Introduction

Cost accounting is a crucial element in understanding an organization's financial landscape. It involves categorizing and analyzing expenses to guide astute financial decisions.

In this article, we will explore various types of cost accounting methods, cost classification techniques, cost behavior analysis, cost-volume-profit analysis, job costing and process costing, cost accounting for decision making, cost accounting in different industries, best practices for implementing cost accounting, and common challenges and solutions in cost accounting. By delving into these topics, we will gain insights into how organizations can optimize costs, enhance operational efficiency, and make informed financial decisions.

Types of Cost Accounting

Cost accounting stands as a pivotal element in deciphering the financial tapestry of an organization, shedding light on the expenditures entwined with the creation of products or services. Peering into the depths of cost accounting unveils a variety of methods, each with its unique application to guide astute financial decisions.

Direct costs are the linchpin of this intricate process, exemplified by materials and direct labor—think of steel and assembly line workers in a car manufacturing scenario—whose precise tracking underpins the Cost of Goods Sold on financial statements. This meticulous categorization of expenses is not merely a ledger entry; it's a strategic cornerstone for businesses, particularly when navigating the complexities of sectors like healthcare and technology, where rapid innovation and regulatory landscapes pose both challenges and opportunities.

The matching principle, a cornerstone of revenue recognition, further illustrates the nuanced dance of accounting. It dictates that, for instance, a multi-year grant for a nonprofit educational program must be recognized in sync with the program's duration.

