Introduction

In today's fast-paced business environment, CFOs are tasked with more than just managing the numbers. Building a robust and efficient finance team is crucial for driving organizational success. This journey starts with assembling a team of skilled professionals who align with the company's culture and extends to fostering an environment that encourages innovation and initiative.

Clear communication across departments and leveraging advanced technology can streamline operations, enhance decision-making, and improve overall efficiency. Standardizing financial processes and promoting continuous learning further empower teams to adapt and excel in their roles. Moreover, effective cross-departmental collaboration ensures that diverse perspectives contribute to strategic goals.

This article delves into practical strategies for CFOs to build and maintain a high-performing finance team, leveraging technology, standardizing processes, and fostering a culture of continuous improvement and collaboration.

Building a Strong and Efficient Finance Team

Building a high-performing financial team is essential for maximizing efficiency. This begins with hiring skilled professionals who not only possess technical expertise but also align with the organization’s culture and values. For instance, embedding monetary partners in other aspects of the business can enhance their understanding of operational needs, leading to better decision-making. As Jared Weitz of United Capital Source Inc. suggests, finance professionals should integrate themselves into the business to provide actionable insights.

Promoting a setting where group members feel empowered to share ideas and take initiative can significantly enhance productivity and innovation. Data shows that organizational effectiveness, which includes factors like employee engagement and alignment with company goals, consistently outperforms other motivational strategies. This underscores the importance of creating a supportive and inclusive work environment.

Moreover, it's crucial for financial leaders to avoid jargon and communicate in plain language, as emphasized by Sonya Thadhani Mughal of Bailard, Inc. Clear communication ensures that all departments are on the same page, facilitating smoother operations and better collaboration across the board. By concentrating on these aspects, CFOs can create a finance group that not only meets but surpasses organizational expectations.

