Introduction

In the realm of business and construction restructuring, the first stride towards recovery for organizations grappling with financial challenges is a meticulous and strategic assessment. This critical phase involves a granular analysis of financial records to pinpoint the core issues impeding success. It's a collaborative effort where consultants and the company's leadership amalgamate their expertise to scrutinize past performance and spotlight prospects for advancement.

Such was the case with a digital technology assessment in the healthcare sector, where an initial evaluation of the requested technology's security, suitability, and compliance was paramount. By delving into the existing technological arsenal, they often unearthed pre-existing solutions, negating the need for new acquisitions. This approach mirrors the thoroughness required in financial restructuring, where fully understanding the current arsenal of assets and liabilities is crucial before plotting a new course.

Moreover, recent news from UpHealth's bankruptcy proceedings underscores the importance of forward-looking statements that hinge on careful analysis and realistic assumptions about the company's future. This level of scrutiny is akin to the assessment stage in restructuring, where every potential risk and opportunity must be weighed with precision.

The analytical process is further bolstered by the insights of seasoned professionals who advocate for a historical review over hypothetical scenarios. Past performance and concrete experiences are the bedrock upon which viable restructuring strategies are built. In the end, the goal is to chart a path forward that is both viable and sustainable, leveraging past insights and current data to steer troubled businesses towards a prosperous horizon.

This involves not just a detailed assessment but also the strategic application of that knowledge to foster recovery and growth.

Assessment and Diagnosis

In the realm of business and construction restructuring, the first stride towards recovery for organizations grappling with financial challenges is a meticulous and strategic assessment. This critical phase involves a granular analysis of financial records to pinpoint the core issues impeding success. It's a collaborative effort where consultants and the company's leadership amalgamate their expertise to scrutinize past performance and spotlight prospects for advancement.

Such was the case with a digital technology assessment in the healthcare sector, where an initial evaluation of the requested technology's security, suitability, and compliance was paramount. By delving into the existing technological arsenal, they often unearthed pre-existing solutions, negating the need for new acquisitions. This approach mirrors the thoroughness required in financial restructuring, where fully understanding the current arsenal of assets and liabilities is crucial before plotting a new course.

Moreover, recent news from UpHealth's bankruptcy proceedings underscores the importance of forward-looking statements that hinge on careful analysis and realistic assumptions about the company's future. This level of scrutiny is akin to the assessment stage in restructuring, where every potential risk and opportunity must be weighed with precision.

The analytical process is further bolstered by the insights of seasoned professionals who advocate for a historical review over hypothetical scenarios. Past performance and concrete experiences are the bedrock upon which viable restructuring strategies are built. For instance, a behavior analyst's decade-long clinical experience was instrumental in enhancing technological solutions for coordinated care, echoing the sentiment that historical mastery informs future triumphs.

In the end, the goal is to chart a path forward that is both viable and sustainable, leveraging past insights and current data to steer troubled businesses towards a prosperous horizon. This involves not just a detailed assessment but also the strategic application of that knowledge to foster recovery and growth.