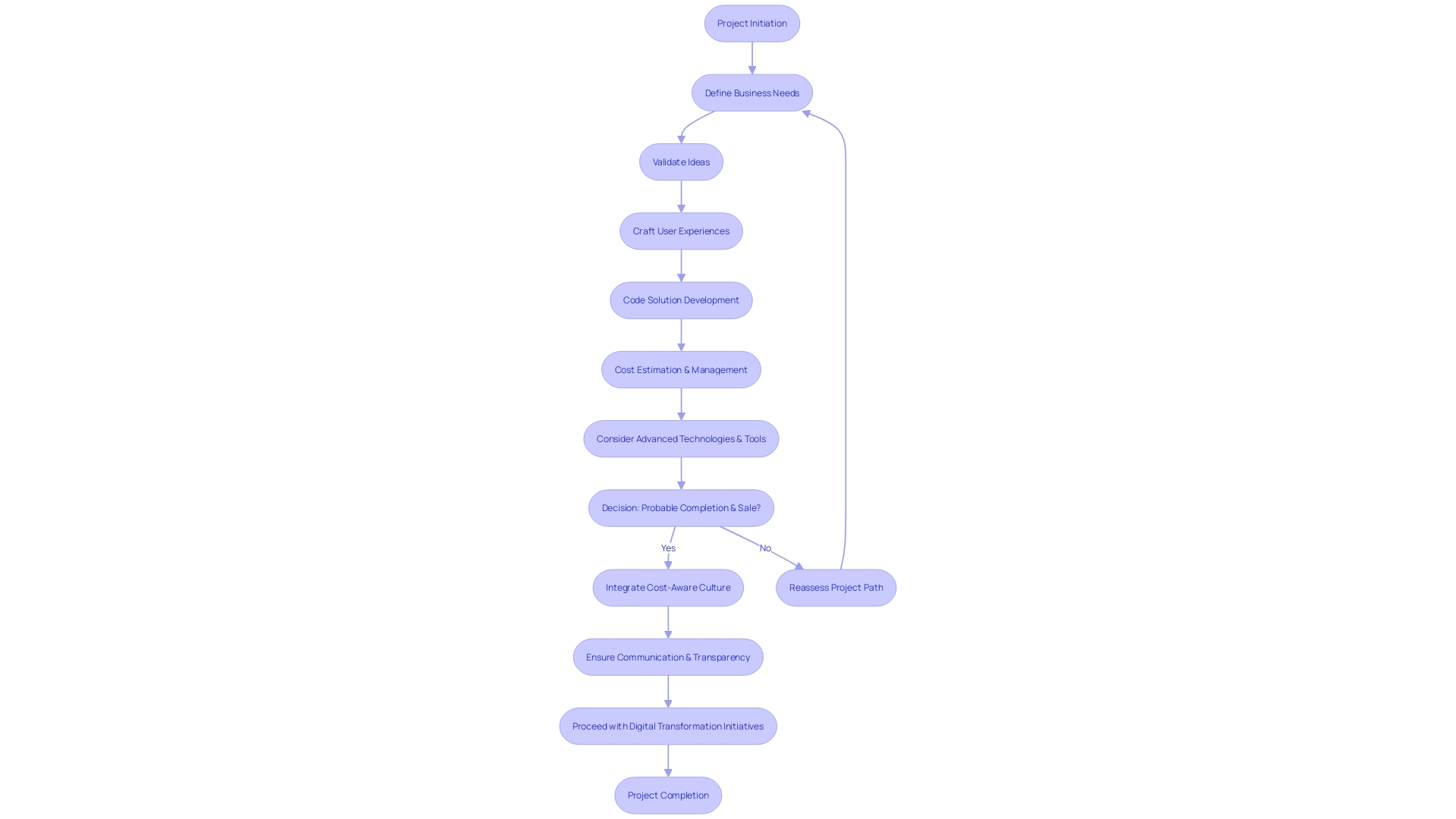

For a small business, revenue crystallizes upon the sale of a product or rendering of a service, a stark contrast that underscores the diversity within cost accounting practices. Embracing a cost-aware culture, as urged by industry experts, propels organizations beyond mere fiscal oversight. It fosters a collective ethos where cost considerations permeate the product development lifecycle and become a shared responsibility. This cultural shift is not just about numbers; it's a strategic pivot that embeds cost optimization into the organization's DNA, aligning it with other non-functional requirements such as system availability, performance, and reliability. Understanding and implementing various cost accounting methods is not just an exercise in financial compliance; it's a strategic maneuver that equips businesses with the acumen to thrive amidst a landscape of constant evolution and competition.

Cost Accounting Methods

Cost accounting methods are instrumental for organizations to pinpoint and assign costs to their various activities, products, or services. By adopting these methods, businesses are equipped to monitor and control costs with precision.

