Introduction

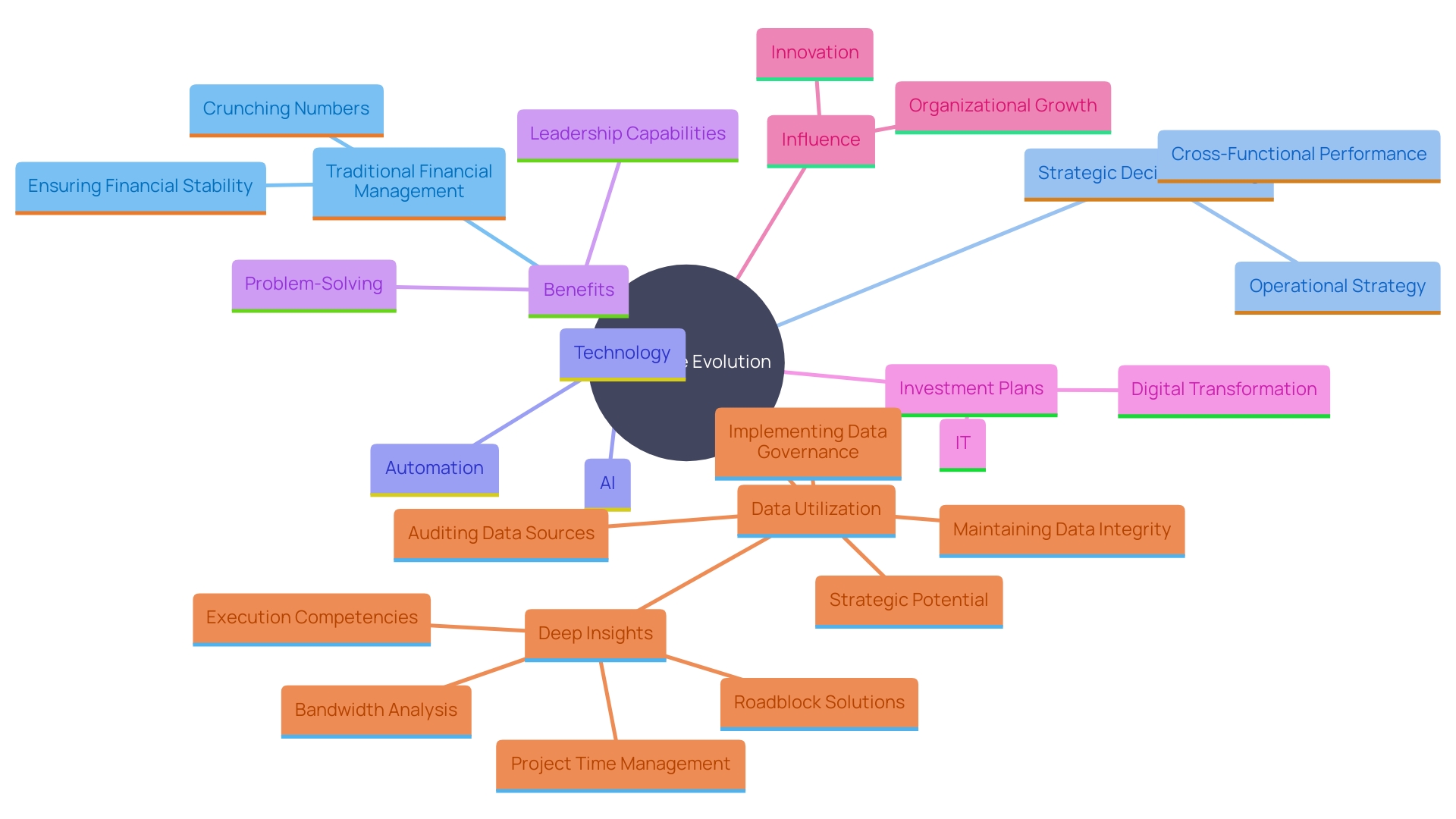

In today's dynamic business environment, the role of the CFO has evolved far beyond traditional financial management. CFOs are now pivotal in strategic decision-making, providing critical insights that drive business growth and innovation. By leveraging cutting-edge technologies such as AI and automated processes, CFOs can focus on high-value tasks, enhancing their problem-solving and leadership capabilities, with 79% and 78% of CFOs respectively acknowledging these benefits.

