Introduction

Navigating the complexities of bankruptcy can be daunting for any business, yet understanding the available options is crucial for making informed decisions during financial distress. With business bankruptcies surging nearly 30% in the past year, it's more important than ever to grasp the nuances between Chapter 7 and Chapter 11 bankruptcies. Chapter 7 involves liquidating assets to satisfy creditors, often leading to closure, while Chapter 11 allows for debt reorganization, enabling continued operations.

Additionally, exploring alternatives such as debt restructuring and proactive financial management can offer less drastic solutions. Recognizing early warning signs and employing pre-bankruptcy strategies can prevent further financial deterioration. Adopting fresh-start accounting post-bankruptcy can also provide a transparent view of financial health, facilitating strategic planning and sustainable growth.

This comprehensive guide aims to equip CFOs with the practical advice and solutions needed to navigate these challenging financial waters.

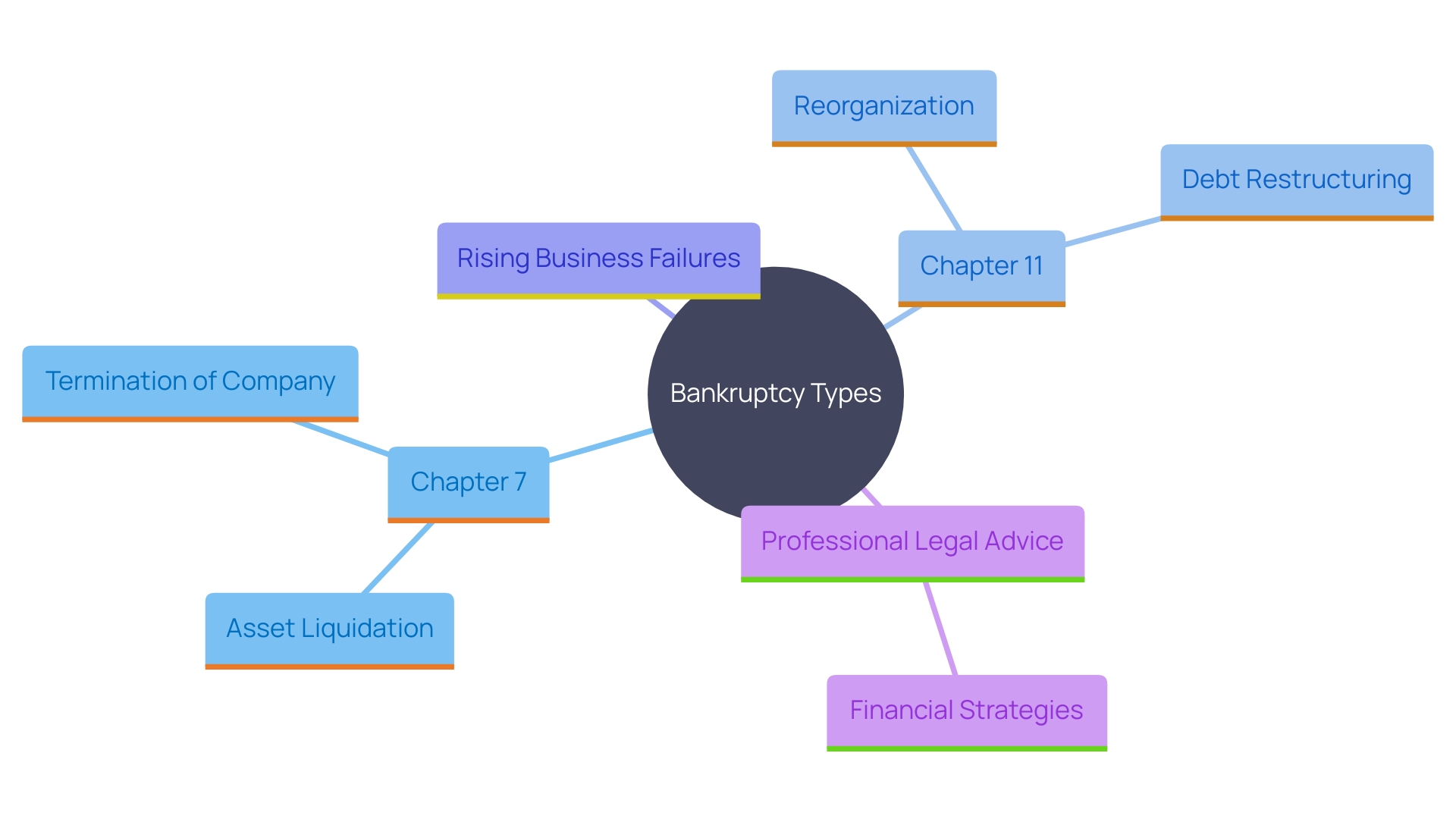

Understanding Bankruptcy Types

'Bankruptcy is an essential legal process for organizations unable to fulfill their monetary commitments.'. Grasping the nuances of different bankruptcy types is essential for navigating financial distress effectively. Section 7 emphasizes selling off assets to meet obligations to creditors, frequently resulting in the company's termination. In contrast, Chapter 11 facilitates reorganization, enabling the enterprise to continue operations while restructuring its debts. With business failures rising nearly 30% in the year ending September 30, 2023, comprehending these options is more pertinent than ever. Consulting a financial lawyer is crucial to explore all avenues and determine the most suitable path, whether refinancing, issuing stock, or considering mergers.

