Introduction

Pro Forma Analysis is a sophisticated forecasting tool that goes beyond financial statement preparation. It anticipates a company's fiscal health by considering hypothetical scenarios, providing strategic advantages in sectors like banking and real estate. This analysis complements technical analysis and serves as a cornerstone in understanding industry trends.

Crafting accurate pro forma statements involves a deep dive into revenue forecasts, expense projections, tax considerations, and the true value of a project. The process of creating pro forma financial statements requires meticulous collection and examination of historical financial data. In real estate, pro forma analysis plays a crucial role in investment decisions, projecting income potential and assessing financial viability.

Calculating Pro Forma Net Operating Income (NOI) is essential for gauging the financial health of real estate investments. CFOs can utilize additional metrics such as Capitalization Rate, Return on Investment, and Cash-on-Cash Return for a comprehensive assessment. Case studies demonstrate the versatility and necessity of pro forma analysis in various sectors.

However, there are common challenges in pro forma analysis, including data accuracy, assumption validity, regulatory changes, and adapting to external factors. Businesses should leverage insights from diverse sectors to enhance the robustness of their pro forma analyses and ensure resilience.

What is Pro Forma Analysis?

Pro Forma Analysis surpasses mere statement preparation; it's a sophisticated forecasting tool that anticipates a company's fiscal health by considering hypothetical scenarios. This method is particularly crucial in sectors like banking, where firms like M&T Bank, steeped in a 165-year history, must navigate the intricacies of digital transformation and stringent regulatory demands. For such institutions, Pro Forma Analysis offers a strategic advantage, ensuring software investments meet quality standards while remaining cost-effective and compliant.

The real estate industry, too, reaps benefits from Pro Forma Analysis as exemplified by Fifth Dimension Ai's revolutionary product, Ellie. It liberates professionals from mundane tasks, allowing for an amplified focus on impactful, value-driven work. This tool mirrors the essence of Pro Forma Analysis by enabling real estate professionals to efficiently forecast and plan with precision, driving industry advancement.

Furthermore, technical assessment, a fundamental element of finance, depends on market data to forecast future security prices. Pro Forma Analysis complements this by providing the foresight needed for robust monetary planning and decision-making. It's not just a retrospective look at financials but a forward-thinking strategy that aligns with the fundamental building blocks of finance.

The significance of Pro Forma Analysis is also evident in the shifting business analysis landscape. As the Global State of Business Analysis Report indicates, understanding industry trends and adopting a data-driven approach is indispensable. Pro Forma Analysis serves as a cornerstone in this context, offering insights that keep businesses ahead in a competitive global market.

In essence, Pro Forma Analysis acts as a navigational compass for businesses, guiding them through the complexities of forecasting and strategic planning to ensure sustainable growth and operational excellence.

