Overview

Courses on stakeholder management are indispensable for CFOs, enhancing their capacity to engage with key stakeholders, align financial strategies with organizational objectives, and refine decision-making processes. This article underscores this necessity by detailing essential features of these courses, including:

- Practical case studies

- Expert instruction

Such elements equip financial leaders with the critical skills required to navigate intricate stakeholder dynamics and promote sustainable growth.

Introduction

In the intricate world of finance, effectively managing stakeholder relationships has emerged as a crucial skill for CFOs aiming for success. As organizations navigate an increasingly complex landscape, understanding the nuances of stakeholder management can significantly influence project outcomes and drive sustainable growth.

This article delves into the essential elements of stakeholder management, underscoring its importance in aligning financial strategies with stakeholder interests. It explores the benefits of specialized courses designed to enhance CFOs' skills in this area, provides a comparative analysis of top course providers, and offers practical recommendations for selecting the right training.

With the growing emphasis on stakeholder engagement, mastering these strategies is not merely advantageous but essential for modern financial leaders.

Understanding Stakeholder Management

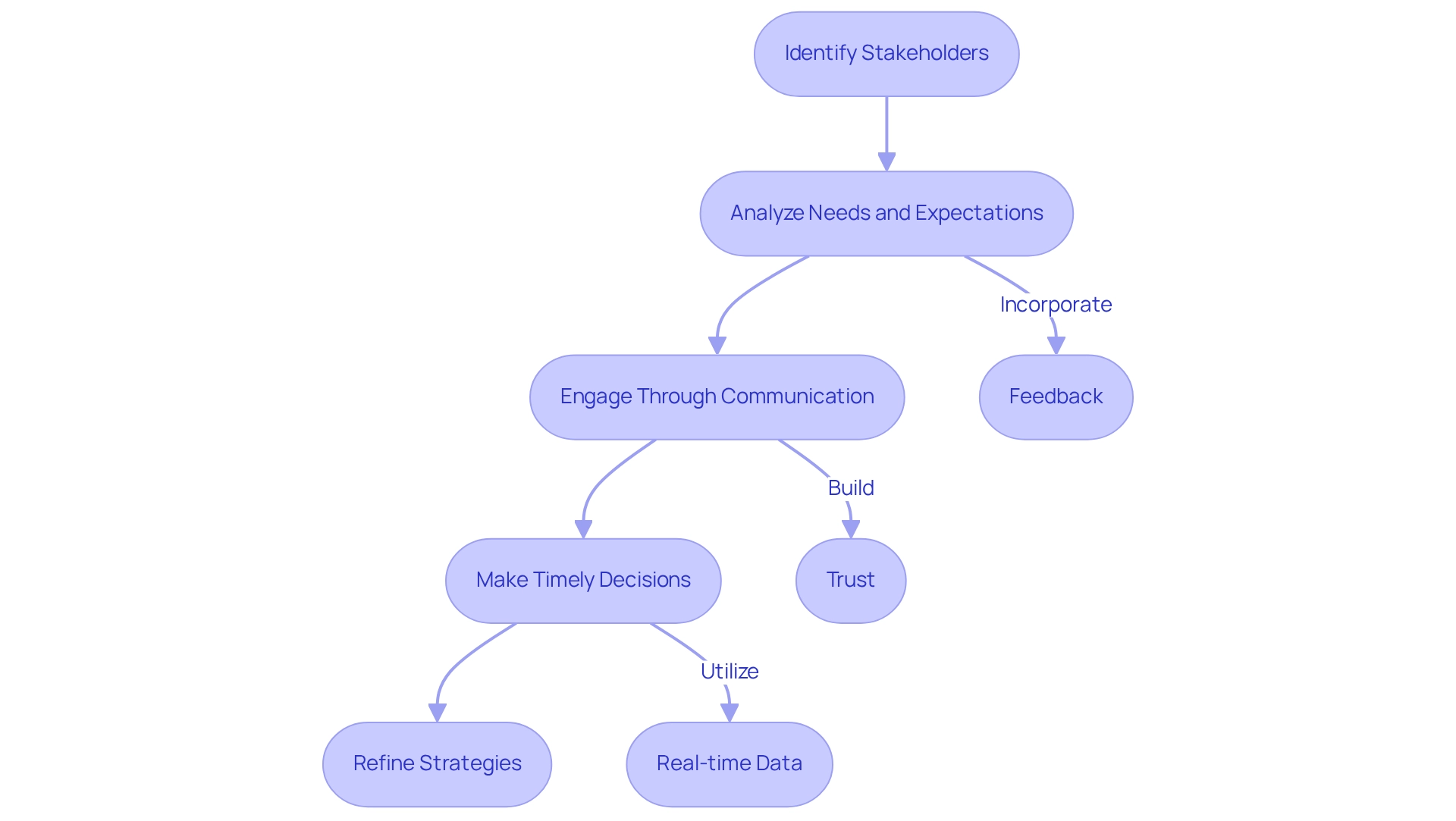

Stakeholder oversight is essential for the systematic identification, analysis, and engagement of individuals or groups with a vested interest in or influence over an organization. This process is particularly crucial for financial leaders, as it aligns financial strategies with the interests of involved parties, ensuring that financial decisions support broader organizational goals.

Efficient management of interested parties necessitates a thorough understanding of their needs and expectations, along with their potential influence on project success. Ongoing dialogue, negotiation, and relationship development are vital for sustaining trust and support from involved parties, especially during crises or restructuring efforts.

