Overview

Effective stakeholder information management software is crucial for CFOs, enhancing data organization, communication, and decision-making capabilities. This ultimately fosters stronger stakeholder relationships. Such software facilitates transparency, real-time analytics, and tailored engagement strategies, which are vital for navigating the complexities of financial management. Moreover, it ensures organizational resilience in a rapidly evolving business landscape. As CFOs seek to optimize their operations, the implementation of such software becomes not just beneficial but essential.

Introduction

In an increasingly interconnected business landscape, the role of stakeholder information management (SIM) has emerged as a crucial element for CFOs navigating the complexities of financial decision-making. As organizations strive to engage diverse stakeholders—from investors to regulatory bodies—understanding their distinct interests is essential for driving strategic success.

Moreover, with a growing emphasis on technology investments, CFOs are turning to advanced SIM practices to foster transparency, build trust, and enhance collaboration. As the demand for robust cybersecurity measures intensifies, the integration of effective SIM tools not only streamlines communication but also fortifies organizations against potential risks.

This article delves into the significance of stakeholder information management, exploring best practices, essential software features, and strategies to overcome common challenges, ultimately equipping CFOs to thrive in a rapidly evolving financial environment.

Understanding Stakeholder Information Management

Stakeholder information management software provides a strategic framework that enables financial executives to systematically identify, analyze, and engage relevant parties throughout the financial decision-making process. As we approach 2025, the significance of stakeholder engagement has never been more pronounced, with 58% of financial executives reporting an increased focus on technology investments to enhance these efforts. Understanding the diverse interests of stakeholders—ranging from investors and employees to customers and regulatory bodies—is crucial for CFOs. These interests directly impact monetary strategies and outcomes.

Effective stakeholder information management software fosters transparency, builds trust, and encourages collaboration, all of which are vital for navigating challenges and achieving organizational objectives. As the demand for enhanced cybersecurity grows, with only 2% of finance and tech leaders implementing cyber resilience actions, the integration of robust stakeholder information management software becomes even more essential. By utilizing advanced technology and real-time analytics, financial executives can significantly enhance their collaboration initiatives, ensuring that all parties stay informed and aligned with the company's financial objectives.

Furthermore, effective information management for involved parties can play a critical role in addressing cybersecurity challenges by ensuring that these individuals are aware of risks and engaged in mitigation strategies. Best practices in stakeholder information management software for CFOs include:

- Regular communication

- Tailored engagement strategies

- The use of analytics to gauge stakeholder sentiment

As highlighted by CFO.com, "Finance automation reduces FTE headcount requirements but necessitates a balance between efficiency and preserving reporting quality." This emphasizes the significance of maintaining high-quality reporting while automating processes.

Moreover, the case study titled 'Understanding the Discount Rate in Business Valuation' demonstrates how assessing a company's value requires examining future cash flows and modifying them for risk, highlighting the importance of participant involvement in monetary decision-making. Effective strategies for involving interested parties not only improve decision-making but also aid in long-term organizational success. As the terrain of economic management evolves, prioritizing stakeholder involvement will be essential for chief financial officers aiming to foster sustainable growth and resilience in their organizations.

Additionally, a thorough financial assessment can help identify opportunities to preserve cash and reduce liabilities, further supporting the overall financial health of the organization.

Benefits of Stakeholder Information Management Software for CFOs

Stakeholder information management software offers numerous advantages for financial executives, significantly enhancing data organization, communication, and decision-making capabilities. By centralizing relevant information, CFOs gain immediate access to pertinent data, enabling them to track interactions and analyze sentiments effectively. This streamlined access fosters informed monetary decisions and proactive engagement strategies, which are crucial in today's dynamic business environment.

In 2025, the advantages of SIM software are particularly pronounced. With 61% of finance professionals expecting higher expenses related to compliance, as highlighted in the Cost of Compliance Report 2023, the ability to provide clear and concise updates to interested parties becomes essential. SIM tools frequently offer strong reporting capabilities that promote transparency and foster trust among stakeholders, ultimately resulting in increased satisfaction and loyalty—essential elements for sustained economic stability.

