Introduction

Forensic accounting is a powerful tool that plays a crucial role in uncovering financial mysteries and protecting businesses and individuals from fraudulent activities. Through real-world case studies, we will explore the impact of forensic accountants in various scenarios, from detecting fraudulent transactions in small businesses to tracing hidden assets in divorce settlements and investigating financial discrepancies in corporate mergers. These stories shed light on the invaluable expertise of forensic accountants in unraveling complex financial landscapes, providing clarity and justice in the face of financial deceit.

Join us as we delve into the world of forensic accounting and discover the pivotal role it plays in safeguarding financial integrity.

Case Study 1: Uncovering Fraudulent Transactions in a Small Business

Forensic accounting is an invaluable tool for small businesses, as it provides the means to detect and prevent fraudulent activities that could threaten their financial health. The case of a small manufacturing company that faced unexplained profit declines, despite consistent sales, serves as a testament to the effectiveness of forensic accountancy.

The business, suspecting foul play, enlisted forensic accountants who embarked on a meticulous examination of financial records and transactional data. Their probe included looking for anomalies such as unexplained expenses and duplicate payments. Interviews with key personnel and evaluations of internal controls were conducted to find potential security lapses.

Their diligent investigation paid off when they uncovered a series of fraudulent transactions. It was revealed that an employee had been siphoning funds by issuing fraudulent invoices from non-existent vendors. The findings were thoroughly documented, paving the way for legal repercussions and the termination of the dishonest employee.

The collaborative efforts of various departments highlighted by the Justice Department's Criminal Division and the U.S. Attorney's Office, alongside multiple agencies, underscore the seriousness with which such cases are treated. The case exemplifies the necessity for vigilance, particularly in times of crisis, to safeguard the interests of small business owners. It also sends a clear message that the authorities are committed to prosecuting financial fraud, as emphasized by the Special Agent in Charge of the FBI's Seattle field office, Richard A. Collodi, in relation to a separate but relevant case.

In an environment where only a quarter of small businesses survive beyond 15 years, and with over 33.2 million small businesses operating in the United States alone, the role of forensic accountants is more crucial than ever. They not only help in identifying and resolving fraud but also fortify businesses against potential threats, ensuring their longevity and sustained contribution to the economy.

Case Study 2: Tracing Hidden Assets in a Divorce Settlement

Forensic accountants are invaluable in divorce proceedings, especially when it involves complex financial landscapes and the potential concealment of assets. A case in point involved a lengthy marriage where one partner had accumulated significant wealth through business ventures. As the relationship dissolved after over a quarter of a century, suspicions arose that not all assets were disclosed—prompting the intervention of forensic accountants.

The financial intricacies of the couple included a mix of retirement accounts, cash savings, and investments totaling millions. The accountants, through meticulous scrutiny of financial records and interviews, unveiled hidden offshore accounts, real estate, and investments veiled under various names. This evidence was critical in adjusting the settlement to accurately reflect the couple's true financial standing.

Cryptocurrency, an increasingly common asset in today's financial portfolios, adds another layer of complexity to such investigations. With millions now investing in this digital currency, it becomes a significant factor to consider during financial analysis in divorce cases. The fluid value of businesses and digital assets like cryptocurrency necessitates professional valuation, which can be costly but is essential for an equitable settlement.

Recent guidelines suggest a collaborative approach where a single joint expert may provide evidence on particular financial issues, promoting efficiency and cost-effectiveness in proceedings. Additionally, individuals are advised to seek counsel from a range of professionals, including matrimonial attorneys, accountants, and financial advisors before finalizing any divorce settlement to ensure all aspects are thoroughly considered.

The lessons drawn from such cases emphasize the importance of transparency and the need for expert financial analysis to protect individual interests and ensure fair outcomes. As personal and business finances become increasingly intertwined, the role of forensic accounting in legal proceedings such as divorce becomes ever more critical.

