Overview

Crisis-driven cost management represents a strategic approach that CFOs can effectively implement by prioritizing essential expenses, maintaining flexibility, utilizing data-driven decision-making, and ensuring effective stakeholder communication. This article outlines these critical principles and provides actionable steps for financial leaders to navigate economic challenges. It emphasizes the importance of thorough financial assessments and strategic initiatives aimed at enhancing operational efficiency and organizational resilience.

Introduction

In times of financial uncertainty, organizations must navigate the complexities of cost management with precision and foresight. The principles of crisis-driven cost management serve as a roadmap for CFOs aiming to stabilize operations while fostering resilience. By prioritizing essential expenses, embracing adaptability, and leveraging data-driven insights, finance leaders can make informed decisions that safeguard their organizations' futures.

This article explores critical strategies for:

- Conducting comprehensive financial assessments

- Implementing effective cost reduction initiatives

- Continuously monitoring performance

Such measures ensure that businesses not only survive but thrive amidst challenges.

Understand Crisis-Driven Cost Management Principles

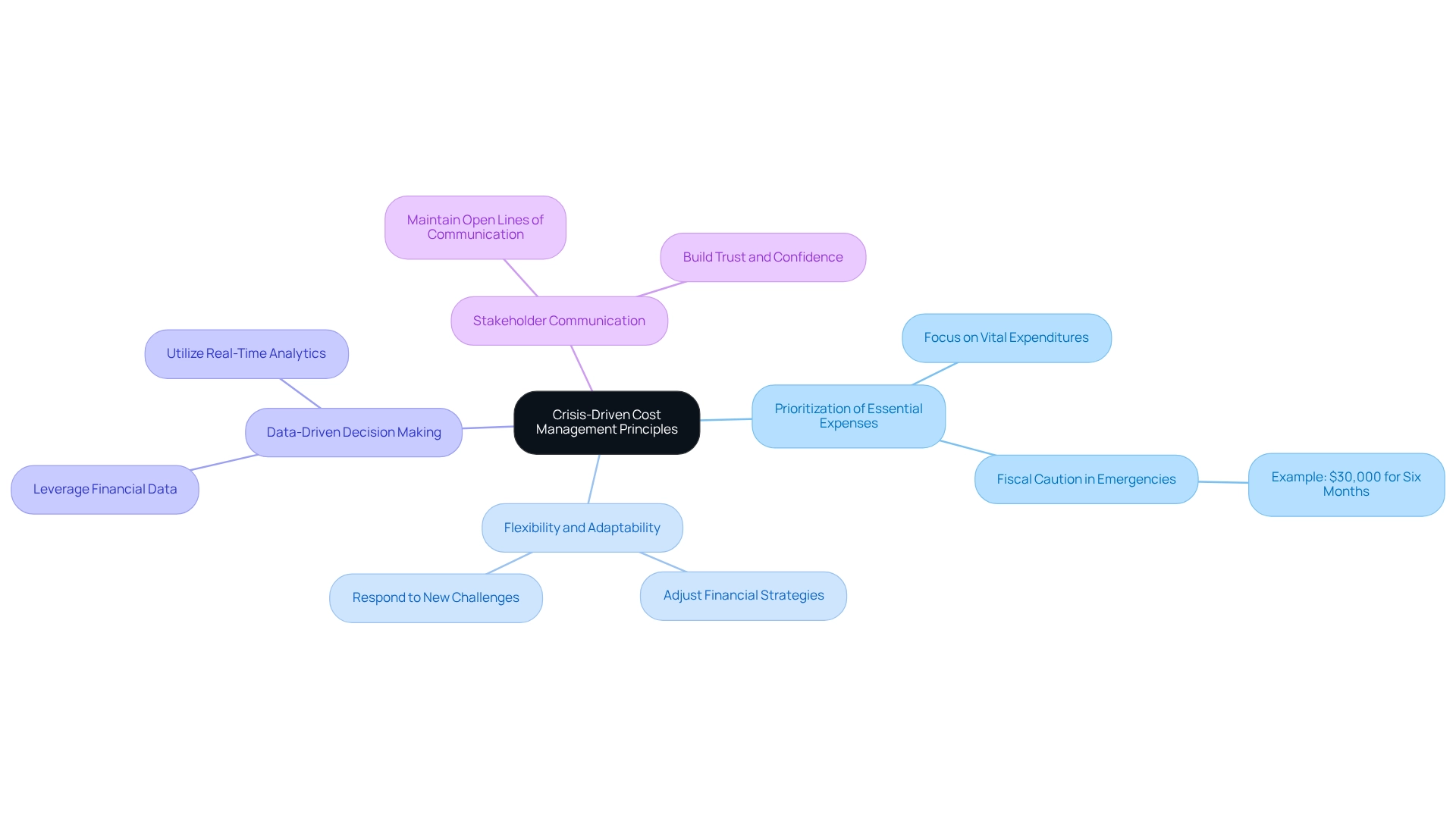

Crisis-driven cost management necessitates a strategic method for regulating expenditures during difficult economic times. The following key principles are essential for CFOs:

- Prioritization of Essential Expenses: Concentrate on recognizing and preserving expenditures that are vital for sustaining operations and generating revenue. This is especially crucial as inhabitants of large urban areas such as New York and Los Angeles require over $30,000 to manage six months of expenditures, highlighting the importance of fiscal caution in prioritizing vital expenses during emergencies.

- Flexibility and Adaptability: Create a financial management strategy that can swiftly adjust to evolving circumstances. This flexibility allows organizations to respond rapidly to new challenges, ensuring resilience in uncertain times.

- Data-Driven Decision Making: Leverage financial data and analytics to guide cost management decisions. By relying on solid evidence rather than assumptions, financial leaders can make informed choices that enhance operational efficiency. Utilizing real-time analytics can significantly improve the decision-making process, allowing for timely adjustments that align with business performance goals.