Moreover, the incorporation of AI and big data within these systems enables executives to manage complexities with enhanced ease. Prioritizing these technologies is vital for successful financial planning and analysis (FP&A) implementation. A recent case study highlighted how AI serves as a strategic partner to financial executives, providing insights that allow them to focus on guiding the company's vision and driving business outcomes.

This partnership not only enhances the strategic role of financial officers but also improves overall decision-making processes. In addition, Transform Your Small/Medium Business supports a shortened decision-making cycle throughout the turnaround process, allowing financial leaders to take decisive action to preserve their business. We continually monitor the success of our plans through a client dashboard that provides real-time business analytics, enabling continuous performance monitoring and relationship-building. Statistics indicate that 35% of business and tech executives view third-party breaches as a significant cyber threat, underscoring the importance of secure and efficient management of involved parties.

Consequently, as financial leaders increasingly adopt stakeholder information management software, they become better equipped to mitigate risks and enhance their decision-making capabilities, ensuring their organizations thrive amidst uncertainty.

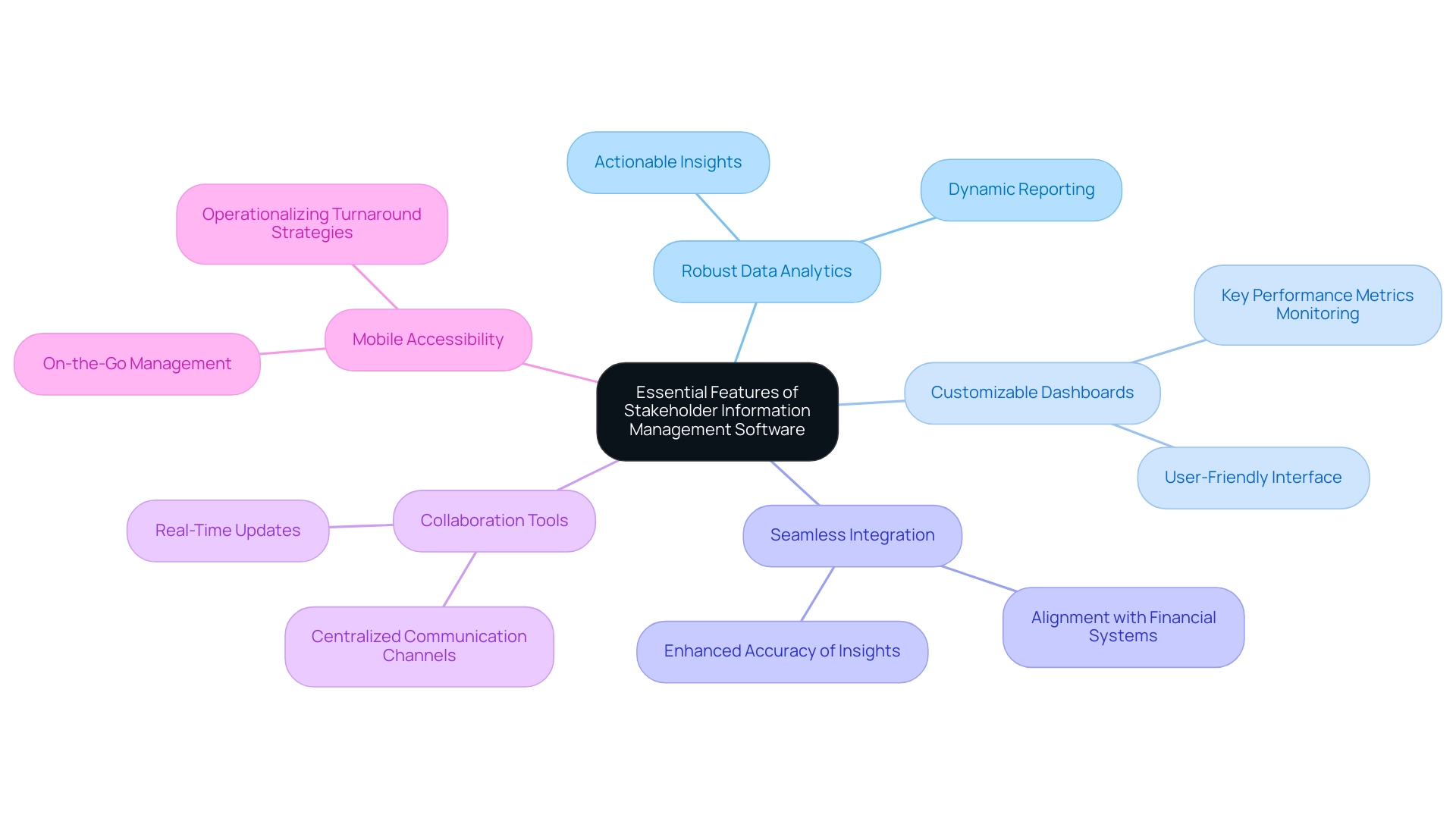

Essential Features of Effective Stakeholder Information Management Software

In selecting stakeholder information management software, financial executives must focus on several essential features that enhance operational efficiency and strategic insight. Foremost among these is robust data analytics, enabling executives to derive actionable insights into participant behavior and preferences. Organizations are moving beyond static reporting dashboards toward a more dynamic interaction with their data, making this capability crucial for informed decision-making and the cultivation of stronger stakeholder relationships.