Case Study 3: Investigating Financial Discrepancies in a Corporate Merger

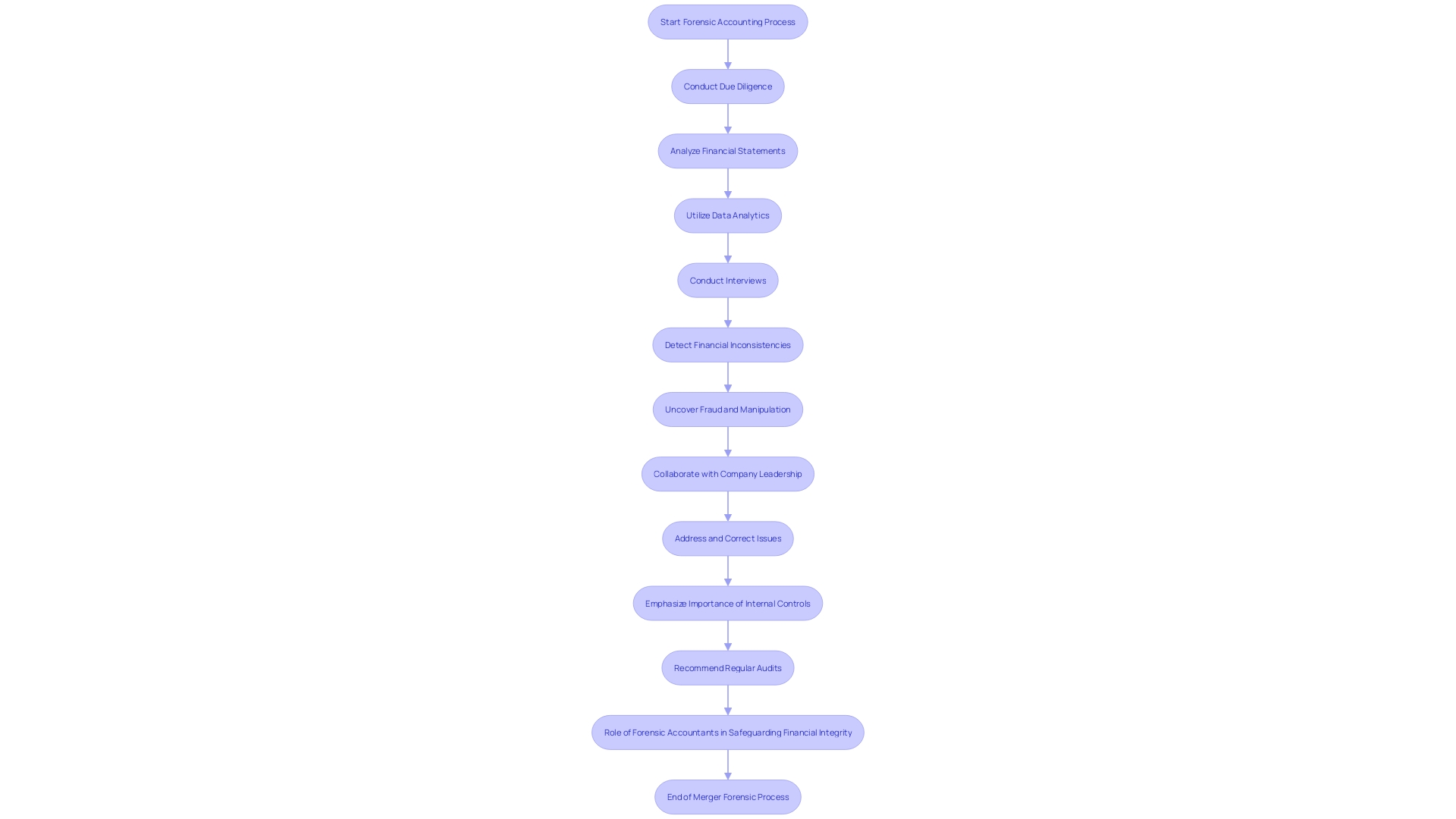

In a strategic merger between two prominent firms aiming to fortify their market presence, the discovery of financial inconsistencies threatened to undermine the entire process. Engaging forensic accountants became crucial when due diligence exposed discrepancies that cast doubts on the financial statements' veracity. These accounting specialists embarked on an exhaustive analysis, scrutinizing every aspect of the company's financials, from revenue and expense reports to intricate financial metrics. They utilized advanced data analytics and conducted in-depth interviews with essential personnel to unearth the roots of the irregularities.

The investigation's outcome was revealing. The forensic team uncovered inflated revenue numbers, liabilities that were not fully disclosed, and hidden related-party transactions. These red flags pointed towards possible fraud and manipulation of financial records. To address these issues, the forensic accountants collaborated with the companies' leadership, facilitating the correction of these financial misstatements and advocating for transparency in the merger process. They stressed the importance of robust internal controls and the necessity of regular audits to avert future discrepancies.

This real-world scenario underscores the critical role that forensic accountants play in safeguarding the integrity of financial information in corporate mergers. Their financial acuity and investigative prowess are invaluable for detecting and resolving financial anomalies, thus protecting the interests of stakeholders and maintaining the merger's integrity.

As the business landscape evolves, with fraud schemes growing in complexity and financial data becoming more voluminous and intricate, the expertise of forensic accountants is increasingly paramount. Their ability to navigate through the intricacies of tax issues across multiple jurisdictions, manage GST and indirect taxes, and advise on transfer pricing makes them indispensable in today's data-driven economy. Their proficiency ensures that businesses can confidently engage in mergers and acquisitions, backed by a thorough understanding of financial complexities and equipped with strategies to mitigate risk.