Types of Pro Forma Financial Statements

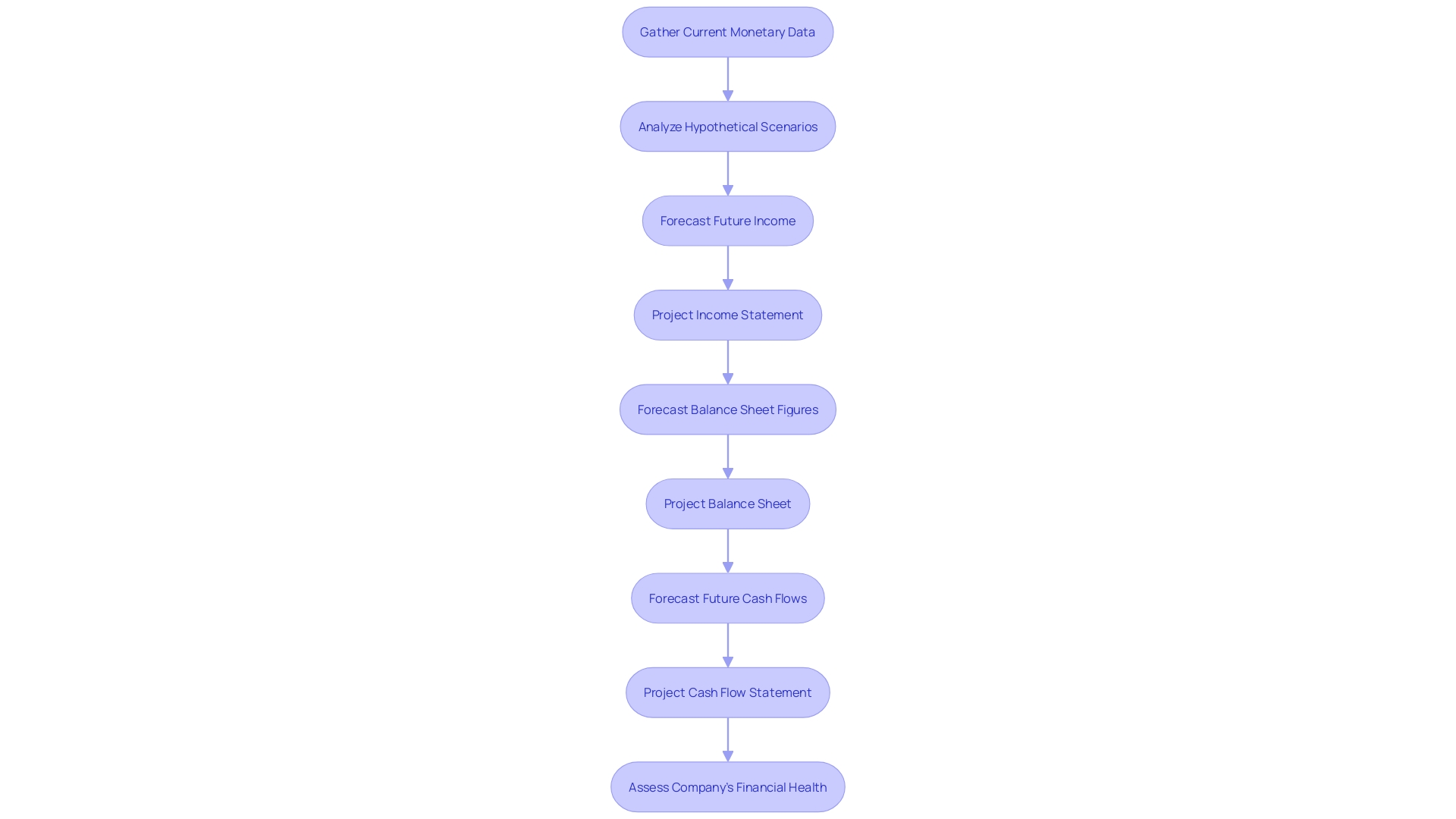

Projected statements are future-oriented reports that businesses use to anticipate future performance. The compilation of these statements takes into account both current monetary data and hypothetical scenarios, enabling companies to forecast future income, balance sheet figures, and cash flows. There are three pivotal projected statements: the income statement, which forecasts profitability; the balance sheet, which provides a projected snapshot of assets, liabilities, and equity; and the cash flow statement, which estimates the flow of cash into and out of the business. Each plays a crucial role in assessing the health of a company, allowing stakeholders to make informed decisions about the company's ability to generate cash, sustain operations, and meet obligations.