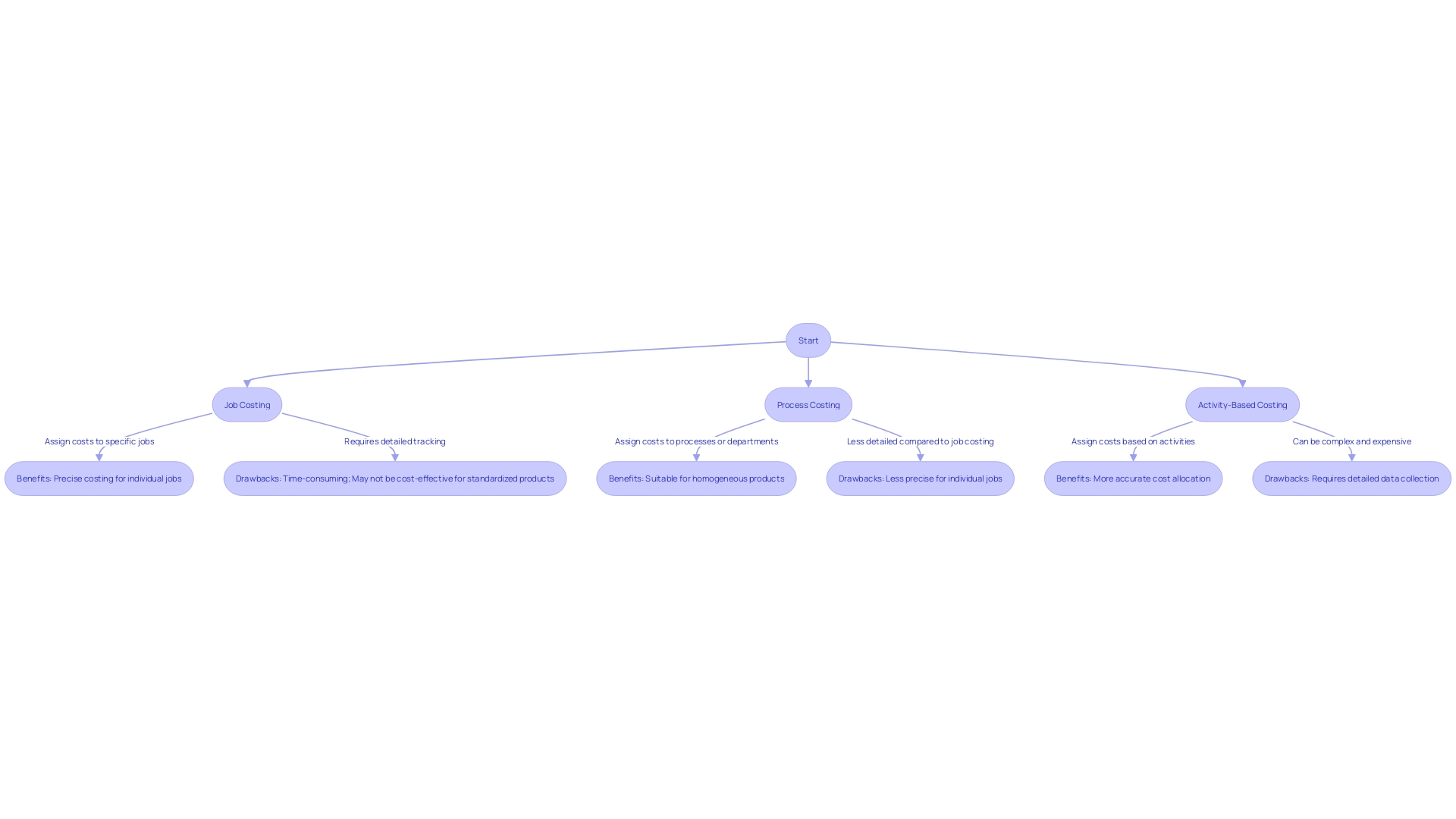

Diving into specifics, job costing is utilized when costs are assigned to individual units or projects, making it ideal for customized orders. Process costing, on the other hand, suits continuous production environments where costs are spread over numerous identical units.

Activity-based costing is a more granular approach that allocates costs based on actual activities, providing a deeper understanding of where and why costs are incurred. Each method carries its unique benefits and potential drawbacks, but all serve the fundamental purpose of enhancing the financial accuracy and operational efficiency of an organization.

Emphasizing the significance of a cost-aware culture, these methods become part of a broader strategy to optimize costs across all facets of product development and operations. This cost-conscious mindset is not solely the domain of the finance team but a collective responsibility that permeates the entire organization. In the realm of software development, for example, the IRS has clarified that activities from planning to building enhancements are part of the development process, further highlighting the intricacy of cost allocation in this sector. With the healthcare and semiconductor industries undergoing rapid transformation, the ability to apply cost accounting methods effectively becomes even more critical to maintaining competitiveness and ensuring financial sustainability.

