Introduction

Navigating the complexities of insolvency and financial distress is a formidable challenge for businesses of all sizes. Early detection of financial instability through meticulous scrutiny of income statements, balance sheets, and cash flow statements is crucial for timely intervention. As recent trends in Canada indicate a significant rise in business insolvencies, the importance of proactive measures cannot be overstated.

Countries adopting out-of-court workouts (OCWs) offer a flexible alternative to the often cumbersome judicial processes, facilitating business rescue plans that preserve operations and maximize creditor repayment rates.

Identifying and addressing financial challenges is paramount. A comprehensive financial assessment, focusing on key performance indicators such as liquidity ratios and debt-to-equity ratios, is essential. Engaging stakeholders and leveraging technology can significantly enhance financial management and forecasting, mitigating common issues like delayed invoicing and poor cash flow management.

Implementing strategic measures to prevent and overcome insolvency involves diversifying revenue streams, optimizing operational costs, and enhancing cash flow management. Effective debt restructuring and a well-structured debt plan are critical in alleviating financial burdens and maintaining liquidity. Engaging professional advisors, conducting due diligence, and adopting best practices for business turnaround and recovery are vital steps in navigating financial distress.

Regular risk assessment and the implementation of a comprehensive risk management framework ensure business stability. Scenario planning and strategic long-term financial planning, emphasizing sustainable growth and operational efficiency, further position businesses for resilient and sustained success.

Understanding Insolvency and Financial Distress

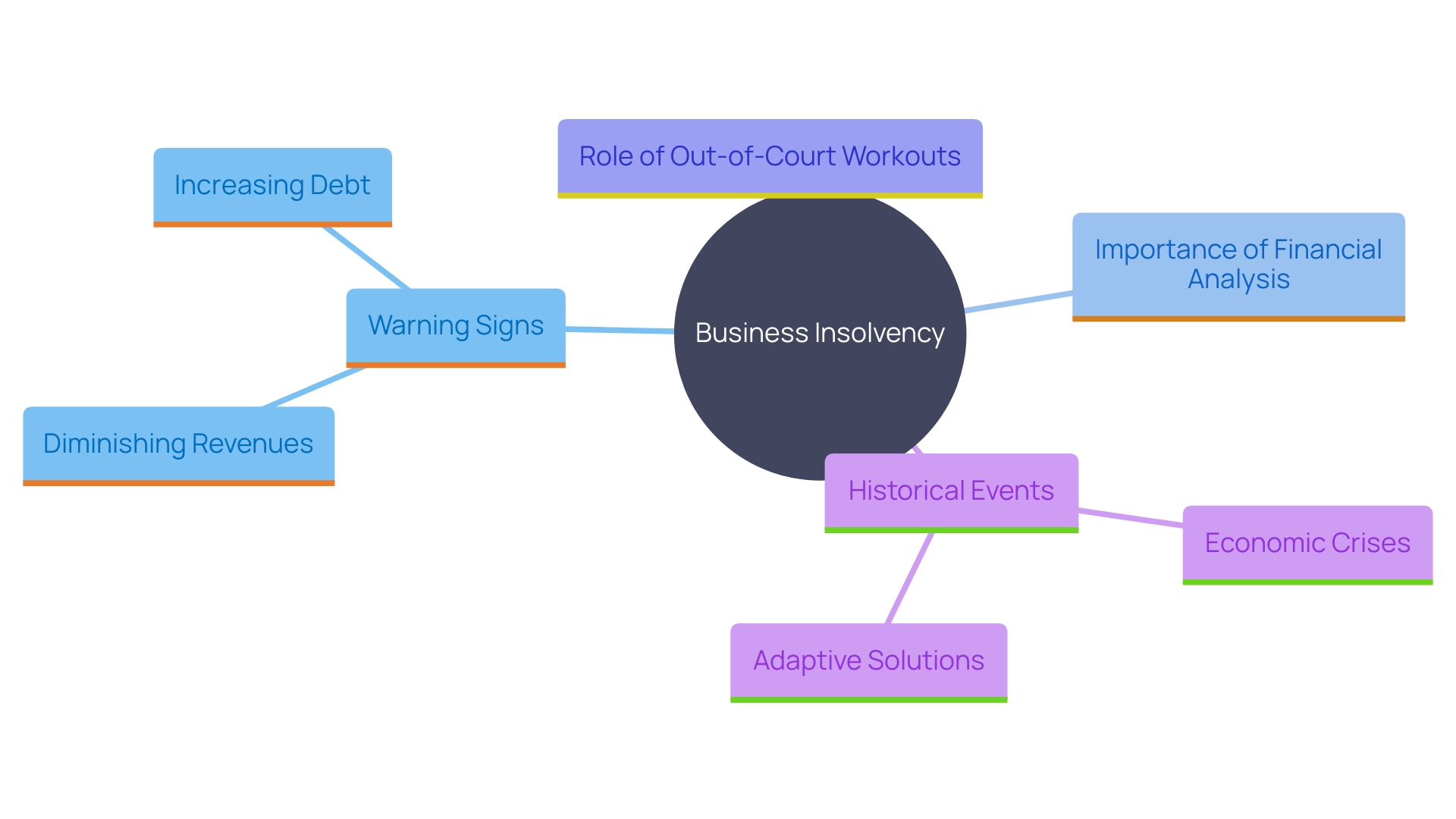

Insolvency is a critical juncture for any business, signifying an inability to meet monetary obligations and often leading to severe distress. The prompt identification of warning signs—such as diminishing revenues, increasing debt, and persistent liquidity shortages—is essential for timely intervention. Through comprehensive financial analysis, including the scrutiny of income statements, balance sheets, and cash flow statements, management can identify specific metrics and indicators that foreshadow financial instability.