Steve Hare, CEO at Sage, emphasizes how technology empowers CFOs to transcend their conventional roles, guiding businesses with greater flexibility and deeper insights. This strategic use of technology not only enhances their role but also broadens their influence within the organization.

Furthermore, CFOs' ability to analyze financial data and market trends allows them to identify opportunities for expansion and innovation effectively. The Economist highlights the importance of such insights, noting that successful companies often rely on their CFOs to navigate challenges and capitalize on opportunities.

With 66% of CFOs planning to increase their IT and digital transformation investments, their role in shaping the company's future has never been more pronounced. These investments are crucial for ensuring efficient resource allocation and capitalizing on growth prospects, as noted in Grant Thornton's recent survey. The modern CFO must adapt, collaborate, and lead with clear purpose to steer their organizations toward sustained success.

The Role of a CFO in Business Growth

In today's dynamic corporate environment, the role of the CFO has evolved far beyond traditional financial management. Financial leaders are now essential in strategic decision-making, offering vital insights that propel organizational growth and innovation. By leveraging cutting-edge technologies such as AI and automated processes, finance leaders can focus on high-value tasks, enhancing their problem-solving and leadership capabilities, with 79% and 78% of them respectively acknowledging these benefits.

'Steve Hare, CEO at Sage, emphasizes how technology empowers financial leaders to transcend their conventional roles, guiding businesses with greater flexibility and deeper insights.'. This strategic use of technology not only enhances their role but also broadens their influence within the organization.

Furthermore, the capability of financial leaders to analyze financial data and market trends allows them to identify opportunities for expansion and innovation effectively. The Economist emphasizes the significance of such insights, pointing out that successful firms frequently depend on their financial leaders to manage challenges and seize opportunities.

With 66% of CFOs planning to increase their IT and digital transformation investments, their role in shaping the company's future has never been more pronounced. These investments are crucial for ensuring efficient resource allocation and capitalizing on growth prospects, as noted in Grant Thornton's recent survey. The modern CFO must adapt, collaborate, and lead with clear purpose to steer their organizations toward sustained success.