Leveraging Technology for Efficiency

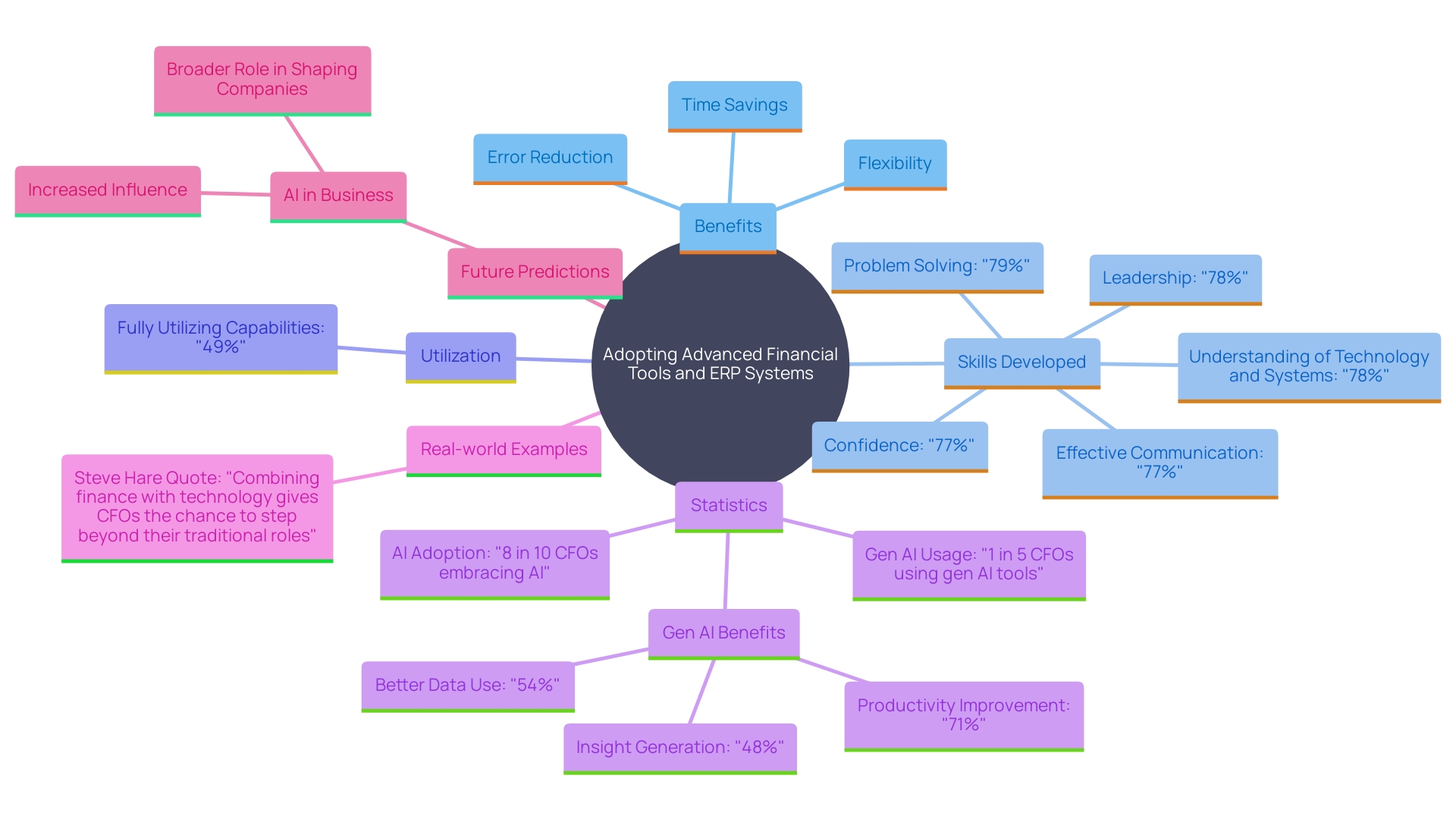

Adopting advanced financial tools and ERP systems can significantly streamline operations within the CFO’s office. By implementing cloud-based solutions, organizations enhance flexibility and security, allowing teams to access critical data anytime, anywhere. Automating repetitive tasks not only saves time but also reduces the risk of errors, freeing up resources for more strategic initiatives.

A recent report highlights that 8 in 10 CFOs are embracing AI and automated processes, gaining valuable time to focus on higher-value tasks. This additional time helps CFOs develop critical skills such as problem-solving (79%), leadership (78%), technology understanding (78%), effective communication (77%), and confidence (77%). Despite these benefits, only 49% are fully utilizing these capabilities.

Steve Hare, CEO of Sage, emphasizes, 'Combining finance with technology gives CFOs the chance to step beyond their traditional roles, guiding their businesses with both flexibility and deeper insight. Success will increasingly depend on their ability to adapt, work together, and lead with clear purpose.'

Real-world examples demonstrate the impact of these technologies. For instance, Sage Intacct has enabled Stark to integrate 20 acquisition firms and 17 legacy systems into a single financial source of truth. This consolidation has not only enhanced efficiency but has additionally provided real-time insight into project expenses, fostering informed decision-making and growth.

Furthermore, Gartner predicts that over 80% of businesses will leverage AI by 2026, underscoring its transformative potential. AI technologies provide seamless integration, optimizing both current and future innovations. This allows businesses to focus on strategic goals and adapt to market changes effectively.