'The recent surge in insolvencies in Canada, with a notable 87% increase from the same quarter last year, underscores the importance of proactive measures.'. Judicial insolvency procedures are frequently slow and costly, potentially diminishing company value or hindering efficient asset reallocation. Consequently, some countries have embraced out-of-court workouts (OCWs) as a flexible alternative. These mechanisms facilitate the negotiation of business rescue plans that maintain operations and maximize creditor repayment rates.

'Historical black swan occurrences such as the 2008 economic crash and the COVID-19 pandemic have emphasized the weaknesses in current insolvency systems.'. High indebtedness, large volumes of non-performing loans, and default risks become particularly pronounced during such crises, necessitating robust and adaptive solutions. By utilizing OCWs, enterprises can more effectively manage economic turbulence, ensuring increased entrepreneurial activity and economic resilience.

Identifying Financial Challenges

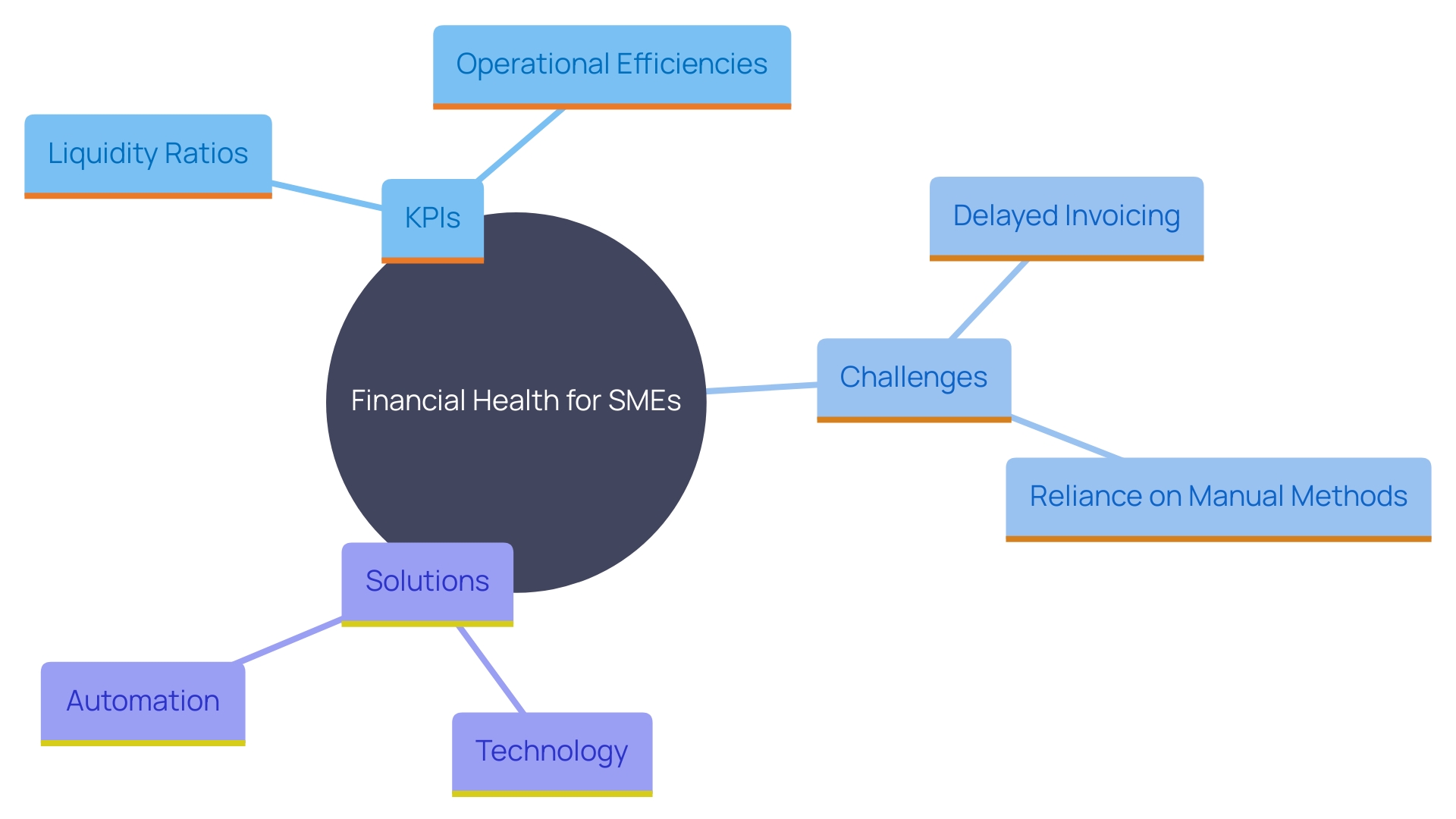

Perform a thorough monetary evaluation to pinpoint essential problems affecting liquidity, profitability, and overall economic well-being. Start by analyzing key performance indicators (KPIs) such as liquidity ratios, debt-to-equity ratios, and operational efficiencies. Considering the Canadian Western Bank's recent study, it's essential to acknowledge that almost half of small and medium-sized enterprises in areas such as agriculture, manufacturing, transportation, and professional services still depend on manual methods for financial flow management. This dependence on spreadsheets and paper documents can hinder precise tracking and forecasting of funds.