Recent trends indicate that 43% of financial executives report being contacted for new opportunities more frequently, underscoring the growing significance of engaging with interested groups in financial decision-making. Industry leaders assert that paying attention to interested parties and integrating their feedback leads to mutually beneficial outcomes.

For instance, companies that embrace technology-enabled consulting services, as demonstrated in the case study on FP&A software and tools, often experience a significant reduction in errors, with those adopting high technology acceptance reporting a 75% decrease in inaccuracies. This illustrates how effective engagement with involved parties can be enhanced through the application of advanced tools and technologies, facilitating streamlined decision-making and real-time analytics that are essential during turnaround efforts.

Moreover, the 'Decide & Execute' process empowers CFOs to make timely decisions that align with the interests of those involved, while the 'Update & Adjust' process ensures that strategies are continuously refined based on real-time data. The client dashboard plays a crucial role in this, providing real-time business analytics that assist in diagnosing the organization's health and guiding management strategies for interested parties.

Real-world examples further demonstrate the effectiveness of engagement strategies for those involved. Organizations prioritizing communication with interested parties—such as through regular email newsletters—foster transparency and trust, which are critical during challenging times. This form of external communication not only keeps interested parties informed but also strengthens their confidence in the organization’s direction.

As Luca Maestri, the financial chief of Apple, notes, the shift towards internal development of essential technologies signifies a broader trend of incorporating insights from interested parties into strategic planning, applying lessons learned to enhance overall performance.

In conclusion, the importance of engaging with interested parties for financial leaders cannot be overstated; it is a vital element that impacts project success and fosters sustainable growth. However, it is also crucial to recognize that 70% of CFOs view their finance transformation initiatives as less effective than anticipated, highlighting the challenges that can arise in successfully managing relationships with interested parties.