- Stakeholder Communication: Foster transparency and trust by maintaining open lines of communication with stakeholders, including employees and investors. Effective communication is crucial during crises, as it helps to build confidence and align efforts towards recovery.

As Patrick Grismer, the Chief Financial Officer of Starbucks, remarked, 'Emerging markets are expanding at a significantly quicker rate than the remainder of the globe,' emphasizing the dynamic nature of market conditions that financial leaders must navigate. By embracing these principles, financial leaders can establish a robust framework for effective cost management, ultimately enhancing firm valuation and building stakeholder trust. This is further supported by case studies, such as 'CFO as Corporate Strategist,' which demonstrate that CFOs who expand their roles beyond finance can significantly enhance firm valuation and foster stakeholder trust, thereby reinforcing the principles discussed.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive monetary assessment, follow these essential steps:

- Gather Financial Statements: Begin by collecting the latest income statements, balance sheets, and cash flow statements. This foundational step provides a comprehensive perspective on the organization's economic well-being.

- Analyze Key Metrics: Focus on critical economic ratios, including liquidity ratios, profitability margins, and debt-to-equity ratios. These metrics serve as vital indicators of financial stability and performance. For instance, the inventory turnover ratio, calculated by dividing total purchases by average inventory in a given period, offers insights into operational efficiency. Utilizing real-time analytics enhances this analysis, allowing for immediate adjustments based on current data.

- Identify Expense Contributors: Scrutinize operational expenditures to uncover major expense contributors. This analysis is crucial for identifying areas where crisis-driven cost management can be implemented while maintaining quality and service. By consistently tracking these financial influencers, financial leaders can make informed decisions that assist in business recovery initiatives.

- Engage Stakeholders: Involve department heads and key stakeholders in the assessment process. Their insights into operational challenges can reveal potential cost-saving measures and enhance the assessment's effectiveness. Streamlined decision-making processes facilitate quicker responses to stakeholder feedback, ensuring that the assessment remains relevant and actionable.

