Introduction

In today's dynamic business environment, the need for restructuring has become a crucial aspect for companies striving to maintain competitiveness and achieve long-term success. Market fluctuations, operational inefficiencies, and financial distress often necessitate a comprehensive assessment to identify critical pain points impeding performance. Effective communication plays a pivotal role in the restructuring process, ensuring transparency and mitigating concerns among stakeholders.

Real-world examples highlight the importance of addressing inefficiencies to improve overall performance, while resilience and adaptability remain key traits for business leaders navigating uncertainties. This article explores the multifaceted nature of restructuring, detailing various strategies, evaluation criteria, and the significance of stakeholder management. Additionally, it underscores the importance of future-proofing businesses post-restructuring to ensure sustained growth and stability.

Understanding the Need for Restructuring

In today’s dynamic commercial landscape, organizations often encounter the necessity for reorganization due to market fluctuations, operational inefficiencies, or financial distress. 'Acknowledging the urgency for reorganization is essential for organizations striving to maintain competitiveness and achieve long-term success.'. Businesses must conduct a comprehensive assessment of their current state, identifying critical pain points that may be impeding performance. A comprehensive examination of operational methods, financial stability, and market placement allows organizations to identify the particular factors requiring reorganization and establish the foundation for successful recovery.

Efficient interaction is a vital component in the reorganization process. As per a McKinsey Global Survey, 66% of successful organizational restructurings had set up a clear messaging strategy for all stakeholders. Clear communication aids in conveying the reasons for reorganization and the anticipated results to staff, which can reduce distractions and worries. Open dialogue ensures that employees are aware of the process, alleviating fears and preventing the spread of misinformation.

Real-world examples underscore the importance of addressing operational inefficiencies. For instance, during a business takeover, the existing finance manager transitioned to a General Manager position, revealing significant issues in housekeeping management. Regular occurrences of out-of-service rooms and inadequate staffing led to minimal revenue and occupancy rates. Such cases emphasize the necessity for systematic assessment and reorganization to tackle inefficiencies and enhance overall performance.

Furthermore, business leaders must remain resilient and adaptable in the face of challenges. As noted by John Simmons, Head of Middle Market Banking & Specialized Industries at JPMorgan Chase, continuous improvement and strategic investments are vital for navigating uncertainties and driving business forward. By iterating with each challenge, organizations can make informed decisions that foster growth and stability.

In summary, reorganization is a multifaceted process that requires thorough analysis, clear communication, and strategic adaptability. By addressing operational inefficiencies and maintaining open dialogue with stakeholders, companies can navigate the complexities of reorganizing and position themselves for sustained success.

Types of Restructuring Strategies

Companies can implement various reorganization strategies designed to tackle particular challenges and enhance performance. Financial reorganization, for instance, focuses on debt management and optimizing the capital structure, which can significantly enhance liquidity and financial stability. For example, Norsk Hydro, a leader in aluminum and renewable energy, achieved record financial performance in 2022 by strategically navigating financial adjustments amidst global challenges, including an energy crisis and geopolitical tensions.

Operational reorganization emphasizes process enhancements and cost reduction initiatives, which are critical for enhancing overall efficiency. Advanced analytics and data-driven insights can play a crucial role here, enabling intelligent decision-making and risk management. Companies that strategically focus on these areas often see significant improvements in revenue and profit margins.

Strategic reorganization involves reevaluating business models and market approaches to drive growth. This could include engaging stakeholders, seeking professional advice, and creating detailed plans outlining specific actions to achieve objectives. For instance, financial institutions leveraging digital transformation, such as cloud computing and AI, can develop new products and services, maintaining a competitive edge and ensuring long-term sustainability.

By comprehending and applying these reorganization strategies, organizations can select the most appropriate route that aligns with their recovery and growth goals, ensuring resilience in the face of economic challenges.