Key Features and Benefits of Stakeholder Management Courses

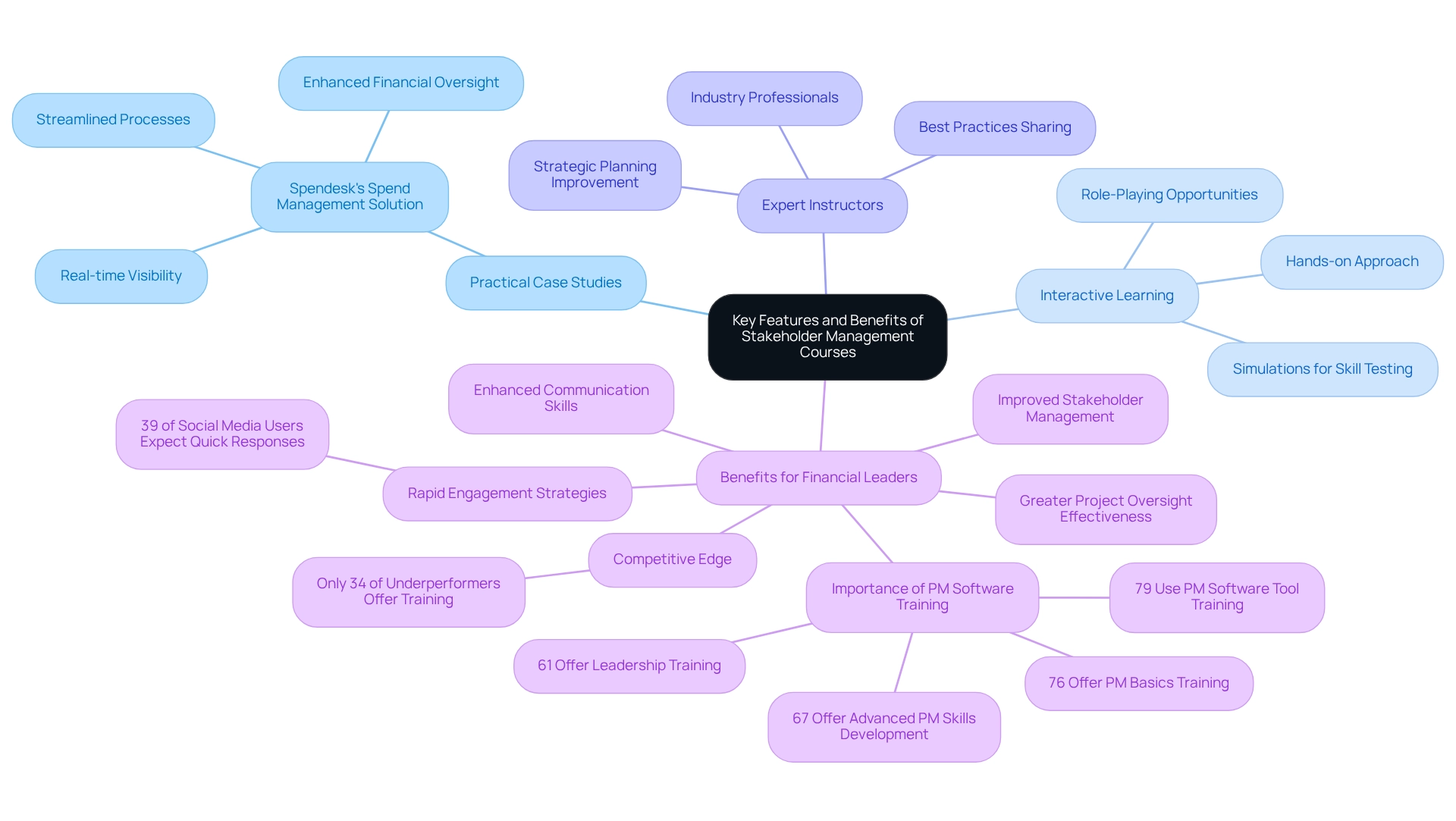

Programs on participant relations encompass a range of vital subjects, including the identification of individuals, analysis, engagement methods, and effective communication strategies. Key aspects of these courses on stakeholder management consist of:

- Practical Case Studies: Real-world examples illustrating effective stakeholder management strategies, such as Spendesk's execution of a comprehensive spend management solution that streamlined processes and enhanced financial oversight. These case studies demonstrate how effective decision-making and real-time analytics can lead to significant business improvements.

- Interactive Learning: Engaging opportunities for participants to practice their skills through role-playing and simulations, fostering a hands-on approach to learning. This interactive format enables financial executives to test hypotheses and measure the effectiveness of their strategies in a controlled environment.

- Expert Instructors: Courses are typically led by industry professionals who provide valuable insights and share best practices from their experiences. Their expertise assists financial executives in implementing lessons learned from previous challenges, thereby improving their strategic planning abilities.