To gain a holistic view, engage with stakeholders to gather insights into market conditions and operational challenges. The majority of businesses (60%) face ongoing difficulties in managing financial flow, with common issues including delayed invoicing and payments (30%) and managing accounts receivable/payable (26%). Implementing technology and automation can not only enhance productivity (32%) and data management (30%) but also create significant efficiencies (28%), as highlighted in the study. Tackling these areas will offer a clearer view of the economic landscape and assist in identifying areas for enhancement.

Strategies for Preventing and Overcoming Insolvency

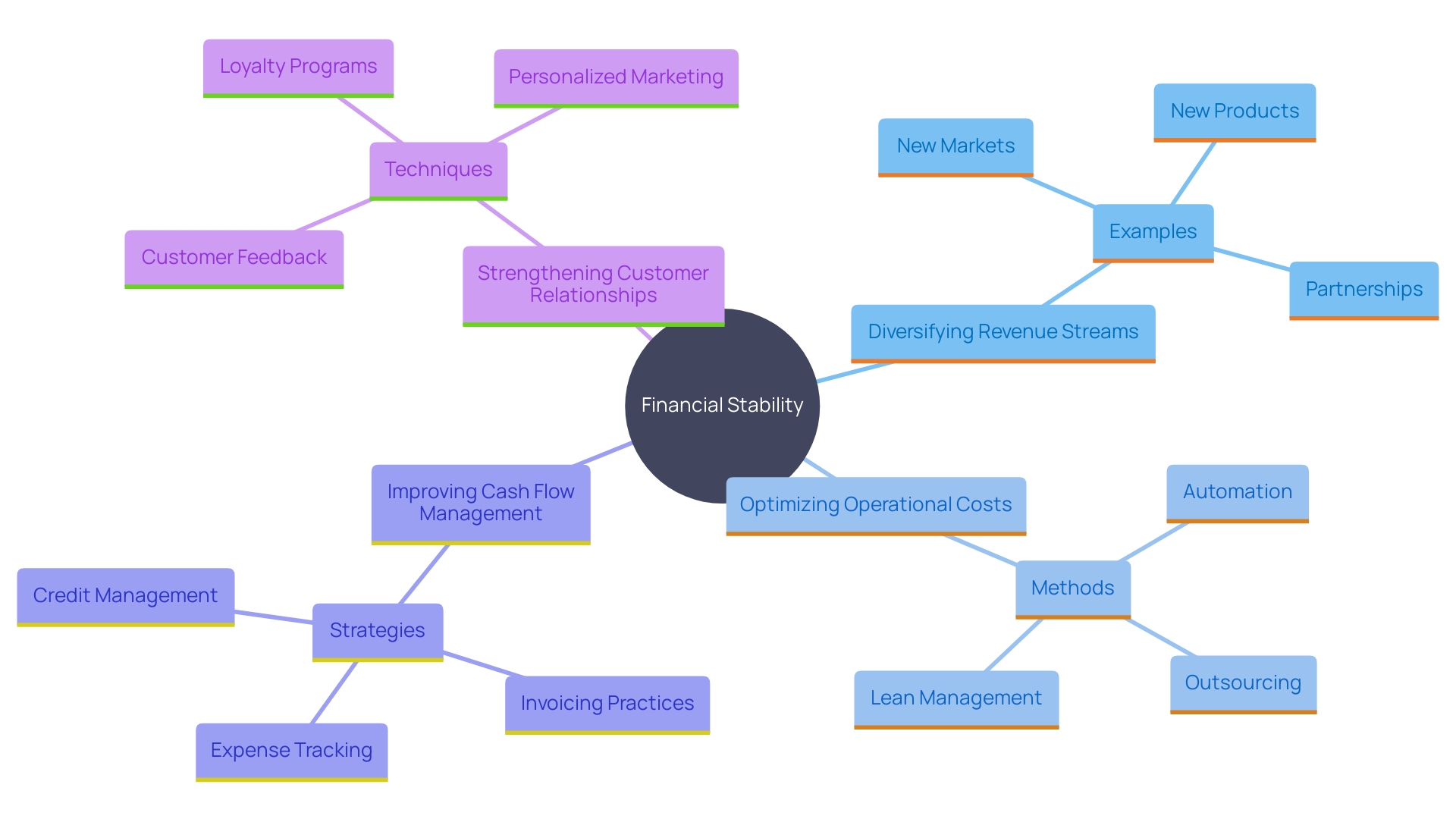

Implementing preventive measures such as diversifying revenue streams, optimizing operational costs, and enhancing cash flow management is crucial for maintaining financial stability. By broadening revenue sources, organizations can mitigate risks associated with market fluctuations. For instance, Revolut's founders, Storonsky and Yatsenko, identified unserved needs in currency exchange and international transactions, leveraging technology to create new revenue streams without hidden fees. This approach can also be applied by other businesses to minimize dependency on a single income source.