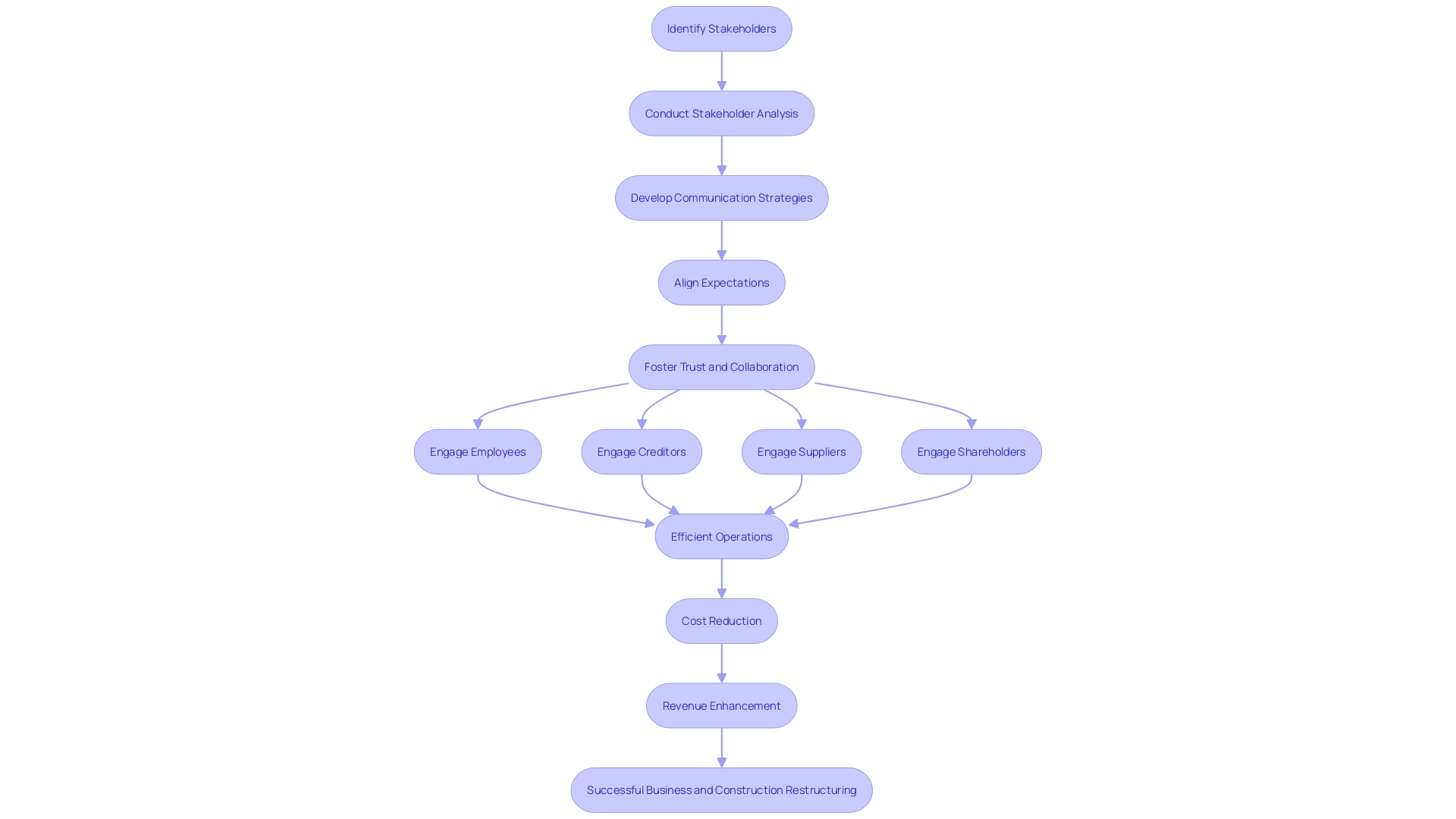

Stakeholder Engagement

A cornerstone of successful business and construction restructuring is the strategic engagement of stakeholders—a lesson underscored by the achievements of top turnaround consulting firms. These consultants excel in orchestrating communication strategies that bring together the interests of employees, creditors, suppliers, and shareholders, much like Virtusa Corporation's Engineering First approach that anticipates execution challenges right from the ideation phase. This preemptive thinking is vital, as it aligns stakeholder expectations with the realities of the restructuring process, thereby fostering trust and collaboration essential for navigating through turbulent financial waters.

In the hospitality industry, for example, a tailored strategy that harnesses a hotel's central location can lead to a significant uptick in sales and guest satisfaction, as evidenced by the increased F&B sales at a major branded hotel in the city center. Similarly, turnaround specialists apply a multi-disciplinary approach to ensure that every facet of the company's operations is geared towards efficiency, cost reduction, and revenue enhancement.

Amidst a backdrop of financial strain, where healthcare organizations grapple with reduced revenues and increased costs, consulting firms have stepped in to provide indispensable guidance. The KLAS 2020 Financial Improvement Consulting report highlights a 56% surge in financial performance improvement engagements, with more than half of the clients reporting enhanced efficiency and performance. This is reflective of the broader market trend, where businesses prioritize operational evaluations to optimize labor, redesign compensation, and negotiate better contracts.

Moreover, the Business Roundtable's redefinition of a corporation's purpose to include a broader range of stakeholders echoes the sentiment that today's business strategies must transcend short-term profits. The proactive engagement of stakeholders not only addresses immediate financial challenges but also lays the groundwork for sustainable growth and resilience, which is particularly pertinent in light of the Federal Reserve's interest rate hikes and the avoidance of a predicted recession.