Evaluating Restructuring Plans

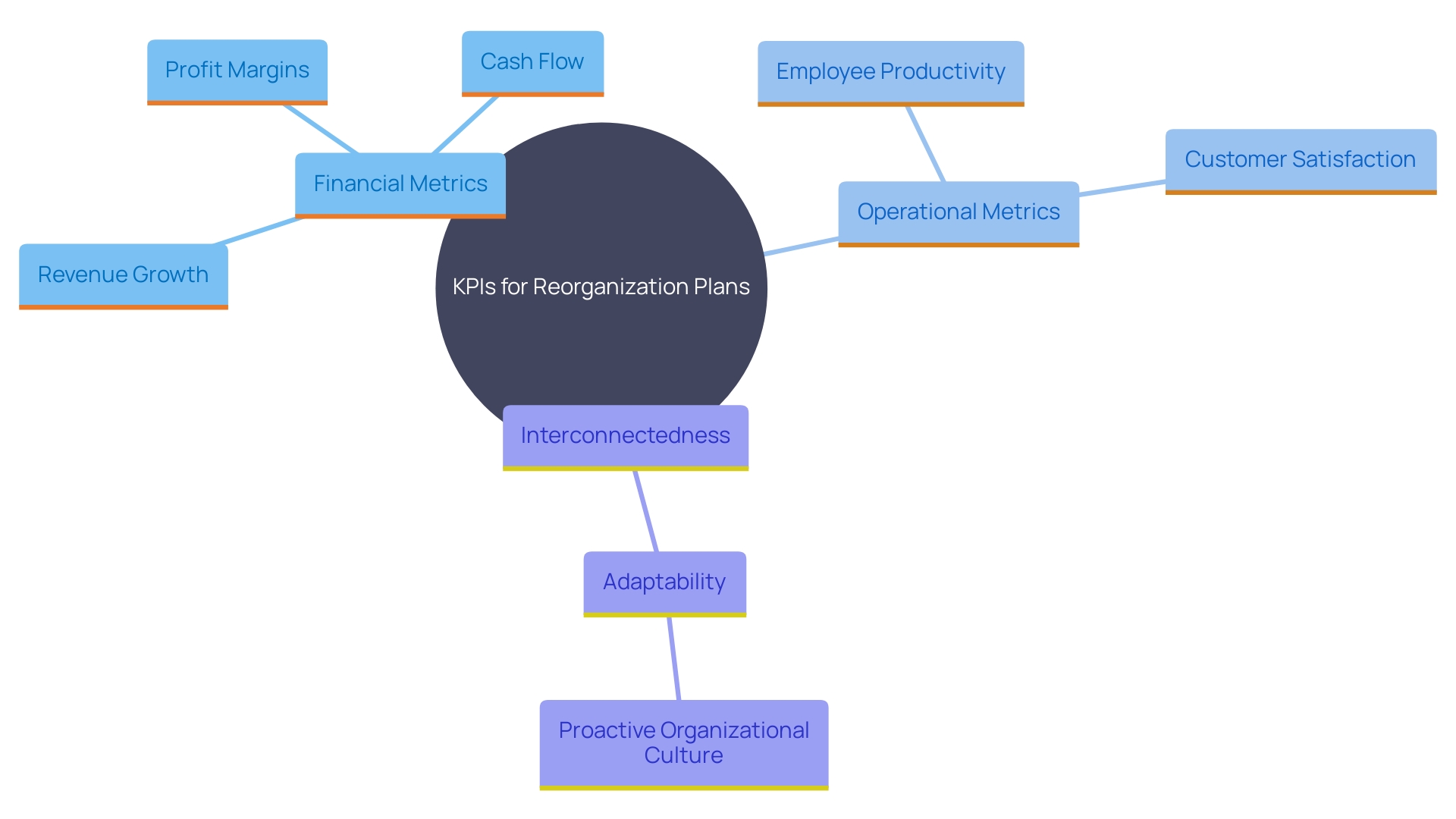

Organizations need to establish robust evaluation criteria to assess the effectiveness of their reorganization plans. Defining key performance indicators (KPIs) is crucial, encompassing financial metrics like revenue growth, profit margins, and cash flow improvements, alongside operational metrics such as employee productivity and customer satisfaction. For instance, Strategic Solution Partners (SSP) successfully implemented these metrics across nearly 1000 hotels, ensuring tailored solutions and substantial performance improvements.