Optimizing operational costs involves scrutinizing expenses and finding efficient ways to reduce them without compromising quality. This can include adopting new technologies, like Spiff's SaaS platform, which automates commission calculations, reducing errors and saving time. Such innovations not only cut costs but also improve employee satisfaction and operational efficiency.

Improving financial flow management is another essential strategy. Developing a strong economic forecast aids in predicting future challenges and aligning resources efficiently. It entails comprehending and creating essential monetary reports, such as income statements, balance sheets, and liquidity statements. This understanding is crucial for making informed choices and persuading possible investors of the venture's economic viability.

Strengthening customer relationships can significantly impact sales and payment cycles. By concentrating on customer requirements and providing outstanding service, companies can enhance cash flow through quicker payments and returning clients. Furthermore, renegotiating conditions with lenders can offer prompt monetary assistance, enabling companies to more effectively handle short-term responsibilities while strategizing for long-term development.

These strategies, when combined, can effectively tackle monetary challenges and position enterprises for sustained success.

Debt Restructuring and Financial Management

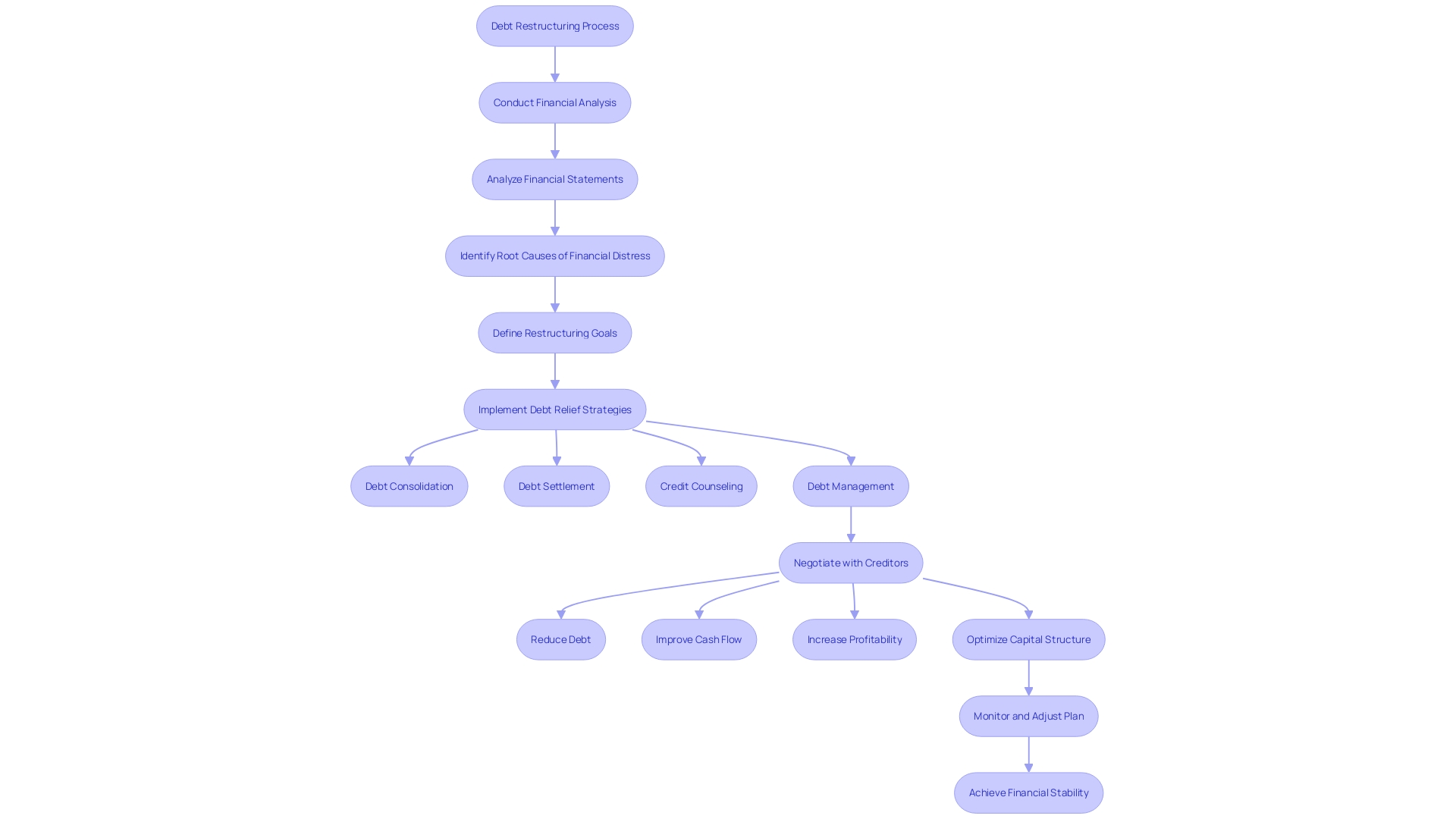

Exploring debt restructuring options can significantly alleviate financial burdens for distressed businesses. This involves negotiating lower interest rates, extending repayment terms, or converting debt to equity. Effective debt restructuring provides essential liquidity, enabling continued operations while managing liabilities more efficiently.