- Document Findings: Compile a detailed report summarizing the assessment results. Highlight areas of concern and opportunities for improvement, providing a clear roadmap for strategic cost reduction initiatives. This documentation not only serves as a reference for future evaluations but also implements lessons learned during the turnaround process, focusing on crisis-driven cost management. This detailed assessment not only guides decision-making but also equips CFOs with the insights necessary to navigate economic challenges effectively. Financial evaluations provide signals for prompt modifications that are essential in crisis-driven cost management to ensure organizational survival and profitability. Furthermore, analyzing the statement of cash flows offers valuable insights into cash management and operational efficiency, enabling businesses to track changes in cash flow over time.

Implement Strategic Cost Reduction Initiatives

To effectively execute strategic expense reduction initiatives, financial leaders should consider the following approaches:

- Streamline Operations: Conduct a thorough evaluation of current processes to identify and eliminate inefficiencies. Implementing lean management principles can greatly minimize waste, with possible lead time reductions of up to 70% and decreases of 30%. However, organizations often face common obstacles during lean implementation, such as resistance to change and lack of sustained focus. For instance, Boeing achieved a 25% increase in production efficiency by embracing Lean practices, which not only reduced lead times but also enhanced customer loyalty. By identifying underlying organizational issues and collaboratively creating a plan, CFOs can reinvest in key strengths while mitigating weaknesses.

- Negotiate with Suppliers: Proactively engage suppliers to negotiate improved terms, discounts, or bulk purchasing agreements. Successful supplier negotiations can result in significant decreases in material expenses, directly influencing the bottom line.

- Enhance Workforce Management: Evaluate existing staffing levels and contemplate temporary reductions or reallocations to match labor expenses with business requirements. Research conducted by McKinsey & Company found that organizations that embrace Lean practices tend to experience 30-50% higher employee engagement scores. This highlights the importance of maintaining employee engagement while optimizing workforce expenditures without compromising operational capabilities.

- Leverage Technology: Invest in technology solutions that automate processes and minimize manual labor. Notably, 29% of companies that effectively manage manufacturing operations utilize Operations Intelligence/Enterprise Manufacturing Intelligence software. Such investments can result in long-term savings and enhanced operational efficiency, as demonstrated by the 35% productivity boost reported by organizations adopting lean methodologies. By testing every hypothesis and utilizing real-time analytics, financial leaders can ensure maximum return on invested capital.

- Review Fixed Expenses: Conduct a comprehensive analysis of fixed expenses, including leases and contracts, to identify opportunities for renegotiation or termination. This proactive assessment can reveal considerable savings that aid in overall financial well-being. By implementing these initiatives together and focusing on a 'Test & Measure' strategy, financial leaders can attain significant reductions through crisis-driven cost management while maintaining operational integrity, ultimately positioning their organizations for sustainable growth during difficult periods.