Benefits of Outsourced CFO Services

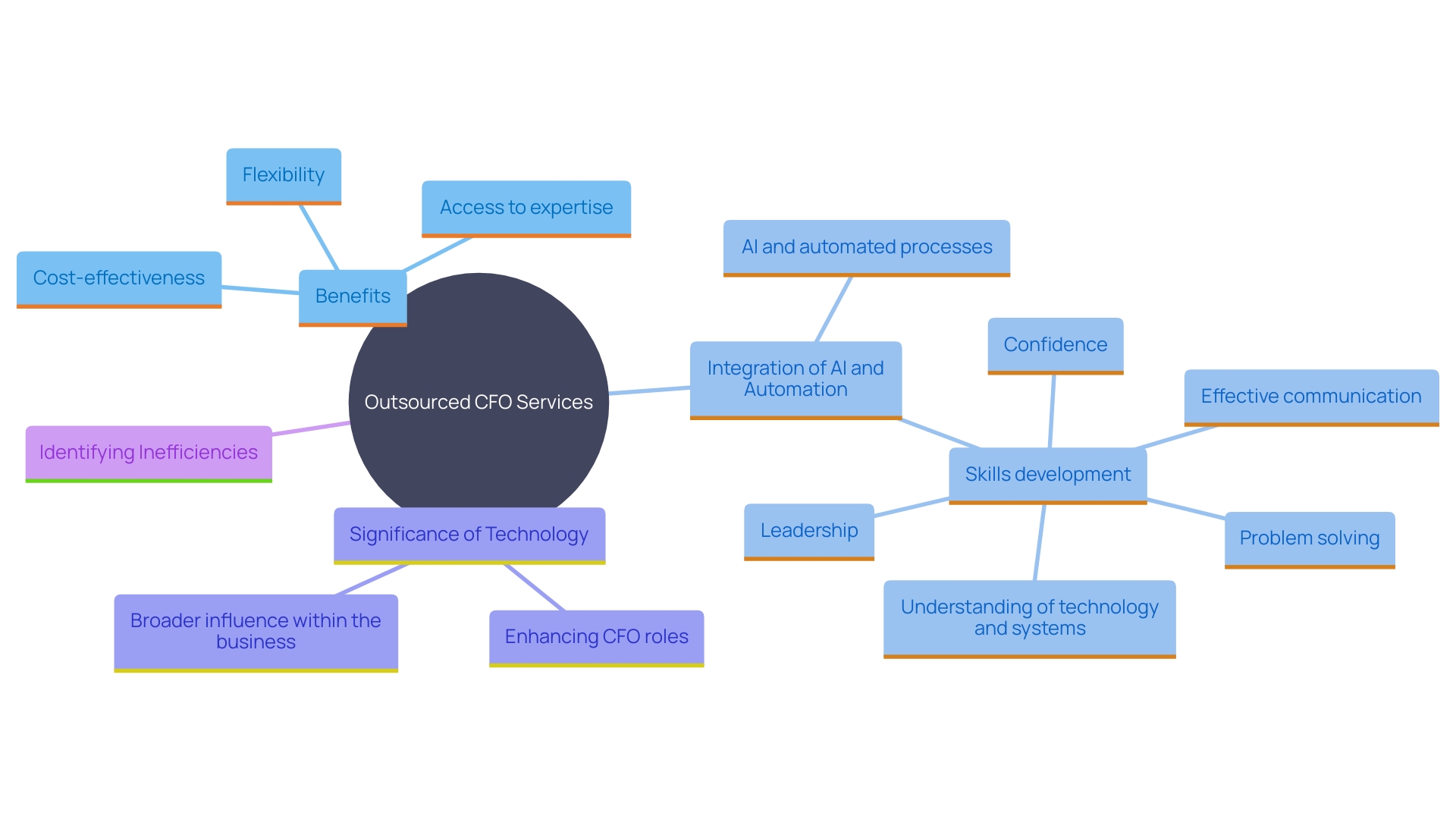

Outsourced CFO services provide companies a flexible and cost-effective way to access high-level monetary expertise. This setup removes the requirement for a full-time CFO, greatly lowering overhead expenses while still gaining from strategic fiscal guidance. Companies can tap into specialized skills tailored to their unique needs, allowing them to enhance financial management without the long-term commitment of hiring a permanent executive. Additionally, outsourced financial executives bring a fresh perspective, often identifying inefficiencies and areas for improvement that internal teams may overlook. According to a recent report, 8 in 10 financial leaders are leveraging AI and automated processes to focus on more valuable tasks, yet only 49% are fully utilizing these capabilities. This underscores the potential for outsourced financial executives to integrate advanced technologies, enhancing problem-solving, leadership, and effective communication skills. Steve Hare, CEO at Sage, underscores the significance of merging finance with technology to provide CFOs flexibility and deeper insights, ultimately expanding their impact within the organization.