A well-structured debt plan is crucial. For instance, the increase in interest rates has significantly hindered access to funding, particularly for SMEs with smaller capital bases and higher risk profiles. To counteract this, organizations should implement agile credit policies and back-office automation. These strategies not only promote better credit control but also enhance financial flow management.

Frequent evaluations of liquidity projections and budgets are crucial to upholding fiscal discipline. This includes overseeing liquid resources, such as currency and easily convertible assets, to ensure adequate liquidity. By concentrating on these monetary management practices, businesses can better navigate the challenges posed by cash flow issues and enhance their economic stability.

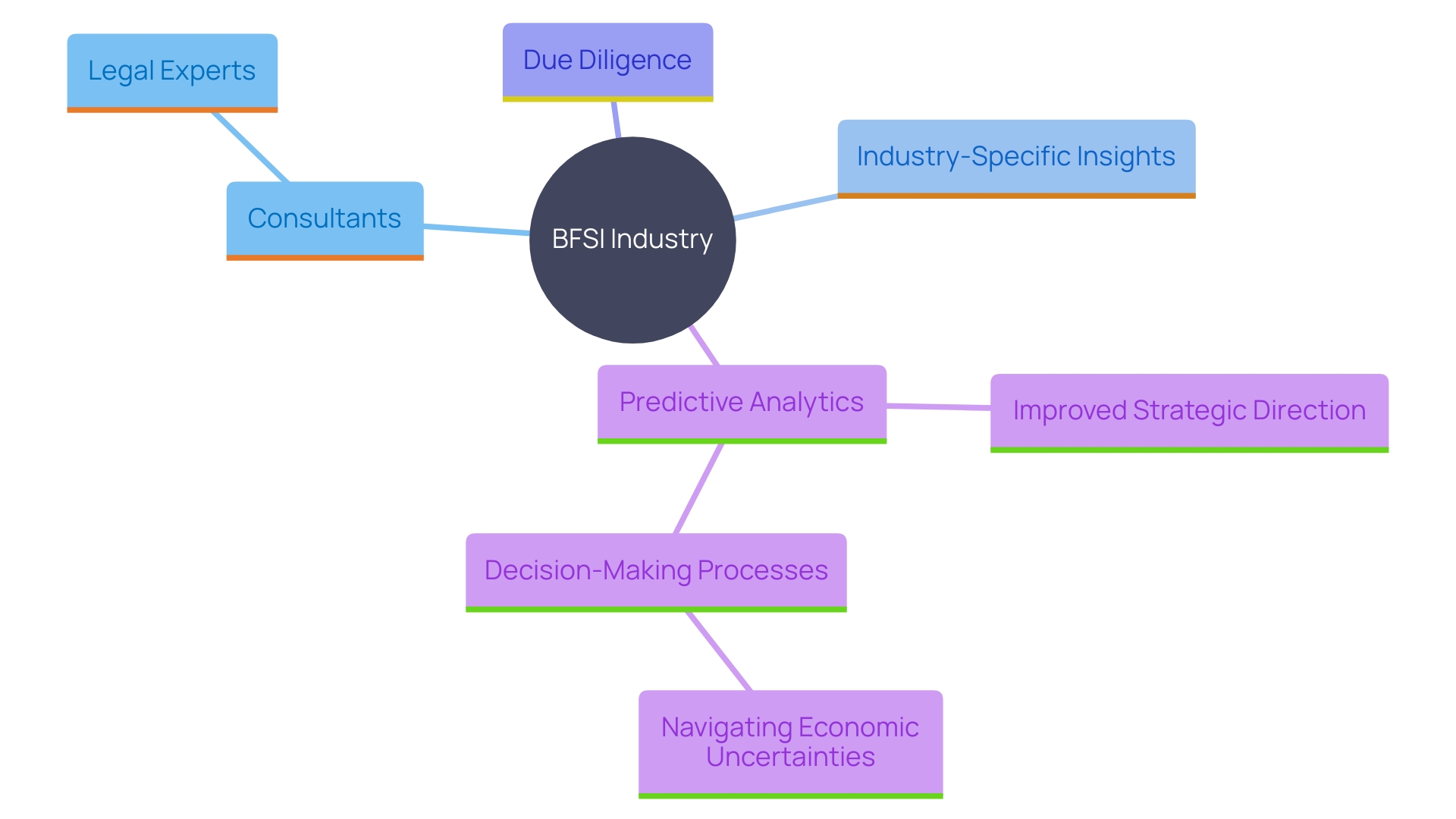

Importance of Professional Advice and Due Diligence

Involving consultants or legal experts can significantly improve your strategic direction and decision-making processes. Industry-specific specialists provide insights that are vital in navigating intricate economic landscapes. For example, Diana Cupps Law exemplifies the impact of expert advice, leveraging efficient payment solutions to optimize client service and operational outcomes. 'Carrying out thorough due diligence is vital for evaluating uncertainties and determining the optimal course of action, ensuring financial stability and growth.'. The BFSI industry's embrace of predictive analytics highlights the significance of knowledgeable decision-making, allowing organizations to foresee future results and handle uncertainties more efficiently.