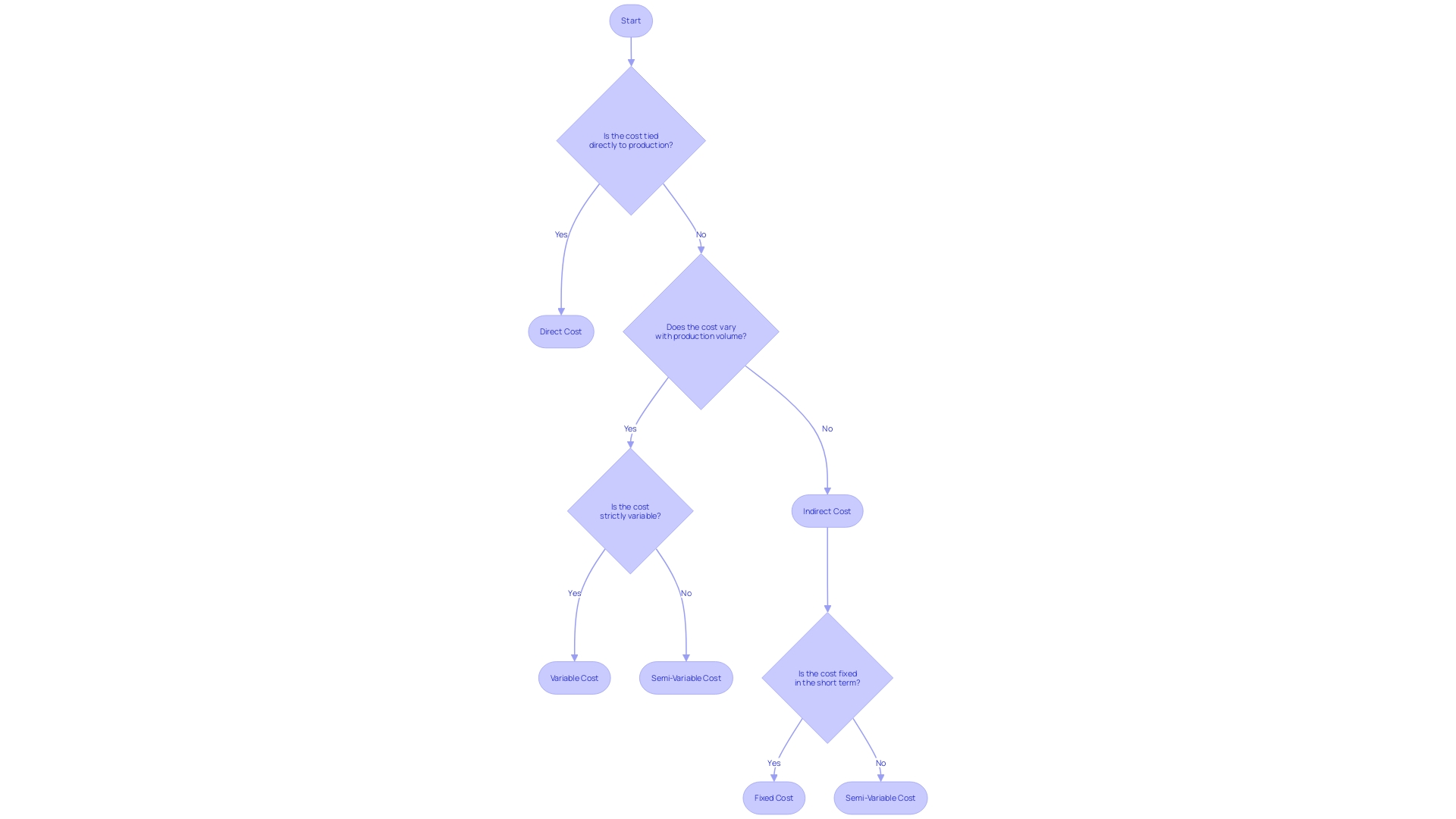

Cost Classification

Grasping the intricacies of cost classification is pivotal for organizations seeking to dissect and comprehend their financial framework. By sorting expenses into distinct categories such as direct, indirect, variable, fixed, and semi-variable costs, businesses can make more informed financial decisions.

Direct costs are easily attributed to a specific product, while indirect costs are not directly traceable to a single product and may include overheads like rent or utilities. Variable costs fluctuate with production volume, whereas fixed costs remain constant regardless of production levels.

Semi-variable costs contain elements of both fixed and variable costs. The challenge lies in the application of these classifications to real-world scenarios, which can prove to be more complex than the theory suggests.

For instance, determining when a software project is 'probable' of completion and ready for market can be nebulous, as noted by Sandra Heuer from Grant Thornton LLP. Furthermore, organizations considering changes to their cost classifications must present a clear rationale, supported by empirical data such as revenue, expenses, employment, or value-added information. This ensures that any modifications align with the core principles of classification: mutual exclusivity, exhaustiveness, and homogeneity within categories. Ultimately, effective cost accounting demands a balance between theoretical knowledge and practical application, enabling organizations to navigate the financial landscape with precision and confidence.

Cost Behavior Analysis

Delving into cost behavior, we uncover how costs fluctuate with varying levels of business activity, a vital component for forecasting and strategizing. Fixed costs remain unchanged irrespective of output, whereas variable costs align directly with production volume.

Mixed costs embody characteristics of both, altering with activity but not in direct proportion. To grasp the financial impact of these costs, cost-volume-profit analysis and contribution margin analysis serve as instrumental techniques.

They aid in discerning the profitability of products and services, guiding decision-makers on pricing and budgeting. For example, a cost-aware culture is paramount, as highlighted by the necessity of incorporating cost considerations into product development cycles.