Strategic Financial Planning and Analysis

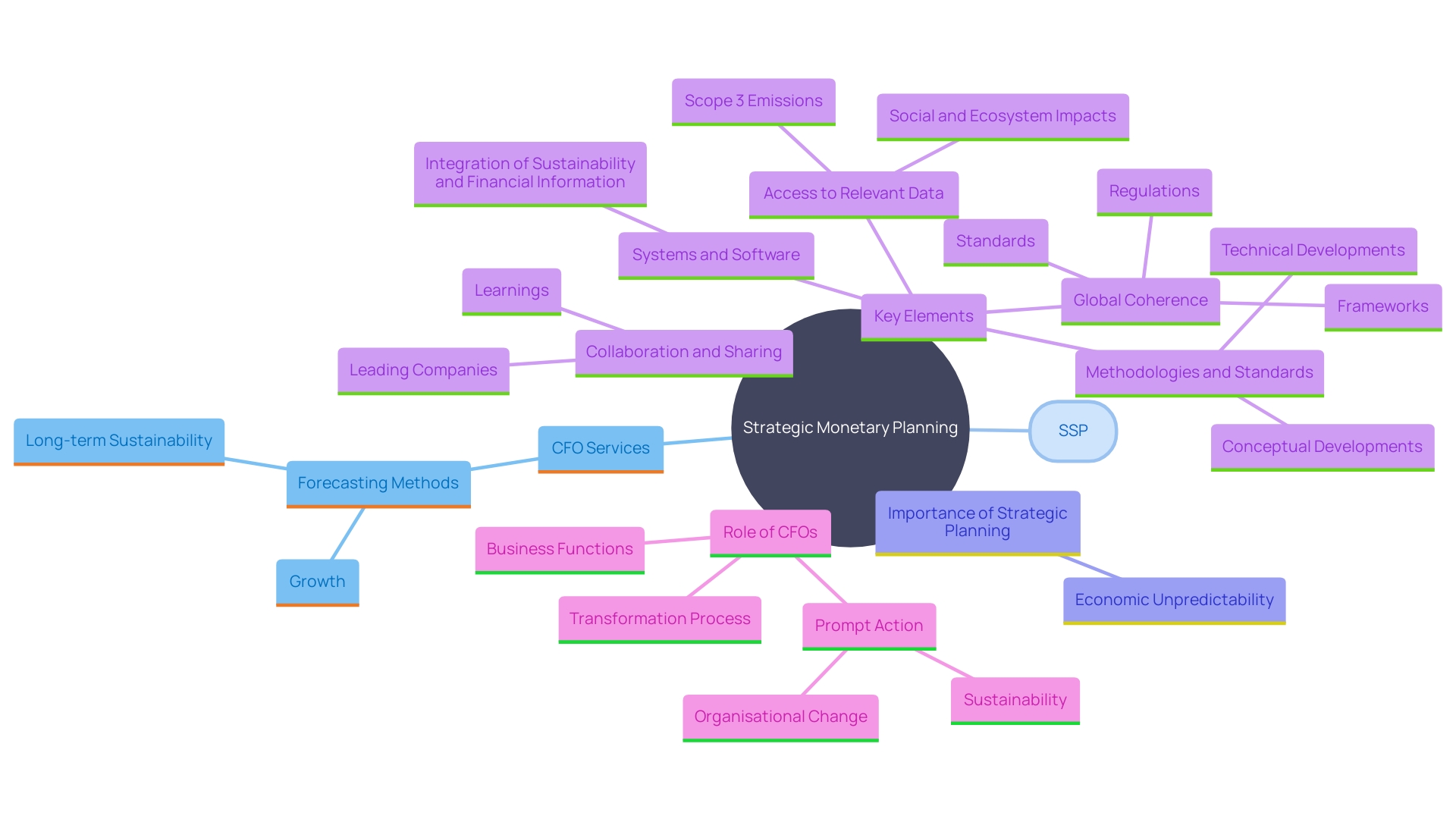

Strategic monetary planning is essential in ensuring a company's economic goals are in sync with its overarching business objectives. CFO services include thorough monetary analysis, allowing organizations to assess their present economic health and predict future performance. Employing advanced forecasting methods and economic modeling, CFOs can provide actionable insights that guide strategic initiatives. This approach not only addresses immediate monetary requirements but also positions the company for long-term sustainability and growth. For instance, Strategic Solution Partners (SSP), a hospitality solutions provider, has effectively utilized planning to assist nearly 1000 hotels in achieving optimal economic outcomes. Moreover, in light of the unpredictable economic landscape, as observed in 2023, financial leaders must continue to prioritize strategic planning to maintain healthy operating margins and robust balance sheets in 2024. Advanced predictive analytics play a crucial role in this process, helping decision-makers respond effectively to economic complexities and regulatory compliance requirements.