Best Practices for Business Turnaround and Recovery

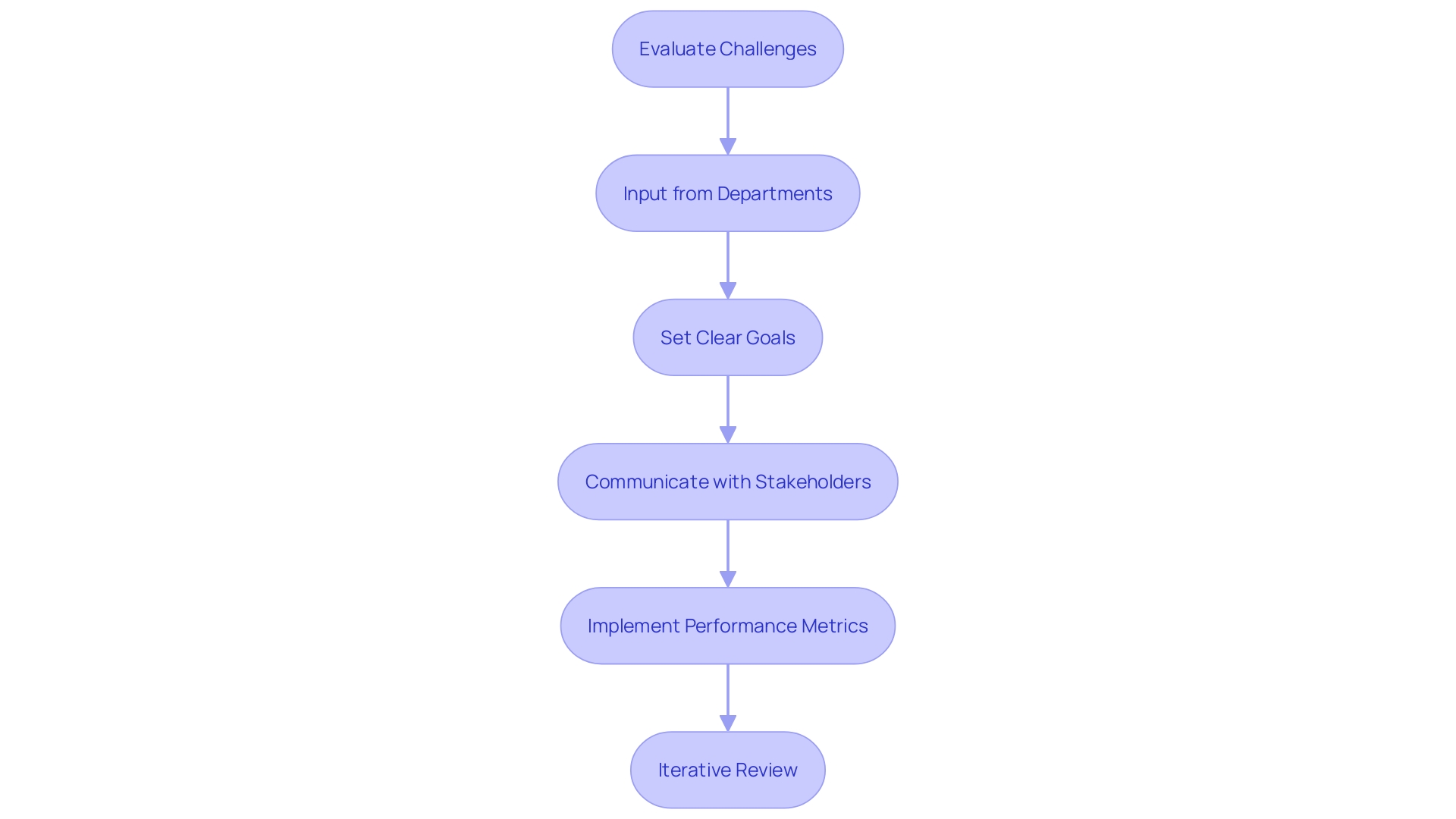

Creating a successful turnaround plan begins with a thorough evaluation of potential challenges and impact analysis. This should include input from various departments such as human resources, legal, facilities, IT, security, and finance to ensure that all potential impacts on people, facilities, legal obligations, finances, reputation, the community, and the environment are considered. Clear goals, timelines, and responsibilities must be established to provide a structured approach to recovery.

Communication is paramount; maintain transparency with employees, investors, and stakeholders to build trust and ensure everyone is informed of progress. Implementing performance metrics is essential to monitor progress and adapt strategies as necessary. A culture of accountability and agility will foster resilience, enabling the organization to respond swiftly to changing conditions.

Management should regularly review and test the turnaround plan, making improvements as needed. This iterative process ensures the plan remains relevant and effective, providing companies the best chance at sustainable recovery.