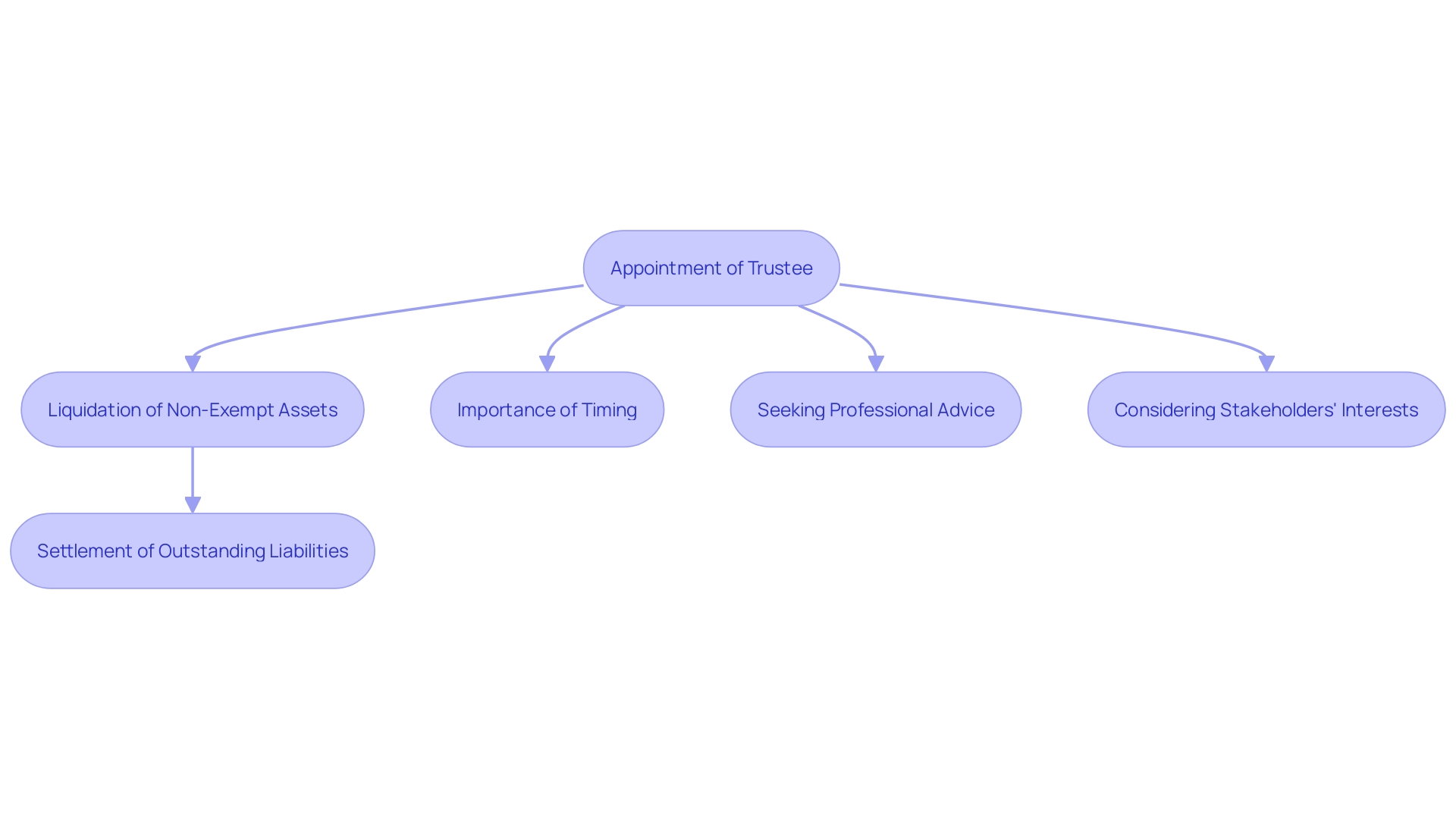

Chapter 7 Bankruptcy: Liquidation Process

'Chapter 7 insolvency, commonly known as liquidation insolvency, involves appointing a trustee to liquidate the debtor's non-exempt assets to repay creditors.'. This process aims to discharge debts entirely, offering a fresh start for owners who can no longer sustain operations. This option is particularly suitable for companies looking to close down in an orderly manner, ensuring that outstanding liabilities are settled. As stated by James Mohs, associate professor at the University of New Haven, understanding when to file for financial relief is essential, and it is recommended to seek advice from a financial lawyer to examine all alternatives before moving forward. Timing is crucial, and organizations should not wait until the last moment to seek professional assistance. The Supreme Court's recent rulings underscore the significance of taking into account all stakeholders with a monetary interest in the estate's resources, stressing the necessity for a thorough strategy for managing insolvency.