Components of a Pro Forma Statement

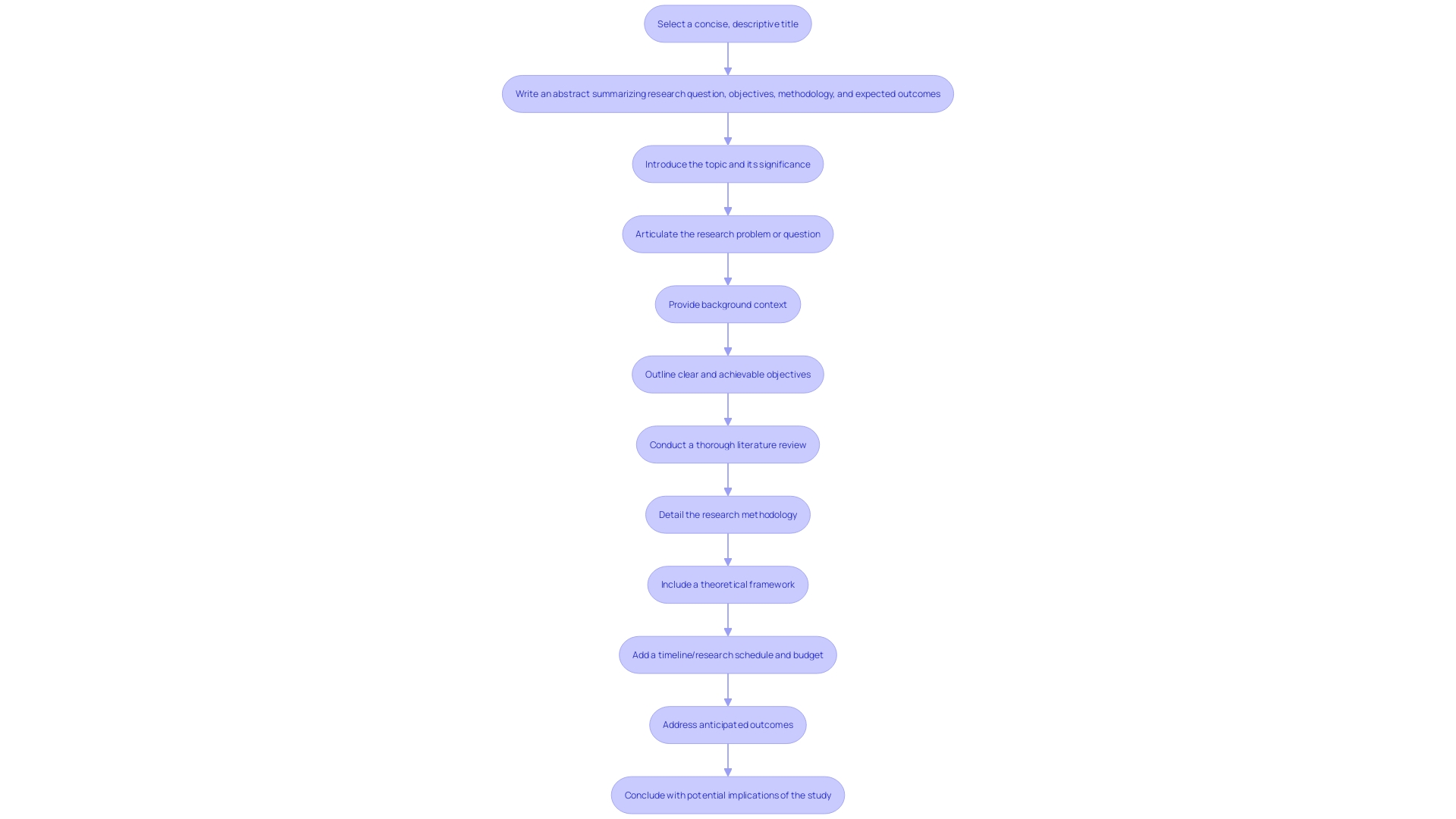

Creating a precise statement is a complex procedure, necessitating a detailed examination of the monetary subtleties of a business. A pro forma statement is not just a document; it's a strategic blueprint that outlines a company's trajectory. It begins with a detailed revenue forecast, hinged on historical performance, market dynamics, and calculated growth expectations. A rigorous analysis of sales, pricing strategies, and market conditions lays the groundwork for revenue estimates. These can be approached from different angles: applying a consistent growth rate, assessing expected units sold against average unit price, or gauging market share against the overall market size.

Following revenue predictions, projecting expenses is the next critical step. It's not just about the cost of goods sold or operating expenses; it's about capturing the entirety of expected outlays that underpin the business's operations. This includes making prudent assumptions and adjustments to navigate the unpredictability of market forces, incorporating capital expenditures to support growth, and understanding the implications of financing activities.