This shift aligns with the necessity for streamlined decision-making processes, facilitated by stakeholder information management software. Such tools empower teams to take decisive actions based on real-time insights, a core principle of Transform Your Small/Medium Business's approach to business turnaround.

Customizable dashboards represent another essential feature, offering a user-friendly interface that allows financial executives to monitor key performance metrics at a glance. These dashboards can be tailored to display relevant data, ensuring that CFOs have immediate access to the most critical information, thereby supporting continuous business performance monitoring.

Moreover, seamless integration with existing financial systems is vital, ensuring that stakeholder information management software aligns participant data with reporting and compliance requirements. This integration not only streamlines processes but also enhances the accuracy of financial insights derived from participant interactions, facilitating better decision-making.

Additionally, stakeholder information management software fosters collaboration by providing real-time updates, task assignments, and centralized communication channels. Automated communication tools enable timely updates and interactions, while secure data storage safeguards sensitive information. Mobile accessibility allows CFOs to manage relationships with interested parties on the go, further operationalizing the lessons learned from turnaround strategies.

As Lulit Tesfaye notes, "By leveraging a combination of AI-powered tools, self-service capabilities, and evolving governance practices, organizations are unlocking the full value of their data and knowledge assets." Furthermore, Transform Your Small/Medium Business offers a centralized system for tracking engagement with interested parties, customizable workflows, and integration with communication tools, showcasing current trends in stakeholder information management software. Together, these features create a comprehensive framework that enhances the efficiency and effectiveness of management efforts, ultimately supporting the organization's strategic objectives.