The benefits of these courses are considerable, particularly for financial leaders. They result in enhanced communication skills, improved abilities to manage stakeholder expectations, and greater effectiveness in overseeing projects. Notably, statistics reveal that only 34% of underperformers offer similar training, highlighting the competitive edge gained through such educational investments. Furthermore, 79% of organizations employ project management software training, underscoring the importance of equipping financial leaders with essential tools to navigate complex financial environments and align the interests of involved parties with organizational goals. Effective engagement of stakeholders is a crucial element of stakeholder capitalism, which makes courses on stakeholder management indispensable for contemporary financial leaders. Additionally, as 39% of social media users expect prompt replies, these programs equip financial leaders with the skills to interact with stakeholders swiftly and efficiently, emphasizing their significance in today’s fast-paced business landscape.

Comparative Analysis of Top Stakeholder Management Course Providers

A comparative analysis of leading stakeholder management course providers reveals distinct offerings tailored for CFOs:

- Provider: Coursera

Course Title: Stakeholder Management

Duration: 4 weeks

Key Features: Comprehensive overview, practical assignments

Cost: $49/month - Provider: LinkedIn Learning

Course Title: Stakeholder Management for Leaders

Duration: 2 hours

Key Features: Focus on leadership strategies, quick learning

Cost: $29.99/month - Provider: eCornell

Course Title: Strategic Stakeholder Management

Duration: 6 weeks

Key Features: In-depth analysis, expert-led sessions

Cost: $1,200 total - Provider: Oxford Management

Course Title: Stakeholder Management Training

Duration: 3 days

Key Features: Interactive workshops, case studies

Cost: $1,500 total

Each provider showcases unique strengths. Coursera's course is particularly beneficial for those seeking flexibility, while eCornell offers a comprehensive exploration ideal for strategic leaders. Involving a varied group of participants is essential, as it greatly improves project results and dedication. As Tracey Travis, CFO of Estée Lauder, notes, "I had the good fortune of starting in a field role and then moving to a headquarters role, so I encourage my team to do that—not just within various levels of the finance organization but cross-functionally as well." This viewpoint emphasizes the significance of managing interests training in promoting cross-functional collaboration and implementing lessons learned from the turnaround process.

The choice of provider for courses on stakeholder management should align with the CFO's specific learning objectives and budget constraints. With 39% of social media users wanting quick replies, prompt interaction with involved parties can significantly enhance project results. Additionally, the case study named 'Waiting to be Shaped and Deployed: Lower Voice and Value' demonstrates the potential advantages of involving underused participants, emphasizing how these programs can enable financial leaders to utilize all available resources efficiently. Moreover, as Luca Maestri addresses the transition to internal development for improved oversight of innovation, finance leaders must adjust their strategies to maneuver through this changing environment. Ongoing business performance evaluation via instant analytics, supported by resources such as a client dashboard, is crucial for achievement, and success narratives from financial executives who have finished these programs emphasize the transformative influence of efficient participant training on their organizations.