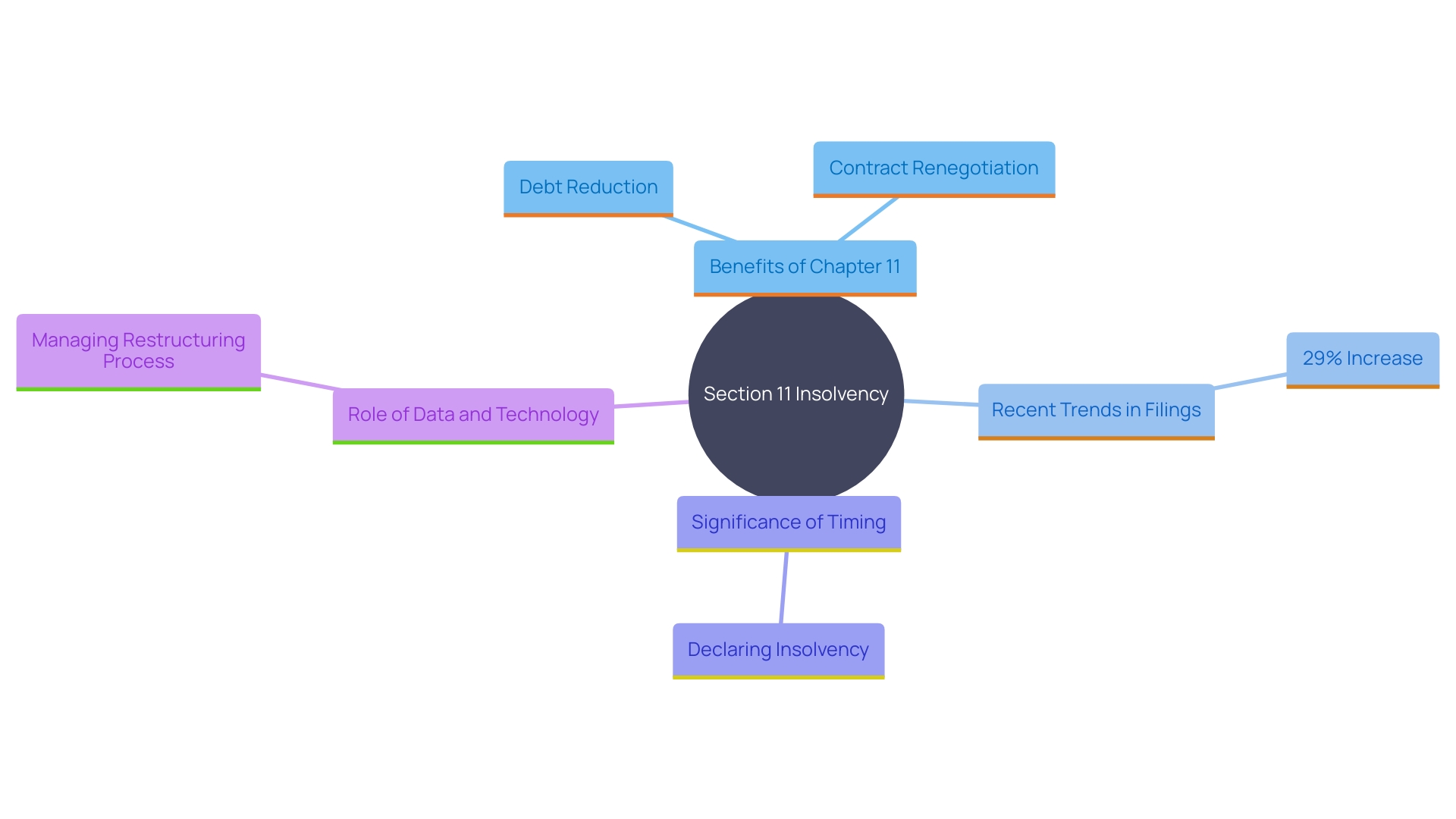

Chapter 11 Bankruptcy: Reorganization Process

Section 11 insolvency acts as an essential reorganization instrument for companies encountering monetary difficulties. This type of financial restructuring allows a company to continue its operations while reorganizing its debts under a court-approved plan. It provides an opportunity to renegotiate contracts, reduce debts, and stabilize finances, with a keen focus on future profitability.

The importance of Section 11 bankruptcy is highlighted by recent trends. According to the American Bankruptcy Institute, there has been a 29% increase in 11 filings in September 2023 compared to the same period in the previous year. This uptick indicates that many businesses are opting for restructuring rather than liquidation, a testament to the viability of Chapter 11 as a lifeline for companies.

James Mohs, an associate professor in the accounting, taxation, and law department at Pompea College of Business, emphasizes the importance of timing in declaring insolvency. The appropriate moment to announce financial insolvency is once you have utilized all your other choices,” he suggests. This sentiment highlights the careful consideration required before opting for Chapter 11, ensuring that all alternative avenues, such as refinancing or debt consolidation, have been explored.

Furthermore, the role of data and technology in managing insolvency processes cannot be overstated. Epiq Bankruptcy, a leader in this field, offers dynamic insolvency data and services, enabling enterprises to navigate the complexities of restructuring with greater efficiency and confidence. Their expertise aids in optimizing the management of insolvency issues, contributing to a more seamless and well-informed restructuring process.

In essence, Chapter 11 reorganization provides a strategic route for enterprises to navigate economic challenges, sustain operations, and strive for a more stable and profitable future.