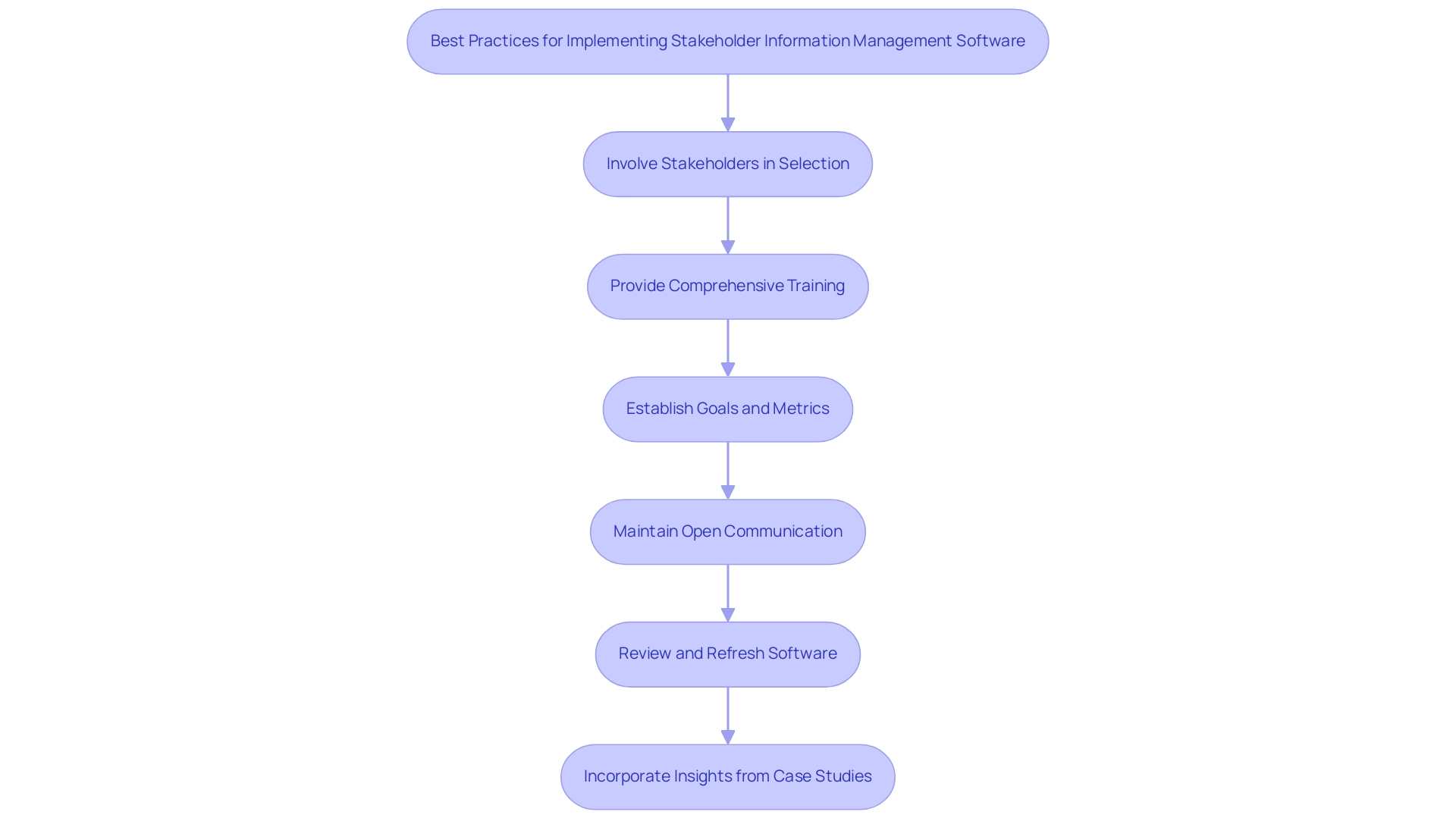

Best Practices for Implementing Stakeholder Information Management Software

To implement information management software effectively for interested parties, CFOs must adhere to several key best practices that emphasize streamlined decision-making and real-time analytics. First and foremost, involving important participants in the software selection process is crucial. This guarantees that the selected solution aligns with their specific requirements and enhances overall engagement.

A recent study indicates that organizations actively involving participants in decision-making processes experience a 30% increase in software adoption rates.

Next, providing comprehensive training for all users is essential for facilitating a smooth transition. Research shows that organizations with robust training programs experience a 50% reduction in implementation time and a significant boost in user satisfaction. Additionally, establishing clear goals and metrics to measure the software's impact on participant engagement and financial performance is vital. This enables financial leaders to monitor progress and implement informed changes as needed, utilizing real-time analytics to consistently assess business health through the client dashboard offered by Transform Your Small/Medium Business.

Moreover, consistently reviewing and refreshing the software is another recommended practice, as it assists organizations in adapting to the changing interests of involved parties and organizational requirements. Maintaining open lines of communication with involved parties throughout the implementation process is equally important. This approach not only addresses concerns but also promotes a culture of feedback, essential for ongoing improvement and relationship-building.

Incorporating insights from successful case studies can further guide financial leaders. For instance, small teams that adopted AI tools like Quorum Copilot reported improved engagement with key individuals by focusing on influential parties rather than attempting to involve everyone equally. This highlights the importance of adapting to new technologies, especially considering that more than 70% of project managers believe Artificial Intelligence is very or extremely likely to change their roles.

Furthermore, Jambo's emphasis on security and the capability to develop comprehensive contact profiles for interested parties can enhance management by efficiently tracking all interactions.

By applying these best practices, financial leaders can ensure that their organizations not only implement information management software for interested parties successfully but also utilize it to foster sustainable growth, operationalizing lessons learned throughout the turnaround process.