Tax considerations also play a pivotal role. They are not an afterthought but a strategic element that can influence business decisions and investment strategies. With the Sec's evolving definitions and rules, such as the recently adopted clarifications on who qualifies as a dealer under the Securities Exchange Act of 1934, it's imperative to stay abreast of regulatory changes and understand their impact on projections.

To capture the real worth of a project, a projected statement must also consider non-monetary contributions and postponements, guaranteeing a comprehensive perspective of the business's economic well-being and support systems. This all-encompassing methodology for generating projected statements is vital in mapping out a path for sustainable growth and economic stability.

Steps to Create Pro Forma Financial Statements

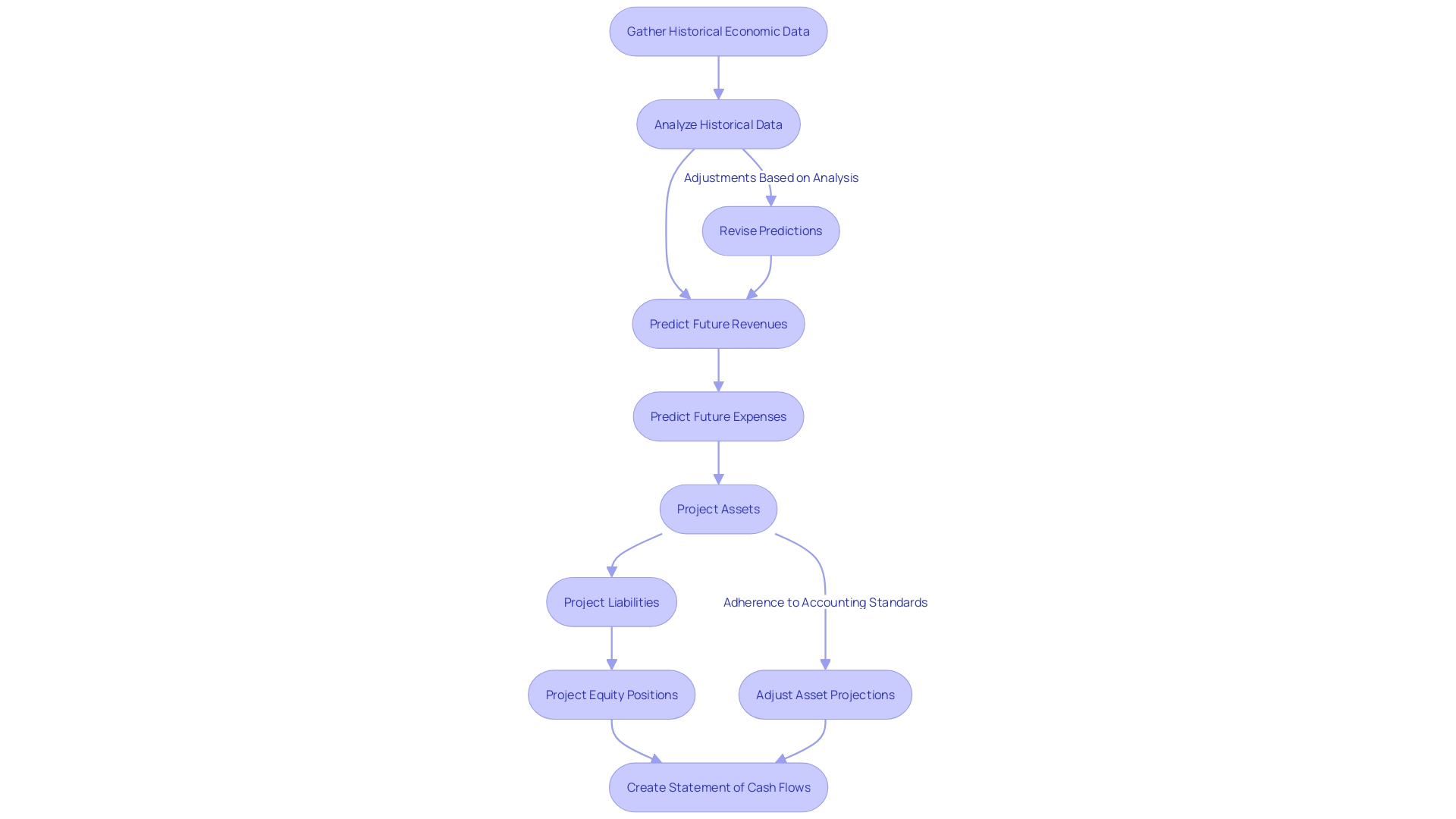

When creating pro forma statements, the procedure is careful and aimed at providing accurate and reliable predictions of a company's monetary path. It begins with the meticulous gathering and analysis of historical economic data to assess past performance patterns. This historical analysis is crucial as it lays the groundwork for informed assumptions and adjustments that will shape future monetary projections.

The creation of a projected income statement is the next crucial stage, where future revenues and expenses are predicted to anticipate profitability. This is followed by the projection of a company's assets, liabilities, and equity positions to create the projected balance sheet, which provides a snapshot of the company's standing at a future point in time.

Especially crucial is the statement of cash flow. It systematically tracks cash movements — operational inflows to investment-related outflows — revealing whether a business is sufficiently self-funding or dependent on external financing. It's a report that speaks volumes about a company's liquidity management and operational efficiency, as well as its overall health.

Considering the recent implementation of IFRS 18 by the International Accounting Standards Board, replacing IAS 1 and aiming to enhance the communication of monetary information, the assessment and improvement of pro forma statements have never been more important. This new standard emphasizes the importance of presenting clear and comparable economic data, especially in profit or loss statements and notes, to facilitate better stakeholder evaluation.