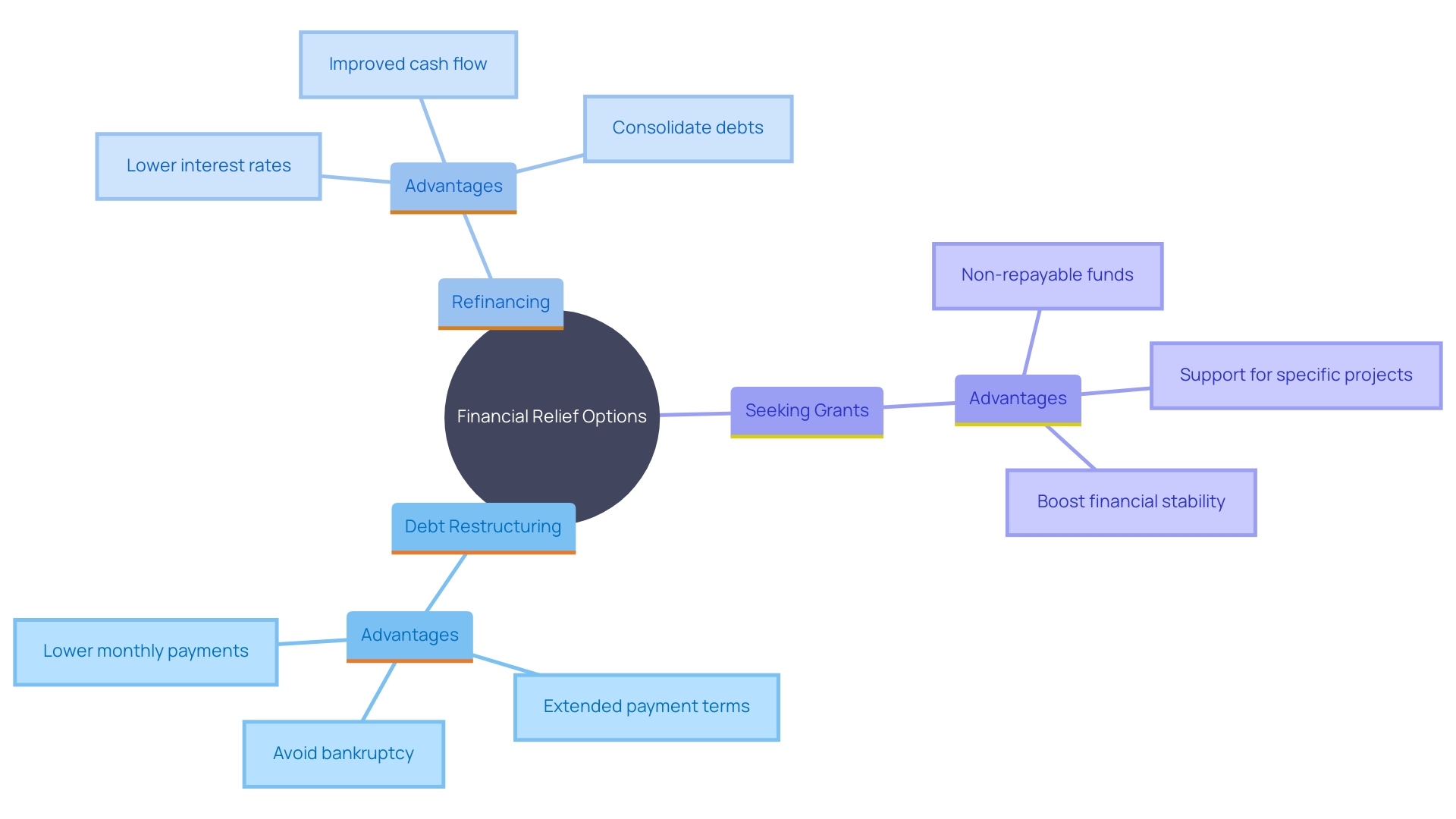

Alternatives to Bankruptcy

Before seeking financial relief, companies should investigate options that might provide a less severe resolution. Options include debt restructuring, negotiating with creditors, or seeking additional financing. Participating in proactive financial management and seeking operational efficiencies can aid in regaining stability without going through insolvency procedures. These alternatives can not only preserve the business's value but also maintain relationships with creditors and stakeholders. “The right time to declare bankruptcy is after you’ve exhausted all your other options,” said James Mohs, associate professor at the University of New Haven. Investigating options such as refinancing, issuing stock, or even contemplating a merger or sale can offer the needed economic support. Additionally, keeping a vigilant eye on grant opportunities from government entities, foundations, and corporations, particularly those focused on specific industries or initiatives, can help secure funds without adding debt. Recognizing funding opportunities that correspond with organizational objectives and committing time to comprehend the application procedure can provide lasting advantages beyond short-term monetary assistance.