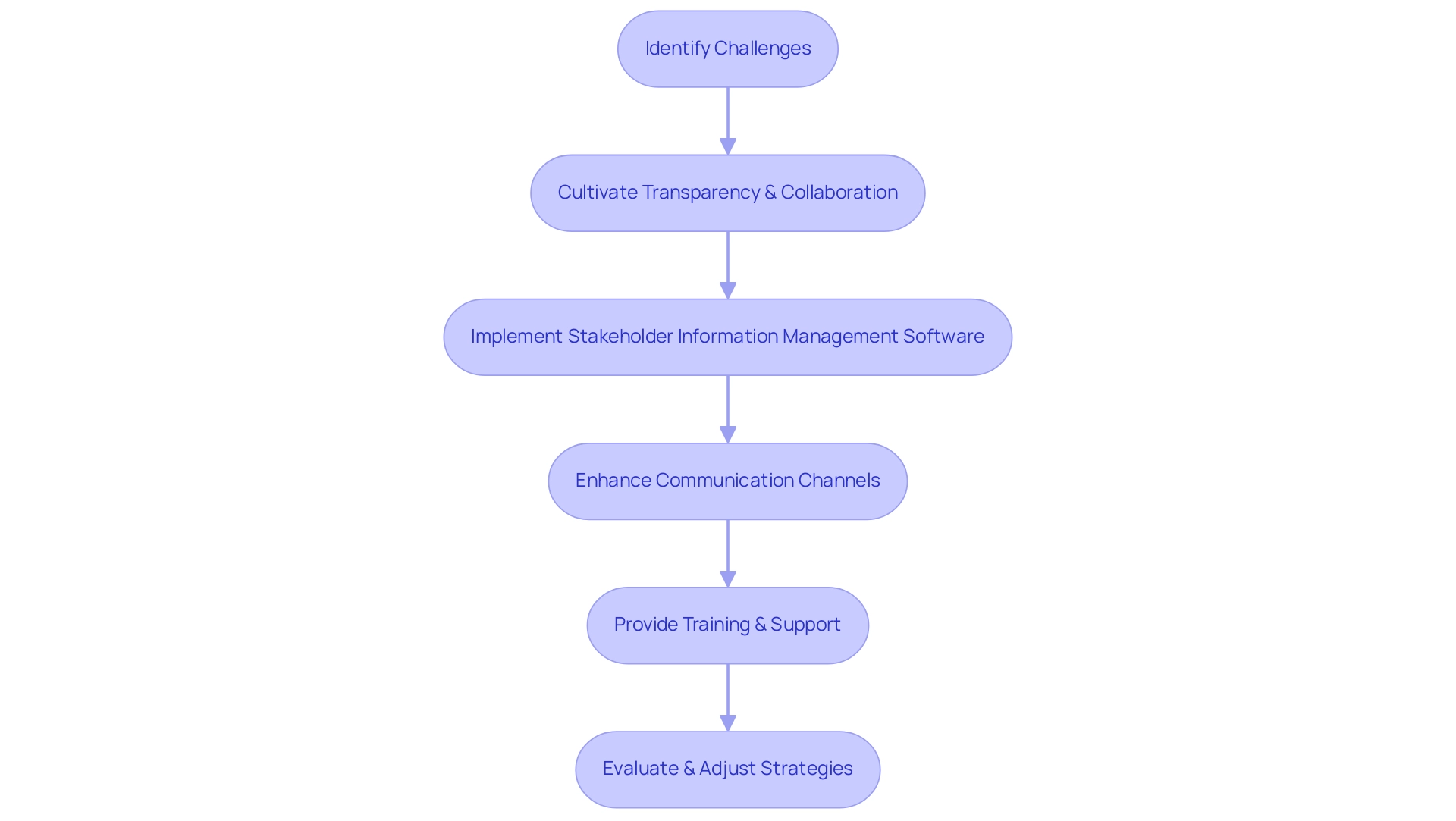

Overcoming Challenges in Stakeholder Information Management

Financial executives frequently face significant challenges in managing information related to interested parties, including data silos, communication breakdowns, and resistance to change. A pivotal strategy for overcoming these obstacles is to cultivate a culture of transparency and collaboration within the organization. By implementing stakeholder information management software, financial leaders can effectively dismantle silos, ensuring that all parties have access to consistent and accurate information.