This approach deems cost a shared responsibility beyond just the finance department. In the context of Software as a Service (SaaS), costs are as critical as availability, performance, and reliability. Furthermore, concrete examples and clear communication of cost models ensure transparency and facilitate ethical decision-making. A case in point is a previous change in organizational efficiency that resulted in substantial savings over time, emphasizing the importance of strategic cost management.

Cost-Volume-Profit Analysis

Cost-volume-profit (CVP) analysis stands as a crucial strategic tool, providing clarity on the intricate dance between costs, sales volume, and profit margins. It's the compass that guides businesses through the fog of financial decision-making, offering insights on where the breakeven point lies and how different scenarios might play out in terms of profitability.

At its core, CVP analysis hinges on the concept of the contribution margin, a vital metric that measures the incremental profit earned for each unit sold, after variable costs are subtracted. This figure is pivotal in determining the break even point—the juncture at which total revenues and total costs equalize, resulting in neither profit nor loss.

Understanding the contribution margin enables businesses to navigate pricing strategies with precision, ensuring sustainable growth and long-term value maximization. Moreover, CVP analysis illuminates the path to a crucial safety net: the margin of safety. This metric reveals the extent to which sales can drop before a business hits its breakeven point, offering a buffer against market fluctuations and strategic missteps. By mastering these components of CVP analysis, organizations can steer their financial course with confidence, optimizing for profitability in both the immediate and distant horizons.

Job Costing and Process Costing

Job costing and process costing serve as the cornerstones of cost accounting, each tailored for different types of production environments. Job costing is ideal for custom jobs or when products are distinctly separate, such as in construction or special-order manufacturing.

It allows for detailed tracking of costs for each job, ensuring accurate billing and financial analysis. On the other hand, process costing suits homogenous product environments, like in chemical production or food processing, where products are indistinguishable from each other and costs are averaged over units produced.

Adopting a cost-aware culture is crucial in applying these costing methods effectively. It's about embedding cost considerations into the development cycle and making it everyone's responsibility, not just the finance team.

This approach ensures that operational efficiency is not just a short-term goal but a sustainable practice. For instance, by leveraging AI and predictive analytics, businesses can refine their costing methods, leading to improved decision-making and potentially reducing long-term expenses by significant margins. Furthermore, the choice between job costing and process costing should align with the company's strategic goals and operational needs. It's important that this decision is made with a clear understanding of how each method impacts the financial statements, which are essential tools for guiding business decisions. By choosing the right costing method, organizations can achieve a more accurate representation of their financial health, driving better strategies for growth and cost management.