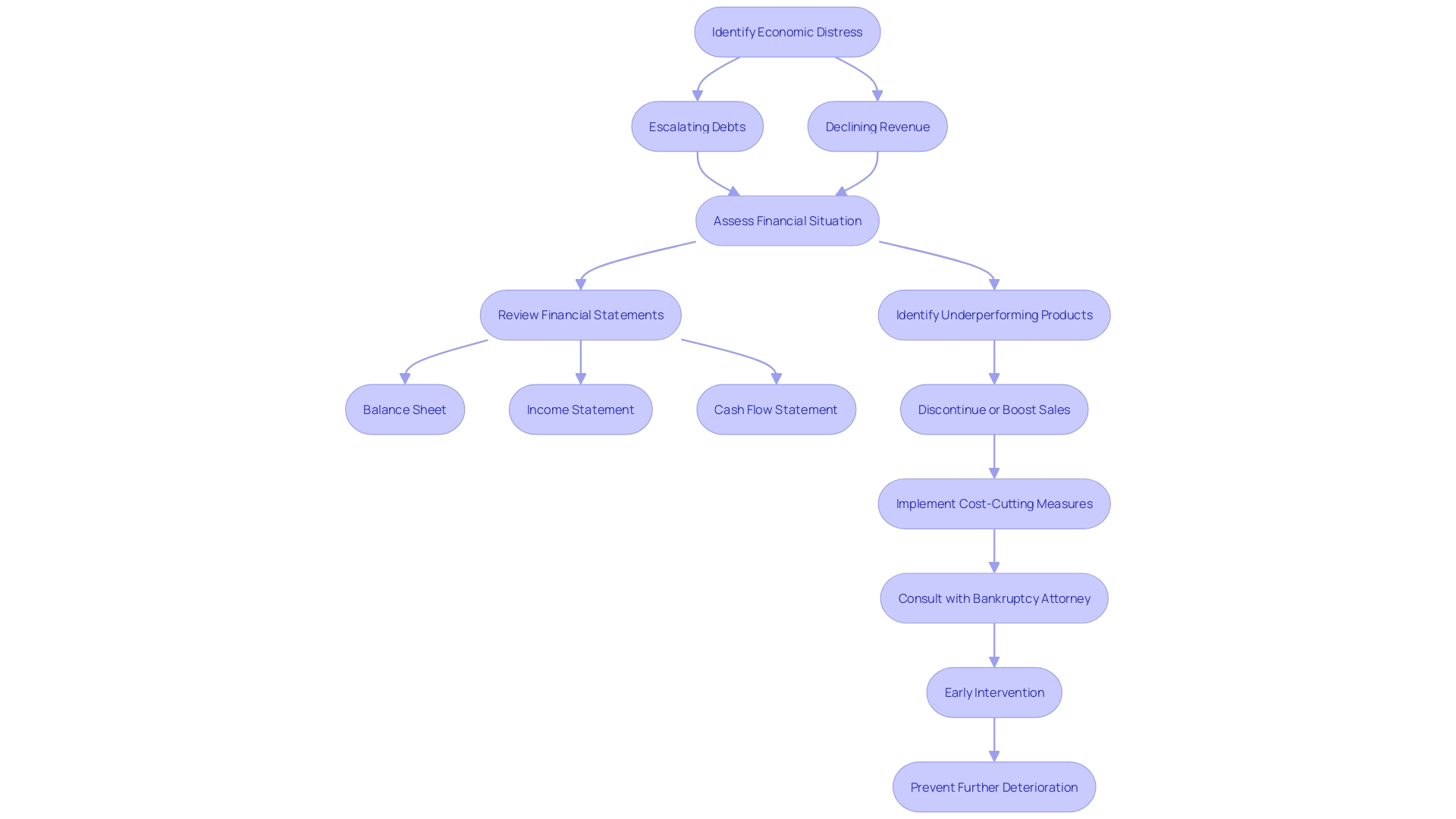

Warning Signs and Pre-Bankruptcy Strategies

'Identifying signs of economic distress early is crucial for proactive intervention.'. Key indicators include escalating debts, declining revenue, and cash flow problems. Addressing these issues promptly can prevent further deterioration. Implementing cost-cutting measures, enhancing cash flow management, and reevaluating business operations are essential strategies. For instance, a detailed monetary review may uncover underperforming products, prompting decisions to discontinue or improve them. Consulting a bankruptcy attorney early can provide valuable guidance on available options, potentially avoiding bankruptcy through refinancing, issuing stock, or exploring mergers and sales.