As emphasized in our collection of 15 report examples, these documents, guided by strict accounting standards, are essential in providing a clear view of a company's performance, from sales and operating expenses to accounts receivable and payable. As the main accountant of the SEC recently emphasized, the dedication to professional skepticism and audit quality is essential, whether it's in assessing management's judgment or in examining reports for accuracy and reliability.

The creation of pro forma statements is not merely a practice in prediction; it serves as a strategic tool for conveying a company's financial narrative, empowering stakeholders to make well-informed decisions. Every statement, from the cash flow details to the equity changes, contributes to a comprehensive narrative of monetary foresight and planning.

Pro Forma Analysis in Real Estate

The strategic implementation of Pro Forma Analysis in real estate investment decisions is not just about number crunching; it's about diving deep into the potential of a property and the intricacies of the market. In a landscape where 77% of home buyers in the U.S. conduct inspections before finalizing a purchase, and where the real estate software market is projected to experience a robust CAGR of 13.7% during the forecast period, investors must utilize projected financial statements to navigate through complex investment terrains.

'Projected income statements and cash flow projections are essential tools for predicting rental income, operational expenditures, and financing overheads.'. They provide a realistic glimpse into the expected ROI, serving as a roadmap that illustrates how a property is poised to perform financially over time. This foresight is particularly valuable when considering the dynamic nature of customer preferences, such as the escalating demand for properties with convenient access to amenities and eco-friendly attributes.

Case studies such as the acquisition of Akiya properties in Chiba Prefecture, Japan, underscore the need for careful planning and assessment. Potential investors, such as the American customer looking for a retreat in the Japanese countryside, depend on comprehensive projections to grasp the complete extent of their endeavors, from primary expenses like the ¥220,000 search charge to long-term predictions.

As the real estate industry evolves with technological advancements like tokenization, which is forecasted to grow from a market revenue of US$ 3.8 Billion in 2024 to US$ 26 Billion by 2034, the role of pro forma analysis becomes increasingly vital. It not only captures the essence of a deal but also adapts to the changing tides of the market, ensuring investors can make informed decisions that align with their overarching business strategies.