Monitor and Adjust Cost Management Strategies

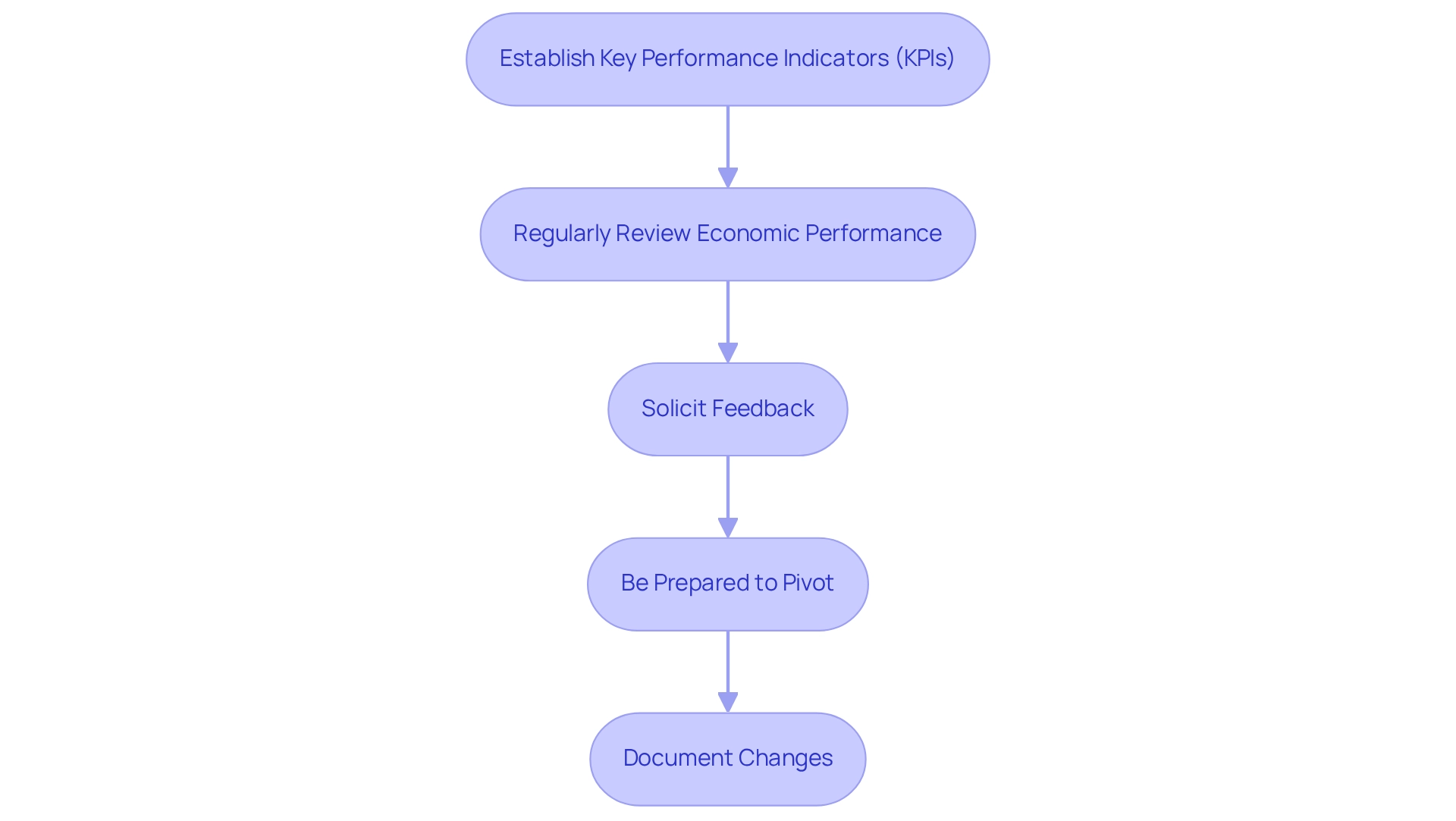

To effectively monitor and adjust financial management strategies, CFOs must adhere to the following guidelines:

- Establish Key Performance Indicators (KPIs): Define KPIs that align with cost management objectives, such as cost savings achieved, operational efficiency metrics, and employee productivity levels. These indicators are crucial for directing companies in managing expenses effectively, ultimately leading to enhanced profitability. Proactive measurement and analysis of these performance indicators position organizations for long-term success, allowing for real-time analytics that inform decision-making.

- Regularly Review Economic Performance: Schedule consistent assessments of economic performance against the established KPIs. This practice enables organizations to recognize trends and areas needing modification, ensuring that strategies remain aligned with business objectives. Utilizing metrics such as Return on Investment (ROI) provides a quantitative measure to evaluate the effectiveness of these strategies, facilitating a data-driven approach to performance monitoring.