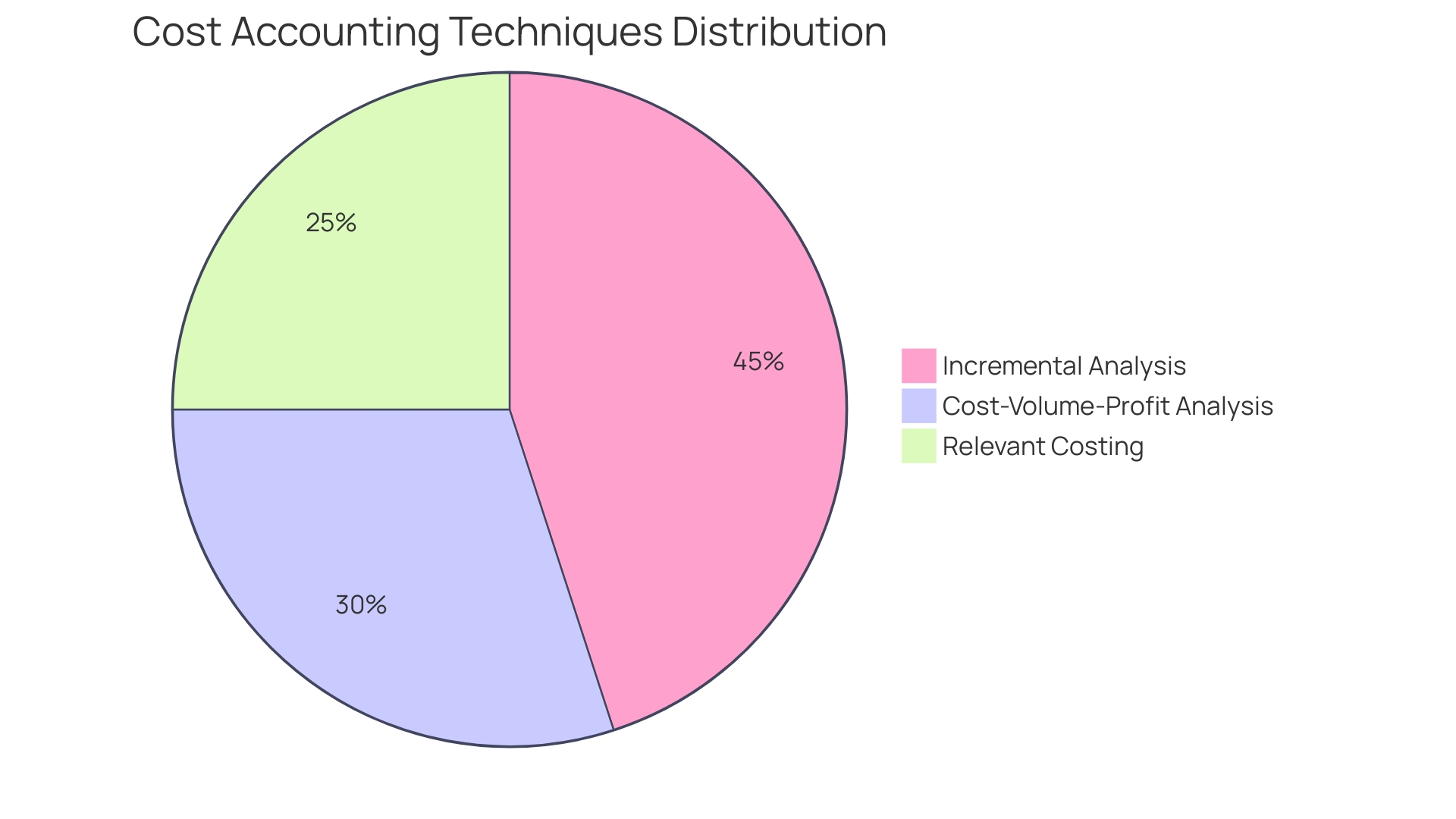

Cost Accounting for Decision Making

Embracing cost accounting is not merely about tracking expenses, but a strategic move towards a cost-aware culture that permeates every aspect of an organization's operations. Techniques such as cost-volume-profit analysis, relevant costing, and incremental analysis become pivotal in navigating decisions that affect pricing, product mix, and the evaluation of make-or-buy scenarios.

For instance, in the healthcare sector, where the fusion of technology and service delivery is reshaping the industry, cost accounting serves as a backbone for assessing the viability and financial impact of integrating advancements like AI. Moreover, the adoption of a true cost accounting method unveils the broader economic, social, and health implications of business activities.

The United Nations Food and Agriculture Organization's SOFA report reveals the hidden costs of food production, highlighting externalities that traditional economic models often overlook. By incorporating cost as a non-functional requirement, businesses can ensure that all stakeholders, not just finance teams, are aligned in the pursuit of cost optimization. This shared responsibility is crucial for sustainable growth and efficiency, as evidenced by organizations that have realized significant savings through strategic cost management. Ultimately, a disciplined approach to cost accounting can lead to enlightened decision-making, fostering a climate where every resource is utilized to its full potential, ensuring organizational agility and resilience.

Cost Accounting in Different Industries

The application of cost accounting is pivotal for businesses to navigate the complexities of financial management within their specific industries. In manufacturing, for example, adopting Design for Manufacturing and Assembly (DFMA) principles can significantly streamline production processes, thereby optimizing costs.

This methodology is crucial for reducing the time-to-market and overall production expenses by focusing on the manufacturability and assembly of product components from the initial design stages, which is particularly prevalent in the automotive sector. In the realm of retail, understanding the Cost of Goods Sold (COGS) is vital.

COGS encapsulates the direct costs tied to the production of goods sold, such as material costs and direct labor, and is a key determinant in pricing strategies and profitability analysis. Effective tracking and accounting of direct costs allow for a transparent and accurate reflection of a company's financial health on the balance sheet.