Calculating Pro Forma Net Operating Income (NOI)

Pro Forma Net Operating Income (NOI) plays a pivotal role in assessing the economic health of real estate investments. It projects a property's income potential by considering gross rental income and then subtracting the operating expenses—these are costs essential to keeping the property functional and compliant but do not include financing or tax expenses. For real estate professionals, understanding and optimizing Pro Forma NOI is crucial. It's more than just a measure of profitability; it's a key indicator of a property's capacity to generate steady cash flow, which is the lifeblood of any real estate investment. A strong understanding of this metric allows investors to make strategic decisions on purchasing, maintaining, and selling properties with a clear picture of the anticipated returns.

Analysts and investors alike scrutinize Pro Forma NOI closely, as it directly impacts investment decisions and the asset's valuation. With the advent of technologies like artificial intelligence, the process of calculating and maximizing NOI can be significantly streamlined, allowing for more precise and less resource-intensive management. AI-driven tools can now automate the manual tasks associated with NOI calculations, giving real estate professionals a substantial competitive edge. By improving their comprehension of Pro Forma NOI and utilizing advanced tools for analysis, investors can more effectively navigate the complexities of the real estate market and achieve their investment objectives.

Additional Metrics in Pro Forma Analysis

Examining the economic performance of businesses and investments extends beyond just looking at the Pro Forma Net Operating Income (NOI). A comprehensive assessment involves a suite of metrics, each providing a unique perspective on an investment's health and potential.

- Capitalization Rate (Cap Rate): This metric is integral to real estate investment, reflecting the potential rate of return based on a property's income. It's a barometer for the investment's profitability and a key figure for comparing different real estate opportunities.

- Return on Investment (ROI): Calculating ROI is fundamental for any investment, representing the profitability as a percentage of the original investment. It's a clear indicator of an investment's success or failure, guiding strategic decision-making.

- Cash-on-Cash Return (CoC Return): For real estate investors, the CoC Return measures the cash income earned on the cash invested in a property. It provides information on the investment's liquidity and cash flow, which are crucial for short-term planning.

Incorporating these metrics into pro forma analysis provides CFOs with a more nuanced understanding of investment viability. For example, a proptech company such as Smartblocks.Agency, which specializes in the tokenization of real estate, equity, and debt, utilizes these metrics to assess and communicate the appeal of their innovative digital real estate tokens. As technology continues to revolutionize real estate investment through advanced analytics and blockchain applications, understanding and applying these indicators become even more pivotal.

The real estate market has seen notable growth, influenced by customer preferences for convenience and sustainability, technological advancements, and favorable government policies. Metrics like Cap Rate, ROI, and Coc Return become essential tools in navigating this evolving landscape, ensuring investments are sound and align with long-term financial goals. These metrics enable CFOs to compare traditional real estate investments with cutting-edge proptech opportunities, ensuring their organization remains at the forefront of industry innovation.

Case Studies of Successful Use Cases

Exploring real-life examples provides a valuable insight into how pro forma examination benefits and impacts business tactics. These illustrative examples demonstrate the flexibility and importance of pro forma evaluation in different sectors. For example, the courier industry's transparent pricing strategies demonstrate the function of pro forma in clarifying costs and highlighting disparities, thereby assisting in strategic decision-making. Furthermore, the competitive environment of AI advancement in cutting-edge laboratories demonstrates pro forma assessment as a technique for evaluating risk and getting ready for challenges specific to the industry.

Real estate technology, like the AI tool 'Ellie' developed by Fifth Dimension AI, is transforming the industry by simplifying routine tasks, which is a result of meticulous analysis. The tool's impact, as described by Dr. Kate Jarvis and Johnny Morris, emphasizes the efficiency gains and the elevated professional satisfaction derived from eliminating repetitive work. These terms mirror the broader application of pro forma examination in enhancing productivity and strategic foresight.