- Solicit Feedback: Actively gather input from team members and stakeholders regarding the effectiveness of financial management initiatives. This input can highlight areas for improvement and foster a culture of continuous enhancement, essential for operationalizing turnaround lessons and building strong relationships with stakeholders.

- Be Prepared to Pivot: Maintain agility in your approach, ready to adjust strategies based on market changes, economic performance, and organizational needs. A data-driven method for cost control allows enterprises to enhance financial performance and adapt to changing conditions, ensuring that decision-making is efficient and adaptable.

- Document Changes: Keep a comprehensive record of any adjustments made to strategies, including the rationale behind them. This practice ensures transparency and accountability, which are vital for maintaining stakeholder trust and demonstrating a commitment to strategic business improvement. By adopting a proactive stance in monitoring and adjusting strategies, CFOs can implement crisis-driven cost management to help their organizations remain resilient and financially stable during crises. The importance of KPIs in this process cannot be overstated, as they serve as essential tools for measuring success and guiding decision-making. For instance, Walmart's operational excellence demonstrates how effective use of KPIs can lead to targeted cost-saving initiatives, maintaining a competitive edge in the market.

Conclusion

Navigating financial uncertainty requires a profound understanding of crisis-driven cost management principles. By prioritizing essential costs, embracing adaptability, and leveraging data-driven insights, CFOs can devise robust strategies that stabilize operations and enhance organizational resilience. The emphasis on comprehensive financial assessments, strategic cost reduction initiatives, and continuous performance monitoring equips finance leaders with the necessary tools to make informed decisions that protect and advance their organizations.

The implementation of these strategies highlights the significance of flexibility and stakeholder communication. Engaging with team members and actively soliciting feedback fosters a culture of continuous improvement, which is vital during challenging times. Moreover, the adoption of key performance indicators ensures that progress is tracked and adjustments are made swiftly, allowing businesses to remain agile and responsive to market changes.

Ultimately, effective crisis-driven cost management transcends mere survival; it positions organizations for future growth and success. By adopting a proactive and strategic approach, CFOs can build a resilient foundation that withstands financial challenges and drives sustainable development. In a rapidly evolving business landscape, the ability to adapt and thrive is paramount, underscoring the essential principles of crisis-driven cost management for long-term success.

Frequently Asked Questions

What is crisis-driven cost management?

Crisis-driven cost management is a strategic approach to regulating expenditures during difficult economic times, focusing on maintaining essential operations and generating revenue.

What is the first key principle for CFOs in managing costs during a crisis?

The first key principle is the prioritization of essential expenses, which involves identifying and preserving expenditures that are crucial for sustaining operations.

Why is prioritizing essential expenses important?

Prioritizing essential expenses is important because individuals in large urban areas may require significant savings to manage their expenditures during emergencies, highlighting the need for fiscal caution.

What does flexibility and adaptability mean in the context of financial management?

Flexibility and adaptability refer to creating a financial management strategy that can quickly adjust to changing circumstances, allowing organizations to respond effectively to new challenges.

How can data-driven decision making benefit cost management?

Data-driven decision making benefits cost management by utilizing financial data and analytics to guide decisions, ensuring that choices are based on solid evidence rather than assumptions, which enhances operational efficiency.

Why is stakeholder communication important during a crisis?

Stakeholder communication is important because it fosters transparency and trust, helping to build confidence and align efforts towards recovery among employees and investors.

What did Patrick Grismer, CFO of Starbucks, emphasize regarding market conditions?

Patrick Grismer emphasized that emerging markets are expanding at a significantly quicker rate than the rest of the globe, highlighting the dynamic nature of market conditions that financial leaders must navigate.

How can CFOs enhance firm valuation and stakeholder trust?

CFOs can enhance firm valuation and stakeholder trust by expanding their roles beyond traditional finance functions, as demonstrated in case studies that show the benefits of this approach.