Standardizing and Simplifying Financial Processes

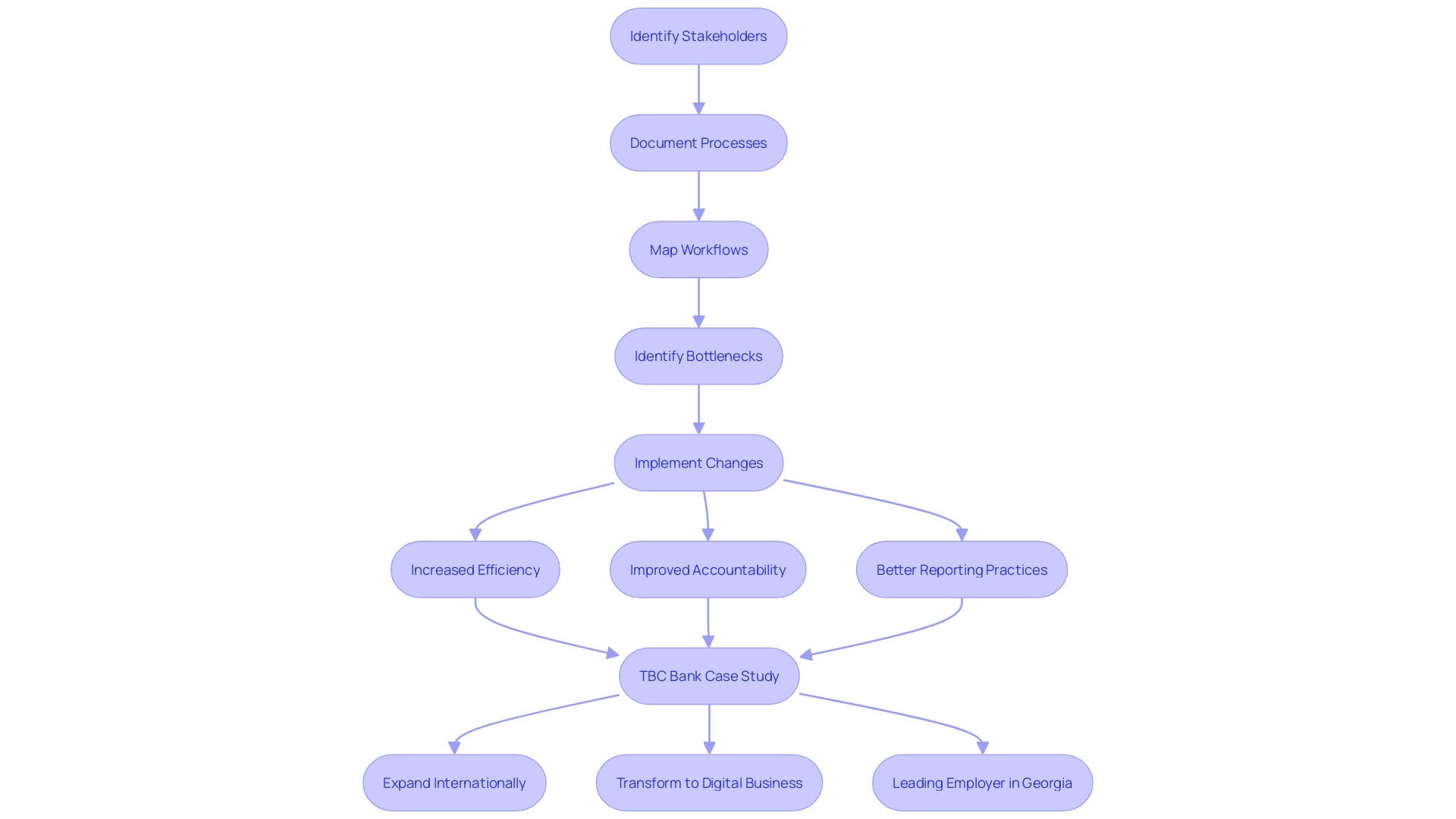

Standardizing financial processes enhances organizational efficiency and transparency. Through meticulous documentation and workflow mapping, companies can uncover and address bottlenecks, streamlining operations. This approach not only improves efficiency but also promotes accountability and alignment within the organization. TBC Bank, for instance, experienced significant benefits from redefining its strategic execution model, achieving a 40% reduction in time-to-market for a key product. Additionally, standardization facilitates the creation of consistent reporting templates, ensuring clear, reliable communication across all departments. As noted by the GFOA, rethinking financial reporting practices can better inform decision-making and enhance public trust.