Real-World Examples of Forensic Accounting Success

Forensic accounting stands at the forefront of combating financial deceptions, with its efficacy underscored by numerous high-profile cases. Take for instance the notorious Enron scandal; forensic accountants were pivotal in demystifying the elaborate deceit, navigating through the maze of complex transactions to spotlight the malpractices. Similarly, in the infamous Bernie Madoff Ponzi scheme, it was the forensic accountants who, through diligent scrutiny of the investment records and financial assessments, unveiled the scheme, aiding in the restitution for the victims.

In another striking case, WorldCom's financial statement manipulations were uncovered thanks to forensic accountants who meticulously traced the fraudulent entries and the flow of funds. These instances not only demonstrate the essential role of forensic accounting in fraud detection and investigation but also their significant contribution to restoring faith in financial systems.

The impact of forensic accounting is not limited to just these notorious examples. Recent developments include the sophisticated use of software solutions like Chainalysis by specialized law firms to handle intricate cryptocurrency-related cases, ensuring transparency and maintaining client trust through efficient process streamlining. Moreover, academic contributions such as Dr. Weber's research at the Eastern Shore of the Chesapeake Bay shed light on why individuals commit financial misconduct in the workplace, thus furthering our understanding of the profile of a typical fraudster.

The methods used to detect fraud are evolving as well, with the 2024 Report to the Nations highlighting the growing reliance on technology and data analytics. This report also underscores the significance of effective anti-fraud controls, pointing out that more than half of occupational frauds occur due to inadequate internal controls or their override.

These examples and data not only exhibit the critical function of forensic accounting in safeguarding financial integrity but also emphasize the need for continuous vigilance and the adoption of advanced technologies to stay ahead in the fight against financial fraud.

The Role of Forensic Accountants in Solving Financial Mysteries

Forensic accountants are the sherlocks of the financial world, unraveling the enigmas of financial records with a blend of accounting prowess and investigative savvy. Their role is multifaceted and impactful, providing clarity in the maze of numbers and transactions.

Forensic accountants are at the forefront of fraud detection and prevention. They possess a deep understanding of accounting principles coupled with sharp investigative skills. By spotting irregularities and patterns that suggest fraudulent activity, they can implement strong internal controls and conduct thorough audits to safeguard organizations.

When it comes to financial analysis, these experts shine brightly. They delve into the complexities of financial data, wielding advanced analytics tools to detect inconsistencies and unearth hidden patterns, offering crucial insights into financial conundrums.

The investigation is another area where forensic accountants excel. They meticulously gather evidence, conduct interviews, and analyze financial data to construct a strong case against fraudulent activities. Their diligence in documenting and presenting evidence is key in legal contexts, often turning the tide in financial disputes.

Moreover, forensic accountants frequently serve as expert witnesses in court, elucidating complex financial issues with authority and clarity. Their expertise lends credibility to legal proceedings and can be pivotal in resolving financial disputes.

Real-world cases like the Post Office's Horizon software debacle, where faulty systems led to wrongful accusations of fraud, highlight the critical need for forensic accounting expertise. Similarly, Dr. Weber's work with students in investigating financial misconduct demonstrates the field's evolving approach, incorporating technology and data analytics to combat financial crime.

The evolving landscape of forensic accounting is further emphasized by the increasing role of technology in fraud detection, as reported in the 2024 Report to the Nations. With over half of occupational frauds arising from inadequate or overridden internal controls, the importance of robust anti-fraud measures is clearer than ever.

In summary, forensic accountants are vital in preserving financial integrity. Their specialized skills in analysis and investigation make them the unsung heroes in the fight against financial fraud, ensuring protection against significant financial losses for organizations and individuals alike.

Conclusion

Forensic accounting is a powerful tool in uncovering financial mysteries and protecting against fraud. Through real-world case studies, we have seen the invaluable impact of forensic accountants in various scenarios. They detect and prevent fraudulent transactions in small businesses, trace hidden assets in divorce settlements, and investigate financial discrepancies in corporate mergers.

Real-world examples like the Enron scandal, Bernie Madoff Ponzi scheme, and WorldCom's financial manipulations highlight the essential role of forensic accounting in combatting financial deceptions. Forensic accountants are the sherlocks of the financial world, providing clarity in complex financial landscapes. Their expertise in financial analysis, investigation, and serving as expert witnesses is crucial in resolving disputes and preserving financial integrity.

As the business landscape evolves, the expertise of forensic accountants is increasingly paramount. They navigate through intricate financial data, utilize advanced technologies, and implement robust anti-fraud measures. Their role is vital in protecting against significant financial losses and ensuring transparency.

In summary, forensic accountants are the unsung heroes in the fight against financial fraud. They provide practical advice and solutions, safeguarding financial integrity for organizations and individuals. Their expertise is crucial for detecting and preventing fraud, resolving disputes, and maintaining trust in financial systems.

With their skills and dedication, forensic accountants play a pivotal role in preserving financial integrity and justice.