Fresh-Start Accounting and Business Recovery

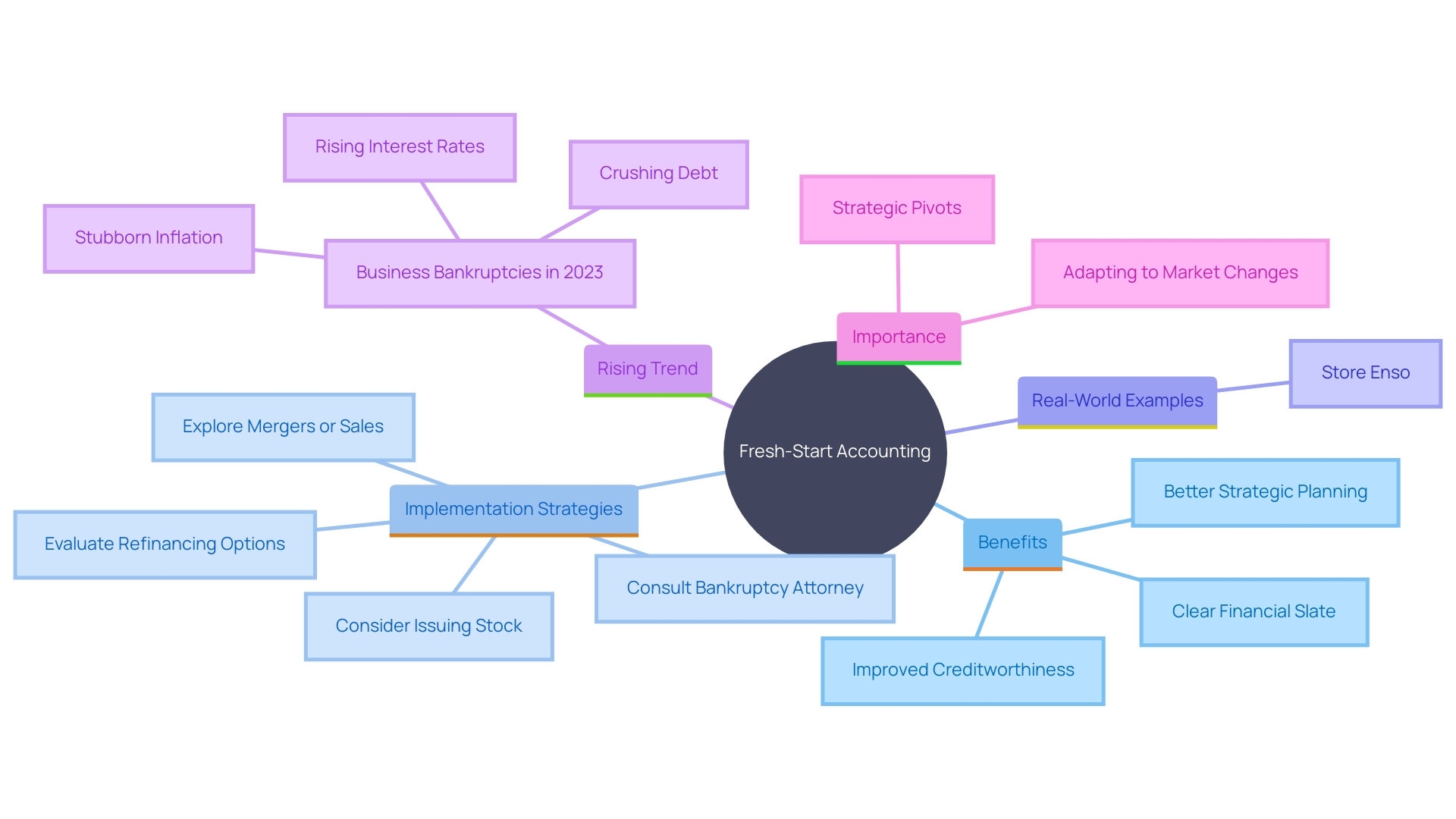

Fresh-start accounting is a strategic tool designed to provide a clear and accurate depiction of a company's economic standing post-bankruptcy. This method allows companies to reset their financial metrics, offering a transparent view of their financial health as they navigate through recovery. Implementing fresh-start accounting principles is crucial for informed decision-making and strategic planning, ultimately positioning companies for sustainable growth.

A notable example is the transformation of Store Enso, one of the world’s top five paper manufacturers. Amid declining demand for paper in the mid-2000s, Store Enso reorganized its operations and embraced a new commercial model focused on renewable materials. This pivot, driven by emerging market trends, involved significant organizational changes, including leadership overhaul and workforce reduction. By realigning its operational strategy, Stora Enso managed to restore profitability and push the frontier in the renewable materials sector, showcasing the potential of fresh-start accounting in facilitating effective restructuring and long-term growth.

In 2023, the significance of such strategic pivots was emphasized by the 30% rise in business bankruptcies, highlighting the need for strong restructuring solutions. Fresh-start accounting serves as a vital framework for companies to reestablish their financial footing and capitalize on new growth opportunities in an evolving market landscape.

Conclusion