The importance of documenting critical use cases is underscored by the UML specification, which defines use cases as essential for grasping system requirements. This principle is reflected in how pro forma evaluation is used to simulate economic scenarios and anticipate operational results. The software industry's inclination to overlook established solutions in the pursuit of innovation serves as a reminder of the lasting worth of proven methodologies like preliminary assessment in overcoming persistent problems.

In the field of money management, the search for steadiness amidst changes in rules and regulations uncovers a foundational technique in maneuvering adherence and reducing uncertainty. This is clear in the financial sector's dependence on tax insurance products to protect against IRS challenges, emphasizing the strategic role of projected assessment in financial planning and risk management.

Finally, the insights of the Global State of Business Analysis Report into industry trends and the transformative effect of Business Data Analytics illustrate the increasing relevance of pro formal examination in data-driven decision-making. As the industry progresses, pro forma assessment remains essential in interpreting the current state and preparing for future challenges, ensuring business resilience and success.

Common Challenges and Considerations in Pro Forma Analysis

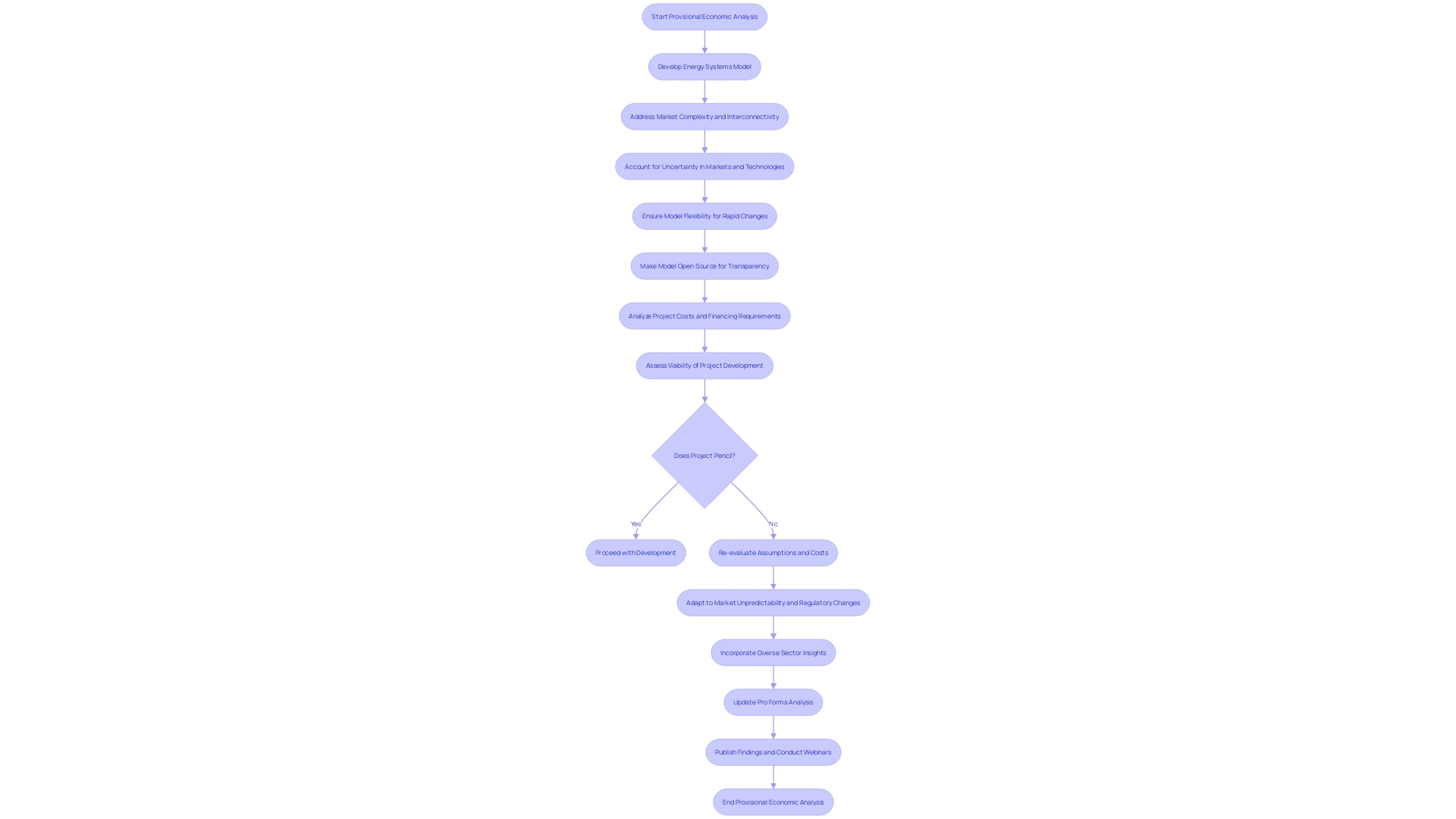

Provisional economic analysis, while a potent tool for envisioning future monetary scenarios, involves navigating a complex landscape where data accuracy and assumption validity are paramount. The challenges are multifaceted: from the unpredictability of market conditions—which can swiftly nullify even the most meticulous forecasts—to the inherent limitations of projecting future outcomes with precision. Businesses must maintain a vigilant approach, adapting to economic fluctuations, regulatory shifts, and evolving industry trends to uphold the integrity of their pro forma projections.

Take, for example, the recent overhaul of reporting standards by the IASB with the introduction of IFRS 18. This development underscores the critical nature of staying abreast with regulatory changes that can significantly impact statements. Likewise, the Sec's recent regulations on the characterization of 'dealer' emphasize the significance of regulatory adherence, which may have wide-ranging impact on a company's monetary operations.

Moreover, the ability to predict and adjust to external factors is not merely a strategic advantage—it's a survival skill. This was evidenced by Germany's energy crisis following geopolitical upheaval, where the country's reliance on a single energy source led to significant policy and economic repercussions. The lesson here is clear: thorough and flexible planning is crucial for enduring unforeseen challenges.