Continuous Improvement and Training

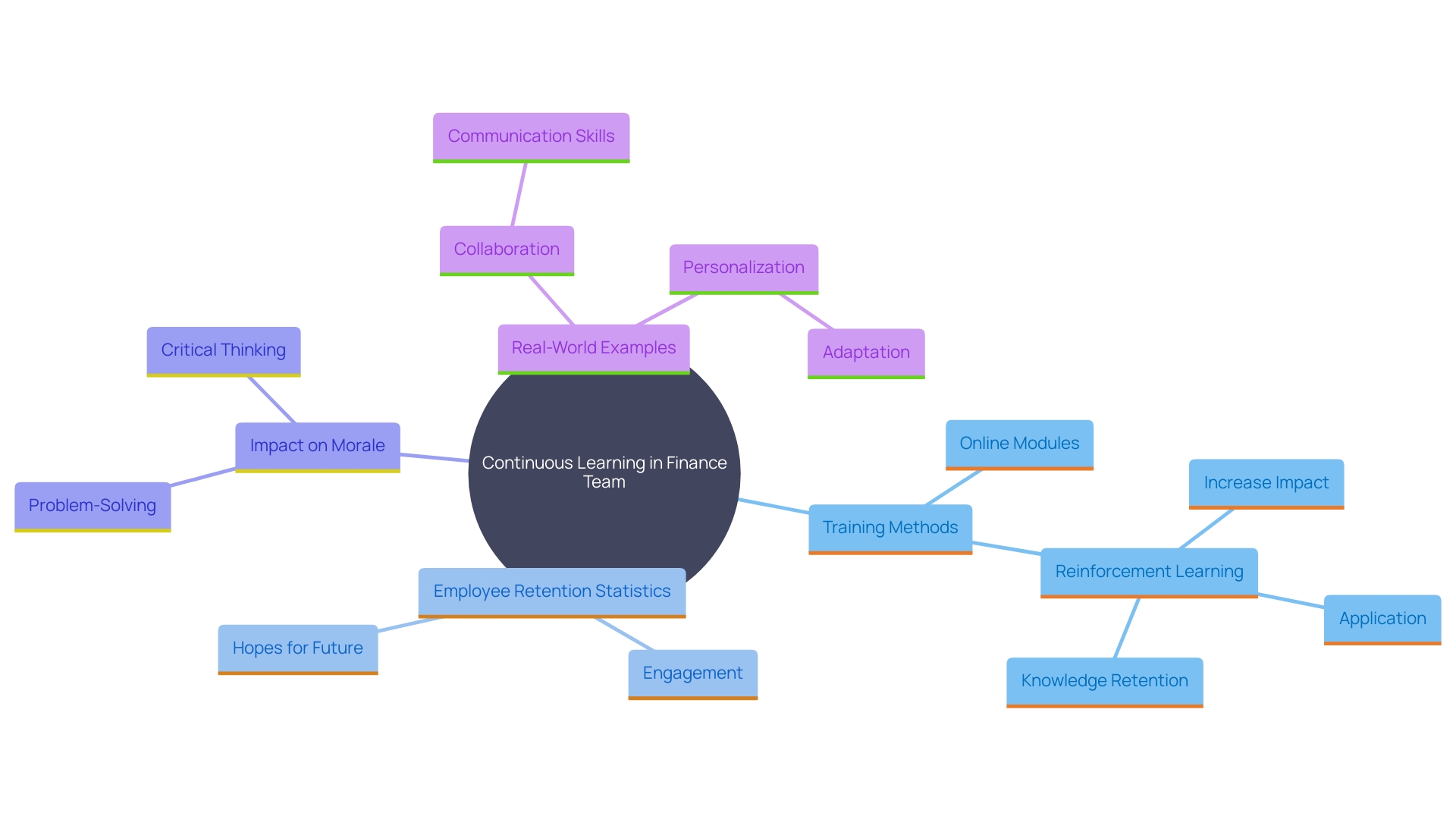

Building a culture of continuous learning within the finance team is essential for maintaining operational efficiency and adaptability. Regular training and development initiatives equip employees with the latest skills and knowledge, enabling them to meet evolving demands. A case in point is the Nets organization, which transformed its traditional face-to-face training into engaging online modules to overcome onboarding delays and compliance challenges. This shift not only streamlined the onboarding process but also enhanced employee engagement and performance.