Consistently tracking these KPIs enables companies to assess the effectiveness of their changes and identify areas needing additional improvement. The ability to adapt is vital; feedback and shifting market conditions necessitate flexible plans. KPIs, when adaptable, can foster a proactive and ownership-driven attitude among managers, leading to a more agile organizational culture. This approach was evident when a prominent cloud provider partnered with Insight to scale its services, demonstrating strategic agility in cost and capacity planning.

Incorporating flexibility into performance indicators can mitigate risks associated with unforeseen changes, ensuring sustainable cash flow and profitability. By maintaining this adaptability, organizations can remain resilient and responsive to evolving challenges and opportunities.

Stakeholder Management and Communication

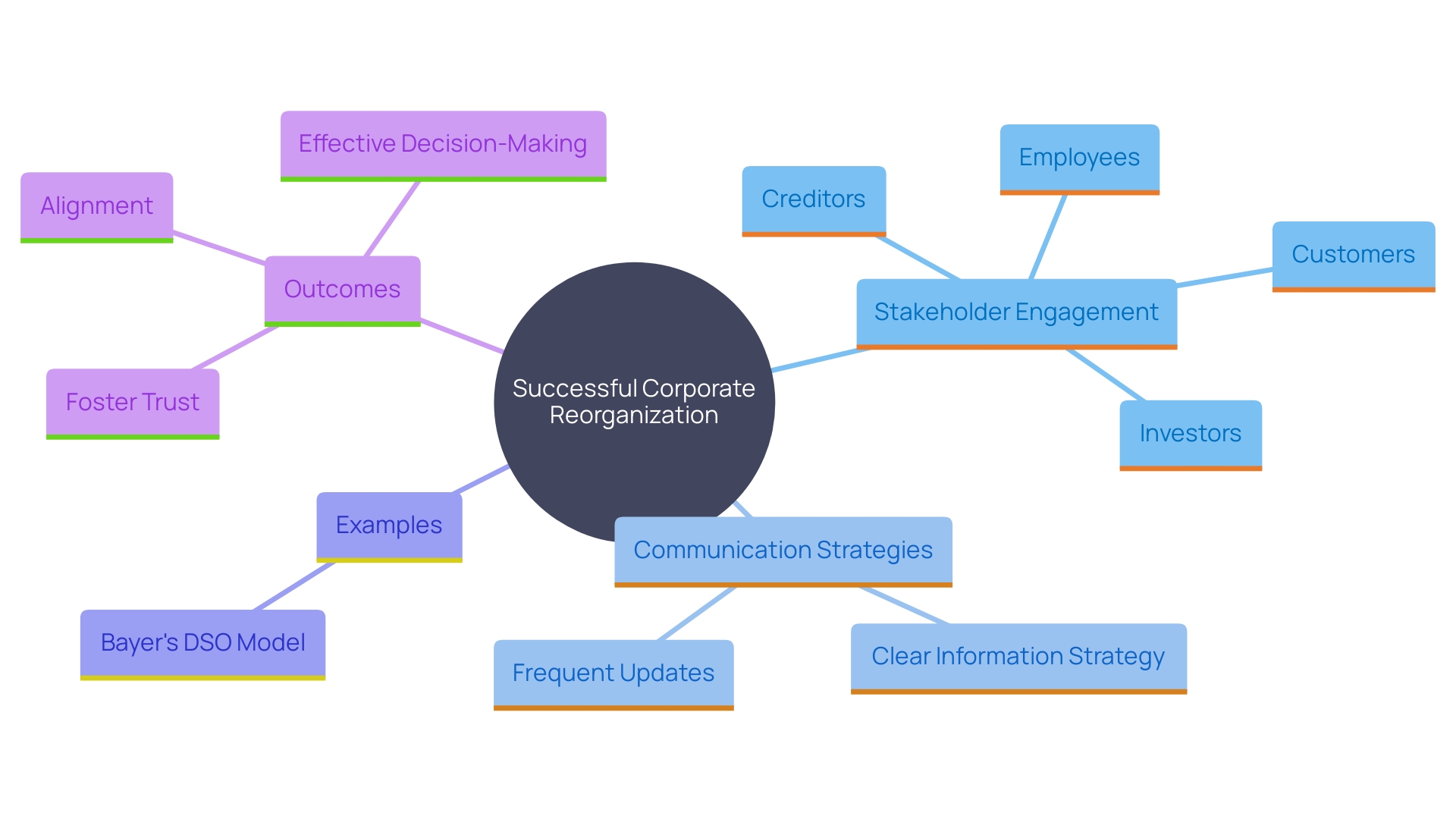

Successful reorganization depends on skilled participant management and transparent interaction. Involving stakeholders—including employees, investors, creditors, and customers—through clear and consistent dialogue is vital for establishing trust and alignment. It is essential to articulate the reasons behind restructuring efforts, expected outcomes, and the impact on various parties involved. For example, a McKinsey Global Survey shows that 66% of successful corporate reorganizations had created a clear information strategy for all internal and external parties. This approach ensures that employees stay informed, thereby reducing distractions and preventing the stalling of growth initiatives.

The Bayer Group’s introduction of its “Dynamic Shared Ownership” (DSO) model exemplifies the importance of stakeholder engagement. This model, created to lessen hierarchies and simplify decision-making, was developed in partnership with employee representatives, showcasing a commitment to inclusive dialogue. The joint declaration by Bayer’s Board of Management and employee representatives highlights the company’s effort to be transparent about the significant staff reductions expected during the restructuring process.

Investors also play a critical role and need to be managed proactively. Different types of investors, such as institutional investors and those with an ESG focus, have varied concerns that must be addressed. A clear, proactive communication strategy can help share information with investors and ensure collective awareness of the processes involved. This is particularly relevant as investors increasingly support new disclosure requirements and demand better information to build trust in sustainability commitments.

Frequent updates and a welcoming atmosphere where input from involved parties is appreciated can greatly improve collaboration and assistance. By fostering such an environment, organizations can mitigate risks and enhance the successful execution of organizational changes. This approach not only aligns with the expectations of stakeholders but also contributes to the long-term stability and growth of the organization.