Moreover, the Financial Accounting Standards Board's recent proposal to update software cost reporting highlights the evolving landscape of accounting requirements. This change, which aims to provide more clarity by standardizing the accounting of software expenses, underscores the importance of staying current with regulatory standards across all industries, including healthcare and services. Understanding the balance sheet intricacies, particularly for construction businesses, is another facet where cost accounting plays a crucial role. The differentiation between balance sheet items and immediate expenses can have profound implications on a company's reported financial position and operational decision-making. As industries continue to evolve, the adherence to industry-specific challenges and best practices in cost accounting will remain a cornerstone of financial strategy and transparency.

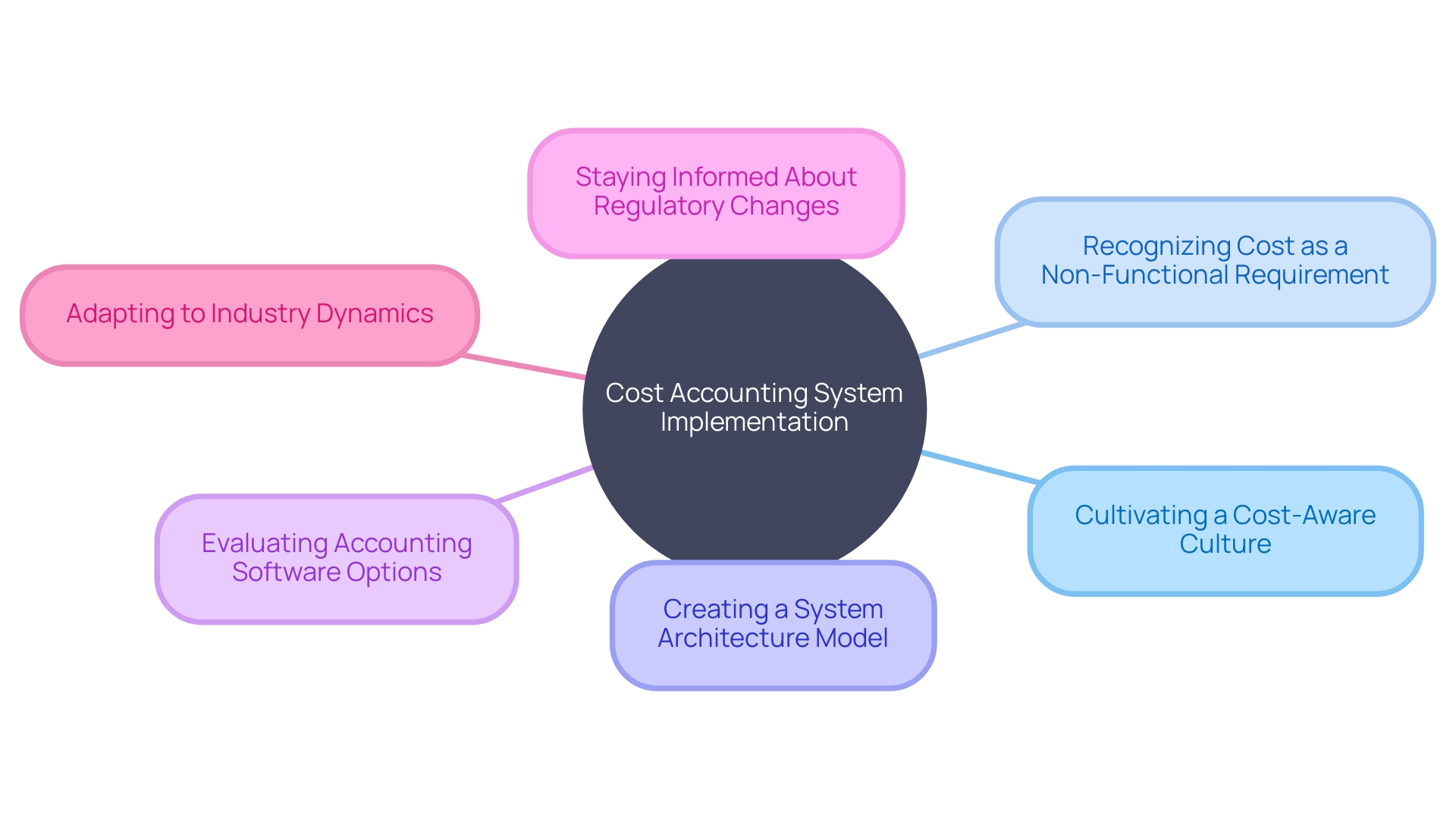

Best Practices for Implementing Cost Accounting

Successful implementation of cost accounting systems hinges on the cultivation of a cost-aware culture within the organization. Recognizing cost as a critical non-functional requirement, akin to system performance or reliability, is essential.