Navigating the complexities of bankruptcy requires a thorough understanding of the options available to businesses in financial distress. Chapter 7 and Chapter 11 bankruptcies serve distinct purposes: Chapter 7 focuses on liquidating assets to settle debts, often resulting in closure, while Chapter 11 allows for reorganization, enabling businesses to continue operations while restructuring their financial obligations. With a significant rise in business bankruptcies, the importance of consulting experienced professionals cannot be overstated, as they can help determine the most appropriate course of action.

Exploring alternatives to bankruptcy can often yield less drastic solutions. Engaging in proactive financial management, negotiating with creditors, or seeking additional financing may restore stability and preserve the business's value. Recognizing early warning signs of financial distress is critical for timely intervention.

Implementing cost-cutting measures and enhancing cash flow management are essential strategies that can prevent further deterioration.

Post-bankruptcy, fresh-start accounting provides a clear framework for companies to reset their financial metrics and navigate recovery effectively. This approach fosters informed decision-making and strategic planning, positioning businesses for sustainable growth. The example of Stora Enso illustrates how a strategic pivot, supported by fresh-start accounting, can lead to renewed profitability and success in a changing market.

In summary, understanding the nuances of bankruptcy and the available alternatives is vital for CFOs facing financial challenges. By taking proactive steps and leveraging strategic tools, businesses can navigate financial distress effectively and emerge stronger.