In summary, stakeholder engagement, when executed with foresight and precision, can be the linchpin in turning around a struggling enterprise. The success stories from various industries underscore the importance of a collaborative approach and the significant role consultants play in bridging the gap between a company's challenges and its path to recovery.

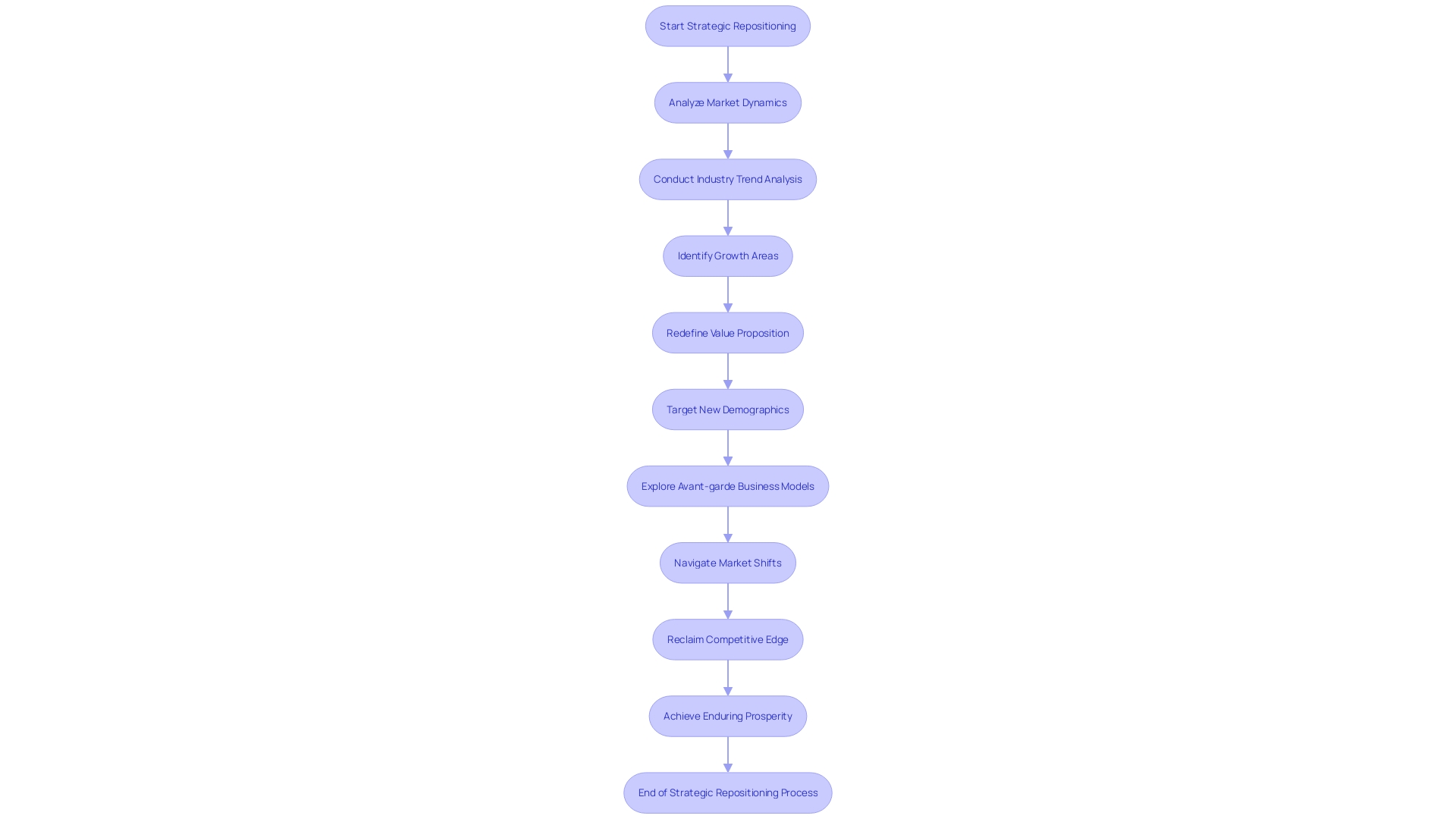

Strategic Repositioning

Strategic repositioning is not just about altering a company's trajectory; it's about a comprehensive evaluation of the current business model to pinpoint competitive advantages and forge a revitalized strategic direction. Turnaround consulting is a meticulous process that involves a collaborative effort between consultants and the management team to scrutinize market dynamics, dissect industry trends, and unearth potential areas for growth.

