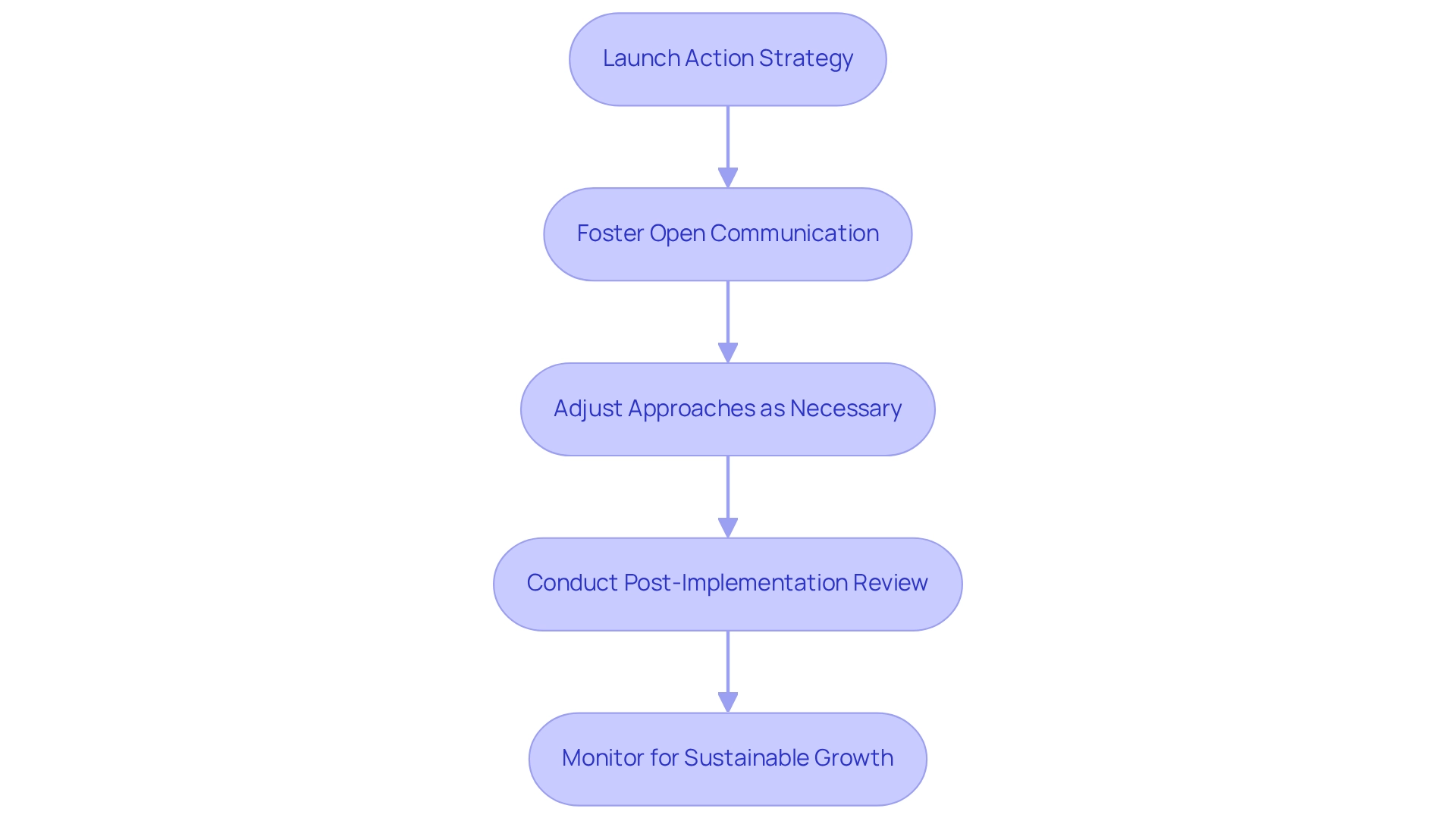

To implement and monitor turnaround strategies effectively, CFOs must adhere to the following steps:

- Launch the Action Strategy: Initiate the execution of the action strategy, ensuring that every team member comprehends their specific roles and responsibilities.