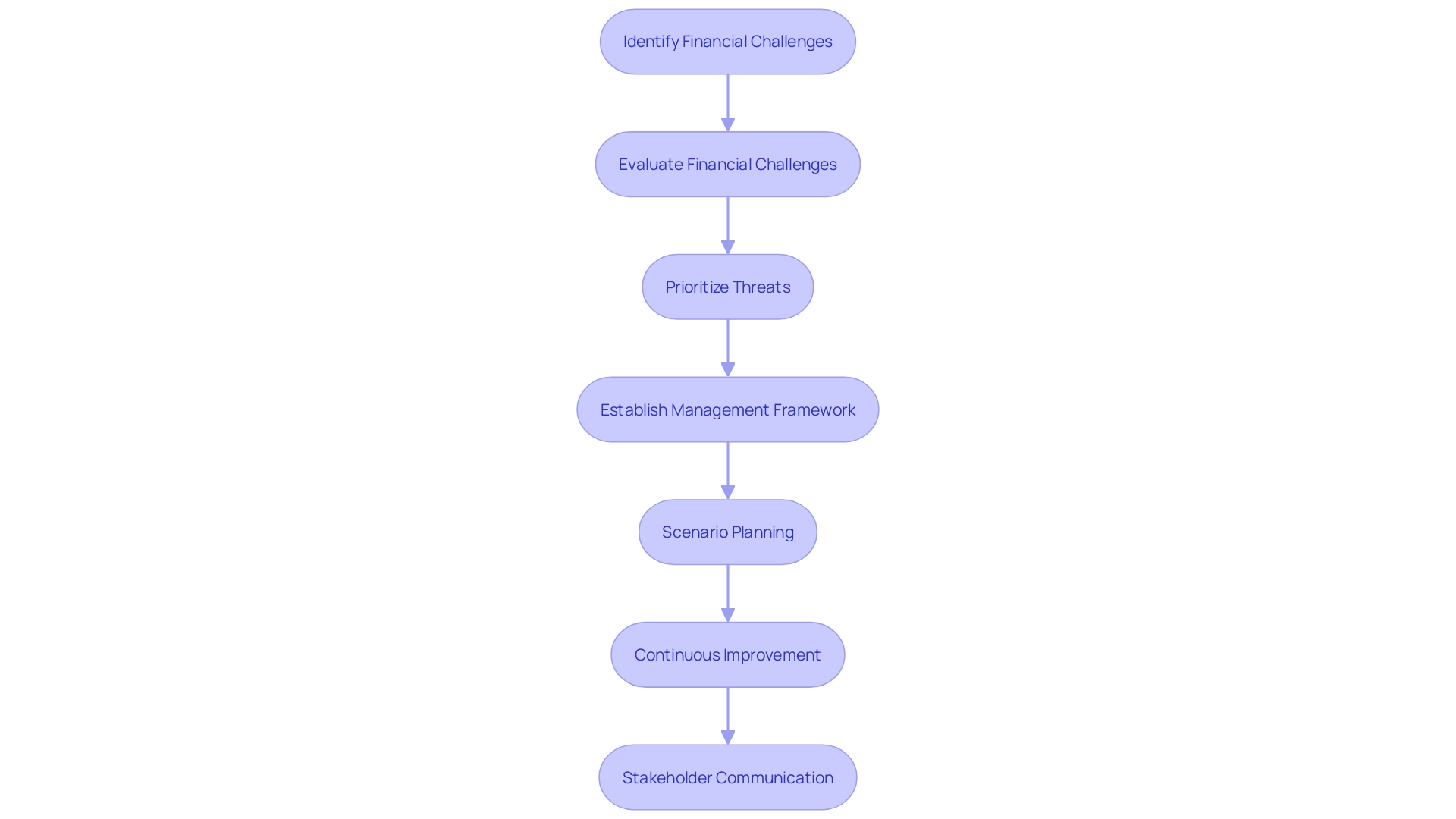

Evaluating and Mitigating Financial Risks

Consistently evaluating possible financial challenges, such as market fluctuations, regulatory changes, and credit issues, is essential for maintaining business stability. Establishing a comprehensive management framework guarantees a structured method for identifying, evaluating, and prioritizing threats. For example, the NIST Risk Management Framework (RMF), originally created for federal information systems, can be modified for any organization to incorporate security and vulnerability management into the system development life cycle. This approach not only addresses immediate threats but also emphasizes continuous improvement and stakeholder communication.

Scenario planning further aids in preparing businesses for various outcomes. By simulating different scenarios, companies can develop robust strategies that enhance their adaptability and resilience. This method is particularly relevant given the increasing complexities and uncertainties in the market, driven by globalization and technological advancements. 'Historical data indicates that as organizations expand and interconnect, the potential challenges they face, such as cybersecurity threats and supply chain disruptions, also increase.'. Therefore, adopting a systematic and transparent risk management process is crucial for minimizing negative impacts and capitalizing on opportunities.