Cash Flow Management and Optimization

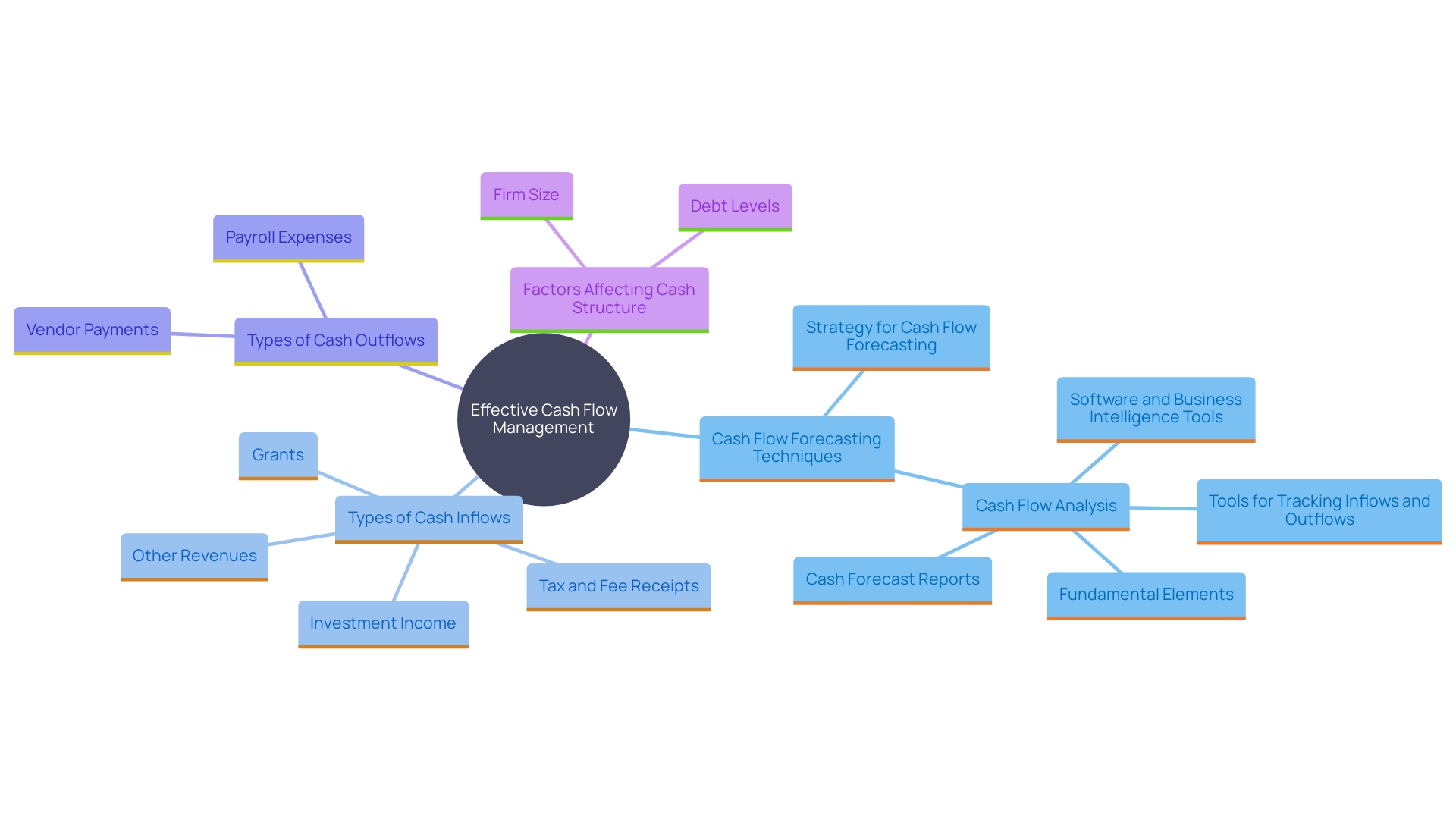

Effective cash flow management is crucial for maintaining economic stability in any organization. Employing advanced cash flow forecasting techniques, financial leaders ensure that businesses can fulfill their operational requirements while strategically preparing for future investments. Regular cash flow analysis help in estimating expected inflows like tax receipts, investment income, and grants, as well as required disbursements such as vendor payments and payroll. This comprehensive approach is designed to measure and assess a company's ability to meet monetary obligations and reduce the necessity for short-term borrowing or using reserve funds.

By closely monitoring cash inflows and outflows, chief financial officers can identify potential bottlenecks and implement strategies to optimize cash reserves, thereby minimizing risks and enhancing liquidity. For example, a study focused on cash holdings in the Indian market highlighted key factors such as firm size, debt levels, and sales growth that significantly impact cash structure. This evidence emphasizes the significance of a proactive method in managing economic uncertainties effectively.

Additionally, the integration of advanced business intelligence tools and software in cash forecasting can provide invaluable insights, aiding CFOs in making informed decisions. Consistently revising cash flow strategies to mirror present market circumstances and new fiscal practices guarantees that entities are well-prepared to tackle both immediate challenges and sustained growth efforts.