By redefining the company's value proposition, targeting new demographics, and exploring avant-garde business models, consultants craft a bespoke path for the company to navigate market shifts, reclaim its competitive edge, and set the stage for enduring prosperity.

This approach has a proven track record. For instance, a well-positioned hotel in a bustling city center saw its fortunes turn after leveraging its prime location to boost food and beverage sales, guided by a savvy consulting strategy. The success was immediate: glowing reviews and a significant uptick in sales in the very first week.

In another scenario, Strategic Solution Partners (SSP) exemplifies market leadership in the hospitality sector by providing interim human capital and operational solutions. Their strategic planning and revenue enhancement initiatives are testament to the power of a well-executed repositioning strategy.

The need for such strategic shifts is underscored by current events and market analysis. For example, the healthcare sector has seen consulting firms play a pivotal role in navigating the choppy financial waters wrought by the pandemic, inflation, and staffing shortages. The latest insights from KLAS report a surge in financial performance improvement engagements and a notable uptick in clients achieving increased efficiency and performance.

In summary, repositioning strategies are not a one-size-fits-all solution but require a deep understanding of a firm's unique challenges and market conditions. It's about crafting a path that not only addresses the present but paves a way for a prosperous future.

Financial Restructuring

Financial restructuring stands at the forefront of corporate revitalization, where consultants bring their expertise to evaluate and optimize a company's financial architecture. They scrutinize the firm's capital distribution, aiming to craft a resilient financial framework that withstands market pressures and supports long-term strategic goals. This multi-layered process includes a deep dive into the company's debt profile and cash flow mechanisms, pinpointing avenues for cutting costs and boosting operational efficiency. Such strategic planning may encompass the renegotiation of debt terms, the sale of non-essential assets, or the introduction of cost-reduction strategies.

For instance, KLAS' report on financial improvement consulting highlighted a 56% spike in engagements focused on financial performance, demonstrating the sector's vital role in enhancing efficiency and revenue generation. Clients frequently report favorable outcomes such as increased net revenue and cost savings, reflecting the tangible impact of these services.

Similarly, the restructuring cases of TBC Bank and WeWork underscore the transformative power of agile methodologies and strategic financial planning. TBC Bank's move toward digitalization and its agile transformation illustrate the potential to reduce organizational complexity and spur growth. WeWork's successful Chapter 11 proceedings and renegotiation of leases exemplify how decisive action in restructuring can lead to a significant debt reduction and a pathway to sustainable, profitable expansion.

In an era marked by financial uncertainties, such as those faced by healthcare organizations during the pandemic, the reliance on consulting firms for navigating decreased revenues and elevated costs has become more pronounced. The strategic reevaluation of all expenditures, without precipitate cost-cutting, ensures that investments align with the company's strategic objectives, thereby setting the stage for a robust turnaround and restructuring process.