Businesses should also be mindful of the complexities involved in obtaining transparent pricing information, as seen in the courier industry, where obtaining a straightforward quote can be a convoluted process. This parallels the requirement for precise and accurate monetary forecasting. The pursuit of reassurance and reliability in financial projections is akin to consumers' desire for confirmation after an online booking—both reflect the need for certainty in the face of pending transactions.

To navigate these challenges successfully, companies are encouraged to leverage insights from diverse sectors, such as those provided by energy market dynamics and investor feedback on climate data credibility. By integrating these broader perspectives, businesses can enhance the robustness of their pro forma analysis, ensuring they are not only informed but also resilient in the face of adversity.

Conclusion

In conclusion, Pro Forma Analysis is a powerful tool that goes beyond financial statement preparation. It provides strategic advantages in sectors like banking and real estate by anticipating a company's fiscal health through hypothetical scenarios. This analysis complements technical analysis and serves as a cornerstone in understanding industry trends.

Crafting accurate pro forma statements involves a deep dive into revenue forecasts, expense projections, tax considerations, and the true value of a project. It is essential to collect and examine historical financial data meticulously. In real estate, pro forma analysis plays a crucial role in investment decisions, projecting income potential and assessing financial viability.

Calculating Pro Forma Net Operating Income (NOI) is essential for gauging the financial health of real estate investments. CFOs can utilize additional metrics such as Capitalization Rate, Return on Investment, and Cash-on-Cash Return for a comprehensive assessment. These metrics provide a nuanced understanding of investment viability and help navigate the complexities of the real estate market.

Pro forma analysis also faces common challenges, including data accuracy, assumption validity, regulatory changes, and adapting to external factors. To overcome these challenges, businesses should leverage insights from diverse sectors to enhance the robustness of their pro forma analyses and ensure resilience.

Overall, Pro Forma Analysis empowers CFOs to make well-informed decisions and take strategic actions. By leveraging this tool and considering additional metrics, CFOs can navigate complex financial landscapes, anticipate future scenarios, and drive sustainable growth and operational excellence.