This approach not only streamlines communication but also enhances decision-making processes by utilizing stakeholder information management software, allowing for quicker responses to emerging challenges. Moreover, fostering open communication channels is essential. Encouraging involved parties to express their concerns and provide feedback can lead to more effective engagement strategies, ultimately strengthening relationships and improving financial outcomes. In 2025, statistics indicate that a staggering 70% of organizations still struggle with data silos, highlighting the urgency for CFOs to address this issue proactively.

Additionally, only 21% of leaders feel prepared to meet the increasing demands of CSRD regulations, underscoring the necessity of utilizing stakeholder information management software for effective management of interested parties. To further mitigate resistance to change, targeted training and support initiatives are crucial. By equipping involved parties with the necessary skills and knowledge to adapt to new processes and technologies, organizations can facilitate smoother transitions and enhance overall relationships.

Tools such as Transform Your Small/Medium Business provide CFOs with a thorough method for handling these complexities by integrating stakeholder information management software, wellness, and data analytics into one platform. This enables continuous business performance monitoring and relationship-building through real-time analytics, operationalizing lessons learned from past experiences. Case studies show that companies prioritizing these strategies not only enhance engagement with interested parties but also attain superior financial performance.

For instance, the shift towards electronic invoicing illustrates how businesses can centralize and digitize their invoicing processes, thereby addressing data silos and enhancing management of interested parties. This exemplifies the tangible benefits of effective stakeholder information management software for interested parties. Additionally, by adopting the 'Decide & Execute' and 'Update & Adjust' strategies, CFOs can ensure that their organizations remain agile and responsive to changing circumstances, while the 'Test & Measure' approach allows for ongoing assessment and refinement of stakeholder engagement practices.

Conclusion

In conclusion, effective stakeholder information management stands as a crucial pillar for CFOs striving for sustainable growth and resilience in an ever-evolving financial landscape. By harnessing the power of advanced SIM tools and best practices, organizations position themselves to thrive amid uncertainty, transforming potential challenges into opportunities for innovation and enhanced stakeholder engagement. Now is the time for CFOs to embrace these strategies decisively, leading their organizations toward a more connected and successful future.

Frequently Asked Questions

What is stakeholder information management software?

Stakeholder information management software provides a strategic framework for financial executives to systematically identify, analyze, and engage relevant parties throughout the financial decision-making process.

Why is stakeholder engagement important as we approach 2025?

Stakeholder engagement is increasingly significant, with 58% of financial executives reporting a heightened focus on technology investments to enhance these efforts, as diverse stakeholder interests directly impact monetary strategies and outcomes.

How does effective stakeholder information management software benefit organizations?

It fosters transparency, builds trust, and encourages collaboration, which are vital for navigating challenges and achieving organizational objectives.

What role does cybersecurity play in stakeholder information management?

As demand for enhanced cybersecurity grows, effective stakeholder information management can help address cybersecurity challenges by ensuring involved parties are aware of risks and engaged in mitigation strategies.

What are some best practices in stakeholder information management software for CFOs?

Best practices include regular communication, tailored engagement strategies, and using analytics to gauge stakeholder sentiment.

How does finance automation relate to stakeholder information management?

While finance automation reduces full-time equivalent (FTE) headcount requirements, it is essential to balance efficiency with maintaining high-quality reporting.

What does the case study on understanding the discount rate in business valuation illustrate?

It highlights the importance of participant involvement in monetary decision-making by examining future cash flows and modifying them for risk.

How can financial assessments contribute to organizational financial health?

A thorough financial assessment can identify opportunities to preserve cash and reduce liabilities, supporting the overall financial health of the organization.

What advantages does stakeholder information management software offer to financial executives?

It enhances data organization, communication, and decision-making capabilities, allowing CFOs to access relevant data, track interactions, and analyze sentiments effectively.

How do AI and big data integration benefit financial planning and analysis?

The incorporation of AI and big data enables executives to manage complexities more easily, enhancing their strategic role and improving overall decision-making processes.

What is the significance of secure management of involved parties?

With 35% of business and tech executives viewing third-party breaches as a significant cyber threat, secure and efficient management of involved parties is crucial for mitigating risks and enhancing decision-making capabilities.