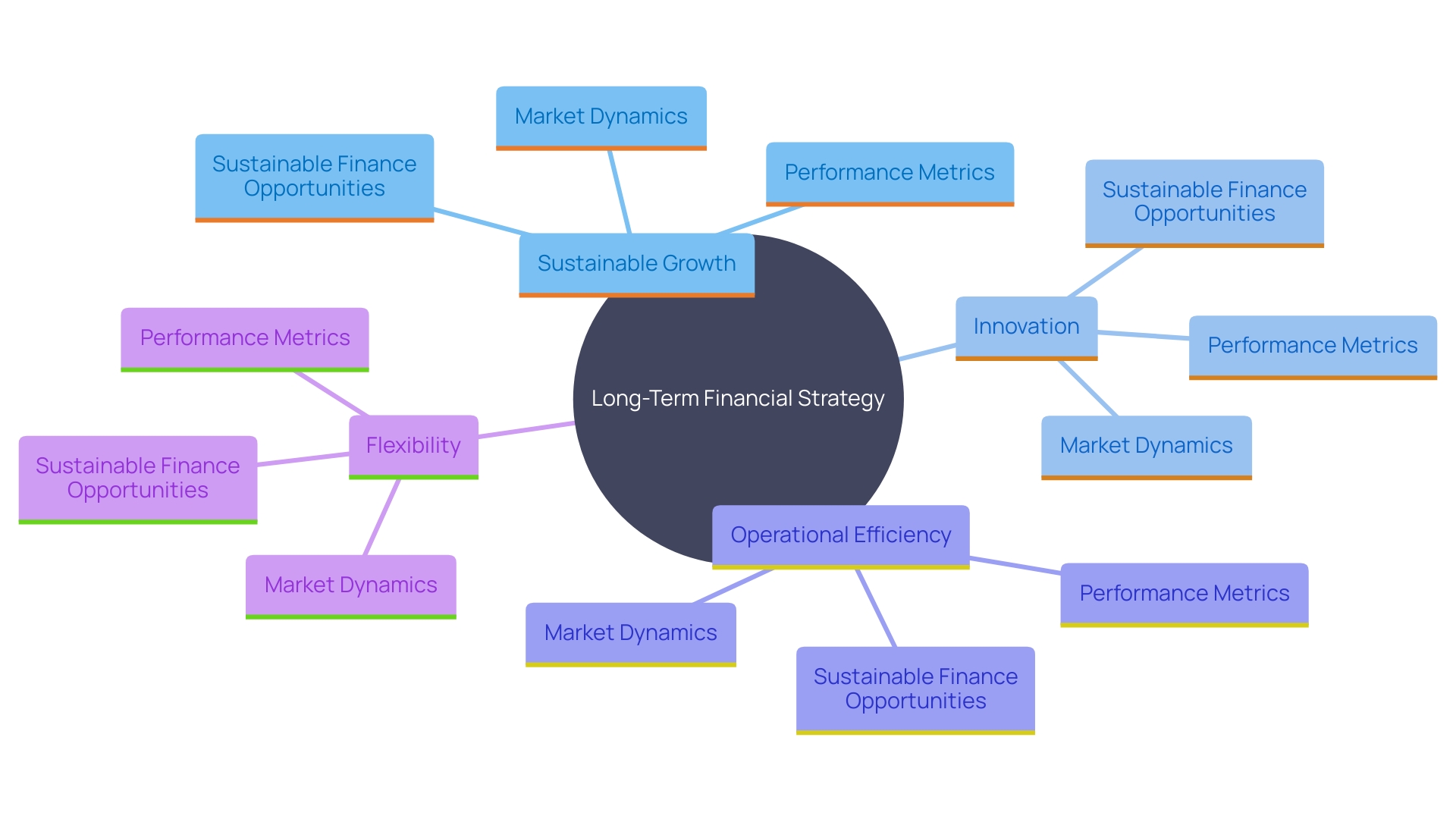

Strategic Planning for Long-Term Financial Health

Developing a comprehensive long-term financial strategy is crucial for aligning with the company's mission and adapting to market conditions. Emphasize sustainable growth, innovation, and operational efficiency as the core pillars of this strategy. According to the Fiserv Small Enterprise Index, small enterprises have demonstrated resilience in the face of changing economic conditions, emphasizing the significance of flexibility and adaptability in strategic planning. Regularly revisit and revise the strategic plan based on performance metrics and evolving market dynamics to ensure the business is not only recovering but also poised for future success. Engaging in sustainable finance opportunities and understanding the impact of financial leverage on performance can further enhance this strategy. The Denver Public Library's strategic approach, which involves collaboration and innovation, serves as a prime example of effective long-term planning and risk identification. By incorporating these elements, businesses can better position themselves for sustained growth and operational excellence.

Conclusion

Navigating insolvency and financial distress requires a proactive approach. Early detection through meticulous analysis of financial statements is crucial, especially given the rising business insolvencies in Canada. Measures like out-of-court workouts (OCWs) can help preserve operations and facilitate effective negotiations.

Identifying financial challenges is key to recovery. Engaging stakeholders and utilizing technology enhances cash flow management and operational efficiencies. Addressing issues such as delayed invoicing and optimizing costs can create a clearer financial picture.

Implementing strategies like diversifying revenue streams and effective debt restructuring can alleviate financial burdens while ensuring liquidity. Regular cash flow forecasts and budget reviews are essential for maintaining financial discipline.

Engaging professional advisors and conducting thorough due diligence improve decision-making processes. Best practices for turnaround and recovery, including risk assessments and transparent communication, align all stakeholders and foster resilience.

A robust long-term financial strategy focused on sustainable growth is vital for success. By integrating innovative practices and continuously evaluating performance metrics, businesses can navigate uncertainties and seize new opportunities, ultimately enhancing financial stability and resilience.