Investing in professional development has a direct impact on employee retention and morale. According to the Work Institute's 2022 Retention Report, 94% of workers are more likely to remain with an organization that invests in their development. This statistic underscores the importance of continuous learning in reducing turnover and fostering a motivated workforce. As Karmela Peček from eWyse Agency emphasizes, well-trained employees become ambassadors for the organization, showcasing it as a great place to work.

Real-world examples further illustrate the benefits of a robust training program. One company faced significant stress and interpersonal issues, leading to decreased performance and increased turnover. Introducing soft skills training as a solution not only improved group dynamics but also enhanced overall productivity. This demonstrates that comprehensive training programs can address both technical and interpersonal challenges, leading to better organizational outcomes.

Incorporating continuous learning into the finance group's culture ensures that employees are equipped to handle the complexities of their roles, ultimately driving the organization's success and growth.

Cross-Departmental Collaboration

Effective collaboration across departments significantly enhances decision-making and resource allocation. Regular inter-departmental meetings are essential to align objectives and clarify roles, ensuring everyone is on the same page. Developing cross-functional teams for specific projects fosters diverse perspectives and expertise, which drives innovation and efficiency in financial management.

For instance, Bouvet, a leading Scandinavian consultancy, successfully navigated the complexities of communication and collaboration across its 17 locations by implementing a unified communication framework. This approach not only preserved but also grew its organizational culture, illustrating the power of cohesive inter-departmental collaboration.

To improve communication, understanding each department's needs is crucial. As Johan Henning of Brookfield Asset Management states, "The business succeeds when everyone is delivering at a high standard." This mutual understanding builds trust and respect, which are foundational for effective teamwork.

Moreover, embedding monetary personnel within other departments can significantly enhance collaboration. Todd Sixt from Strait & Sound Wealth Management LLC advocates for this approach, suggesting that it fosters teamwork and allows finance professionals to experience the day-to-day events within different departments.

However, directing cross-disciplinary groups to collaborate harmoniously is not without challenges. Harvard research reveals that about 75% of such groups tend to underperform due to clashes of interests and conflicting loyalties. Stanford Professor Behnam Tabrizi emphasizes that while diversity prepares groups for innovative solutions, it can also be a source of discord without strategic leadership. Recognizing these challenges and implementing informed strategies are necessary to harness the full potential of cross-functional teams.

Conclusion

Building an efficient finance team is vital for organizational success. Hiring skilled professionals who align with company culture enhances decision-making and fosters collaboration. An empowering environment that encourages innovation and clear communication boosts productivity and helps teams exceed expectations.

Leveraging technology is crucial for streamlining finance operations. Advanced tools and automation allow teams to focus on strategic tasks, reducing errors and improving efficiency. Embracing AI and cloud solutions unlocks transformative potential, enabling real-time data access and adaptability to market changes.

Standardizing financial processes improves transparency and accountability. Consistent documentation and reporting streamline operations and enhance communication, facilitating better decision-making and building trust within the organization.

Fostering a culture of continuous improvement and training is essential for maintaining a motivated workforce. Investing in employee development leads to higher retention rates and equips team members with the skills needed to navigate complexities effectively.

Cross-departmental collaboration optimizes resource allocation and drives innovation. Regular meetings and cross-functional teams leverage diverse perspectives, enhancing financial management. Understanding departmental needs and embedding finance personnel within them fosters collaboration and trust.

By implementing these strategies, CFOs can build high-performing finance teams ready to tackle today’s dynamic business challenges. Emphasizing culture, technology, standardization, continuous learning, and collaboration will streamline operations and drive organizational success.