Future-Proofing Your Business Post-Restructuring

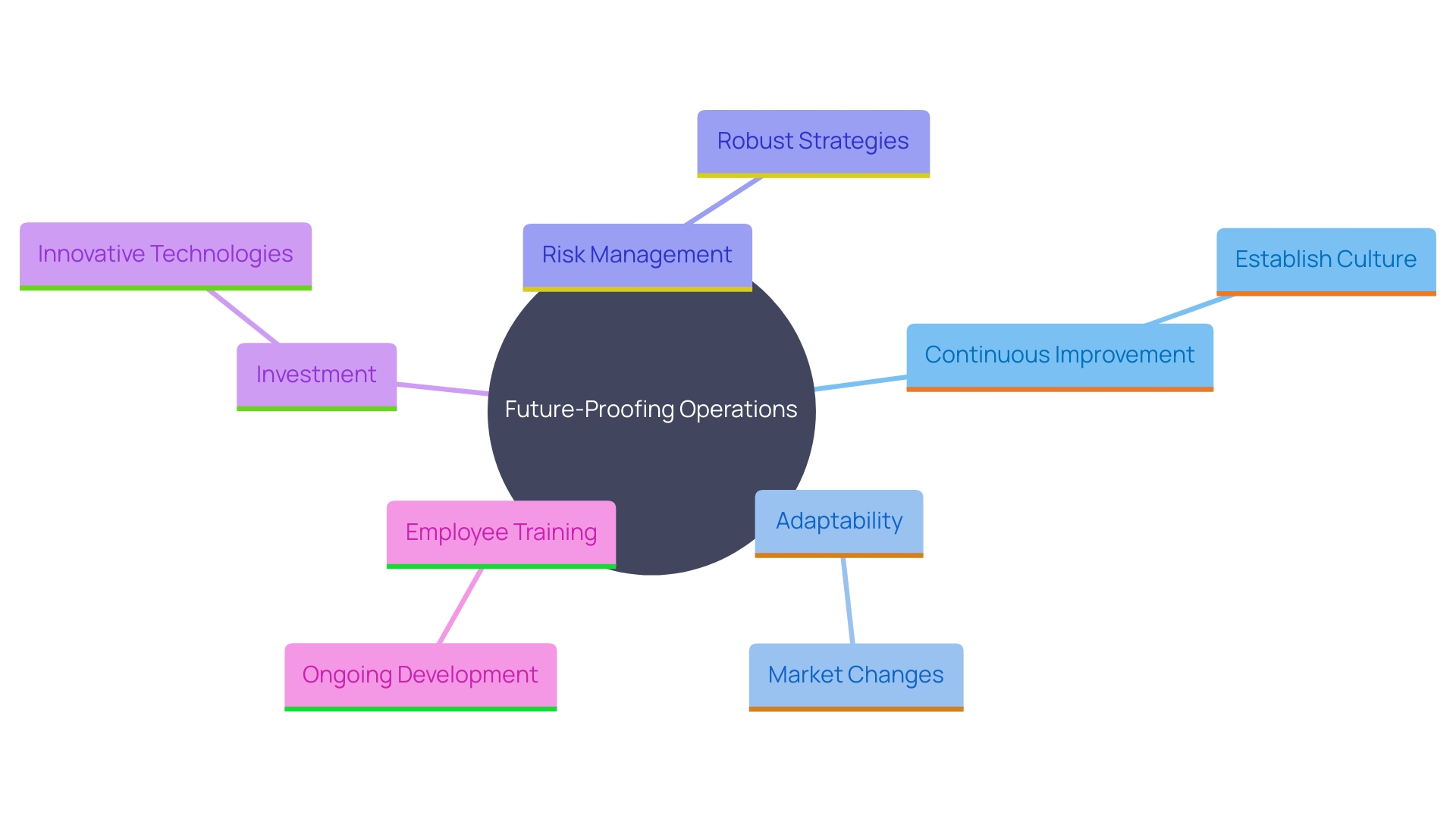

Once reorganization is complete, organizations must focus on future-proofing their operations. This involves establishing a culture of continuous improvement and adaptability to market changes. Implementing robust risk management practices and investing in innovative technologies can enhance resilience. Additionally, ongoing training and development for employees ensure that the workforce is equipped with the necessary skills to navigate future challenges. By embedding these practices into the company culture, businesses can position themselves for sustained success beyond the restructuring phase.

Conclusion

Restructuring is a critical process that enables companies to adapt to the ever-changing business landscape. By understanding the need for restructuring, organizations can identify operational inefficiencies and financial challenges that hinder performance. Effective communication throughout this process is essential, as it fosters transparency and alleviates stakeholders' concerns, thus ensuring a smoother transition.

Various restructuring strategies, including financial, operational, and strategic restructuring, provide tailored solutions to specific challenges. Implementing these strategies allows firms to enhance liquidity, improve efficiency, and reevaluate their business models. Real-world examples, such as Norsk Hydro’s successful financial restructuring, illustrate how targeted approaches can lead to remarkable recovery and growth.

Evaluating the success of restructuring plans through robust key performance indicators is crucial for ongoing improvement. Regular monitoring of these metrics helps organizations identify areas for enhancement while maintaining flexibility to adapt to changing market conditions. This proactive approach fosters a culture of agility and ownership among employees, which is vital for long-term resilience.

Finally, effective stakeholder management and communication play a pivotal role in the restructuring process. Engaging with all stakeholders, from employees to investors, ensures alignment and builds trust. By establishing a culture of continuous improvement and investing in innovative practices post-restructuring, businesses can not only navigate current challenges but also position themselves for sustained success in the future.

Emphasizing these strategies will empower organizations to thrive in a competitive environment.