Recommendations for Selecting the Right Stakeholder Management Course

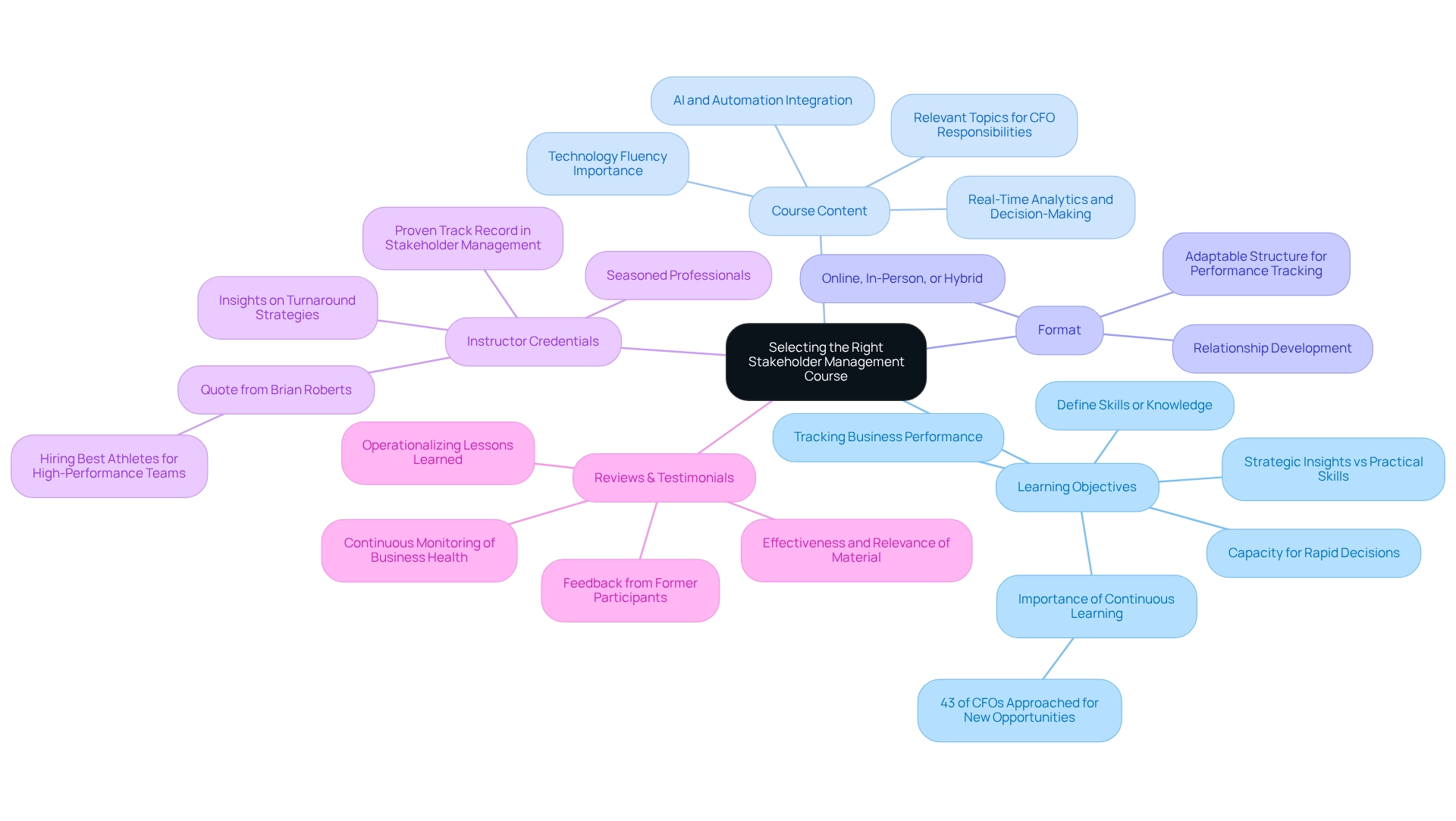

When selecting a stakeholder management course, CFOs should consider the following key recommendations:

- Assess Your Learning Objectives: Clearly define the specific skills or knowledge you aim to acquire. Are you seeking strategic insights, practical skills, or a combination of both? Continuous learning is essential, especially as 43% of CFOs report being approached for new opportunities more often, highlighting the competitive nature of the role. Moreover, consider how the program can improve your capacity to make rapid decisions and track business performance in real-time, which is essential during turnaround situations.

- Evaluate Course Content: Scrutinize the syllabus to ensure it encompasses relevant topics that align with your responsibilities as a CFO. Courses should address the evolving landscape of finance, where technology fluency is becoming as crucial as traditional financial knowledge. This is especially significant in the context of interest group coordination, as the incorporation of AI and automation is transforming the finance function. Seek programs that emphasize real-time analytics and decision-making frameworks that can be applied in practical scenarios.