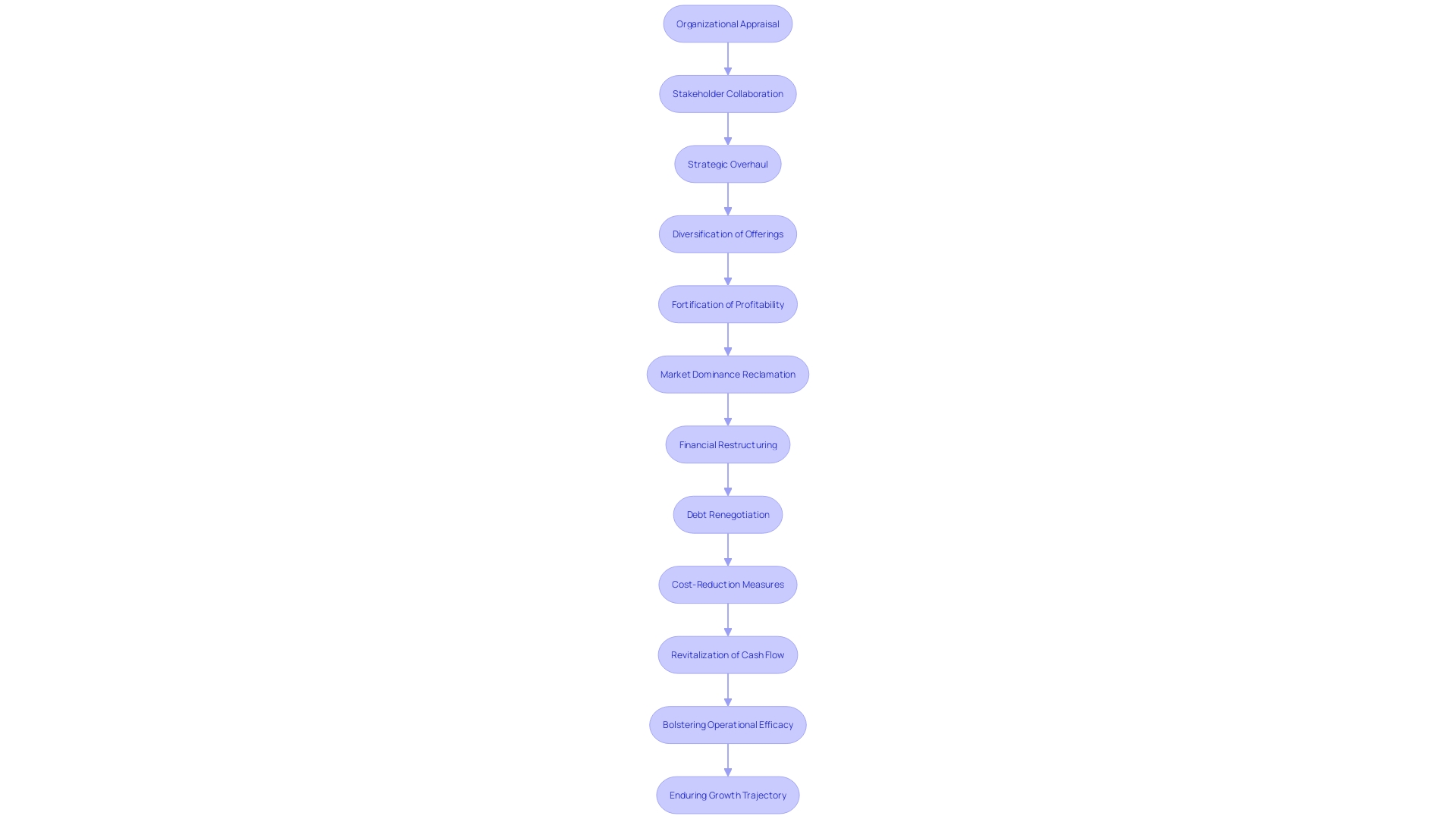

Case Study: Successful Turnaround Examples

Highlighting the impact of strategic turnaround and restructuring, we delve into two compelling narratives that underscore the transformative power of such interventions. Firstly, we examine the tale of a renowned construction enterprise grappling with financial instability triggered by a market slump. A decisive engagement with a turnaround consultancy catalyzed a thorough organizational appraisal and stakeholder collaboration, culminating in a strategic overhaul. This pivotal move not only diversified the firm's offerings but also fortified its profitability and reclaimed its market dominance.

In a similar vein, we turn our attention to a manufacturing entity besieged by crippling debt and operational inefficiencies. Here, the expertise of turnaround consultants was pivotal, guiding the company through a meticulous financial restructuring. By renegotiating debt conditions and instituting cost-reduction measures, the company revitalized its cash flow, bolstered operational efficacy, and embarked on a trajectory of enduring growth.

These narratives underscore crucial elements such as a data-centric approach, active stakeholder involvement, strategic repositioning, and financial restructuring as cornerstones for the successful rejuvenation of business enterprises. They serve as testament to the profound impact that targeted, expert-led turnaround strategies can have on the fortunes of ailing organizations.

Conclusion

In conclusion, successful business and construction restructuring requires a meticulous assessment to pinpoint core issues and uncover existing solutions. Strategic stakeholder engagement fosters trust and collaboration, while strategic repositioning helps navigate market shifts and regain a competitive edge. Financial restructuring optimizes the financial framework for long-term goals.

By leveraging past insights and current data, organizations can chart a path towards recovery and growth. CFOs must take a confident and action-oriented approach, implementing strategic interventions to rejuvenate ailing businesses. Through assessment, stakeholder engagement, repositioning, and financial restructuring, troubled businesses can steer towards a prosperous horizon.