Enhanced Financial Controls and Compliance

A pivotal aspect of CFO advisory services is the establishment and maintenance of robust monetary controls. These controls involve the development of comprehensive policies and procedures to ensure strict adherence to legal and regulatory requirements. By implementing such effective internal controls, CFOs play a crucial role in reducing the risks linked to mismanagement and fraud, thus enhancing the overall fiscal integrity of the entity.

For instance, the case of Pacific Steel highlights the importance of transparency and strict oversight of finances. Faced with escalating healthcare costs, the company undertook a detailed examination of its insurance claims data. By partnering with a smaller administrator, they discovered significant overpayments compared to Medicare rates. This led them to adopt reference-based pricing, significantly reducing costs while maintaining compliance with industry standards.

In the broader context, effective internal controls are integral to any best practices compliance program. Key controls include the delegation of authority, meticulous maintenance of vendor master files, and stringent contracts with third parties. These controls not only assist in detecting and preventing fraud but also guarantee that the entity is well-prepared to meet regulatory expectations.

The significance of such measures is underscored by the Financial Accounting Standards Board (FASB) and the Securities and Exchange Commission (SEC), which continually emphasize the importance of professional skepticism and audit quality. With ongoing developments in regulatory requirements, such as the anticipated SEC rule on climate-related disclosures, maintaining strong economic controls is more critical than ever.

Furthermore, predictive analytics is becoming increasingly vital in the finance sector, assisting businesses in anticipating future outcomes and making more informed decisions. This approach, combined with strict adherence to regulations, is crucial for promoting sustainable growth and protecting the economic well-being of the organization.

Access to a Network of Financial Expertise

Utilizing CFO services offers companies access to a dynamic network of monetary experts, including accountants, auditors, and tax professionals. This network is crucial in tackling complex financial challenges and ensuring organizations remain well-informed about best practices and regulatory changes. For example, a recent survey highlighted the growing reliance on predictive analytics for finance functions, underscoring its crucial role in solving complex organizational challenges and improving performance amid uncertain economic conditions. By leveraging these relationships, CFOs can facilitate strategic partnerships and collaborations that significantly enhance organizational growth and resilience. Chris Khoury of Cheetah Capital emphasizes the importance of strategic partnerships, stating, 'There's no point in reinventing the wheel to grow your company.'. Instead, consider seeking out strategic partnerships with companies that align with your vision.' This approach allows businesses to tap into specialized expertise and resources, fostering long-term, fruitful relationships. Furthermore, comprehending economic indicators like EBITDA and share price is crucial for chief financial officers to fulfill legal responsibilities and offer valuable insights on fiscal performance. This comprehensive network and strategic collaboration enable CFOs to steer their organizations through financial complexities while maintaining robust growth trajectories.

Conclusion

The evolving role of the CFO is pivotal in today's fast-paced business landscape. As financial leaders, CFOs are no longer confined to traditional financial management; they are now strategic decision-makers who leverage technology to drive growth and innovation. By embracing advanced tools such as AI and automation, CFOs can enhance their leadership capabilities and focus on high-value tasks, ultimately positioning themselves as key players in shaping their organizations' futures.

Outsourced CFO services present an effective solution for businesses seeking specialized financial expertise without the overhead of a full-time executive. This flexibility allows companies to access tailored financial guidance and fresh perspectives that can uncover inefficiencies and drive improvement. The integration of advanced technologies by outsourced CFOs further amplifies their impact, enabling organizations to optimize financial management and strategic planning.

Strategic financial planning and cash flow management are essential components of a CFO's responsibilities. By employing sophisticated forecasting techniques and regular cash flow analyses, CFOs can ensure that organizations remain financially stable and poised for growth. Additionally, robust financial controls and compliance measures are crucial for mitigating risks and maintaining the integrity of financial operations.

Access to a network of financial experts enhances the CFO's ability to navigate complex challenges and stay informed about regulatory changes. Strategic partnerships foster collaboration and resource sharing, enabling organizations to thrive in an increasingly competitive environment. The modern CFO must continue to adapt, innovate, and lead with purpose, ensuring sustained success for their organizations in a rapidly changing marketplace.