- Consider the Format: Decide whether you prefer online, in-person, or hybrid learning environments, taking into account your schedule and preferred learning style. An adaptable structure can aid in continuous performance tracking and relationship development, crucial for effective engagement with involved parties.

- Check Instructor Credentials: Prioritize classes led by seasoned professionals with a proven track record in stakeholder management, as their expertise can significantly enhance the learning experience. As Brian Roberts, CFO of Lyft, emphasizes, "From a finance hiring perspective, you need to hire the best athletes who want to be part of a high-performance team." Instructors who understand the nuances of turnaround strategies can provide invaluable insights.

- Read Reviews and Testimonials: Collect feedback from former participants to evaluate the effectiveness and relevance of the material. This insight can help assess how effectively the program meets the needs of financial leaders, particularly in terms of operationalizing lessons learned from past experiences and continuously monitoring business health.

By adhering to these recommendations, CFOs can select courses on stakeholder management that not only sharpen their skills but also bolster their overall effectiveness in financial leadership, ultimately positioning them as key players in their organizations' strategic initiatives.

Conclusion

Mastering stakeholder management is imperative for CFOs navigating the complexities of today's financial landscape. Effective stakeholder engagement not only aligns financial strategies with organizational objectives but also fosters trust and transparency—critical elements during challenging times. With 43% of CFOs reporting increased opportunities, the necessity for robust stakeholder management practices has never been clearer.

Specialized training in stakeholder management equips financial leaders with essential skills such as communication, negotiation, and strategic decision-making. Analyzing various course providers reveals that tailored educational programs can significantly enhance a CFO's ability to manage relationships effectively. This comparative analysis underscores the importance of selecting a course that aligns with individual learning objectives, ensuring that CFOs are well-prepared to meet the evolving demands of their roles.

In conclusion, investing in stakeholder management training is not merely an enhancement but a necessity for modern CFOs. As organizations strive for sustainable growth, the ability to engage stakeholders meaningfully will be a key differentiator in driving project success and overall performance. Embracing this discipline empowers CFOs to leverage stakeholder insights, adapt strategies in real-time, and ultimately lead their organizations toward a prosperous future.

Frequently Asked Questions

What is the importance of stakeholder oversight in organizations?

Stakeholder oversight is essential for systematically identifying, analyzing, and engaging individuals or groups with a vested interest in or influence over an organization. It aligns financial strategies with the interests of involved parties, ensuring that financial decisions support broader organizational goals.

How can financial leaders effectively manage interested parties?

Efficient management requires a thorough understanding of the needs and expectations of interested parties, along with their potential influence on project success. Ongoing dialogue, negotiation, and relationship development are vital for sustaining trust and support, especially during crises or restructuring efforts.

What recent trends highlight the significance of engaging with interested groups in financial decision-making?

Recent trends indicate that 43% of financial executives report being contacted for new opportunities more frequently, underscoring the growing importance of engaging with interested groups in financial decision-making.

How can technology enhance engagement with involved parties?

Companies that adopt technology-enabled consulting services, such as FP&A software and tools, often experience a significant reduction in errors. High technology acceptance can lead to a 75% decrease in inaccuracies, facilitating streamlined decision-making and real-time analytics during turnaround efforts.

What is the 'Decide & Execute' process, and how does it benefit CFOs?

The 'Decide & Execute' process empowers CFOs to make timely decisions that align with the interests of involved parties, while the 'Update & Adjust' process ensures that strategies are continuously refined based on real-time data.

How does communication with interested parties impact organizational trust?

Organizations that prioritize communication with interested parties, such as through regular email newsletters, foster transparency and trust, which are critical during challenging times. This communication keeps interested parties informed and strengthens their confidence in the organization’s direction.

What challenges do CFOs face in finance transformation initiatives?

Despite the importance of engaging with interested parties, 70% of CFOs view their finance transformation initiatives as less effective than anticipated, highlighting the challenges in successfully managing these relationships.

What role does the client dashboard play in stakeholder engagement?

The client dashboard provides real-time business analytics that assist in diagnosing the organization’s health and guiding management strategies for interested parties, thus enhancing engagement and decision-making.