Regularly Review Progress: Establish a schedule for frequent check-ins to evaluate progress against the defined KPIs. This practice enables the timely identification of issues and necessary adjustments to the plan, supported by real-time business analytics that continually diagnose the organization's health. - Foster Open Communication: Promote transparent communication among team members and stakeholders to encourage feedback and collaboration, which are vital for successful implementation.

- Adjust Approaches as Necessary: Stay flexible by altering methods based on performance data and external influences. Adaptability is essential for overcoming challenges during the recovery process, and a shortened decision-making cycle can facilitate decisive actions.

Celebrate Milestones: Acknowledge and celebrate achievements throughout the process to sustain morale and motivation within the team. - Conducting a Post-Implementation Review is essential: Once the recovery plan is fully executed, perform a thorough review to assess overall success and extract lessons learned for future initiatives, operationalizing these insights to strengthen relationships and enhance future performance.

Implementing and monitoring these corporate turnaround plans not only aids in navigating the complexities of corporate restructuring but also positions organizations for sustainable growth. Statistics indicate that effective turnaround strategies help ensure compliance with strict regulations, particularly in the Oil and Gas sector, avoiding potential legal and financial implications. By following these best practices, CFOs can lead their organizations toward recovery and long-term success, fostering a culture of continuous improvement.

Conclusion

Navigating the complexities of a corporate turnaround necessitates a multifaceted approach, as outlined throughout this article. From conducting a comprehensive financial assessment to developing and implementing a strategic turnaround plan, each step is crucial for revitalizing a struggling organization. By engaging stakeholders and fostering open communication, CFOs can cultivate an environment conducive to collaboration—essential for the successful execution of turnaround initiatives.

The significance of setting clear objectives and establishing performance metrics cannot be overstated. These elements provide a roadmap for progress, enabling organizations to adapt and respond to challenges while maintaining focus on their goals. Moreover, the insights gained from regular progress reviews and flexibility in strategy adjustments ensure that businesses remain resilient in the face of market changes.

Ultimately, a well-crafted corporate turnaround plan addresses immediate financial distress while laying the groundwork for sustainable growth. By mastering these fundamental components, CFOs can transform obstacles into opportunities, guiding their organizations toward a more prosperous future. In an ever-evolving business landscape, the ability to execute effective turnaround strategies is not merely a necessity but a pathway to long-term success.

Frequently Asked Questions

What is the purpose of corporate turnaround plans?

Corporate turnaround plans serve as a strategic framework designed to revitalize a struggling business by addressing its economic and operational challenges.

What is the first step in creating a corporate turnaround plan?

The first step is the assessment of the current situation, which involves a thorough evaluation of the business's economic and operational health to identify the underlying causes of distress.

Why is setting clear objectives important in a turnaround plan?

Setting clear objectives is important because it establishes specific, measurable goals that the recovery plan aims to achieve, such as enhancing cash flow or reducing debt.

How should stakeholders be involved in the turnaround process?

Stakeholders, including employees, investors, and creditors, should be actively engaged to secure their support and commitment to the recovery initiatives, fostering a collaborative environment.

What does strategic focus entail in a corporate turnaround plan?

Strategic focus involves concentrating on the organization’s core competencies and identifying areas where it can regain a competitive edge, which is essential for sustainable growth.

What is the role of an implementation framework in a turnaround plan?

The implementation framework provides a comprehensive structure for executing the recovery plan, outlining timelines and designating responsibilities to ensure accountability.

How can interim management services contribute to a turnaround plan?

Interim management services provide hands-on executive leadership for crisis resolution and transformational change, utilizing structured processes to support the recovery plan.

What recent trends can enhance the effectiveness of recovery strategies?

Recent trends indicate that incorporating employee involvement, fostering open communication, and leveraging technology can significantly enhance the effectiveness of recovery strategies.

What is the significance of corporate citizenship in turnaround plans?

Prioritizing corporate citizenship can enhance a company’s reputation and foster trust among stakeholders, which is crucial for successful turnaround efforts.