This shift in perspective ensures that cost considerations are embedded in the product development cycle and are not solely the finance team's concern but a collective responsibility. To navigate this, create a detailed model of your system's architecture, even if some technology choices are pending.

This model should outline the key components and their usage and cost profiles, providing a conceptual understanding of where resources are allocated and expenses incurred. Additionally, evaluating accounting software options through a comparative spreadsheet can be invaluable.

Key criteria to consider include cost, features, user feedback, scalability, and customer support quality. Hands-on assessments and product demonstrations, along with inquiries into post-implementation resources and the software's analytical capabilities, such as CPOR, RevPAR, and GOPPAR, will further inform your decision-making process. As regulations evolve, like the Financial Accounting Standards Board's recent proposal for more detailed software cost reporting, staying informed and adaptable is crucial. This ensures your cost accounting practices remain compliant and reflective of current standards, positioning your organization to thrive amidst the dynamic changes in industries such as healthcare and semiconductor manufacturing.

Common Challenges and Solutions in Cost Accounting

Navigating the intricacies of cost accounting can be as challenging as it is crucial. One of the primary hurdles is ensuring accurate cost allocation.

It's a nuanced process, particularly in complex sectors like software development, where predicting a project's completion and success isn't always clear-cut. As Sandra Heuer from Grant Thornton LLP points out, determining when a software project is 'probable' for completion and sale might seem straightforward, yet the practical application of such predictions can be inconsistent.

To tackle such challenges, fostering a cost-aware culture within your organization is key. This means embedding cost considerations into your product development cycle as a non-functional requirement, akin to system performance or reliability.

In the realm of Software as a Service (SaaS), for instance, treating cost on par with these other criteria is essential. Moreover, the responsibility for cost management should not fall solely on the finance team.

It's a collective responsibility that requires clear communication and transparency. Stating and justifying assumptions is fundamental for model validation, as it provides clarity and allows for the assessment of a model's validity and reliability. Despite the availability of advanced technologies and improved platform reliability, the effective leverage of these tools remains a stumbling block for many. As conversations around the use of agent-based versus equation-based models in technology implementations continue, the common challenge is gaining meaningful traction with technology for digital transformation initiatives. Statistics show that precision in estimates is vital, with measures of reliability available to ensure estimates fall within an acceptable range for their intended purpose. This approach helps to avoid direct comparisons between disparate sectors, such as state and local government benefits and private industry, acknowledging the inherent differences in work activities and structures.

Conclusion

In conclusion, cost accounting plays a pivotal role in understanding an organization's financial landscape and making informed financial decisions. By adopting various cost accounting methods such as job costing, process costing, and activity-based costing, businesses can monitor and control costs with precision.

Cost classification techniques, including direct costs, indirect costs, variable costs, fixed costs, and semi-variable costs, provide a framework for analyzing expenses and guiding financial decision-making. Cost behavior analysis helps organizations understand how costs fluctuate with varying levels of business activity.

Techniques such as cost-volume-profit analysis and contribution margin analysis aid in discerning the profitability of products and services, guiding pricing strategies and budgeting decisions. Cost accounting also enables businesses to navigate the complexities of decision-making through techniques like relevant costing and incremental analysis.

Implementing cost accounting requires cultivating a cost-aware culture within the organization. This cultural shift ensures that cost considerations are embedded into the product development lifecycle and become a shared responsibility.

It is crucial to stay informed about industry-specific challenges and best practices in cost accounting to optimize financial strategy and transparency. However, there are common challenges in cost accounting, such as accurate cost allocation and leveraging advanced technologies effectively. Overcoming these challenges requires clear communication, transparency, and justifying assumptions when validating models. Precision in estimates is also essential to ensure reliability. In conclusion, by implementing sound cost accounting practices and embracing a cost-aware culture, organizations can optimize costs, enhance operational efficiency, and make informed financial decisions. With the ever-evolving business landscape, cost accounting remains a vital tool for achieving sustainable growth and resilience.